User login

Despite the influx of adalimumab biosimilars entering the market in 2023, Humira remains on top.

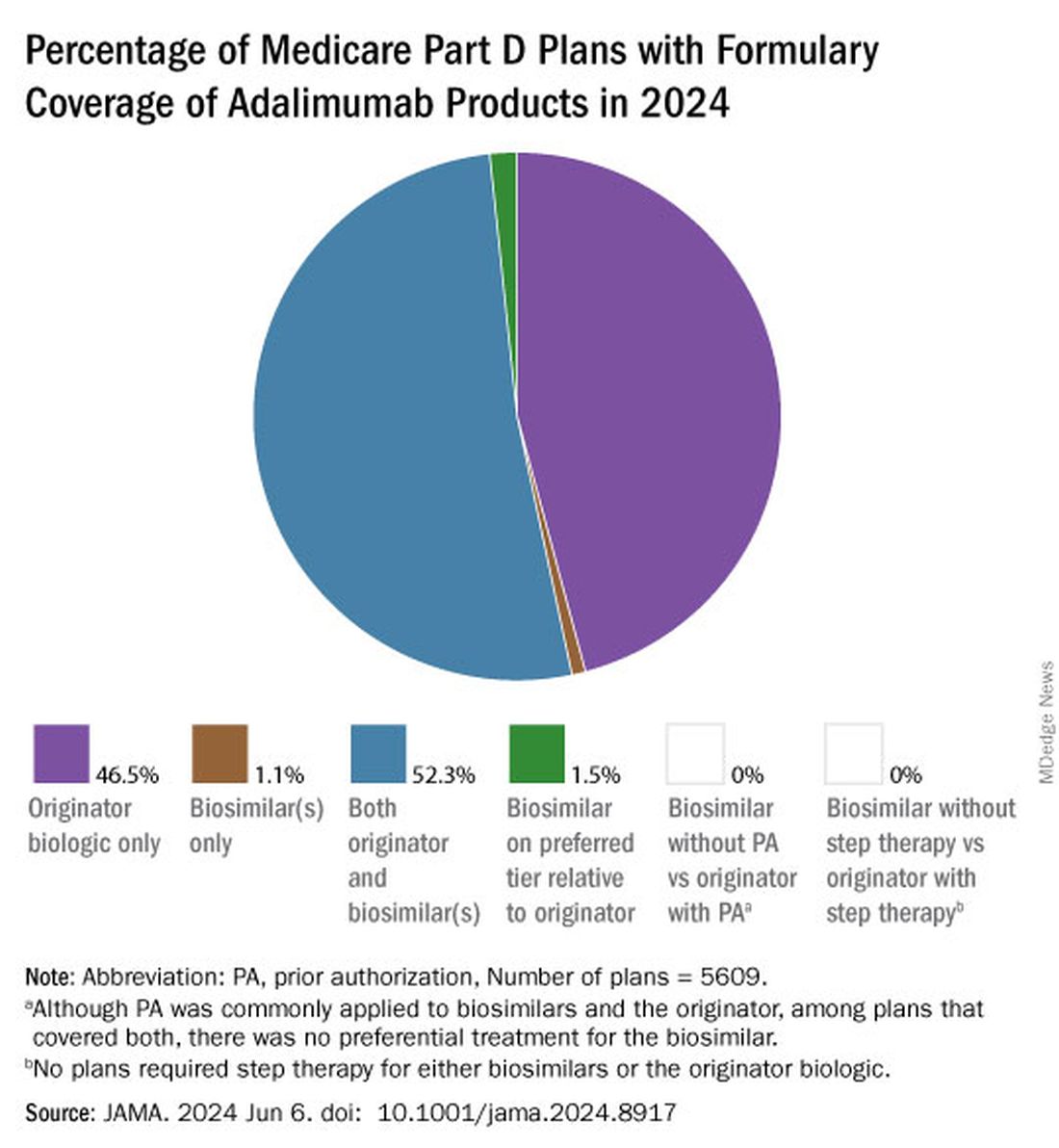

As of January 2024, both high and low concentrations of Humira, the originator adalimumab product, are nearly universally covered by Medicare Part D plans, while only half of these plans covered adalimumab biosimilars, according to a new research letter published online on June 6, 2024, in JAMA.

Of the plans that covered both, only 1.5% had lower-tier placement for biosimilars.

“This study of formulary coverage helps explain limited uptake of adalimumab biosimilars,” wrote the authors, led by Matthew J. Klebanoff, MD, of the University of Pennsylvania, Philadelphia. “Subpar biosimilar adoption will not only undermine their potential to reduce spending but also may deter investments in biosimilar development.”

The analysis included the formulary and enrollment files for 5609 Medicare Part D plans, representing 44.4 million beneficiaries. Drug list prices and whole acquisition costs (WAC) were pulled from the Red Book database, which provides prices for prescription and over-the-counter drugs as well as medical devices and supplies.

Nearly all (98.9%) of Part D plans covered the high-concentration (100 mg/mL) version of adalimumab with a WAC of $6923. This higher concentration is the most popular formulation of the drug, making up an estimated 85% of prescriptions. By comparison, 26.8% of plans covered the high-concentration version of adalimumab-adaz (Hyrimoz), with a WAC 5% less than the reference product.

The unbranded version of adalimumab-adaz, sold at an 81% discount from the reference product, was covered by 13% of plans. Only 4.6% of plans covered high-concentration adalimumab-bwwd (Hadlima), manufactured by Samsung Bioepis.

In January 2024, no high-concentration adalimumab biosimilar had been granted interchangeability status by the US Food and Drug Administration (FDA). Adalimumab-ryvk (Simlandi) was the first biosimilar to receive this designation and was launched in late May 2024.

Coverage for the lower concentration of adalimumab was nearly universal (98.7% of plans). About half of the plans (50.7%) covered adalimumab-adbm (Cyltezo) at a 5% discount. Adalimumab-adbm (Boehringer Ingelheim) was the first interchangeable Humira biosimilar approved by the FDA, but it is only interchangeable with the less popular, lower concentration formulation of adalimumab.

All other biosimilars were covered by less than 5% of Medicare Part D plans, even with some having a WAC 86% below Humira.

Few plans (1.5%) had biosimilars on preferred tiers compared with the reference product, and no plans used prior authorization to incentivize use of biosimilars. Most plans preferred the higher-priced version of adalimumab biosimilars, which appeals to pharmacy benefit managers who can therefore receive higher rebates, the authors noted.

“Ultimately, biosimilars’ true effect on spending will depend not on their list price but rather on their net price (after rebates) and their influence on originator biologics’ net price,” they wrote. They pointed to the 38% drop in Humira’s annual net price at the end of 2023 compared with the prior year.

“Despite this price decrease, biosimilars offer far greater potential savings: Several adalimumab biosimilars have list prices that are less than half of Humira’s net price,” the authors continued, and encouraged policy makers to mandate coverage for these lower-priced options.

Dr. Klebanoff was supported by a grant from the Health Resources and Services Administration. Two coauthors were supported by a grant from the National Institute on Aging. One author reported receiving consulting fees from AbbVie, which manufactures Humira.

A version of this article appeared on Medscape.com .

Despite the influx of adalimumab biosimilars entering the market in 2023, Humira remains on top.

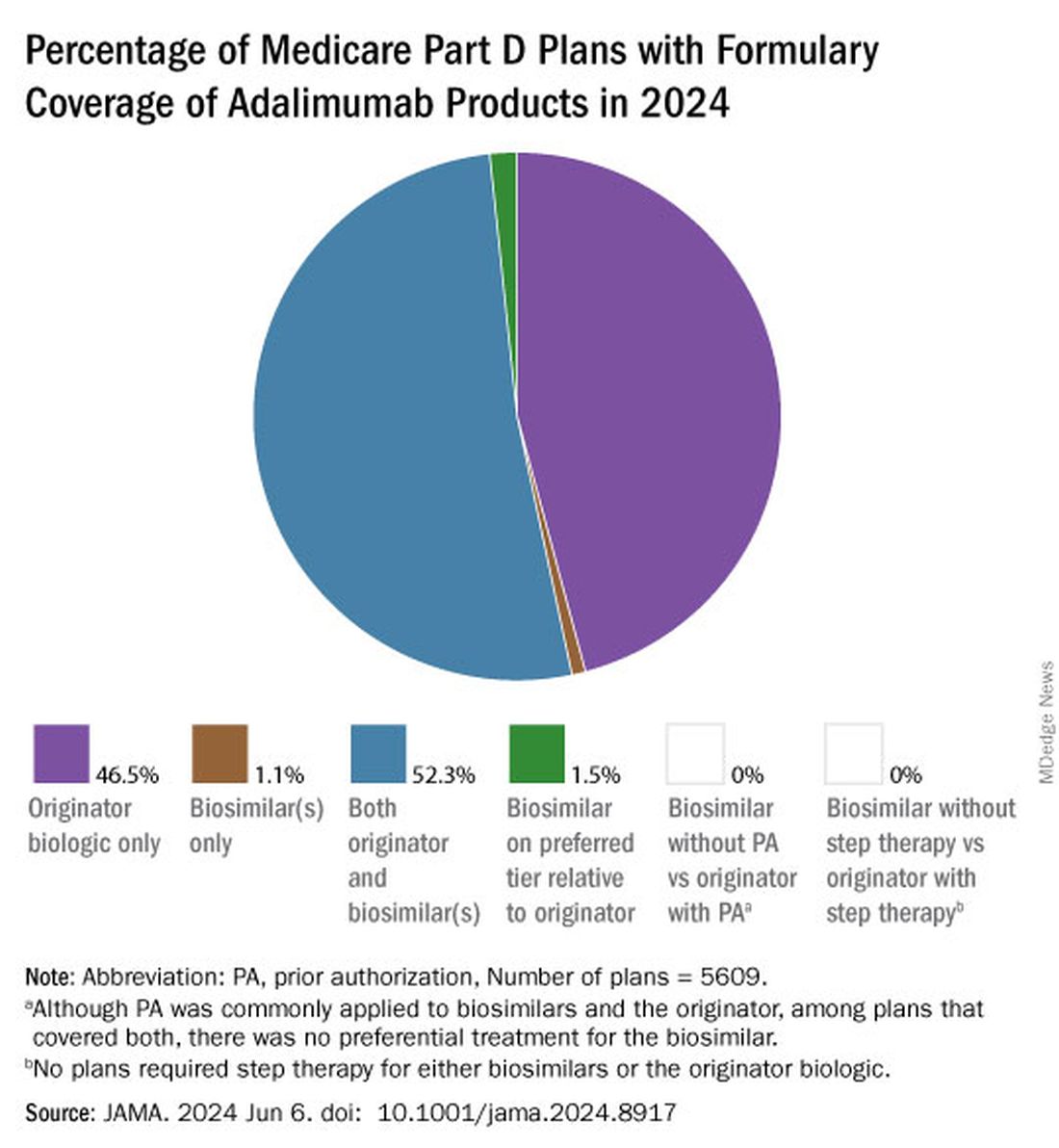

As of January 2024, both high and low concentrations of Humira, the originator adalimumab product, are nearly universally covered by Medicare Part D plans, while only half of these plans covered adalimumab biosimilars, according to a new research letter published online on June 6, 2024, in JAMA.

Of the plans that covered both, only 1.5% had lower-tier placement for biosimilars.

“This study of formulary coverage helps explain limited uptake of adalimumab biosimilars,” wrote the authors, led by Matthew J. Klebanoff, MD, of the University of Pennsylvania, Philadelphia. “Subpar biosimilar adoption will not only undermine their potential to reduce spending but also may deter investments in biosimilar development.”

The analysis included the formulary and enrollment files for 5609 Medicare Part D plans, representing 44.4 million beneficiaries. Drug list prices and whole acquisition costs (WAC) were pulled from the Red Book database, which provides prices for prescription and over-the-counter drugs as well as medical devices and supplies.

Nearly all (98.9%) of Part D plans covered the high-concentration (100 mg/mL) version of adalimumab with a WAC of $6923. This higher concentration is the most popular formulation of the drug, making up an estimated 85% of prescriptions. By comparison, 26.8% of plans covered the high-concentration version of adalimumab-adaz (Hyrimoz), with a WAC 5% less than the reference product.

The unbranded version of adalimumab-adaz, sold at an 81% discount from the reference product, was covered by 13% of plans. Only 4.6% of plans covered high-concentration adalimumab-bwwd (Hadlima), manufactured by Samsung Bioepis.

In January 2024, no high-concentration adalimumab biosimilar had been granted interchangeability status by the US Food and Drug Administration (FDA). Adalimumab-ryvk (Simlandi) was the first biosimilar to receive this designation and was launched in late May 2024.

Coverage for the lower concentration of adalimumab was nearly universal (98.7% of plans). About half of the plans (50.7%) covered adalimumab-adbm (Cyltezo) at a 5% discount. Adalimumab-adbm (Boehringer Ingelheim) was the first interchangeable Humira biosimilar approved by the FDA, but it is only interchangeable with the less popular, lower concentration formulation of adalimumab.

All other biosimilars were covered by less than 5% of Medicare Part D plans, even with some having a WAC 86% below Humira.

Few plans (1.5%) had biosimilars on preferred tiers compared with the reference product, and no plans used prior authorization to incentivize use of biosimilars. Most plans preferred the higher-priced version of adalimumab biosimilars, which appeals to pharmacy benefit managers who can therefore receive higher rebates, the authors noted.

“Ultimately, biosimilars’ true effect on spending will depend not on their list price but rather on their net price (after rebates) and their influence on originator biologics’ net price,” they wrote. They pointed to the 38% drop in Humira’s annual net price at the end of 2023 compared with the prior year.

“Despite this price decrease, biosimilars offer far greater potential savings: Several adalimumab biosimilars have list prices that are less than half of Humira’s net price,” the authors continued, and encouraged policy makers to mandate coverage for these lower-priced options.

Dr. Klebanoff was supported by a grant from the Health Resources and Services Administration. Two coauthors were supported by a grant from the National Institute on Aging. One author reported receiving consulting fees from AbbVie, which manufactures Humira.

A version of this article appeared on Medscape.com .

Despite the influx of adalimumab biosimilars entering the market in 2023, Humira remains on top.

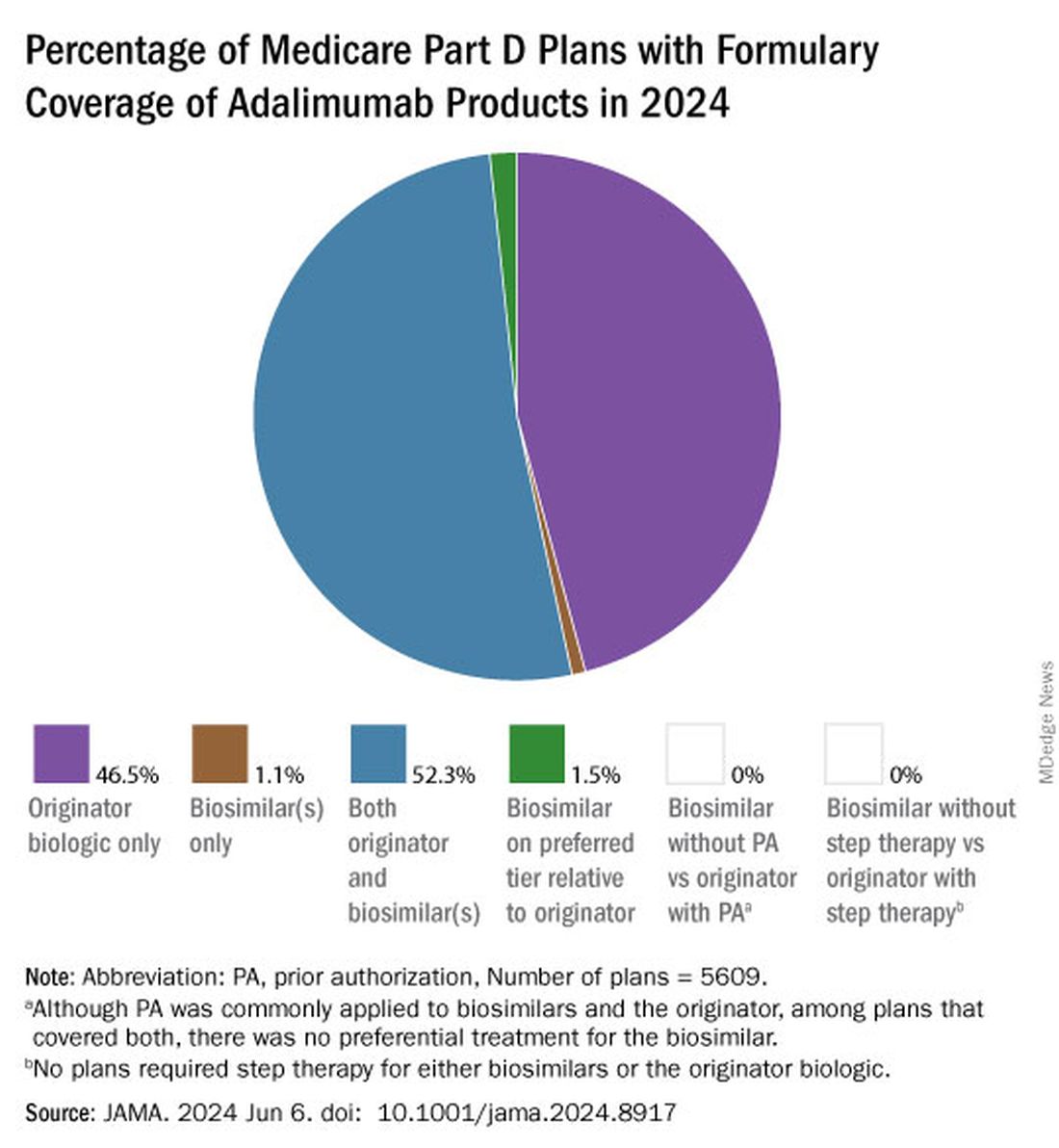

As of January 2024, both high and low concentrations of Humira, the originator adalimumab product, are nearly universally covered by Medicare Part D plans, while only half of these plans covered adalimumab biosimilars, according to a new research letter published online on June 6, 2024, in JAMA.

Of the plans that covered both, only 1.5% had lower-tier placement for biosimilars.

“This study of formulary coverage helps explain limited uptake of adalimumab biosimilars,” wrote the authors, led by Matthew J. Klebanoff, MD, of the University of Pennsylvania, Philadelphia. “Subpar biosimilar adoption will not only undermine their potential to reduce spending but also may deter investments in biosimilar development.”

The analysis included the formulary and enrollment files for 5609 Medicare Part D plans, representing 44.4 million beneficiaries. Drug list prices and whole acquisition costs (WAC) were pulled from the Red Book database, which provides prices for prescription and over-the-counter drugs as well as medical devices and supplies.

Nearly all (98.9%) of Part D plans covered the high-concentration (100 mg/mL) version of adalimumab with a WAC of $6923. This higher concentration is the most popular formulation of the drug, making up an estimated 85% of prescriptions. By comparison, 26.8% of plans covered the high-concentration version of adalimumab-adaz (Hyrimoz), with a WAC 5% less than the reference product.

The unbranded version of adalimumab-adaz, sold at an 81% discount from the reference product, was covered by 13% of plans. Only 4.6% of plans covered high-concentration adalimumab-bwwd (Hadlima), manufactured by Samsung Bioepis.

In January 2024, no high-concentration adalimumab biosimilar had been granted interchangeability status by the US Food and Drug Administration (FDA). Adalimumab-ryvk (Simlandi) was the first biosimilar to receive this designation and was launched in late May 2024.

Coverage for the lower concentration of adalimumab was nearly universal (98.7% of plans). About half of the plans (50.7%) covered adalimumab-adbm (Cyltezo) at a 5% discount. Adalimumab-adbm (Boehringer Ingelheim) was the first interchangeable Humira biosimilar approved by the FDA, but it is only interchangeable with the less popular, lower concentration formulation of adalimumab.

All other biosimilars were covered by less than 5% of Medicare Part D plans, even with some having a WAC 86% below Humira.

Few plans (1.5%) had biosimilars on preferred tiers compared with the reference product, and no plans used prior authorization to incentivize use of biosimilars. Most plans preferred the higher-priced version of adalimumab biosimilars, which appeals to pharmacy benefit managers who can therefore receive higher rebates, the authors noted.

“Ultimately, biosimilars’ true effect on spending will depend not on their list price but rather on their net price (after rebates) and their influence on originator biologics’ net price,” they wrote. They pointed to the 38% drop in Humira’s annual net price at the end of 2023 compared with the prior year.

“Despite this price decrease, biosimilars offer far greater potential savings: Several adalimumab biosimilars have list prices that are less than half of Humira’s net price,” the authors continued, and encouraged policy makers to mandate coverage for these lower-priced options.

Dr. Klebanoff was supported by a grant from the Health Resources and Services Administration. Two coauthors were supported by a grant from the National Institute on Aging. One author reported receiving consulting fees from AbbVie, which manufactures Humira.

A version of this article appeared on Medscape.com .

FROM JAMA