User login

On November 15, 2005, enrollment opened for Medicare’s new prescription drug program. You have most likely been asked by patients for help in understanding the complexity of the options. No small task. Though there is a lot to disagree with in the way the Medicare drug benefit has been crafted, it’s what we now have and many beneficiaries can benefit from it. In addition to knowing which agencies in your communities serve seniors, you can better equip your elderly patients to make decisions by becoming familiar with web sites and other resources listed in this article.

Confusion reigns

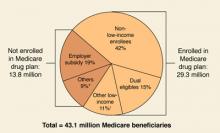

By May 15, 2006, when the initial enrollment period ends, the government predicts that over 29 million of 43 million eligible beneficiaries will have signed up for the new benefit, with another 9 to 10 million beneficiaries maintaining their drug coverage through an employer-sponsored plan (FIGURE 1).

Whether these predictions come to pass is an open question. A Kaiser Family Foundation survey from late October 2005 found that 60% of senior citizens did not understand the benefit and 50% thought it would not help them. Of those surveyed, 43% did not know whether they would enroll, 37% said they would not enroll, and only 20% said they would definitely enroll.

One problem for seniors is that unlike the traditional Medicare program in which there are only 2 choices—whether to sign up for the traditional fee-for-service plan or a managed care plan—the new drug plan is administered by a large number of private plans that cover different medications and charge different prices for them. Seniors who said they understood the drug benefit (a minority) were more likely to view the program favorably. Perhaps most relevant for physicians is that seniors said they would likely turn to the Medicare program (33%), their personal doctor (32%), or their pharmacist (25%) for assistance.1

A quick review

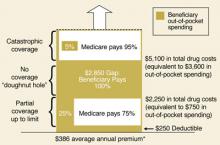

Readers may recall that the prescription drug benefit portion of the Medicare Modernization Act of 2003 includes a premium (current national average of $32/month), an annual deductible, copays, and the infamous “donut hole” (FIGURE 2).2

With the program beginning in January 2006, however, there is more to keep in mind than the costs to beneficiaries: for example, who will be offering the benefit, what medications will be covered (formularies), and the effect on dual-eligibles (beneficiaries covered by both Medicare and Medicaid), so-called “Medigap” policyholders, and low-income beneficiaries.

FIGURE 1

Estimated Medicare prescription drug benefit participation, 2006

* “Others” not enrolled includes federal retirees with drug coverage through FEHBP or TRICARE, and those who lack drug coverage.

† “Other low-income” includes non-dual-eligibles with incomes <150% FPL.

Source: HHS OACT, MMA final rule, January 2005.

FIGURE 2

Standard Medicare prescription drug benefit, 2006

* Annual amount based on $32.20 national average beneficiary premium (CMS, August 2005)

Source: Kaiser Family Foundation illustration of standard Medicare drug benefit described in the Medicare Modernization Act of 2003

Who offers the plans

Medicare beneficiaries can obtain the drug benefit in either of 2 ways: through a stand-alone prescription drug plan (PDP) that covers only drugs (with the usual medical benefits obtained through the traditional Medicare program), or through a Medicare Advantage plan (MA) that is essentially a managed care plan, providing drug coverage and medical benefits in place of the traditional Medicare program.

The Bush administration has long promoted MA plans as a way to better control Medicare costs, even though the federal government currently spends more per MA beneficiary than for beneficiaries in traditional Medicare. MA plans can offer additional benefits and adjust premiums to attract customers—drug benefits for a lower premium, vision benefits, and dental benefits. However, there may be limits on using providers outside the MA plan’s network of physicians and hospitals.3

Drug plans must cover at least 2 drugs in each therapeutic class approved by Medicare, but they may use tiered cost-sharing (eg, generics and brand-name drugs in different tiers) and other management tools as long as they meet the minimum requirements of the overall bill. The decision by the White House and Congress to approve the privatization of the drug benefit has led to the current situation in which multiple private plans are competing for enrollment in each geographic region and offering different drugs for different prices. For instance, in my county, there are 7 MA plans and 43 PDP plans being offered. This makes the system overly complex and confusing. In addition, the Medicare Modernization Act allows plans to increase the copays or even end coverage of specific drugs with 60 days notice.

Dual eligibles and low-income beneficiaries

The Medicare Modernization Act provided additional assistance to persons of limited means—those currently covered by Medicare and Medicaid plans who receive their medications through Medicaid (the dual-eligibles) and those who have limited income and resources but are only covered by Medicare. The former group will automatically be enrolled into PDPs if they do not sign up on their own, and they will pay reduced fees for their medications. The states, in turn, will reimburse the federal government for the drug cost savings gained by their Medicaid programs.

Other low-income individuals may also be eligible for drug benefit subsidies based on their income and assets (TABLE). Clearly, the Medicare Modernization Act offers significant drug benefits to beneficiaries of limited means. The Centers for Medicare and Medicaid Services (CMS) projects that 10.9 million beneficiaries will receive low-income subsidies out of 14.5 million eligible.

TABLE

Medicare prescription drug benefit subsidies for low-income beneficiaries, 2006

| LOW-INCOME SUBSIDY LEVEL | PREMIUM | MONTHLY DEDUCTIBLE | ANNUAL COPAYMENTS |

|---|---|---|---|

| Full-benefit dual eligibles Income <100% of poverty ($9750 individual; $12,830/couple) | $0 | $0 | $1/generic, $3/brand-name; no copays after total drug spending reaches $5100 |

| Full-benefit dual eligibles Income ≥100% of poverty | $0 | $0 | $2/generic, $5/brand-name; no copays after total drug spending reaches $5100 |

| Institutionalized full-benefit dual eligibles | $0 | $0 | No copays |

| Individuals with income <135% of poverty ($12,920 individuals, $17,321/couple) and assets <$6000/individual; $9000/couple | $0 | $0 | $2/generic, $5/brand-name; no copays after total drug spending reaches $5100 |

| Individuals with income 135%–150% of poverty ($12,920–$14,355 individuals, $17,321–$19,245/couple) and assets <$10,000/individual, $20,000/couple | Sliding scale up to $32.20* | $50 | 15% of total costs up to $5100; $2/generic, $5/brand-name thereafter |

| Note: Poverty-level dollar amounts are for 2005. Additional assests of up to $1500/individual and $3000/couple for funeral or burial expenses are permitted. *$32.20 is the national monthly Part D base beneficiary premium for 2006. | |||

| Source: Kaiser Family Foundation summary of Medicare prescription drug benefit low-income subsidies in 2006. | |||

Medigap and employer-sponsored plans

Many current beneficiaries have Medigap insurance policies, which cover part or all of the financial holes in the traditional Medicare plan—eg, deductibles, copays, and other benefits such as drug coverage. Beginning in January 2006, new policies that include drug coverage can no longer be issued. Policyholders can keep their current Medigap policies that cover medications; however, these are generally not considered equivalent to the new coverage. In addition, Medicare will provide subsidies to employers to encourage them to continue any current retiree plans that provide drug coverage comparable to the new plans.4

Enrollment

While the new drug plans start on January 1, 2006, the initial enrollment period runs until May 15, 2006. Beneficiaries who enroll after that time and do not currently have drug coverage as good as the new Medicare drug benefit will pay a higher premium equal to 1% of the average monthly premium for each month they delay enrollment. Those who enroll may change plans one time between December 31, 2005 and May 15, 2006. After May 15, the next enrollment period will be from November 15 to December 31, 2006. Any enrollee can change plans during that time.

In order to assist beneficiaries in making a decision about whether to enroll in a Medicare drug plan and which to choose, the federal government, assisted by a number of medical organizations (such as the AAFP) and nonprofits like the local Area Agencies on Aging, is providing seniors with information in a variety of formats. Beneficiaries should all have received a booklet, “Medicare and You,” in October 2005. There is a 24-hour telephone help line, 1-800-MEDICARE, that has automated answers and can provide access to a real person.

Finally, there is the Internet: www.medicare.gov. While 3 of 4 seniors have never been online, this is the best method to locate available plans in your area, find out which specific medications are included in each plan, and try to compare costs.5 For many seniors, it will be worth asking family members, friends, or community agencies for help in navigating the web site and the information it contains.

CORRESPONDENCE

Eric A. Henley, MD, MPH, Department of Family and Community Medicine, University of Illinois College of Medicine at Rockford, 1601 Parkview Avenue, Rockford, IL 61107-1897. E-mail: [email protected]

1. Kaiser Family Foundation news release. Available at: www.kff.org/kaiserpolls/med111005nr.cfm. Accessed on November 21, 2005.

2. Henley E. What the new Medicare prescription drug bill may mean for providers and patients. J Fam Pract 2004;53:389-392.

3. Fuhrmans V, Lueck S. Insurers sweeten health plans for seniors. Wall Street Journal, November 8, 2005.

4. The Medicare Prescription Drug Benefit. Kaiser Family Foundation. Available at: www.kff.org/medicare/7044-02.cfm. Accessed on December 4, 2005.

5. Glendinning D. Patients look to doctors for help on Medicare drug plans. AMA News, December 5, 2005.

On November 15, 2005, enrollment opened for Medicare’s new prescription drug program. You have most likely been asked by patients for help in understanding the complexity of the options. No small task. Though there is a lot to disagree with in the way the Medicare drug benefit has been crafted, it’s what we now have and many beneficiaries can benefit from it. In addition to knowing which agencies in your communities serve seniors, you can better equip your elderly patients to make decisions by becoming familiar with web sites and other resources listed in this article.

Confusion reigns

By May 15, 2006, when the initial enrollment period ends, the government predicts that over 29 million of 43 million eligible beneficiaries will have signed up for the new benefit, with another 9 to 10 million beneficiaries maintaining their drug coverage through an employer-sponsored plan (FIGURE 1).

Whether these predictions come to pass is an open question. A Kaiser Family Foundation survey from late October 2005 found that 60% of senior citizens did not understand the benefit and 50% thought it would not help them. Of those surveyed, 43% did not know whether they would enroll, 37% said they would not enroll, and only 20% said they would definitely enroll.

One problem for seniors is that unlike the traditional Medicare program in which there are only 2 choices—whether to sign up for the traditional fee-for-service plan or a managed care plan—the new drug plan is administered by a large number of private plans that cover different medications and charge different prices for them. Seniors who said they understood the drug benefit (a minority) were more likely to view the program favorably. Perhaps most relevant for physicians is that seniors said they would likely turn to the Medicare program (33%), their personal doctor (32%), or their pharmacist (25%) for assistance.1

A quick review

Readers may recall that the prescription drug benefit portion of the Medicare Modernization Act of 2003 includes a premium (current national average of $32/month), an annual deductible, copays, and the infamous “donut hole” (FIGURE 2).2

With the program beginning in January 2006, however, there is more to keep in mind than the costs to beneficiaries: for example, who will be offering the benefit, what medications will be covered (formularies), and the effect on dual-eligibles (beneficiaries covered by both Medicare and Medicaid), so-called “Medigap” policyholders, and low-income beneficiaries.

FIGURE 1

Estimated Medicare prescription drug benefit participation, 2006

* “Others” not enrolled includes federal retirees with drug coverage through FEHBP or TRICARE, and those who lack drug coverage.

† “Other low-income” includes non-dual-eligibles with incomes <150% FPL.

Source: HHS OACT, MMA final rule, January 2005.

FIGURE 2

Standard Medicare prescription drug benefit, 2006

* Annual amount based on $32.20 national average beneficiary premium (CMS, August 2005)

Source: Kaiser Family Foundation illustration of standard Medicare drug benefit described in the Medicare Modernization Act of 2003

Who offers the plans

Medicare beneficiaries can obtain the drug benefit in either of 2 ways: through a stand-alone prescription drug plan (PDP) that covers only drugs (with the usual medical benefits obtained through the traditional Medicare program), or through a Medicare Advantage plan (MA) that is essentially a managed care plan, providing drug coverage and medical benefits in place of the traditional Medicare program.

The Bush administration has long promoted MA plans as a way to better control Medicare costs, even though the federal government currently spends more per MA beneficiary than for beneficiaries in traditional Medicare. MA plans can offer additional benefits and adjust premiums to attract customers—drug benefits for a lower premium, vision benefits, and dental benefits. However, there may be limits on using providers outside the MA plan’s network of physicians and hospitals.3

Drug plans must cover at least 2 drugs in each therapeutic class approved by Medicare, but they may use tiered cost-sharing (eg, generics and brand-name drugs in different tiers) and other management tools as long as they meet the minimum requirements of the overall bill. The decision by the White House and Congress to approve the privatization of the drug benefit has led to the current situation in which multiple private plans are competing for enrollment in each geographic region and offering different drugs for different prices. For instance, in my county, there are 7 MA plans and 43 PDP plans being offered. This makes the system overly complex and confusing. In addition, the Medicare Modernization Act allows plans to increase the copays or even end coverage of specific drugs with 60 days notice.

Dual eligibles and low-income beneficiaries

The Medicare Modernization Act provided additional assistance to persons of limited means—those currently covered by Medicare and Medicaid plans who receive their medications through Medicaid (the dual-eligibles) and those who have limited income and resources but are only covered by Medicare. The former group will automatically be enrolled into PDPs if they do not sign up on their own, and they will pay reduced fees for their medications. The states, in turn, will reimburse the federal government for the drug cost savings gained by their Medicaid programs.

Other low-income individuals may also be eligible for drug benefit subsidies based on their income and assets (TABLE). Clearly, the Medicare Modernization Act offers significant drug benefits to beneficiaries of limited means. The Centers for Medicare and Medicaid Services (CMS) projects that 10.9 million beneficiaries will receive low-income subsidies out of 14.5 million eligible.

TABLE

Medicare prescription drug benefit subsidies for low-income beneficiaries, 2006

| LOW-INCOME SUBSIDY LEVEL | PREMIUM | MONTHLY DEDUCTIBLE | ANNUAL COPAYMENTS |

|---|---|---|---|

| Full-benefit dual eligibles Income <100% of poverty ($9750 individual; $12,830/couple) | $0 | $0 | $1/generic, $3/brand-name; no copays after total drug spending reaches $5100 |

| Full-benefit dual eligibles Income ≥100% of poverty | $0 | $0 | $2/generic, $5/brand-name; no copays after total drug spending reaches $5100 |

| Institutionalized full-benefit dual eligibles | $0 | $0 | No copays |

| Individuals with income <135% of poverty ($12,920 individuals, $17,321/couple) and assets <$6000/individual; $9000/couple | $0 | $0 | $2/generic, $5/brand-name; no copays after total drug spending reaches $5100 |

| Individuals with income 135%–150% of poverty ($12,920–$14,355 individuals, $17,321–$19,245/couple) and assets <$10,000/individual, $20,000/couple | Sliding scale up to $32.20* | $50 | 15% of total costs up to $5100; $2/generic, $5/brand-name thereafter |

| Note: Poverty-level dollar amounts are for 2005. Additional assests of up to $1500/individual and $3000/couple for funeral or burial expenses are permitted. *$32.20 is the national monthly Part D base beneficiary premium for 2006. | |||

| Source: Kaiser Family Foundation summary of Medicare prescription drug benefit low-income subsidies in 2006. | |||

Medigap and employer-sponsored plans

Many current beneficiaries have Medigap insurance policies, which cover part or all of the financial holes in the traditional Medicare plan—eg, deductibles, copays, and other benefits such as drug coverage. Beginning in January 2006, new policies that include drug coverage can no longer be issued. Policyholders can keep their current Medigap policies that cover medications; however, these are generally not considered equivalent to the new coverage. In addition, Medicare will provide subsidies to employers to encourage them to continue any current retiree plans that provide drug coverage comparable to the new plans.4

Enrollment

While the new drug plans start on January 1, 2006, the initial enrollment period runs until May 15, 2006. Beneficiaries who enroll after that time and do not currently have drug coverage as good as the new Medicare drug benefit will pay a higher premium equal to 1% of the average monthly premium for each month they delay enrollment. Those who enroll may change plans one time between December 31, 2005 and May 15, 2006. After May 15, the next enrollment period will be from November 15 to December 31, 2006. Any enrollee can change plans during that time.

In order to assist beneficiaries in making a decision about whether to enroll in a Medicare drug plan and which to choose, the federal government, assisted by a number of medical organizations (such as the AAFP) and nonprofits like the local Area Agencies on Aging, is providing seniors with information in a variety of formats. Beneficiaries should all have received a booklet, “Medicare and You,” in October 2005. There is a 24-hour telephone help line, 1-800-MEDICARE, that has automated answers and can provide access to a real person.

Finally, there is the Internet: www.medicare.gov. While 3 of 4 seniors have never been online, this is the best method to locate available plans in your area, find out which specific medications are included in each plan, and try to compare costs.5 For many seniors, it will be worth asking family members, friends, or community agencies for help in navigating the web site and the information it contains.

CORRESPONDENCE

Eric A. Henley, MD, MPH, Department of Family and Community Medicine, University of Illinois College of Medicine at Rockford, 1601 Parkview Avenue, Rockford, IL 61107-1897. E-mail: [email protected]

On November 15, 2005, enrollment opened for Medicare’s new prescription drug program. You have most likely been asked by patients for help in understanding the complexity of the options. No small task. Though there is a lot to disagree with in the way the Medicare drug benefit has been crafted, it’s what we now have and many beneficiaries can benefit from it. In addition to knowing which agencies in your communities serve seniors, you can better equip your elderly patients to make decisions by becoming familiar with web sites and other resources listed in this article.

Confusion reigns

By May 15, 2006, when the initial enrollment period ends, the government predicts that over 29 million of 43 million eligible beneficiaries will have signed up for the new benefit, with another 9 to 10 million beneficiaries maintaining their drug coverage through an employer-sponsored plan (FIGURE 1).

Whether these predictions come to pass is an open question. A Kaiser Family Foundation survey from late October 2005 found that 60% of senior citizens did not understand the benefit and 50% thought it would not help them. Of those surveyed, 43% did not know whether they would enroll, 37% said they would not enroll, and only 20% said they would definitely enroll.

One problem for seniors is that unlike the traditional Medicare program in which there are only 2 choices—whether to sign up for the traditional fee-for-service plan or a managed care plan—the new drug plan is administered by a large number of private plans that cover different medications and charge different prices for them. Seniors who said they understood the drug benefit (a minority) were more likely to view the program favorably. Perhaps most relevant for physicians is that seniors said they would likely turn to the Medicare program (33%), their personal doctor (32%), or their pharmacist (25%) for assistance.1

A quick review

Readers may recall that the prescription drug benefit portion of the Medicare Modernization Act of 2003 includes a premium (current national average of $32/month), an annual deductible, copays, and the infamous “donut hole” (FIGURE 2).2

With the program beginning in January 2006, however, there is more to keep in mind than the costs to beneficiaries: for example, who will be offering the benefit, what medications will be covered (formularies), and the effect on dual-eligibles (beneficiaries covered by both Medicare and Medicaid), so-called “Medigap” policyholders, and low-income beneficiaries.

FIGURE 1

Estimated Medicare prescription drug benefit participation, 2006

* “Others” not enrolled includes federal retirees with drug coverage through FEHBP or TRICARE, and those who lack drug coverage.

† “Other low-income” includes non-dual-eligibles with incomes <150% FPL.

Source: HHS OACT, MMA final rule, January 2005.

FIGURE 2

Standard Medicare prescription drug benefit, 2006

* Annual amount based on $32.20 national average beneficiary premium (CMS, August 2005)

Source: Kaiser Family Foundation illustration of standard Medicare drug benefit described in the Medicare Modernization Act of 2003

Who offers the plans

Medicare beneficiaries can obtain the drug benefit in either of 2 ways: through a stand-alone prescription drug plan (PDP) that covers only drugs (with the usual medical benefits obtained through the traditional Medicare program), or through a Medicare Advantage plan (MA) that is essentially a managed care plan, providing drug coverage and medical benefits in place of the traditional Medicare program.

The Bush administration has long promoted MA plans as a way to better control Medicare costs, even though the federal government currently spends more per MA beneficiary than for beneficiaries in traditional Medicare. MA plans can offer additional benefits and adjust premiums to attract customers—drug benefits for a lower premium, vision benefits, and dental benefits. However, there may be limits on using providers outside the MA plan’s network of physicians and hospitals.3

Drug plans must cover at least 2 drugs in each therapeutic class approved by Medicare, but they may use tiered cost-sharing (eg, generics and brand-name drugs in different tiers) and other management tools as long as they meet the minimum requirements of the overall bill. The decision by the White House and Congress to approve the privatization of the drug benefit has led to the current situation in which multiple private plans are competing for enrollment in each geographic region and offering different drugs for different prices. For instance, in my county, there are 7 MA plans and 43 PDP plans being offered. This makes the system overly complex and confusing. In addition, the Medicare Modernization Act allows plans to increase the copays or even end coverage of specific drugs with 60 days notice.

Dual eligibles and low-income beneficiaries

The Medicare Modernization Act provided additional assistance to persons of limited means—those currently covered by Medicare and Medicaid plans who receive their medications through Medicaid (the dual-eligibles) and those who have limited income and resources but are only covered by Medicare. The former group will automatically be enrolled into PDPs if they do not sign up on their own, and they will pay reduced fees for their medications. The states, in turn, will reimburse the federal government for the drug cost savings gained by their Medicaid programs.

Other low-income individuals may also be eligible for drug benefit subsidies based on their income and assets (TABLE). Clearly, the Medicare Modernization Act offers significant drug benefits to beneficiaries of limited means. The Centers for Medicare and Medicaid Services (CMS) projects that 10.9 million beneficiaries will receive low-income subsidies out of 14.5 million eligible.

TABLE

Medicare prescription drug benefit subsidies for low-income beneficiaries, 2006

| LOW-INCOME SUBSIDY LEVEL | PREMIUM | MONTHLY DEDUCTIBLE | ANNUAL COPAYMENTS |

|---|---|---|---|

| Full-benefit dual eligibles Income <100% of poverty ($9750 individual; $12,830/couple) | $0 | $0 | $1/generic, $3/brand-name; no copays after total drug spending reaches $5100 |

| Full-benefit dual eligibles Income ≥100% of poverty | $0 | $0 | $2/generic, $5/brand-name; no copays after total drug spending reaches $5100 |

| Institutionalized full-benefit dual eligibles | $0 | $0 | No copays |

| Individuals with income <135% of poverty ($12,920 individuals, $17,321/couple) and assets <$6000/individual; $9000/couple | $0 | $0 | $2/generic, $5/brand-name; no copays after total drug spending reaches $5100 |

| Individuals with income 135%–150% of poverty ($12,920–$14,355 individuals, $17,321–$19,245/couple) and assets <$10,000/individual, $20,000/couple | Sliding scale up to $32.20* | $50 | 15% of total costs up to $5100; $2/generic, $5/brand-name thereafter |

| Note: Poverty-level dollar amounts are for 2005. Additional assests of up to $1500/individual and $3000/couple for funeral or burial expenses are permitted. *$32.20 is the national monthly Part D base beneficiary premium for 2006. | |||

| Source: Kaiser Family Foundation summary of Medicare prescription drug benefit low-income subsidies in 2006. | |||

Medigap and employer-sponsored plans

Many current beneficiaries have Medigap insurance policies, which cover part or all of the financial holes in the traditional Medicare plan—eg, deductibles, copays, and other benefits such as drug coverage. Beginning in January 2006, new policies that include drug coverage can no longer be issued. Policyholders can keep their current Medigap policies that cover medications; however, these are generally not considered equivalent to the new coverage. In addition, Medicare will provide subsidies to employers to encourage them to continue any current retiree plans that provide drug coverage comparable to the new plans.4

Enrollment

While the new drug plans start on January 1, 2006, the initial enrollment period runs until May 15, 2006. Beneficiaries who enroll after that time and do not currently have drug coverage as good as the new Medicare drug benefit will pay a higher premium equal to 1% of the average monthly premium for each month they delay enrollment. Those who enroll may change plans one time between December 31, 2005 and May 15, 2006. After May 15, the next enrollment period will be from November 15 to December 31, 2006. Any enrollee can change plans during that time.

In order to assist beneficiaries in making a decision about whether to enroll in a Medicare drug plan and which to choose, the federal government, assisted by a number of medical organizations (such as the AAFP) and nonprofits like the local Area Agencies on Aging, is providing seniors with information in a variety of formats. Beneficiaries should all have received a booklet, “Medicare and You,” in October 2005. There is a 24-hour telephone help line, 1-800-MEDICARE, that has automated answers and can provide access to a real person.

Finally, there is the Internet: www.medicare.gov. While 3 of 4 seniors have never been online, this is the best method to locate available plans in your area, find out which specific medications are included in each plan, and try to compare costs.5 For many seniors, it will be worth asking family members, friends, or community agencies for help in navigating the web site and the information it contains.

CORRESPONDENCE

Eric A. Henley, MD, MPH, Department of Family and Community Medicine, University of Illinois College of Medicine at Rockford, 1601 Parkview Avenue, Rockford, IL 61107-1897. E-mail: [email protected]

1. Kaiser Family Foundation news release. Available at: www.kff.org/kaiserpolls/med111005nr.cfm. Accessed on November 21, 2005.

2. Henley E. What the new Medicare prescription drug bill may mean for providers and patients. J Fam Pract 2004;53:389-392.

3. Fuhrmans V, Lueck S. Insurers sweeten health plans for seniors. Wall Street Journal, November 8, 2005.

4. The Medicare Prescription Drug Benefit. Kaiser Family Foundation. Available at: www.kff.org/medicare/7044-02.cfm. Accessed on December 4, 2005.

5. Glendinning D. Patients look to doctors for help on Medicare drug plans. AMA News, December 5, 2005.

1. Kaiser Family Foundation news release. Available at: www.kff.org/kaiserpolls/med111005nr.cfm. Accessed on November 21, 2005.

2. Henley E. What the new Medicare prescription drug bill may mean for providers and patients. J Fam Pract 2004;53:389-392.

3. Fuhrmans V, Lueck S. Insurers sweeten health plans for seniors. Wall Street Journal, November 8, 2005.

4. The Medicare Prescription Drug Benefit. Kaiser Family Foundation. Available at: www.kff.org/medicare/7044-02.cfm. Accessed on December 4, 2005.

5. Glendinning D. Patients look to doctors for help on Medicare drug plans. AMA News, December 5, 2005.