User login

The Departments of Labor, Health & Human Services, and the Treasury issued guidance in 2022 that plans and insurers “must cover and may not impose cost sharing with respect to a colonoscopy conducted after a positive non-invasive stool-based screening test” for plan or policy years1 beginning on or after May 31, 2022, and, further, “may not impose cost-sharing with respect to a polyp removal during a colonoscopy performed as a screening procedure.”2 So why are so many patients still being charged fees for these screening services? In many cases, the answer comes down to missing code modifiers.

Commercial insurers want you to use modifier 33

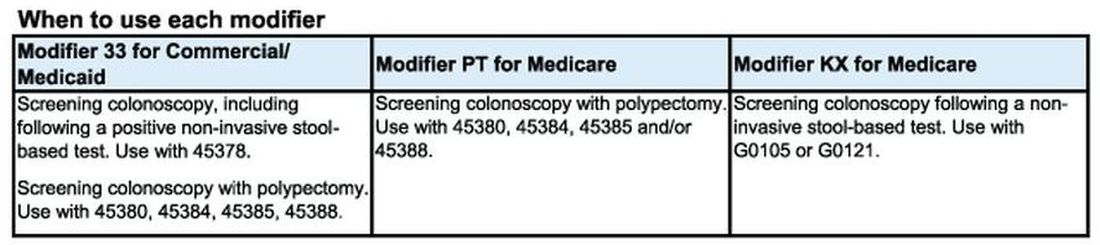

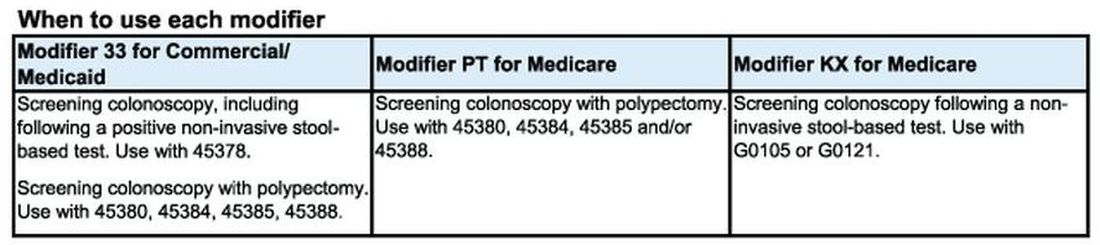

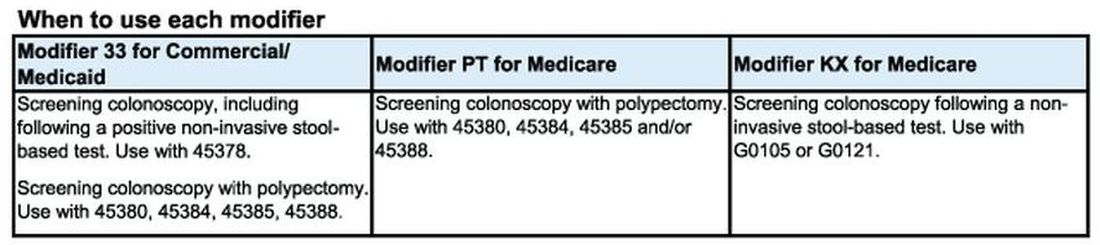

AGA spoke to Elevance (formerly Anthem), Cigna, Aetna, and Blue Cross Blue Shield Association about how physicians should report colorectal cancer screening procedures and tests. They said using the 33 modifier (preventive service) is essential for their systems to trigger the screening benefits for beneficiaries. Without the 33 modifier, the claim will be processed as a diagnostic service, and coinsurance may apply.

According to the CPT manual, modifier 33 should be used “when the primary purpose of the service is the delivery of an evidence-based service in accordance with a U.S. Preventive Services Task Force A or B rating in effect and other preventive services identified in preventive mandates (legislative or regulatory) ...” Use modifier 33 with colonoscopies that start out as screening procedures and with colonoscopies following a positive non-invasive stool-based test, like fecal immunochemical test (FIT) or Cologuard™ multi-target stool DNA test.

It is important to note that modifier 33 won’t ensure all screening colonoscopy claims are paid, because not all commercial plans are required to cover 100 percent of the costs of CRC screening tests and procedures. For example, employer-sponsored insurance plans and legacy plans can choose not to adopt the expanded CRC benefits. Patients who are covered under these plans may not be aware that their CRC test or procedure will not be fully covered. These patients may still receive a “surprise” bill if their screening colonoscopy requires removal of polyps or if they have a colonoscopy following a positive non-invasive CRC test.

Medicare wants you to use modifiers PT and KX, but not together

CMS uses Healthcare Common Procedural Coding System (HCPCS) codes to differentiate between screening and diagnostic colonoscopies to apply screening benefits. For Medicare beneficiaries who choose colonoscopy as their CRC screening, use HCPCS code G0105 (Colorectal cancer screening; colonoscopy on individual at high risk) or G0121 (Colorectal cancer screening; colonoscopy on individual not meeting the criteria for high risk) for screening colonoscopies as appropriate. No modifier is necessary with G0105 or G0121.

Effective for claims with dates of service on or after 1/1/2023, use the appropriate HCPCS codes G0105 or G0121 with the KX modifier for colonoscopy following a positive result for any of the following non-invasive stool-based CRC screening tests:

• Screening guaiac-based fecal occult blood test (gFOBT) (CPT 82270)

• Screening immunoassay-based fecal occult blood test (iFOBT) (HCPCS G0328)

• Cologuard™ – multi-target stool DNA (sDNA) test (CPT 81528)

According to the guidance in the CMS Manual System, if modifier KX is not added to G0105 or G0121 for colonoscopy following a positive non-invasive stool-based test, Medicare will return the screening colonoscopy claim as “unprocessable.”3 If this happens, add modifier KX and resubmit the claim.

If polyps are removed during a screening colonoscopy, use the appropriate CPT code (45380, 45384, 45385, 45388) and add modifier PT (colorectal cancer screening test; converted to diagnostic test or other procedure) to each CPT code for Medicare. However, it is important to note that if a polyp is removed during a screening colonoscopy, the Medicare beneficiary is responsible for 15% of the cost from 2023 to 2026. This falls to 10% of the cost from 2027 to 2029, and by 2030 it will be covered 100% by Medicare. Some Medicare beneficiaries are not aware that Medicare has not fully eliminated the coinsurance responsibility yet.

What to do if your patient gets an unexpected bill

If your patient gets an unexpected bill and you coded the procedure correctly with the correct modifier, direct them to the AGA GI Patient Care Center’s “Colorectal cancer screening: what to expect when paying” resource for help with next steps.4

The authors have no conflicts to declare.

References

1. U.S. Department of Labor (2022, Jan. 10) FAQs About Affordable Care Act Implementation Part 51. https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/faqs/aca-part-51.pdf

2. Centers for Medicare and Medicaid Services (n.d.) Affordable Care Act Implementation FAQs - Set 12. https://www.cms.gov/CCIIO/Resources/Fact-Sheets-and-FAQs/aca_implementation_faqs12.

3. Centers for Medicare and Medicaid Services (2023, Jan. 27) CMS Manual System Pub 100-03 Medicare National Coverage Determinations Transmittal 11824. https://www.cms.gov/files/document/r11824ncd.pdf.

4. American Gastroenterological Association (2023, Feb. 21) AGA GI Patient Center Colorectal Cancer Screening: What to expect when paying. https://patient.gastro.org/paying-for-your-colonoscopy/.

The Departments of Labor, Health & Human Services, and the Treasury issued guidance in 2022 that plans and insurers “must cover and may not impose cost sharing with respect to a colonoscopy conducted after a positive non-invasive stool-based screening test” for plan or policy years1 beginning on or after May 31, 2022, and, further, “may not impose cost-sharing with respect to a polyp removal during a colonoscopy performed as a screening procedure.”2 So why are so many patients still being charged fees for these screening services? In many cases, the answer comes down to missing code modifiers.

Commercial insurers want you to use modifier 33

AGA spoke to Elevance (formerly Anthem), Cigna, Aetna, and Blue Cross Blue Shield Association about how physicians should report colorectal cancer screening procedures and tests. They said using the 33 modifier (preventive service) is essential for their systems to trigger the screening benefits for beneficiaries. Without the 33 modifier, the claim will be processed as a diagnostic service, and coinsurance may apply.

According to the CPT manual, modifier 33 should be used “when the primary purpose of the service is the delivery of an evidence-based service in accordance with a U.S. Preventive Services Task Force A or B rating in effect and other preventive services identified in preventive mandates (legislative or regulatory) ...” Use modifier 33 with colonoscopies that start out as screening procedures and with colonoscopies following a positive non-invasive stool-based test, like fecal immunochemical test (FIT) or Cologuard™ multi-target stool DNA test.

It is important to note that modifier 33 won’t ensure all screening colonoscopy claims are paid, because not all commercial plans are required to cover 100 percent of the costs of CRC screening tests and procedures. For example, employer-sponsored insurance plans and legacy plans can choose not to adopt the expanded CRC benefits. Patients who are covered under these plans may not be aware that their CRC test or procedure will not be fully covered. These patients may still receive a “surprise” bill if their screening colonoscopy requires removal of polyps or if they have a colonoscopy following a positive non-invasive CRC test.

Medicare wants you to use modifiers PT and KX, but not together

CMS uses Healthcare Common Procedural Coding System (HCPCS) codes to differentiate between screening and diagnostic colonoscopies to apply screening benefits. For Medicare beneficiaries who choose colonoscopy as their CRC screening, use HCPCS code G0105 (Colorectal cancer screening; colonoscopy on individual at high risk) or G0121 (Colorectal cancer screening; colonoscopy on individual not meeting the criteria for high risk) for screening colonoscopies as appropriate. No modifier is necessary with G0105 or G0121.

Effective for claims with dates of service on or after 1/1/2023, use the appropriate HCPCS codes G0105 or G0121 with the KX modifier for colonoscopy following a positive result for any of the following non-invasive stool-based CRC screening tests:

• Screening guaiac-based fecal occult blood test (gFOBT) (CPT 82270)

• Screening immunoassay-based fecal occult blood test (iFOBT) (HCPCS G0328)

• Cologuard™ – multi-target stool DNA (sDNA) test (CPT 81528)

According to the guidance in the CMS Manual System, if modifier KX is not added to G0105 or G0121 for colonoscopy following a positive non-invasive stool-based test, Medicare will return the screening colonoscopy claim as “unprocessable.”3 If this happens, add modifier KX and resubmit the claim.

If polyps are removed during a screening colonoscopy, use the appropriate CPT code (45380, 45384, 45385, 45388) and add modifier PT (colorectal cancer screening test; converted to diagnostic test or other procedure) to each CPT code for Medicare. However, it is important to note that if a polyp is removed during a screening colonoscopy, the Medicare beneficiary is responsible for 15% of the cost from 2023 to 2026. This falls to 10% of the cost from 2027 to 2029, and by 2030 it will be covered 100% by Medicare. Some Medicare beneficiaries are not aware that Medicare has not fully eliminated the coinsurance responsibility yet.

What to do if your patient gets an unexpected bill

If your patient gets an unexpected bill and you coded the procedure correctly with the correct modifier, direct them to the AGA GI Patient Care Center’s “Colorectal cancer screening: what to expect when paying” resource for help with next steps.4

The authors have no conflicts to declare.

References

1. U.S. Department of Labor (2022, Jan. 10) FAQs About Affordable Care Act Implementation Part 51. https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/faqs/aca-part-51.pdf

2. Centers for Medicare and Medicaid Services (n.d.) Affordable Care Act Implementation FAQs - Set 12. https://www.cms.gov/CCIIO/Resources/Fact-Sheets-and-FAQs/aca_implementation_faqs12.

3. Centers for Medicare and Medicaid Services (2023, Jan. 27) CMS Manual System Pub 100-03 Medicare National Coverage Determinations Transmittal 11824. https://www.cms.gov/files/document/r11824ncd.pdf.

4. American Gastroenterological Association (2023, Feb. 21) AGA GI Patient Center Colorectal Cancer Screening: What to expect when paying. https://patient.gastro.org/paying-for-your-colonoscopy/.

The Departments of Labor, Health & Human Services, and the Treasury issued guidance in 2022 that plans and insurers “must cover and may not impose cost sharing with respect to a colonoscopy conducted after a positive non-invasive stool-based screening test” for plan or policy years1 beginning on or after May 31, 2022, and, further, “may not impose cost-sharing with respect to a polyp removal during a colonoscopy performed as a screening procedure.”2 So why are so many patients still being charged fees for these screening services? In many cases, the answer comes down to missing code modifiers.

Commercial insurers want you to use modifier 33

AGA spoke to Elevance (formerly Anthem), Cigna, Aetna, and Blue Cross Blue Shield Association about how physicians should report colorectal cancer screening procedures and tests. They said using the 33 modifier (preventive service) is essential for their systems to trigger the screening benefits for beneficiaries. Without the 33 modifier, the claim will be processed as a diagnostic service, and coinsurance may apply.

According to the CPT manual, modifier 33 should be used “when the primary purpose of the service is the delivery of an evidence-based service in accordance with a U.S. Preventive Services Task Force A or B rating in effect and other preventive services identified in preventive mandates (legislative or regulatory) ...” Use modifier 33 with colonoscopies that start out as screening procedures and with colonoscopies following a positive non-invasive stool-based test, like fecal immunochemical test (FIT) or Cologuard™ multi-target stool DNA test.

It is important to note that modifier 33 won’t ensure all screening colonoscopy claims are paid, because not all commercial plans are required to cover 100 percent of the costs of CRC screening tests and procedures. For example, employer-sponsored insurance plans and legacy plans can choose not to adopt the expanded CRC benefits. Patients who are covered under these plans may not be aware that their CRC test or procedure will not be fully covered. These patients may still receive a “surprise” bill if their screening colonoscopy requires removal of polyps or if they have a colonoscopy following a positive non-invasive CRC test.

Medicare wants you to use modifiers PT and KX, but not together

CMS uses Healthcare Common Procedural Coding System (HCPCS) codes to differentiate between screening and diagnostic colonoscopies to apply screening benefits. For Medicare beneficiaries who choose colonoscopy as their CRC screening, use HCPCS code G0105 (Colorectal cancer screening; colonoscopy on individual at high risk) or G0121 (Colorectal cancer screening; colonoscopy on individual not meeting the criteria for high risk) for screening colonoscopies as appropriate. No modifier is necessary with G0105 or G0121.

Effective for claims with dates of service on or after 1/1/2023, use the appropriate HCPCS codes G0105 or G0121 with the KX modifier for colonoscopy following a positive result for any of the following non-invasive stool-based CRC screening tests:

• Screening guaiac-based fecal occult blood test (gFOBT) (CPT 82270)

• Screening immunoassay-based fecal occult blood test (iFOBT) (HCPCS G0328)

• Cologuard™ – multi-target stool DNA (sDNA) test (CPT 81528)

According to the guidance in the CMS Manual System, if modifier KX is not added to G0105 or G0121 for colonoscopy following a positive non-invasive stool-based test, Medicare will return the screening colonoscopy claim as “unprocessable.”3 If this happens, add modifier KX and resubmit the claim.

If polyps are removed during a screening colonoscopy, use the appropriate CPT code (45380, 45384, 45385, 45388) and add modifier PT (colorectal cancer screening test; converted to diagnostic test or other procedure) to each CPT code for Medicare. However, it is important to note that if a polyp is removed during a screening colonoscopy, the Medicare beneficiary is responsible for 15% of the cost from 2023 to 2026. This falls to 10% of the cost from 2027 to 2029, and by 2030 it will be covered 100% by Medicare. Some Medicare beneficiaries are not aware that Medicare has not fully eliminated the coinsurance responsibility yet.

What to do if your patient gets an unexpected bill

If your patient gets an unexpected bill and you coded the procedure correctly with the correct modifier, direct them to the AGA GI Patient Care Center’s “Colorectal cancer screening: what to expect when paying” resource for help with next steps.4

The authors have no conflicts to declare.

References

1. U.S. Department of Labor (2022, Jan. 10) FAQs About Affordable Care Act Implementation Part 51. https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/faqs/aca-part-51.pdf

2. Centers for Medicare and Medicaid Services (n.d.) Affordable Care Act Implementation FAQs - Set 12. https://www.cms.gov/CCIIO/Resources/Fact-Sheets-and-FAQs/aca_implementation_faqs12.

3. Centers for Medicare and Medicaid Services (2023, Jan. 27) CMS Manual System Pub 100-03 Medicare National Coverage Determinations Transmittal 11824. https://www.cms.gov/files/document/r11824ncd.pdf.

4. American Gastroenterological Association (2023, Feb. 21) AGA GI Patient Center Colorectal Cancer Screening: What to expect when paying. https://patient.gastro.org/paying-for-your-colonoscopy/.