User login

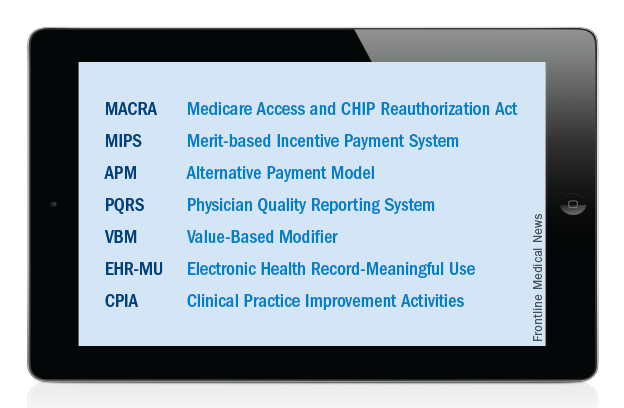

Just over a year ago, Congress passed and the President signed into law the MACRA legislation, which will serve as the basis for Medicare physician payment beginning in 2019. At the recent Leadership and Advocacy Summit, it became apparent to me that a “refresher” on seven key acronyms would be useful for surgeons as they gear up to understand and effectively participate in this “brave new world” which is rapidly approaching.

Accordingly, let us start at the beginning. MACRA stands for the Medicare Access and CHIP (Children’s Health Insurance Program) Reauthorization Act of 2015. As noted above, this legislation, signed into law by President Obama on April 16, 2015, replaces the flawed sustainable growth rate formula and will be the template utilized to determine Medicare physician payment beginning in 2019. However, it is important to note that it is anticipated that the data to be utilized as the basis for payment in 2019 will likely be collected sometime in 2017.

MACRA provides modest but stable positive updates of 0.5 percent/year for the 5-year period of 2015-2019. Fellows may remember that this provision was included in the legislation as a direct result of objections made by the leadership of the ACS to the original draft legislation, which contained no provision for a positive update. In addition, MACRA provides for the elimination, after 2018, of the current-law penalties associated with the existing Medicare quality programs, including the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program. That said, and as outlined below, we will not be saying goodbye to these programs completely. Accordingly, surgeons need to remain, or become, familiar with those acronyms and the programs they represent.

MACRA has two payment pathways. Physicians will choose to participate in one or the other. Those choices are: 1) MIPS (Merit-based Incentive Payment System) and 2) APMs (Alternative Payment Models).

Beginning in 2019, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program will be combined into MIPS (Merit-based Incentive Payment System). In this program, it is possible for all surgeons to receive an annual positive update based on their individual performance in the four categories of Quality, Resource Use, Electronic Health Record–Meaningful Use, and lastly the newly created category of Clinical Practice Improvement Activities (CPIA).

Individual surgeons’ performance in the four categories will be combined into a composite score. Each individual composite score will then be compared with a performance threshold. The threshold will be set as either the mean or median of the composite performance scores for all MIPS-eligible professionals from a prior performance period. The threshold will reset every year. Those with an individual composite performance score above the threshold will receive a positive payment adjustment while those with an individual composite performance score below the threshold will receive a negative payment adjustment.

The Quality component of the MIPS will consist of quality measures currently used in existing quality performance programs namely, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier program), and EHR-MU (Electronic Health Record–Meaningful Use), as well as measures developed by stakeholders to meet the needs of specialties lacking meaningful measures in the current programs. The RESOURCE USE component of MIPS will include the cost measures used in the current VBM (Value-Based Modifier) program. With regard to the Electronic Health Record–Meaningful Use (EHR-MU) component of MIPS, current EHR-MU requirements will continue to apply but are expected to be modified significantly. ACS continues to advocate for changes to the EHR-MU program to make it easier for surgeons to comply with requirements. Evidence of the effectiveness of our advocacy in this area is found in the success achieved in obtaining a blanket exception for the 2015 reporting period, Stage 2 Meaningful Use rule about which I wrote in the December 2015 and January 2016 editions of this column.

The CPIA (Clinical Practice Improvement Activities) are designed to assess surgeons’ effort toward improving their clinical practice and/or their preparation toward participating in APMs (Alternative Payment Models). The menu of specific, approved activities has yet to be firmly established. ACS provided significant input on the CPIA component of MIPS in our November 2015 response to the request for information issued by the Centers for Medicare & Medicaid Services (CMS) last fall. The MACRA legislation specifies that the CPIA be applicable to all specialties and be attainable for small practices and professionals in rural and underserved areas.

Those Fellows interested in knowing specifically the areas on which CMS requested input in the process of drafting the first proposed rule on MACRA and how ACS responded to same may find the letter sent in response to CMS at https://www.facs.org/~/media/files/advocacy/medicare/cms%20mips%20apm%20rfi%20final.ashx.

The new law takes concerted steps to incentivize and encourage providers to develop and participate in APMs (Alternative Payment Models). As with the CPIA discussed above, the details of APMs are not yet fully clear and are currently being developed. ACS is actively working on behalf of surgeons to develop APMs as part of the policy efforts of the Division of Advocacy and Health Policy. In general, these programs will require quality measures, the inclusion of elements of upside and downside financial risk for providers and use of certified electronic health record technology. For those surgeons who receive a significant share of their revenue from an APM, an annual 5% bonus will be available for each of the years 2019-2024. To qualify for that bonus, surgeons must receive 25% of their Medicare revenue from an APM in the years 2019 and 2020. That threshold requirement subsequently increases to 50% in 2021 and ultimately to 75% beginning in 2023.

As MACRA specifies that providers participate in either MIPS or APMs, surgeons who meet the aforementioned threshold of payment from a qualified APM will be exempted from many of the MIPS reporting requirements and receive the 5% bonus in lieu of the previously described MIPS payment adjustment. Those who participate in APMs but fail to meet the threshold necessary to receive the 5% bonus will receive credit for their participation in the CPIA component of their MIPS composite score but will not receive the 5% incentive.

While it is completely understandable that acronyms add to surgeons’ collective frustration, I am confident that all Fellows can, with relative ease, master the seven acronyms above and thus be well on their way to both understanding and successfully participating in the new Medicare physician payment system.

Until next month …

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.

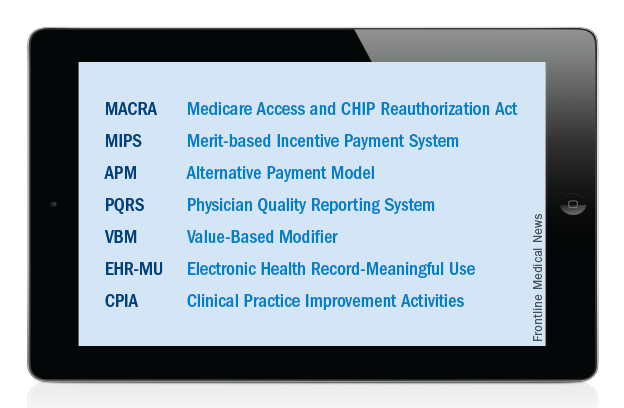

Just over a year ago, Congress passed and the President signed into law the MACRA legislation, which will serve as the basis for Medicare physician payment beginning in 2019. At the recent Leadership and Advocacy Summit, it became apparent to me that a “refresher” on seven key acronyms would be useful for surgeons as they gear up to understand and effectively participate in this “brave new world” which is rapidly approaching.

Accordingly, let us start at the beginning. MACRA stands for the Medicare Access and CHIP (Children’s Health Insurance Program) Reauthorization Act of 2015. As noted above, this legislation, signed into law by President Obama on April 16, 2015, replaces the flawed sustainable growth rate formula and will be the template utilized to determine Medicare physician payment beginning in 2019. However, it is important to note that it is anticipated that the data to be utilized as the basis for payment in 2019 will likely be collected sometime in 2017.

MACRA provides modest but stable positive updates of 0.5 percent/year for the 5-year period of 2015-2019. Fellows may remember that this provision was included in the legislation as a direct result of objections made by the leadership of the ACS to the original draft legislation, which contained no provision for a positive update. In addition, MACRA provides for the elimination, after 2018, of the current-law penalties associated with the existing Medicare quality programs, including the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program. That said, and as outlined below, we will not be saying goodbye to these programs completely. Accordingly, surgeons need to remain, or become, familiar with those acronyms and the programs they represent.

MACRA has two payment pathways. Physicians will choose to participate in one or the other. Those choices are: 1) MIPS (Merit-based Incentive Payment System) and 2) APMs (Alternative Payment Models).

Beginning in 2019, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program will be combined into MIPS (Merit-based Incentive Payment System). In this program, it is possible for all surgeons to receive an annual positive update based on their individual performance in the four categories of Quality, Resource Use, Electronic Health Record–Meaningful Use, and lastly the newly created category of Clinical Practice Improvement Activities (CPIA).

Individual surgeons’ performance in the four categories will be combined into a composite score. Each individual composite score will then be compared with a performance threshold. The threshold will be set as either the mean or median of the composite performance scores for all MIPS-eligible professionals from a prior performance period. The threshold will reset every year. Those with an individual composite performance score above the threshold will receive a positive payment adjustment while those with an individual composite performance score below the threshold will receive a negative payment adjustment.

The Quality component of the MIPS will consist of quality measures currently used in existing quality performance programs namely, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier program), and EHR-MU (Electronic Health Record–Meaningful Use), as well as measures developed by stakeholders to meet the needs of specialties lacking meaningful measures in the current programs. The RESOURCE USE component of MIPS will include the cost measures used in the current VBM (Value-Based Modifier) program. With regard to the Electronic Health Record–Meaningful Use (EHR-MU) component of MIPS, current EHR-MU requirements will continue to apply but are expected to be modified significantly. ACS continues to advocate for changes to the EHR-MU program to make it easier for surgeons to comply with requirements. Evidence of the effectiveness of our advocacy in this area is found in the success achieved in obtaining a blanket exception for the 2015 reporting period, Stage 2 Meaningful Use rule about which I wrote in the December 2015 and January 2016 editions of this column.

The CPIA (Clinical Practice Improvement Activities) are designed to assess surgeons’ effort toward improving their clinical practice and/or their preparation toward participating in APMs (Alternative Payment Models). The menu of specific, approved activities has yet to be firmly established. ACS provided significant input on the CPIA component of MIPS in our November 2015 response to the request for information issued by the Centers for Medicare & Medicaid Services (CMS) last fall. The MACRA legislation specifies that the CPIA be applicable to all specialties and be attainable for small practices and professionals in rural and underserved areas.

Those Fellows interested in knowing specifically the areas on which CMS requested input in the process of drafting the first proposed rule on MACRA and how ACS responded to same may find the letter sent in response to CMS at https://www.facs.org/~/media/files/advocacy/medicare/cms%20mips%20apm%20rfi%20final.ashx.

The new law takes concerted steps to incentivize and encourage providers to develop and participate in APMs (Alternative Payment Models). As with the CPIA discussed above, the details of APMs are not yet fully clear and are currently being developed. ACS is actively working on behalf of surgeons to develop APMs as part of the policy efforts of the Division of Advocacy and Health Policy. In general, these programs will require quality measures, the inclusion of elements of upside and downside financial risk for providers and use of certified electronic health record technology. For those surgeons who receive a significant share of their revenue from an APM, an annual 5% bonus will be available for each of the years 2019-2024. To qualify for that bonus, surgeons must receive 25% of their Medicare revenue from an APM in the years 2019 and 2020. That threshold requirement subsequently increases to 50% in 2021 and ultimately to 75% beginning in 2023.

As MACRA specifies that providers participate in either MIPS or APMs, surgeons who meet the aforementioned threshold of payment from a qualified APM will be exempted from many of the MIPS reporting requirements and receive the 5% bonus in lieu of the previously described MIPS payment adjustment. Those who participate in APMs but fail to meet the threshold necessary to receive the 5% bonus will receive credit for their participation in the CPIA component of their MIPS composite score but will not receive the 5% incentive.

While it is completely understandable that acronyms add to surgeons’ collective frustration, I am confident that all Fellows can, with relative ease, master the seven acronyms above and thus be well on their way to both understanding and successfully participating in the new Medicare physician payment system.

Until next month …

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.

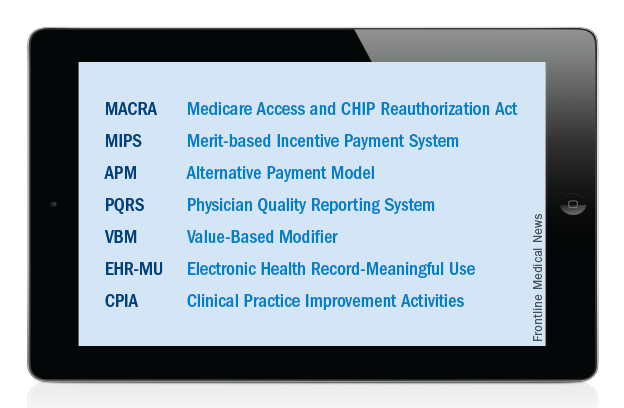

Just over a year ago, Congress passed and the President signed into law the MACRA legislation, which will serve as the basis for Medicare physician payment beginning in 2019. At the recent Leadership and Advocacy Summit, it became apparent to me that a “refresher” on seven key acronyms would be useful for surgeons as they gear up to understand and effectively participate in this “brave new world” which is rapidly approaching.

Accordingly, let us start at the beginning. MACRA stands for the Medicare Access and CHIP (Children’s Health Insurance Program) Reauthorization Act of 2015. As noted above, this legislation, signed into law by President Obama on April 16, 2015, replaces the flawed sustainable growth rate formula and will be the template utilized to determine Medicare physician payment beginning in 2019. However, it is important to note that it is anticipated that the data to be utilized as the basis for payment in 2019 will likely be collected sometime in 2017.

MACRA provides modest but stable positive updates of 0.5 percent/year for the 5-year period of 2015-2019. Fellows may remember that this provision was included in the legislation as a direct result of objections made by the leadership of the ACS to the original draft legislation, which contained no provision for a positive update. In addition, MACRA provides for the elimination, after 2018, of the current-law penalties associated with the existing Medicare quality programs, including the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program. That said, and as outlined below, we will not be saying goodbye to these programs completely. Accordingly, surgeons need to remain, or become, familiar with those acronyms and the programs they represent.

MACRA has two payment pathways. Physicians will choose to participate in one or the other. Those choices are: 1) MIPS (Merit-based Incentive Payment System) and 2) APMs (Alternative Payment Models).

Beginning in 2019, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program will be combined into MIPS (Merit-based Incentive Payment System). In this program, it is possible for all surgeons to receive an annual positive update based on their individual performance in the four categories of Quality, Resource Use, Electronic Health Record–Meaningful Use, and lastly the newly created category of Clinical Practice Improvement Activities (CPIA).

Individual surgeons’ performance in the four categories will be combined into a composite score. Each individual composite score will then be compared with a performance threshold. The threshold will be set as either the mean or median of the composite performance scores for all MIPS-eligible professionals from a prior performance period. The threshold will reset every year. Those with an individual composite performance score above the threshold will receive a positive payment adjustment while those with an individual composite performance score below the threshold will receive a negative payment adjustment.

The Quality component of the MIPS will consist of quality measures currently used in existing quality performance programs namely, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier program), and EHR-MU (Electronic Health Record–Meaningful Use), as well as measures developed by stakeholders to meet the needs of specialties lacking meaningful measures in the current programs. The RESOURCE USE component of MIPS will include the cost measures used in the current VBM (Value-Based Modifier) program. With regard to the Electronic Health Record–Meaningful Use (EHR-MU) component of MIPS, current EHR-MU requirements will continue to apply but are expected to be modified significantly. ACS continues to advocate for changes to the EHR-MU program to make it easier for surgeons to comply with requirements. Evidence of the effectiveness of our advocacy in this area is found in the success achieved in obtaining a blanket exception for the 2015 reporting period, Stage 2 Meaningful Use rule about which I wrote in the December 2015 and January 2016 editions of this column.

The CPIA (Clinical Practice Improvement Activities) are designed to assess surgeons’ effort toward improving their clinical practice and/or their preparation toward participating in APMs (Alternative Payment Models). The menu of specific, approved activities has yet to be firmly established. ACS provided significant input on the CPIA component of MIPS in our November 2015 response to the request for information issued by the Centers for Medicare & Medicaid Services (CMS) last fall. The MACRA legislation specifies that the CPIA be applicable to all specialties and be attainable for small practices and professionals in rural and underserved areas.

Those Fellows interested in knowing specifically the areas on which CMS requested input in the process of drafting the first proposed rule on MACRA and how ACS responded to same may find the letter sent in response to CMS at https://www.facs.org/~/media/files/advocacy/medicare/cms%20mips%20apm%20rfi%20final.ashx.

The new law takes concerted steps to incentivize and encourage providers to develop and participate in APMs (Alternative Payment Models). As with the CPIA discussed above, the details of APMs are not yet fully clear and are currently being developed. ACS is actively working on behalf of surgeons to develop APMs as part of the policy efforts of the Division of Advocacy and Health Policy. In general, these programs will require quality measures, the inclusion of elements of upside and downside financial risk for providers and use of certified electronic health record technology. For those surgeons who receive a significant share of their revenue from an APM, an annual 5% bonus will be available for each of the years 2019-2024. To qualify for that bonus, surgeons must receive 25% of their Medicare revenue from an APM in the years 2019 and 2020. That threshold requirement subsequently increases to 50% in 2021 and ultimately to 75% beginning in 2023.

As MACRA specifies that providers participate in either MIPS or APMs, surgeons who meet the aforementioned threshold of payment from a qualified APM will be exempted from many of the MIPS reporting requirements and receive the 5% bonus in lieu of the previously described MIPS payment adjustment. Those who participate in APMs but fail to meet the threshold necessary to receive the 5% bonus will receive credit for their participation in the CPIA component of their MIPS composite score but will not receive the 5% incentive.

While it is completely understandable that acronyms add to surgeons’ collective frustration, I am confident that all Fellows can, with relative ease, master the seven acronyms above and thus be well on their way to both understanding and successfully participating in the new Medicare physician payment system.

Until next month …

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.