User login

Pre-exposure prophylaxis (PrEP) for HIV is valuable enough for the federal government to mandate insurance coverage, a group of experts told the personal finance website WalletHub, but individuals who are at risk for infection may be missing out for other reasons.

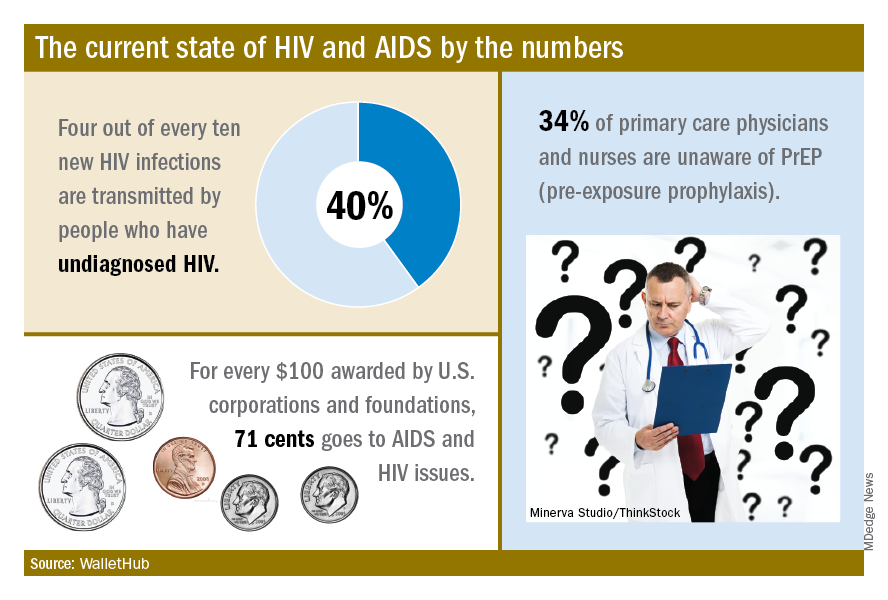

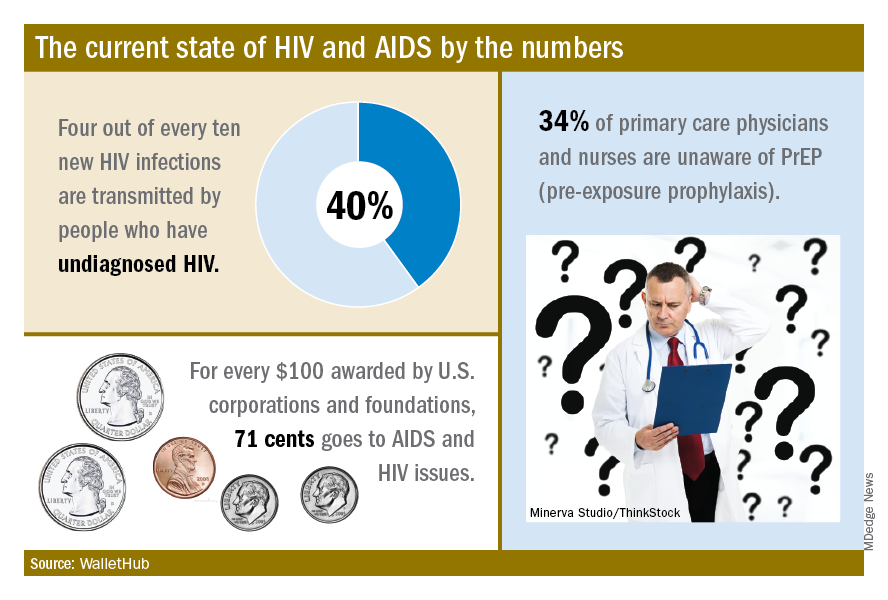

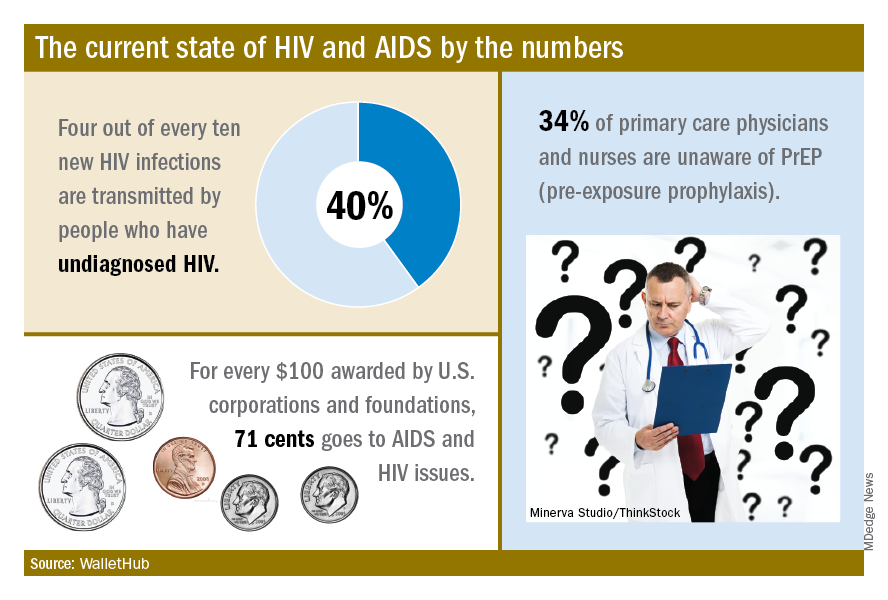

The effectiveness of PrEP is clear, those experts said, but 34% of primary care physicians and nurses in the United States are unaware of the preventive regimen, according to the WalletHub report, which also noted that the majority of Americans with AIDS (61%) are not seeing a specialist.

“Even among [men who have sex with men] in the U.S., coverage is only about 10%, which is abysmal. We can and need to do better. If we don’t pay now, we’ll pay later,” Steffanie Strathdee, PhD, associate dean of global health sciences and Harold Simon Professor at the University of California, San Diego, told WalletHub.

Those taking PrEP have a 90% chance of avoiding HIV infection, the report noted.

“Making PrEP available to all is a giant step forward in the fight against HIV. Mandating this critical prevention be covered by all insurance plans makes it part of mainstream medicine and will only increase its use and help prevent HIV acquisition in exposed populations. I can’t think of other low-risk, high-reward prophylaxis for a lifelong disease,” said Sharon Nachman, MD, professor of pediatrics and associate dean for research at the State University of New York at Stony Brook.

To get PrEP covered, the U.S. Preventive Services Task Force needs to act, explained Gerald M. Oppenheimer, PhD, MPH, of the department of health policy and management at the City University of New York.

“Under the Affordable Care Act, if the [USPSTF] finds that PrEP serves as an effective prevention to disease and gives it a grade of A or B, all insurers must offer it free. That, of course, may lead to an increase in premiums. This is another example of pharmaceutical companies charging high prices in the U.S., compared to what other countries pay, and cries out for an amendment to Medicare Part D, allowing the federal government to negotiate lower drug prices,” he said.

Pre-exposure prophylaxis (PrEP) for HIV is valuable enough for the federal government to mandate insurance coverage, a group of experts told the personal finance website WalletHub, but individuals who are at risk for infection may be missing out for other reasons.

The effectiveness of PrEP is clear, those experts said, but 34% of primary care physicians and nurses in the United States are unaware of the preventive regimen, according to the WalletHub report, which also noted that the majority of Americans with AIDS (61%) are not seeing a specialist.

“Even among [men who have sex with men] in the U.S., coverage is only about 10%, which is abysmal. We can and need to do better. If we don’t pay now, we’ll pay later,” Steffanie Strathdee, PhD, associate dean of global health sciences and Harold Simon Professor at the University of California, San Diego, told WalletHub.

Those taking PrEP have a 90% chance of avoiding HIV infection, the report noted.

“Making PrEP available to all is a giant step forward in the fight against HIV. Mandating this critical prevention be covered by all insurance plans makes it part of mainstream medicine and will only increase its use and help prevent HIV acquisition in exposed populations. I can’t think of other low-risk, high-reward prophylaxis for a lifelong disease,” said Sharon Nachman, MD, professor of pediatrics and associate dean for research at the State University of New York at Stony Brook.

To get PrEP covered, the U.S. Preventive Services Task Force needs to act, explained Gerald M. Oppenheimer, PhD, MPH, of the department of health policy and management at the City University of New York.

“Under the Affordable Care Act, if the [USPSTF] finds that PrEP serves as an effective prevention to disease and gives it a grade of A or B, all insurers must offer it free. That, of course, may lead to an increase in premiums. This is another example of pharmaceutical companies charging high prices in the U.S., compared to what other countries pay, and cries out for an amendment to Medicare Part D, allowing the federal government to negotiate lower drug prices,” he said.

Pre-exposure prophylaxis (PrEP) for HIV is valuable enough for the federal government to mandate insurance coverage, a group of experts told the personal finance website WalletHub, but individuals who are at risk for infection may be missing out for other reasons.

The effectiveness of PrEP is clear, those experts said, but 34% of primary care physicians and nurses in the United States are unaware of the preventive regimen, according to the WalletHub report, which also noted that the majority of Americans with AIDS (61%) are not seeing a specialist.

“Even among [men who have sex with men] in the U.S., coverage is only about 10%, which is abysmal. We can and need to do better. If we don’t pay now, we’ll pay later,” Steffanie Strathdee, PhD, associate dean of global health sciences and Harold Simon Professor at the University of California, San Diego, told WalletHub.

Those taking PrEP have a 90% chance of avoiding HIV infection, the report noted.

“Making PrEP available to all is a giant step forward in the fight against HIV. Mandating this critical prevention be covered by all insurance plans makes it part of mainstream medicine and will only increase its use and help prevent HIV acquisition in exposed populations. I can’t think of other low-risk, high-reward prophylaxis for a lifelong disease,” said Sharon Nachman, MD, professor of pediatrics and associate dean for research at the State University of New York at Stony Brook.

To get PrEP covered, the U.S. Preventive Services Task Force needs to act, explained Gerald M. Oppenheimer, PhD, MPH, of the department of health policy and management at the City University of New York.

“Under the Affordable Care Act, if the [USPSTF] finds that PrEP serves as an effective prevention to disease and gives it a grade of A or B, all insurers must offer it free. That, of course, may lead to an increase in premiums. This is another example of pharmaceutical companies charging high prices in the U.S., compared to what other countries pay, and cries out for an amendment to Medicare Part D, allowing the federal government to negotiate lower drug prices,” he said.