User login

The uproar and confusion over readmissions penalties has consumed umpteen hours of senior leaders’ time (especially that of CFOs), not to mention that of front-line nurses, case managers, quality-improvement (QI) coordinators, hospitalists, and others involved in discharge planning and ensuring a safe transition for patients out of the hospital. For many, the math is fuzzy, and for most, the return on investment is even fuzzier. After all, avoided readmissions are lost revenue to those who are running a business known as an acute-care hospital.

Let me start with the conclusion: Eliminating avoidable readmissions is the right thing to do, period. But the financial downside to doing so is probably greater than any upside realized through avoidance of the penalties that began affecting hospital payments on Oct. 1—at least in the fee-for-service world we live in. At some point in the future, when most patients are under a global payment, the math might be clearer, but today, penalties probably won’t offset lost revenue from reduced readmissions added to the cost of paying lots of people to work in meetings (and at the bedside) to devise better care transitions. (Caveat: If your hospital is bursting at the seams with full occupancy, reducing readmissions and replacing them with higher-reimbursing patients, such as those undergoing elective major surgery, likely will be a net financial gain for your hospital.)

Part of the Affordable Care Act (ACA), the Hospital Readmissions Reduction Program (HRRP) will reduce total Medicare DRG reimbursement for hospitals beginning in fiscal-year 2013 based on actual 30-day readmission rates for myocardial infarction (MI), heart failure (HF), and pneumonia that are in excess of risk-adjusted expected rates. The reduction is capped at 1% in 2013, 2% in 2014, and 3% in 2015 and beyond. Hospital readmission rates are based on calculated baseline rates using Medicare data from July 1, 2008, to June 30, 2011.

Cost of a Readmissions-Reduction Program

How much does it cost for a hospital to implement a care-transitions program—such as SHM’s Project BOOST—to reduce readmissions? Last year, I interviewed a dozen hospitals that successfully implemented SHM’s formal mentored implementation program. The result? In the first year of the program, hospitals spent about $170,000 on training and staff time devoted to the project.

Lost Revenue

Let’s look at a sample penalty calculation, then examine a scenario sizing up how revenue is lost when a hospital is successful in reducing readmissions. The ACA defines the payments for excess readmissions as:

The number of patients with the applicable condition (HF, MI, or pneumonia) multiplied by the base DRG payment made for those patients multiplied by the percentage of readmissions beyond the expected.

As an example, let’s take a hospital that treats 500 pneumonia patients (# with the applicable condition), has a base DRG payment for pneumonia of $5,000, and a readmission rate that is 4% higher than expected (in this example, the actual rate is 25% and the expected rate is 24%; 1/25=4%). The penalty is 500 X $5,000 X .04, or $100,000. We’ll assume that the readmission rate for myocardial infarction and heart failure are less than expected, so the total penalty is $100,000.

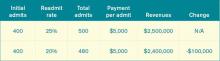

Let’s say the hospital works hard to decrease pneumonia readmissions from 25% to 20% and avoids the penalty. As outlined in Table 1, the hospital will lose $100,000 in revenue (admittedly, reducing readmissions to 20% from 25% represents a big jump, but this is for illustration purposes—we haven’t added in lost revenue from reduced readmissions for other conditions). What’s the final cost of avoiding the $100,000 readmission penalty? Lost revenue of $100,000 plus the cost of implementing the readmission reduction program of $170,000=$270,000.

Why Are We Doing This?

I see the value in care transitions and readmissions-reduction programs, such as Project BOOST, first and foremost as a way to improve patient safety; as such, if implemented effectively, they are likely worth the investment. Second, their value lies in the preparation all hospitals and health systems should be undergoing to remain market-competitive and solvent under global payment systems. Because the penalties in the HRRP might come with lost revenues and the costs of program implementation, be clear about your team’s motivation for reducing readmissions. Your CFO will see to it if I don’t.

Dr. Whitcomb is medical director of healthcare quality at Baystate Medical Center in Springfield, Mass. He is a co-founder and past president of SHM. Email him at [email protected].

The uproar and confusion over readmissions penalties has consumed umpteen hours of senior leaders’ time (especially that of CFOs), not to mention that of front-line nurses, case managers, quality-improvement (QI) coordinators, hospitalists, and others involved in discharge planning and ensuring a safe transition for patients out of the hospital. For many, the math is fuzzy, and for most, the return on investment is even fuzzier. After all, avoided readmissions are lost revenue to those who are running a business known as an acute-care hospital.

Let me start with the conclusion: Eliminating avoidable readmissions is the right thing to do, period. But the financial downside to doing so is probably greater than any upside realized through avoidance of the penalties that began affecting hospital payments on Oct. 1—at least in the fee-for-service world we live in. At some point in the future, when most patients are under a global payment, the math might be clearer, but today, penalties probably won’t offset lost revenue from reduced readmissions added to the cost of paying lots of people to work in meetings (and at the bedside) to devise better care transitions. (Caveat: If your hospital is bursting at the seams with full occupancy, reducing readmissions and replacing them with higher-reimbursing patients, such as those undergoing elective major surgery, likely will be a net financial gain for your hospital.)

Part of the Affordable Care Act (ACA), the Hospital Readmissions Reduction Program (HRRP) will reduce total Medicare DRG reimbursement for hospitals beginning in fiscal-year 2013 based on actual 30-day readmission rates for myocardial infarction (MI), heart failure (HF), and pneumonia that are in excess of risk-adjusted expected rates. The reduction is capped at 1% in 2013, 2% in 2014, and 3% in 2015 and beyond. Hospital readmission rates are based on calculated baseline rates using Medicare data from July 1, 2008, to June 30, 2011.

Cost of a Readmissions-Reduction Program

How much does it cost for a hospital to implement a care-transitions program—such as SHM’s Project BOOST—to reduce readmissions? Last year, I interviewed a dozen hospitals that successfully implemented SHM’s formal mentored implementation program. The result? In the first year of the program, hospitals spent about $170,000 on training and staff time devoted to the project.

Lost Revenue

Let’s look at a sample penalty calculation, then examine a scenario sizing up how revenue is lost when a hospital is successful in reducing readmissions. The ACA defines the payments for excess readmissions as:

The number of patients with the applicable condition (HF, MI, or pneumonia) multiplied by the base DRG payment made for those patients multiplied by the percentage of readmissions beyond the expected.

As an example, let’s take a hospital that treats 500 pneumonia patients (# with the applicable condition), has a base DRG payment for pneumonia of $5,000, and a readmission rate that is 4% higher than expected (in this example, the actual rate is 25% and the expected rate is 24%; 1/25=4%). The penalty is 500 X $5,000 X .04, or $100,000. We’ll assume that the readmission rate for myocardial infarction and heart failure are less than expected, so the total penalty is $100,000.

Let’s say the hospital works hard to decrease pneumonia readmissions from 25% to 20% and avoids the penalty. As outlined in Table 1, the hospital will lose $100,000 in revenue (admittedly, reducing readmissions to 20% from 25% represents a big jump, but this is for illustration purposes—we haven’t added in lost revenue from reduced readmissions for other conditions). What’s the final cost of avoiding the $100,000 readmission penalty? Lost revenue of $100,000 plus the cost of implementing the readmission reduction program of $170,000=$270,000.

Why Are We Doing This?

I see the value in care transitions and readmissions-reduction programs, such as Project BOOST, first and foremost as a way to improve patient safety; as such, if implemented effectively, they are likely worth the investment. Second, their value lies in the preparation all hospitals and health systems should be undergoing to remain market-competitive and solvent under global payment systems. Because the penalties in the HRRP might come with lost revenues and the costs of program implementation, be clear about your team’s motivation for reducing readmissions. Your CFO will see to it if I don’t.

Dr. Whitcomb is medical director of healthcare quality at Baystate Medical Center in Springfield, Mass. He is a co-founder and past president of SHM. Email him at [email protected].

The uproar and confusion over readmissions penalties has consumed umpteen hours of senior leaders’ time (especially that of CFOs), not to mention that of front-line nurses, case managers, quality-improvement (QI) coordinators, hospitalists, and others involved in discharge planning and ensuring a safe transition for patients out of the hospital. For many, the math is fuzzy, and for most, the return on investment is even fuzzier. After all, avoided readmissions are lost revenue to those who are running a business known as an acute-care hospital.

Let me start with the conclusion: Eliminating avoidable readmissions is the right thing to do, period. But the financial downside to doing so is probably greater than any upside realized through avoidance of the penalties that began affecting hospital payments on Oct. 1—at least in the fee-for-service world we live in. At some point in the future, when most patients are under a global payment, the math might be clearer, but today, penalties probably won’t offset lost revenue from reduced readmissions added to the cost of paying lots of people to work in meetings (and at the bedside) to devise better care transitions. (Caveat: If your hospital is bursting at the seams with full occupancy, reducing readmissions and replacing them with higher-reimbursing patients, such as those undergoing elective major surgery, likely will be a net financial gain for your hospital.)

Part of the Affordable Care Act (ACA), the Hospital Readmissions Reduction Program (HRRP) will reduce total Medicare DRG reimbursement for hospitals beginning in fiscal-year 2013 based on actual 30-day readmission rates for myocardial infarction (MI), heart failure (HF), and pneumonia that are in excess of risk-adjusted expected rates. The reduction is capped at 1% in 2013, 2% in 2014, and 3% in 2015 and beyond. Hospital readmission rates are based on calculated baseline rates using Medicare data from July 1, 2008, to June 30, 2011.

Cost of a Readmissions-Reduction Program

How much does it cost for a hospital to implement a care-transitions program—such as SHM’s Project BOOST—to reduce readmissions? Last year, I interviewed a dozen hospitals that successfully implemented SHM’s formal mentored implementation program. The result? In the first year of the program, hospitals spent about $170,000 on training and staff time devoted to the project.

Lost Revenue

Let’s look at a sample penalty calculation, then examine a scenario sizing up how revenue is lost when a hospital is successful in reducing readmissions. The ACA defines the payments for excess readmissions as:

The number of patients with the applicable condition (HF, MI, or pneumonia) multiplied by the base DRG payment made for those patients multiplied by the percentage of readmissions beyond the expected.

As an example, let’s take a hospital that treats 500 pneumonia patients (# with the applicable condition), has a base DRG payment for pneumonia of $5,000, and a readmission rate that is 4% higher than expected (in this example, the actual rate is 25% and the expected rate is 24%; 1/25=4%). The penalty is 500 X $5,000 X .04, or $100,000. We’ll assume that the readmission rate for myocardial infarction and heart failure are less than expected, so the total penalty is $100,000.

Let’s say the hospital works hard to decrease pneumonia readmissions from 25% to 20% and avoids the penalty. As outlined in Table 1, the hospital will lose $100,000 in revenue (admittedly, reducing readmissions to 20% from 25% represents a big jump, but this is for illustration purposes—we haven’t added in lost revenue from reduced readmissions for other conditions). What’s the final cost of avoiding the $100,000 readmission penalty? Lost revenue of $100,000 plus the cost of implementing the readmission reduction program of $170,000=$270,000.

Why Are We Doing This?

I see the value in care transitions and readmissions-reduction programs, such as Project BOOST, first and foremost as a way to improve patient safety; as such, if implemented effectively, they are likely worth the investment. Second, their value lies in the preparation all hospitals and health systems should be undergoing to remain market-competitive and solvent under global payment systems. Because the penalties in the HRRP might come with lost revenues and the costs of program implementation, be clear about your team’s motivation for reducing readmissions. Your CFO will see to it if I don’t.

Dr. Whitcomb is medical director of healthcare quality at Baystate Medical Center in Springfield, Mass. He is a co-founder and past president of SHM. Email him at [email protected].