User login

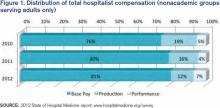

Hospitalists have long recognized that compensation varies significantly by geographic location and by the type of hospitalist medicine group (HMG) you work in: private vs. hospital-owned vs. national-management-owned. A review of SHM’s 2012 State of Hospital Medicine report suggests that hospitalist compensation is also evolving toward a model that more routinely includes both some production variable and performance-based pay (see Figure 1). Although the proportion of compensation paid as a base salary has been trending up over the last few years, so has the proportion paid as a performance incentive.

Source: 2012 State of Hospital Medicine report; www.hospitalmedicine.org/survey

The pay distribution of adult-medicine hospitalists employed by management companies is composed of a high base percentage (mean 88.3% by survey data) and relatively low production and performance variables (mean 6.8% and 4.9%, respectively) compared with other employment models. Contrast that with private hospitalist-only groups, where the mean base is 76.3% with an emphasis on a production component (19.4%) and slightly less on performance pay at 4.2%.

Of the three employment models, however, hospital-/health-system-employed groups have the highest proportion of compensation based on performance metrics with a mean of 7.8%. This makes sense given the financial penalties hospitals and health systems are facing from the Centers for Medicare & Medicaid Services (CMS) around pay-for-performance measures. Hospitals are looking for help from hospitalists in improving quality of care and patient satisfaction and avoiding incurring future penalties. Compensation models in these groups reflect the goals of aligning performance on these measures with financial incentives/risk for hospitalists working in these environments.

What are the top performance metrics hospitalists are being compensated for? CMS’ hospital value-based purchasing (HVBP) core measures and patient satisfaction scores are at the top of the list. More than 70% of all HMGs identify these two measures as part of their performance pay incentive, which is seen consistently by geographic location and by type of hospitalist group.

Beyond these top two metrics, management-company-employed groups also focus on ED throughput measures and early morning discharge times, with more than 70% of these groups having pay incentives aligned with these goals. They also have a higher proportion of their groups participating in several other measures, such as clinical protocols, medication reconciliation, EHR utilization, transitions of care, and readmission rates. In comparison, both hospital-employed and private groups have a wider variety of performance measures in which they participate. Differences are seen geographically, too, with hospitalists located in the Western region having a wider variety of performance measures than other regions.

How hospitalists are compensated for their work will likely continue to evolve. Overall, for nonacademic HMGs serving adults only, we are seeing an upward trend in percentage paid as base pay (from 76% in 2010 to 81% in 2012) and in performance (from 5% in 2010 to 7% in 2012). Hospitalists should anticipate that performance-based pay will continue to account for an increasingly larger percentage of their overall compensation, especially as CMS’ pay-for-performance measures for hospital systems really start to take effect.

Hospital CEOs and CFOs are looking to hospitalists to help deliver on quality, satisfaction, and other performance measures. Incentives will be put in place to reward those groups who do it well.

Dr. Sites is senior medical director of hospitalist programs at Providence Health and Services in Oregon. She is a member of SHM’s Practice Analysis Committee.

Hospitalists have long recognized that compensation varies significantly by geographic location and by the type of hospitalist medicine group (HMG) you work in: private vs. hospital-owned vs. national-management-owned. A review of SHM’s 2012 State of Hospital Medicine report suggests that hospitalist compensation is also evolving toward a model that more routinely includes both some production variable and performance-based pay (see Figure 1). Although the proportion of compensation paid as a base salary has been trending up over the last few years, so has the proportion paid as a performance incentive.

Source: 2012 State of Hospital Medicine report; www.hospitalmedicine.org/survey

The pay distribution of adult-medicine hospitalists employed by management companies is composed of a high base percentage (mean 88.3% by survey data) and relatively low production and performance variables (mean 6.8% and 4.9%, respectively) compared with other employment models. Contrast that with private hospitalist-only groups, where the mean base is 76.3% with an emphasis on a production component (19.4%) and slightly less on performance pay at 4.2%.

Of the three employment models, however, hospital-/health-system-employed groups have the highest proportion of compensation based on performance metrics with a mean of 7.8%. This makes sense given the financial penalties hospitals and health systems are facing from the Centers for Medicare & Medicaid Services (CMS) around pay-for-performance measures. Hospitals are looking for help from hospitalists in improving quality of care and patient satisfaction and avoiding incurring future penalties. Compensation models in these groups reflect the goals of aligning performance on these measures with financial incentives/risk for hospitalists working in these environments.

What are the top performance metrics hospitalists are being compensated for? CMS’ hospital value-based purchasing (HVBP) core measures and patient satisfaction scores are at the top of the list. More than 70% of all HMGs identify these two measures as part of their performance pay incentive, which is seen consistently by geographic location and by type of hospitalist group.

Beyond these top two metrics, management-company-employed groups also focus on ED throughput measures and early morning discharge times, with more than 70% of these groups having pay incentives aligned with these goals. They also have a higher proportion of their groups participating in several other measures, such as clinical protocols, medication reconciliation, EHR utilization, transitions of care, and readmission rates. In comparison, both hospital-employed and private groups have a wider variety of performance measures in which they participate. Differences are seen geographically, too, with hospitalists located in the Western region having a wider variety of performance measures than other regions.

How hospitalists are compensated for their work will likely continue to evolve. Overall, for nonacademic HMGs serving adults only, we are seeing an upward trend in percentage paid as base pay (from 76% in 2010 to 81% in 2012) and in performance (from 5% in 2010 to 7% in 2012). Hospitalists should anticipate that performance-based pay will continue to account for an increasingly larger percentage of their overall compensation, especially as CMS’ pay-for-performance measures for hospital systems really start to take effect.

Hospital CEOs and CFOs are looking to hospitalists to help deliver on quality, satisfaction, and other performance measures. Incentives will be put in place to reward those groups who do it well.

Dr. Sites is senior medical director of hospitalist programs at Providence Health and Services in Oregon. She is a member of SHM’s Practice Analysis Committee.

Hospitalists have long recognized that compensation varies significantly by geographic location and by the type of hospitalist medicine group (HMG) you work in: private vs. hospital-owned vs. national-management-owned. A review of SHM’s 2012 State of Hospital Medicine report suggests that hospitalist compensation is also evolving toward a model that more routinely includes both some production variable and performance-based pay (see Figure 1). Although the proportion of compensation paid as a base salary has been trending up over the last few years, so has the proportion paid as a performance incentive.

Source: 2012 State of Hospital Medicine report; www.hospitalmedicine.org/survey

The pay distribution of adult-medicine hospitalists employed by management companies is composed of a high base percentage (mean 88.3% by survey data) and relatively low production and performance variables (mean 6.8% and 4.9%, respectively) compared with other employment models. Contrast that with private hospitalist-only groups, where the mean base is 76.3% with an emphasis on a production component (19.4%) and slightly less on performance pay at 4.2%.

Of the three employment models, however, hospital-/health-system-employed groups have the highest proportion of compensation based on performance metrics with a mean of 7.8%. This makes sense given the financial penalties hospitals and health systems are facing from the Centers for Medicare & Medicaid Services (CMS) around pay-for-performance measures. Hospitals are looking for help from hospitalists in improving quality of care and patient satisfaction and avoiding incurring future penalties. Compensation models in these groups reflect the goals of aligning performance on these measures with financial incentives/risk for hospitalists working in these environments.

What are the top performance metrics hospitalists are being compensated for? CMS’ hospital value-based purchasing (HVBP) core measures and patient satisfaction scores are at the top of the list. More than 70% of all HMGs identify these two measures as part of their performance pay incentive, which is seen consistently by geographic location and by type of hospitalist group.

Beyond these top two metrics, management-company-employed groups also focus on ED throughput measures and early morning discharge times, with more than 70% of these groups having pay incentives aligned with these goals. They also have a higher proportion of their groups participating in several other measures, such as clinical protocols, medication reconciliation, EHR utilization, transitions of care, and readmission rates. In comparison, both hospital-employed and private groups have a wider variety of performance measures in which they participate. Differences are seen geographically, too, with hospitalists located in the Western region having a wider variety of performance measures than other regions.

How hospitalists are compensated for their work will likely continue to evolve. Overall, for nonacademic HMGs serving adults only, we are seeing an upward trend in percentage paid as base pay (from 76% in 2010 to 81% in 2012) and in performance (from 5% in 2010 to 7% in 2012). Hospitalists should anticipate that performance-based pay will continue to account for an increasingly larger percentage of their overall compensation, especially as CMS’ pay-for-performance measures for hospital systems really start to take effect.

Hospital CEOs and CFOs are looking to hospitalists to help deliver on quality, satisfaction, and other performance measures. Incentives will be put in place to reward those groups who do it well.

Dr. Sites is senior medical director of hospitalist programs at Providence Health and Services in Oregon. She is a member of SHM’s Practice Analysis Committee.