User login

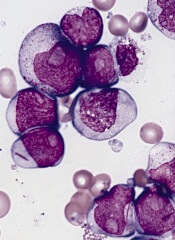

Sunesis Pharmaceuticals, Inc. is withdrawing its European Marketing Authorization Application (MAA) for the anticancer quinolone derivative vosaroxin.

The MAA was for vosaroxin as a treatment for relapsed/refractory acute myeloid leukemia (AML) in patients age 60 years and older.

Along with the MAA withdrawal, Sunesis has decided to scale back its investment in vosaroxin.

However, the company said it will continue developing the drug.

These decisions were made after Sunesis learned the European Medicine Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) was unlikely to recommend approval for vosaroxin.

“We are disappointed to not achieve approval for vosaroxin’s MAA, given its reported efficacy in a patient population with such poor outcomes,” said Daniel Swisher, president and chief executive officer of Sunesis.

“Although we did not receive a definitive CHMP opinion, we believed that a positive opinion was unlikely. Following our appearances before the committee’s Scientific Advisory Group on Oncology and CHMP, we carefully considered feedback from our rapporteurs and input from retained regulatory experts to make our decision to notify EMA to withdraw vosaroxin’s MAA, as our assessment concluded it was unlikely we could achieve a majority vote of CHMP members at this time or upon an immediate re-examination for our proposed indication based on VALOR data from a subgroup of a single pivotal trial that had missed reaching full statistical significance in its primary analysis.”

“In light of this, we are significantly reducing our investment in the AML program and shifting an increasing portion of resources to our kinase inhibitor pipeline . . . . We expect to continue to advance the development of vosaroxin through a modest investment in investigator-sponsored group trials and will carefully assess business development alternatives to support the conduct of another pivotal trial to achieve future regulatory approval of vosaroxin. We expect that our current cash resources are sufficient to fund the company beyond Q1 2018.” ![]()

Sunesis Pharmaceuticals, Inc. is withdrawing its European Marketing Authorization Application (MAA) for the anticancer quinolone derivative vosaroxin.

The MAA was for vosaroxin as a treatment for relapsed/refractory acute myeloid leukemia (AML) in patients age 60 years and older.

Along with the MAA withdrawal, Sunesis has decided to scale back its investment in vosaroxin.

However, the company said it will continue developing the drug.

These decisions were made after Sunesis learned the European Medicine Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) was unlikely to recommend approval for vosaroxin.

“We are disappointed to not achieve approval for vosaroxin’s MAA, given its reported efficacy in a patient population with such poor outcomes,” said Daniel Swisher, president and chief executive officer of Sunesis.

“Although we did not receive a definitive CHMP opinion, we believed that a positive opinion was unlikely. Following our appearances before the committee’s Scientific Advisory Group on Oncology and CHMP, we carefully considered feedback from our rapporteurs and input from retained regulatory experts to make our decision to notify EMA to withdraw vosaroxin’s MAA, as our assessment concluded it was unlikely we could achieve a majority vote of CHMP members at this time or upon an immediate re-examination for our proposed indication based on VALOR data from a subgroup of a single pivotal trial that had missed reaching full statistical significance in its primary analysis.”

“In light of this, we are significantly reducing our investment in the AML program and shifting an increasing portion of resources to our kinase inhibitor pipeline . . . . We expect to continue to advance the development of vosaroxin through a modest investment in investigator-sponsored group trials and will carefully assess business development alternatives to support the conduct of another pivotal trial to achieve future regulatory approval of vosaroxin. We expect that our current cash resources are sufficient to fund the company beyond Q1 2018.” ![]()

Sunesis Pharmaceuticals, Inc. is withdrawing its European Marketing Authorization Application (MAA) for the anticancer quinolone derivative vosaroxin.

The MAA was for vosaroxin as a treatment for relapsed/refractory acute myeloid leukemia (AML) in patients age 60 years and older.

Along with the MAA withdrawal, Sunesis has decided to scale back its investment in vosaroxin.

However, the company said it will continue developing the drug.

These decisions were made after Sunesis learned the European Medicine Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) was unlikely to recommend approval for vosaroxin.

“We are disappointed to not achieve approval for vosaroxin’s MAA, given its reported efficacy in a patient population with such poor outcomes,” said Daniel Swisher, president and chief executive officer of Sunesis.

“Although we did not receive a definitive CHMP opinion, we believed that a positive opinion was unlikely. Following our appearances before the committee’s Scientific Advisory Group on Oncology and CHMP, we carefully considered feedback from our rapporteurs and input from retained regulatory experts to make our decision to notify EMA to withdraw vosaroxin’s MAA, as our assessment concluded it was unlikely we could achieve a majority vote of CHMP members at this time or upon an immediate re-examination for our proposed indication based on VALOR data from a subgroup of a single pivotal trial that had missed reaching full statistical significance in its primary analysis.”

“In light of this, we are significantly reducing our investment in the AML program and shifting an increasing portion of resources to our kinase inhibitor pipeline . . . . We expect to continue to advance the development of vosaroxin through a modest investment in investigator-sponsored group trials and will carefully assess business development alternatives to support the conduct of another pivotal trial to achieve future regulatory approval of vosaroxin. We expect that our current cash resources are sufficient to fund the company beyond Q1 2018.” ![]()