User login

The young gastroenterologist has no shortage of personal finance topics to juggle, ranging from investments, to life and disability coverage, and planning for retirement. But the elephant in the room is student loan management. Average medical student debt today is approximately $240,000, and debt burdens greater than $300,000 are becoming common.1,2 With this staggering amount of debt, it is understandable why student loans are a major source of anxiety. Here, I will provide a brief introduction to student loan management for gastroenterologists.

Student loans: Basic strategy

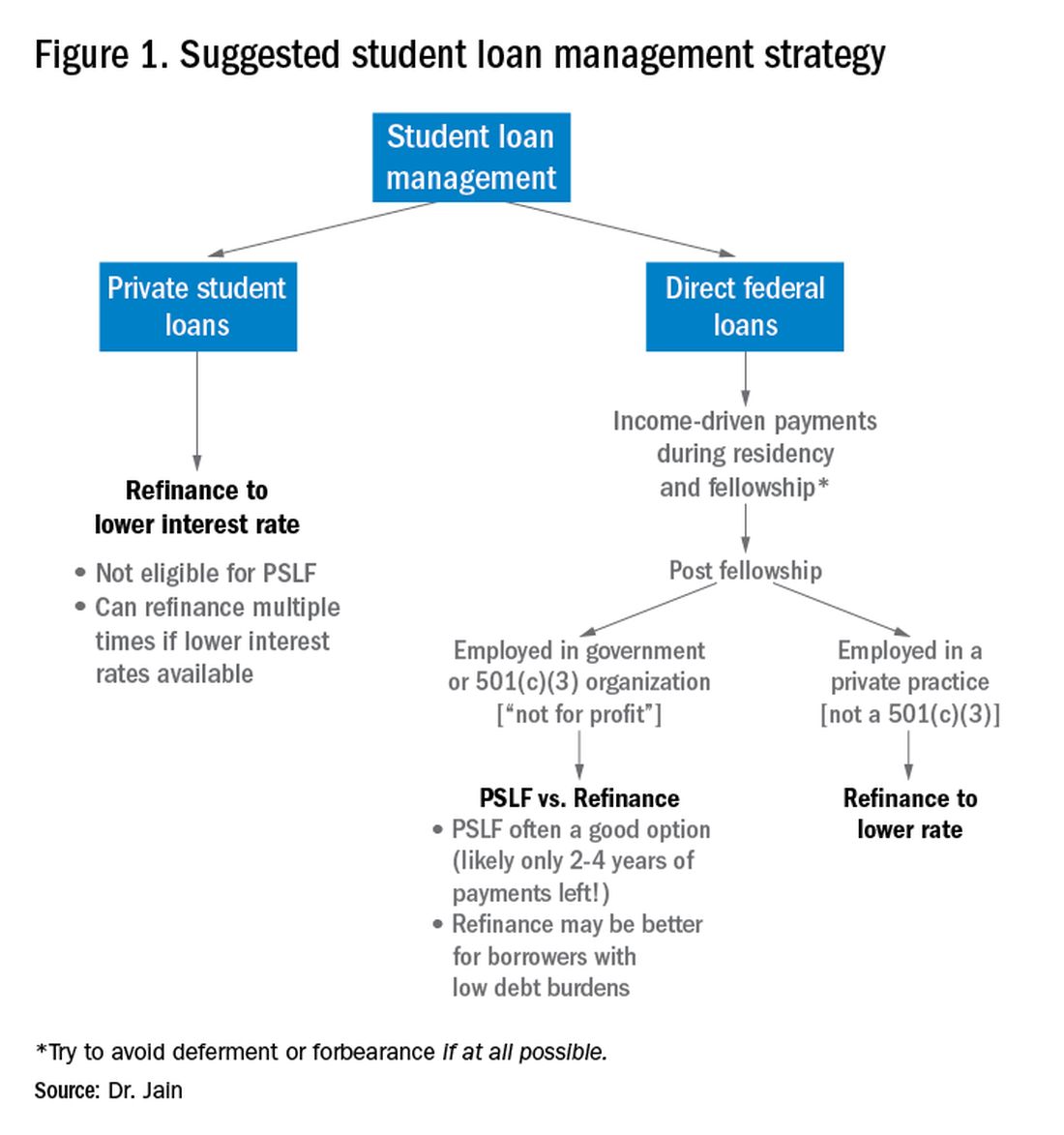

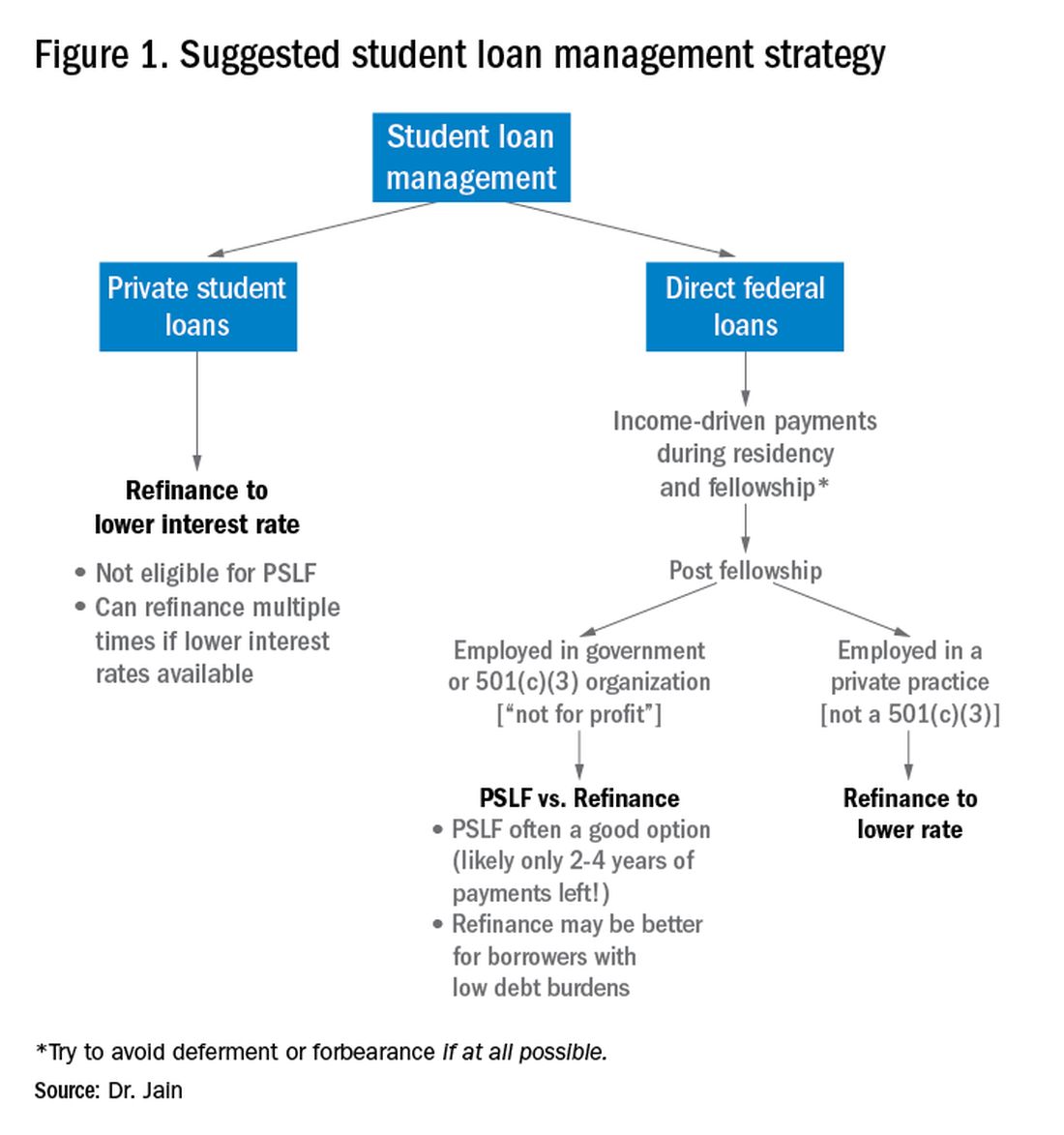

It is important to distinguish between two major types of loans: private student loans and direct federal loans. With private student loans the best strategy in most cases is to refinance to a lower interest rate. For direct federal loans, however, the decision making is more complex. There are two major approaches to these federal loans – either 1) refinance, or 2) go for public service loan forgiveness (PSLF). See Figure 1 for a flowchart summarizing my general approach to student loan management.

Refinance basics

One potential approach is to refinance your federal loans. Most federal loans today are at a relatively high interest rate of 6%-8%.3 Private refinancing can yield rates in the 3%-5% range, depending on the type of loan and other factors. For a loan balance of $200,000, the savings by refinancing could be approximately $2,000-$10,000 per year in interest alone. However, refinancing your loans with a private company eliminates the possibility of PSLF. Hence, you should only refinance federal loans once you are sure that you will not be pursuing PSLF. You may refinance your private loans anytime since they do not qualify for PSLF. There are multiple companies that provide student loan refinancing. The process can be done online, sometimes in as little as 30 minutes. There is generally little or no cost to refinancing, and many companies even provide a small cash-back incentive to refinance.

PSLF basics

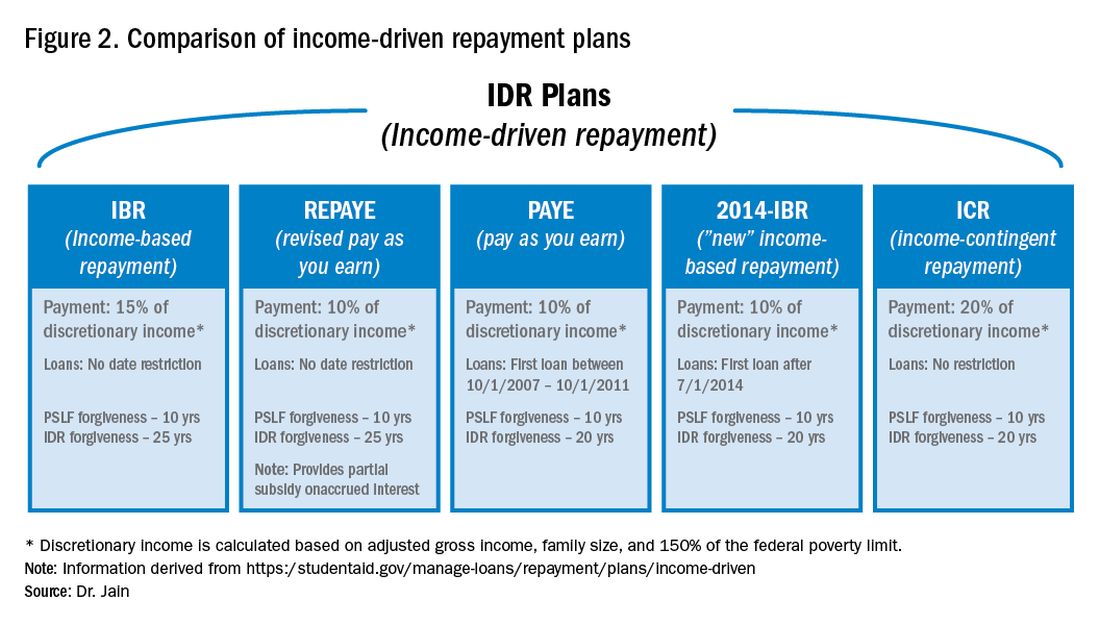

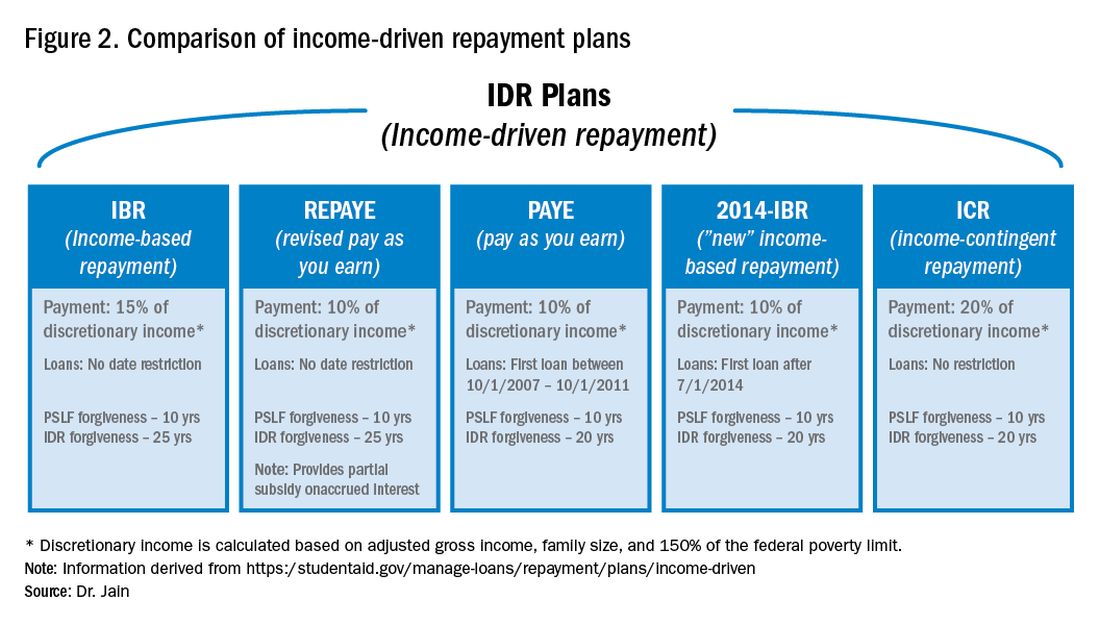

The PSLF program allows borrowers to have the remainder of their direct loans forgiven after 10 years (120 monthly payments) under a qualifying income-driven repayment (IDR) plan.4 Figure 2 shows an overview of the various IDR plans. During the 120 payments, the borrower must work full time for a qualifying employer, which includes a government employer or a not-for-profit 501(c)(3) organization. Loan forgiveness with PSLF is completely tax free. Importantly, the PSLF program only applies to direct federal loans. You can see your federal loan types and balances by visiting https://studentaid.gov/.

To PSLF or not to PSLF?

With direct federal loans, the decision to refinance or go for PSLF is a major fork in the road. PSLF can be a good option for borrowers with long training programs and with high student loan burdens (e.g., loan-to-income ratios of 1:1, 2:1 or higher). By contrast, borrowers with short training programs or relatively small loan burdens may be better off refinancing to a low interest rate and paying off loans quickly. Virtually all institutions that train residents and fellows are qualified government or 501(c)(3) organizations. Hence, a gastroenterology graduate generally will have completed at least 6 out of 10 years of payments by the end of training. Trainees who did a chief resident year or gastroenterology research track may have completed 7 or 8 years of qualifying payments already.

For trainees who are already planning an academic career, PSLF is often a good option. While PSLF can be a nice benefit, I would not advise making a career decision purely based on PSLF. Private practice jobs generally come with substantially higher salaries than academic and government jobs. This salary differential typically more than compensates for the loss of access to PSLF. Hence, I advise trainees to choose the practice setting that is best for their personal and career satisfaction, and then build a student loan management plan around that. The exception may be the trainee who has a very large student loan burden (e.g., loan-to-income ratio of 2:1 or 3:1).

Caveats with PSLF

There have been well publicized concerns about the future of PSLF, including proposals to eliminate or cap the program.5,6 However, most proposed legislation has only recommended changes to PSLF for new borrowers. If you currently have existing federal loans, you would very likely be grandfathered into the existing PSLF terms. All federal master promissory notes since 2007 have cited PSLF as a loan repayment option.7 Hence, eliminating PSLF for existing borrowers seems unlikely since it would be changing the terms of an executed contract.8

There have also been widespread reports of high numbers of borrowers being denied applications for PSLF.9,10 However, the majority of these applicants did not have correct types of loans, had not worked full time for qualifying employers or had not made the full 120 payments.11 Yet some denials have apparently resulted from errors in tracking qualifying payments by FedLoan servicing.12 Therefore it would be prudent to keep your own careful records of all qualifying payments towards PSLF.

The nuclear option: 20- to 25-year IDR-based forgiveness

An additional option allows borrowers to make IDRs for 20-25 years (details in Figure 2) and then having their remaining loan balance forgiven.13 This option is completely independent of PSLF. Borrowers can work full time or part time and can work for any employer, including private employers.

One additional option: NIH loan repayment programs

One additional solution to consider are the NIH Loan Repayment Programs (LRPs). These programs can provide substantial loan repayment (up to $50,000 annually) for trainees and attendings engaged in research that aligns with NIH priorities, including clinical research or health disparities research.14 Notably, the applicant’s research does not have to be NIH sponsored research.

Getting more information

The approach above is a general overview of student loan concepts for gastroenterologists. However, there are countless nuances and tactics that are beyond the scope of this introductory article. I encourage everyone to get additional information and advice when making your own loan management plan. There are many helpful online resources, podcasts, and books discussing the topic. Several companies provide detailed consultation on managing student loans. Such services may cost a few hundred dollars but could potentially save tens of thousands of dollars on student loan costs.

Dr. Jain is assistant professor of medicine, division of gastroenterology & hepatology, department of medicine, University of North Carolina School of Medicine, Chapel Hill. Dr. Jain has no conflicts of interest and no funding source.

References

1. https://nces.ed.gov/programs/digest/d18/tables/dt18_332.45.asp

2. https://www.credible.com/blog/statistics/average-medical-school-debt/

3. https://studentaid.gov/understand-aid/types/loans/interest-rates

4. https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

5. https://www.forbes.com/sites/robertfarrington/2019/09/24/how-to-get-your-public-service-loan-forgiveness-qualifying-payments-recounted/#18567f061f5d

6. https://www.cbo.gov/budget-options/2018/54721

7. https://static.studentloans.gov/images/ApplicationAndPromissoryNote.pdf

8. https://www.biglawinvestor.com/pslf-promissory-note/

9. https://bostonstudentloanlawyer.com/scary-stats-for-public-service-loan-forgiveness/

10. https://www.marketwatch.com/story/this-government-loan-forgiveness-program-has-rejected-99-of-borrowers-so-far-2018-09-20

11. https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data

12. https://www.nytimes.com/2019/04/12/your-money/public-service-loan-forgiveness.html

13. https://studentaid.gov/manage-loans/repayment/plans/income-driven

14. https://www.lrp.nih.gov/eligibility-programs

The young gastroenterologist has no shortage of personal finance topics to juggle, ranging from investments, to life and disability coverage, and planning for retirement. But the elephant in the room is student loan management. Average medical student debt today is approximately $240,000, and debt burdens greater than $300,000 are becoming common.1,2 With this staggering amount of debt, it is understandable why student loans are a major source of anxiety. Here, I will provide a brief introduction to student loan management for gastroenterologists.

Student loans: Basic strategy

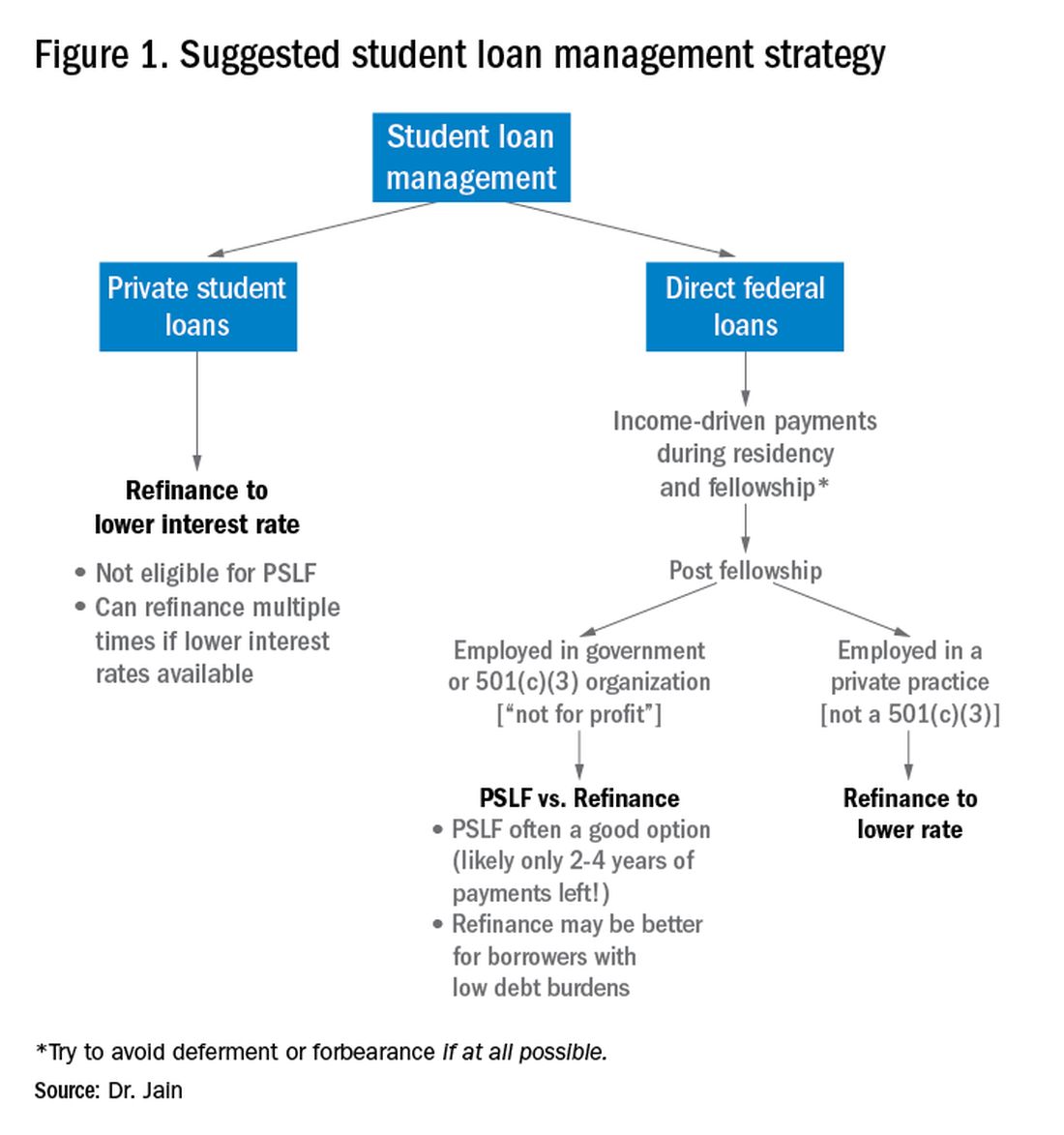

It is important to distinguish between two major types of loans: private student loans and direct federal loans. With private student loans the best strategy in most cases is to refinance to a lower interest rate. For direct federal loans, however, the decision making is more complex. There are two major approaches to these federal loans – either 1) refinance, or 2) go for public service loan forgiveness (PSLF). See Figure 1 for a flowchart summarizing my general approach to student loan management.

Refinance basics

One potential approach is to refinance your federal loans. Most federal loans today are at a relatively high interest rate of 6%-8%.3 Private refinancing can yield rates in the 3%-5% range, depending on the type of loan and other factors. For a loan balance of $200,000, the savings by refinancing could be approximately $2,000-$10,000 per year in interest alone. However, refinancing your loans with a private company eliminates the possibility of PSLF. Hence, you should only refinance federal loans once you are sure that you will not be pursuing PSLF. You may refinance your private loans anytime since they do not qualify for PSLF. There are multiple companies that provide student loan refinancing. The process can be done online, sometimes in as little as 30 minutes. There is generally little or no cost to refinancing, and many companies even provide a small cash-back incentive to refinance.

PSLF basics

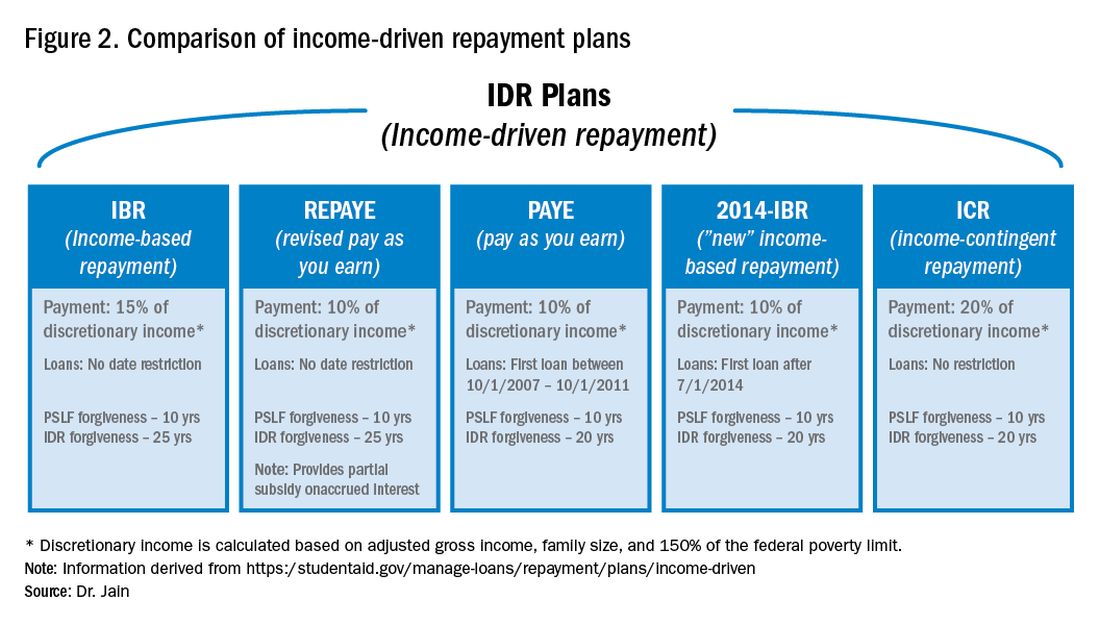

The PSLF program allows borrowers to have the remainder of their direct loans forgiven after 10 years (120 monthly payments) under a qualifying income-driven repayment (IDR) plan.4 Figure 2 shows an overview of the various IDR plans. During the 120 payments, the borrower must work full time for a qualifying employer, which includes a government employer or a not-for-profit 501(c)(3) organization. Loan forgiveness with PSLF is completely tax free. Importantly, the PSLF program only applies to direct federal loans. You can see your federal loan types and balances by visiting https://studentaid.gov/.

To PSLF or not to PSLF?

With direct federal loans, the decision to refinance or go for PSLF is a major fork in the road. PSLF can be a good option for borrowers with long training programs and with high student loan burdens (e.g., loan-to-income ratios of 1:1, 2:1 or higher). By contrast, borrowers with short training programs or relatively small loan burdens may be better off refinancing to a low interest rate and paying off loans quickly. Virtually all institutions that train residents and fellows are qualified government or 501(c)(3) organizations. Hence, a gastroenterology graduate generally will have completed at least 6 out of 10 years of payments by the end of training. Trainees who did a chief resident year or gastroenterology research track may have completed 7 or 8 years of qualifying payments already.

For trainees who are already planning an academic career, PSLF is often a good option. While PSLF can be a nice benefit, I would not advise making a career decision purely based on PSLF. Private practice jobs generally come with substantially higher salaries than academic and government jobs. This salary differential typically more than compensates for the loss of access to PSLF. Hence, I advise trainees to choose the practice setting that is best for their personal and career satisfaction, and then build a student loan management plan around that. The exception may be the trainee who has a very large student loan burden (e.g., loan-to-income ratio of 2:1 or 3:1).

Caveats with PSLF

There have been well publicized concerns about the future of PSLF, including proposals to eliminate or cap the program.5,6 However, most proposed legislation has only recommended changes to PSLF for new borrowers. If you currently have existing federal loans, you would very likely be grandfathered into the existing PSLF terms. All federal master promissory notes since 2007 have cited PSLF as a loan repayment option.7 Hence, eliminating PSLF for existing borrowers seems unlikely since it would be changing the terms of an executed contract.8

There have also been widespread reports of high numbers of borrowers being denied applications for PSLF.9,10 However, the majority of these applicants did not have correct types of loans, had not worked full time for qualifying employers or had not made the full 120 payments.11 Yet some denials have apparently resulted from errors in tracking qualifying payments by FedLoan servicing.12 Therefore it would be prudent to keep your own careful records of all qualifying payments towards PSLF.

The nuclear option: 20- to 25-year IDR-based forgiveness

An additional option allows borrowers to make IDRs for 20-25 years (details in Figure 2) and then having their remaining loan balance forgiven.13 This option is completely independent of PSLF. Borrowers can work full time or part time and can work for any employer, including private employers.

One additional option: NIH loan repayment programs

One additional solution to consider are the NIH Loan Repayment Programs (LRPs). These programs can provide substantial loan repayment (up to $50,000 annually) for trainees and attendings engaged in research that aligns with NIH priorities, including clinical research or health disparities research.14 Notably, the applicant’s research does not have to be NIH sponsored research.

Getting more information

The approach above is a general overview of student loan concepts for gastroenterologists. However, there are countless nuances and tactics that are beyond the scope of this introductory article. I encourage everyone to get additional information and advice when making your own loan management plan. There are many helpful online resources, podcasts, and books discussing the topic. Several companies provide detailed consultation on managing student loans. Such services may cost a few hundred dollars but could potentially save tens of thousands of dollars on student loan costs.

Dr. Jain is assistant professor of medicine, division of gastroenterology & hepatology, department of medicine, University of North Carolina School of Medicine, Chapel Hill. Dr. Jain has no conflicts of interest and no funding source.

References

1. https://nces.ed.gov/programs/digest/d18/tables/dt18_332.45.asp

2. https://www.credible.com/blog/statistics/average-medical-school-debt/

3. https://studentaid.gov/understand-aid/types/loans/interest-rates

4. https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

5. https://www.forbes.com/sites/robertfarrington/2019/09/24/how-to-get-your-public-service-loan-forgiveness-qualifying-payments-recounted/#18567f061f5d

6. https://www.cbo.gov/budget-options/2018/54721

7. https://static.studentloans.gov/images/ApplicationAndPromissoryNote.pdf

8. https://www.biglawinvestor.com/pslf-promissory-note/

9. https://bostonstudentloanlawyer.com/scary-stats-for-public-service-loan-forgiveness/

10. https://www.marketwatch.com/story/this-government-loan-forgiveness-program-has-rejected-99-of-borrowers-so-far-2018-09-20

11. https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data

12. https://www.nytimes.com/2019/04/12/your-money/public-service-loan-forgiveness.html

13. https://studentaid.gov/manage-loans/repayment/plans/income-driven

14. https://www.lrp.nih.gov/eligibility-programs

The young gastroenterologist has no shortage of personal finance topics to juggle, ranging from investments, to life and disability coverage, and planning for retirement. But the elephant in the room is student loan management. Average medical student debt today is approximately $240,000, and debt burdens greater than $300,000 are becoming common.1,2 With this staggering amount of debt, it is understandable why student loans are a major source of anxiety. Here, I will provide a brief introduction to student loan management for gastroenterologists.

Student loans: Basic strategy

It is important to distinguish between two major types of loans: private student loans and direct federal loans. With private student loans the best strategy in most cases is to refinance to a lower interest rate. For direct federal loans, however, the decision making is more complex. There are two major approaches to these federal loans – either 1) refinance, or 2) go for public service loan forgiveness (PSLF). See Figure 1 for a flowchart summarizing my general approach to student loan management.

Refinance basics

One potential approach is to refinance your federal loans. Most federal loans today are at a relatively high interest rate of 6%-8%.3 Private refinancing can yield rates in the 3%-5% range, depending on the type of loan and other factors. For a loan balance of $200,000, the savings by refinancing could be approximately $2,000-$10,000 per year in interest alone. However, refinancing your loans with a private company eliminates the possibility of PSLF. Hence, you should only refinance federal loans once you are sure that you will not be pursuing PSLF. You may refinance your private loans anytime since they do not qualify for PSLF. There are multiple companies that provide student loan refinancing. The process can be done online, sometimes in as little as 30 minutes. There is generally little or no cost to refinancing, and many companies even provide a small cash-back incentive to refinance.

PSLF basics

The PSLF program allows borrowers to have the remainder of their direct loans forgiven after 10 years (120 monthly payments) under a qualifying income-driven repayment (IDR) plan.4 Figure 2 shows an overview of the various IDR plans. During the 120 payments, the borrower must work full time for a qualifying employer, which includes a government employer or a not-for-profit 501(c)(3) organization. Loan forgiveness with PSLF is completely tax free. Importantly, the PSLF program only applies to direct federal loans. You can see your federal loan types and balances by visiting https://studentaid.gov/.

To PSLF or not to PSLF?

With direct federal loans, the decision to refinance or go for PSLF is a major fork in the road. PSLF can be a good option for borrowers with long training programs and with high student loan burdens (e.g., loan-to-income ratios of 1:1, 2:1 or higher). By contrast, borrowers with short training programs or relatively small loan burdens may be better off refinancing to a low interest rate and paying off loans quickly. Virtually all institutions that train residents and fellows are qualified government or 501(c)(3) organizations. Hence, a gastroenterology graduate generally will have completed at least 6 out of 10 years of payments by the end of training. Trainees who did a chief resident year or gastroenterology research track may have completed 7 or 8 years of qualifying payments already.

For trainees who are already planning an academic career, PSLF is often a good option. While PSLF can be a nice benefit, I would not advise making a career decision purely based on PSLF. Private practice jobs generally come with substantially higher salaries than academic and government jobs. This salary differential typically more than compensates for the loss of access to PSLF. Hence, I advise trainees to choose the practice setting that is best for their personal and career satisfaction, and then build a student loan management plan around that. The exception may be the trainee who has a very large student loan burden (e.g., loan-to-income ratio of 2:1 or 3:1).

Caveats with PSLF

There have been well publicized concerns about the future of PSLF, including proposals to eliminate or cap the program.5,6 However, most proposed legislation has only recommended changes to PSLF for new borrowers. If you currently have existing federal loans, you would very likely be grandfathered into the existing PSLF terms. All federal master promissory notes since 2007 have cited PSLF as a loan repayment option.7 Hence, eliminating PSLF for existing borrowers seems unlikely since it would be changing the terms of an executed contract.8

There have also been widespread reports of high numbers of borrowers being denied applications for PSLF.9,10 However, the majority of these applicants did not have correct types of loans, had not worked full time for qualifying employers or had not made the full 120 payments.11 Yet some denials have apparently resulted from errors in tracking qualifying payments by FedLoan servicing.12 Therefore it would be prudent to keep your own careful records of all qualifying payments towards PSLF.

The nuclear option: 20- to 25-year IDR-based forgiveness

An additional option allows borrowers to make IDRs for 20-25 years (details in Figure 2) and then having their remaining loan balance forgiven.13 This option is completely independent of PSLF. Borrowers can work full time or part time and can work for any employer, including private employers.

One additional option: NIH loan repayment programs

One additional solution to consider are the NIH Loan Repayment Programs (LRPs). These programs can provide substantial loan repayment (up to $50,000 annually) for trainees and attendings engaged in research that aligns with NIH priorities, including clinical research or health disparities research.14 Notably, the applicant’s research does not have to be NIH sponsored research.

Getting more information

The approach above is a general overview of student loan concepts for gastroenterologists. However, there are countless nuances and tactics that are beyond the scope of this introductory article. I encourage everyone to get additional information and advice when making your own loan management plan. There are many helpful online resources, podcasts, and books discussing the topic. Several companies provide detailed consultation on managing student loans. Such services may cost a few hundred dollars but could potentially save tens of thousands of dollars on student loan costs.

Dr. Jain is assistant professor of medicine, division of gastroenterology & hepatology, department of medicine, University of North Carolina School of Medicine, Chapel Hill. Dr. Jain has no conflicts of interest and no funding source.

References

1. https://nces.ed.gov/programs/digest/d18/tables/dt18_332.45.asp

2. https://www.credible.com/blog/statistics/average-medical-school-debt/

3. https://studentaid.gov/understand-aid/types/loans/interest-rates

4. https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

5. https://www.forbes.com/sites/robertfarrington/2019/09/24/how-to-get-your-public-service-loan-forgiveness-qualifying-payments-recounted/#18567f061f5d

6. https://www.cbo.gov/budget-options/2018/54721

7. https://static.studentloans.gov/images/ApplicationAndPromissoryNote.pdf

8. https://www.biglawinvestor.com/pslf-promissory-note/

9. https://bostonstudentloanlawyer.com/scary-stats-for-public-service-loan-forgiveness/

10. https://www.marketwatch.com/story/this-government-loan-forgiveness-program-has-rejected-99-of-borrowers-so-far-2018-09-20

11. https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data

12. https://www.nytimes.com/2019/04/12/your-money/public-service-loan-forgiveness.html

13. https://studentaid.gov/manage-loans/repayment/plans/income-driven

14. https://www.lrp.nih.gov/eligibility-programs