User login

New York has the highest cigarette excise tax in the United States and Missouri has the lowest, with a difference of more than $4 in between, the American Lung Association said in a report released Jan. 22.

New York currently adds $4.35 to the price of each pack of cigarettes sold in the state, compared with Missouri’s lowest-in-the-nation rate of 17 cents per pack. Massachusetts has the second-highest tax at $3.51, while Virginia is second lowest at 30 cents. The U.S. average is $1.53 per pack, according to the association’s "State of Tobacco Control 2014" report.

The report noted a general lack of progress among states in smoking cessation and prevention in 2013, with only two states – Massachusetts and Minnesota – passing significant tax increases, "no states approving comprehensive smokefree workplace laws," and two states – Alaska and North Dakota – funding their tobacco prevention programs "at or above levels" recommended by the Centers for Disease Control and Prevention."

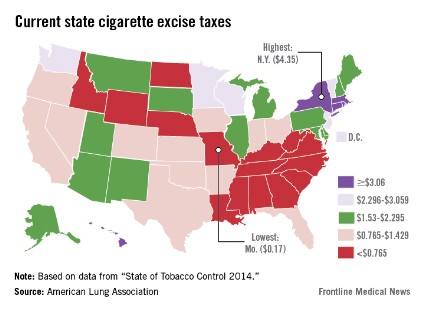

New York has the highest cigarette excise tax in the United States and Missouri has the lowest, with a difference of more than $4 in between, the American Lung Association said in a report released Jan. 22.

New York currently adds $4.35 to the price of each pack of cigarettes sold in the state, compared with Missouri’s lowest-in-the-nation rate of 17 cents per pack. Massachusetts has the second-highest tax at $3.51, while Virginia is second lowest at 30 cents. The U.S. average is $1.53 per pack, according to the association’s "State of Tobacco Control 2014" report.

The report noted a general lack of progress among states in smoking cessation and prevention in 2013, with only two states – Massachusetts and Minnesota – passing significant tax increases, "no states approving comprehensive smokefree workplace laws," and two states – Alaska and North Dakota – funding their tobacco prevention programs "at or above levels" recommended by the Centers for Disease Control and Prevention."

New York has the highest cigarette excise tax in the United States and Missouri has the lowest, with a difference of more than $4 in between, the American Lung Association said in a report released Jan. 22.

New York currently adds $4.35 to the price of each pack of cigarettes sold in the state, compared with Missouri’s lowest-in-the-nation rate of 17 cents per pack. Massachusetts has the second-highest tax at $3.51, while Virginia is second lowest at 30 cents. The U.S. average is $1.53 per pack, according to the association’s "State of Tobacco Control 2014" report.

The report noted a general lack of progress among states in smoking cessation and prevention in 2013, with only two states – Massachusetts and Minnesota – passing significant tax increases, "no states approving comprehensive smokefree workplace laws," and two states – Alaska and North Dakota – funding their tobacco prevention programs "at or above levels" recommended by the Centers for Disease Control and Prevention."