User login

More states are enacting laws that require private plans to cover telehealth services, but fair payment remains a challenge for providers, a new analysis finds.

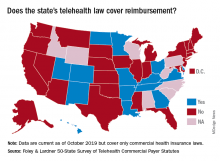

In 2019, 42 states and the District of Columbia had commercial payer telehealth laws, according to a December report by Foley & Lardner LLP, an international law firm. In contrast, about 30 states had such laws in 2015, according to a 2015 report by the National Conference of State Legislatures. Telehealth coverage laws generally require private plans to cover services provided via telehealth to the extent they cover in-person services of the same nature. The measures also frequently protect patients from cost-shifting, in which an insurer imposes higher deductibles or copays for telehealth services.

Private coverage for asynchronous telehealth and remote patient monitoring (RPM) is also growing. Twenty-four states mandate coverage for store and forward asynchronous telehealth, while 13 states require commercial health plans to cover RPM services, the analysis found. In addition, most telehealth coverage laws do not limit where a patient can receive telehealth services. However, some states, such as Arizona, Tennessee, and Washington, still require that patients be located in a particular clinical setting at the time of the telehealth consultation.

Overall, the landscape for reimbursement of telehealth services by commercial payers has improved, said Jacqueline Acosta, a health care attorney with Foley & Lardner and a coauthor of the report.

“[Foley& Lardner’s] 2017 report really noted that implementation [of telehealth] had really picked up both from providers and patients asking for telemedicine, but reimbursement still lagged behind,” Ms. Acosta said in an interview. “This one shows real progress on that front.”

However, the survey notes that payment parity for telehealth services remains lacking. Payment parity refers to insurers paying for telehealth services at the same or an equivalent rate as those delivered in-person. In 2019, 16 states had laws that specifically addressed reimbursement of telehealth services, but only 10 offer true payment parity, according to the Foley analysis. The 10 states with payment parity laws are Arkansas, Delaware, Georgia, Hawaii, Kentucky, Minnesota, Missouri, New Mexico, Utah, and Virginia. Other telehealth reimbursement measures often include ambiguity or allow room for payment negotiation, Ms. Acosta said.

She predicts that more payment parity laws and improved telehealth coverage laws are on the horizon for 2020 and beyond. California, for example, recently revised its telehealth law to require both coverage and payment parity for telehealth services. Mississippi meanwhile, recently expanded its law to include RPM coverage.

That states are revising existing laws and expanding their statutes shows an optimistic trend toward telehealth acceptance and coverage growth, Ms. Acosta said.

More states are enacting laws that require private plans to cover telehealth services, but fair payment remains a challenge for providers, a new analysis finds.

In 2019, 42 states and the District of Columbia had commercial payer telehealth laws, according to a December report by Foley & Lardner LLP, an international law firm. In contrast, about 30 states had such laws in 2015, according to a 2015 report by the National Conference of State Legislatures. Telehealth coverage laws generally require private plans to cover services provided via telehealth to the extent they cover in-person services of the same nature. The measures also frequently protect patients from cost-shifting, in which an insurer imposes higher deductibles or copays for telehealth services.

Private coverage for asynchronous telehealth and remote patient monitoring (RPM) is also growing. Twenty-four states mandate coverage for store and forward asynchronous telehealth, while 13 states require commercial health plans to cover RPM services, the analysis found. In addition, most telehealth coverage laws do not limit where a patient can receive telehealth services. However, some states, such as Arizona, Tennessee, and Washington, still require that patients be located in a particular clinical setting at the time of the telehealth consultation.

Overall, the landscape for reimbursement of telehealth services by commercial payers has improved, said Jacqueline Acosta, a health care attorney with Foley & Lardner and a coauthor of the report.

“[Foley& Lardner’s] 2017 report really noted that implementation [of telehealth] had really picked up both from providers and patients asking for telemedicine, but reimbursement still lagged behind,” Ms. Acosta said in an interview. “This one shows real progress on that front.”

However, the survey notes that payment parity for telehealth services remains lacking. Payment parity refers to insurers paying for telehealth services at the same or an equivalent rate as those delivered in-person. In 2019, 16 states had laws that specifically addressed reimbursement of telehealth services, but only 10 offer true payment parity, according to the Foley analysis. The 10 states with payment parity laws are Arkansas, Delaware, Georgia, Hawaii, Kentucky, Minnesota, Missouri, New Mexico, Utah, and Virginia. Other telehealth reimbursement measures often include ambiguity or allow room for payment negotiation, Ms. Acosta said.

She predicts that more payment parity laws and improved telehealth coverage laws are on the horizon for 2020 and beyond. California, for example, recently revised its telehealth law to require both coverage and payment parity for telehealth services. Mississippi meanwhile, recently expanded its law to include RPM coverage.

That states are revising existing laws and expanding their statutes shows an optimistic trend toward telehealth acceptance and coverage growth, Ms. Acosta said.

More states are enacting laws that require private plans to cover telehealth services, but fair payment remains a challenge for providers, a new analysis finds.

In 2019, 42 states and the District of Columbia had commercial payer telehealth laws, according to a December report by Foley & Lardner LLP, an international law firm. In contrast, about 30 states had such laws in 2015, according to a 2015 report by the National Conference of State Legislatures. Telehealth coverage laws generally require private plans to cover services provided via telehealth to the extent they cover in-person services of the same nature. The measures also frequently protect patients from cost-shifting, in which an insurer imposes higher deductibles or copays for telehealth services.

Private coverage for asynchronous telehealth and remote patient monitoring (RPM) is also growing. Twenty-four states mandate coverage for store and forward asynchronous telehealth, while 13 states require commercial health plans to cover RPM services, the analysis found. In addition, most telehealth coverage laws do not limit where a patient can receive telehealth services. However, some states, such as Arizona, Tennessee, and Washington, still require that patients be located in a particular clinical setting at the time of the telehealth consultation.

Overall, the landscape for reimbursement of telehealth services by commercial payers has improved, said Jacqueline Acosta, a health care attorney with Foley & Lardner and a coauthor of the report.

“[Foley& Lardner’s] 2017 report really noted that implementation [of telehealth] had really picked up both from providers and patients asking for telemedicine, but reimbursement still lagged behind,” Ms. Acosta said in an interview. “This one shows real progress on that front.”

However, the survey notes that payment parity for telehealth services remains lacking. Payment parity refers to insurers paying for telehealth services at the same or an equivalent rate as those delivered in-person. In 2019, 16 states had laws that specifically addressed reimbursement of telehealth services, but only 10 offer true payment parity, according to the Foley analysis. The 10 states with payment parity laws are Arkansas, Delaware, Georgia, Hawaii, Kentucky, Minnesota, Missouri, New Mexico, Utah, and Virginia. Other telehealth reimbursement measures often include ambiguity or allow room for payment negotiation, Ms. Acosta said.

She predicts that more payment parity laws and improved telehealth coverage laws are on the horizon for 2020 and beyond. California, for example, recently revised its telehealth law to require both coverage and payment parity for telehealth services. Mississippi meanwhile, recently expanded its law to include RPM coverage.

That states are revising existing laws and expanding their statutes shows an optimistic trend toward telehealth acceptance and coverage growth, Ms. Acosta said.