User login

The Medicare Physician Feedback Program provides physicians with comparative information about the quality and cost of care delivered to their Medicare fee-for-service patients through feedback reports known as Quality Resource and Use Reports (QRUR).

Why are QRURs important?

The Patient Protection and Affordable Care Act (PPACA) directed the Health and Human Services Secretary to develop and implement a budget-neutral payment modifier that will adjust Medicare physician payments based on the relative quality and costs of care provided. Quality and cost measures will be risk adjusted, geographically standardized, and should promote systems-based care. The Medicare Physician Feedback Program serves as the foundation for the modifier.

In the 2013 Medicare physician fee schedule final rule published in November of 2012, the Centers for Medicare and Medicaid Services (CMS) announced the first phase toward implementation of the value-based payment modifier. Initially, the value modifier will be applied to group practices of 100 or more eligible professionals – about 1,100 groups nationally. These groups will be able to elect how their payment modifier will be calculated. This will affect payment in 2015 based on 2013 performance. Smaller groups of 2-99 eligible professionals will remain unaffected during the first reporting year. However, CMS is required by statute to apply the modifier to all physicians by 2017. In the future, CMS will be using QRURs to provide all physicians with information about how the value modifier will affect their payment.

The QRURs provide comparative quality and cost data for quality improvement purposes. This is the first time that many physicians will have seen such performance information from CMS. The report previews quality and cost measures that will be used in the value modifier. The report can count as one of the group options to fulfill the Physician Quality Reporting System (PQRS) requirement for group reporting and also for the value modifier.

How will QRURs impact the value modifier?

Groups of physicians with 100 or more eligible professionals will have the option of either zero adjustment, a minus one adjustment, or will elect quality tiering calculation based on their PQRS participation. To be a successful PQRS reporter, groups must have registered and will report at least one measure for the Group Practice Reporting Option (GPRO) Web interface, CMS-approved registries, or the administrative claims option that includes administrative claims performance, quality performance measures that will be calculated by CMS. These groups will have the option of having zero adjustment for the value modifier applied to them or the option to elect a quality tiering calculation in which there would be an upward or a downward adjustment (or no adjustment) based on the quality tiering.

Overview of how CMS will calculate the value modifier

Groups that decide that the amount of downward adjustment is not worth the effort or do not wish to participate in PQRS reporting will be considered non-PQRS reporters. Non-PQRS reporters will be subject to a minus 1% downward adjustment of the value modifier and a minus 1.5% downward adjustment for PQRS; note that the amount of downward adjustment is additive for the two programs.

For the value modifier, physicians elect one of three possible group practice options. One option is the Web-based interface that is largely primary care and preventive measures. The second option is to select measures from a registry. The third option is the administrative claim option calculated by CMS. For the first two options, physicians choose which option for quality measures goes into the quality composite of the value modifier. Physicians who choose the administrative claims method are not allowed to choose which measures will be examined for the value modifier.

How is the value modifier calculated?

The value modifier is calculated at the group or taxpayer identification number (TIN) level. The attribution method focuses on the delivery of primary services through a two-step process. The first step identifies whether a physician is in primary care. Beneficiaries are attributed based on those who have had at least one primary care physician (PCP) in service. CMS then examines whether the PCP(s) delivered the plurality of care. The second step checks if the TIN provided the plurality of the primary care services by nonprimary care physicians.

There are five cost measures grouped into two domains: total overall cost or the total per capita measure. The reports examine the total cost of beneficiaries with specific conditions including chronic obstructive pulmonary disease, coronary artery disease, diabetes, and heart failure. Each measure within each domain is weighted equally and each domain is weighted equally to form a cost composite.

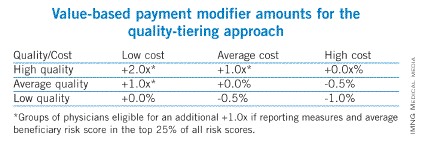

CMS will be tiering the two composites – quality of care and cost of care – based on the group’s standardized performance as compared to national benchmarks. High-cost/ low-quality providers will have a downward adjustment of minus 1% – the same downward adjustment as non-PQRS reporters (see table). High-quality/low-cost, high-quality/average-cost, or average-quality/low-cost providers will have an upward adjustment. As this is a budget-neutral program, until CMS knows how much money is in the pot from those who are not reporting or received downward adjustments, Medicare will not be able to calculate how much money will be distributed for those receiving an upward adjustment.

Groups are eligible for an additional 1% if reporting clinical data for quality measures for an average beneficiary risk score is in the top 25% of all beneficiary risk scores. So, those groups who perform at high levels and have a complex patient population would receive an additional 1% to their value modifier.

I have my QRUR, but how do I read it?

On the performance highlight page of the QRUR, the first box indicates the number of Medicare fee-for-service patients that you treated and, on average, the number of physicians that treated each Medicare patient for whom claims were submitted. On this highlight page, CMS also shows performance on PQRS measures and claim-based quality measures compared with other PQRS participants nationwide regardless of specialty.

Quality of care

The claims-based quality measures section also gives information on the quality of care received by beneficiaries, regardless of who provided the care. This information is provided to give a preview of the measures and the performance rates that physicians will see if they select the PQRS administrative claims reporting option for 2013.

Costs of care

Medicare recognizes that not all of these measures assess care provided by certain specialists. Therefore, CMS risk adjusts and standardizes payments for all cost measures based on a physician’s patient characteristics (age, gender, Medicaid eligibility, history of medical conditions, and end-stage renal disease). Based on these characteristics, CMS risk adjusts the total annual per capita costs up or down for all of a physician’s Medicare patients.

Though counterintuitive, if a physician’s cost were adjusted upward, this means that on average, a physician treated beneficiaries who were less complex than the average Medicare fee-for-service beneficiary. And if a physician’s cost were adjusted downward, this means that on average, the patients a physician treated were more complex than the average Medicare fee-for-services beneficiary.

CMS categorizes Medicare fee-for-service patients according to the degree of a physician’s involvement with each patient. "Directed" patients are considered those patients for whom a physician billed 35% or more of their office or other evaluation and management (E&M) visits, which would be most characteristic of a primary care provider. The patients whose care a physician "influenced" are those for whom a physician billed fewer than 35% of their office or other E&M visits, but for 20% or more of all cost. This might be more characteristic of a specialist such as a gastroenterologist. The "contributed" category includes the rest of the beneficiaries and those would be less than 35% of office and E&M visits and less than 20% of cost billed by the physician.

The report indicates the number of patients and individual physician share of costs billed by medical professionals. The benchmarks for the cost measures are those in your specialty. The total per capita costs are all risk adjusted and price standardized to ensure fair comparison.

CMS recognizes that Medicare fee-for-service patients may have seen multiple physicians. A patient can be attributed to multiple physicians, each in the appropriate care category. Because of the 35% rule for directing, up to two physicians can "direct" care and up to five physicians can "influence" care, but multiple physicians can "contribute" to care.

The report will indicate the results for the Medicare patient whose care you directed, the average for Medicare patients whose care was directed by physicians in your specialty in the nine states, and then the amount by which your Medicare patients costs were higher or lower than average.

CMS will also show you the number of other physicians who submitted claims for your patients. Many physicians may be unaware of how many physicians their fee-for-service patients are seeing. The reports indicate where your patient’s Medicare costs fall relative to other physicians in your specialty. The same analysis is repeated for "influenced" and "contributed," and would be shown in your report if you had patients who were attributed to you in those categories.

In the report, CMS provides the total per capita cost for patients with the four chronic conditions that will compose the cost composite for the value modifier. These costs are risk adjusted and include services furnished by you and all other Medicare providers seen by the beneficiary.

Moving forward

For calendar year 2014 physician feedback reports, CMS will provide reports to all groups of physicians with 25 or more eligible professionals. CMS expects to send out the reports in the fall of 2014 based on 2013 data, so that reports are based on the performance year for the value modifier. CMS will show the amount of the value modifier and the basis for determination.

CMS is expecting to add patient-level data to the QRURs for outcomes measures. In the future, CMS will also provide episode-based cost measures for several episode types in the physician feedback report.

Dr. Brill is the Chief Medical Officer of Predictive Health, LLC, in Phoenix and is an assistant clinical professor of medicine at the University of Arizona School of Medicine.

The Medicare Physician Feedback Program provides physicians with comparative information about the quality and cost of care delivered to their Medicare fee-for-service patients through feedback reports known as Quality Resource and Use Reports (QRUR).

Why are QRURs important?

The Patient Protection and Affordable Care Act (PPACA) directed the Health and Human Services Secretary to develop and implement a budget-neutral payment modifier that will adjust Medicare physician payments based on the relative quality and costs of care provided. Quality and cost measures will be risk adjusted, geographically standardized, and should promote systems-based care. The Medicare Physician Feedback Program serves as the foundation for the modifier.

In the 2013 Medicare physician fee schedule final rule published in November of 2012, the Centers for Medicare and Medicaid Services (CMS) announced the first phase toward implementation of the value-based payment modifier. Initially, the value modifier will be applied to group practices of 100 or more eligible professionals – about 1,100 groups nationally. These groups will be able to elect how their payment modifier will be calculated. This will affect payment in 2015 based on 2013 performance. Smaller groups of 2-99 eligible professionals will remain unaffected during the first reporting year. However, CMS is required by statute to apply the modifier to all physicians by 2017. In the future, CMS will be using QRURs to provide all physicians with information about how the value modifier will affect their payment.

The QRURs provide comparative quality and cost data for quality improvement purposes. This is the first time that many physicians will have seen such performance information from CMS. The report previews quality and cost measures that will be used in the value modifier. The report can count as one of the group options to fulfill the Physician Quality Reporting System (PQRS) requirement for group reporting and also for the value modifier.

How will QRURs impact the value modifier?

Groups of physicians with 100 or more eligible professionals will have the option of either zero adjustment, a minus one adjustment, or will elect quality tiering calculation based on their PQRS participation. To be a successful PQRS reporter, groups must have registered and will report at least one measure for the Group Practice Reporting Option (GPRO) Web interface, CMS-approved registries, or the administrative claims option that includes administrative claims performance, quality performance measures that will be calculated by CMS. These groups will have the option of having zero adjustment for the value modifier applied to them or the option to elect a quality tiering calculation in which there would be an upward or a downward adjustment (or no adjustment) based on the quality tiering.

Overview of how CMS will calculate the value modifier

Groups that decide that the amount of downward adjustment is not worth the effort or do not wish to participate in PQRS reporting will be considered non-PQRS reporters. Non-PQRS reporters will be subject to a minus 1% downward adjustment of the value modifier and a minus 1.5% downward adjustment for PQRS; note that the amount of downward adjustment is additive for the two programs.

For the value modifier, physicians elect one of three possible group practice options. One option is the Web-based interface that is largely primary care and preventive measures. The second option is to select measures from a registry. The third option is the administrative claim option calculated by CMS. For the first two options, physicians choose which option for quality measures goes into the quality composite of the value modifier. Physicians who choose the administrative claims method are not allowed to choose which measures will be examined for the value modifier.

How is the value modifier calculated?

The value modifier is calculated at the group or taxpayer identification number (TIN) level. The attribution method focuses on the delivery of primary services through a two-step process. The first step identifies whether a physician is in primary care. Beneficiaries are attributed based on those who have had at least one primary care physician (PCP) in service. CMS then examines whether the PCP(s) delivered the plurality of care. The second step checks if the TIN provided the plurality of the primary care services by nonprimary care physicians.

There are five cost measures grouped into two domains: total overall cost or the total per capita measure. The reports examine the total cost of beneficiaries with specific conditions including chronic obstructive pulmonary disease, coronary artery disease, diabetes, and heart failure. Each measure within each domain is weighted equally and each domain is weighted equally to form a cost composite.

CMS will be tiering the two composites – quality of care and cost of care – based on the group’s standardized performance as compared to national benchmarks. High-cost/ low-quality providers will have a downward adjustment of minus 1% – the same downward adjustment as non-PQRS reporters (see table). High-quality/low-cost, high-quality/average-cost, or average-quality/low-cost providers will have an upward adjustment. As this is a budget-neutral program, until CMS knows how much money is in the pot from those who are not reporting or received downward adjustments, Medicare will not be able to calculate how much money will be distributed for those receiving an upward adjustment.

Groups are eligible for an additional 1% if reporting clinical data for quality measures for an average beneficiary risk score is in the top 25% of all beneficiary risk scores. So, those groups who perform at high levels and have a complex patient population would receive an additional 1% to their value modifier.

I have my QRUR, but how do I read it?

On the performance highlight page of the QRUR, the first box indicates the number of Medicare fee-for-service patients that you treated and, on average, the number of physicians that treated each Medicare patient for whom claims were submitted. On this highlight page, CMS also shows performance on PQRS measures and claim-based quality measures compared with other PQRS participants nationwide regardless of specialty.

Quality of care

The claims-based quality measures section also gives information on the quality of care received by beneficiaries, regardless of who provided the care. This information is provided to give a preview of the measures and the performance rates that physicians will see if they select the PQRS administrative claims reporting option for 2013.

Costs of care

Medicare recognizes that not all of these measures assess care provided by certain specialists. Therefore, CMS risk adjusts and standardizes payments for all cost measures based on a physician’s patient characteristics (age, gender, Medicaid eligibility, history of medical conditions, and end-stage renal disease). Based on these characteristics, CMS risk adjusts the total annual per capita costs up or down for all of a physician’s Medicare patients.

Though counterintuitive, if a physician’s cost were adjusted upward, this means that on average, a physician treated beneficiaries who were less complex than the average Medicare fee-for-service beneficiary. And if a physician’s cost were adjusted downward, this means that on average, the patients a physician treated were more complex than the average Medicare fee-for-services beneficiary.

CMS categorizes Medicare fee-for-service patients according to the degree of a physician’s involvement with each patient. "Directed" patients are considered those patients for whom a physician billed 35% or more of their office or other evaluation and management (E&M) visits, which would be most characteristic of a primary care provider. The patients whose care a physician "influenced" are those for whom a physician billed fewer than 35% of their office or other E&M visits, but for 20% or more of all cost. This might be more characteristic of a specialist such as a gastroenterologist. The "contributed" category includes the rest of the beneficiaries and those would be less than 35% of office and E&M visits and less than 20% of cost billed by the physician.

The report indicates the number of patients and individual physician share of costs billed by medical professionals. The benchmarks for the cost measures are those in your specialty. The total per capita costs are all risk adjusted and price standardized to ensure fair comparison.

CMS recognizes that Medicare fee-for-service patients may have seen multiple physicians. A patient can be attributed to multiple physicians, each in the appropriate care category. Because of the 35% rule for directing, up to two physicians can "direct" care and up to five physicians can "influence" care, but multiple physicians can "contribute" to care.

The report will indicate the results for the Medicare patient whose care you directed, the average for Medicare patients whose care was directed by physicians in your specialty in the nine states, and then the amount by which your Medicare patients costs were higher or lower than average.

CMS will also show you the number of other physicians who submitted claims for your patients. Many physicians may be unaware of how many physicians their fee-for-service patients are seeing. The reports indicate where your patient’s Medicare costs fall relative to other physicians in your specialty. The same analysis is repeated for "influenced" and "contributed," and would be shown in your report if you had patients who were attributed to you in those categories.

In the report, CMS provides the total per capita cost for patients with the four chronic conditions that will compose the cost composite for the value modifier. These costs are risk adjusted and include services furnished by you and all other Medicare providers seen by the beneficiary.

Moving forward

For calendar year 2014 physician feedback reports, CMS will provide reports to all groups of physicians with 25 or more eligible professionals. CMS expects to send out the reports in the fall of 2014 based on 2013 data, so that reports are based on the performance year for the value modifier. CMS will show the amount of the value modifier and the basis for determination.

CMS is expecting to add patient-level data to the QRURs for outcomes measures. In the future, CMS will also provide episode-based cost measures for several episode types in the physician feedback report.

Dr. Brill is the Chief Medical Officer of Predictive Health, LLC, in Phoenix and is an assistant clinical professor of medicine at the University of Arizona School of Medicine.

The Medicare Physician Feedback Program provides physicians with comparative information about the quality and cost of care delivered to their Medicare fee-for-service patients through feedback reports known as Quality Resource and Use Reports (QRUR).

Why are QRURs important?

The Patient Protection and Affordable Care Act (PPACA) directed the Health and Human Services Secretary to develop and implement a budget-neutral payment modifier that will adjust Medicare physician payments based on the relative quality and costs of care provided. Quality and cost measures will be risk adjusted, geographically standardized, and should promote systems-based care. The Medicare Physician Feedback Program serves as the foundation for the modifier.

In the 2013 Medicare physician fee schedule final rule published in November of 2012, the Centers for Medicare and Medicaid Services (CMS) announced the first phase toward implementation of the value-based payment modifier. Initially, the value modifier will be applied to group practices of 100 or more eligible professionals – about 1,100 groups nationally. These groups will be able to elect how their payment modifier will be calculated. This will affect payment in 2015 based on 2013 performance. Smaller groups of 2-99 eligible professionals will remain unaffected during the first reporting year. However, CMS is required by statute to apply the modifier to all physicians by 2017. In the future, CMS will be using QRURs to provide all physicians with information about how the value modifier will affect their payment.

The QRURs provide comparative quality and cost data for quality improvement purposes. This is the first time that many physicians will have seen such performance information from CMS. The report previews quality and cost measures that will be used in the value modifier. The report can count as one of the group options to fulfill the Physician Quality Reporting System (PQRS) requirement for group reporting and also for the value modifier.

How will QRURs impact the value modifier?

Groups of physicians with 100 or more eligible professionals will have the option of either zero adjustment, a minus one adjustment, or will elect quality tiering calculation based on their PQRS participation. To be a successful PQRS reporter, groups must have registered and will report at least one measure for the Group Practice Reporting Option (GPRO) Web interface, CMS-approved registries, or the administrative claims option that includes administrative claims performance, quality performance measures that will be calculated by CMS. These groups will have the option of having zero adjustment for the value modifier applied to them or the option to elect a quality tiering calculation in which there would be an upward or a downward adjustment (or no adjustment) based on the quality tiering.

Overview of how CMS will calculate the value modifier

Groups that decide that the amount of downward adjustment is not worth the effort or do not wish to participate in PQRS reporting will be considered non-PQRS reporters. Non-PQRS reporters will be subject to a minus 1% downward adjustment of the value modifier and a minus 1.5% downward adjustment for PQRS; note that the amount of downward adjustment is additive for the two programs.

For the value modifier, physicians elect one of three possible group practice options. One option is the Web-based interface that is largely primary care and preventive measures. The second option is to select measures from a registry. The third option is the administrative claim option calculated by CMS. For the first two options, physicians choose which option for quality measures goes into the quality composite of the value modifier. Physicians who choose the administrative claims method are not allowed to choose which measures will be examined for the value modifier.

How is the value modifier calculated?

The value modifier is calculated at the group or taxpayer identification number (TIN) level. The attribution method focuses on the delivery of primary services through a two-step process. The first step identifies whether a physician is in primary care. Beneficiaries are attributed based on those who have had at least one primary care physician (PCP) in service. CMS then examines whether the PCP(s) delivered the plurality of care. The second step checks if the TIN provided the plurality of the primary care services by nonprimary care physicians.

There are five cost measures grouped into two domains: total overall cost or the total per capita measure. The reports examine the total cost of beneficiaries with specific conditions including chronic obstructive pulmonary disease, coronary artery disease, diabetes, and heart failure. Each measure within each domain is weighted equally and each domain is weighted equally to form a cost composite.

CMS will be tiering the two composites – quality of care and cost of care – based on the group’s standardized performance as compared to national benchmarks. High-cost/ low-quality providers will have a downward adjustment of minus 1% – the same downward adjustment as non-PQRS reporters (see table). High-quality/low-cost, high-quality/average-cost, or average-quality/low-cost providers will have an upward adjustment. As this is a budget-neutral program, until CMS knows how much money is in the pot from those who are not reporting or received downward adjustments, Medicare will not be able to calculate how much money will be distributed for those receiving an upward adjustment.

Groups are eligible for an additional 1% if reporting clinical data for quality measures for an average beneficiary risk score is in the top 25% of all beneficiary risk scores. So, those groups who perform at high levels and have a complex patient population would receive an additional 1% to their value modifier.

I have my QRUR, but how do I read it?

On the performance highlight page of the QRUR, the first box indicates the number of Medicare fee-for-service patients that you treated and, on average, the number of physicians that treated each Medicare patient for whom claims were submitted. On this highlight page, CMS also shows performance on PQRS measures and claim-based quality measures compared with other PQRS participants nationwide regardless of specialty.

Quality of care

The claims-based quality measures section also gives information on the quality of care received by beneficiaries, regardless of who provided the care. This information is provided to give a preview of the measures and the performance rates that physicians will see if they select the PQRS administrative claims reporting option for 2013.

Costs of care

Medicare recognizes that not all of these measures assess care provided by certain specialists. Therefore, CMS risk adjusts and standardizes payments for all cost measures based on a physician’s patient characteristics (age, gender, Medicaid eligibility, history of medical conditions, and end-stage renal disease). Based on these characteristics, CMS risk adjusts the total annual per capita costs up or down for all of a physician’s Medicare patients.

Though counterintuitive, if a physician’s cost were adjusted upward, this means that on average, a physician treated beneficiaries who were less complex than the average Medicare fee-for-service beneficiary. And if a physician’s cost were adjusted downward, this means that on average, the patients a physician treated were more complex than the average Medicare fee-for-services beneficiary.

CMS categorizes Medicare fee-for-service patients according to the degree of a physician’s involvement with each patient. "Directed" patients are considered those patients for whom a physician billed 35% or more of their office or other evaluation and management (E&M) visits, which would be most characteristic of a primary care provider. The patients whose care a physician "influenced" are those for whom a physician billed fewer than 35% of their office or other E&M visits, but for 20% or more of all cost. This might be more characteristic of a specialist such as a gastroenterologist. The "contributed" category includes the rest of the beneficiaries and those would be less than 35% of office and E&M visits and less than 20% of cost billed by the physician.

The report indicates the number of patients and individual physician share of costs billed by medical professionals. The benchmarks for the cost measures are those in your specialty. The total per capita costs are all risk adjusted and price standardized to ensure fair comparison.

CMS recognizes that Medicare fee-for-service patients may have seen multiple physicians. A patient can be attributed to multiple physicians, each in the appropriate care category. Because of the 35% rule for directing, up to two physicians can "direct" care and up to five physicians can "influence" care, but multiple physicians can "contribute" to care.

The report will indicate the results for the Medicare patient whose care you directed, the average for Medicare patients whose care was directed by physicians in your specialty in the nine states, and then the amount by which your Medicare patients costs were higher or lower than average.

CMS will also show you the number of other physicians who submitted claims for your patients. Many physicians may be unaware of how many physicians their fee-for-service patients are seeing. The reports indicate where your patient’s Medicare costs fall relative to other physicians in your specialty. The same analysis is repeated for "influenced" and "contributed," and would be shown in your report if you had patients who were attributed to you in those categories.

In the report, CMS provides the total per capita cost for patients with the four chronic conditions that will compose the cost composite for the value modifier. These costs are risk adjusted and include services furnished by you and all other Medicare providers seen by the beneficiary.

Moving forward

For calendar year 2014 physician feedback reports, CMS will provide reports to all groups of physicians with 25 or more eligible professionals. CMS expects to send out the reports in the fall of 2014 based on 2013 data, so that reports are based on the performance year for the value modifier. CMS will show the amount of the value modifier and the basis for determination.

CMS is expecting to add patient-level data to the QRURs for outcomes measures. In the future, CMS will also provide episode-based cost measures for several episode types in the physician feedback report.

Dr. Brill is the Chief Medical Officer of Predictive Health, LLC, in Phoenix and is an assistant clinical professor of medicine at the University of Arizona School of Medicine.