User login

Value-based payment: Time to start getting ready

WASHINGTON– Are physicians ready for the shift toward value-based compensation?

A report from the American Medical Association and the RAND Corporation aims to get physicians thinking about what investments they should expect to make and what obstacles they may encounter as they prepare for the federal government’s switch from fee-for-service to value-based medicine in 2018.

“There is a lot of enthusiasm for change,” Dr. Mark W. Friedberg, senior natural scientist at RAND in Boston and lead researcher on the report, said in an interview. “There is a lot of hope this will result in better patient care and physician success. It’s a matter of the details.”

The report is based on survey data from 34 practices across the country, all of which have some form of alternative payment structure in place, whether it be accountable care or bundled services. Practices were located in rural and urban settings ranging from hospital- to physician-owned or corporately managed, all with varying sizes of patient panels.

The top concern that practice managers faced was matching the appropriate alternative payment model to their particular patient population, researchers found. Other concerns included how best to use incentives without adversely affecting patient care and how to avoid physician burn-out.

These concerns, Dr. Friedberg said, point to a need for payers to offer guidance about what makes sense when and why. “We got the message that more communication between payers and physician practices tends to be a good thing.”

Many of the coming changes will require updated technology. Finding the money for such an overhaul is a universal preoccupation of many practice managers, and another reason some practices have yet to switch. “Some of the time, practices can get a loan, or have the reserves to do it on their own, but sometimes they don’t and they need to partner with a large organization like a hospital or a large physician group,” Dr. Friedberg said.

Payers are not likely to help foot the bill, according to Susan DeVore, president and chief executive officer of Premier Health, a performance improvement alliance of hospitals and other providers.

“It would be wonderful if the health plans would spend hundreds of millions of dollars for the technology enablement of the physician practices and the health systems,” Ms. DeVore said at the press conference. “The truth is, health systems and physicians are [already] spending the billions to build these technology infrastructures, and they need to do that together.”

She called for more systemwide transparent collaboration in how cost is determined and in how quality and outcomes are measured. “It’s not fair to say we need a coordinated system of care, but then we can’t do it for lots of regulatory reasons,” she said noting that ultimately, she believed such information sharing would be determined by Congress.

Payers, should, however, make sure that physicians and other providers have a seat at the table when performance metrics are determined, Dr. Friedberg said.

“Some of the concerns we heard were that, in addition to the number of measures, was also whether individual measures are clinically valid, and do they really reflect true differences in the quality of the patient care. Is it possible that the measure isn’t really reliable and not adequately risk adjusted, and therefore might not be ready for prime time in a payment contract?”

Although the report did not offer specific time frames practice managers could expect before a new structure would take hold, Ms. DeVore said she was aware of some practices that realized more than a third more profits within 3 years of switching to value-based care models.

Chet Burrell, president and CEO of CareFirst BlueCross BlueShield, said his group’s experience was that overall, physicians were not ready for the change to value-based care. This, despite the insurer’s announcement that $1 in every $5 it spends on reimbursement is now tied to quality care.

For physicians who are ready to make the shift to value-based payment, Mr. Burrell said an average of 5 years was necessary to fully integrate. “Each practice is its own ecosystem. Some physicians catch on very quickly, but some are hostile.”

On Twitter @whitneymcknight

WASHINGTON– Are physicians ready for the shift toward value-based compensation?

A report from the American Medical Association and the RAND Corporation aims to get physicians thinking about what investments they should expect to make and what obstacles they may encounter as they prepare for the federal government’s switch from fee-for-service to value-based medicine in 2018.

“There is a lot of enthusiasm for change,” Dr. Mark W. Friedberg, senior natural scientist at RAND in Boston and lead researcher on the report, said in an interview. “There is a lot of hope this will result in better patient care and physician success. It’s a matter of the details.”

The report is based on survey data from 34 practices across the country, all of which have some form of alternative payment structure in place, whether it be accountable care or bundled services. Practices were located in rural and urban settings ranging from hospital- to physician-owned or corporately managed, all with varying sizes of patient panels.

The top concern that practice managers faced was matching the appropriate alternative payment model to their particular patient population, researchers found. Other concerns included how best to use incentives without adversely affecting patient care and how to avoid physician burn-out.

These concerns, Dr. Friedberg said, point to a need for payers to offer guidance about what makes sense when and why. “We got the message that more communication between payers and physician practices tends to be a good thing.”

Many of the coming changes will require updated technology. Finding the money for such an overhaul is a universal preoccupation of many practice managers, and another reason some practices have yet to switch. “Some of the time, practices can get a loan, or have the reserves to do it on their own, but sometimes they don’t and they need to partner with a large organization like a hospital or a large physician group,” Dr. Friedberg said.

Payers are not likely to help foot the bill, according to Susan DeVore, president and chief executive officer of Premier Health, a performance improvement alliance of hospitals and other providers.

“It would be wonderful if the health plans would spend hundreds of millions of dollars for the technology enablement of the physician practices and the health systems,” Ms. DeVore said at the press conference. “The truth is, health systems and physicians are [already] spending the billions to build these technology infrastructures, and they need to do that together.”

She called for more systemwide transparent collaboration in how cost is determined and in how quality and outcomes are measured. “It’s not fair to say we need a coordinated system of care, but then we can’t do it for lots of regulatory reasons,” she said noting that ultimately, she believed such information sharing would be determined by Congress.

Payers, should, however, make sure that physicians and other providers have a seat at the table when performance metrics are determined, Dr. Friedberg said.

“Some of the concerns we heard were that, in addition to the number of measures, was also whether individual measures are clinically valid, and do they really reflect true differences in the quality of the patient care. Is it possible that the measure isn’t really reliable and not adequately risk adjusted, and therefore might not be ready for prime time in a payment contract?”

Although the report did not offer specific time frames practice managers could expect before a new structure would take hold, Ms. DeVore said she was aware of some practices that realized more than a third more profits within 3 years of switching to value-based care models.

Chet Burrell, president and CEO of CareFirst BlueCross BlueShield, said his group’s experience was that overall, physicians were not ready for the change to value-based care. This, despite the insurer’s announcement that $1 in every $5 it spends on reimbursement is now tied to quality care.

For physicians who are ready to make the shift to value-based payment, Mr. Burrell said an average of 5 years was necessary to fully integrate. “Each practice is its own ecosystem. Some physicians catch on very quickly, but some are hostile.”

On Twitter @whitneymcknight

WASHINGTON– Are physicians ready for the shift toward value-based compensation?

A report from the American Medical Association and the RAND Corporation aims to get physicians thinking about what investments they should expect to make and what obstacles they may encounter as they prepare for the federal government’s switch from fee-for-service to value-based medicine in 2018.

“There is a lot of enthusiasm for change,” Dr. Mark W. Friedberg, senior natural scientist at RAND in Boston and lead researcher on the report, said in an interview. “There is a lot of hope this will result in better patient care and physician success. It’s a matter of the details.”

The report is based on survey data from 34 practices across the country, all of which have some form of alternative payment structure in place, whether it be accountable care or bundled services. Practices were located in rural and urban settings ranging from hospital- to physician-owned or corporately managed, all with varying sizes of patient panels.

The top concern that practice managers faced was matching the appropriate alternative payment model to their particular patient population, researchers found. Other concerns included how best to use incentives without adversely affecting patient care and how to avoid physician burn-out.

These concerns, Dr. Friedberg said, point to a need for payers to offer guidance about what makes sense when and why. “We got the message that more communication between payers and physician practices tends to be a good thing.”

Many of the coming changes will require updated technology. Finding the money for such an overhaul is a universal preoccupation of many practice managers, and another reason some practices have yet to switch. “Some of the time, practices can get a loan, or have the reserves to do it on their own, but sometimes they don’t and they need to partner with a large organization like a hospital or a large physician group,” Dr. Friedberg said.

Payers are not likely to help foot the bill, according to Susan DeVore, president and chief executive officer of Premier Health, a performance improvement alliance of hospitals and other providers.

“It would be wonderful if the health plans would spend hundreds of millions of dollars for the technology enablement of the physician practices and the health systems,” Ms. DeVore said at the press conference. “The truth is, health systems and physicians are [already] spending the billions to build these technology infrastructures, and they need to do that together.”

She called for more systemwide transparent collaboration in how cost is determined and in how quality and outcomes are measured. “It’s not fair to say we need a coordinated system of care, but then we can’t do it for lots of regulatory reasons,” she said noting that ultimately, she believed such information sharing would be determined by Congress.

Payers, should, however, make sure that physicians and other providers have a seat at the table when performance metrics are determined, Dr. Friedberg said.

“Some of the concerns we heard were that, in addition to the number of measures, was also whether individual measures are clinically valid, and do they really reflect true differences in the quality of the patient care. Is it possible that the measure isn’t really reliable and not adequately risk adjusted, and therefore might not be ready for prime time in a payment contract?”

Although the report did not offer specific time frames practice managers could expect before a new structure would take hold, Ms. DeVore said she was aware of some practices that realized more than a third more profits within 3 years of switching to value-based care models.

Chet Burrell, president and CEO of CareFirst BlueCross BlueShield, said his group’s experience was that overall, physicians were not ready for the change to value-based care. This, despite the insurer’s announcement that $1 in every $5 it spends on reimbursement is now tied to quality care.

For physicians who are ready to make the shift to value-based payment, Mr. Burrell said an average of 5 years was necessary to fully integrate. “Each practice is its own ecosystem. Some physicians catch on very quickly, but some are hostile.”

On Twitter @whitneymcknight

AT AN AMA/RAND BRIEFING

FAQ: What’s in the House proposal to fix the SGR?

It’s make-or-break time for a Medicare “doc fix” replacement.

The House is likely to vote the week of March 23 on a proposal to scrap Medicare’s troubled physician payment formula, just days before a March 31 deadline when doctors who treat Medicare patients will see a 21% payment cut. Senate action could come this week as well, but probably not until the chamber completes a lengthy series of votes on the GOP’s fiscal 2016 budget package.

After negotiating behind closed doors for more than a week, Republican and Democratic leaders of two key House committees that handle Medicare unveiled details of the package late Friday. According to a summary of the deal, the current system would be scrapped and replaced with payment increases for doctors for the next 5 years as Medicare transitions to a new system focused “on quality, value and accountability.”

There’s enough in the wide-ranging deal for both sides to love or hate.

Senate Democrats have pressed to add to the proposal 4 years of funding for an unrelated program, the Children’s Health Insurance Program (CHIP). The House package extends CHIP for 2 years. In a statement Saturday, Senate Finance Democrats said they were “united by the necessity of extending CHIP funding for another 4 years.”

Their statement also signaled other potential problems for the package in the Senate, including concerns about asking Medicare beneficiaries to pay for more of their medical care, the impact of the package on women’s health services, and cuts to Medicare providers.

Still, some Democratic allies said the CHIP disagreement should not undermine the proposal. Shortly after the package was unveiled Friday, Ron Pollack, executive director of the consumers group Families USA, said in a statement that “while we would have preferred a 4-year extension, the House bill has our full support.”

Some GOP conservatives and Democrats will balk that the package isn’t fully paid for, with policy changes governing Medicare beneficiaries and providers paying for only about $70 billion of the approximately $200 billion package.

For doctors, the package offers an end to a familiar but frustrating rite. Lawmakers have invariably deferred the cuts prescribed by a 1997 reimbursement formula, which everyone agrees is broken beyond repair. But the deferrals have always been temporary because Congress has not agreed to offsetting cuts to pay for a permanent fix. In 2010, Congress delayed scheduled cuts five times. In a statement Sunday, the American Medical Association urged Congress “to seize the moment” to enact the changes.

Here are some answers to frequently asked questions about the proposal and the congressional ritual known as the doc fix.

Q: What are the options that Congress is looking at?

The House package would scrap the Sustainable Growth Rate (SGR) formula and give doctors a 0.5% bump for each of the next 5 years as Medicare transitions to a payment system designed to reward physicians based on the quality of care provided, rather than the quantity of procedures performed, as the current payment formula does.

The measure, which builds upon last year’s legislation from the House Energy and Commerce and Ways and Means Committees and the Senate Finance Committee, would encourage better care coordination and chronic care management, ideas that experts have said are needed in the Medicare program. It would give a 5% payment bonus to providers who receive a “significant portion” of their revenue from an “alternative payment model” or patient-centered medical home. It would also allow broader use of Medicare data for “transparency and quality improvement” purposes.

“The SGR has generated repeated crises for nearly 2 decades,” Energy and Commerce Committee Chairman Fred Upton (R-Mich.), one of the bill’s drafters, said in a statement. “We have a historic opportunity to finally move to a system that promotes quality over quantity and begins the important work of addressing Medicare’s structural issues.”

The package, which House Speaker John Boehner (R-Ohio) and Minority Leader Nancy Pelosi (D-Calif.) began negotiating weeks ago, also includes an additional $7.2 billion for community health centers over the next 2 years. NARAL Pro-Choice America denounced the deal because the health center funding would be subject to the Hyde Amendment, a common legislative provision that says federal money can be used for abortions only when a pregnancy is the result of rape, incest, or to save the life of the mother.

In a letter to Democratic colleagues, Rep. Pelosi said the funding would occur “under the same terms that Members have previously supported and voted on almost every year since 1979.” In a statement, the National Association of Community Health Centers said the proposal “represents no change in current policy for Health Centers, and would not change anything about how Health Centers operate today.”

The “working summary” of the House plan says the package also includes other health measures – known as extenders – that Congress has renewed each year during the SGR debate. The list includes funding for therapy services, ambulance services, and rural hospitals, as well as for continuing a program that allows low-income people to keep their Medicaid coverage as they transition into employment and earn more money. The deal also would permanently extend the Qualifying Individual, or QI, program, which helps low-income seniors pay their Medicare premiums.

Q. What is the plan for CHIP?

The House plan would add 2 years of funding for CHIP, a federal-state program that provides insurance for low-income children whose families earned too much money to qualify for Medicaid. While the health law continues CHIP authorization through 2019, funding for the program has not been extended beyond the end of September.

The length of the proposed extension could cause strains with Senate Democrats beyond those on the Finance panel who have raised objections to the House package. Last month, the Senate Democratic caucus signed on to legislation from Sen. Sherrod Brown (D-Ohio) calling for a 4-year extension of the current CHIP program.

Q: How would Congress pay for all of that?

It might not. That would be a major departure from the GOP’s mantra that all legislation must be financed. Tired of the yearly SGR battle, veteran members in both chambers may be willing to repeal the SGR on the basis that it’s a budget gimmick – the cuts are never made – and therefore financing is unnecessary. But that strategy could run into stiff opposition from Republican lawmakers and some Democrats

Most lawmakers are expected to feel the need to find financing for the Medicare extenders, the CHIP extension, and any increase in physician payments over the current pay schedule. Those items would account for about $70 billion of financing in an approximately $200 billion package.

Conservative groups are urging Republicans to fully finance any SGR repeal. “Americans didn’t hand Republicans a historic House majority to engage in more deficit spending and budget gimmickry,” Dan Holler, communications director of Heritage Action for America, said earlier this month.

Q. Will seniors and Medicare providers have to help pay for the plan?

Starting in 2018, wealthier Medicare beneficiaries (individuals with incomes between $133,500 and $214,000, with thresholds likely higher for couples) would pay more for their Medicare coverage, a provision impacting just 2% of beneficiaries, according to the summary.

Starting in 2020, “first-dollar” supplemental Medicare insurance known as “Medigap” would not be able to cover the Part B deductible for new beneficiaries, which is currently $147 per year but has increased in past years.

But the effect of that change may be mitigated, according to one analysis.

“Because Medigap policies would no longer pay the Part B deductible, Medigap premiums for the affected policies would go down. Most affected beneficiaries would come out ahead – the drop in their Medigap premiums would exceed the increase in their cost sharing for health services,” according to an analysis from the Center on Budget and Policy Priorities, a left-leaning think tank. “Some others would come out behind. In both cases, the effect would be small – generally no more than $100 a year.”

Experts contend that the “first-dollar” plans, which cover nearly all deductibles and copayments, keep beneficiaries from being judicious when making medical decisions. According to lobbyists and aides, an earlier version of the doc fix legislation that negotiators considered would have prohibited first-dollar plans from covering the first $250 in costs for new beneficiaries.

Postacute providers, such as long-term care and inpatient rehabilitation hospitals, skilled nursing facilities, and home health and hospice organizations, would help finance the repeal, receiving base pay increases of 1% in 2018, about half of what was previously expected.

Other changes include phasing in a one-time 3.2 percentage-point boost in the base payment rate for hospitals currently scheduled to take effect in fiscal 2018. The number of years of the phase-in isn’t specified in the bill summary.

Scheduled reductions in Medicaid “disproportionate share” payments to hospitals that care for large numbers of people who are uninsured or covered by Medicaid would be delayed by 1 year to fiscal 2018 but extended for an additional year to fiscal 2025.

Q. How quickly could Congress act?

Legislation to repeal the SGR is expected to move in the House this week. The House is scheduled to begin a 2-week recess March 27.

Senate Democrats and Republicans may want to offer amendments to the emerging House package, which could mean that the chamber does not resolve the SGR issue before the Senate’s 2-week break, which is scheduled to begin starting March 30.

If the SGR issue can’t be resolved by March 31, Congress could pass a temporary patch as negotiations continue or ask the Centers for Medicare & Medicaid Services, which oversees Medicare, to hold the claims in order to avoid physicians seeing their payments cut 21%.

This article is adapted from content created by and first published by Kaiser Health News (KHN), a nonprofit national health policy news service.

It’s make-or-break time for a Medicare “doc fix” replacement.

The House is likely to vote the week of March 23 on a proposal to scrap Medicare’s troubled physician payment formula, just days before a March 31 deadline when doctors who treat Medicare patients will see a 21% payment cut. Senate action could come this week as well, but probably not until the chamber completes a lengthy series of votes on the GOP’s fiscal 2016 budget package.

After negotiating behind closed doors for more than a week, Republican and Democratic leaders of two key House committees that handle Medicare unveiled details of the package late Friday. According to a summary of the deal, the current system would be scrapped and replaced with payment increases for doctors for the next 5 years as Medicare transitions to a new system focused “on quality, value and accountability.”

There’s enough in the wide-ranging deal for both sides to love or hate.

Senate Democrats have pressed to add to the proposal 4 years of funding for an unrelated program, the Children’s Health Insurance Program (CHIP). The House package extends CHIP for 2 years. In a statement Saturday, Senate Finance Democrats said they were “united by the necessity of extending CHIP funding for another 4 years.”

Their statement also signaled other potential problems for the package in the Senate, including concerns about asking Medicare beneficiaries to pay for more of their medical care, the impact of the package on women’s health services, and cuts to Medicare providers.

Still, some Democratic allies said the CHIP disagreement should not undermine the proposal. Shortly after the package was unveiled Friday, Ron Pollack, executive director of the consumers group Families USA, said in a statement that “while we would have preferred a 4-year extension, the House bill has our full support.”

Some GOP conservatives and Democrats will balk that the package isn’t fully paid for, with policy changes governing Medicare beneficiaries and providers paying for only about $70 billion of the approximately $200 billion package.

For doctors, the package offers an end to a familiar but frustrating rite. Lawmakers have invariably deferred the cuts prescribed by a 1997 reimbursement formula, which everyone agrees is broken beyond repair. But the deferrals have always been temporary because Congress has not agreed to offsetting cuts to pay for a permanent fix. In 2010, Congress delayed scheduled cuts five times. In a statement Sunday, the American Medical Association urged Congress “to seize the moment” to enact the changes.

Here are some answers to frequently asked questions about the proposal and the congressional ritual known as the doc fix.

Q: What are the options that Congress is looking at?

The House package would scrap the Sustainable Growth Rate (SGR) formula and give doctors a 0.5% bump for each of the next 5 years as Medicare transitions to a payment system designed to reward physicians based on the quality of care provided, rather than the quantity of procedures performed, as the current payment formula does.

The measure, which builds upon last year’s legislation from the House Energy and Commerce and Ways and Means Committees and the Senate Finance Committee, would encourage better care coordination and chronic care management, ideas that experts have said are needed in the Medicare program. It would give a 5% payment bonus to providers who receive a “significant portion” of their revenue from an “alternative payment model” or patient-centered medical home. It would also allow broader use of Medicare data for “transparency and quality improvement” purposes.

“The SGR has generated repeated crises for nearly 2 decades,” Energy and Commerce Committee Chairman Fred Upton (R-Mich.), one of the bill’s drafters, said in a statement. “We have a historic opportunity to finally move to a system that promotes quality over quantity and begins the important work of addressing Medicare’s structural issues.”

The package, which House Speaker John Boehner (R-Ohio) and Minority Leader Nancy Pelosi (D-Calif.) began negotiating weeks ago, also includes an additional $7.2 billion for community health centers over the next 2 years. NARAL Pro-Choice America denounced the deal because the health center funding would be subject to the Hyde Amendment, a common legislative provision that says federal money can be used for abortions only when a pregnancy is the result of rape, incest, or to save the life of the mother.

In a letter to Democratic colleagues, Rep. Pelosi said the funding would occur “under the same terms that Members have previously supported and voted on almost every year since 1979.” In a statement, the National Association of Community Health Centers said the proposal “represents no change in current policy for Health Centers, and would not change anything about how Health Centers operate today.”

The “working summary” of the House plan says the package also includes other health measures – known as extenders – that Congress has renewed each year during the SGR debate. The list includes funding for therapy services, ambulance services, and rural hospitals, as well as for continuing a program that allows low-income people to keep their Medicaid coverage as they transition into employment and earn more money. The deal also would permanently extend the Qualifying Individual, or QI, program, which helps low-income seniors pay their Medicare premiums.

Q. What is the plan for CHIP?

The House plan would add 2 years of funding for CHIP, a federal-state program that provides insurance for low-income children whose families earned too much money to qualify for Medicaid. While the health law continues CHIP authorization through 2019, funding for the program has not been extended beyond the end of September.

The length of the proposed extension could cause strains with Senate Democrats beyond those on the Finance panel who have raised objections to the House package. Last month, the Senate Democratic caucus signed on to legislation from Sen. Sherrod Brown (D-Ohio) calling for a 4-year extension of the current CHIP program.

Q: How would Congress pay for all of that?

It might not. That would be a major departure from the GOP’s mantra that all legislation must be financed. Tired of the yearly SGR battle, veteran members in both chambers may be willing to repeal the SGR on the basis that it’s a budget gimmick – the cuts are never made – and therefore financing is unnecessary. But that strategy could run into stiff opposition from Republican lawmakers and some Democrats

Most lawmakers are expected to feel the need to find financing for the Medicare extenders, the CHIP extension, and any increase in physician payments over the current pay schedule. Those items would account for about $70 billion of financing in an approximately $200 billion package.

Conservative groups are urging Republicans to fully finance any SGR repeal. “Americans didn’t hand Republicans a historic House majority to engage in more deficit spending and budget gimmickry,” Dan Holler, communications director of Heritage Action for America, said earlier this month.

Q. Will seniors and Medicare providers have to help pay for the plan?

Starting in 2018, wealthier Medicare beneficiaries (individuals with incomes between $133,500 and $214,000, with thresholds likely higher for couples) would pay more for their Medicare coverage, a provision impacting just 2% of beneficiaries, according to the summary.

Starting in 2020, “first-dollar” supplemental Medicare insurance known as “Medigap” would not be able to cover the Part B deductible for new beneficiaries, which is currently $147 per year but has increased in past years.

But the effect of that change may be mitigated, according to one analysis.

“Because Medigap policies would no longer pay the Part B deductible, Medigap premiums for the affected policies would go down. Most affected beneficiaries would come out ahead – the drop in their Medigap premiums would exceed the increase in their cost sharing for health services,” according to an analysis from the Center on Budget and Policy Priorities, a left-leaning think tank. “Some others would come out behind. In both cases, the effect would be small – generally no more than $100 a year.”

Experts contend that the “first-dollar” plans, which cover nearly all deductibles and copayments, keep beneficiaries from being judicious when making medical decisions. According to lobbyists and aides, an earlier version of the doc fix legislation that negotiators considered would have prohibited first-dollar plans from covering the first $250 in costs for new beneficiaries.

Postacute providers, such as long-term care and inpatient rehabilitation hospitals, skilled nursing facilities, and home health and hospice organizations, would help finance the repeal, receiving base pay increases of 1% in 2018, about half of what was previously expected.

Other changes include phasing in a one-time 3.2 percentage-point boost in the base payment rate for hospitals currently scheduled to take effect in fiscal 2018. The number of years of the phase-in isn’t specified in the bill summary.

Scheduled reductions in Medicaid “disproportionate share” payments to hospitals that care for large numbers of people who are uninsured or covered by Medicaid would be delayed by 1 year to fiscal 2018 but extended for an additional year to fiscal 2025.

Q. How quickly could Congress act?

Legislation to repeal the SGR is expected to move in the House this week. The House is scheduled to begin a 2-week recess March 27.

Senate Democrats and Republicans may want to offer amendments to the emerging House package, which could mean that the chamber does not resolve the SGR issue before the Senate’s 2-week break, which is scheduled to begin starting March 30.

If the SGR issue can’t be resolved by March 31, Congress could pass a temporary patch as negotiations continue or ask the Centers for Medicare & Medicaid Services, which oversees Medicare, to hold the claims in order to avoid physicians seeing their payments cut 21%.

This article is adapted from content created by and first published by Kaiser Health News (KHN), a nonprofit national health policy news service.

It’s make-or-break time for a Medicare “doc fix” replacement.

The House is likely to vote the week of March 23 on a proposal to scrap Medicare’s troubled physician payment formula, just days before a March 31 deadline when doctors who treat Medicare patients will see a 21% payment cut. Senate action could come this week as well, but probably not until the chamber completes a lengthy series of votes on the GOP’s fiscal 2016 budget package.

After negotiating behind closed doors for more than a week, Republican and Democratic leaders of two key House committees that handle Medicare unveiled details of the package late Friday. According to a summary of the deal, the current system would be scrapped and replaced with payment increases for doctors for the next 5 years as Medicare transitions to a new system focused “on quality, value and accountability.”

There’s enough in the wide-ranging deal for both sides to love or hate.

Senate Democrats have pressed to add to the proposal 4 years of funding for an unrelated program, the Children’s Health Insurance Program (CHIP). The House package extends CHIP for 2 years. In a statement Saturday, Senate Finance Democrats said they were “united by the necessity of extending CHIP funding for another 4 years.”

Their statement also signaled other potential problems for the package in the Senate, including concerns about asking Medicare beneficiaries to pay for more of their medical care, the impact of the package on women’s health services, and cuts to Medicare providers.

Still, some Democratic allies said the CHIP disagreement should not undermine the proposal. Shortly after the package was unveiled Friday, Ron Pollack, executive director of the consumers group Families USA, said in a statement that “while we would have preferred a 4-year extension, the House bill has our full support.”

Some GOP conservatives and Democrats will balk that the package isn’t fully paid for, with policy changes governing Medicare beneficiaries and providers paying for only about $70 billion of the approximately $200 billion package.

For doctors, the package offers an end to a familiar but frustrating rite. Lawmakers have invariably deferred the cuts prescribed by a 1997 reimbursement formula, which everyone agrees is broken beyond repair. But the deferrals have always been temporary because Congress has not agreed to offsetting cuts to pay for a permanent fix. In 2010, Congress delayed scheduled cuts five times. In a statement Sunday, the American Medical Association urged Congress “to seize the moment” to enact the changes.

Here are some answers to frequently asked questions about the proposal and the congressional ritual known as the doc fix.

Q: What are the options that Congress is looking at?

The House package would scrap the Sustainable Growth Rate (SGR) formula and give doctors a 0.5% bump for each of the next 5 years as Medicare transitions to a payment system designed to reward physicians based on the quality of care provided, rather than the quantity of procedures performed, as the current payment formula does.

The measure, which builds upon last year’s legislation from the House Energy and Commerce and Ways and Means Committees and the Senate Finance Committee, would encourage better care coordination and chronic care management, ideas that experts have said are needed in the Medicare program. It would give a 5% payment bonus to providers who receive a “significant portion” of their revenue from an “alternative payment model” or patient-centered medical home. It would also allow broader use of Medicare data for “transparency and quality improvement” purposes.

“The SGR has generated repeated crises for nearly 2 decades,” Energy and Commerce Committee Chairman Fred Upton (R-Mich.), one of the bill’s drafters, said in a statement. “We have a historic opportunity to finally move to a system that promotes quality over quantity and begins the important work of addressing Medicare’s structural issues.”

The package, which House Speaker John Boehner (R-Ohio) and Minority Leader Nancy Pelosi (D-Calif.) began negotiating weeks ago, also includes an additional $7.2 billion for community health centers over the next 2 years. NARAL Pro-Choice America denounced the deal because the health center funding would be subject to the Hyde Amendment, a common legislative provision that says federal money can be used for abortions only when a pregnancy is the result of rape, incest, or to save the life of the mother.

In a letter to Democratic colleagues, Rep. Pelosi said the funding would occur “under the same terms that Members have previously supported and voted on almost every year since 1979.” In a statement, the National Association of Community Health Centers said the proposal “represents no change in current policy for Health Centers, and would not change anything about how Health Centers operate today.”

The “working summary” of the House plan says the package also includes other health measures – known as extenders – that Congress has renewed each year during the SGR debate. The list includes funding for therapy services, ambulance services, and rural hospitals, as well as for continuing a program that allows low-income people to keep their Medicaid coverage as they transition into employment and earn more money. The deal also would permanently extend the Qualifying Individual, or QI, program, which helps low-income seniors pay their Medicare premiums.

Q. What is the plan for CHIP?

The House plan would add 2 years of funding for CHIP, a federal-state program that provides insurance for low-income children whose families earned too much money to qualify for Medicaid. While the health law continues CHIP authorization through 2019, funding for the program has not been extended beyond the end of September.

The length of the proposed extension could cause strains with Senate Democrats beyond those on the Finance panel who have raised objections to the House package. Last month, the Senate Democratic caucus signed on to legislation from Sen. Sherrod Brown (D-Ohio) calling for a 4-year extension of the current CHIP program.

Q: How would Congress pay for all of that?

It might not. That would be a major departure from the GOP’s mantra that all legislation must be financed. Tired of the yearly SGR battle, veteran members in both chambers may be willing to repeal the SGR on the basis that it’s a budget gimmick – the cuts are never made – and therefore financing is unnecessary. But that strategy could run into stiff opposition from Republican lawmakers and some Democrats

Most lawmakers are expected to feel the need to find financing for the Medicare extenders, the CHIP extension, and any increase in physician payments over the current pay schedule. Those items would account for about $70 billion of financing in an approximately $200 billion package.

Conservative groups are urging Republicans to fully finance any SGR repeal. “Americans didn’t hand Republicans a historic House majority to engage in more deficit spending and budget gimmickry,” Dan Holler, communications director of Heritage Action for America, said earlier this month.

Q. Will seniors and Medicare providers have to help pay for the plan?

Starting in 2018, wealthier Medicare beneficiaries (individuals with incomes between $133,500 and $214,000, with thresholds likely higher for couples) would pay more for their Medicare coverage, a provision impacting just 2% of beneficiaries, according to the summary.

Starting in 2020, “first-dollar” supplemental Medicare insurance known as “Medigap” would not be able to cover the Part B deductible for new beneficiaries, which is currently $147 per year but has increased in past years.

But the effect of that change may be mitigated, according to one analysis.

“Because Medigap policies would no longer pay the Part B deductible, Medigap premiums for the affected policies would go down. Most affected beneficiaries would come out ahead – the drop in their Medigap premiums would exceed the increase in their cost sharing for health services,” according to an analysis from the Center on Budget and Policy Priorities, a left-leaning think tank. “Some others would come out behind. In both cases, the effect would be small – generally no more than $100 a year.”

Experts contend that the “first-dollar” plans, which cover nearly all deductibles and copayments, keep beneficiaries from being judicious when making medical decisions. According to lobbyists and aides, an earlier version of the doc fix legislation that negotiators considered would have prohibited first-dollar plans from covering the first $250 in costs for new beneficiaries.

Postacute providers, such as long-term care and inpatient rehabilitation hospitals, skilled nursing facilities, and home health and hospice organizations, would help finance the repeal, receiving base pay increases of 1% in 2018, about half of what was previously expected.

Other changes include phasing in a one-time 3.2 percentage-point boost in the base payment rate for hospitals currently scheduled to take effect in fiscal 2018. The number of years of the phase-in isn’t specified in the bill summary.

Scheduled reductions in Medicaid “disproportionate share” payments to hospitals that care for large numbers of people who are uninsured or covered by Medicaid would be delayed by 1 year to fiscal 2018 but extended for an additional year to fiscal 2025.

Q. How quickly could Congress act?

Legislation to repeal the SGR is expected to move in the House this week. The House is scheduled to begin a 2-week recess March 27.

Senate Democrats and Republicans may want to offer amendments to the emerging House package, which could mean that the chamber does not resolve the SGR issue before the Senate’s 2-week break, which is scheduled to begin starting March 30.

If the SGR issue can’t be resolved by March 31, Congress could pass a temporary patch as negotiations continue or ask the Centers for Medicare & Medicaid Services, which oversees Medicare, to hold the claims in order to avoid physicians seeing their payments cut 21%.

This article is adapted from content created by and first published by Kaiser Health News (KHN), a nonprofit national health policy news service.

FROM KAISER HEALTH NEWS

SGR repeal bill reintroduced; payment mechanism not addressed

A bill to repeal the Medicare Sustainable Growth Rate formula was reintroduced into the House and Senate March 19.

H.R. 1470, the SGR Repeal and Medicare Provider Payment Modernization Act, is described as “nearly identical” to the bicameral, bipartisan bill that was passed in the House in April 2014, with a spokesman for the House Ways & Means Committee describing the changes as technical in nature.

The bill’s introduction comes as the latest so-called “doc fix” patch set to expire on March 31, with a physician payment cut of 21% set to go into effect on April 1. Congress previously has passed 17 patches.

In addition to repealing the SGR, the bill includes a 0.5% pay increase per year for the next 5 years; consolidates existing quality programs into a single value-based performance program; incentivizes physicians to use alternate payment models that focus on care coordination and prevention to improve quality and reduce costs; and pushes more transparency of Medicare data for both patients and providers to help them improve care.

It does not address any how to pay for SGR repeal, nor does it include any language to extend funding for the Children’s Health Insurance Program, which expires in 2015.

Dr. David Fleming, president of the American College of Physicians, said in a statement that the bill “achieves ACP’s top priorities for physician payment reform,” and “strongly urges” its passage before the current patch expires.

A March 16 letter, signed by more than 750 organizations, including national and state medical societies, was sent to House Speaker John Boehner (R-Ohio), calling for passage of last year’s SGR repeal.

Rep. Michael C. Burgess (R-Texas) cosponsored the bill in the House with Republican and Democratic leadership in the Ways and Means and Energy and Commerce Committees and the chairmen and ranking members of their health subcommittees. The Senate version of the bill was introduce by Finance Committee Chairman Orrin Hatch (R-Utah).

A bill to repeal the Medicare Sustainable Growth Rate formula was reintroduced into the House and Senate March 19.

H.R. 1470, the SGR Repeal and Medicare Provider Payment Modernization Act, is described as “nearly identical” to the bicameral, bipartisan bill that was passed in the House in April 2014, with a spokesman for the House Ways & Means Committee describing the changes as technical in nature.

The bill’s introduction comes as the latest so-called “doc fix” patch set to expire on March 31, with a physician payment cut of 21% set to go into effect on April 1. Congress previously has passed 17 patches.

In addition to repealing the SGR, the bill includes a 0.5% pay increase per year for the next 5 years; consolidates existing quality programs into a single value-based performance program; incentivizes physicians to use alternate payment models that focus on care coordination and prevention to improve quality and reduce costs; and pushes more transparency of Medicare data for both patients and providers to help them improve care.

It does not address any how to pay for SGR repeal, nor does it include any language to extend funding for the Children’s Health Insurance Program, which expires in 2015.

Dr. David Fleming, president of the American College of Physicians, said in a statement that the bill “achieves ACP’s top priorities for physician payment reform,” and “strongly urges” its passage before the current patch expires.

A March 16 letter, signed by more than 750 organizations, including national and state medical societies, was sent to House Speaker John Boehner (R-Ohio), calling for passage of last year’s SGR repeal.

Rep. Michael C. Burgess (R-Texas) cosponsored the bill in the House with Republican and Democratic leadership in the Ways and Means and Energy and Commerce Committees and the chairmen and ranking members of their health subcommittees. The Senate version of the bill was introduce by Finance Committee Chairman Orrin Hatch (R-Utah).

A bill to repeal the Medicare Sustainable Growth Rate formula was reintroduced into the House and Senate March 19.

H.R. 1470, the SGR Repeal and Medicare Provider Payment Modernization Act, is described as “nearly identical” to the bicameral, bipartisan bill that was passed in the House in April 2014, with a spokesman for the House Ways & Means Committee describing the changes as technical in nature.

The bill’s introduction comes as the latest so-called “doc fix” patch set to expire on March 31, with a physician payment cut of 21% set to go into effect on April 1. Congress previously has passed 17 patches.

In addition to repealing the SGR, the bill includes a 0.5% pay increase per year for the next 5 years; consolidates existing quality programs into a single value-based performance program; incentivizes physicians to use alternate payment models that focus on care coordination and prevention to improve quality and reduce costs; and pushes more transparency of Medicare data for both patients and providers to help them improve care.

It does not address any how to pay for SGR repeal, nor does it include any language to extend funding for the Children’s Health Insurance Program, which expires in 2015.

Dr. David Fleming, president of the American College of Physicians, said in a statement that the bill “achieves ACP’s top priorities for physician payment reform,” and “strongly urges” its passage before the current patch expires.

A March 16 letter, signed by more than 750 organizations, including national and state medical societies, was sent to House Speaker John Boehner (R-Ohio), calling for passage of last year’s SGR repeal.

Rep. Michael C. Burgess (R-Texas) cosponsored the bill in the House with Republican and Democratic leadership in the Ways and Means and Energy and Commerce Committees and the chairmen and ranking members of their health subcommittees. The Senate version of the bill was introduce by Finance Committee Chairman Orrin Hatch (R-Utah).

Feds recover $3 billion in health fraud in 2014

The federal government recouped $3 billion in health fraud settlements and judgments in fiscal 2014, down from $4 billion in 2013, according to a March 19 announcement by the Department of Health and Human Services.

The Health Care Fraud and Abuse Control (HCFAC) Program has recovered nearly $30 billion since it began in 1997.

The Department of Justice (DOJ) in 2014 also opened 924 new criminal health care fraud investigations, and federal prosecutors filed criminal charges in 496 cases involving 805 defendants, HHS said in its report. A total of 734 defendants were convicted of health care fraud–related crimes during last year.

Meanwhile, investigations by the HHS Office of Inspector General resulted in 867 criminal actions against individuals or entities that engaged in crimes related to Medicare and Medicaid and 529 civil actions, which include false claims and unjust-enrichment lawsuits. HHS excluded 4,017 health providers from participation in Medicare and Medicaid and other federal health care programs as a result of program violations, criminal actions, and licensure revocations.

The government touted the False Claims Act (FCA) as a leading tool in the fight against health fraud and recoupment of funding.

In 2014, the DOJ civil division, along with state officials, obtained $2.3 billion in settlements and judgments from FCA cases involving fraud and false claims. The department also opened 782 new civil health care fraud investigations under the FCA and had 957 civil health care fraud matters pending at the end of 2014.

For every dollar spent on health care–related fraud and abuse investigations in the last 3 years, HHS officials said they recovered $7.70. This is about $2 higher than the average return on investment when HCFAC was created in 1997.

However, the report noted that there were fewer resources for the federal government to fight health fraud and abuses because of sequestration of mandatory funding in 2014. A total of $32 million was sequestered from the HCFAC program in fiscal 2014, for a combined total of $62 million in the past 2 years.

[email protected]

On Twitter @legal_med

The federal government recouped $3 billion in health fraud settlements and judgments in fiscal 2014, down from $4 billion in 2013, according to a March 19 announcement by the Department of Health and Human Services.

The Health Care Fraud and Abuse Control (HCFAC) Program has recovered nearly $30 billion since it began in 1997.

The Department of Justice (DOJ) in 2014 also opened 924 new criminal health care fraud investigations, and federal prosecutors filed criminal charges in 496 cases involving 805 defendants, HHS said in its report. A total of 734 defendants were convicted of health care fraud–related crimes during last year.

Meanwhile, investigations by the HHS Office of Inspector General resulted in 867 criminal actions against individuals or entities that engaged in crimes related to Medicare and Medicaid and 529 civil actions, which include false claims and unjust-enrichment lawsuits. HHS excluded 4,017 health providers from participation in Medicare and Medicaid and other federal health care programs as a result of program violations, criminal actions, and licensure revocations.

The government touted the False Claims Act (FCA) as a leading tool in the fight against health fraud and recoupment of funding.

In 2014, the DOJ civil division, along with state officials, obtained $2.3 billion in settlements and judgments from FCA cases involving fraud and false claims. The department also opened 782 new civil health care fraud investigations under the FCA and had 957 civil health care fraud matters pending at the end of 2014.

For every dollar spent on health care–related fraud and abuse investigations in the last 3 years, HHS officials said they recovered $7.70. This is about $2 higher than the average return on investment when HCFAC was created in 1997.

However, the report noted that there were fewer resources for the federal government to fight health fraud and abuses because of sequestration of mandatory funding in 2014. A total of $32 million was sequestered from the HCFAC program in fiscal 2014, for a combined total of $62 million in the past 2 years.

[email protected]

On Twitter @legal_med

The federal government recouped $3 billion in health fraud settlements and judgments in fiscal 2014, down from $4 billion in 2013, according to a March 19 announcement by the Department of Health and Human Services.

The Health Care Fraud and Abuse Control (HCFAC) Program has recovered nearly $30 billion since it began in 1997.

The Department of Justice (DOJ) in 2014 also opened 924 new criminal health care fraud investigations, and federal prosecutors filed criminal charges in 496 cases involving 805 defendants, HHS said in its report. A total of 734 defendants were convicted of health care fraud–related crimes during last year.

Meanwhile, investigations by the HHS Office of Inspector General resulted in 867 criminal actions against individuals or entities that engaged in crimes related to Medicare and Medicaid and 529 civil actions, which include false claims and unjust-enrichment lawsuits. HHS excluded 4,017 health providers from participation in Medicare and Medicaid and other federal health care programs as a result of program violations, criminal actions, and licensure revocations.

The government touted the False Claims Act (FCA) as a leading tool in the fight against health fraud and recoupment of funding.

In 2014, the DOJ civil division, along with state officials, obtained $2.3 billion in settlements and judgments from FCA cases involving fraud and false claims. The department also opened 782 new civil health care fraud investigations under the FCA and had 957 civil health care fraud matters pending at the end of 2014.

For every dollar spent on health care–related fraud and abuse investigations in the last 3 years, HHS officials said they recovered $7.70. This is about $2 higher than the average return on investment when HCFAC was created in 1997.

However, the report noted that there were fewer resources for the federal government to fight health fraud and abuses because of sequestration of mandatory funding in 2014. A total of $32 million was sequestered from the HCFAC program in fiscal 2014, for a combined total of $62 million in the past 2 years.

[email protected]

On Twitter @legal_med

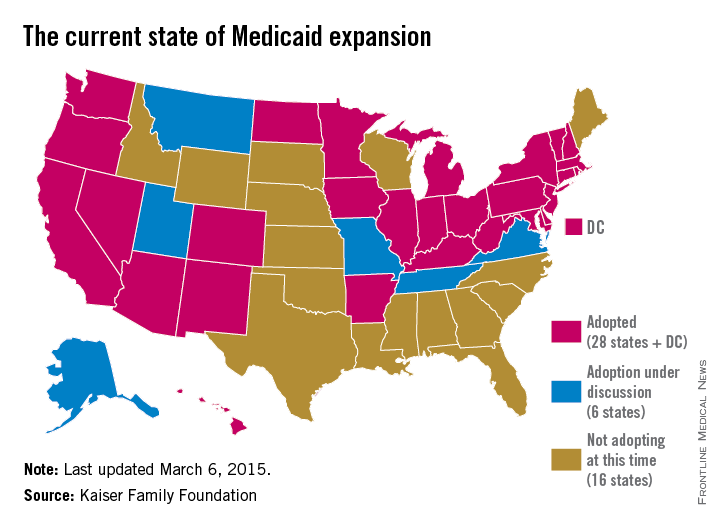

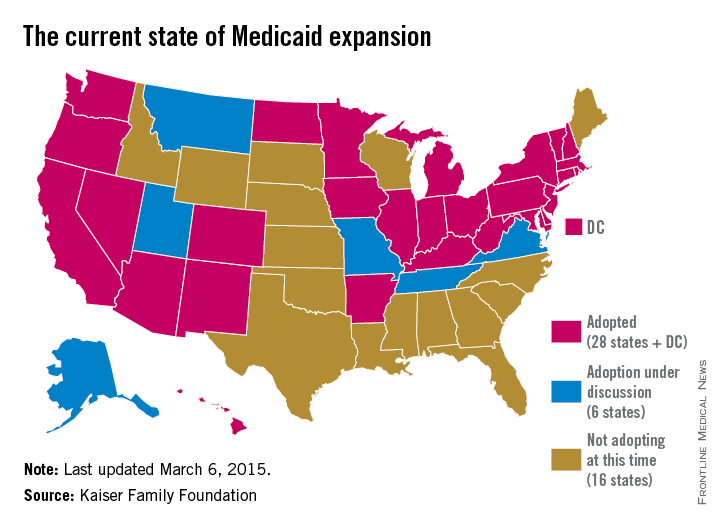

States expand Medicaid through unique approaches

State government officials are getting creative in their efforts to expand Medicaid under the Affordable Care Act.

After the 2014 election, some states sought to expand their Medicaid programs “with some kind of special arrangement in an attempt to fine tune it to their specific state needs and political objectives,” James F. Blumstein, a constitutional and health law professor at Vanderbilt University in Nashville, said in an interview. The Republican-controlled Congress is a key reason why, he said. “The Obama [administration] realized if they didn’t make some substantial concessions [in the form of Medicaid waivers] to various local political needs and goals, that those states would not have expanded.”

While at least 12 states chose to expand Medicaid in the 2 years immediately after ACA enactment, others held back.

Debate over the ideal expansion plan – and refusal by some states to expand – is largely based on political views, budget concerns, and resistance to federal programs, Robin Rudowitz, associate director for the Kaiser Commission on Medicaid and the Uninsured said during a webinar.

“Some of the states that have opposed have certainly [refused to expand] on ideological grounds,” she said during the presentation. “Some states have cited concerns about cost. Some states are concerned about the federal government’s commitment to maintain the high match.”

So far, six states have earned a federal waiver to create their own brand of Medicaid reform; New Hampshire is the latest. Gov. Maggie Hassan (D) announced on March 5 that the Centers for Medicare & Medicaid Services approved her state’s waiver to expand the New Hampshire Health Protection Program. New Hampshire’s plan implements mandatory qualified health plan (QHP) premium assistance for new patients to purchase coverage. QHPs refer to health plans that are certified by the federal health insurance marketplace, provide essential health benefits, follow established limits on cost-sharing, and meet other federal requirements. New Hampshire’s plan also includes the authority to waive retroactive coverage, a provision that has not been approved in other states.

Expansion waivers approved in Arkansas and Iowa follow similar QHP approaches. Arkansas’s expansion program, approved by CMS through December 2016, allows the state to implement Medicaid expansion through a premium assistance model that uses federal Medicaid funds to purchase coverage through QHPs. Iowa is using the same premium assistance model and also received approval for another option that provides Medicaid coverage through a medical home model for patients with incomes up to 100% of the federal poverty line (FPL) and for medically frail patients up to 138% of the FPL. Meanwhile, Michigan’s alternative program, called Healthy Michigan allows patients to participate in health savings accounts that can be used for required cost-sharing payments. Pennsylvania is transitioning from an approved alternative model to a traditional expansion approach. Former Pennsylvania Gov. Tom Corbett’s (R) Healthy PA program was undone when Gov. Tom Wolf (D) took office. Gov. Wolf plans to move the state to a traditional expansion by Sept. 1.

Indiana’s expansion approach is perhaps the most unique. Similar to other waivers, the state’s plan includes premium assistance and monthly contributions by patients to a personal health savings account. However, unlike other states, Indiana can prevent beneficiaries from reenrolling in coverage for 6 months if they are disenrolled for nonpayment of premiums. The plan also provides a less-generous benefit package to newly eligible beneficiaries at or below the federal poverty level who do not pay premiums. To receive the more generous benefit package, even patients with very little or no income must pay premiums of $1 per month, and medically frail patients above the federal poverty level who do not pay premiums must pay state plan copayments.

Indiana’s expansion encourages personal responsibility by patients, Gov. Mike Pence(R) said in a statement. “We have worked hard to ensure that low-income Hoosiers have access to a health care plan that empowers them to take charge of their health and prepares them to move to private insurance as they improve their lives.”

But constitutional and health law professor David Orentlicher of Indiana University, Indianapolis, said that he believes the expansion may backfire.

“When patients are expected to pay more for their health care, whether through increases in premiums, deductibles, or copayments, they are less able to afford health care,” Mr. Orentlicher said in an interview. “For low-income persons, that can mean not filling prescriptions or seeing a physician when sick. As a result, the health of poor patients may suffer.”

Indiana’s expansion could encourage more states to adopt similar approaches. “It’s important to understand what CMS has approved and what they have said they would deny because these actions set the guideposts and parameters for other states that are considering waiver approaches to implement the expansion,” Ms. Rudowitz said during the webinar.

Traditional Medicaid expansion bills are currently under consideration in Florida, Montana, and Alaska. In other states, alternative Medicaid expansions has been voted down. The Utah House on March 5 killed Gov. Gary Herbert’s (R) Healthy Utah plan in a 16-56 vote. The proposal would have covered residents earning up to 138% of the poverty line. Instead, the Utah House on Mar. 6 passed Utah Cares, an expansion plan that would use traditional Medicaid and the state’s Primary Care Network to provide limited health care to Utahans earning up to 100% of the poverty line. That bill, sponsored by House Majority Leader Jim Dunnigan (R), has been sent on to the state senate.

And in February, a Senate panel defeated Tennessee Gov. Bill Haslam’s alternative plan to expand Medicaid under the ACA. Tennessee was widely seen as the next Republican state that could expand Medicaid, with Gov. Haslam negotiating for months with the federal government for a plan that included conservative policy elements. The governor’s Insure Tennessee plan had included two coverage tracks for patients making less than 138% of the poverty level. One plan included defined contributions for beneficiaries with employer-sponsored plans to help them pay for premiums and copays. The other option would have created health savings accounts for consumers who can earn credits to pay for health care costs by engaging in healthy behaviors.

A wild card in the future of Medicaid expansions is the case of King v. Burwell before the Supreme Court, Mr. Blumstein said. Justices are weighing whether patients in states that use the federal exchange can receive federal tax credits to buy insurance or whether the credits apply only in state-run exchanges The high court heard oral arguments in the case March 4. Some states, such as North Carolina, will not consider expanding until after the court rules.

If the court rules for the plaintiffs, “there’s going to have to be a reassessment,” Mr. Blumstein said. “The Legislature and various states will have to figure out how they want to handle Medicaid expansion and whether they want to get into the business of handling an exchange. It adds a level of complexity.”

On Twitter @legal_med

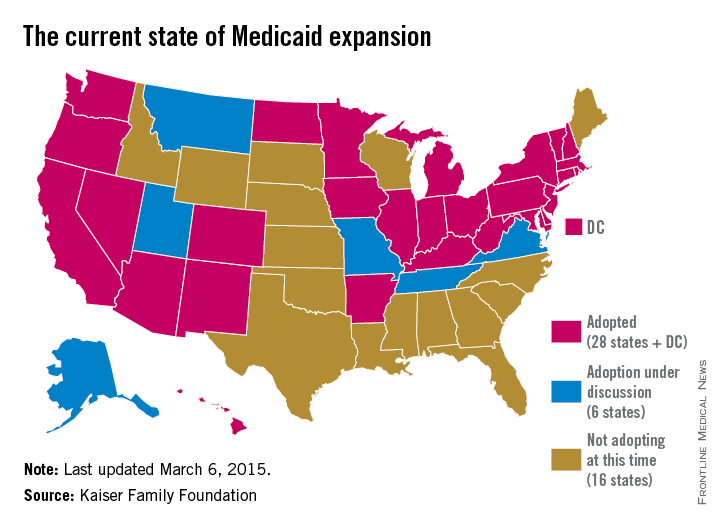

State government officials are getting creative in their efforts to expand Medicaid under the Affordable Care Act.

After the 2014 election, some states sought to expand their Medicaid programs “with some kind of special arrangement in an attempt to fine tune it to their specific state needs and political objectives,” James F. Blumstein, a constitutional and health law professor at Vanderbilt University in Nashville, said in an interview. The Republican-controlled Congress is a key reason why, he said. “The Obama [administration] realized if they didn’t make some substantial concessions [in the form of Medicaid waivers] to various local political needs and goals, that those states would not have expanded.”

While at least 12 states chose to expand Medicaid in the 2 years immediately after ACA enactment, others held back.

Debate over the ideal expansion plan – and refusal by some states to expand – is largely based on political views, budget concerns, and resistance to federal programs, Robin Rudowitz, associate director for the Kaiser Commission on Medicaid and the Uninsured said during a webinar.

“Some of the states that have opposed have certainly [refused to expand] on ideological grounds,” she said during the presentation. “Some states have cited concerns about cost. Some states are concerned about the federal government’s commitment to maintain the high match.”

So far, six states have earned a federal waiver to create their own brand of Medicaid reform; New Hampshire is the latest. Gov. Maggie Hassan (D) announced on March 5 that the Centers for Medicare & Medicaid Services approved her state’s waiver to expand the New Hampshire Health Protection Program. New Hampshire’s plan implements mandatory qualified health plan (QHP) premium assistance for new patients to purchase coverage. QHPs refer to health plans that are certified by the federal health insurance marketplace, provide essential health benefits, follow established limits on cost-sharing, and meet other federal requirements. New Hampshire’s plan also includes the authority to waive retroactive coverage, a provision that has not been approved in other states.

Expansion waivers approved in Arkansas and Iowa follow similar QHP approaches. Arkansas’s expansion program, approved by CMS through December 2016, allows the state to implement Medicaid expansion through a premium assistance model that uses federal Medicaid funds to purchase coverage through QHPs. Iowa is using the same premium assistance model and also received approval for another option that provides Medicaid coverage through a medical home model for patients with incomes up to 100% of the federal poverty line (FPL) and for medically frail patients up to 138% of the FPL. Meanwhile, Michigan’s alternative program, called Healthy Michigan allows patients to participate in health savings accounts that can be used for required cost-sharing payments. Pennsylvania is transitioning from an approved alternative model to a traditional expansion approach. Former Pennsylvania Gov. Tom Corbett’s (R) Healthy PA program was undone when Gov. Tom Wolf (D) took office. Gov. Wolf plans to move the state to a traditional expansion by Sept. 1.

Indiana’s expansion approach is perhaps the most unique. Similar to other waivers, the state’s plan includes premium assistance and monthly contributions by patients to a personal health savings account. However, unlike other states, Indiana can prevent beneficiaries from reenrolling in coverage for 6 months if they are disenrolled for nonpayment of premiums. The plan also provides a less-generous benefit package to newly eligible beneficiaries at or below the federal poverty level who do not pay premiums. To receive the more generous benefit package, even patients with very little or no income must pay premiums of $1 per month, and medically frail patients above the federal poverty level who do not pay premiums must pay state plan copayments.

Indiana’s expansion encourages personal responsibility by patients, Gov. Mike Pence(R) said in a statement. “We have worked hard to ensure that low-income Hoosiers have access to a health care plan that empowers them to take charge of their health and prepares them to move to private insurance as they improve their lives.”

But constitutional and health law professor David Orentlicher of Indiana University, Indianapolis, said that he believes the expansion may backfire.

“When patients are expected to pay more for their health care, whether through increases in premiums, deductibles, or copayments, they are less able to afford health care,” Mr. Orentlicher said in an interview. “For low-income persons, that can mean not filling prescriptions or seeing a physician when sick. As a result, the health of poor patients may suffer.”

Indiana’s expansion could encourage more states to adopt similar approaches. “It’s important to understand what CMS has approved and what they have said they would deny because these actions set the guideposts and parameters for other states that are considering waiver approaches to implement the expansion,” Ms. Rudowitz said during the webinar.

Traditional Medicaid expansion bills are currently under consideration in Florida, Montana, and Alaska. In other states, alternative Medicaid expansions has been voted down. The Utah House on March 5 killed Gov. Gary Herbert’s (R) Healthy Utah plan in a 16-56 vote. The proposal would have covered residents earning up to 138% of the poverty line. Instead, the Utah House on Mar. 6 passed Utah Cares, an expansion plan that would use traditional Medicaid and the state’s Primary Care Network to provide limited health care to Utahans earning up to 100% of the poverty line. That bill, sponsored by House Majority Leader Jim Dunnigan (R), has been sent on to the state senate.

And in February, a Senate panel defeated Tennessee Gov. Bill Haslam’s alternative plan to expand Medicaid under the ACA. Tennessee was widely seen as the next Republican state that could expand Medicaid, with Gov. Haslam negotiating for months with the federal government for a plan that included conservative policy elements. The governor’s Insure Tennessee plan had included two coverage tracks for patients making less than 138% of the poverty level. One plan included defined contributions for beneficiaries with employer-sponsored plans to help them pay for premiums and copays. The other option would have created health savings accounts for consumers who can earn credits to pay for health care costs by engaging in healthy behaviors.

A wild card in the future of Medicaid expansions is the case of King v. Burwell before the Supreme Court, Mr. Blumstein said. Justices are weighing whether patients in states that use the federal exchange can receive federal tax credits to buy insurance or whether the credits apply only in state-run exchanges The high court heard oral arguments in the case March 4. Some states, such as North Carolina, will not consider expanding until after the court rules.

If the court rules for the plaintiffs, “there’s going to have to be a reassessment,” Mr. Blumstein said. “The Legislature and various states will have to figure out how they want to handle Medicaid expansion and whether they want to get into the business of handling an exchange. It adds a level of complexity.”

On Twitter @legal_med

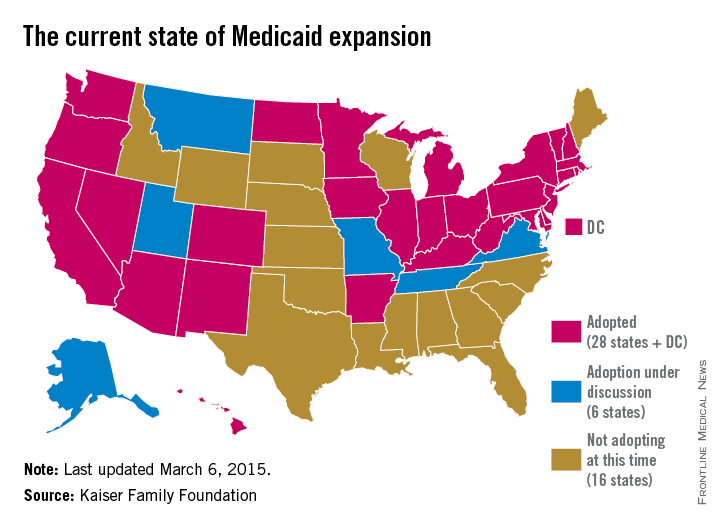

State government officials are getting creative in their efforts to expand Medicaid under the Affordable Care Act.

After the 2014 election, some states sought to expand their Medicaid programs “with some kind of special arrangement in an attempt to fine tune it to their specific state needs and political objectives,” James F. Blumstein, a constitutional and health law professor at Vanderbilt University in Nashville, said in an interview. The Republican-controlled Congress is a key reason why, he said. “The Obama [administration] realized if they didn’t make some substantial concessions [in the form of Medicaid waivers] to various local political needs and goals, that those states would not have expanded.”

While at least 12 states chose to expand Medicaid in the 2 years immediately after ACA enactment, others held back.

Debate over the ideal expansion plan – and refusal by some states to expand – is largely based on political views, budget concerns, and resistance to federal programs, Robin Rudowitz, associate director for the Kaiser Commission on Medicaid and the Uninsured said during a webinar.

“Some of the states that have opposed have certainly [refused to expand] on ideological grounds,” she said during the presentation. “Some states have cited concerns about cost. Some states are concerned about the federal government’s commitment to maintain the high match.”

So far, six states have earned a federal waiver to create their own brand of Medicaid reform; New Hampshire is the latest. Gov. Maggie Hassan (D) announced on March 5 that the Centers for Medicare & Medicaid Services approved her state’s waiver to expand the New Hampshire Health Protection Program. New Hampshire’s plan implements mandatory qualified health plan (QHP) premium assistance for new patients to purchase coverage. QHPs refer to health plans that are certified by the federal health insurance marketplace, provide essential health benefits, follow established limits on cost-sharing, and meet other federal requirements. New Hampshire’s plan also includes the authority to waive retroactive coverage, a provision that has not been approved in other states.

Expansion waivers approved in Arkansas and Iowa follow similar QHP approaches. Arkansas’s expansion program, approved by CMS through December 2016, allows the state to implement Medicaid expansion through a premium assistance model that uses federal Medicaid funds to purchase coverage through QHPs. Iowa is using the same premium assistance model and also received approval for another option that provides Medicaid coverage through a medical home model for patients with incomes up to 100% of the federal poverty line (FPL) and for medically frail patients up to 138% of the FPL. Meanwhile, Michigan’s alternative program, called Healthy Michigan allows patients to participate in health savings accounts that can be used for required cost-sharing payments. Pennsylvania is transitioning from an approved alternative model to a traditional expansion approach. Former Pennsylvania Gov. Tom Corbett’s (R) Healthy PA program was undone when Gov. Tom Wolf (D) took office. Gov. Wolf plans to move the state to a traditional expansion by Sept. 1.

Indiana’s expansion approach is perhaps the most unique. Similar to other waivers, the state’s plan includes premium assistance and monthly contributions by patients to a personal health savings account. However, unlike other states, Indiana can prevent beneficiaries from reenrolling in coverage for 6 months if they are disenrolled for nonpayment of premiums. The plan also provides a less-generous benefit package to newly eligible beneficiaries at or below the federal poverty level who do not pay premiums. To receive the more generous benefit package, even patients with very little or no income must pay premiums of $1 per month, and medically frail patients above the federal poverty level who do not pay premiums must pay state plan copayments.

Indiana’s expansion encourages personal responsibility by patients, Gov. Mike Pence(R) said in a statement. “We have worked hard to ensure that low-income Hoosiers have access to a health care plan that empowers them to take charge of their health and prepares them to move to private insurance as they improve their lives.”

But constitutional and health law professor David Orentlicher of Indiana University, Indianapolis, said that he believes the expansion may backfire.

“When patients are expected to pay more for their health care, whether through increases in premiums, deductibles, or copayments, they are less able to afford health care,” Mr. Orentlicher said in an interview. “For low-income persons, that can mean not filling prescriptions or seeing a physician when sick. As a result, the health of poor patients may suffer.”

Indiana’s expansion could encourage more states to adopt similar approaches. “It’s important to understand what CMS has approved and what they have said they would deny because these actions set the guideposts and parameters for other states that are considering waiver approaches to implement the expansion,” Ms. Rudowitz said during the webinar.

Traditional Medicaid expansion bills are currently under consideration in Florida, Montana, and Alaska. In other states, alternative Medicaid expansions has been voted down. The Utah House on March 5 killed Gov. Gary Herbert’s (R) Healthy Utah plan in a 16-56 vote. The proposal would have covered residents earning up to 138% of the poverty line. Instead, the Utah House on Mar. 6 passed Utah Cares, an expansion plan that would use traditional Medicaid and the state’s Primary Care Network to provide limited health care to Utahans earning up to 100% of the poverty line. That bill, sponsored by House Majority Leader Jim Dunnigan (R), has been sent on to the state senate.

And in February, a Senate panel defeated Tennessee Gov. Bill Haslam’s alternative plan to expand Medicaid under the ACA. Tennessee was widely seen as the next Republican state that could expand Medicaid, with Gov. Haslam negotiating for months with the federal government for a plan that included conservative policy elements. The governor’s Insure Tennessee plan had included two coverage tracks for patients making less than 138% of the poverty level. One plan included defined contributions for beneficiaries with employer-sponsored plans to help them pay for premiums and copays. The other option would have created health savings accounts for consumers who can earn credits to pay for health care costs by engaging in healthy behaviors.

A wild card in the future of Medicaid expansions is the case of King v. Burwell before the Supreme Court, Mr. Blumstein said. Justices are weighing whether patients in states that use the federal exchange can receive federal tax credits to buy insurance or whether the credits apply only in state-run exchanges The high court heard oral arguments in the case March 4. Some states, such as North Carolina, will not consider expanding until after the court rules.

If the court rules for the plaintiffs, “there’s going to have to be a reassessment,” Mr. Blumstein said. “The Legislature and various states will have to figure out how they want to handle Medicaid expansion and whether they want to get into the business of handling an exchange. It adds a level of complexity.”

On Twitter @legal_med

HHS report: Record number of patients covered under ACA