User login

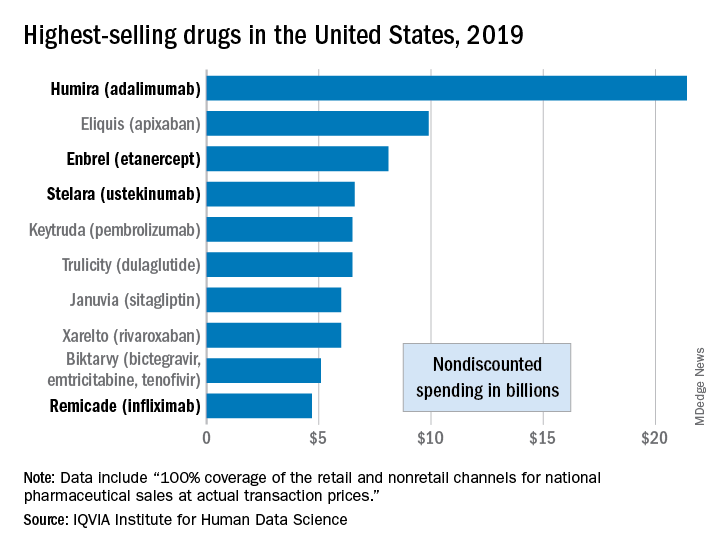

Humira outsold all other drugs in 2019 in terms of revenue as cytokine inhibitor medications earned their way to three of the first four spots on the pharmaceutical best-seller list, according to a new analysis from the IQVIA Institute for Human Data Science.

Sales of Humira (adalimumab) amounted to $21.4 billion before discounting, Murray Aitken, the institute’s executive director, and associates wrote in their analysis. That’s more than double the total of the anticoagulant Eliquis (apixaban), which brought in $9.9 billion in its last year before generic forms became available.

The next two spots were filled by the tumor necrosis factor inhibitor Enbrel (etanercept) with $8.1 billion in sales and the interleukin 12/23 inhibitor Stelara (ustekinumab) with sales totaling $6.6 billion, followed by the chemotherapy drug Keytruda (pembrolizumab) close behind after racking up $6.5 billion in sales, the researchers reported.

Total nondiscounted spending on all drugs in the U.S. market came to $511 billion in 2019, an increase of 5.7% over the $484 billion spent in 2018, based on data from the July 2020 IQVIA National Sales Perspectives.

These figures are “not adjusted for estimates of off-invoice discounts and rebates,” the authors noted, but they include “prescription and insulin products sold into chain and independent pharmacies, food store pharmacies, mail service pharmacies, long-term care facilities, hospitals, clinics, and other institutional settings.”

Those “discounts and rebates” do exist, however, and they can add up. Drug sales for 2019, “after deducting negotiated rebates, discounts, and other forms of price concessions, such as patient coupons or vouchers that offset out-of-pocket costs,” were $235 billion less than overall nondiscounted spending, the report noted.

Now that we’ve shown you the money, let’s take a quick look at volume. The leading drugs by number of dispensed prescriptions in 2019 were, not surprisingly, quite different. First, with 118 million prescriptions, was atorvastatin, followed by levothyroxine (113 million), lisinopril (96), amlodipine (89), and metoprolol (85), Mr. Aitken and associates reported.

Altogether, over 4.2 billion prescriptions were dispensed last year, with a couple of caveats: 90-day and 30-day fills were both counted as one prescription, and OTC drugs were not included, they pointed out.

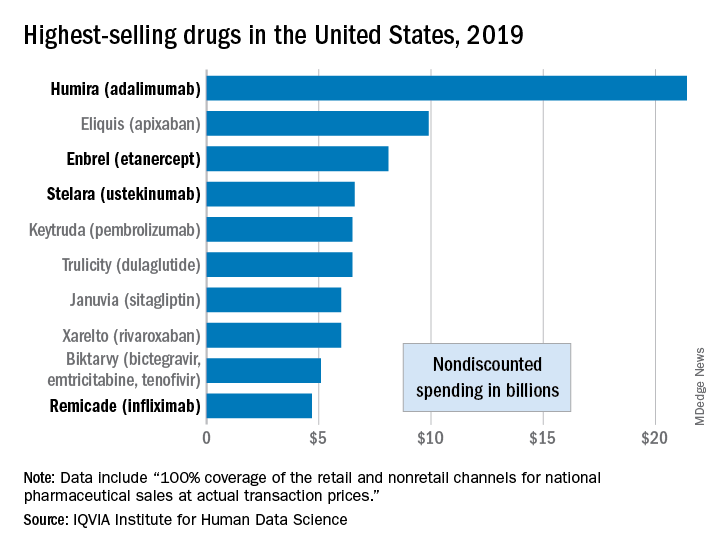

Humira outsold all other drugs in 2019 in terms of revenue as cytokine inhibitor medications earned their way to three of the first four spots on the pharmaceutical best-seller list, according to a new analysis from the IQVIA Institute for Human Data Science.

Sales of Humira (adalimumab) amounted to $21.4 billion before discounting, Murray Aitken, the institute’s executive director, and associates wrote in their analysis. That’s more than double the total of the anticoagulant Eliquis (apixaban), which brought in $9.9 billion in its last year before generic forms became available.

The next two spots were filled by the tumor necrosis factor inhibitor Enbrel (etanercept) with $8.1 billion in sales and the interleukin 12/23 inhibitor Stelara (ustekinumab) with sales totaling $6.6 billion, followed by the chemotherapy drug Keytruda (pembrolizumab) close behind after racking up $6.5 billion in sales, the researchers reported.

Total nondiscounted spending on all drugs in the U.S. market came to $511 billion in 2019, an increase of 5.7% over the $484 billion spent in 2018, based on data from the July 2020 IQVIA National Sales Perspectives.

These figures are “not adjusted for estimates of off-invoice discounts and rebates,” the authors noted, but they include “prescription and insulin products sold into chain and independent pharmacies, food store pharmacies, mail service pharmacies, long-term care facilities, hospitals, clinics, and other institutional settings.”

Those “discounts and rebates” do exist, however, and they can add up. Drug sales for 2019, “after deducting negotiated rebates, discounts, and other forms of price concessions, such as patient coupons or vouchers that offset out-of-pocket costs,” were $235 billion less than overall nondiscounted spending, the report noted.

Now that we’ve shown you the money, let’s take a quick look at volume. The leading drugs by number of dispensed prescriptions in 2019 were, not surprisingly, quite different. First, with 118 million prescriptions, was atorvastatin, followed by levothyroxine (113 million), lisinopril (96), amlodipine (89), and metoprolol (85), Mr. Aitken and associates reported.

Altogether, over 4.2 billion prescriptions were dispensed last year, with a couple of caveats: 90-day and 30-day fills were both counted as one prescription, and OTC drugs were not included, they pointed out.

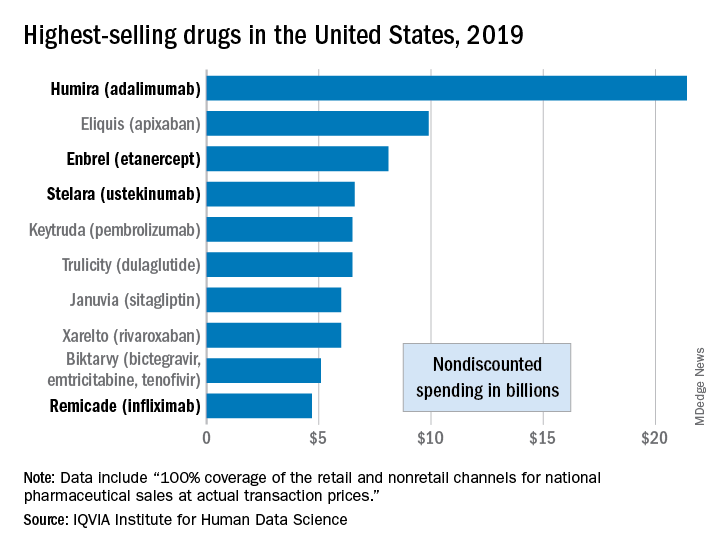

Humira outsold all other drugs in 2019 in terms of revenue as cytokine inhibitor medications earned their way to three of the first four spots on the pharmaceutical best-seller list, according to a new analysis from the IQVIA Institute for Human Data Science.

Sales of Humira (adalimumab) amounted to $21.4 billion before discounting, Murray Aitken, the institute’s executive director, and associates wrote in their analysis. That’s more than double the total of the anticoagulant Eliquis (apixaban), which brought in $9.9 billion in its last year before generic forms became available.

The next two spots were filled by the tumor necrosis factor inhibitor Enbrel (etanercept) with $8.1 billion in sales and the interleukin 12/23 inhibitor Stelara (ustekinumab) with sales totaling $6.6 billion, followed by the chemotherapy drug Keytruda (pembrolizumab) close behind after racking up $6.5 billion in sales, the researchers reported.

Total nondiscounted spending on all drugs in the U.S. market came to $511 billion in 2019, an increase of 5.7% over the $484 billion spent in 2018, based on data from the July 2020 IQVIA National Sales Perspectives.

These figures are “not adjusted for estimates of off-invoice discounts and rebates,” the authors noted, but they include “prescription and insulin products sold into chain and independent pharmacies, food store pharmacies, mail service pharmacies, long-term care facilities, hospitals, clinics, and other institutional settings.”

Those “discounts and rebates” do exist, however, and they can add up. Drug sales for 2019, “after deducting negotiated rebates, discounts, and other forms of price concessions, such as patient coupons or vouchers that offset out-of-pocket costs,” were $235 billion less than overall nondiscounted spending, the report noted.

Now that we’ve shown you the money, let’s take a quick look at volume. The leading drugs by number of dispensed prescriptions in 2019 were, not surprisingly, quite different. First, with 118 million prescriptions, was atorvastatin, followed by levothyroxine (113 million), lisinopril (96), amlodipine (89), and metoprolol (85), Mr. Aitken and associates reported.

Altogether, over 4.2 billion prescriptions were dispensed last year, with a couple of caveats: 90-day and 30-day fills were both counted as one prescription, and OTC drugs were not included, they pointed out.