User login

How to decide on purchasing new medical equipment

Providing state-of-the-art health care for women often requires the use of various types of medical equipment, and decisions regarding their purchase can be complicated. With rising costs and reduced reimbursements, capital expenditures must be made with great care. Some equipment may not generate revenue but is required at a basic care-giving level: examination tables, procedure instruments, autoclaves, etc. Conversely, other equipment may not be necessary but strongly desired to offer a full complement of care. Unfortunately, sometimes a decision to buy expensive equipment is based more on a sales representative's ability to rationalize the purchase as a sound investment than on its necessity or practicality. This article focuses on tools to help you make a decision to obtain revenue-generating medical equipment.

First consideration: Nonfinancial evaluation

Nonfinancial criteria should be your first concern. They may have a greater impact on your practice than any financial consideration.

Does this investment align with your overall goals?

If your focus is to provide the best and most efficient obstetric care in the community, it may not make sense to purchase urodynamic equipment, even if using the equipment could be profitable.1 If the equipment begins to distract the practice from its strategic focus, then complications from managing this new equipment might be more harmful than helpful.

What are the pros and cons of the investment?

Concern that the equipment may not be effective or may become obsolete in a few years would preclude having to consider the financial purchase in the first place.1

Consider a PESTLE analysis

Before starting a new project, use a PESTLE analysis to assess external factors that are political, economic, social, technological, legal, and environmental. Its purpose is to identify issues that are beyond the control of the organization and have some level of impact on the organization.2,3

If you are considering the purchase of a laser hair removal machine, what could be the political considerations, such as your reputation among peers or other physicians who refer patients to your practice? What are the economic (financial) considerations? How would the social (or marketing) message be communicated, and do you have the organizational skills to implement a marketing strategy? What are the technical challenges required for maintaining this machine, and how much skill and training would be required to safely use it? What are the legal ramifications for implementing this service? Does your malpractice insurance cover it? And finally, what kind of environment (physical space) would be required?

What alternative investment opportunities might compete?

When considering a significant investment, other opportunities may no longer be feasible. Think about other ways your practice could use the money and which investment prospects would be the best fit.1 For instance, purchasing equipment that is very time intensive may not necessarily be the most profitable decision, especially if it takes the provider away from other services with higher margins. Could investing in expensive equipment delay bringing in another provider who might have a higher financial impact?

Next stage: Financial evaluation

To begin a basic cash flow analysis of the new investment, gather your practice's financial data. Estimate the cash flow resulting from the equipment investment, including any additional expenses and revenues. Here are some steps:

- Identify the revenue generated by each use of the equipment.

- Estimate the variable costs (costs that increase with each incremental unit of activity). Variable costs include expenses associated with each use, such as disposable accessories. For a hysteroscope, the variable cost may be the tubing and fluid used. Some procedures, such as office hysteroscopic sterilization, require the purchase of intratubal occlusion devices.

Also consider the cost of your time. One way to determine this is to investigate the hourly rate you would be paid if you were hypothetically hired by a third party to perform the procedure.

- Estimate the step costs. Step costs are constant over a narrow range of activity but shift to a higher level with increased activity. One example is staffing costs. If the number of these procedures significantly increases, additional staffing will be required. Include the hourly pay for your medical assistants in the analysis.

- Determine the contribution margin. Subtract the revenue from the sum of the variable and step costs to find the contribution margin (dollar contribution per unit) to your practice.4,5

- Estimate the approximate volume of procedures. It is hard to predict future demand, but a good rule of thumb is to estimate the best, expected, and pessimistic volumes. Then average the 3 scenarios and use that figure as the anticipated volume. Multiply the volume by the contribution margin to calculate profit.

Additional financial tools

Once the basic cash flow analysis of the new investment is undertaken, add these methods to your analysis:

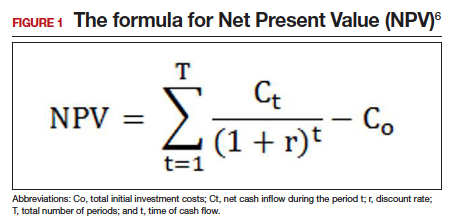

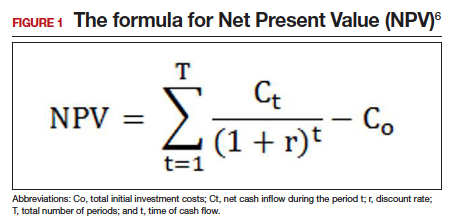

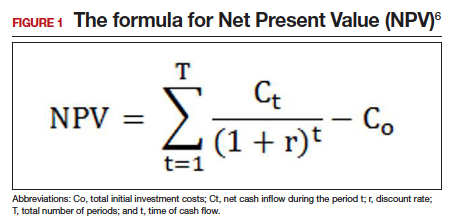

Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows (FIGURE 1).6 NPV takes into consideration the time value of money, where money in the present is worth more than the same value sometime in the future due to inflation and earning capacity. NPV is used in capital budgeting to analyze the profitability of a projected investment or project.1,4,5

Consider the discount rate as the expected rate of return or cost of capital. By discounting the future cash flow each year by the discount rate, you can get the present value of cash flow. Subtract the present value of cash flow from the original investment to get the NPV for the equipment's investment. A positive value is a favorable analysis to purchase the equipment; a negative value may suggest that the equipment may be a poor investment.

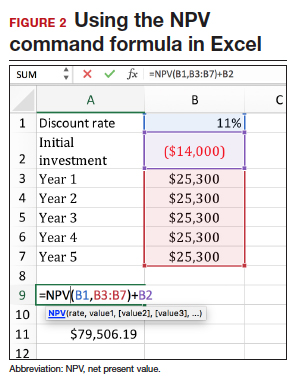

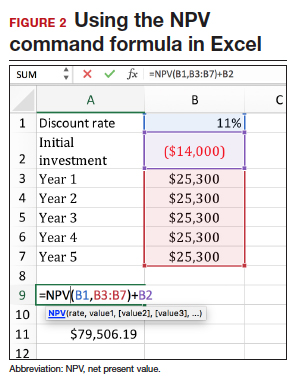

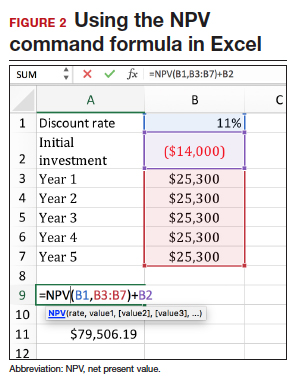

The NPV can be calculated in a spreadsheet using the following NPV command formula: NPV(rate,value1,[value2],...). This formula gives you the present value of cash inflows. The rate is the discount rate and the values are the series of cash flows occurring over a period of time. The NPV command formula in Excel, despite its misleading name, only gives the present value of cash flows.7 Therefore, it is important that the present value of cash inflows is subtracted from the initial capital investment to get the NPV.

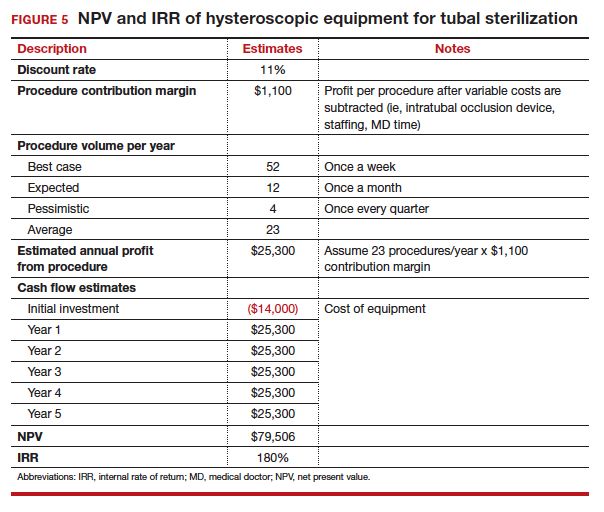

FIGURE 2 shows analysis of a piece of equipment that requires a $14,000 initial investment in Year 0. Each year the use of the equipment generates $25,300 per year through year 5. Assign a discount rate of 11%, about what you would expect for a stock market investment.

Consider other investment opportunities. The historical rate of return for a stock index fund is 11.5%.8 Using this discount rate, you can compare whether the money would be better invested in the medical equipment or stock.

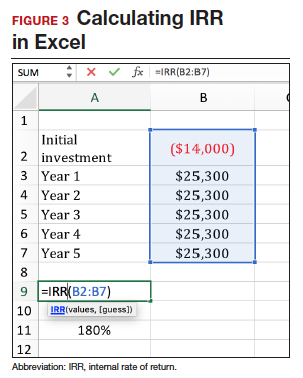

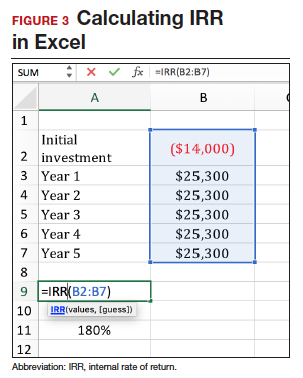

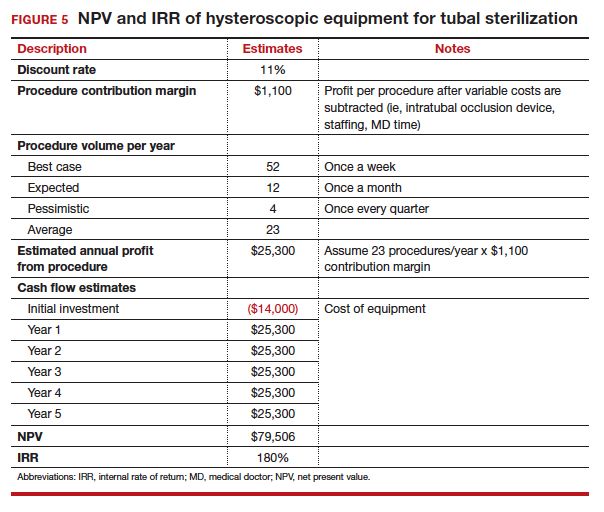

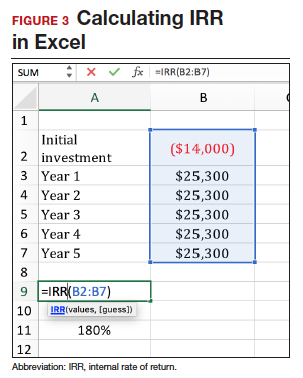

Internal rate of return (IRR) is a metric used in capital budgeting to measure the profitability of potential investments. The IRR determines if the discount rate at which the present value of expected net cash inflow is equal to the cash outlay. In other words, the IRR is the discount rate that makes the net present cash flows from a project equal zero. The decision rule related to the IRR criterion is to accept a project in which the IRR is greater than the required rate of return (cutoff rate). The formula for the IRR is the same as the NPV formula, except that the NPV is set at zero and the discount rate is calculated through iterative calculation. The IRR can be calculated in a spreadsheet using the following command formula: IRR(values, [guess]).1,5,9 In FIGURE 3, the IRR is 180%, far superior than the return you would find in other investments such as the stock market.

The IRR is somewhat different from return on investment (ROI). ROI is the percent of return on the initial investment over a period of time. Each piece of equipment has a different ROI over a different time period. ROI does not take into account the time value of money (TVM). Incorporating the IRR (or the TVM) allows for equal comparison between 2 pieces of equipment in the analysis.10

If you are not comparing 2 different types of equipment for purchase, then using the cutoff of 11.5% may be helpful (the historical average stock market return). If the IRR is less than 11.5%, then in theory, it would be better to put your money in the stock market than in new equipment.7

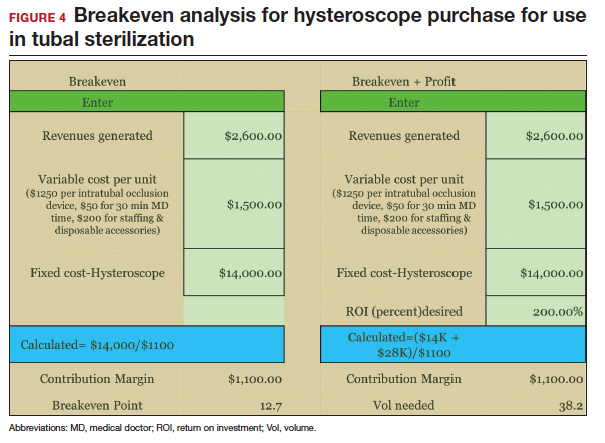

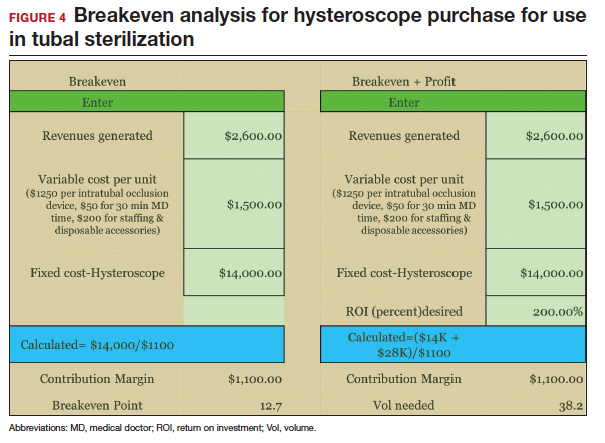

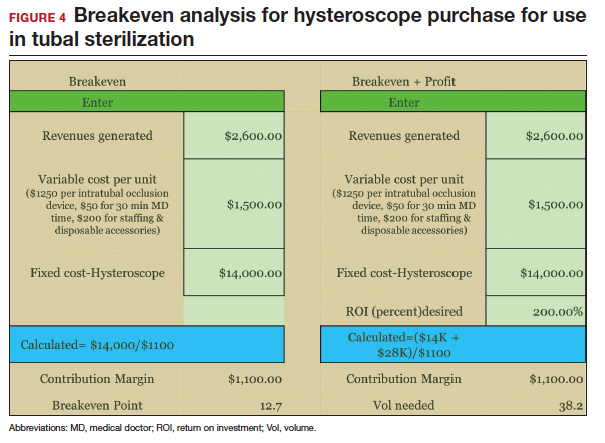

Breakeven analysis calculates the volume of procedures that would be needed to break even or make a profit. It can also determine if there is enough demand to meet the volume required to break even or profit. Unlike the first 2 methods, where you have to guess at future volume, this method calculates the volume required to break even, but does not specify a time period. Your practice would have to use subjective experience to determine how long it would take to reach that volume, given your patient population and the ability to reach the targeted market segment.

Fixed costs are costs that do not change with the varying volume of units of service or products sold. After calculating the contribution margin, divide the fixed costs of the equipment by the contribution margin. Then you will have the volume required to break even (FIGURE 4). Add the dollar amount of profit you would like to attain to the fixed costs, then divide that total by the contribution margin, and you'll have the volume required to meet those specifications.1,4,5

Even though the calculations described above relate to medical equipment, you can use this same method to analyze the cost of adding new providers or any other business development project to determine the required volume to break even on the capital outlay.

CASE New equipment requests

A new ObGyn in your practice requests that you purchase a hysteroscope so that she can start performing office-based hysteroscopic sterilization. Another partner would like to acquire urodynamic equipment instead of referring urinary incontinent patients to a urogynecologist. How do you decide what to purchase?

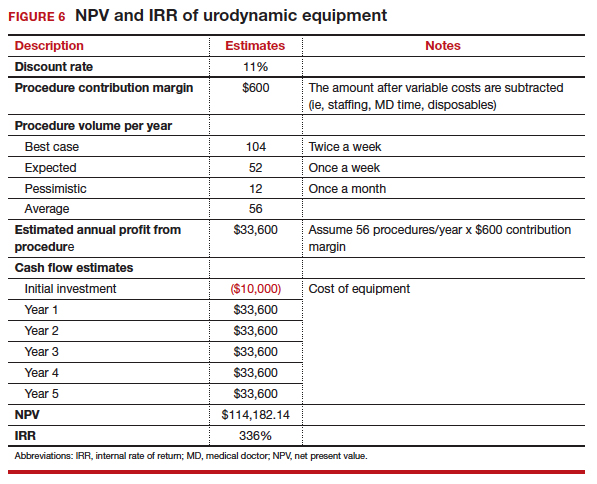

First calculate the contribution margins for each product. Next, since you do not know for certain the volume you might achieve for each procedure, create 3 scenarios for the best, expected, and pessimistic situations. Assume equal probability for each of these categories and average the volumes of the estimates. Even though you may keep the equipment longer, estimate the financial analysis over 5 years. In this example, we assume a discount rate of 11% for the NPV calculation for both pieces of equipment.

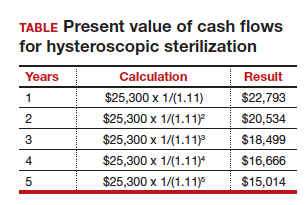

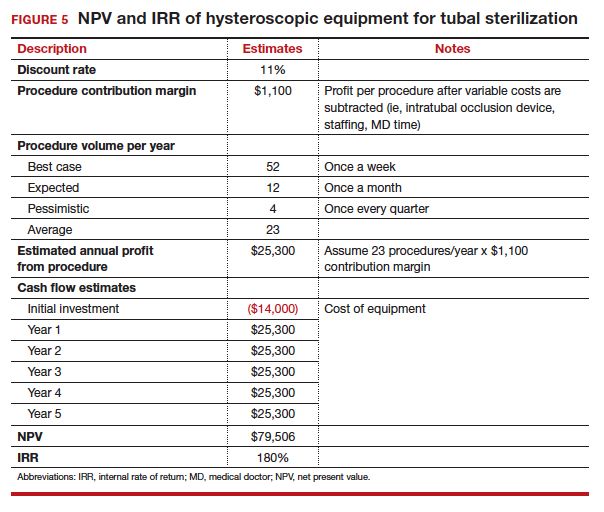

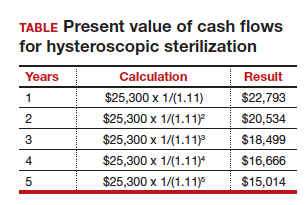

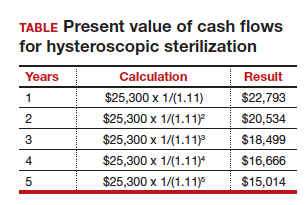

Calculate the IRR using a spreadsheet based on the cash flow for each piece of equipment. Say that the practice anticipates doing 23 hysteroscopic sterilizations per year. If the reimbursement is $2,600 per procedure, and the variable costs are $1,500, the contribution margin is $1,100. So 23 procedures multiplied by $1,100 equals an annual profit of $25,300. Then discount the $25,300 for each year. In this example, we use a discount rate of 11%. The TABLE shows the amount discounted each year.

The sum of the discounted cash flows is $93,506. However, we have to subtract the initial investment of $14,000, so the final NPV equals $79,506 (FIGURE 5).

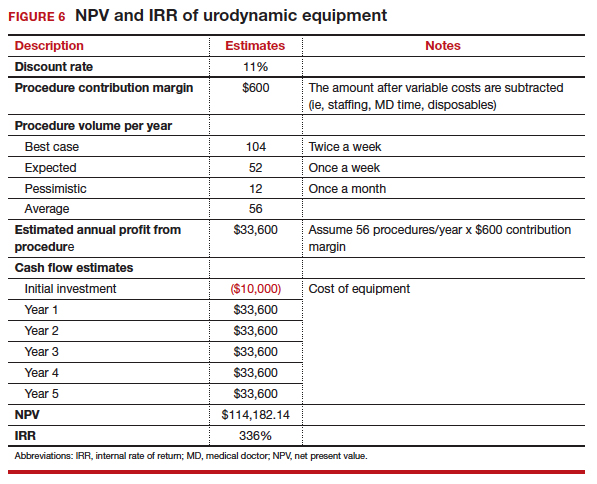

Apply the same financial NPV and IRR calculations used to assess the hysteroscope to the urodynamic equipment. From the analysis (FIGUREs 5 and 6), both purchases would be financially successful. However, it appears that the urodynamic equipment is a superior investment over the hysteroscope, with a higher NPV ($115,877 vs $81,880, respectively) and IRR (336% vs 180%, respectively). This is likely due to the higher anticipated volume of use with the urodynamic equipment and lower cost of initial investment, despite having a lower contribution margin than the hysteroscope.

Caveats

For simplicity, this analysis does not account for the fact that the hysteroscope could be used for other revenue-generating procedures such as diagnostic hysteroscopy. Factoring in these potential additional services using the same hysteroscope might change the decision analysis in favor of the hysteroscope.

Remember that, although the financial analysis is very helpful in decision making, nonfinancial evaluations should also influence your choice. In this example, while there may be a financial advantage to purchasing the urodynamic equipment over the hysteroscopic equipment, nonfinancial considerations can help you decide which purchase would be a better aligned with the goals and strategies of your practice.

These tools for nonfinancial and financial analysis can be used for any investment in your practice, whether it is in medical equipment, personnel, or development of other profit centers.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

- Willis DR. How to decide whether to buy new medical equipment. Fam Pract Manag. 2004;11(3):53−58.

- PESTLE Analysis Strategy Skills. http://www.free-management-ebooks.com/dldebk-pdf/fme-pestle-analysis.pdf. Published 2013. Accessed March 2, 2018.

- What is PESTLE analysis? A tool for business analysis. http://pestleanalysis.com/what-is-pestle-analysis/. Published 2018. Accessed March 2, 2018.

- Nowicki M, ed. Introduction to the Financial Management of Healthcare Organizations. 6th ed. Chicago, Illinois: Health Administration Press; 2014:150−151, 299−316.

- Ross SA, Westerfield RW, Jaffe J. Corporate Finance. 8th ed. New York, New York: McGraw Hill; 2008:271−288.

- Net Present Value - NPV. Investopia. https://www.investopedia.com/terms/n/npv.asp. Accessed April 10, 2018.

- NPV function. Microsoft Office Support. https://support.office.com/en-us/article/npv-function-8672cb67-2576-4d07-b67b-ac28acf2a568. Accessed April 10, 2018.

- Damodaran A. Annual Returns on Stock, T.Bonds and T.Bills: 1928 - Current. http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html. Updated January 5, 2018. Accessed March 2, 2018.

- IRR function. Microsoft Office Support. https://support.office.com/en-us/article/irr-function-64925eaa-9988-495b-b290-3ad0c163c1bc. Accessed April 10, 2018.

- Time Value of Money (TVM). Investopedia. https://www.investopedia.com/terms/t/timevalueofmoney.asp. Published 2018. Accessed March 2, 2018.

Providing state-of-the-art health care for women often requires the use of various types of medical equipment, and decisions regarding their purchase can be complicated. With rising costs and reduced reimbursements, capital expenditures must be made with great care. Some equipment may not generate revenue but is required at a basic care-giving level: examination tables, procedure instruments, autoclaves, etc. Conversely, other equipment may not be necessary but strongly desired to offer a full complement of care. Unfortunately, sometimes a decision to buy expensive equipment is based more on a sales representative's ability to rationalize the purchase as a sound investment than on its necessity or practicality. This article focuses on tools to help you make a decision to obtain revenue-generating medical equipment.

First consideration: Nonfinancial evaluation

Nonfinancial criteria should be your first concern. They may have a greater impact on your practice than any financial consideration.

Does this investment align with your overall goals?

If your focus is to provide the best and most efficient obstetric care in the community, it may not make sense to purchase urodynamic equipment, even if using the equipment could be profitable.1 If the equipment begins to distract the practice from its strategic focus, then complications from managing this new equipment might be more harmful than helpful.

What are the pros and cons of the investment?

Concern that the equipment may not be effective or may become obsolete in a few years would preclude having to consider the financial purchase in the first place.1

Consider a PESTLE analysis

Before starting a new project, use a PESTLE analysis to assess external factors that are political, economic, social, technological, legal, and environmental. Its purpose is to identify issues that are beyond the control of the organization and have some level of impact on the organization.2,3

If you are considering the purchase of a laser hair removal machine, what could be the political considerations, such as your reputation among peers or other physicians who refer patients to your practice? What are the economic (financial) considerations? How would the social (or marketing) message be communicated, and do you have the organizational skills to implement a marketing strategy? What are the technical challenges required for maintaining this machine, and how much skill and training would be required to safely use it? What are the legal ramifications for implementing this service? Does your malpractice insurance cover it? And finally, what kind of environment (physical space) would be required?

What alternative investment opportunities might compete?

When considering a significant investment, other opportunities may no longer be feasible. Think about other ways your practice could use the money and which investment prospects would be the best fit.1 For instance, purchasing equipment that is very time intensive may not necessarily be the most profitable decision, especially if it takes the provider away from other services with higher margins. Could investing in expensive equipment delay bringing in another provider who might have a higher financial impact?

Next stage: Financial evaluation

To begin a basic cash flow analysis of the new investment, gather your practice's financial data. Estimate the cash flow resulting from the equipment investment, including any additional expenses and revenues. Here are some steps:

- Identify the revenue generated by each use of the equipment.

- Estimate the variable costs (costs that increase with each incremental unit of activity). Variable costs include expenses associated with each use, such as disposable accessories. For a hysteroscope, the variable cost may be the tubing and fluid used. Some procedures, such as office hysteroscopic sterilization, require the purchase of intratubal occlusion devices.

Also consider the cost of your time. One way to determine this is to investigate the hourly rate you would be paid if you were hypothetically hired by a third party to perform the procedure.

- Estimate the step costs. Step costs are constant over a narrow range of activity but shift to a higher level with increased activity. One example is staffing costs. If the number of these procedures significantly increases, additional staffing will be required. Include the hourly pay for your medical assistants in the analysis.

- Determine the contribution margin. Subtract the revenue from the sum of the variable and step costs to find the contribution margin (dollar contribution per unit) to your practice.4,5

- Estimate the approximate volume of procedures. It is hard to predict future demand, but a good rule of thumb is to estimate the best, expected, and pessimistic volumes. Then average the 3 scenarios and use that figure as the anticipated volume. Multiply the volume by the contribution margin to calculate profit.

Additional financial tools

Once the basic cash flow analysis of the new investment is undertaken, add these methods to your analysis:

Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows (FIGURE 1).6 NPV takes into consideration the time value of money, where money in the present is worth more than the same value sometime in the future due to inflation and earning capacity. NPV is used in capital budgeting to analyze the profitability of a projected investment or project.1,4,5

Consider the discount rate as the expected rate of return or cost of capital. By discounting the future cash flow each year by the discount rate, you can get the present value of cash flow. Subtract the present value of cash flow from the original investment to get the NPV for the equipment's investment. A positive value is a favorable analysis to purchase the equipment; a negative value may suggest that the equipment may be a poor investment.

The NPV can be calculated in a spreadsheet using the following NPV command formula: NPV(rate,value1,[value2],...). This formula gives you the present value of cash inflows. The rate is the discount rate and the values are the series of cash flows occurring over a period of time. The NPV command formula in Excel, despite its misleading name, only gives the present value of cash flows.7 Therefore, it is important that the present value of cash inflows is subtracted from the initial capital investment to get the NPV.

FIGURE 2 shows analysis of a piece of equipment that requires a $14,000 initial investment in Year 0. Each year the use of the equipment generates $25,300 per year through year 5. Assign a discount rate of 11%, about what you would expect for a stock market investment.

Consider other investment opportunities. The historical rate of return for a stock index fund is 11.5%.8 Using this discount rate, you can compare whether the money would be better invested in the medical equipment or stock.

Internal rate of return (IRR) is a metric used in capital budgeting to measure the profitability of potential investments. The IRR determines if the discount rate at which the present value of expected net cash inflow is equal to the cash outlay. In other words, the IRR is the discount rate that makes the net present cash flows from a project equal zero. The decision rule related to the IRR criterion is to accept a project in which the IRR is greater than the required rate of return (cutoff rate). The formula for the IRR is the same as the NPV formula, except that the NPV is set at zero and the discount rate is calculated through iterative calculation. The IRR can be calculated in a spreadsheet using the following command formula: IRR(values, [guess]).1,5,9 In FIGURE 3, the IRR is 180%, far superior than the return you would find in other investments such as the stock market.

The IRR is somewhat different from return on investment (ROI). ROI is the percent of return on the initial investment over a period of time. Each piece of equipment has a different ROI over a different time period. ROI does not take into account the time value of money (TVM). Incorporating the IRR (or the TVM) allows for equal comparison between 2 pieces of equipment in the analysis.10

If you are not comparing 2 different types of equipment for purchase, then using the cutoff of 11.5% may be helpful (the historical average stock market return). If the IRR is less than 11.5%, then in theory, it would be better to put your money in the stock market than in new equipment.7

Breakeven analysis calculates the volume of procedures that would be needed to break even or make a profit. It can also determine if there is enough demand to meet the volume required to break even or profit. Unlike the first 2 methods, where you have to guess at future volume, this method calculates the volume required to break even, but does not specify a time period. Your practice would have to use subjective experience to determine how long it would take to reach that volume, given your patient population and the ability to reach the targeted market segment.

Fixed costs are costs that do not change with the varying volume of units of service or products sold. After calculating the contribution margin, divide the fixed costs of the equipment by the contribution margin. Then you will have the volume required to break even (FIGURE 4). Add the dollar amount of profit you would like to attain to the fixed costs, then divide that total by the contribution margin, and you'll have the volume required to meet those specifications.1,4,5

Even though the calculations described above relate to medical equipment, you can use this same method to analyze the cost of adding new providers or any other business development project to determine the required volume to break even on the capital outlay.

CASE New equipment requests

A new ObGyn in your practice requests that you purchase a hysteroscope so that she can start performing office-based hysteroscopic sterilization. Another partner would like to acquire urodynamic equipment instead of referring urinary incontinent patients to a urogynecologist. How do you decide what to purchase?

First calculate the contribution margins for each product. Next, since you do not know for certain the volume you might achieve for each procedure, create 3 scenarios for the best, expected, and pessimistic situations. Assume equal probability for each of these categories and average the volumes of the estimates. Even though you may keep the equipment longer, estimate the financial analysis over 5 years. In this example, we assume a discount rate of 11% for the NPV calculation for both pieces of equipment.

Calculate the IRR using a spreadsheet based on the cash flow for each piece of equipment. Say that the practice anticipates doing 23 hysteroscopic sterilizations per year. If the reimbursement is $2,600 per procedure, and the variable costs are $1,500, the contribution margin is $1,100. So 23 procedures multiplied by $1,100 equals an annual profit of $25,300. Then discount the $25,300 for each year. In this example, we use a discount rate of 11%. The TABLE shows the amount discounted each year.

The sum of the discounted cash flows is $93,506. However, we have to subtract the initial investment of $14,000, so the final NPV equals $79,506 (FIGURE 5).

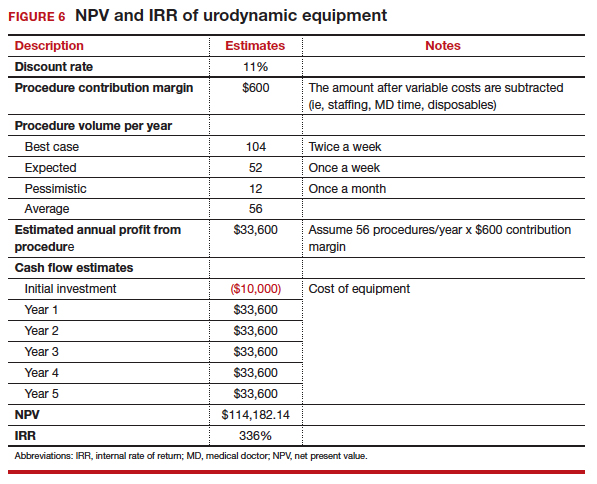

Apply the same financial NPV and IRR calculations used to assess the hysteroscope to the urodynamic equipment. From the analysis (FIGUREs 5 and 6), both purchases would be financially successful. However, it appears that the urodynamic equipment is a superior investment over the hysteroscope, with a higher NPV ($115,877 vs $81,880, respectively) and IRR (336% vs 180%, respectively). This is likely due to the higher anticipated volume of use with the urodynamic equipment and lower cost of initial investment, despite having a lower contribution margin than the hysteroscope.

Caveats

For simplicity, this analysis does not account for the fact that the hysteroscope could be used for other revenue-generating procedures such as diagnostic hysteroscopy. Factoring in these potential additional services using the same hysteroscope might change the decision analysis in favor of the hysteroscope.

Remember that, although the financial analysis is very helpful in decision making, nonfinancial evaluations should also influence your choice. In this example, while there may be a financial advantage to purchasing the urodynamic equipment over the hysteroscopic equipment, nonfinancial considerations can help you decide which purchase would be a better aligned with the goals and strategies of your practice.

These tools for nonfinancial and financial analysis can be used for any investment in your practice, whether it is in medical equipment, personnel, or development of other profit centers.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

Providing state-of-the-art health care for women often requires the use of various types of medical equipment, and decisions regarding their purchase can be complicated. With rising costs and reduced reimbursements, capital expenditures must be made with great care. Some equipment may not generate revenue but is required at a basic care-giving level: examination tables, procedure instruments, autoclaves, etc. Conversely, other equipment may not be necessary but strongly desired to offer a full complement of care. Unfortunately, sometimes a decision to buy expensive equipment is based more on a sales representative's ability to rationalize the purchase as a sound investment than on its necessity or practicality. This article focuses on tools to help you make a decision to obtain revenue-generating medical equipment.

First consideration: Nonfinancial evaluation

Nonfinancial criteria should be your first concern. They may have a greater impact on your practice than any financial consideration.

Does this investment align with your overall goals?

If your focus is to provide the best and most efficient obstetric care in the community, it may not make sense to purchase urodynamic equipment, even if using the equipment could be profitable.1 If the equipment begins to distract the practice from its strategic focus, then complications from managing this new equipment might be more harmful than helpful.

What are the pros and cons of the investment?

Concern that the equipment may not be effective or may become obsolete in a few years would preclude having to consider the financial purchase in the first place.1

Consider a PESTLE analysis

Before starting a new project, use a PESTLE analysis to assess external factors that are political, economic, social, technological, legal, and environmental. Its purpose is to identify issues that are beyond the control of the organization and have some level of impact on the organization.2,3

If you are considering the purchase of a laser hair removal machine, what could be the political considerations, such as your reputation among peers or other physicians who refer patients to your practice? What are the economic (financial) considerations? How would the social (or marketing) message be communicated, and do you have the organizational skills to implement a marketing strategy? What are the technical challenges required for maintaining this machine, and how much skill and training would be required to safely use it? What are the legal ramifications for implementing this service? Does your malpractice insurance cover it? And finally, what kind of environment (physical space) would be required?

What alternative investment opportunities might compete?

When considering a significant investment, other opportunities may no longer be feasible. Think about other ways your practice could use the money and which investment prospects would be the best fit.1 For instance, purchasing equipment that is very time intensive may not necessarily be the most profitable decision, especially if it takes the provider away from other services with higher margins. Could investing in expensive equipment delay bringing in another provider who might have a higher financial impact?

Next stage: Financial evaluation

To begin a basic cash flow analysis of the new investment, gather your practice's financial data. Estimate the cash flow resulting from the equipment investment, including any additional expenses and revenues. Here are some steps:

- Identify the revenue generated by each use of the equipment.

- Estimate the variable costs (costs that increase with each incremental unit of activity). Variable costs include expenses associated with each use, such as disposable accessories. For a hysteroscope, the variable cost may be the tubing and fluid used. Some procedures, such as office hysteroscopic sterilization, require the purchase of intratubal occlusion devices.

Also consider the cost of your time. One way to determine this is to investigate the hourly rate you would be paid if you were hypothetically hired by a third party to perform the procedure.

- Estimate the step costs. Step costs are constant over a narrow range of activity but shift to a higher level with increased activity. One example is staffing costs. If the number of these procedures significantly increases, additional staffing will be required. Include the hourly pay for your medical assistants in the analysis.

- Determine the contribution margin. Subtract the revenue from the sum of the variable and step costs to find the contribution margin (dollar contribution per unit) to your practice.4,5

- Estimate the approximate volume of procedures. It is hard to predict future demand, but a good rule of thumb is to estimate the best, expected, and pessimistic volumes. Then average the 3 scenarios and use that figure as the anticipated volume. Multiply the volume by the contribution margin to calculate profit.

Additional financial tools

Once the basic cash flow analysis of the new investment is undertaken, add these methods to your analysis:

Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows (FIGURE 1).6 NPV takes into consideration the time value of money, where money in the present is worth more than the same value sometime in the future due to inflation and earning capacity. NPV is used in capital budgeting to analyze the profitability of a projected investment or project.1,4,5

Consider the discount rate as the expected rate of return or cost of capital. By discounting the future cash flow each year by the discount rate, you can get the present value of cash flow. Subtract the present value of cash flow from the original investment to get the NPV for the equipment's investment. A positive value is a favorable analysis to purchase the equipment; a negative value may suggest that the equipment may be a poor investment.

The NPV can be calculated in a spreadsheet using the following NPV command formula: NPV(rate,value1,[value2],...). This formula gives you the present value of cash inflows. The rate is the discount rate and the values are the series of cash flows occurring over a period of time. The NPV command formula in Excel, despite its misleading name, only gives the present value of cash flows.7 Therefore, it is important that the present value of cash inflows is subtracted from the initial capital investment to get the NPV.

FIGURE 2 shows analysis of a piece of equipment that requires a $14,000 initial investment in Year 0. Each year the use of the equipment generates $25,300 per year through year 5. Assign a discount rate of 11%, about what you would expect for a stock market investment.

Consider other investment opportunities. The historical rate of return for a stock index fund is 11.5%.8 Using this discount rate, you can compare whether the money would be better invested in the medical equipment or stock.

Internal rate of return (IRR) is a metric used in capital budgeting to measure the profitability of potential investments. The IRR determines if the discount rate at which the present value of expected net cash inflow is equal to the cash outlay. In other words, the IRR is the discount rate that makes the net present cash flows from a project equal zero. The decision rule related to the IRR criterion is to accept a project in which the IRR is greater than the required rate of return (cutoff rate). The formula for the IRR is the same as the NPV formula, except that the NPV is set at zero and the discount rate is calculated through iterative calculation. The IRR can be calculated in a spreadsheet using the following command formula: IRR(values, [guess]).1,5,9 In FIGURE 3, the IRR is 180%, far superior than the return you would find in other investments such as the stock market.

The IRR is somewhat different from return on investment (ROI). ROI is the percent of return on the initial investment over a period of time. Each piece of equipment has a different ROI over a different time period. ROI does not take into account the time value of money (TVM). Incorporating the IRR (or the TVM) allows for equal comparison between 2 pieces of equipment in the analysis.10

If you are not comparing 2 different types of equipment for purchase, then using the cutoff of 11.5% may be helpful (the historical average stock market return). If the IRR is less than 11.5%, then in theory, it would be better to put your money in the stock market than in new equipment.7

Breakeven analysis calculates the volume of procedures that would be needed to break even or make a profit. It can also determine if there is enough demand to meet the volume required to break even or profit. Unlike the first 2 methods, where you have to guess at future volume, this method calculates the volume required to break even, but does not specify a time period. Your practice would have to use subjective experience to determine how long it would take to reach that volume, given your patient population and the ability to reach the targeted market segment.

Fixed costs are costs that do not change with the varying volume of units of service or products sold. After calculating the contribution margin, divide the fixed costs of the equipment by the contribution margin. Then you will have the volume required to break even (FIGURE 4). Add the dollar amount of profit you would like to attain to the fixed costs, then divide that total by the contribution margin, and you'll have the volume required to meet those specifications.1,4,5

Even though the calculations described above relate to medical equipment, you can use this same method to analyze the cost of adding new providers or any other business development project to determine the required volume to break even on the capital outlay.

CASE New equipment requests

A new ObGyn in your practice requests that you purchase a hysteroscope so that she can start performing office-based hysteroscopic sterilization. Another partner would like to acquire urodynamic equipment instead of referring urinary incontinent patients to a urogynecologist. How do you decide what to purchase?

First calculate the contribution margins for each product. Next, since you do not know for certain the volume you might achieve for each procedure, create 3 scenarios for the best, expected, and pessimistic situations. Assume equal probability for each of these categories and average the volumes of the estimates. Even though you may keep the equipment longer, estimate the financial analysis over 5 years. In this example, we assume a discount rate of 11% for the NPV calculation for both pieces of equipment.

Calculate the IRR using a spreadsheet based on the cash flow for each piece of equipment. Say that the practice anticipates doing 23 hysteroscopic sterilizations per year. If the reimbursement is $2,600 per procedure, and the variable costs are $1,500, the contribution margin is $1,100. So 23 procedures multiplied by $1,100 equals an annual profit of $25,300. Then discount the $25,300 for each year. In this example, we use a discount rate of 11%. The TABLE shows the amount discounted each year.

The sum of the discounted cash flows is $93,506. However, we have to subtract the initial investment of $14,000, so the final NPV equals $79,506 (FIGURE 5).

Apply the same financial NPV and IRR calculations used to assess the hysteroscope to the urodynamic equipment. From the analysis (FIGUREs 5 and 6), both purchases would be financially successful. However, it appears that the urodynamic equipment is a superior investment over the hysteroscope, with a higher NPV ($115,877 vs $81,880, respectively) and IRR (336% vs 180%, respectively). This is likely due to the higher anticipated volume of use with the urodynamic equipment and lower cost of initial investment, despite having a lower contribution margin than the hysteroscope.

Caveats

For simplicity, this analysis does not account for the fact that the hysteroscope could be used for other revenue-generating procedures such as diagnostic hysteroscopy. Factoring in these potential additional services using the same hysteroscope might change the decision analysis in favor of the hysteroscope.

Remember that, although the financial analysis is very helpful in decision making, nonfinancial evaluations should also influence your choice. In this example, while there may be a financial advantage to purchasing the urodynamic equipment over the hysteroscopic equipment, nonfinancial considerations can help you decide which purchase would be a better aligned with the goals and strategies of your practice.

These tools for nonfinancial and financial analysis can be used for any investment in your practice, whether it is in medical equipment, personnel, or development of other profit centers.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

- Willis DR. How to decide whether to buy new medical equipment. Fam Pract Manag. 2004;11(3):53−58.

- PESTLE Analysis Strategy Skills. http://www.free-management-ebooks.com/dldebk-pdf/fme-pestle-analysis.pdf. Published 2013. Accessed March 2, 2018.

- What is PESTLE analysis? A tool for business analysis. http://pestleanalysis.com/what-is-pestle-analysis/. Published 2018. Accessed March 2, 2018.

- Nowicki M, ed. Introduction to the Financial Management of Healthcare Organizations. 6th ed. Chicago, Illinois: Health Administration Press; 2014:150−151, 299−316.

- Ross SA, Westerfield RW, Jaffe J. Corporate Finance. 8th ed. New York, New York: McGraw Hill; 2008:271−288.

- Net Present Value - NPV. Investopia. https://www.investopedia.com/terms/n/npv.asp. Accessed April 10, 2018.

- NPV function. Microsoft Office Support. https://support.office.com/en-us/article/npv-function-8672cb67-2576-4d07-b67b-ac28acf2a568. Accessed April 10, 2018.

- Damodaran A. Annual Returns on Stock, T.Bonds and T.Bills: 1928 - Current. http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html. Updated January 5, 2018. Accessed March 2, 2018.

- IRR function. Microsoft Office Support. https://support.office.com/en-us/article/irr-function-64925eaa-9988-495b-b290-3ad0c163c1bc. Accessed April 10, 2018.

- Time Value of Money (TVM). Investopedia. https://www.investopedia.com/terms/t/timevalueofmoney.asp. Published 2018. Accessed March 2, 2018.

- Willis DR. How to decide whether to buy new medical equipment. Fam Pract Manag. 2004;11(3):53−58.

- PESTLE Analysis Strategy Skills. http://www.free-management-ebooks.com/dldebk-pdf/fme-pestle-analysis.pdf. Published 2013. Accessed March 2, 2018.

- What is PESTLE analysis? A tool for business analysis. http://pestleanalysis.com/what-is-pestle-analysis/. Published 2018. Accessed March 2, 2018.

- Nowicki M, ed. Introduction to the Financial Management of Healthcare Organizations. 6th ed. Chicago, Illinois: Health Administration Press; 2014:150−151, 299−316.

- Ross SA, Westerfield RW, Jaffe J. Corporate Finance. 8th ed. New York, New York: McGraw Hill; 2008:271−288.

- Net Present Value - NPV. Investopia. https://www.investopedia.com/terms/n/npv.asp. Accessed April 10, 2018.

- NPV function. Microsoft Office Support. https://support.office.com/en-us/article/npv-function-8672cb67-2576-4d07-b67b-ac28acf2a568. Accessed April 10, 2018.

- Damodaran A. Annual Returns on Stock, T.Bonds and T.Bills: 1928 - Current. http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html. Updated January 5, 2018. Accessed March 2, 2018.

- IRR function. Microsoft Office Support. https://support.office.com/en-us/article/irr-function-64925eaa-9988-495b-b290-3ad0c163c1bc. Accessed April 10, 2018.

- Time Value of Money (TVM). Investopedia. https://www.investopedia.com/terms/t/timevalueofmoney.asp. Published 2018. Accessed March 2, 2018.

IN THIS ARTICLE

- Financial evaluation steps

- Breakeven analysis

- Compare 2 investment opportunities

Accounting 101: Basics you need to know

Physicians practice medicine and communicate within the world of medical language, yet there is a lack of awareness and understanding by many health care professionals of the universal language of business, which is accounting. Just as Latin provides the basic framework for medically related terminology, accounting is the standard language used to convey financial information to both internal and external stakeholders.

Accounting principles are important to physicians at any level. Whether you are starting out in private practice, running a clinical department, or working as an executive in a health care system, most decisions are based on the interpretation of financial data using accounting principles. Accounting standards in the United States are developed by the Financial Accounting Standard Board (FASB) and established as a set of principles and guidelines called Generally Accepted Accounting Principles (GAAP).1–3

Accrual- vs cash-based accounting

There are 2 approaches to recording financial transactions: accrual- and cash-based accounting methods. The main difference between them is in the timing of the recorded financial transactions (when revenue and expenses are recognized on the accounting books). Under GAAP, the matching principle, which is one of the most basic and utilized guidelines of accounting, specifies that accrual accounting be used. In the United States, most businesses (publically traded companies and moderate- to large-sized companies) use accrual accounting, while some individual and smaller businesses, including health care services such as physician practices, use the cash method.1–4

Accrual-based accounting

Accrual-based accounting specifies that revenues are recorded when they are earned, and expenses are recorded when they occur. A health care business may earn revenue for services on one day, but the cash may not be received or recorded on the accounting books for several weeks or months and at an amount less than billed.

Accrual-based accounting provides a more accurate representation of a business’ financial performance, since it uses the principle in which expenses are matched to revenues in the same time period. This enables a more precise representation of true financial performance during a given time frame.1–4

Cash-based accounting

Cash-based accounting is the easiest method to understand and implement because financial transactions are recorded in the accounting books when money is received or spent without the need for complex accounting techniques or integration of accounts receivable or payable.

Despite the ease of use and simplicity in tracking cash flow, this method can be deceiving because revenue may be received or expenses may need to be paid at times that are not consistent with when the revenue has been earned or expenses incurred. This can result in misleading information on the business’ health and the accuracy of tracking financial performance over time, since revenue and expenses for a particular transaction may occur at different times.1–4

Which accounting process to choose?

Even though accrual-based accounting may provide a more accurate financial representation of a business’ performance, many smaller businesses, including physician practices, prefer to use cash-based accounting. In addition, many health care businesses are eligible to use cash-based accounting per Internal Revenue Service (IRS) rules by qualifying for the Gross Receipts Test and being a qualified Personal Service Corporation (PSC):

- The Gross Receipts Test states that if the average annual gross receipts of the business are less than $5 million, the business can use the cash-based accounting method.

- If at least 95% of a business activity involves performing health care services, and at least 95% of the business is owned by employees performing health care services, then the business qualifies as a PSC that may use the cash-based accounting method.

Many physician practices qualify to use cash-based accounting, which reduces the complexity of following accrual-based accounting rules and simplifies overall cash-flow management.5

Read about insurance, capital equipment depreciation, more

CASE New practice opens

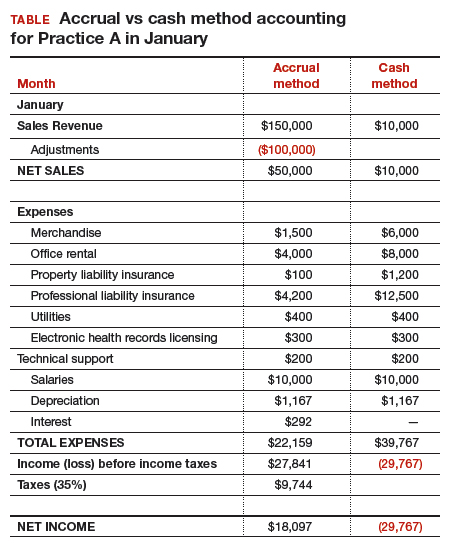

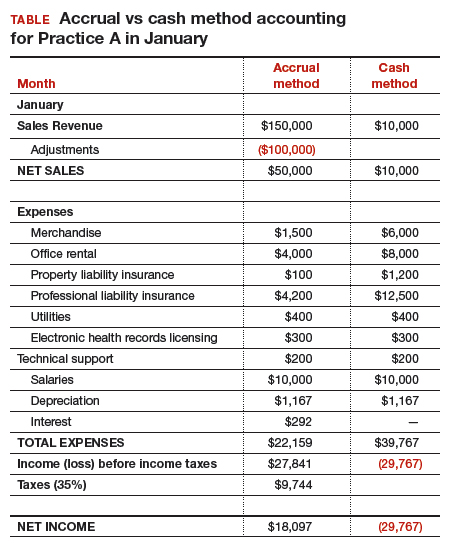

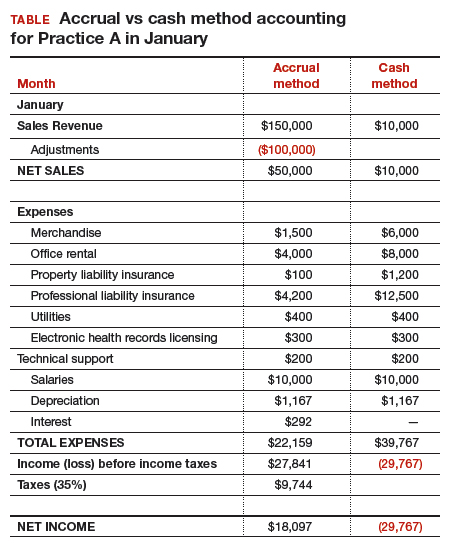

Practice A opens its practice on January 1. The practice borrows $20,000 from the bank to purchase hysteroscopic equipment for office-based tubal sterilizations and an additional $50,000 for an ultrasound machine. Both loans have a 5% annual interest rate amortized over 5 years. The practice leases office space and pays rent 2 months in advance at $8,000 ($4,000 per month). On January 1, the practice pays a $1,200 premium for annual property and liability insurance and $12,500 for the first quarter payment for professional liability insurance ($50,000 annually, paid quarterly). Other costs the practice pays in January include: utilities, $400; EHR licensing, $300; technical support, $200; and salaries, $10,000.

The practice purchases 4 sets of sterilization spring devices at $1,500 each ($6,000) to have in stock. One hysteroscopic sterilization procedure is performed on a patient in January using 1 device. The practice is reimbursed $2,500 for the procedure.

In January, the practice bills $150,000 in charges, but after insurance contractual adjustments, January’s revenue is $50,000. Actual cash payments from billings received are $10,000 in January, $30,000 in February, and $10,000 in March.

At first glance, there is a noticeable difference on the sales or recognition of revenues based on the type of accounting (TABLE). With the accrual method, because the billing charges are submitted in January when the services were provided (minus the insurance contractual adjustments), the $50,000 revenue is immediately counted and recognized, even though the practice only received $10,000 cash for those billings during January. While the benefit to accrual accounting is the timely recognition of the revenue when the service was provided, the downside is that much of those billings might actually be paid over 90 days, and some of those billings may go unpaid by the insurance company or the patients, which would require adjustments in later months.

The cash-based method is simpler to understand because the cash received for the month is recognized as the revenue, regardless of the amount charged that month.

Merchandise. In the accrual method, the cost of merchandise sold (the hysteroscopic sterilization implants) is recognized as an expense when the revenue is generated from its sale. In this case, the date that the patient has the hysteroscopic in-office sterilization procedure is when the revenue and the expense of the implant are recognized.

In a cash-based accounting method, the $6,000 cost of the implants is recognized at the time of purchase in January.

Lease. In this scenario, even though 2 months of lease for the office were paid, the accrual method only recognizes the January payment; the second payment is recognized in February. In the cash method, because both months were paid in January, the total expense of $8,000 is recognized in January.

Property liability insurance. The property liability insurance payment is required at the start of the year. In accrual accounting, this expense is divided over 12 months, while in the cash method, the expense is counted at the time the payment is made.

Professional liability insurance. The professional liability insurance expense of $50,000 per year is made in quarterly payments, so for the accrual method, the annual amount would be distributed over 12 months at $4,200 per month. With the cash method, it would be paid—and recognized as an expense—quarterly at $12,500, starting in January.

Capital equipment depreciation. Capital medical equipment (hysteroscopy and ultrasound) can be depreciated using a straight-line 5-year depreciation. A total $70,000 worth of equipment divided by 5 years is $14,000 per year, depreciated over 5 years. One-twelfth of $14,000 equals $1,167, which is recorded as a January depreciation expense. Because the Internal Revenue Code requires capital assets to be depreciated, even for cash-basis taxpayers, the common practice is to record depreciation expense for both cash- and accrual-basis income accounting.6

Interest on loans. A loan’s principal payment will not be included on the income statement. The principal payment, a reduction of a liability (loans payable), is reported on the balance sheet. Only the interest portion of a loan payment is reported on the income statement (interest expense). In accrual accounting, the accrued interest on the loan payment for the year is $3,500 ($292 for January). For the cash-basis method, because the interest is paid annually at year-end, interest will not be expensed until December.

Taxes. The IRS states that, “Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed. Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.”7

Assuming 35% tax liability, the accrual method would create a tax liability of $9,744 on a profit of $27,841. With the cash method, there would be no tax liability because there was no net profit.

Other expenses. The utilities, EHR licensing, tech support, and salaries are expensed the same way for both methods.

Net income. The resulting final net income is vastly different for the month of January depending on the accounting method utilized. The accrual method results in a net income of $18,097, while the cash-basis method results in a net loss of $29,767. Over the course of the year, these imbalances are likely to even out.

Related article:

Business law critical to your practice

Choosing an accounting method

Depending on the accounting method, a practice’s performance and profit will seem very different. The type of accounting method chosen will depend on what goals the owners want to achieve.

The accrual method provides a more accurate picture of business flow and performance and will be less subject to monthly variations due to large purchases or variations in expenses. If the practice chooses this method using an income statement, it should also employ a cash-flow statement.

The cash method of accounting will give a convenient and practical summary of the practice’s cash flow.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

- About the FASB. Financial Accounting Standards Board website. http://www.fasb.org/jsp/FASB/PageSectionPage&cid=1176154526495. Accessed November 7, 2017.

- What is the difference between accrual accounting and cash accounting? Investopedia. https://www.investopedia.com/ask/answers/121514/what-difference-between-accrual-accounting-and-cash-accounting.asp. Accessed November 7, 2017.

- Accounting Basics (Explanation). Part 2: Income Statement. Accounting Coach. https://www.accountingcoach.com/accounting-basics/explanation/2. Accessed November 7, 2017.

- Stickney C, Weil R. Financial Accounting: An Introduction to Concepts, Methods, and Uses. 11th ed. Nashville, TN: Southwestern College Publishing Group; 2006:97-110.

- Internal Revenue Service. Publication 538 (12/2016), Accounting Periods and Methods. https://www.irs.gov/publications/p538#en_US_201612_publink1000270634. Revised December 2016. Accessed November 7, 2017.

- Klinefelter D, McCorkle D, Klose S. Financial Management: Cash vs. Accrual Accounting. Risk Management. AgriLife Extension. Texas A&M System. http://agrilife.org/agecoext/files/2013/10/rm5-16.pdf. Published 2013. Accessed November 7, 2017.

- Internal Revenue Service. Small Business and Self-Employed Tax Center: Estimated Taxes. https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes. Updated November 2, 2017. Accessed November 7, 2017.

Physicians practice medicine and communicate within the world of medical language, yet there is a lack of awareness and understanding by many health care professionals of the universal language of business, which is accounting. Just as Latin provides the basic framework for medically related terminology, accounting is the standard language used to convey financial information to both internal and external stakeholders.

Accounting principles are important to physicians at any level. Whether you are starting out in private practice, running a clinical department, or working as an executive in a health care system, most decisions are based on the interpretation of financial data using accounting principles. Accounting standards in the United States are developed by the Financial Accounting Standard Board (FASB) and established as a set of principles and guidelines called Generally Accepted Accounting Principles (GAAP).1–3

Accrual- vs cash-based accounting

There are 2 approaches to recording financial transactions: accrual- and cash-based accounting methods. The main difference between them is in the timing of the recorded financial transactions (when revenue and expenses are recognized on the accounting books). Under GAAP, the matching principle, which is one of the most basic and utilized guidelines of accounting, specifies that accrual accounting be used. In the United States, most businesses (publically traded companies and moderate- to large-sized companies) use accrual accounting, while some individual and smaller businesses, including health care services such as physician practices, use the cash method.1–4

Accrual-based accounting

Accrual-based accounting specifies that revenues are recorded when they are earned, and expenses are recorded when they occur. A health care business may earn revenue for services on one day, but the cash may not be received or recorded on the accounting books for several weeks or months and at an amount less than billed.

Accrual-based accounting provides a more accurate representation of a business’ financial performance, since it uses the principle in which expenses are matched to revenues in the same time period. This enables a more precise representation of true financial performance during a given time frame.1–4

Cash-based accounting

Cash-based accounting is the easiest method to understand and implement because financial transactions are recorded in the accounting books when money is received or spent without the need for complex accounting techniques or integration of accounts receivable or payable.

Despite the ease of use and simplicity in tracking cash flow, this method can be deceiving because revenue may be received or expenses may need to be paid at times that are not consistent with when the revenue has been earned or expenses incurred. This can result in misleading information on the business’ health and the accuracy of tracking financial performance over time, since revenue and expenses for a particular transaction may occur at different times.1–4

Which accounting process to choose?

Even though accrual-based accounting may provide a more accurate financial representation of a business’ performance, many smaller businesses, including physician practices, prefer to use cash-based accounting. In addition, many health care businesses are eligible to use cash-based accounting per Internal Revenue Service (IRS) rules by qualifying for the Gross Receipts Test and being a qualified Personal Service Corporation (PSC):

- The Gross Receipts Test states that if the average annual gross receipts of the business are less than $5 million, the business can use the cash-based accounting method.

- If at least 95% of a business activity involves performing health care services, and at least 95% of the business is owned by employees performing health care services, then the business qualifies as a PSC that may use the cash-based accounting method.

Many physician practices qualify to use cash-based accounting, which reduces the complexity of following accrual-based accounting rules and simplifies overall cash-flow management.5

Read about insurance, capital equipment depreciation, more

CASE New practice opens

Practice A opens its practice on January 1. The practice borrows $20,000 from the bank to purchase hysteroscopic equipment for office-based tubal sterilizations and an additional $50,000 for an ultrasound machine. Both loans have a 5% annual interest rate amortized over 5 years. The practice leases office space and pays rent 2 months in advance at $8,000 ($4,000 per month). On January 1, the practice pays a $1,200 premium for annual property and liability insurance and $12,500 for the first quarter payment for professional liability insurance ($50,000 annually, paid quarterly). Other costs the practice pays in January include: utilities, $400; EHR licensing, $300; technical support, $200; and salaries, $10,000.

The practice purchases 4 sets of sterilization spring devices at $1,500 each ($6,000) to have in stock. One hysteroscopic sterilization procedure is performed on a patient in January using 1 device. The practice is reimbursed $2,500 for the procedure.

In January, the practice bills $150,000 in charges, but after insurance contractual adjustments, January’s revenue is $50,000. Actual cash payments from billings received are $10,000 in January, $30,000 in February, and $10,000 in March.

At first glance, there is a noticeable difference on the sales or recognition of revenues based on the type of accounting (TABLE). With the accrual method, because the billing charges are submitted in January when the services were provided (minus the insurance contractual adjustments), the $50,000 revenue is immediately counted and recognized, even though the practice only received $10,000 cash for those billings during January. While the benefit to accrual accounting is the timely recognition of the revenue when the service was provided, the downside is that much of those billings might actually be paid over 90 days, and some of those billings may go unpaid by the insurance company or the patients, which would require adjustments in later months.

The cash-based method is simpler to understand because the cash received for the month is recognized as the revenue, regardless of the amount charged that month.

Merchandise. In the accrual method, the cost of merchandise sold (the hysteroscopic sterilization implants) is recognized as an expense when the revenue is generated from its sale. In this case, the date that the patient has the hysteroscopic in-office sterilization procedure is when the revenue and the expense of the implant are recognized.

In a cash-based accounting method, the $6,000 cost of the implants is recognized at the time of purchase in January.

Lease. In this scenario, even though 2 months of lease for the office were paid, the accrual method only recognizes the January payment; the second payment is recognized in February. In the cash method, because both months were paid in January, the total expense of $8,000 is recognized in January.

Property liability insurance. The property liability insurance payment is required at the start of the year. In accrual accounting, this expense is divided over 12 months, while in the cash method, the expense is counted at the time the payment is made.

Professional liability insurance. The professional liability insurance expense of $50,000 per year is made in quarterly payments, so for the accrual method, the annual amount would be distributed over 12 months at $4,200 per month. With the cash method, it would be paid—and recognized as an expense—quarterly at $12,500, starting in January.

Capital equipment depreciation. Capital medical equipment (hysteroscopy and ultrasound) can be depreciated using a straight-line 5-year depreciation. A total $70,000 worth of equipment divided by 5 years is $14,000 per year, depreciated over 5 years. One-twelfth of $14,000 equals $1,167, which is recorded as a January depreciation expense. Because the Internal Revenue Code requires capital assets to be depreciated, even for cash-basis taxpayers, the common practice is to record depreciation expense for both cash- and accrual-basis income accounting.6

Interest on loans. A loan’s principal payment will not be included on the income statement. The principal payment, a reduction of a liability (loans payable), is reported on the balance sheet. Only the interest portion of a loan payment is reported on the income statement (interest expense). In accrual accounting, the accrued interest on the loan payment for the year is $3,500 ($292 for January). For the cash-basis method, because the interest is paid annually at year-end, interest will not be expensed until December.

Taxes. The IRS states that, “Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed. Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.”7

Assuming 35% tax liability, the accrual method would create a tax liability of $9,744 on a profit of $27,841. With the cash method, there would be no tax liability because there was no net profit.

Other expenses. The utilities, EHR licensing, tech support, and salaries are expensed the same way for both methods.

Net income. The resulting final net income is vastly different for the month of January depending on the accounting method utilized. The accrual method results in a net income of $18,097, while the cash-basis method results in a net loss of $29,767. Over the course of the year, these imbalances are likely to even out.

Related article:

Business law critical to your practice

Choosing an accounting method

Depending on the accounting method, a practice’s performance and profit will seem very different. The type of accounting method chosen will depend on what goals the owners want to achieve.

The accrual method provides a more accurate picture of business flow and performance and will be less subject to monthly variations due to large purchases or variations in expenses. If the practice chooses this method using an income statement, it should also employ a cash-flow statement.

The cash method of accounting will give a convenient and practical summary of the practice’s cash flow.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

Physicians practice medicine and communicate within the world of medical language, yet there is a lack of awareness and understanding by many health care professionals of the universal language of business, which is accounting. Just as Latin provides the basic framework for medically related terminology, accounting is the standard language used to convey financial information to both internal and external stakeholders.

Accounting principles are important to physicians at any level. Whether you are starting out in private practice, running a clinical department, or working as an executive in a health care system, most decisions are based on the interpretation of financial data using accounting principles. Accounting standards in the United States are developed by the Financial Accounting Standard Board (FASB) and established as a set of principles and guidelines called Generally Accepted Accounting Principles (GAAP).1–3

Accrual- vs cash-based accounting

There are 2 approaches to recording financial transactions: accrual- and cash-based accounting methods. The main difference between them is in the timing of the recorded financial transactions (when revenue and expenses are recognized on the accounting books). Under GAAP, the matching principle, which is one of the most basic and utilized guidelines of accounting, specifies that accrual accounting be used. In the United States, most businesses (publically traded companies and moderate- to large-sized companies) use accrual accounting, while some individual and smaller businesses, including health care services such as physician practices, use the cash method.1–4

Accrual-based accounting

Accrual-based accounting specifies that revenues are recorded when they are earned, and expenses are recorded when they occur. A health care business may earn revenue for services on one day, but the cash may not be received or recorded on the accounting books for several weeks or months and at an amount less than billed.

Accrual-based accounting provides a more accurate representation of a business’ financial performance, since it uses the principle in which expenses are matched to revenues in the same time period. This enables a more precise representation of true financial performance during a given time frame.1–4

Cash-based accounting

Cash-based accounting is the easiest method to understand and implement because financial transactions are recorded in the accounting books when money is received or spent without the need for complex accounting techniques or integration of accounts receivable or payable.

Despite the ease of use and simplicity in tracking cash flow, this method can be deceiving because revenue may be received or expenses may need to be paid at times that are not consistent with when the revenue has been earned or expenses incurred. This can result in misleading information on the business’ health and the accuracy of tracking financial performance over time, since revenue and expenses for a particular transaction may occur at different times.1–4

Which accounting process to choose?

Even though accrual-based accounting may provide a more accurate financial representation of a business’ performance, many smaller businesses, including physician practices, prefer to use cash-based accounting. In addition, many health care businesses are eligible to use cash-based accounting per Internal Revenue Service (IRS) rules by qualifying for the Gross Receipts Test and being a qualified Personal Service Corporation (PSC):

- The Gross Receipts Test states that if the average annual gross receipts of the business are less than $5 million, the business can use the cash-based accounting method.

- If at least 95% of a business activity involves performing health care services, and at least 95% of the business is owned by employees performing health care services, then the business qualifies as a PSC that may use the cash-based accounting method.

Many physician practices qualify to use cash-based accounting, which reduces the complexity of following accrual-based accounting rules and simplifies overall cash-flow management.5

Read about insurance, capital equipment depreciation, more

CASE New practice opens

Practice A opens its practice on January 1. The practice borrows $20,000 from the bank to purchase hysteroscopic equipment for office-based tubal sterilizations and an additional $50,000 for an ultrasound machine. Both loans have a 5% annual interest rate amortized over 5 years. The practice leases office space and pays rent 2 months in advance at $8,000 ($4,000 per month). On January 1, the practice pays a $1,200 premium for annual property and liability insurance and $12,500 for the first quarter payment for professional liability insurance ($50,000 annually, paid quarterly). Other costs the practice pays in January include: utilities, $400; EHR licensing, $300; technical support, $200; and salaries, $10,000.

The practice purchases 4 sets of sterilization spring devices at $1,500 each ($6,000) to have in stock. One hysteroscopic sterilization procedure is performed on a patient in January using 1 device. The practice is reimbursed $2,500 for the procedure.

In January, the practice bills $150,000 in charges, but after insurance contractual adjustments, January’s revenue is $50,000. Actual cash payments from billings received are $10,000 in January, $30,000 in February, and $10,000 in March.

At first glance, there is a noticeable difference on the sales or recognition of revenues based on the type of accounting (TABLE). With the accrual method, because the billing charges are submitted in January when the services were provided (minus the insurance contractual adjustments), the $50,000 revenue is immediately counted and recognized, even though the practice only received $10,000 cash for those billings during January. While the benefit to accrual accounting is the timely recognition of the revenue when the service was provided, the downside is that much of those billings might actually be paid over 90 days, and some of those billings may go unpaid by the insurance company or the patients, which would require adjustments in later months.

The cash-based method is simpler to understand because the cash received for the month is recognized as the revenue, regardless of the amount charged that month.

Merchandise. In the accrual method, the cost of merchandise sold (the hysteroscopic sterilization implants) is recognized as an expense when the revenue is generated from its sale. In this case, the date that the patient has the hysteroscopic in-office sterilization procedure is when the revenue and the expense of the implant are recognized.

In a cash-based accounting method, the $6,000 cost of the implants is recognized at the time of purchase in January.

Lease. In this scenario, even though 2 months of lease for the office were paid, the accrual method only recognizes the January payment; the second payment is recognized in February. In the cash method, because both months were paid in January, the total expense of $8,000 is recognized in January.

Property liability insurance. The property liability insurance payment is required at the start of the year. In accrual accounting, this expense is divided over 12 months, while in the cash method, the expense is counted at the time the payment is made.

Professional liability insurance. The professional liability insurance expense of $50,000 per year is made in quarterly payments, so for the accrual method, the annual amount would be distributed over 12 months at $4,200 per month. With the cash method, it would be paid—and recognized as an expense—quarterly at $12,500, starting in January.

Capital equipment depreciation. Capital medical equipment (hysteroscopy and ultrasound) can be depreciated using a straight-line 5-year depreciation. A total $70,000 worth of equipment divided by 5 years is $14,000 per year, depreciated over 5 years. One-twelfth of $14,000 equals $1,167, which is recorded as a January depreciation expense. Because the Internal Revenue Code requires capital assets to be depreciated, even for cash-basis taxpayers, the common practice is to record depreciation expense for both cash- and accrual-basis income accounting.6

Interest on loans. A loan’s principal payment will not be included on the income statement. The principal payment, a reduction of a liability (loans payable), is reported on the balance sheet. Only the interest portion of a loan payment is reported on the income statement (interest expense). In accrual accounting, the accrued interest on the loan payment for the year is $3,500 ($292 for January). For the cash-basis method, because the interest is paid annually at year-end, interest will not be expensed until December.

Taxes. The IRS states that, “Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed. Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.”7

Assuming 35% tax liability, the accrual method would create a tax liability of $9,744 on a profit of $27,841. With the cash method, there would be no tax liability because there was no net profit.

Other expenses. The utilities, EHR licensing, tech support, and salaries are expensed the same way for both methods.

Net income. The resulting final net income is vastly different for the month of January depending on the accounting method utilized. The accrual method results in a net income of $18,097, while the cash-basis method results in a net loss of $29,767. Over the course of the year, these imbalances are likely to even out.

Related article:

Business law critical to your practice

Choosing an accounting method

Depending on the accounting method, a practice’s performance and profit will seem very different. The type of accounting method chosen will depend on what goals the owners want to achieve.

The accrual method provides a more accurate picture of business flow and performance and will be less subject to monthly variations due to large purchases or variations in expenses. If the practice chooses this method using an income statement, it should also employ a cash-flow statement.

The cash method of accounting will give a convenient and practical summary of the practice’s cash flow.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

- About the FASB. Financial Accounting Standards Board website. http://www.fasb.org/jsp/FASB/PageSectionPage&cid=1176154526495. Accessed November 7, 2017.

- What is the difference between accrual accounting and cash accounting? Investopedia. https://www.investopedia.com/ask/answers/121514/what-difference-between-accrual-accounting-and-cash-accounting.asp. Accessed November 7, 2017.

- Accounting Basics (Explanation). Part 2: Income Statement. Accounting Coach. https://www.accountingcoach.com/accounting-basics/explanation/2. Accessed November 7, 2017.

- Stickney C, Weil R. Financial Accounting: An Introduction to Concepts, Methods, and Uses. 11th ed. Nashville, TN: Southwestern College Publishing Group; 2006:97-110.

- Internal Revenue Service. Publication 538 (12/2016), Accounting Periods and Methods. https://www.irs.gov/publications/p538#en_US_201612_publink1000270634. Revised December 2016. Accessed November 7, 2017.

- Klinefelter D, McCorkle D, Klose S. Financial Management: Cash vs. Accrual Accounting. Risk Management. AgriLife Extension. Texas A&M System. http://agrilife.org/agecoext/files/2013/10/rm5-16.pdf. Published 2013. Accessed November 7, 2017.

- Internal Revenue Service. Small Business and Self-Employed Tax Center: Estimated Taxes. https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes. Updated November 2, 2017. Accessed November 7, 2017.

- About the FASB. Financial Accounting Standards Board website. http://www.fasb.org/jsp/FASB/PageSectionPage&cid=1176154526495. Accessed November 7, 2017.