User login

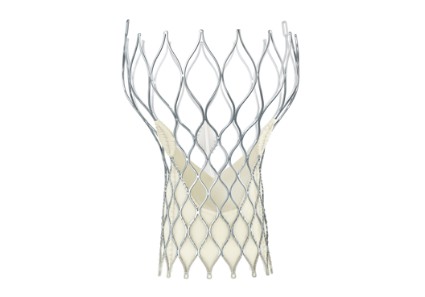

When the Food and Drug Administration in January granted marketing approval to a second transcatheter aortic valve replacement system for inoperable patients with aortic stenosis, the CoreValve marketed by Medtronic, the new valve conceded a greater than 2-year head start to the first system on the U.S. market, Sapien marketed by Edwards.

But cardiologists see that 2-year edge in familiarity eclipsed for at least some patients by two major advantages that CoreValve currently holds over Sapien: delivery via a significantly thinner sheath, and the option of larger-diameter valves that allow replacement in patients with a wider aortic annulus.

The CoreValve delivery sheath is 18 French, compared with a 22F or 24F size for the Sapien transcatheter aortic valve replacement (TAVR) with U.S. approval, and the Sapien valves come in diameters of 23 and 26 mm, compared with options of 23, 26, 29, and 31 mm for the CoreValve.

"CoreValve is the device of choice for patients with smaller vessel sizes. Sapien has been a wonderful device to use, and we have so much experience with it, but the smaller CoreValve size will allow many more patients to be done with a transfemoral approach," said Dr. Peter C. Block, a professor of medicine at Emory University in Atlanta and an interventional cardiologist who performs TAVR.

"More patients will qualify for TAVR and will be treated transfemorally with the larger valve diameters and smaller sheath size," agreed Dr. Mauricio G. Cohen, director of cardiac catheterization at the University of Miami and TAVR interventionalist. Another potential positive of having CoreValve on the U.S. market is that competition between the two options will likely drive down the cost of a TAVR system, which until now has run more than $30,000, Dr. Cohen said in an interview.

CoreValve received FDA approval less than 3 months after researchers first reported data from the company’s U.S. Pivotal Trial Extreme Risk Iliofemoral Study last October at the TCT (Transcatheter Cardiovascular Therapeutics) annual meeting. In that study, 471 inoperable aortic stenosis patients had a 26% 1-year rate of death or major stroke, substantially surpassing the 43% rate that the study set up as the target for superiority, reported Dr. Jeffrey J. Popma, lead investigator on the study.

Dr. Popma warned against comparing CoreValve’s efficacy and safety performance in the trial and the Sapien system’s performance in its pivotal trial in inoperable patients, the PARTNER cohort B trial (N. Engl. J. Med. 2010;363:1597-607). "It’s very difficult to make cross-trial comparison," he said in an interview, a limitation also noted by Dr. Cohen and Dr. Block. But Dr. Popma highlighted the 2.4% 30-day stroke rate in the pivotal trial, and a 1.8% 30-day stroke rate seen with CoreValve in inoperable patients in a continued access program at the trial’s study sites. He also highlighted the 11% rate of moderate paravalvular aortic regurgitation after 30 days that dropped to a 4% rate after 1 year.

Perhaps the biggest downside of CoreValve’s performance in the pivotal trial was that 22% of patients required a permanent pacemaker implant within the first 30 days, increasing to 27% of patients with 1-year follow-up. Increased risk for a pacemaker is an inherent downside of CoreValve because of its longer size compared with the Sapien valve and how the CoreValve sits in the aortic annulus. The CoreValve is designed for supravalvular placement and anchoring in the left ventricular outflow tract near the left bundle branch that can result in mechanical irritation and arrhythmia with the need for pacing, explained Dr. Popma, professor of medicine at Harvard University and an interventional cardiologist at Beth Israel Deaconess Medical Center, Boston.

"I think our pacemaker rate was very acceptable. I don’t think it will ever be as low as with Sapien, but it’s a worthwhile trade-off because the CoreValve functions well and results in a low rate of paravalvular regurgitation," he said.

Dr. Popma also stressed that 1-year mortality was no greater among the patients who required a pacemaker implant in the pivotal trial. A subgroup analysis of results from the trial to try to identify which patients had the greatest risk for needing a pacemaker after a CoreValve implant has not yet finished, he said. It’s possible that certain patients with preexisting conduction abnormalities, such as a right bundle branch block coupled with a left anterior fascicular block, have the greatest vulnerability.

Patients for whom the Sapien system remains ideal are those with a narrow sinus of Valsalva, because the longer CoreValve frame crosses the sinus and may compromise coronary blood flow in patients with a narrow sinus, Dr. Popma said.

The choice between CoreValve and Sapien systems will grow even more complicated for U.S. cardiologists and surgeons when the Sapien XT valve system receives FDA marketing approval, likely later this year. The Sapien XT delivery sheath matches the 18F size of CoreValve and will also come in a 29-mm size, blunting two of CoreValves main advantages.

Medtronic also faces charges of patent infringement by its CoreValve in a court case initiated by Edwards. In mid-January, a jury in a U.S. District Court assessed a penalty of $394 million against Medtronic. Edwards is also seeking a court-ordered halt to U.S. marketing of CoreValve. But Medtronic is appealing the jury verdict and continues to fight the injunction, and a company spokesperson said in an interview that the legal maneuverings will likely take at least another year to fully resolve. In the meantime, Medtronic began U.S. distribution of the CoreValve on Jan. 17.

Dr. Block said that his institution received a research grant to participate in Sapien trials. Dr. Cohen said that he has been a consultant to Medtronic and Edwards. Dr. Popma said that his institution received research support from Medtronic and that he has been a consultant to and received research support from Boston Scientific.

When the Food and Drug Administration in January granted marketing approval to a second transcatheter aortic valve replacement system for inoperable patients with aortic stenosis, the CoreValve marketed by Medtronic, the new valve conceded a greater than 2-year head start to the first system on the U.S. market, Sapien marketed by Edwards.

But cardiologists see that 2-year edge in familiarity eclipsed for at least some patients by two major advantages that CoreValve currently holds over Sapien: delivery via a significantly thinner sheath, and the option of larger-diameter valves that allow replacement in patients with a wider aortic annulus.

The CoreValve delivery sheath is 18 French, compared with a 22F or 24F size for the Sapien transcatheter aortic valve replacement (TAVR) with U.S. approval, and the Sapien valves come in diameters of 23 and 26 mm, compared with options of 23, 26, 29, and 31 mm for the CoreValve.

"CoreValve is the device of choice for patients with smaller vessel sizes. Sapien has been a wonderful device to use, and we have so much experience with it, but the smaller CoreValve size will allow many more patients to be done with a transfemoral approach," said Dr. Peter C. Block, a professor of medicine at Emory University in Atlanta and an interventional cardiologist who performs TAVR.

"More patients will qualify for TAVR and will be treated transfemorally with the larger valve diameters and smaller sheath size," agreed Dr. Mauricio G. Cohen, director of cardiac catheterization at the University of Miami and TAVR interventionalist. Another potential positive of having CoreValve on the U.S. market is that competition between the two options will likely drive down the cost of a TAVR system, which until now has run more than $30,000, Dr. Cohen said in an interview.

CoreValve received FDA approval less than 3 months after researchers first reported data from the company’s U.S. Pivotal Trial Extreme Risk Iliofemoral Study last October at the TCT (Transcatheter Cardiovascular Therapeutics) annual meeting. In that study, 471 inoperable aortic stenosis patients had a 26% 1-year rate of death or major stroke, substantially surpassing the 43% rate that the study set up as the target for superiority, reported Dr. Jeffrey J. Popma, lead investigator on the study.

Dr. Popma warned against comparing CoreValve’s efficacy and safety performance in the trial and the Sapien system’s performance in its pivotal trial in inoperable patients, the PARTNER cohort B trial (N. Engl. J. Med. 2010;363:1597-607). "It’s very difficult to make cross-trial comparison," he said in an interview, a limitation also noted by Dr. Cohen and Dr. Block. But Dr. Popma highlighted the 2.4% 30-day stroke rate in the pivotal trial, and a 1.8% 30-day stroke rate seen with CoreValve in inoperable patients in a continued access program at the trial’s study sites. He also highlighted the 11% rate of moderate paravalvular aortic regurgitation after 30 days that dropped to a 4% rate after 1 year.

Perhaps the biggest downside of CoreValve’s performance in the pivotal trial was that 22% of patients required a permanent pacemaker implant within the first 30 days, increasing to 27% of patients with 1-year follow-up. Increased risk for a pacemaker is an inherent downside of CoreValve because of its longer size compared with the Sapien valve and how the CoreValve sits in the aortic annulus. The CoreValve is designed for supravalvular placement and anchoring in the left ventricular outflow tract near the left bundle branch that can result in mechanical irritation and arrhythmia with the need for pacing, explained Dr. Popma, professor of medicine at Harvard University and an interventional cardiologist at Beth Israel Deaconess Medical Center, Boston.

"I think our pacemaker rate was very acceptable. I don’t think it will ever be as low as with Sapien, but it’s a worthwhile trade-off because the CoreValve functions well and results in a low rate of paravalvular regurgitation," he said.

Dr. Popma also stressed that 1-year mortality was no greater among the patients who required a pacemaker implant in the pivotal trial. A subgroup analysis of results from the trial to try to identify which patients had the greatest risk for needing a pacemaker after a CoreValve implant has not yet finished, he said. It’s possible that certain patients with preexisting conduction abnormalities, such as a right bundle branch block coupled with a left anterior fascicular block, have the greatest vulnerability.

Patients for whom the Sapien system remains ideal are those with a narrow sinus of Valsalva, because the longer CoreValve frame crosses the sinus and may compromise coronary blood flow in patients with a narrow sinus, Dr. Popma said.

The choice between CoreValve and Sapien systems will grow even more complicated for U.S. cardiologists and surgeons when the Sapien XT valve system receives FDA marketing approval, likely later this year. The Sapien XT delivery sheath matches the 18F size of CoreValve and will also come in a 29-mm size, blunting two of CoreValves main advantages.

Medtronic also faces charges of patent infringement by its CoreValve in a court case initiated by Edwards. In mid-January, a jury in a U.S. District Court assessed a penalty of $394 million against Medtronic. Edwards is also seeking a court-ordered halt to U.S. marketing of CoreValve. But Medtronic is appealing the jury verdict and continues to fight the injunction, and a company spokesperson said in an interview that the legal maneuverings will likely take at least another year to fully resolve. In the meantime, Medtronic began U.S. distribution of the CoreValve on Jan. 17.

Dr. Block said that his institution received a research grant to participate in Sapien trials. Dr. Cohen said that he has been a consultant to Medtronic and Edwards. Dr. Popma said that his institution received research support from Medtronic and that he has been a consultant to and received research support from Boston Scientific.

When the Food and Drug Administration in January granted marketing approval to a second transcatheter aortic valve replacement system for inoperable patients with aortic stenosis, the CoreValve marketed by Medtronic, the new valve conceded a greater than 2-year head start to the first system on the U.S. market, Sapien marketed by Edwards.

But cardiologists see that 2-year edge in familiarity eclipsed for at least some patients by two major advantages that CoreValve currently holds over Sapien: delivery via a significantly thinner sheath, and the option of larger-diameter valves that allow replacement in patients with a wider aortic annulus.

The CoreValve delivery sheath is 18 French, compared with a 22F or 24F size for the Sapien transcatheter aortic valve replacement (TAVR) with U.S. approval, and the Sapien valves come in diameters of 23 and 26 mm, compared with options of 23, 26, 29, and 31 mm for the CoreValve.

"CoreValve is the device of choice for patients with smaller vessel sizes. Sapien has been a wonderful device to use, and we have so much experience with it, but the smaller CoreValve size will allow many more patients to be done with a transfemoral approach," said Dr. Peter C. Block, a professor of medicine at Emory University in Atlanta and an interventional cardiologist who performs TAVR.

"More patients will qualify for TAVR and will be treated transfemorally with the larger valve diameters and smaller sheath size," agreed Dr. Mauricio G. Cohen, director of cardiac catheterization at the University of Miami and TAVR interventionalist. Another potential positive of having CoreValve on the U.S. market is that competition between the two options will likely drive down the cost of a TAVR system, which until now has run more than $30,000, Dr. Cohen said in an interview.

CoreValve received FDA approval less than 3 months after researchers first reported data from the company’s U.S. Pivotal Trial Extreme Risk Iliofemoral Study last October at the TCT (Transcatheter Cardiovascular Therapeutics) annual meeting. In that study, 471 inoperable aortic stenosis patients had a 26% 1-year rate of death or major stroke, substantially surpassing the 43% rate that the study set up as the target for superiority, reported Dr. Jeffrey J. Popma, lead investigator on the study.

Dr. Popma warned against comparing CoreValve’s efficacy and safety performance in the trial and the Sapien system’s performance in its pivotal trial in inoperable patients, the PARTNER cohort B trial (N. Engl. J. Med. 2010;363:1597-607). "It’s very difficult to make cross-trial comparison," he said in an interview, a limitation also noted by Dr. Cohen and Dr. Block. But Dr. Popma highlighted the 2.4% 30-day stroke rate in the pivotal trial, and a 1.8% 30-day stroke rate seen with CoreValve in inoperable patients in a continued access program at the trial’s study sites. He also highlighted the 11% rate of moderate paravalvular aortic regurgitation after 30 days that dropped to a 4% rate after 1 year.

Perhaps the biggest downside of CoreValve’s performance in the pivotal trial was that 22% of patients required a permanent pacemaker implant within the first 30 days, increasing to 27% of patients with 1-year follow-up. Increased risk for a pacemaker is an inherent downside of CoreValve because of its longer size compared with the Sapien valve and how the CoreValve sits in the aortic annulus. The CoreValve is designed for supravalvular placement and anchoring in the left ventricular outflow tract near the left bundle branch that can result in mechanical irritation and arrhythmia with the need for pacing, explained Dr. Popma, professor of medicine at Harvard University and an interventional cardiologist at Beth Israel Deaconess Medical Center, Boston.

"I think our pacemaker rate was very acceptable. I don’t think it will ever be as low as with Sapien, but it’s a worthwhile trade-off because the CoreValve functions well and results in a low rate of paravalvular regurgitation," he said.

Dr. Popma also stressed that 1-year mortality was no greater among the patients who required a pacemaker implant in the pivotal trial. A subgroup analysis of results from the trial to try to identify which patients had the greatest risk for needing a pacemaker after a CoreValve implant has not yet finished, he said. It’s possible that certain patients with preexisting conduction abnormalities, such as a right bundle branch block coupled with a left anterior fascicular block, have the greatest vulnerability.

Patients for whom the Sapien system remains ideal are those with a narrow sinus of Valsalva, because the longer CoreValve frame crosses the sinus and may compromise coronary blood flow in patients with a narrow sinus, Dr. Popma said.

The choice between CoreValve and Sapien systems will grow even more complicated for U.S. cardiologists and surgeons when the Sapien XT valve system receives FDA marketing approval, likely later this year. The Sapien XT delivery sheath matches the 18F size of CoreValve and will also come in a 29-mm size, blunting two of CoreValves main advantages.

Medtronic also faces charges of patent infringement by its CoreValve in a court case initiated by Edwards. In mid-January, a jury in a U.S. District Court assessed a penalty of $394 million against Medtronic. Edwards is also seeking a court-ordered halt to U.S. marketing of CoreValve. But Medtronic is appealing the jury verdict and continues to fight the injunction, and a company spokesperson said in an interview that the legal maneuverings will likely take at least another year to fully resolve. In the meantime, Medtronic began U.S. distribution of the CoreValve on Jan. 17.

Dr. Block said that his institution received a research grant to participate in Sapien trials. Dr. Cohen said that he has been a consultant to Medtronic and Edwards. Dr. Popma said that his institution received research support from Medtronic and that he has been a consultant to and received research support from Boston Scientific.