User login

Physicians practice medicine and communicate within the world of medical language, yet there is a lack of awareness and understanding by many health care professionals of the universal language of business, which is accounting. Just as Latin provides the basic framework for medically related terminology, accounting is the standard language used to convey financial information to both internal and external stakeholders.

Accounting principles are important to physicians at any level. Whether you are starting out in private practice, running a clinical department, or working as an executive in a health care system, most decisions are based on the interpretation of financial data using accounting principles. Accounting standards in the United States are developed by the Financial Accounting Standard Board (FASB) and established as a set of principles and guidelines called Generally Accepted Accounting Principles (GAAP).1–3

Accrual- vs cash-based accounting

There are 2 approaches to recording financial transactions: accrual- and cash-based accounting methods. The main difference between them is in the timing of the recorded financial transactions (when revenue and expenses are recognized on the accounting books). Under GAAP, the matching principle, which is one of the most basic and utilized guidelines of accounting, specifies that accrual accounting be used. In the United States, most businesses (publically traded companies and moderate- to large-sized companies) use accrual accounting, while some individual and smaller businesses, including health care services such as physician practices, use the cash method.1–4

Accrual-based accounting

Accrual-based accounting specifies that revenues are recorded when they are earned, and expenses are recorded when they occur. A health care business may earn revenue for services on one day, but the cash may not be received or recorded on the accounting books for several weeks or months and at an amount less than billed.

Accrual-based accounting provides a more accurate representation of a business’ financial performance, since it uses the principle in which expenses are matched to revenues in the same time period. This enables a more precise representation of true financial performance during a given time frame.1–4

Cash-based accounting

Cash-based accounting is the easiest method to understand and implement because financial transactions are recorded in the accounting books when money is received or spent without the need for complex accounting techniques or integration of accounts receivable or payable.

Despite the ease of use and simplicity in tracking cash flow, this method can be deceiving because revenue may be received or expenses may need to be paid at times that are not consistent with when the revenue has been earned or expenses incurred. This can result in misleading information on the business’ health and the accuracy of tracking financial performance over time, since revenue and expenses for a particular transaction may occur at different times.1–4

Which accounting process to choose?

Even though accrual-based accounting may provide a more accurate financial representation of a business’ performance, many smaller businesses, including physician practices, prefer to use cash-based accounting. In addition, many health care businesses are eligible to use cash-based accounting per Internal Revenue Service (IRS) rules by qualifying for the Gross Receipts Test and being a qualified Personal Service Corporation (PSC):

- The Gross Receipts Test states that if the average annual gross receipts of the business are less than $5 million, the business can use the cash-based accounting method.

- If at least 95% of a business activity involves performing health care services, and at least 95% of the business is owned by employees performing health care services, then the business qualifies as a PSC that may use the cash-based accounting method.

Many physician practices qualify to use cash-based accounting, which reduces the complexity of following accrual-based accounting rules and simplifies overall cash-flow management.5

Read about insurance, capital equipment depreciation, more

CASE New practice opens

Practice A opens its practice on January 1. The practice borrows $20,000 from the bank to purchase hysteroscopic equipment for office-based tubal sterilizations and an additional $50,000 for an ultrasound machine. Both loans have a 5% annual interest rate amortized over 5 years. The practice leases office space and pays rent 2 months in advance at $8,000 ($4,000 per month). On January 1, the practice pays a $1,200 premium for annual property and liability insurance and $12,500 for the first quarter payment for professional liability insurance ($50,000 annually, paid quarterly). Other costs the practice pays in January include: utilities, $400; EHR licensing, $300; technical support, $200; and salaries, $10,000.

The practice purchases 4 sets of sterilization spring devices at $1,500 each ($6,000) to have in stock. One hysteroscopic sterilization procedure is performed on a patient in January using 1 device. The practice is reimbursed $2,500 for the procedure.

In January, the practice bills $150,000 in charges, but after insurance contractual adjustments, January’s revenue is $50,000. Actual cash payments from billings received are $10,000 in January, $30,000 in February, and $10,000 in March.

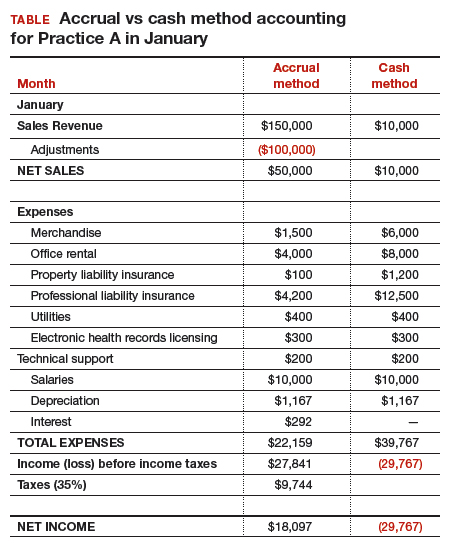

At first glance, there is a noticeable difference on the sales or recognition of revenues based on the type of accounting (TABLE). With the accrual method, because the billing charges are submitted in January when the services were provided (minus the insurance contractual adjustments), the $50,000 revenue is immediately counted and recognized, even though the practice only received $10,000 cash for those billings during January. While the benefit to accrual accounting is the timely recognition of the revenue when the service was provided, the downside is that much of those billings might actually be paid over 90 days, and some of those billings may go unpaid by the insurance company or the patients, which would require adjustments in later months.

The cash-based method is simpler to understand because the cash received for the month is recognized as the revenue, regardless of the amount charged that month.

Merchandise. In the accrual method, the cost of merchandise sold (the hysteroscopic sterilization implants) is recognized as an expense when the revenue is generated from its sale. In this case, the date that the patient has the hysteroscopic in-office sterilization procedure is when the revenue and the expense of the implant are recognized.

In a cash-based accounting method, the $6,000 cost of the implants is recognized at the time of purchase in January.

Lease. In this scenario, even though 2 months of lease for the office were paid, the accrual method only recognizes the January payment; the second payment is recognized in February. In the cash method, because both months were paid in January, the total expense of $8,000 is recognized in January.

Property liability insurance. The property liability insurance payment is required at the start of the year. In accrual accounting, this expense is divided over 12 months, while in the cash method, the expense is counted at the time the payment is made.

Professional liability insurance. The professional liability insurance expense of $50,000 per year is made in quarterly payments, so for the accrual method, the annual amount would be distributed over 12 months at $4,200 per month. With the cash method, it would be paid—and recognized as an expense—quarterly at $12,500, starting in January.

Capital equipment depreciation. Capital medical equipment (hysteroscopy and ultrasound) can be depreciated using a straight-line 5-year depreciation. A total $70,000 worth of equipment divided by 5 years is $14,000 per year, depreciated over 5 years. One-twelfth of $14,000 equals $1,167, which is recorded as a January depreciation expense. Because the Internal Revenue Code requires capital assets to be depreciated, even for cash-basis taxpayers, the common practice is to record depreciation expense for both cash- and accrual-basis income accounting.6

Interest on loans. A loan’s principal payment will not be included on the income statement. The principal payment, a reduction of a liability (loans payable), is reported on the balance sheet. Only the interest portion of a loan payment is reported on the income statement (interest expense). In accrual accounting, the accrued interest on the loan payment for the year is $3,500 ($292 for January). For the cash-basis method, because the interest is paid annually at year-end, interest will not be expensed until December.

Taxes. The IRS states that, “Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed. Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.”7

Assuming 35% tax liability, the accrual method would create a tax liability of $9,744 on a profit of $27,841. With the cash method, there would be no tax liability because there was no net profit.

Other expenses. The utilities, EHR licensing, tech support, and salaries are expensed the same way for both methods.

Net income. The resulting final net income is vastly different for the month of January depending on the accounting method utilized. The accrual method results in a net income of $18,097, while the cash-basis method results in a net loss of $29,767. Over the course of the year, these imbalances are likely to even out.

Related article:

Business law critical to your practice

Choosing an accounting method

Depending on the accounting method, a practice’s performance and profit will seem very different. The type of accounting method chosen will depend on what goals the owners want to achieve.

The accrual method provides a more accurate picture of business flow and performance and will be less subject to monthly variations due to large purchases or variations in expenses. If the practice chooses this method using an income statement, it should also employ a cash-flow statement.

The cash method of accounting will give a convenient and practical summary of the practice’s cash flow.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

- About the FASB. Financial Accounting Standards Board website. http://www.fasb.org/jsp/FASB/PageSectionPage&cid=1176154526495. Accessed November 7, 2017.

- What is the difference between accrual accounting and cash accounting? Investopedia. https://www.investopedia.com/ask/answers/121514/what-difference-between-accrual-accounting-and-cash-accounting.asp. Accessed November 7, 2017.

- Accounting Basics (Explanation). Part 2: Income Statement. Accounting Coach. https://www.accountingcoach.com/accounting-basics/explanation/2. Accessed November 7, 2017.

- Stickney C, Weil R. Financial Accounting: An Introduction to Concepts, Methods, and Uses. 11th ed. Nashville, TN: Southwestern College Publishing Group; 2006:97-110.

- Internal Revenue Service. Publication 538 (12/2016), Accounting Periods and Methods. https://www.irs.gov/publications/p538#en_US_201612_publink1000270634. Revised December 2016. Accessed November 7, 2017.

- Klinefelter D, McCorkle D, Klose S. Financial Management: Cash vs. Accrual Accounting. Risk Management. AgriLife Extension. Texas A&M System. http://agrilife.org/agecoext/files/2013/10/rm5-16.pdf. Published 2013. Accessed November 7, 2017.

- Internal Revenue Service. Small Business and Self-Employed Tax Center: Estimated Taxes. https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes. Updated November 2, 2017. Accessed November 7, 2017.

Physicians practice medicine and communicate within the world of medical language, yet there is a lack of awareness and understanding by many health care professionals of the universal language of business, which is accounting. Just as Latin provides the basic framework for medically related terminology, accounting is the standard language used to convey financial information to both internal and external stakeholders.

Accounting principles are important to physicians at any level. Whether you are starting out in private practice, running a clinical department, or working as an executive in a health care system, most decisions are based on the interpretation of financial data using accounting principles. Accounting standards in the United States are developed by the Financial Accounting Standard Board (FASB) and established as a set of principles and guidelines called Generally Accepted Accounting Principles (GAAP).1–3

Accrual- vs cash-based accounting

There are 2 approaches to recording financial transactions: accrual- and cash-based accounting methods. The main difference between them is in the timing of the recorded financial transactions (when revenue and expenses are recognized on the accounting books). Under GAAP, the matching principle, which is one of the most basic and utilized guidelines of accounting, specifies that accrual accounting be used. In the United States, most businesses (publically traded companies and moderate- to large-sized companies) use accrual accounting, while some individual and smaller businesses, including health care services such as physician practices, use the cash method.1–4

Accrual-based accounting

Accrual-based accounting specifies that revenues are recorded when they are earned, and expenses are recorded when they occur. A health care business may earn revenue for services on one day, but the cash may not be received or recorded on the accounting books for several weeks or months and at an amount less than billed.

Accrual-based accounting provides a more accurate representation of a business’ financial performance, since it uses the principle in which expenses are matched to revenues in the same time period. This enables a more precise representation of true financial performance during a given time frame.1–4

Cash-based accounting

Cash-based accounting is the easiest method to understand and implement because financial transactions are recorded in the accounting books when money is received or spent without the need for complex accounting techniques or integration of accounts receivable or payable.

Despite the ease of use and simplicity in tracking cash flow, this method can be deceiving because revenue may be received or expenses may need to be paid at times that are not consistent with when the revenue has been earned or expenses incurred. This can result in misleading information on the business’ health and the accuracy of tracking financial performance over time, since revenue and expenses for a particular transaction may occur at different times.1–4

Which accounting process to choose?

Even though accrual-based accounting may provide a more accurate financial representation of a business’ performance, many smaller businesses, including physician practices, prefer to use cash-based accounting. In addition, many health care businesses are eligible to use cash-based accounting per Internal Revenue Service (IRS) rules by qualifying for the Gross Receipts Test and being a qualified Personal Service Corporation (PSC):

- The Gross Receipts Test states that if the average annual gross receipts of the business are less than $5 million, the business can use the cash-based accounting method.

- If at least 95% of a business activity involves performing health care services, and at least 95% of the business is owned by employees performing health care services, then the business qualifies as a PSC that may use the cash-based accounting method.

Many physician practices qualify to use cash-based accounting, which reduces the complexity of following accrual-based accounting rules and simplifies overall cash-flow management.5

Read about insurance, capital equipment depreciation, more

CASE New practice opens

Practice A opens its practice on January 1. The practice borrows $20,000 from the bank to purchase hysteroscopic equipment for office-based tubal sterilizations and an additional $50,000 for an ultrasound machine. Both loans have a 5% annual interest rate amortized over 5 years. The practice leases office space and pays rent 2 months in advance at $8,000 ($4,000 per month). On January 1, the practice pays a $1,200 premium for annual property and liability insurance and $12,500 for the first quarter payment for professional liability insurance ($50,000 annually, paid quarterly). Other costs the practice pays in January include: utilities, $400; EHR licensing, $300; technical support, $200; and salaries, $10,000.

The practice purchases 4 sets of sterilization spring devices at $1,500 each ($6,000) to have in stock. One hysteroscopic sterilization procedure is performed on a patient in January using 1 device. The practice is reimbursed $2,500 for the procedure.

In January, the practice bills $150,000 in charges, but after insurance contractual adjustments, January’s revenue is $50,000. Actual cash payments from billings received are $10,000 in January, $30,000 in February, and $10,000 in March.

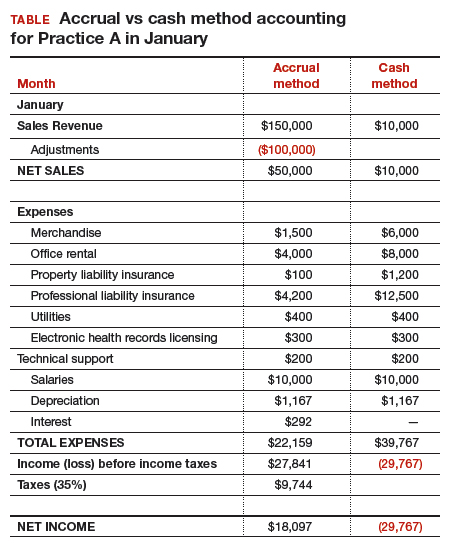

At first glance, there is a noticeable difference on the sales or recognition of revenues based on the type of accounting (TABLE). With the accrual method, because the billing charges are submitted in January when the services were provided (minus the insurance contractual adjustments), the $50,000 revenue is immediately counted and recognized, even though the practice only received $10,000 cash for those billings during January. While the benefit to accrual accounting is the timely recognition of the revenue when the service was provided, the downside is that much of those billings might actually be paid over 90 days, and some of those billings may go unpaid by the insurance company or the patients, which would require adjustments in later months.

The cash-based method is simpler to understand because the cash received for the month is recognized as the revenue, regardless of the amount charged that month.

Merchandise. In the accrual method, the cost of merchandise sold (the hysteroscopic sterilization implants) is recognized as an expense when the revenue is generated from its sale. In this case, the date that the patient has the hysteroscopic in-office sterilization procedure is when the revenue and the expense of the implant are recognized.

In a cash-based accounting method, the $6,000 cost of the implants is recognized at the time of purchase in January.

Lease. In this scenario, even though 2 months of lease for the office were paid, the accrual method only recognizes the January payment; the second payment is recognized in February. In the cash method, because both months were paid in January, the total expense of $8,000 is recognized in January.

Property liability insurance. The property liability insurance payment is required at the start of the year. In accrual accounting, this expense is divided over 12 months, while in the cash method, the expense is counted at the time the payment is made.

Professional liability insurance. The professional liability insurance expense of $50,000 per year is made in quarterly payments, so for the accrual method, the annual amount would be distributed over 12 months at $4,200 per month. With the cash method, it would be paid—and recognized as an expense—quarterly at $12,500, starting in January.

Capital equipment depreciation. Capital medical equipment (hysteroscopy and ultrasound) can be depreciated using a straight-line 5-year depreciation. A total $70,000 worth of equipment divided by 5 years is $14,000 per year, depreciated over 5 years. One-twelfth of $14,000 equals $1,167, which is recorded as a January depreciation expense. Because the Internal Revenue Code requires capital assets to be depreciated, even for cash-basis taxpayers, the common practice is to record depreciation expense for both cash- and accrual-basis income accounting.6

Interest on loans. A loan’s principal payment will not be included on the income statement. The principal payment, a reduction of a liability (loans payable), is reported on the balance sheet. Only the interest portion of a loan payment is reported on the income statement (interest expense). In accrual accounting, the accrued interest on the loan payment for the year is $3,500 ($292 for January). For the cash-basis method, because the interest is paid annually at year-end, interest will not be expensed until December.

Taxes. The IRS states that, “Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed. Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.”7

Assuming 35% tax liability, the accrual method would create a tax liability of $9,744 on a profit of $27,841. With the cash method, there would be no tax liability because there was no net profit.

Other expenses. The utilities, EHR licensing, tech support, and salaries are expensed the same way for both methods.

Net income. The resulting final net income is vastly different for the month of January depending on the accounting method utilized. The accrual method results in a net income of $18,097, while the cash-basis method results in a net loss of $29,767. Over the course of the year, these imbalances are likely to even out.

Related article:

Business law critical to your practice

Choosing an accounting method

Depending on the accounting method, a practice’s performance and profit will seem very different. The type of accounting method chosen will depend on what goals the owners want to achieve.

The accrual method provides a more accurate picture of business flow and performance and will be less subject to monthly variations due to large purchases or variations in expenses. If the practice chooses this method using an income statement, it should also employ a cash-flow statement.

The cash method of accounting will give a convenient and practical summary of the practice’s cash flow.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

Physicians practice medicine and communicate within the world of medical language, yet there is a lack of awareness and understanding by many health care professionals of the universal language of business, which is accounting. Just as Latin provides the basic framework for medically related terminology, accounting is the standard language used to convey financial information to both internal and external stakeholders.

Accounting principles are important to physicians at any level. Whether you are starting out in private practice, running a clinical department, or working as an executive in a health care system, most decisions are based on the interpretation of financial data using accounting principles. Accounting standards in the United States are developed by the Financial Accounting Standard Board (FASB) and established as a set of principles and guidelines called Generally Accepted Accounting Principles (GAAP).1–3

Accrual- vs cash-based accounting

There are 2 approaches to recording financial transactions: accrual- and cash-based accounting methods. The main difference between them is in the timing of the recorded financial transactions (when revenue and expenses are recognized on the accounting books). Under GAAP, the matching principle, which is one of the most basic and utilized guidelines of accounting, specifies that accrual accounting be used. In the United States, most businesses (publically traded companies and moderate- to large-sized companies) use accrual accounting, while some individual and smaller businesses, including health care services such as physician practices, use the cash method.1–4

Accrual-based accounting

Accrual-based accounting specifies that revenues are recorded when they are earned, and expenses are recorded when they occur. A health care business may earn revenue for services on one day, but the cash may not be received or recorded on the accounting books for several weeks or months and at an amount less than billed.

Accrual-based accounting provides a more accurate representation of a business’ financial performance, since it uses the principle in which expenses are matched to revenues in the same time period. This enables a more precise representation of true financial performance during a given time frame.1–4

Cash-based accounting

Cash-based accounting is the easiest method to understand and implement because financial transactions are recorded in the accounting books when money is received or spent without the need for complex accounting techniques or integration of accounts receivable or payable.

Despite the ease of use and simplicity in tracking cash flow, this method can be deceiving because revenue may be received or expenses may need to be paid at times that are not consistent with when the revenue has been earned or expenses incurred. This can result in misleading information on the business’ health and the accuracy of tracking financial performance over time, since revenue and expenses for a particular transaction may occur at different times.1–4

Which accounting process to choose?

Even though accrual-based accounting may provide a more accurate financial representation of a business’ performance, many smaller businesses, including physician practices, prefer to use cash-based accounting. In addition, many health care businesses are eligible to use cash-based accounting per Internal Revenue Service (IRS) rules by qualifying for the Gross Receipts Test and being a qualified Personal Service Corporation (PSC):

- The Gross Receipts Test states that if the average annual gross receipts of the business are less than $5 million, the business can use the cash-based accounting method.

- If at least 95% of a business activity involves performing health care services, and at least 95% of the business is owned by employees performing health care services, then the business qualifies as a PSC that may use the cash-based accounting method.

Many physician practices qualify to use cash-based accounting, which reduces the complexity of following accrual-based accounting rules and simplifies overall cash-flow management.5

Read about insurance, capital equipment depreciation, more

CASE New practice opens

Practice A opens its practice on January 1. The practice borrows $20,000 from the bank to purchase hysteroscopic equipment for office-based tubal sterilizations and an additional $50,000 for an ultrasound machine. Both loans have a 5% annual interest rate amortized over 5 years. The practice leases office space and pays rent 2 months in advance at $8,000 ($4,000 per month). On January 1, the practice pays a $1,200 premium for annual property and liability insurance and $12,500 for the first quarter payment for professional liability insurance ($50,000 annually, paid quarterly). Other costs the practice pays in January include: utilities, $400; EHR licensing, $300; technical support, $200; and salaries, $10,000.

The practice purchases 4 sets of sterilization spring devices at $1,500 each ($6,000) to have in stock. One hysteroscopic sterilization procedure is performed on a patient in January using 1 device. The practice is reimbursed $2,500 for the procedure.

In January, the practice bills $150,000 in charges, but after insurance contractual adjustments, January’s revenue is $50,000. Actual cash payments from billings received are $10,000 in January, $30,000 in February, and $10,000 in March.

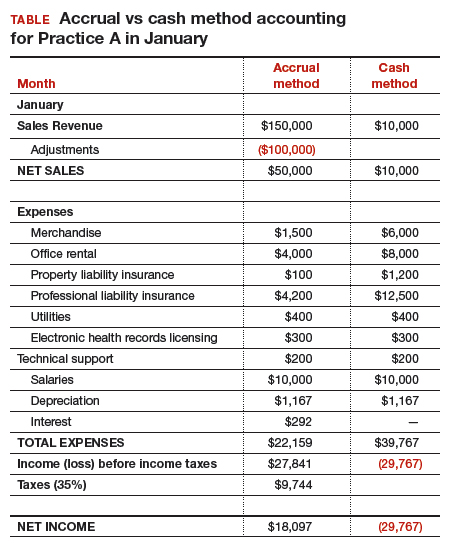

At first glance, there is a noticeable difference on the sales or recognition of revenues based on the type of accounting (TABLE). With the accrual method, because the billing charges are submitted in January when the services were provided (minus the insurance contractual adjustments), the $50,000 revenue is immediately counted and recognized, even though the practice only received $10,000 cash for those billings during January. While the benefit to accrual accounting is the timely recognition of the revenue when the service was provided, the downside is that much of those billings might actually be paid over 90 days, and some of those billings may go unpaid by the insurance company or the patients, which would require adjustments in later months.

The cash-based method is simpler to understand because the cash received for the month is recognized as the revenue, regardless of the amount charged that month.

Merchandise. In the accrual method, the cost of merchandise sold (the hysteroscopic sterilization implants) is recognized as an expense when the revenue is generated from its sale. In this case, the date that the patient has the hysteroscopic in-office sterilization procedure is when the revenue and the expense of the implant are recognized.

In a cash-based accounting method, the $6,000 cost of the implants is recognized at the time of purchase in January.

Lease. In this scenario, even though 2 months of lease for the office were paid, the accrual method only recognizes the January payment; the second payment is recognized in February. In the cash method, because both months were paid in January, the total expense of $8,000 is recognized in January.

Property liability insurance. The property liability insurance payment is required at the start of the year. In accrual accounting, this expense is divided over 12 months, while in the cash method, the expense is counted at the time the payment is made.

Professional liability insurance. The professional liability insurance expense of $50,000 per year is made in quarterly payments, so for the accrual method, the annual amount would be distributed over 12 months at $4,200 per month. With the cash method, it would be paid—and recognized as an expense—quarterly at $12,500, starting in January.

Capital equipment depreciation. Capital medical equipment (hysteroscopy and ultrasound) can be depreciated using a straight-line 5-year depreciation. A total $70,000 worth of equipment divided by 5 years is $14,000 per year, depreciated over 5 years. One-twelfth of $14,000 equals $1,167, which is recorded as a January depreciation expense. Because the Internal Revenue Code requires capital assets to be depreciated, even for cash-basis taxpayers, the common practice is to record depreciation expense for both cash- and accrual-basis income accounting.6

Interest on loans. A loan’s principal payment will not be included on the income statement. The principal payment, a reduction of a liability (loans payable), is reported on the balance sheet. Only the interest portion of a loan payment is reported on the income statement (interest expense). In accrual accounting, the accrued interest on the loan payment for the year is $3,500 ($292 for January). For the cash-basis method, because the interest is paid annually at year-end, interest will not be expensed until December.

Taxes. The IRS states that, “Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed. Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.”7

Assuming 35% tax liability, the accrual method would create a tax liability of $9,744 on a profit of $27,841. With the cash method, there would be no tax liability because there was no net profit.

Other expenses. The utilities, EHR licensing, tech support, and salaries are expensed the same way for both methods.

Net income. The resulting final net income is vastly different for the month of January depending on the accounting method utilized. The accrual method results in a net income of $18,097, while the cash-basis method results in a net loss of $29,767. Over the course of the year, these imbalances are likely to even out.

Related article:

Business law critical to your practice

Choosing an accounting method

Depending on the accounting method, a practice’s performance and profit will seem very different. The type of accounting method chosen will depend on what goals the owners want to achieve.

The accrual method provides a more accurate picture of business flow and performance and will be less subject to monthly variations due to large purchases or variations in expenses. If the practice chooses this method using an income statement, it should also employ a cash-flow statement.

The cash method of accounting will give a convenient and practical summary of the practice’s cash flow.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

- About the FASB. Financial Accounting Standards Board website. http://www.fasb.org/jsp/FASB/PageSectionPage&cid=1176154526495. Accessed November 7, 2017.

- What is the difference between accrual accounting and cash accounting? Investopedia. https://www.investopedia.com/ask/answers/121514/what-difference-between-accrual-accounting-and-cash-accounting.asp. Accessed November 7, 2017.

- Accounting Basics (Explanation). Part 2: Income Statement. Accounting Coach. https://www.accountingcoach.com/accounting-basics/explanation/2. Accessed November 7, 2017.

- Stickney C, Weil R. Financial Accounting: An Introduction to Concepts, Methods, and Uses. 11th ed. Nashville, TN: Southwestern College Publishing Group; 2006:97-110.

- Internal Revenue Service. Publication 538 (12/2016), Accounting Periods and Methods. https://www.irs.gov/publications/p538#en_US_201612_publink1000270634. Revised December 2016. Accessed November 7, 2017.

- Klinefelter D, McCorkle D, Klose S. Financial Management: Cash vs. Accrual Accounting. Risk Management. AgriLife Extension. Texas A&M System. http://agrilife.org/agecoext/files/2013/10/rm5-16.pdf. Published 2013. Accessed November 7, 2017.

- Internal Revenue Service. Small Business and Self-Employed Tax Center: Estimated Taxes. https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes. Updated November 2, 2017. Accessed November 7, 2017.

- About the FASB. Financial Accounting Standards Board website. http://www.fasb.org/jsp/FASB/PageSectionPage&cid=1176154526495. Accessed November 7, 2017.

- What is the difference between accrual accounting and cash accounting? Investopedia. https://www.investopedia.com/ask/answers/121514/what-difference-between-accrual-accounting-and-cash-accounting.asp. Accessed November 7, 2017.

- Accounting Basics (Explanation). Part 2: Income Statement. Accounting Coach. https://www.accountingcoach.com/accounting-basics/explanation/2. Accessed November 7, 2017.

- Stickney C, Weil R. Financial Accounting: An Introduction to Concepts, Methods, and Uses. 11th ed. Nashville, TN: Southwestern College Publishing Group; 2006:97-110.

- Internal Revenue Service. Publication 538 (12/2016), Accounting Periods and Methods. https://www.irs.gov/publications/p538#en_US_201612_publink1000270634. Revised December 2016. Accessed November 7, 2017.

- Klinefelter D, McCorkle D, Klose S. Financial Management: Cash vs. Accrual Accounting. Risk Management. AgriLife Extension. Texas A&M System. http://agrilife.org/agecoext/files/2013/10/rm5-16.pdf. Published 2013. Accessed November 7, 2017.

- Internal Revenue Service. Small Business and Self-Employed Tax Center: Estimated Taxes. https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes. Updated November 2, 2017. Accessed November 7, 2017.