User login

Most physicians realize that the specter of the Sustainable Growth Rate (SGR) has been replaced by a “new plan” enacted by Congress under the guise of the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015. A major goal of the programs defined by MACRA is to provide quality care while improving value, the Quality Payment Program (QPP). There are currently two paths for reimbursement from which physicians may choose defined by QPP: the Merit-based Incentive Payment System (MIPS) or the Advanced Alternative Payment Models (APMs). These will be explained in general terms but it would benefit all health-care professionals to visit the CMS website for additional details on the program.

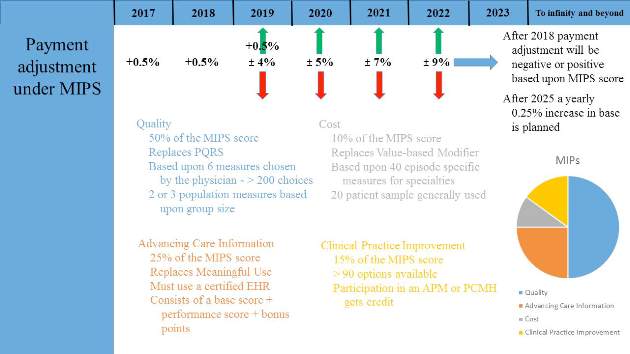

Most physicians will initially choose MIPS by default as most do not currently participate in programs that qualify as APMs. MIPS will eventually result in the demise of the multiple reporting systems presently used by CMS to include the Physician Quality Reporting System (PQRS), the Value-Based Modifier (VBM) Program, and the Medicare Electronic Health Record (EHR) Incentive Program (Meaningful Use). These will be streamlined into a single program, although many of the components are carried through to MIPS (Fig. 1).

Data from health-care providers will be collected through a variety of sources beginning in January 2017 and this will be used to determine the MIPS score as briefly outlined by the colored text in Figure 1. The 2017 data will determine the MIPS Composite Performance Score (CPS). From 2017 through 2019, CMS will provide a 0.5% increase in payment for services. Between 2020 and 2025, no increase is planned, but starting in 2026, a yearly 0.25% increase in reimbursement is planned. In 2019, physician payment will be adjusted positively or negatively by 4% based upon their MIPS CPS and a threshold CPS determined for all participants. This adjustment will be revenue-neutral, so for every winner there will be a corresponding loser based upon one’s MIPS score. However, there is a scaling factor built into the system for years 2019 to 2024, using up to $500 million to reward those whose CPS are at the highest levels. This adjustment will increase to 5% in 2020, 7% in 2021, and 9% from 2022 onward. Eligible providers can participate as an individual or as a group.

The Advanced Alternative Payment Model, as defined by MACRA, may include a CMS Innovation Center model, MSSP (Medicare Shared Savings Program), Demonstration under the Health Care Quality Demonstration Program, or Demonstration required by federal law. To be an eligible APM requires that these entities: require participants to use certified EHR technology; base payment on quality measures comparable to those in the MIPS quality performance category; either require APM entities to bear more than nominal financial risk for monetary losses; or be a Medical Home Model expanded under Center for Medicare and Medicaid Innovation authority.

To become a qualifying participant (QP) one must have either a percentage of payments or a percentage of patients through an eligible APM. CMS will calculate a threshold score using Medicare Part B data for professional services and payments in that APM. The percentage of each is illustrated in Figure 2 and will increase from 2019 to 2024. 2017 will be the first year eligible participants will be assessed to determine whether they qualify. If an eligible participant qualifies, year 2018 base payments will be used to determine year 2019 lump sum payment. This is set at 5%. This cycle will continue each year to determine if the participant qualifies for the lump sum distribution. In addition, qualified APMs will receive a yearly 0.75% increase in base payments starting in year 2026. If one participates in an APM but does not meet the threshold for QP set by CMS, one receives either no payment adjustment or may opt to participate in MIPS. Beginning in 2021, CMS may count data from other non-Medicare payers to determine eligibility as a QP.

The goal of the Quality Payment Program is to change the way Medicare pays clinicians and to offer financial incentives for providing high value care. Physicians will be required to participate in either the MIPS or APM programs unless they are in their first year of Part B participation or have a low volume of patients. The program will almost certainly continue to change as input is received from many stakeholders, most importantly health-care professionals and patients. Physicians are, therefore, encouraged to learn more about the program to maximize your reimbursement.

Most physicians realize that the specter of the Sustainable Growth Rate (SGR) has been replaced by a “new plan” enacted by Congress under the guise of the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015. A major goal of the programs defined by MACRA is to provide quality care while improving value, the Quality Payment Program (QPP). There are currently two paths for reimbursement from which physicians may choose defined by QPP: the Merit-based Incentive Payment System (MIPS) or the Advanced Alternative Payment Models (APMs). These will be explained in general terms but it would benefit all health-care professionals to visit the CMS website for additional details on the program.

Most physicians will initially choose MIPS by default as most do not currently participate in programs that qualify as APMs. MIPS will eventually result in the demise of the multiple reporting systems presently used by CMS to include the Physician Quality Reporting System (PQRS), the Value-Based Modifier (VBM) Program, and the Medicare Electronic Health Record (EHR) Incentive Program (Meaningful Use). These will be streamlined into a single program, although many of the components are carried through to MIPS (Fig. 1).

Data from health-care providers will be collected through a variety of sources beginning in January 2017 and this will be used to determine the MIPS score as briefly outlined by the colored text in Figure 1. The 2017 data will determine the MIPS Composite Performance Score (CPS). From 2017 through 2019, CMS will provide a 0.5% increase in payment for services. Between 2020 and 2025, no increase is planned, but starting in 2026, a yearly 0.25% increase in reimbursement is planned. In 2019, physician payment will be adjusted positively or negatively by 4% based upon their MIPS CPS and a threshold CPS determined for all participants. This adjustment will be revenue-neutral, so for every winner there will be a corresponding loser based upon one’s MIPS score. However, there is a scaling factor built into the system for years 2019 to 2024, using up to $500 million to reward those whose CPS are at the highest levels. This adjustment will increase to 5% in 2020, 7% in 2021, and 9% from 2022 onward. Eligible providers can participate as an individual or as a group.

The Advanced Alternative Payment Model, as defined by MACRA, may include a CMS Innovation Center model, MSSP (Medicare Shared Savings Program), Demonstration under the Health Care Quality Demonstration Program, or Demonstration required by federal law. To be an eligible APM requires that these entities: require participants to use certified EHR technology; base payment on quality measures comparable to those in the MIPS quality performance category; either require APM entities to bear more than nominal financial risk for monetary losses; or be a Medical Home Model expanded under Center for Medicare and Medicaid Innovation authority.

To become a qualifying participant (QP) one must have either a percentage of payments or a percentage of patients through an eligible APM. CMS will calculate a threshold score using Medicare Part B data for professional services and payments in that APM. The percentage of each is illustrated in Figure 2 and will increase from 2019 to 2024. 2017 will be the first year eligible participants will be assessed to determine whether they qualify. If an eligible participant qualifies, year 2018 base payments will be used to determine year 2019 lump sum payment. This is set at 5%. This cycle will continue each year to determine if the participant qualifies for the lump sum distribution. In addition, qualified APMs will receive a yearly 0.75% increase in base payments starting in year 2026. If one participates in an APM but does not meet the threshold for QP set by CMS, one receives either no payment adjustment or may opt to participate in MIPS. Beginning in 2021, CMS may count data from other non-Medicare payers to determine eligibility as a QP.

The goal of the Quality Payment Program is to change the way Medicare pays clinicians and to offer financial incentives for providing high value care. Physicians will be required to participate in either the MIPS or APM programs unless they are in their first year of Part B participation or have a low volume of patients. The program will almost certainly continue to change as input is received from many stakeholders, most importantly health-care professionals and patients. Physicians are, therefore, encouraged to learn more about the program to maximize your reimbursement.

Most physicians realize that the specter of the Sustainable Growth Rate (SGR) has been replaced by a “new plan” enacted by Congress under the guise of the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015. A major goal of the programs defined by MACRA is to provide quality care while improving value, the Quality Payment Program (QPP). There are currently two paths for reimbursement from which physicians may choose defined by QPP: the Merit-based Incentive Payment System (MIPS) or the Advanced Alternative Payment Models (APMs). These will be explained in general terms but it would benefit all health-care professionals to visit the CMS website for additional details on the program.

Most physicians will initially choose MIPS by default as most do not currently participate in programs that qualify as APMs. MIPS will eventually result in the demise of the multiple reporting systems presently used by CMS to include the Physician Quality Reporting System (PQRS), the Value-Based Modifier (VBM) Program, and the Medicare Electronic Health Record (EHR) Incentive Program (Meaningful Use). These will be streamlined into a single program, although many of the components are carried through to MIPS (Fig. 1).

Data from health-care providers will be collected through a variety of sources beginning in January 2017 and this will be used to determine the MIPS score as briefly outlined by the colored text in Figure 1. The 2017 data will determine the MIPS Composite Performance Score (CPS). From 2017 through 2019, CMS will provide a 0.5% increase in payment for services. Between 2020 and 2025, no increase is planned, but starting in 2026, a yearly 0.25% increase in reimbursement is planned. In 2019, physician payment will be adjusted positively or negatively by 4% based upon their MIPS CPS and a threshold CPS determined for all participants. This adjustment will be revenue-neutral, so for every winner there will be a corresponding loser based upon one’s MIPS score. However, there is a scaling factor built into the system for years 2019 to 2024, using up to $500 million to reward those whose CPS are at the highest levels. This adjustment will increase to 5% in 2020, 7% in 2021, and 9% from 2022 onward. Eligible providers can participate as an individual or as a group.

The Advanced Alternative Payment Model, as defined by MACRA, may include a CMS Innovation Center model, MSSP (Medicare Shared Savings Program), Demonstration under the Health Care Quality Demonstration Program, or Demonstration required by federal law. To be an eligible APM requires that these entities: require participants to use certified EHR technology; base payment on quality measures comparable to those in the MIPS quality performance category; either require APM entities to bear more than nominal financial risk for monetary losses; or be a Medical Home Model expanded under Center for Medicare and Medicaid Innovation authority.

To become a qualifying participant (QP) one must have either a percentage of payments or a percentage of patients through an eligible APM. CMS will calculate a threshold score using Medicare Part B data for professional services and payments in that APM. The percentage of each is illustrated in Figure 2 and will increase from 2019 to 2024. 2017 will be the first year eligible participants will be assessed to determine whether they qualify. If an eligible participant qualifies, year 2018 base payments will be used to determine year 2019 lump sum payment. This is set at 5%. This cycle will continue each year to determine if the participant qualifies for the lump sum distribution. In addition, qualified APMs will receive a yearly 0.75% increase in base payments starting in year 2026. If one participates in an APM but does not meet the threshold for QP set by CMS, one receives either no payment adjustment or may opt to participate in MIPS. Beginning in 2021, CMS may count data from other non-Medicare payers to determine eligibility as a QP.

The goal of the Quality Payment Program is to change the way Medicare pays clinicians and to offer financial incentives for providing high value care. Physicians will be required to participate in either the MIPS or APM programs unless they are in their first year of Part B participation or have a low volume of patients. The program will almost certainly continue to change as input is received from many stakeholders, most importantly health-care professionals and patients. Physicians are, therefore, encouraged to learn more about the program to maximize your reimbursement.