User login

Child of The New Gastroenterologist

Navigating your childcare options in a post-COVID world

When we found out we were expecting our first child, we were ecstatic. Our excitement soon gave way to panic, however, as we realized that we needed a plan for childcare. As full-time physicians early in our careers, neither of us was prepared to drop to part-time or become a stay-at-home caregiver. Not knowing where to start, we turned to our friends and colleagues, and of course, the Internet, for advice on our options.

In our research, we discovered three things. First, with COVID-19, the cost of childcare has skyrocketed, and availability has decreased. Second, there are several options for childcare, each with its own benefits and drawbacks. Third, there is no one-size-fits-all solution.

Family

Using family members to provide childcare is often cost-effective and provides a familiar, supportive environment for children. Proximity does not guarantee a willingness or ability to provide long-term care, however, and it can cause strain on family relationships, lead to intrusions and boundary issues, and create feelings of obligation and guilt. It is important to have very honest, up-front discussions with family members about hopes and expectations if this is your childcare plan.

Daycare, facility-based

Daycare centers are commercial facilities that offer care to multiple children of varying ages, starting from as young as 6 weeks. They have trained professionals and provide structured activities and educational programs for children. Many daycares also provide snacks and lunch, which is included in their tuition. They are a popular choice for families seeking full-time childcare and the social and educational benefits that come with a structured setting.

Daycares also have some downsides. They usually operate during normal workday hours, from 7:00 a.m. to 6:00 p.m., which may not be convenient for physicians who work outside of these hours. Even with feasible hours, getting children dressed, ready, and dropped off each morning could add significant time and stress to your morning routine. Additionally, most daycares have policies that prohibit attendance if a child is sick or febrile, which is a common occurrence, particularly for daycare kids. In case of an illness outbreak, the daycare may even close for several days. Both scenarios require at least one parent to take a day off or have an alternative childcare plan available on short notice.

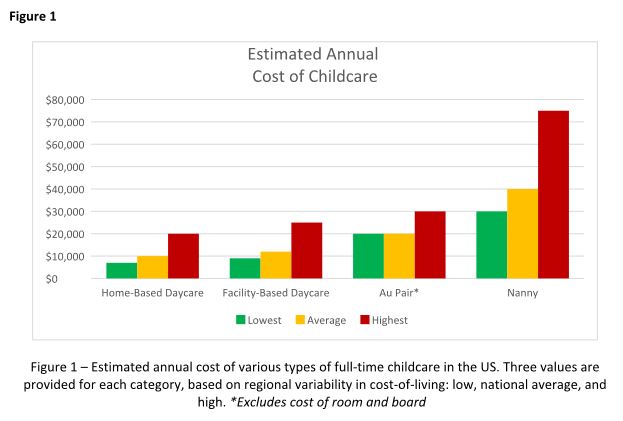

Availability of daycare can be limited, particularly since the COVID pandemic, creating waitlists that can be several months long. Early registration, even during pregnancy, is recommended to secure a spot. It can be helpful to find out if your employer has an agreement with a specific daycare that has “physician-friendly” hours and gives waitlist priority to trainees or even attending physicians. The cost of daycare for one child is typically affordable, around $12,000 per year on average, but can be as high as $25,000 in cities with high cost of living. A sibling discount may be offered, but the cost of daycare for multiple children could still exceed in-home childcare options.1

Daycare, home-based (also known as family care centers)

Family care centers offer a home-like alternative to daycares, with smaller staff-to-child ratios and often more personalized care. They are favored by families seeking a more intimate setting. They might offer more flexible scheduling and are typically less expensive than facility-based daycares, at up to 25% lower cost.1 They may lack the same structure and educational opportunities as facility-based daycares, however, and are not subject to the same health and safety regulations.

Nannies

Nannies are professional caregivers who provide in-home childcare services. Their responsibilities may include feeding, changing, dressing, bathing, and playing with children. In some cases, they may also be expected to do light housekeeping tasks like meal preparation, laundry, and cleaning. It is common for nannies in high-demand markets to refuse to perform these additional tasks, however. Nannies are preferred by families with hectic schedules due to their flexibility. They can work early, late, or even overnight shifts, and provide care in the comfort of your home, avoiding the hassle of drop-off and pick-up times. Nannies also can provide personalized care to meet each child’s specific needs, and they can care for children who are sick or febrile.

When hiring a nanny, it is important to have a written contract outlining their expected hours, wages, benefits, and duties to prevent misunderstandings in the future. Finding a trustworthy and reliable nanny can be a challenge, and families have several options for finding one. They can post jobs on free websites and browse nanny CVs or use a fee-based nanny agency. The cost of using an agency can range from a few hundred to several thousand dollars, so it is important to ask friends and colleagues for recommendations before paying for an agency’s services.

The cost of hiring a nanny is one of its main drawbacks. Nannies typically earn $15 to $30 per hour, and if they work in the family’s home, they are typically considered “household employees” by the IRS. Household employees are entitled to overtime pay for work beyond 40 hours per week, and the employer (you!) is responsible for payroll taxes, withholding, and providing an annual W-2 tax statement.2 There are affordable online nanny payroll services that handle payroll and tax-filing to simplify the process, however. The average annual cost of a full-time nanny is around $40,000 and can be as high as $75,000 in some markets.1 A nanny-share with other families can lower costs, but it may also result in less control over the caregiver and schedule.

It is important to consult a tax professional or the IRS for guidance on nanny wages, taxes, and payroll, as a nanny might rarely be considered an “independent contractor” if they meet certain criteria.

Au pair

An au pair is a live-in childcare provider who travels to a host family’s home from a foreign country on a special J-1 visa. The goal is to provide care for children and participate in cultural exchange activities. Au pairs bring many benefits, such as cost savings compared to traditional childcare options and greater flexibility and customization. They can work up to 10 hours per day and 45 hours a week, performing tasks such as light housekeeping, meal preparation, and transportation for the children. Host families must provide a safe and comfortable living environment, including a private room, meals, and some travel and education expenses.1

The process of hiring an au pair involves working with a designated agency that matches families with applicants and sponsors the J-1 visa. The entire process can take several months, and average program fees cost around $10,000 per placement. Au pairs are hired on a 12-month J-1 visa, which can be extended for up to an additional 12 months, allowing families up to 2 years with the same au pair before needing to find a new placement.

Au pairs earn a minimum weekly stipend of $195.75, set forth by the U.S. State Department.3 Currently, au pairs are not subject to local and state wage requirements, but legal proceedings in various states have recently questioned whether au pairs should be protected under local regulations. Massachusetts has been the most progressive, explicitly protecting au pairs as domestic workers under state labor laws, raising their weekly stipend to roughly $600 to comply with state minimum wage requirements.4 The federal government is expected to provide clarity on this issue, but for the time being, au pairs remain an affordable alternative to a nanny in most states.

Conclusion

Choosing childcare is a complicated process with multiple factors to consider. Figure 1 breaks down the estimated annual cost of each of the options outlined above for a single child in low, average, and high cost-of-living areas. But your decision likely hinges on much more than just cost, and may include family dynamics, scheduling needs, and personal preferences. Gather as much advice and information as possible, but remember to trust your instincts and make the decision that works best for your family. At the end of the day, what matters most is the happiness and well-being of your child.

Dr. Hathorn and Dr. Creighton are married, and both work full-time with a 1-year-old child. Dr. Hathorn is a bariatric and advanced therapeutic endoscopist at the University of North Carolina at Chapel Hill. Dr. Creighton is an anesthesiologist at UNC Chapel Hill. Neither reported any conflicts of interest.

References

1. Care.com. This is how much childcare costs in 2022. 2022 Jun 15.

2. Internal Revenue Service. Publication 926 - Household Employer’s Tax Guide 2023.

3. U.S. Department of State. Au Pair.

4. Commonwealth of Massachusetts. Domestic workers.

Disclaimer

The financial and tax information presented in this article are believed to be true and accurate at the time of writing. However, it’s important to note that tax laws and regulations are subject to change. The authors are not certified financial advisers or tax specialists. It is recommended to seek verification from a local tax expert or the Internal Revenue Service to discuss your specific situation.

When we found out we were expecting our first child, we were ecstatic. Our excitement soon gave way to panic, however, as we realized that we needed a plan for childcare. As full-time physicians early in our careers, neither of us was prepared to drop to part-time or become a stay-at-home caregiver. Not knowing where to start, we turned to our friends and colleagues, and of course, the Internet, for advice on our options.

In our research, we discovered three things. First, with COVID-19, the cost of childcare has skyrocketed, and availability has decreased. Second, there are several options for childcare, each with its own benefits and drawbacks. Third, there is no one-size-fits-all solution.

Family

Using family members to provide childcare is often cost-effective and provides a familiar, supportive environment for children. Proximity does not guarantee a willingness or ability to provide long-term care, however, and it can cause strain on family relationships, lead to intrusions and boundary issues, and create feelings of obligation and guilt. It is important to have very honest, up-front discussions with family members about hopes and expectations if this is your childcare plan.

Daycare, facility-based

Daycare centers are commercial facilities that offer care to multiple children of varying ages, starting from as young as 6 weeks. They have trained professionals and provide structured activities and educational programs for children. Many daycares also provide snacks and lunch, which is included in their tuition. They are a popular choice for families seeking full-time childcare and the social and educational benefits that come with a structured setting.

Daycares also have some downsides. They usually operate during normal workday hours, from 7:00 a.m. to 6:00 p.m., which may not be convenient for physicians who work outside of these hours. Even with feasible hours, getting children dressed, ready, and dropped off each morning could add significant time and stress to your morning routine. Additionally, most daycares have policies that prohibit attendance if a child is sick or febrile, which is a common occurrence, particularly for daycare kids. In case of an illness outbreak, the daycare may even close for several days. Both scenarios require at least one parent to take a day off or have an alternative childcare plan available on short notice.

Availability of daycare can be limited, particularly since the COVID pandemic, creating waitlists that can be several months long. Early registration, even during pregnancy, is recommended to secure a spot. It can be helpful to find out if your employer has an agreement with a specific daycare that has “physician-friendly” hours and gives waitlist priority to trainees or even attending physicians. The cost of daycare for one child is typically affordable, around $12,000 per year on average, but can be as high as $25,000 in cities with high cost of living. A sibling discount may be offered, but the cost of daycare for multiple children could still exceed in-home childcare options.1

Daycare, home-based (also known as family care centers)

Family care centers offer a home-like alternative to daycares, with smaller staff-to-child ratios and often more personalized care. They are favored by families seeking a more intimate setting. They might offer more flexible scheduling and are typically less expensive than facility-based daycares, at up to 25% lower cost.1 They may lack the same structure and educational opportunities as facility-based daycares, however, and are not subject to the same health and safety regulations.

Nannies

Nannies are professional caregivers who provide in-home childcare services. Their responsibilities may include feeding, changing, dressing, bathing, and playing with children. In some cases, they may also be expected to do light housekeeping tasks like meal preparation, laundry, and cleaning. It is common for nannies in high-demand markets to refuse to perform these additional tasks, however. Nannies are preferred by families with hectic schedules due to their flexibility. They can work early, late, or even overnight shifts, and provide care in the comfort of your home, avoiding the hassle of drop-off and pick-up times. Nannies also can provide personalized care to meet each child’s specific needs, and they can care for children who are sick or febrile.

When hiring a nanny, it is important to have a written contract outlining their expected hours, wages, benefits, and duties to prevent misunderstandings in the future. Finding a trustworthy and reliable nanny can be a challenge, and families have several options for finding one. They can post jobs on free websites and browse nanny CVs or use a fee-based nanny agency. The cost of using an agency can range from a few hundred to several thousand dollars, so it is important to ask friends and colleagues for recommendations before paying for an agency’s services.

The cost of hiring a nanny is one of its main drawbacks. Nannies typically earn $15 to $30 per hour, and if they work in the family’s home, they are typically considered “household employees” by the IRS. Household employees are entitled to overtime pay for work beyond 40 hours per week, and the employer (you!) is responsible for payroll taxes, withholding, and providing an annual W-2 tax statement.2 There are affordable online nanny payroll services that handle payroll and tax-filing to simplify the process, however. The average annual cost of a full-time nanny is around $40,000 and can be as high as $75,000 in some markets.1 A nanny-share with other families can lower costs, but it may also result in less control over the caregiver and schedule.

It is important to consult a tax professional or the IRS for guidance on nanny wages, taxes, and payroll, as a nanny might rarely be considered an “independent contractor” if they meet certain criteria.

Au pair

An au pair is a live-in childcare provider who travels to a host family’s home from a foreign country on a special J-1 visa. The goal is to provide care for children and participate in cultural exchange activities. Au pairs bring many benefits, such as cost savings compared to traditional childcare options and greater flexibility and customization. They can work up to 10 hours per day and 45 hours a week, performing tasks such as light housekeeping, meal preparation, and transportation for the children. Host families must provide a safe and comfortable living environment, including a private room, meals, and some travel and education expenses.1

The process of hiring an au pair involves working with a designated agency that matches families with applicants and sponsors the J-1 visa. The entire process can take several months, and average program fees cost around $10,000 per placement. Au pairs are hired on a 12-month J-1 visa, which can be extended for up to an additional 12 months, allowing families up to 2 years with the same au pair before needing to find a new placement.

Au pairs earn a minimum weekly stipend of $195.75, set forth by the U.S. State Department.3 Currently, au pairs are not subject to local and state wage requirements, but legal proceedings in various states have recently questioned whether au pairs should be protected under local regulations. Massachusetts has been the most progressive, explicitly protecting au pairs as domestic workers under state labor laws, raising their weekly stipend to roughly $600 to comply with state minimum wage requirements.4 The federal government is expected to provide clarity on this issue, but for the time being, au pairs remain an affordable alternative to a nanny in most states.

Conclusion

Choosing childcare is a complicated process with multiple factors to consider. Figure 1 breaks down the estimated annual cost of each of the options outlined above for a single child in low, average, and high cost-of-living areas. But your decision likely hinges on much more than just cost, and may include family dynamics, scheduling needs, and personal preferences. Gather as much advice and information as possible, but remember to trust your instincts and make the decision that works best for your family. At the end of the day, what matters most is the happiness and well-being of your child.

Dr. Hathorn and Dr. Creighton are married, and both work full-time with a 1-year-old child. Dr. Hathorn is a bariatric and advanced therapeutic endoscopist at the University of North Carolina at Chapel Hill. Dr. Creighton is an anesthesiologist at UNC Chapel Hill. Neither reported any conflicts of interest.

References

1. Care.com. This is how much childcare costs in 2022. 2022 Jun 15.

2. Internal Revenue Service. Publication 926 - Household Employer’s Tax Guide 2023.

3. U.S. Department of State. Au Pair.

4. Commonwealth of Massachusetts. Domestic workers.

Disclaimer

The financial and tax information presented in this article are believed to be true and accurate at the time of writing. However, it’s important to note that tax laws and regulations are subject to change. The authors are not certified financial advisers or tax specialists. It is recommended to seek verification from a local tax expert or the Internal Revenue Service to discuss your specific situation.

When we found out we were expecting our first child, we were ecstatic. Our excitement soon gave way to panic, however, as we realized that we needed a plan for childcare. As full-time physicians early in our careers, neither of us was prepared to drop to part-time or become a stay-at-home caregiver. Not knowing where to start, we turned to our friends and colleagues, and of course, the Internet, for advice on our options.

In our research, we discovered three things. First, with COVID-19, the cost of childcare has skyrocketed, and availability has decreased. Second, there are several options for childcare, each with its own benefits and drawbacks. Third, there is no one-size-fits-all solution.

Family

Using family members to provide childcare is often cost-effective and provides a familiar, supportive environment for children. Proximity does not guarantee a willingness or ability to provide long-term care, however, and it can cause strain on family relationships, lead to intrusions and boundary issues, and create feelings of obligation and guilt. It is important to have very honest, up-front discussions with family members about hopes and expectations if this is your childcare plan.

Daycare, facility-based

Daycare centers are commercial facilities that offer care to multiple children of varying ages, starting from as young as 6 weeks. They have trained professionals and provide structured activities and educational programs for children. Many daycares also provide snacks and lunch, which is included in their tuition. They are a popular choice for families seeking full-time childcare and the social and educational benefits that come with a structured setting.

Daycares also have some downsides. They usually operate during normal workday hours, from 7:00 a.m. to 6:00 p.m., which may not be convenient for physicians who work outside of these hours. Even with feasible hours, getting children dressed, ready, and dropped off each morning could add significant time and stress to your morning routine. Additionally, most daycares have policies that prohibit attendance if a child is sick or febrile, which is a common occurrence, particularly for daycare kids. In case of an illness outbreak, the daycare may even close for several days. Both scenarios require at least one parent to take a day off or have an alternative childcare plan available on short notice.

Availability of daycare can be limited, particularly since the COVID pandemic, creating waitlists that can be several months long. Early registration, even during pregnancy, is recommended to secure a spot. It can be helpful to find out if your employer has an agreement with a specific daycare that has “physician-friendly” hours and gives waitlist priority to trainees or even attending physicians. The cost of daycare for one child is typically affordable, around $12,000 per year on average, but can be as high as $25,000 in cities with high cost of living. A sibling discount may be offered, but the cost of daycare for multiple children could still exceed in-home childcare options.1

Daycare, home-based (also known as family care centers)

Family care centers offer a home-like alternative to daycares, with smaller staff-to-child ratios and often more personalized care. They are favored by families seeking a more intimate setting. They might offer more flexible scheduling and are typically less expensive than facility-based daycares, at up to 25% lower cost.1 They may lack the same structure and educational opportunities as facility-based daycares, however, and are not subject to the same health and safety regulations.

Nannies

Nannies are professional caregivers who provide in-home childcare services. Their responsibilities may include feeding, changing, dressing, bathing, and playing with children. In some cases, they may also be expected to do light housekeeping tasks like meal preparation, laundry, and cleaning. It is common for nannies in high-demand markets to refuse to perform these additional tasks, however. Nannies are preferred by families with hectic schedules due to their flexibility. They can work early, late, or even overnight shifts, and provide care in the comfort of your home, avoiding the hassle of drop-off and pick-up times. Nannies also can provide personalized care to meet each child’s specific needs, and they can care for children who are sick or febrile.

When hiring a nanny, it is important to have a written contract outlining their expected hours, wages, benefits, and duties to prevent misunderstandings in the future. Finding a trustworthy and reliable nanny can be a challenge, and families have several options for finding one. They can post jobs on free websites and browse nanny CVs or use a fee-based nanny agency. The cost of using an agency can range from a few hundred to several thousand dollars, so it is important to ask friends and colleagues for recommendations before paying for an agency’s services.

The cost of hiring a nanny is one of its main drawbacks. Nannies typically earn $15 to $30 per hour, and if they work in the family’s home, they are typically considered “household employees” by the IRS. Household employees are entitled to overtime pay for work beyond 40 hours per week, and the employer (you!) is responsible for payroll taxes, withholding, and providing an annual W-2 tax statement.2 There are affordable online nanny payroll services that handle payroll and tax-filing to simplify the process, however. The average annual cost of a full-time nanny is around $40,000 and can be as high as $75,000 in some markets.1 A nanny-share with other families can lower costs, but it may also result in less control over the caregiver and schedule.

It is important to consult a tax professional or the IRS for guidance on nanny wages, taxes, and payroll, as a nanny might rarely be considered an “independent contractor” if they meet certain criteria.

Au pair

An au pair is a live-in childcare provider who travels to a host family’s home from a foreign country on a special J-1 visa. The goal is to provide care for children and participate in cultural exchange activities. Au pairs bring many benefits, such as cost savings compared to traditional childcare options and greater flexibility and customization. They can work up to 10 hours per day and 45 hours a week, performing tasks such as light housekeeping, meal preparation, and transportation for the children. Host families must provide a safe and comfortable living environment, including a private room, meals, and some travel and education expenses.1

The process of hiring an au pair involves working with a designated agency that matches families with applicants and sponsors the J-1 visa. The entire process can take several months, and average program fees cost around $10,000 per placement. Au pairs are hired on a 12-month J-1 visa, which can be extended for up to an additional 12 months, allowing families up to 2 years with the same au pair before needing to find a new placement.

Au pairs earn a minimum weekly stipend of $195.75, set forth by the U.S. State Department.3 Currently, au pairs are not subject to local and state wage requirements, but legal proceedings in various states have recently questioned whether au pairs should be protected under local regulations. Massachusetts has been the most progressive, explicitly protecting au pairs as domestic workers under state labor laws, raising their weekly stipend to roughly $600 to comply with state minimum wage requirements.4 The federal government is expected to provide clarity on this issue, but for the time being, au pairs remain an affordable alternative to a nanny in most states.

Conclusion

Choosing childcare is a complicated process with multiple factors to consider. Figure 1 breaks down the estimated annual cost of each of the options outlined above for a single child in low, average, and high cost-of-living areas. But your decision likely hinges on much more than just cost, and may include family dynamics, scheduling needs, and personal preferences. Gather as much advice and information as possible, but remember to trust your instincts and make the decision that works best for your family. At the end of the day, what matters most is the happiness and well-being of your child.

Dr. Hathorn and Dr. Creighton are married, and both work full-time with a 1-year-old child. Dr. Hathorn is a bariatric and advanced therapeutic endoscopist at the University of North Carolina at Chapel Hill. Dr. Creighton is an anesthesiologist at UNC Chapel Hill. Neither reported any conflicts of interest.

References

1. Care.com. This is how much childcare costs in 2022. 2022 Jun 15.

2. Internal Revenue Service. Publication 926 - Household Employer’s Tax Guide 2023.

3. U.S. Department of State. Au Pair.

4. Commonwealth of Massachusetts. Domestic workers.

Disclaimer

The financial and tax information presented in this article are believed to be true and accurate at the time of writing. However, it’s important to note that tax laws and regulations are subject to change. The authors are not certified financial advisers or tax specialists. It is recommended to seek verification from a local tax expert or the Internal Revenue Service to discuss your specific situation.

Telemedicine increases access to care and optimizes practice revenue

The first time I considered telehealth as a viable option for care delivery was in February 2020. I had just heard that one of my patients had been diagnosed with COVID-19 and admitted to Evergreen Health, a hospital our practice covered just outside of Seattle. The news was jarring. Suddenly, it became crystal clear that patient access to care and the economic survival of our business would require another approach. Seemingly overnight, we built a telehealth program and began seeing patients virtually from the comfort and safety of home.

We certainly weren’t alone. From January to March 2020, the Centers for Disease Control and Prevention showed a 154% increase in telehealth visits.1 Even as the postpandemic era settles in, the use of telehealth today is 38 times greater than the pre-COVID baseline, creating a market valued at $250 billion per year.2 What value might gastroenterologists gain from the use of telehealth going forward? 3 For today’s overburdened GI practices, telehealth can improve patient access to care, alleviate the clinician shortage with work-from-home options for practitioners, and present innovative methods of increasing revenue streams – all while improving quality of care.

As GI demand outpaces supply, it’s time to consider alternative channels of care

The prevalence of gastrointestinal illness, the size of the market, and the growing difficulty in gaining access to care makes it natural to consider whether virtual care may benefit patients and GI practices alike. Approximately 70 million Americans, or 1 in 5, live with chronic GI symptoms.4 On an annual basis, more than 50 million primary care visits and 15 million ER visits in the United States have a primary diagnostic code for GI disease.5 Annual expenditures to address GI conditions, valued at $136 billion, outpace those of other high-cost conditions such as heart disease or mental health.6 And with the recent addition of 21 million patients between 45 and 49 years of age who now require colon cancer screening, plus the expected postpandemic increase in GI illness, those numbers are likely to grow.7

Compounding matters is a shortage of clinicians. Between early physician retirements and a limited number of GI fellowships, gastroenterology was recently identified by a Merritt Hawkins survey as the “most in-demand” specialty.8 Patients are already waiting months, and even up to a year in some parts of the country, to see a gastroenterologist. GI physicians, likewise, are running ragged trying to keep up and are burning out in the process.

The case for virtual GI care

Until the pandemic, many of us would not have seriously considered a significant role for virtual care in GI. When necessity demanded it, however, we used this channel effectively with both patients and providers reporting high rates of satisfaction with telehealth for GI clinic visits.9

In a recent published study with a sizable cohort of GI patients across a wide spectrum of conditions, only 17% required a physical exam following a telehealth visit. Over 50% said they were very likely or likely to continue using telehealth in the future. Interestingly, it was not only a young or tech-savvy population that ranked telehealth highly. In fact, Net Promoter Scores (a proven measure of customer experience) were consistently high for employed patients aged 60 or younger.10

Recent research also has demonstrated that telehealth visits meet quality standards and do so efficiently. A Mayo Clinic study demonstrated that telehealth visits in GI were delivered with a similar level of quality based on diagnostic concordance,11 and a recent study by Tang et al. found that 98% of visits for routine GI issues were completed within 20 minutes.12

Finally, establishing a virtual channel allows a clinic to increase its staffing radius by using geographically dispersed GI providers, including appropriately licensed physicians or advanced practice providers who may reside in other states. The use of remote providers opens up the possibility for “time zone arbitrage” to allow for more flexible staffing that’s similar to urgent care with wraparound and weekend hours – all without adding office space or overhead.

Financial implications

Given the long tail of demand in GI, increasing capacity will increase revenue. Telehealth increases capacity by allowing for the efficient use of resources and expanding the reach of practices in engaging potential providers.

The majority of telehealth visits are reimbursable. Since 1995, 40 states and the District of Columbia have enacted mandatory telehealth coverage laws, and 20 states require that telehealth visits be paid on par with in-person visits.13 With the pandemic Medicare waivers, parity was extended through government programs and is expected by many insiders to continue in some form going forward. By an overwhelming bipartisan majority, the House of Representatives recently passed the Advancing Telehealth Beyond COVID-19 Act, which would extend most temporary telemedicine policies through 2024. This legislation would affect only Medicare reimbursement, but changes in Medicare policy often influence the policies of commercial payers.14

While reimbursement for clinic visits is important, the larger financial implication for extending clinics virtually is in the endoscopy suite. Most revenue (70%-80%) in community GI practices is generated from endoscopic services and related ancillary streams. For an endoscopist, spending time in the clinic is effectively a loss leader. Adding capacity with a virtual clinic and geographically dispersed providers can open up GI physicians to spend more time in the endoscopy suite, thereby generating additional revenue.

Given the rapid consolidation of the GI space, income repair post private equity transaction is top of mind for both established physicians and young physicians entering the labor market. Having a virtual ancillary differentiates practices and may prove useful for recruitment. Increasing access by using remote providers during evenings and weekends may “unclog the pipes,” improve the patient and provider experience, and increase revenue.

Overcoming obstacles

Creating a telehealth platform – particularly one that crosses state lines – requires an understanding of a complex and evolving regulatory environment. Licensing is one example. When telehealth is used, it is considered to be rendered at the location of the patient. A provider typically has to be licensed in the state where the patient is located at the time of the clinical encounter. So, if providers cross jurisdictional boundaries to provide care, multiple state licenses may be required.

In addition, medical malpractice and cyber insurance for telemedicine providers are niche products. And as with the use of any technology, risks of a data breach or other unauthorized disclosure of protected health information make it vital to ensure data are fully encrypted, networks are secure, and all safeguards are followed according to the Health Information and Portability and Accountability Act (HIPAA).

Perhaps most challenging are payers, both commercial and governmental. The location of a distant site provider can affect network participation for some but not all payers. Understanding payer reimbursement policies is time-intensive, and building relationships within these organizations is crucial in today’s rapidly changing environment.

The ultimate aim: Better patient outcomes

Of course, the main goal is to take care of patients well and in a timely fashion. Better access will lead to an improved patient experience and a greater emphasis on the important cognitive aspects of GI care. Moreover, efficient use of physician time will also improve clinician satisfaction while increasing revenue and downstream value. Most importantly, increased access via a virtual channel may positively impact patient outcomes. For instance, data show that distance from an endoscopy center is negatively associated with the stage of colon cancer diagnosis.15 Providing a virtual channel to reach these distant patients will likely increase the opportunity for high-impact procedures like colonoscopy.

Change can be hard, but it will come

The old saying is that change comes slowly, then all at once. Access is a chronic pain point for GI practices that has now reached a critical level.

The GI market is enormous and rapidly evolving; it will continue to attract disruptive interest and several early-stage digital first GI companies have entered the ecosystem. There is a risk for disintermediation as well as opportunities for collaboration. The next few years will be interesting.

As we transition to a postpandemic environment, telehealth can continue to improve patient access and present new revenue streams for GI practices – all while improving quality of care. Seeing around the corner likely means expanding the reach of your clinic and offering multiple channels of care. There is likely a significant opportunity for those who choose to adapt.

Dr. Arjal is cofounder, chief medical officer, and president of Telebelly Health and is a board-certified gastroenterologist who previously served as vice president of Puget Sound Gastroenterology and a vice president of clinical affairs for GastroHealth. He currently serves on the American Gastroenterological Association (AGA) Practice Management and Economics Committee. He has no conflicts. He is on LinkedIn and Twitter (@RussArjalMD).

References

1. Koonin LM et al. Trends in the use of telehealth during the emergence of the COVID-19 pandemic – United States, January-March 2020. MMWR Morb Mortal Wkly Rep. 2020. Oct 30;69(43):1595-9.

2. “Telehealth: A quarter-trillion-dollar post-COVID-19 reality?” McKinsey & Company, July 9, 2021.

3. The telehealth era is just beginning, Robert Pearl and Brian Wayling, Harvard Business Review, May-June, 2022.

4. Peery et al. Burden and cost of gastrointestinal, liver, and pancreatic diseases in the United States: Update 2018. Gastroenterology. 2019. Jan;156(1):254-72.

5. See id.

6. See id.

7. Sieh, K. Post-COVID-19 functional gastrointestinal disorders: Prepare for a GI aftershock. J Gastroenterol Hepatol. 2022 March;37(3):413-4.

8. Newitt, P. Gastroenterology’s biggest threats. Becker’s, GI & Endoscopy, 2021 Oct 8, and Physician Compensation Report, 2022. Physicians Thrive (projecting a shortage of over 1,600 Gastroenterologists by 2025).

9. Dobrusin et al. Gastroenterologists and patients report high satisfaction rates with Telehealth services during the novel coronavirus 2019 pandemic. Clin Gastroenterol Hepatol. 2020;8(11):2393-7.

10. Dobrusin et al. Patients with gastrointestinal conditions consider telehealth equivalent to in-person care. Gastroenterology. 2022 Oct 4. doi: 10.1053/j.gastro.2022.09.035.

11. Demaerschalk et al. Assessment of clinician diagnostic concordance with video telemedicine in the integrated multispecialty practice at Mayo Clinic during the beginning of COVID-19 pandemic from March to June, 2020. JAMA Netw Open. 2022 Sep;5(9):e2229958.

12. Tang et al. A model for the pandemic and beyond: Telemedicine for all gastroenterology referrals reduces unnecessary clinic visits. J Telemed Telecare. 2022 Sep 28(8):577-82.

13. Dills A. Policy brief: Telehealth payment parity laws at the state level. Mercatus Center, George Mason University.

14. H.R.4040 – Advancing Telehealth Beyond COVID-19 Act of 2021. Congress.gov.

15. Brand et al. Association of distance, region, and insurance with advanced colon cancer at initial diagnosis. JAMA Netw Open. 2022 Sep 1;5(9):e2229954.

The first time I considered telehealth as a viable option for care delivery was in February 2020. I had just heard that one of my patients had been diagnosed with COVID-19 and admitted to Evergreen Health, a hospital our practice covered just outside of Seattle. The news was jarring. Suddenly, it became crystal clear that patient access to care and the economic survival of our business would require another approach. Seemingly overnight, we built a telehealth program and began seeing patients virtually from the comfort and safety of home.

We certainly weren’t alone. From January to March 2020, the Centers for Disease Control and Prevention showed a 154% increase in telehealth visits.1 Even as the postpandemic era settles in, the use of telehealth today is 38 times greater than the pre-COVID baseline, creating a market valued at $250 billion per year.2 What value might gastroenterologists gain from the use of telehealth going forward? 3 For today’s overburdened GI practices, telehealth can improve patient access to care, alleviate the clinician shortage with work-from-home options for practitioners, and present innovative methods of increasing revenue streams – all while improving quality of care.

As GI demand outpaces supply, it’s time to consider alternative channels of care

The prevalence of gastrointestinal illness, the size of the market, and the growing difficulty in gaining access to care makes it natural to consider whether virtual care may benefit patients and GI practices alike. Approximately 70 million Americans, or 1 in 5, live with chronic GI symptoms.4 On an annual basis, more than 50 million primary care visits and 15 million ER visits in the United States have a primary diagnostic code for GI disease.5 Annual expenditures to address GI conditions, valued at $136 billion, outpace those of other high-cost conditions such as heart disease or mental health.6 And with the recent addition of 21 million patients between 45 and 49 years of age who now require colon cancer screening, plus the expected postpandemic increase in GI illness, those numbers are likely to grow.7

Compounding matters is a shortage of clinicians. Between early physician retirements and a limited number of GI fellowships, gastroenterology was recently identified by a Merritt Hawkins survey as the “most in-demand” specialty.8 Patients are already waiting months, and even up to a year in some parts of the country, to see a gastroenterologist. GI physicians, likewise, are running ragged trying to keep up and are burning out in the process.

The case for virtual GI care

Until the pandemic, many of us would not have seriously considered a significant role for virtual care in GI. When necessity demanded it, however, we used this channel effectively with both patients and providers reporting high rates of satisfaction with telehealth for GI clinic visits.9

In a recent published study with a sizable cohort of GI patients across a wide spectrum of conditions, only 17% required a physical exam following a telehealth visit. Over 50% said they were very likely or likely to continue using telehealth in the future. Interestingly, it was not only a young or tech-savvy population that ranked telehealth highly. In fact, Net Promoter Scores (a proven measure of customer experience) were consistently high for employed patients aged 60 or younger.10

Recent research also has demonstrated that telehealth visits meet quality standards and do so efficiently. A Mayo Clinic study demonstrated that telehealth visits in GI were delivered with a similar level of quality based on diagnostic concordance,11 and a recent study by Tang et al. found that 98% of visits for routine GI issues were completed within 20 minutes.12

Finally, establishing a virtual channel allows a clinic to increase its staffing radius by using geographically dispersed GI providers, including appropriately licensed physicians or advanced practice providers who may reside in other states. The use of remote providers opens up the possibility for “time zone arbitrage” to allow for more flexible staffing that’s similar to urgent care with wraparound and weekend hours – all without adding office space or overhead.

Financial implications

Given the long tail of demand in GI, increasing capacity will increase revenue. Telehealth increases capacity by allowing for the efficient use of resources and expanding the reach of practices in engaging potential providers.

The majority of telehealth visits are reimbursable. Since 1995, 40 states and the District of Columbia have enacted mandatory telehealth coverage laws, and 20 states require that telehealth visits be paid on par with in-person visits.13 With the pandemic Medicare waivers, parity was extended through government programs and is expected by many insiders to continue in some form going forward. By an overwhelming bipartisan majority, the House of Representatives recently passed the Advancing Telehealth Beyond COVID-19 Act, which would extend most temporary telemedicine policies through 2024. This legislation would affect only Medicare reimbursement, but changes in Medicare policy often influence the policies of commercial payers.14

While reimbursement for clinic visits is important, the larger financial implication for extending clinics virtually is in the endoscopy suite. Most revenue (70%-80%) in community GI practices is generated from endoscopic services and related ancillary streams. For an endoscopist, spending time in the clinic is effectively a loss leader. Adding capacity with a virtual clinic and geographically dispersed providers can open up GI physicians to spend more time in the endoscopy suite, thereby generating additional revenue.

Given the rapid consolidation of the GI space, income repair post private equity transaction is top of mind for both established physicians and young physicians entering the labor market. Having a virtual ancillary differentiates practices and may prove useful for recruitment. Increasing access by using remote providers during evenings and weekends may “unclog the pipes,” improve the patient and provider experience, and increase revenue.

Overcoming obstacles

Creating a telehealth platform – particularly one that crosses state lines – requires an understanding of a complex and evolving regulatory environment. Licensing is one example. When telehealth is used, it is considered to be rendered at the location of the patient. A provider typically has to be licensed in the state where the patient is located at the time of the clinical encounter. So, if providers cross jurisdictional boundaries to provide care, multiple state licenses may be required.

In addition, medical malpractice and cyber insurance for telemedicine providers are niche products. And as with the use of any technology, risks of a data breach or other unauthorized disclosure of protected health information make it vital to ensure data are fully encrypted, networks are secure, and all safeguards are followed according to the Health Information and Portability and Accountability Act (HIPAA).

Perhaps most challenging are payers, both commercial and governmental. The location of a distant site provider can affect network participation for some but not all payers. Understanding payer reimbursement policies is time-intensive, and building relationships within these organizations is crucial in today’s rapidly changing environment.

The ultimate aim: Better patient outcomes

Of course, the main goal is to take care of patients well and in a timely fashion. Better access will lead to an improved patient experience and a greater emphasis on the important cognitive aspects of GI care. Moreover, efficient use of physician time will also improve clinician satisfaction while increasing revenue and downstream value. Most importantly, increased access via a virtual channel may positively impact patient outcomes. For instance, data show that distance from an endoscopy center is negatively associated with the stage of colon cancer diagnosis.15 Providing a virtual channel to reach these distant patients will likely increase the opportunity for high-impact procedures like colonoscopy.

Change can be hard, but it will come

The old saying is that change comes slowly, then all at once. Access is a chronic pain point for GI practices that has now reached a critical level.

The GI market is enormous and rapidly evolving; it will continue to attract disruptive interest and several early-stage digital first GI companies have entered the ecosystem. There is a risk for disintermediation as well as opportunities for collaboration. The next few years will be interesting.

As we transition to a postpandemic environment, telehealth can continue to improve patient access and present new revenue streams for GI practices – all while improving quality of care. Seeing around the corner likely means expanding the reach of your clinic and offering multiple channels of care. There is likely a significant opportunity for those who choose to adapt.

Dr. Arjal is cofounder, chief medical officer, and president of Telebelly Health and is a board-certified gastroenterologist who previously served as vice president of Puget Sound Gastroenterology and a vice president of clinical affairs for GastroHealth. He currently serves on the American Gastroenterological Association (AGA) Practice Management and Economics Committee. He has no conflicts. He is on LinkedIn and Twitter (@RussArjalMD).

References

1. Koonin LM et al. Trends in the use of telehealth during the emergence of the COVID-19 pandemic – United States, January-March 2020. MMWR Morb Mortal Wkly Rep. 2020. Oct 30;69(43):1595-9.

2. “Telehealth: A quarter-trillion-dollar post-COVID-19 reality?” McKinsey & Company, July 9, 2021.

3. The telehealth era is just beginning, Robert Pearl and Brian Wayling, Harvard Business Review, May-June, 2022.

4. Peery et al. Burden and cost of gastrointestinal, liver, and pancreatic diseases in the United States: Update 2018. Gastroenterology. 2019. Jan;156(1):254-72.

5. See id.

6. See id.

7. Sieh, K. Post-COVID-19 functional gastrointestinal disorders: Prepare for a GI aftershock. J Gastroenterol Hepatol. 2022 March;37(3):413-4.

8. Newitt, P. Gastroenterology’s biggest threats. Becker’s, GI & Endoscopy, 2021 Oct 8, and Physician Compensation Report, 2022. Physicians Thrive (projecting a shortage of over 1,600 Gastroenterologists by 2025).

9. Dobrusin et al. Gastroenterologists and patients report high satisfaction rates with Telehealth services during the novel coronavirus 2019 pandemic. Clin Gastroenterol Hepatol. 2020;8(11):2393-7.

10. Dobrusin et al. Patients with gastrointestinal conditions consider telehealth equivalent to in-person care. Gastroenterology. 2022 Oct 4. doi: 10.1053/j.gastro.2022.09.035.

11. Demaerschalk et al. Assessment of clinician diagnostic concordance with video telemedicine in the integrated multispecialty practice at Mayo Clinic during the beginning of COVID-19 pandemic from March to June, 2020. JAMA Netw Open. 2022 Sep;5(9):e2229958.

12. Tang et al. A model for the pandemic and beyond: Telemedicine for all gastroenterology referrals reduces unnecessary clinic visits. J Telemed Telecare. 2022 Sep 28(8):577-82.

13. Dills A. Policy brief: Telehealth payment parity laws at the state level. Mercatus Center, George Mason University.

14. H.R.4040 – Advancing Telehealth Beyond COVID-19 Act of 2021. Congress.gov.

15. Brand et al. Association of distance, region, and insurance with advanced colon cancer at initial diagnosis. JAMA Netw Open. 2022 Sep 1;5(9):e2229954.

The first time I considered telehealth as a viable option for care delivery was in February 2020. I had just heard that one of my patients had been diagnosed with COVID-19 and admitted to Evergreen Health, a hospital our practice covered just outside of Seattle. The news was jarring. Suddenly, it became crystal clear that patient access to care and the economic survival of our business would require another approach. Seemingly overnight, we built a telehealth program and began seeing patients virtually from the comfort and safety of home.

We certainly weren’t alone. From January to March 2020, the Centers for Disease Control and Prevention showed a 154% increase in telehealth visits.1 Even as the postpandemic era settles in, the use of telehealth today is 38 times greater than the pre-COVID baseline, creating a market valued at $250 billion per year.2 What value might gastroenterologists gain from the use of telehealth going forward? 3 For today’s overburdened GI practices, telehealth can improve patient access to care, alleviate the clinician shortage with work-from-home options for practitioners, and present innovative methods of increasing revenue streams – all while improving quality of care.

As GI demand outpaces supply, it’s time to consider alternative channels of care

The prevalence of gastrointestinal illness, the size of the market, and the growing difficulty in gaining access to care makes it natural to consider whether virtual care may benefit patients and GI practices alike. Approximately 70 million Americans, or 1 in 5, live with chronic GI symptoms.4 On an annual basis, more than 50 million primary care visits and 15 million ER visits in the United States have a primary diagnostic code for GI disease.5 Annual expenditures to address GI conditions, valued at $136 billion, outpace those of other high-cost conditions such as heart disease or mental health.6 And with the recent addition of 21 million patients between 45 and 49 years of age who now require colon cancer screening, plus the expected postpandemic increase in GI illness, those numbers are likely to grow.7

Compounding matters is a shortage of clinicians. Between early physician retirements and a limited number of GI fellowships, gastroenterology was recently identified by a Merritt Hawkins survey as the “most in-demand” specialty.8 Patients are already waiting months, and even up to a year in some parts of the country, to see a gastroenterologist. GI physicians, likewise, are running ragged trying to keep up and are burning out in the process.

The case for virtual GI care

Until the pandemic, many of us would not have seriously considered a significant role for virtual care in GI. When necessity demanded it, however, we used this channel effectively with both patients and providers reporting high rates of satisfaction with telehealth for GI clinic visits.9

In a recent published study with a sizable cohort of GI patients across a wide spectrum of conditions, only 17% required a physical exam following a telehealth visit. Over 50% said they were very likely or likely to continue using telehealth in the future. Interestingly, it was not only a young or tech-savvy population that ranked telehealth highly. In fact, Net Promoter Scores (a proven measure of customer experience) were consistently high for employed patients aged 60 or younger.10

Recent research also has demonstrated that telehealth visits meet quality standards and do so efficiently. A Mayo Clinic study demonstrated that telehealth visits in GI were delivered with a similar level of quality based on diagnostic concordance,11 and a recent study by Tang et al. found that 98% of visits for routine GI issues were completed within 20 minutes.12

Finally, establishing a virtual channel allows a clinic to increase its staffing radius by using geographically dispersed GI providers, including appropriately licensed physicians or advanced practice providers who may reside in other states. The use of remote providers opens up the possibility for “time zone arbitrage” to allow for more flexible staffing that’s similar to urgent care with wraparound and weekend hours – all without adding office space or overhead.

Financial implications

Given the long tail of demand in GI, increasing capacity will increase revenue. Telehealth increases capacity by allowing for the efficient use of resources and expanding the reach of practices in engaging potential providers.

The majority of telehealth visits are reimbursable. Since 1995, 40 states and the District of Columbia have enacted mandatory telehealth coverage laws, and 20 states require that telehealth visits be paid on par with in-person visits.13 With the pandemic Medicare waivers, parity was extended through government programs and is expected by many insiders to continue in some form going forward. By an overwhelming bipartisan majority, the House of Representatives recently passed the Advancing Telehealth Beyond COVID-19 Act, which would extend most temporary telemedicine policies through 2024. This legislation would affect only Medicare reimbursement, but changes in Medicare policy often influence the policies of commercial payers.14

While reimbursement for clinic visits is important, the larger financial implication for extending clinics virtually is in the endoscopy suite. Most revenue (70%-80%) in community GI practices is generated from endoscopic services and related ancillary streams. For an endoscopist, spending time in the clinic is effectively a loss leader. Adding capacity with a virtual clinic and geographically dispersed providers can open up GI physicians to spend more time in the endoscopy suite, thereby generating additional revenue.

Given the rapid consolidation of the GI space, income repair post private equity transaction is top of mind for both established physicians and young physicians entering the labor market. Having a virtual ancillary differentiates practices and may prove useful for recruitment. Increasing access by using remote providers during evenings and weekends may “unclog the pipes,” improve the patient and provider experience, and increase revenue.

Overcoming obstacles

Creating a telehealth platform – particularly one that crosses state lines – requires an understanding of a complex and evolving regulatory environment. Licensing is one example. When telehealth is used, it is considered to be rendered at the location of the patient. A provider typically has to be licensed in the state where the patient is located at the time of the clinical encounter. So, if providers cross jurisdictional boundaries to provide care, multiple state licenses may be required.

In addition, medical malpractice and cyber insurance for telemedicine providers are niche products. And as with the use of any technology, risks of a data breach or other unauthorized disclosure of protected health information make it vital to ensure data are fully encrypted, networks are secure, and all safeguards are followed according to the Health Information and Portability and Accountability Act (HIPAA).

Perhaps most challenging are payers, both commercial and governmental. The location of a distant site provider can affect network participation for some but not all payers. Understanding payer reimbursement policies is time-intensive, and building relationships within these organizations is crucial in today’s rapidly changing environment.

The ultimate aim: Better patient outcomes

Of course, the main goal is to take care of patients well and in a timely fashion. Better access will lead to an improved patient experience and a greater emphasis on the important cognitive aspects of GI care. Moreover, efficient use of physician time will also improve clinician satisfaction while increasing revenue and downstream value. Most importantly, increased access via a virtual channel may positively impact patient outcomes. For instance, data show that distance from an endoscopy center is negatively associated with the stage of colon cancer diagnosis.15 Providing a virtual channel to reach these distant patients will likely increase the opportunity for high-impact procedures like colonoscopy.

Change can be hard, but it will come

The old saying is that change comes slowly, then all at once. Access is a chronic pain point for GI practices that has now reached a critical level.

The GI market is enormous and rapidly evolving; it will continue to attract disruptive interest and several early-stage digital first GI companies have entered the ecosystem. There is a risk for disintermediation as well as opportunities for collaboration. The next few years will be interesting.

As we transition to a postpandemic environment, telehealth can continue to improve patient access and present new revenue streams for GI practices – all while improving quality of care. Seeing around the corner likely means expanding the reach of your clinic and offering multiple channels of care. There is likely a significant opportunity for those who choose to adapt.

Dr. Arjal is cofounder, chief medical officer, and president of Telebelly Health and is a board-certified gastroenterologist who previously served as vice president of Puget Sound Gastroenterology and a vice president of clinical affairs for GastroHealth. He currently serves on the American Gastroenterological Association (AGA) Practice Management and Economics Committee. He has no conflicts. He is on LinkedIn and Twitter (@RussArjalMD).

References

1. Koonin LM et al. Trends in the use of telehealth during the emergence of the COVID-19 pandemic – United States, January-March 2020. MMWR Morb Mortal Wkly Rep. 2020. Oct 30;69(43):1595-9.

2. “Telehealth: A quarter-trillion-dollar post-COVID-19 reality?” McKinsey & Company, July 9, 2021.

3. The telehealth era is just beginning, Robert Pearl and Brian Wayling, Harvard Business Review, May-June, 2022.

4. Peery et al. Burden and cost of gastrointestinal, liver, and pancreatic diseases in the United States: Update 2018. Gastroenterology. 2019. Jan;156(1):254-72.

5. See id.

6. See id.

7. Sieh, K. Post-COVID-19 functional gastrointestinal disorders: Prepare for a GI aftershock. J Gastroenterol Hepatol. 2022 March;37(3):413-4.

8. Newitt, P. Gastroenterology’s biggest threats. Becker’s, GI & Endoscopy, 2021 Oct 8, and Physician Compensation Report, 2022. Physicians Thrive (projecting a shortage of over 1,600 Gastroenterologists by 2025).

9. Dobrusin et al. Gastroenterologists and patients report high satisfaction rates with Telehealth services during the novel coronavirus 2019 pandemic. Clin Gastroenterol Hepatol. 2020;8(11):2393-7.

10. Dobrusin et al. Patients with gastrointestinal conditions consider telehealth equivalent to in-person care. Gastroenterology. 2022 Oct 4. doi: 10.1053/j.gastro.2022.09.035.

11. Demaerschalk et al. Assessment of clinician diagnostic concordance with video telemedicine in the integrated multispecialty practice at Mayo Clinic during the beginning of COVID-19 pandemic from March to June, 2020. JAMA Netw Open. 2022 Sep;5(9):e2229958.

12. Tang et al. A model for the pandemic and beyond: Telemedicine for all gastroenterology referrals reduces unnecessary clinic visits. J Telemed Telecare. 2022 Sep 28(8):577-82.

13. Dills A. Policy brief: Telehealth payment parity laws at the state level. Mercatus Center, George Mason University.

14. H.R.4040 – Advancing Telehealth Beyond COVID-19 Act of 2021. Congress.gov.

15. Brand et al. Association of distance, region, and insurance with advanced colon cancer at initial diagnosis. JAMA Netw Open. 2022 Sep 1;5(9):e2229954.

Passive income for the astute gastroenterologist

I don’t think I heard the term “passive income” until I was already an attending gastroenterologist.

That was no surprise. Why would I as a gastroenterologist with a focus in inflammatory bowel diseases be even remotely interested in that term?

Like most physicians, I went into medicine to take care of patients. That was my entire dream. It was a pleasant surprise to hear that gastroenterologists were relatively well paid compared to many other internal medicine specialties.

That was a bonus. I was not practicing medicine for the money. I was here to do good, only. Money was the evil one. It’s no surprise money remained a taboo topic amongst physicians.

This is reflected in the lack of financial education in our training.

I went through all my medical training without getting any financial education. In my last year of training, I wondered how I was going to not end up being a burned out, overworked physician mom. I knew I was going to work in a large hospital-based practice or academic center. I was already aware that employed physicians had a higher burnout rate compared to independent physicians. My desperation to avoid what looked like the natural history of most physicians in medicine was what led me to my financial awakening, as you could call it.

I became curious about where my money was going as it hit my bank account. Where was I investing? How was I going to ensure that I wasn’t putting all my financial eggs in one basket by relying solely on my clinical income? This road led me into a world that I didn’t know existed. It was the world of physician entrepreneurs.

I began thinking more critically of how I was spending my time outside of the hospital. As a busy physician mom, there already were a lot of competing needs and demands on the 24 hours that I was limited to within a day. How could I get things done and increase my earnability without needing to exchange more time for money in a one-to-one ratio?

Passive income!

First of all, what exactly is passive income?

It refers to money earned that does not require you to physically and actively pump in time in order to get money out. For instance, seeing patients clinically is not passive. Performing procedures is not passive.

What are some examples of passive income?

• Dividend paying stocks or funds

• Investing through retirement accounts

• Passive real estate investment through syndications, crowdfunding, REITs

• Book writing

• Business partnership or ownership such as surgery center co-ownership

• Peer-to-peer lending

• Affiliate marketing

• House hacking

• Rent out your car

• Rent out your backyard/ swimming pool

• Invention with royalty payment

• Podcasting

There are some myths about passive income that are worth exploring

1. Passive income is completely passive: This is relative passivity, meaning that for every investment, there is a phase of learning, acquiring knowledge, vetting, and possibly researching that is not passive. After the initial phase of set up, most passive sources of income may require some monitoring or checking in. However, what makes an investment passive is the absence of that one-to-one ratio of input to output that would normally exist in a more active income source.

2. Making passive income is lazy: If you are a physician, you are probably not lazy. Yes, we have a high standard of expectation for ourselves, but anyone that is able to withstand the rigors of medical training, residency, and fellowship is not lazy in my books. Burnout can present in various ways, including apathy. Let’s not confuse that as lazy because, if we do, that would qualify as gaslighting and self-splaining. As someone that teaches physicians how to have money, here is my opinion: In order to make money ethically, there has to be exchange in value. One person gives value, the other gives money as a thank you. Value can be physical as seen in clinical work. Value can also be monetary. For example, I could give $100,000 to a start-up company that needs that money to execute their brilliant idea, and, in return for my investment, they could give me a 15% return per year. Is that lazy? Without this, their brilliant idea may not see daylight. Value exchange is the key. Giving value comes in different ways.

3. Finding ideas for passive income is hard: Many of us are invested in the stock market, most commonly through retirement accounts. This would qualify as passive income. Typically, we have simply elected that the growth in our investment or dividends be reinvested as we are choosing to use this money long term. In other words, if you have a retirement account, you already have passive income. The question now is how you can find additional passive ways to invest.

What are the benefits to passive income as a gastroenterologist?

1. Changing landscape of medicine: Over the last few decades, we have seen a growing shift in the landscape of medicine. There has been an increase in administrations surpassing the increase in physicians. There seem to be more and more growing bodies that are wedging between physicians and patients. This has led to increasing dissatisfaction for patients and physicians alike. In order to respond to these changes and create lasting changes, there is a need for a change in the leadership. It is fair to say that when you have a more diversified source of income, there is less pressure on a single source of income to provide “food and shelter” for your family. Physician leaders that are liberated have to have a sense of financial liberation.

2. Not putting eggs in one basket: At the beginning of the COVID-19 pandemic, there was significant fear of the unknown. Elective procedures were canceled, leading to financial strain for physicians. Gastroenterologists were not spared. When your income source is diverse, it provides more peace of mind.

3. Mental resourcefulness: This is an understated benefit of passive income and diversified income. As physicians, we went through a lot of hard work to get to where we are today. An average incoming medical student has had extensive demonstration of activity, volunteerism, and problem solving. Yet, as attending physicians, because of the burden of everyday clinical responsibilities and endless paperwork, as well as the platform and “warehouse” and “administrative-type involvement” in medicine, the average physician isn’t creating avenues to expend their cognitive abilities in a way that is diverse outside of the clinical setting. Having passive income opportunities creates a gym for mental resourcefulness that increases work satisfaction and may positively impact burnout.

4. Relationship building: As physicians, we tend to stick with our own. After working 60-80 hours per week, it is no surprise that most of your social network may end up being those that you work with. Passive income opportunities expose physicians to networking and social opportunities that may be critical for relationship building. This may improve mental wellness and overall sense of well-being.

5. Longevity in medicine: As more physicians elect to be employed by larger organizations outside of academics, sabbaticals are becoming less and less available. Having passive sources of income may permit a physician who would otherwise not be able to suffer loss of income the opportunity to take a leave of absence in the short term that may provide long-term longevity in medicine, while promoting wellness.

6. Wealth building: Wealth has had a negative reputation in the world. We seem to equate wealth as bad and being the source of evil. We forget that money is simply a tool that takes the shape of the container you place it in. If you are good, money becomes a tool for more good. Having passive income can help accelerate the journey to wealth building. This can be a great resource as physicians can support unique lifesaving, community-building, and environment-protecting initiatives, as well as support political candidates who will have a positive effect on patient care and the future of medicine.

I hope you are convinced that, Gastroenterologists have to do their due diligence to ensure that their finances are future proof to the best of their abilities.

Dr. Alli-Akintade, a gastroenterologist with Kaiser Permanente South Sacramento (Calif.) Medical Center, is founder of The MoneyFitMD and creator of The MoneyFitMD podcast (www.moneyfitmd.com).

I don’t think I heard the term “passive income” until I was already an attending gastroenterologist.

That was no surprise. Why would I as a gastroenterologist with a focus in inflammatory bowel diseases be even remotely interested in that term?

Like most physicians, I went into medicine to take care of patients. That was my entire dream. It was a pleasant surprise to hear that gastroenterologists were relatively well paid compared to many other internal medicine specialties.

That was a bonus. I was not practicing medicine for the money. I was here to do good, only. Money was the evil one. It’s no surprise money remained a taboo topic amongst physicians.

This is reflected in the lack of financial education in our training.

I went through all my medical training without getting any financial education. In my last year of training, I wondered how I was going to not end up being a burned out, overworked physician mom. I knew I was going to work in a large hospital-based practice or academic center. I was already aware that employed physicians had a higher burnout rate compared to independent physicians. My desperation to avoid what looked like the natural history of most physicians in medicine was what led me to my financial awakening, as you could call it.

I became curious about where my money was going as it hit my bank account. Where was I investing? How was I going to ensure that I wasn’t putting all my financial eggs in one basket by relying solely on my clinical income? This road led me into a world that I didn’t know existed. It was the world of physician entrepreneurs.

I began thinking more critically of how I was spending my time outside of the hospital. As a busy physician mom, there already were a lot of competing needs and demands on the 24 hours that I was limited to within a day. How could I get things done and increase my earnability without needing to exchange more time for money in a one-to-one ratio?

Passive income!

First of all, what exactly is passive income?

It refers to money earned that does not require you to physically and actively pump in time in order to get money out. For instance, seeing patients clinically is not passive. Performing procedures is not passive.

What are some examples of passive income?

• Dividend paying stocks or funds

• Investing through retirement accounts

• Passive real estate investment through syndications, crowdfunding, REITs

• Book writing

• Business partnership or ownership such as surgery center co-ownership

• Peer-to-peer lending

• Affiliate marketing

• House hacking

• Rent out your car

• Rent out your backyard/ swimming pool

• Invention with royalty payment

• Podcasting

There are some myths about passive income that are worth exploring

1. Passive income is completely passive: This is relative passivity, meaning that for every investment, there is a phase of learning, acquiring knowledge, vetting, and possibly researching that is not passive. After the initial phase of set up, most passive sources of income may require some monitoring or checking in. However, what makes an investment passive is the absence of that one-to-one ratio of input to output that would normally exist in a more active income source.

2. Making passive income is lazy: If you are a physician, you are probably not lazy. Yes, we have a high standard of expectation for ourselves, but anyone that is able to withstand the rigors of medical training, residency, and fellowship is not lazy in my books. Burnout can present in various ways, including apathy. Let’s not confuse that as lazy because, if we do, that would qualify as gaslighting and self-splaining. As someone that teaches physicians how to have money, here is my opinion: In order to make money ethically, there has to be exchange in value. One person gives value, the other gives money as a thank you. Value can be physical as seen in clinical work. Value can also be monetary. For example, I could give $100,000 to a start-up company that needs that money to execute their brilliant idea, and, in return for my investment, they could give me a 15% return per year. Is that lazy? Without this, their brilliant idea may not see daylight. Value exchange is the key. Giving value comes in different ways.

3. Finding ideas for passive income is hard: Many of us are invested in the stock market, most commonly through retirement accounts. This would qualify as passive income. Typically, we have simply elected that the growth in our investment or dividends be reinvested as we are choosing to use this money long term. In other words, if you have a retirement account, you already have passive income. The question now is how you can find additional passive ways to invest.

What are the benefits to passive income as a gastroenterologist?

1. Changing landscape of medicine: Over the last few decades, we have seen a growing shift in the landscape of medicine. There has been an increase in administrations surpassing the increase in physicians. There seem to be more and more growing bodies that are wedging between physicians and patients. This has led to increasing dissatisfaction for patients and physicians alike. In order to respond to these changes and create lasting changes, there is a need for a change in the leadership. It is fair to say that when you have a more diversified source of income, there is less pressure on a single source of income to provide “food and shelter” for your family. Physician leaders that are liberated have to have a sense of financial liberation.

2. Not putting eggs in one basket: At the beginning of the COVID-19 pandemic, there was significant fear of the unknown. Elective procedures were canceled, leading to financial strain for physicians. Gastroenterologists were not spared. When your income source is diverse, it provides more peace of mind.

3. Mental resourcefulness: This is an understated benefit of passive income and diversified income. As physicians, we went through a lot of hard work to get to where we are today. An average incoming medical student has had extensive demonstration of activity, volunteerism, and problem solving. Yet, as attending physicians, because of the burden of everyday clinical responsibilities and endless paperwork, as well as the platform and “warehouse” and “administrative-type involvement” in medicine, the average physician isn’t creating avenues to expend their cognitive abilities in a way that is diverse outside of the clinical setting. Having passive income opportunities creates a gym for mental resourcefulness that increases work satisfaction and may positively impact burnout.

4. Relationship building: As physicians, we tend to stick with our own. After working 60-80 hours per week, it is no surprise that most of your social network may end up being those that you work with. Passive income opportunities expose physicians to networking and social opportunities that may be critical for relationship building. This may improve mental wellness and overall sense of well-being.