User login

In a widely anticipated judgment on the Affordable Care Act (ACA), the US Supreme Court ruled 6-3 in favor of the law on June 26, 2015. The case at hand, King v. Burwell, challenged whether individuals purchasing health insurance through federal exchanges were eligible for federal premium subsidies. This ruling cemented the ACA into law and avoided a potential calamity in the private health insurance market. Let’s take a closer look.

What the case was about

The ACA allows states to set up their own health insurance exchanges or participate in a federally run exchange. Although the drafters of the ACA had expected each state to set up its own exchange, two-thirds of the states declined to do so, many in opposition to the ACA. As a result, 7 million citizens in 34 states now purchase their health insurance through federally created exchanges.

The plaintiffs in King v. Burwell argued that, because the legislation refers to those enrolled “through an Exchange established by the State,” individuals in states with federally run exchanges are not eligible for subsidies.

The law states:

(A) the monthly premiums for such month for 1 or more qualified health plans offered in the individual market within a State which cover the taxpayer, the taxpayer’s spouse, or any dependent (as defined in section 152) of the taxpayer and which were enrolled in through an Exchange established by the State under 1311 of the Patient Protection and Affordable Care Act…[emphasis added].

The Supreme Court was asked to decide whether to adhere to those exact words or to honor Congress’ intent to allow individuals to purchase subsidized insurance on any type of exchange.

What might have happened

We’ve explored in previous articles the interconnectedness of many sections of the ACA. Nowhere is that interconnectedness more clearly demonstrated than here. In order to ensure that private health insurers provide better coverage, the law requires them to abide by important consumer protections, including the elimination of “preexisting condition” exclusions. In order to prevent adverse selection and keep insurers solvent under these new rules, all individuals are required to have health care coverage—the individual mandate. If everyone is required to purchase health insurance, it has to be affordable, so lower-income individuals were promised subsidies, paid for 100% by the federal government, to help them cover their premiums when insurance is purchased through an exchange. Take away the subsidies and the whole thing starts to unravel.

The Urban Institute estimated that a Supreme Court ruling in favor of King, which would have eliminated the subsidies in states using a federal exchange, would have reduced federal tax subsidies by $29 billion in 2016, making coverage unaffordable for many and increasing the ranks of the uninsured by 8.2 million people.1

Louise Sheiner and Brendan Mochoruk of the Brookings Institute speculated that healthy individuals would disproportionately leave the marketplace, triggering 35% increases in insurance premiums for those remaining, as well as significant increases in premiums for those who just lost their subsidies.2 Many observers, including these experts, forecast that insurance companies would exit the federal exchanges altogether, triggering a health insurance “death spiral”: As premiums rise, the healthiest customers leave the marketplace, causing premiums to rise more, causing more healthy people to leave, and so on.

Clearly, this Supreme Court decision has had dramatic, long-term, real-world effects on millions of Americans. On the national level, 6,387,789 individuals were at risk of losing their tax credits if the Supreme Court had ruled in favor of King. That number represents more than $1.7 billion in total monthly tax credits. For a look at how a judgment in favor of King would have affected subsidies on a state-by-state basis, see TABLE 1.

What other commentators are saying about the King v. Burwell decision

In his majority opinion, Chief Justice John Roberts noted that the “meaning of the phrase ‘established by the State’ is not so clear.” And as Amy Howe articulated on SCOTUSblog: “if the phrase…is in fact not clear…then the next step is to look at the Affordable Care Act more broadly to determine what Congress meant by the phrase. And when you do that, the Court reasoned, it becomes apparent that Congress actually intended for the subsidies to be available to everyone who buys health insurance on an exchange, no matter who created it. If the subsidies weren’t available in the states with federal exchanges, the Court explained, the insurance markets in those states simply wouldn’t work properly: without the subsidies, almost all of the people who purchased insurance on the exchanges would no longer be required to purchase insurance because it would be too expensive. This would create a ‘death spiral’….”

—Amy Howe, SCOTUSblog3

“Additional court challenges to other ACA provisions are still possible, but King’s six-member majority shows little appetite for challenges threatening the Act’s core structure. Even Scalia’s dissent recognizes that the ACA may one day ‘attain the enduring status of the Social Security Act.’ Thus, the decision may usher in a new era of policy maturity, in which efforts to undermine the ACA diminish, as focus shifts to efforts to implement and improve it.”

—Mark A. Hall, JD, New England Journal of Medicine4

“With the Court upholding the administration’s interpretation of the law, the Obama administration has little reason to accede to

Republican proposals. The Court’s decision effectively puts the future of the ACA on hold until the 2016 elections, when the people will decide whether to stay the course or to chart a very different path.”

—Timothy Jost, Health Affairs5

“A case that 6 months ago seemed to offer the Court’s conservatives a low-risk opportunity to accomplish what they almost did in 2012—kill the Affordable Care Act—became suffused with danger, for the millions of newly insured Americans, of course, but also for the Supreme Court itself. Ideology came face to face with reality, and reality prevailed.”

—Linda Greenhouse, New York Times6

How premium subsidies work

Premium subsidies are actually tax credits. Individuals and families can qualify for them to purchase any type of health insurance offered on an exchange, except catastrophic coverage. To receive the premium tax credit for coverage starting in 2015, a marketplace enrollee must:

- have a household income that is 1 to4 times the federal poverty level. In 2015, the range of incomes that qualify for subsidies is $11,670 for an individual and $23,850 for a family of 4 at 100% of the federal poverty level. At 400% of the federal poverty level, it is $46,680 for an individual and $95,400 for a family of 4.

- lack access to affordable coverage through an employer (including a family member’s employer)

- be ineligible for coverage through Medicare, Medicaid, the Children’s Health Insurance Program, or other forms of public assistance

- have US citizenship or proof of legal residency

- file taxes jointly if married.

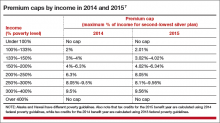

The premium tax credit caps the amount that an individual or family must spend on their monthly payments for health insurance. The cap depends on the family’s income; lower-income families have a lower cap. The amount of the tax credit remains the same, so a person who purchases a more expensive plan pays the cost difference (TABLE 2).

The ruling’s effect on women’s health

On June 26, American College of Obstetricians and Gynecologists President Mark S. DeFrancesco, MD, MBA, hailed the Supreme Court decision, saying, “Importantly, recent data have shown that newly insured adults under the ACA were more likely to be women. Those who did gain coverage through the ACA reported better access to health care and better financial security from medical costs.”

“Without question, many women enrollees were able to purchase health insurance coverage due, in part, to the ACA subsidies that helped make this purchase affordable. In fact, government data have suggested that roughly 85% of health exchange enrollees received subsidies,” Dr. DeFrancesco said.

“If the Supreme Court had overturned this important assistance, approximately 4.8 million women would have been unable to afford the coverage that they need. The impact also would have been widespread; as these women were forced to leave the insurance marketplace, it is likely that premiums throughout the marketplace would have risen dramatically,” he continued.

“Instead, patients—especially the low- and moderate-income American women who have particularly benefited from ACA subsidies—will continue to have the peace of mind that comes with insurance coverage.”

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

1. Blumberg LJ, Buettgens M, Holahan J. The implications of a Supreme Court finding for the plaintiff in King v. Burwell: 8.2 million more uninsured and 35% higher premiums. Urban Institute. http://www.urban.org/research/publication/implications-supreme-court-finding-plaintiff-king-vs-burwell-82-million-more-uninsured-and-35-higher-premiums. Published January 8, 2015. Accessed July 2, 2015.

2. Sheiner L, Mochoruk B. King v. Burwell explained. Brookings Institute. http://www.brookings.edu/blogs/health360/posts/2015/03/03-king-v-burwell-explainer-sheiner. Published March 3, 2015. Accessed July 2, 2015.

3. Howe A. Court backs Obama administration on health care subsidies: In plain English. SCOTUSblog. http://www.scotusblog.com/2015/06/court-backs-obama-administration-on-health-care-subsidies-in-plain-english/. Published June 25, 2015. Accessed July 1, 2015.

4. Hall MA. King v. Burwell—ACA Armageddon averted. N Engl J Med. http://www.nejm.org/doi/full/10.1056/NEJMp1504077. Published July 1, 2015. Accessed July 2, 2015.

5. Jost T. Implementing health reform: The Supreme Court upholds tax credits in the federal exchange. Health Affairs blog. http://healthaffairs.org/blog/2015/06/25/implementing-health-reform-the-supreme-court-upholds-tax-credits-in-the-federal-exchange/. Published June 25, 2015. Accessed July 1, 2015.

6. Greenhouse L. The Roberts Court’s reality check. New York Times. http://www.nytimes.com/2015/06/26/opinion/the-roberts-courts-reality-check.html. Published June 25, 2015. Accessed July 1, 2015.

7. Henry J. Kaiser Family Foundation. Explaining health care reform: questions about health insurance subsidies. Table 2. http://kff.org/health-reform/issue-brief/explaining-health-care-reform-questions-about-health/. Published October 27, 2014. Accessed July 2, 2015.

In a widely anticipated judgment on the Affordable Care Act (ACA), the US Supreme Court ruled 6-3 in favor of the law on June 26, 2015. The case at hand, King v. Burwell, challenged whether individuals purchasing health insurance through federal exchanges were eligible for federal premium subsidies. This ruling cemented the ACA into law and avoided a potential calamity in the private health insurance market. Let’s take a closer look.

What the case was about

The ACA allows states to set up their own health insurance exchanges or participate in a federally run exchange. Although the drafters of the ACA had expected each state to set up its own exchange, two-thirds of the states declined to do so, many in opposition to the ACA. As a result, 7 million citizens in 34 states now purchase their health insurance through federally created exchanges.

The plaintiffs in King v. Burwell argued that, because the legislation refers to those enrolled “through an Exchange established by the State,” individuals in states with federally run exchanges are not eligible for subsidies.

The law states:

(A) the monthly premiums for such month for 1 or more qualified health plans offered in the individual market within a State which cover the taxpayer, the taxpayer’s spouse, or any dependent (as defined in section 152) of the taxpayer and which were enrolled in through an Exchange established by the State under 1311 of the Patient Protection and Affordable Care Act…[emphasis added].

The Supreme Court was asked to decide whether to adhere to those exact words or to honor Congress’ intent to allow individuals to purchase subsidized insurance on any type of exchange.

What might have happened

We’ve explored in previous articles the interconnectedness of many sections of the ACA. Nowhere is that interconnectedness more clearly demonstrated than here. In order to ensure that private health insurers provide better coverage, the law requires them to abide by important consumer protections, including the elimination of “preexisting condition” exclusions. In order to prevent adverse selection and keep insurers solvent under these new rules, all individuals are required to have health care coverage—the individual mandate. If everyone is required to purchase health insurance, it has to be affordable, so lower-income individuals were promised subsidies, paid for 100% by the federal government, to help them cover their premiums when insurance is purchased through an exchange. Take away the subsidies and the whole thing starts to unravel.

The Urban Institute estimated that a Supreme Court ruling in favor of King, which would have eliminated the subsidies in states using a federal exchange, would have reduced federal tax subsidies by $29 billion in 2016, making coverage unaffordable for many and increasing the ranks of the uninsured by 8.2 million people.1

Louise Sheiner and Brendan Mochoruk of the Brookings Institute speculated that healthy individuals would disproportionately leave the marketplace, triggering 35% increases in insurance premiums for those remaining, as well as significant increases in premiums for those who just lost their subsidies.2 Many observers, including these experts, forecast that insurance companies would exit the federal exchanges altogether, triggering a health insurance “death spiral”: As premiums rise, the healthiest customers leave the marketplace, causing premiums to rise more, causing more healthy people to leave, and so on.

Clearly, this Supreme Court decision has had dramatic, long-term, real-world effects on millions of Americans. On the national level, 6,387,789 individuals were at risk of losing their tax credits if the Supreme Court had ruled in favor of King. That number represents more than $1.7 billion in total monthly tax credits. For a look at how a judgment in favor of King would have affected subsidies on a state-by-state basis, see TABLE 1.

What other commentators are saying about the King v. Burwell decision

In his majority opinion, Chief Justice John Roberts noted that the “meaning of the phrase ‘established by the State’ is not so clear.” And as Amy Howe articulated on SCOTUSblog: “if the phrase…is in fact not clear…then the next step is to look at the Affordable Care Act more broadly to determine what Congress meant by the phrase. And when you do that, the Court reasoned, it becomes apparent that Congress actually intended for the subsidies to be available to everyone who buys health insurance on an exchange, no matter who created it. If the subsidies weren’t available in the states with federal exchanges, the Court explained, the insurance markets in those states simply wouldn’t work properly: without the subsidies, almost all of the people who purchased insurance on the exchanges would no longer be required to purchase insurance because it would be too expensive. This would create a ‘death spiral’….”

—Amy Howe, SCOTUSblog3

“Additional court challenges to other ACA provisions are still possible, but King’s six-member majority shows little appetite for challenges threatening the Act’s core structure. Even Scalia’s dissent recognizes that the ACA may one day ‘attain the enduring status of the Social Security Act.’ Thus, the decision may usher in a new era of policy maturity, in which efforts to undermine the ACA diminish, as focus shifts to efforts to implement and improve it.”

—Mark A. Hall, JD, New England Journal of Medicine4

“With the Court upholding the administration’s interpretation of the law, the Obama administration has little reason to accede to

Republican proposals. The Court’s decision effectively puts the future of the ACA on hold until the 2016 elections, when the people will decide whether to stay the course or to chart a very different path.”

—Timothy Jost, Health Affairs5

“A case that 6 months ago seemed to offer the Court’s conservatives a low-risk opportunity to accomplish what they almost did in 2012—kill the Affordable Care Act—became suffused with danger, for the millions of newly insured Americans, of course, but also for the Supreme Court itself. Ideology came face to face with reality, and reality prevailed.”

—Linda Greenhouse, New York Times6

How premium subsidies work

Premium subsidies are actually tax credits. Individuals and families can qualify for them to purchase any type of health insurance offered on an exchange, except catastrophic coverage. To receive the premium tax credit for coverage starting in 2015, a marketplace enrollee must:

- have a household income that is 1 to4 times the federal poverty level. In 2015, the range of incomes that qualify for subsidies is $11,670 for an individual and $23,850 for a family of 4 at 100% of the federal poverty level. At 400% of the federal poverty level, it is $46,680 for an individual and $95,400 for a family of 4.

- lack access to affordable coverage through an employer (including a family member’s employer)

- be ineligible for coverage through Medicare, Medicaid, the Children’s Health Insurance Program, or other forms of public assistance

- have US citizenship or proof of legal residency

- file taxes jointly if married.

The premium tax credit caps the amount that an individual or family must spend on their monthly payments for health insurance. The cap depends on the family’s income; lower-income families have a lower cap. The amount of the tax credit remains the same, so a person who purchases a more expensive plan pays the cost difference (TABLE 2).

The ruling’s effect on women’s health

On June 26, American College of Obstetricians and Gynecologists President Mark S. DeFrancesco, MD, MBA, hailed the Supreme Court decision, saying, “Importantly, recent data have shown that newly insured adults under the ACA were more likely to be women. Those who did gain coverage through the ACA reported better access to health care and better financial security from medical costs.”

“Without question, many women enrollees were able to purchase health insurance coverage due, in part, to the ACA subsidies that helped make this purchase affordable. In fact, government data have suggested that roughly 85% of health exchange enrollees received subsidies,” Dr. DeFrancesco said.

“If the Supreme Court had overturned this important assistance, approximately 4.8 million women would have been unable to afford the coverage that they need. The impact also would have been widespread; as these women were forced to leave the insurance marketplace, it is likely that premiums throughout the marketplace would have risen dramatically,” he continued.

“Instead, patients—especially the low- and moderate-income American women who have particularly benefited from ACA subsidies—will continue to have the peace of mind that comes with insurance coverage.”

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

In a widely anticipated judgment on the Affordable Care Act (ACA), the US Supreme Court ruled 6-3 in favor of the law on June 26, 2015. The case at hand, King v. Burwell, challenged whether individuals purchasing health insurance through federal exchanges were eligible for federal premium subsidies. This ruling cemented the ACA into law and avoided a potential calamity in the private health insurance market. Let’s take a closer look.

What the case was about

The ACA allows states to set up their own health insurance exchanges or participate in a federally run exchange. Although the drafters of the ACA had expected each state to set up its own exchange, two-thirds of the states declined to do so, many in opposition to the ACA. As a result, 7 million citizens in 34 states now purchase their health insurance through federally created exchanges.

The plaintiffs in King v. Burwell argued that, because the legislation refers to those enrolled “through an Exchange established by the State,” individuals in states with federally run exchanges are not eligible for subsidies.

The law states:

(A) the monthly premiums for such month for 1 or more qualified health plans offered in the individual market within a State which cover the taxpayer, the taxpayer’s spouse, or any dependent (as defined in section 152) of the taxpayer and which were enrolled in through an Exchange established by the State under 1311 of the Patient Protection and Affordable Care Act…[emphasis added].

The Supreme Court was asked to decide whether to adhere to those exact words or to honor Congress’ intent to allow individuals to purchase subsidized insurance on any type of exchange.

What might have happened

We’ve explored in previous articles the interconnectedness of many sections of the ACA. Nowhere is that interconnectedness more clearly demonstrated than here. In order to ensure that private health insurers provide better coverage, the law requires them to abide by important consumer protections, including the elimination of “preexisting condition” exclusions. In order to prevent adverse selection and keep insurers solvent under these new rules, all individuals are required to have health care coverage—the individual mandate. If everyone is required to purchase health insurance, it has to be affordable, so lower-income individuals were promised subsidies, paid for 100% by the federal government, to help them cover their premiums when insurance is purchased through an exchange. Take away the subsidies and the whole thing starts to unravel.

The Urban Institute estimated that a Supreme Court ruling in favor of King, which would have eliminated the subsidies in states using a federal exchange, would have reduced federal tax subsidies by $29 billion in 2016, making coverage unaffordable for many and increasing the ranks of the uninsured by 8.2 million people.1

Louise Sheiner and Brendan Mochoruk of the Brookings Institute speculated that healthy individuals would disproportionately leave the marketplace, triggering 35% increases in insurance premiums for those remaining, as well as significant increases in premiums for those who just lost their subsidies.2 Many observers, including these experts, forecast that insurance companies would exit the federal exchanges altogether, triggering a health insurance “death spiral”: As premiums rise, the healthiest customers leave the marketplace, causing premiums to rise more, causing more healthy people to leave, and so on.

Clearly, this Supreme Court decision has had dramatic, long-term, real-world effects on millions of Americans. On the national level, 6,387,789 individuals were at risk of losing their tax credits if the Supreme Court had ruled in favor of King. That number represents more than $1.7 billion in total monthly tax credits. For a look at how a judgment in favor of King would have affected subsidies on a state-by-state basis, see TABLE 1.

What other commentators are saying about the King v. Burwell decision

In his majority opinion, Chief Justice John Roberts noted that the “meaning of the phrase ‘established by the State’ is not so clear.” And as Amy Howe articulated on SCOTUSblog: “if the phrase…is in fact not clear…then the next step is to look at the Affordable Care Act more broadly to determine what Congress meant by the phrase. And when you do that, the Court reasoned, it becomes apparent that Congress actually intended for the subsidies to be available to everyone who buys health insurance on an exchange, no matter who created it. If the subsidies weren’t available in the states with federal exchanges, the Court explained, the insurance markets in those states simply wouldn’t work properly: without the subsidies, almost all of the people who purchased insurance on the exchanges would no longer be required to purchase insurance because it would be too expensive. This would create a ‘death spiral’….”

—Amy Howe, SCOTUSblog3

“Additional court challenges to other ACA provisions are still possible, but King’s six-member majority shows little appetite for challenges threatening the Act’s core structure. Even Scalia’s dissent recognizes that the ACA may one day ‘attain the enduring status of the Social Security Act.’ Thus, the decision may usher in a new era of policy maturity, in which efforts to undermine the ACA diminish, as focus shifts to efforts to implement and improve it.”

—Mark A. Hall, JD, New England Journal of Medicine4

“With the Court upholding the administration’s interpretation of the law, the Obama administration has little reason to accede to

Republican proposals. The Court’s decision effectively puts the future of the ACA on hold until the 2016 elections, when the people will decide whether to stay the course or to chart a very different path.”

—Timothy Jost, Health Affairs5

“A case that 6 months ago seemed to offer the Court’s conservatives a low-risk opportunity to accomplish what they almost did in 2012—kill the Affordable Care Act—became suffused with danger, for the millions of newly insured Americans, of course, but also for the Supreme Court itself. Ideology came face to face with reality, and reality prevailed.”

—Linda Greenhouse, New York Times6

How premium subsidies work

Premium subsidies are actually tax credits. Individuals and families can qualify for them to purchase any type of health insurance offered on an exchange, except catastrophic coverage. To receive the premium tax credit for coverage starting in 2015, a marketplace enrollee must:

- have a household income that is 1 to4 times the federal poverty level. In 2015, the range of incomes that qualify for subsidies is $11,670 for an individual and $23,850 for a family of 4 at 100% of the federal poverty level. At 400% of the federal poverty level, it is $46,680 for an individual and $95,400 for a family of 4.

- lack access to affordable coverage through an employer (including a family member’s employer)

- be ineligible for coverage through Medicare, Medicaid, the Children’s Health Insurance Program, or other forms of public assistance

- have US citizenship or proof of legal residency

- file taxes jointly if married.

The premium tax credit caps the amount that an individual or family must spend on their monthly payments for health insurance. The cap depends on the family’s income; lower-income families have a lower cap. The amount of the tax credit remains the same, so a person who purchases a more expensive plan pays the cost difference (TABLE 2).

The ruling’s effect on women’s health

On June 26, American College of Obstetricians and Gynecologists President Mark S. DeFrancesco, MD, MBA, hailed the Supreme Court decision, saying, “Importantly, recent data have shown that newly insured adults under the ACA were more likely to be women. Those who did gain coverage through the ACA reported better access to health care and better financial security from medical costs.”

“Without question, many women enrollees were able to purchase health insurance coverage due, in part, to the ACA subsidies that helped make this purchase affordable. In fact, government data have suggested that roughly 85% of health exchange enrollees received subsidies,” Dr. DeFrancesco said.

“If the Supreme Court had overturned this important assistance, approximately 4.8 million women would have been unable to afford the coverage that they need. The impact also would have been widespread; as these women were forced to leave the insurance marketplace, it is likely that premiums throughout the marketplace would have risen dramatically,” he continued.

“Instead, patients—especially the low- and moderate-income American women who have particularly benefited from ACA subsidies—will continue to have the peace of mind that comes with insurance coverage.”

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

1. Blumberg LJ, Buettgens M, Holahan J. The implications of a Supreme Court finding for the plaintiff in King v. Burwell: 8.2 million more uninsured and 35% higher premiums. Urban Institute. http://www.urban.org/research/publication/implications-supreme-court-finding-plaintiff-king-vs-burwell-82-million-more-uninsured-and-35-higher-premiums. Published January 8, 2015. Accessed July 2, 2015.

2. Sheiner L, Mochoruk B. King v. Burwell explained. Brookings Institute. http://www.brookings.edu/blogs/health360/posts/2015/03/03-king-v-burwell-explainer-sheiner. Published March 3, 2015. Accessed July 2, 2015.

3. Howe A. Court backs Obama administration on health care subsidies: In plain English. SCOTUSblog. http://www.scotusblog.com/2015/06/court-backs-obama-administration-on-health-care-subsidies-in-plain-english/. Published June 25, 2015. Accessed July 1, 2015.

4. Hall MA. King v. Burwell—ACA Armageddon averted. N Engl J Med. http://www.nejm.org/doi/full/10.1056/NEJMp1504077. Published July 1, 2015. Accessed July 2, 2015.

5. Jost T. Implementing health reform: The Supreme Court upholds tax credits in the federal exchange. Health Affairs blog. http://healthaffairs.org/blog/2015/06/25/implementing-health-reform-the-supreme-court-upholds-tax-credits-in-the-federal-exchange/. Published June 25, 2015. Accessed July 1, 2015.

6. Greenhouse L. The Roberts Court’s reality check. New York Times. http://www.nytimes.com/2015/06/26/opinion/the-roberts-courts-reality-check.html. Published June 25, 2015. Accessed July 1, 2015.

7. Henry J. Kaiser Family Foundation. Explaining health care reform: questions about health insurance subsidies. Table 2. http://kff.org/health-reform/issue-brief/explaining-health-care-reform-questions-about-health/. Published October 27, 2014. Accessed July 2, 2015.

1. Blumberg LJ, Buettgens M, Holahan J. The implications of a Supreme Court finding for the plaintiff in King v. Burwell: 8.2 million more uninsured and 35% higher premiums. Urban Institute. http://www.urban.org/research/publication/implications-supreme-court-finding-plaintiff-king-vs-burwell-82-million-more-uninsured-and-35-higher-premiums. Published January 8, 2015. Accessed July 2, 2015.

2. Sheiner L, Mochoruk B. King v. Burwell explained. Brookings Institute. http://www.brookings.edu/blogs/health360/posts/2015/03/03-king-v-burwell-explainer-sheiner. Published March 3, 2015. Accessed July 2, 2015.

3. Howe A. Court backs Obama administration on health care subsidies: In plain English. SCOTUSblog. http://www.scotusblog.com/2015/06/court-backs-obama-administration-on-health-care-subsidies-in-plain-english/. Published June 25, 2015. Accessed July 1, 2015.

4. Hall MA. King v. Burwell—ACA Armageddon averted. N Engl J Med. http://www.nejm.org/doi/full/10.1056/NEJMp1504077. Published July 1, 2015. Accessed July 2, 2015.

5. Jost T. Implementing health reform: The Supreme Court upholds tax credits in the federal exchange. Health Affairs blog. http://healthaffairs.org/blog/2015/06/25/implementing-health-reform-the-supreme-court-upholds-tax-credits-in-the-federal-exchange/. Published June 25, 2015. Accessed July 1, 2015.

6. Greenhouse L. The Roberts Court’s reality check. New York Times. http://www.nytimes.com/2015/06/26/opinion/the-roberts-courts-reality-check.html. Published June 25, 2015. Accessed July 1, 2015.

7. Henry J. Kaiser Family Foundation. Explaining health care reform: questions about health insurance subsidies. Table 2. http://kff.org/health-reform/issue-brief/explaining-health-care-reform-questions-about-health/. Published October 27, 2014. Accessed July 2, 2015.