User login

As most of you know, Medicare publishes its proposed rule, which determines the physician fee schedule, around July 1 each year, accepts comments for 60 days, and then publishes a final rule on or around Nov. 1, which becomes final on Jan. 1 of the following year. The proposed rule is watched closely and has great impact, because not only are Medicare fees based on the rule, but most private insurances are based on Medicare.

This year’s proposed rule, announced in early August, is extraordinary by any past standard. It can be found here.

It cuts the conversion factor (which is what the work, practice expense, and malpractice values are multiplied by to get a payment) by 10.6%, from $36.09 to $32.26. This is necessary to maintain “budget neutrality” since there is a fixed pool of money, and payments for cognitive services are increasing. The overall effect on dermatology is a 2% cut, which is mild, compared with other specialties, such as nurse anesthetists and radiologists, both with an 11% decrease; chiropractors, with a 10% decrease; and interventional radiology, pathology, physical and occupational therapy, and cardiac surgery, all with a 9% decrease. General surgery will see a 7% decrease. Those with major increases are endocrinology, with a 17% increase; rheumatology, with a 16% increase; and hematology/oncology, with a 14% increase.

The overall push by CMS (and the relative value update committee) is to improve the pay for cognitive services, that is evaluation and management (E/M) services. Since dermatology also provides such services, the effect of the proposed rule will vary dramatically depending on your case mix. I must also point out that, since existing overhead is relatively fixed, say at 50%, a 10% decrease in revenue may translate into a 20% loss in physician income.

The good

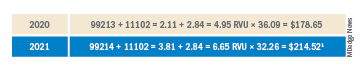

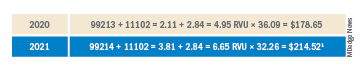

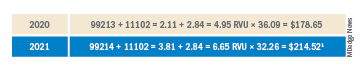

Simplified coding and billing requirements for E/M visits will go into effect Jan. 1, 2021. For dermatology, any visit where a decision to do a minor procedure or prescribe a medication takes place will become a level 4 visit. Most of the useless documentation requirements and need to examine multiple organ systems will be eliminated. The most common E/M code currently used by dermatologists is a level 3, and this will on average move up to a level 4. Thus, general dermatology will benefit from the new rule. For example, if a dermatologist sees a patient and does a tangential biopsy of the skin, the payment will be $214.52, compared with $178.65 in 2020.

The bad

As mentioned above, the impact will vary by case mix. Those doing a lot of surgery will see a much larger cut. Mohs surgeons, for example will see about a 6.5% decrease.1

Aggravating the cuts to surgery is the fact that, while CMS has bolstered the pay for E/M stand-alone codes, they did not increase the reimbursement level of the built-in follow-up visits inside the 10- and 90-day global periods.

The ugly

Procedure codes with a lot of practice expense built into them, such as Mohs and reconstruction, are not hit as hard by the conversion factor cut because the practice expense is generally spared. There is much less practice expense in a pathology code so dermatopathology faces the most severe cuts. Pathology and other specialties that do not generally bill office/outpatient E/M codes are estimated to see the greatest decrease in payment in 2021.

Code 88305, the most common dermatopathology code, will decrease overall from $71.46 to $66.78 (–6.5%). Digging a little deeper, we find that the technical charge (the payment to process and make the slide) actually increases from $32.12 to $32.26, but the professional component (the interpretation of the slide and report generation) decreases from $39.34 to $34.52 (–12.3%).

I must also point out that this proposed rule allows for nurse practitioners (NPs), clinical nurse specialists (CNSs), physician assistants (PAs), and certified nurse-midwives (CNMs) to supervise the performance of diagnostic tests in addition to physicians. I wonder if we will see an increase in billing of dermatopathology by the untrained.

Adding more confusion – and an additional hit to hospital-based practices – is the federal appeals court decision affirming the ability of the Centers for Medicare & Medicaid Services to mandate site-neutral payments for E/M codes. This means that hospital-affiliated practices, which used to enjoy payment of up to 114% more than offices, will be paid the same as offices. This will save CMS $300 million, but these savings will not be flowing back into the physician fee schedule.

Fixing this will require congressional action since CMS is bound by law to maintain budget neutrality. The specialty societies saw this coming and have already been lobbying furiously to waive budget neutrality requirements, especially in this time of a pandemic that has had an adverse impact on physicians. This is noted in detail on the AADA website, accessible to AAD members.

Since this will take a legislative fix, you should contact your congressional representative or senator and ask them to enact legislation to waive Medicare’s budget neutrality requirements to apply the increased E/M adjustment to all 10- and 90-day global code values. You might also inquire where the $300 million saved by site neutral payment reform will go, and suggest applying it towards restoring the conversion factor to a more normal number.

Dr. Coldiron is in private practice but maintains a clinical assistant professorship at the University of Cincinnati. He cares for patients, teaches medical students and residents, and has several active clinical research projects. Dr. Coldiron is the author of more than 80 scientific letters, papers, and several book chapters, and he speaks frequently on a variety of topics. He is a past president of the American Academy of Dermatology. Write to him at [email protected].

Reference

1. Calculations and tables courtesy of Brent Moody, M.D., AAD AMA relative value update committee practice expense representative and specialist.

As most of you know, Medicare publishes its proposed rule, which determines the physician fee schedule, around July 1 each year, accepts comments for 60 days, and then publishes a final rule on or around Nov. 1, which becomes final on Jan. 1 of the following year. The proposed rule is watched closely and has great impact, because not only are Medicare fees based on the rule, but most private insurances are based on Medicare.

This year’s proposed rule, announced in early August, is extraordinary by any past standard. It can be found here.

It cuts the conversion factor (which is what the work, practice expense, and malpractice values are multiplied by to get a payment) by 10.6%, from $36.09 to $32.26. This is necessary to maintain “budget neutrality” since there is a fixed pool of money, and payments for cognitive services are increasing. The overall effect on dermatology is a 2% cut, which is mild, compared with other specialties, such as nurse anesthetists and radiologists, both with an 11% decrease; chiropractors, with a 10% decrease; and interventional radiology, pathology, physical and occupational therapy, and cardiac surgery, all with a 9% decrease. General surgery will see a 7% decrease. Those with major increases are endocrinology, with a 17% increase; rheumatology, with a 16% increase; and hematology/oncology, with a 14% increase.

The overall push by CMS (and the relative value update committee) is to improve the pay for cognitive services, that is evaluation and management (E/M) services. Since dermatology also provides such services, the effect of the proposed rule will vary dramatically depending on your case mix. I must also point out that, since existing overhead is relatively fixed, say at 50%, a 10% decrease in revenue may translate into a 20% loss in physician income.

The good

Simplified coding and billing requirements for E/M visits will go into effect Jan. 1, 2021. For dermatology, any visit where a decision to do a minor procedure or prescribe a medication takes place will become a level 4 visit. Most of the useless documentation requirements and need to examine multiple organ systems will be eliminated. The most common E/M code currently used by dermatologists is a level 3, and this will on average move up to a level 4. Thus, general dermatology will benefit from the new rule. For example, if a dermatologist sees a patient and does a tangential biopsy of the skin, the payment will be $214.52, compared with $178.65 in 2020.

The bad

As mentioned above, the impact will vary by case mix. Those doing a lot of surgery will see a much larger cut. Mohs surgeons, for example will see about a 6.5% decrease.1

Aggravating the cuts to surgery is the fact that, while CMS has bolstered the pay for E/M stand-alone codes, they did not increase the reimbursement level of the built-in follow-up visits inside the 10- and 90-day global periods.

The ugly

Procedure codes with a lot of practice expense built into them, such as Mohs and reconstruction, are not hit as hard by the conversion factor cut because the practice expense is generally spared. There is much less practice expense in a pathology code so dermatopathology faces the most severe cuts. Pathology and other specialties that do not generally bill office/outpatient E/M codes are estimated to see the greatest decrease in payment in 2021.

Code 88305, the most common dermatopathology code, will decrease overall from $71.46 to $66.78 (–6.5%). Digging a little deeper, we find that the technical charge (the payment to process and make the slide) actually increases from $32.12 to $32.26, but the professional component (the interpretation of the slide and report generation) decreases from $39.34 to $34.52 (–12.3%).

I must also point out that this proposed rule allows for nurse practitioners (NPs), clinical nurse specialists (CNSs), physician assistants (PAs), and certified nurse-midwives (CNMs) to supervise the performance of diagnostic tests in addition to physicians. I wonder if we will see an increase in billing of dermatopathology by the untrained.

Adding more confusion – and an additional hit to hospital-based practices – is the federal appeals court decision affirming the ability of the Centers for Medicare & Medicaid Services to mandate site-neutral payments for E/M codes. This means that hospital-affiliated practices, which used to enjoy payment of up to 114% more than offices, will be paid the same as offices. This will save CMS $300 million, but these savings will not be flowing back into the physician fee schedule.

Fixing this will require congressional action since CMS is bound by law to maintain budget neutrality. The specialty societies saw this coming and have already been lobbying furiously to waive budget neutrality requirements, especially in this time of a pandemic that has had an adverse impact on physicians. This is noted in detail on the AADA website, accessible to AAD members.

Since this will take a legislative fix, you should contact your congressional representative or senator and ask them to enact legislation to waive Medicare’s budget neutrality requirements to apply the increased E/M adjustment to all 10- and 90-day global code values. You might also inquire where the $300 million saved by site neutral payment reform will go, and suggest applying it towards restoring the conversion factor to a more normal number.

Dr. Coldiron is in private practice but maintains a clinical assistant professorship at the University of Cincinnati. He cares for patients, teaches medical students and residents, and has several active clinical research projects. Dr. Coldiron is the author of more than 80 scientific letters, papers, and several book chapters, and he speaks frequently on a variety of topics. He is a past president of the American Academy of Dermatology. Write to him at [email protected].

Reference

1. Calculations and tables courtesy of Brent Moody, M.D., AAD AMA relative value update committee practice expense representative and specialist.

As most of you know, Medicare publishes its proposed rule, which determines the physician fee schedule, around July 1 each year, accepts comments for 60 days, and then publishes a final rule on or around Nov. 1, which becomes final on Jan. 1 of the following year. The proposed rule is watched closely and has great impact, because not only are Medicare fees based on the rule, but most private insurances are based on Medicare.

This year’s proposed rule, announced in early August, is extraordinary by any past standard. It can be found here.

It cuts the conversion factor (which is what the work, practice expense, and malpractice values are multiplied by to get a payment) by 10.6%, from $36.09 to $32.26. This is necessary to maintain “budget neutrality” since there is a fixed pool of money, and payments for cognitive services are increasing. The overall effect on dermatology is a 2% cut, which is mild, compared with other specialties, such as nurse anesthetists and radiologists, both with an 11% decrease; chiropractors, with a 10% decrease; and interventional radiology, pathology, physical and occupational therapy, and cardiac surgery, all with a 9% decrease. General surgery will see a 7% decrease. Those with major increases are endocrinology, with a 17% increase; rheumatology, with a 16% increase; and hematology/oncology, with a 14% increase.

The overall push by CMS (and the relative value update committee) is to improve the pay for cognitive services, that is evaluation and management (E/M) services. Since dermatology also provides such services, the effect of the proposed rule will vary dramatically depending on your case mix. I must also point out that, since existing overhead is relatively fixed, say at 50%, a 10% decrease in revenue may translate into a 20% loss in physician income.

The good

Simplified coding and billing requirements for E/M visits will go into effect Jan. 1, 2021. For dermatology, any visit where a decision to do a minor procedure or prescribe a medication takes place will become a level 4 visit. Most of the useless documentation requirements and need to examine multiple organ systems will be eliminated. The most common E/M code currently used by dermatologists is a level 3, and this will on average move up to a level 4. Thus, general dermatology will benefit from the new rule. For example, if a dermatologist sees a patient and does a tangential biopsy of the skin, the payment will be $214.52, compared with $178.65 in 2020.

The bad

As mentioned above, the impact will vary by case mix. Those doing a lot of surgery will see a much larger cut. Mohs surgeons, for example will see about a 6.5% decrease.1

Aggravating the cuts to surgery is the fact that, while CMS has bolstered the pay for E/M stand-alone codes, they did not increase the reimbursement level of the built-in follow-up visits inside the 10- and 90-day global periods.

The ugly

Procedure codes with a lot of practice expense built into them, such as Mohs and reconstruction, are not hit as hard by the conversion factor cut because the practice expense is generally spared. There is much less practice expense in a pathology code so dermatopathology faces the most severe cuts. Pathology and other specialties that do not generally bill office/outpatient E/M codes are estimated to see the greatest decrease in payment in 2021.

Code 88305, the most common dermatopathology code, will decrease overall from $71.46 to $66.78 (–6.5%). Digging a little deeper, we find that the technical charge (the payment to process and make the slide) actually increases from $32.12 to $32.26, but the professional component (the interpretation of the slide and report generation) decreases from $39.34 to $34.52 (–12.3%).

I must also point out that this proposed rule allows for nurse practitioners (NPs), clinical nurse specialists (CNSs), physician assistants (PAs), and certified nurse-midwives (CNMs) to supervise the performance of diagnostic tests in addition to physicians. I wonder if we will see an increase in billing of dermatopathology by the untrained.

Adding more confusion – and an additional hit to hospital-based practices – is the federal appeals court decision affirming the ability of the Centers for Medicare & Medicaid Services to mandate site-neutral payments for E/M codes. This means that hospital-affiliated practices, which used to enjoy payment of up to 114% more than offices, will be paid the same as offices. This will save CMS $300 million, but these savings will not be flowing back into the physician fee schedule.

Fixing this will require congressional action since CMS is bound by law to maintain budget neutrality. The specialty societies saw this coming and have already been lobbying furiously to waive budget neutrality requirements, especially in this time of a pandemic that has had an adverse impact on physicians. This is noted in detail on the AADA website, accessible to AAD members.

Since this will take a legislative fix, you should contact your congressional representative or senator and ask them to enact legislation to waive Medicare’s budget neutrality requirements to apply the increased E/M adjustment to all 10- and 90-day global code values. You might also inquire where the $300 million saved by site neutral payment reform will go, and suggest applying it towards restoring the conversion factor to a more normal number.

Dr. Coldiron is in private practice but maintains a clinical assistant professorship at the University of Cincinnati. He cares for patients, teaches medical students and residents, and has several active clinical research projects. Dr. Coldiron is the author of more than 80 scientific letters, papers, and several book chapters, and he speaks frequently on a variety of topics. He is a past president of the American Academy of Dermatology. Write to him at [email protected].

Reference

1. Calculations and tables courtesy of Brent Moody, M.D., AAD AMA relative value update committee practice expense representative and specialist.