User login

New State of Hospital Medicine Report Better Than Ever

For the last six months or so, not a week has gone by in which someone hasn’t asked me when the new SHM survey report will be released. The anticipation level is high, and rightly so. This will be the first new look at hospitalist practice characteristics in two years, and boy, have they been an eventful two years!

On behalf of SHM and the SHM Practice Analysis Committee (PAC), I’m thrilled to introduce SHM’s 2014 State of Hospital Medicine Report (SOHM) and the resumption of the monthly “Survey Insights” article written by PAC members. Here are a few key things you should know about the new SOHM report:

- The content is more wide-ranging than ever. SHM leaves the collection of hospitalist compensation and productivity data to the Medical Group Management Association—SHM licenses compensation and production data from MGMA and has incorporated it into the new SOHM report—but covers just about every other aspect of hospitalist group structure and operations imaginable. In addition to traditional questions regarding scope of services, staffing and scheduling models, and financial support, this year’s report includes new information about hospitalist back-up staffing plans, how academic hospitalist time is allocated, accountable care organization participation, electronic health record use, and the presence of other hospital-focused practice specialties.

—Leslie Flores, MHA

- The number of survey participants is larger than ever. This year SHM received eligible responses from 499 different hospitalist groups, an increase of about 7% over 2012. Respondents continue to represent all employer/ownership models and geographic regions, in roughly similar proportions to previous surveys. And we continue to get good participation by both academic and nonacademic hospital medicine groups. This means we have more—and more reliable—information than ever for different subgroups of hospitalists.

- The report is more accessible and easier to read than it has ever been. This year SHM has produced the SOHM report in full color, with professional layout and graphics; it’s a pleasure to read compared to previous versions. And, for the first time, SHM is making available a web-based version of the full report, so that you can refer to it anywhere and at any time.

As a consultant, I refer to my copy of the SOHM report almost every day and find it indispensable as a source of context when offering advice to my clients. And I’m always interested to see the diverse ways in which hospitalist groups across the country use survey information to make decisions about how to run their practices and to explain their environments to hospital leaders and other stakeholders.

I encourage you to obtain a copy of the SOHM report and review it carefully; you’ll almost certainly find more than one interesting and useful tidbit of information. Use the report to assess how your practice compares to your peers, but always keep in mind that surveys don’t tell you what should be—they only tell you what currently is. New best practices not reflected in survey data are emerging all the time, and the ways others do things won’t always be right for your group’s unique situation and needs. Whether you are partners or employees, you and your colleagues “own” the success of your practice and are the best judges of what is right for you.

Leslie Flores is a PAC member and partner of Nelson Flores Hospital Medicine Consultants.

For the last six months or so, not a week has gone by in which someone hasn’t asked me when the new SHM survey report will be released. The anticipation level is high, and rightly so. This will be the first new look at hospitalist practice characteristics in two years, and boy, have they been an eventful two years!

On behalf of SHM and the SHM Practice Analysis Committee (PAC), I’m thrilled to introduce SHM’s 2014 State of Hospital Medicine Report (SOHM) and the resumption of the monthly “Survey Insights” article written by PAC members. Here are a few key things you should know about the new SOHM report:

- The content is more wide-ranging than ever. SHM leaves the collection of hospitalist compensation and productivity data to the Medical Group Management Association—SHM licenses compensation and production data from MGMA and has incorporated it into the new SOHM report—but covers just about every other aspect of hospitalist group structure and operations imaginable. In addition to traditional questions regarding scope of services, staffing and scheduling models, and financial support, this year’s report includes new information about hospitalist back-up staffing plans, how academic hospitalist time is allocated, accountable care organization participation, electronic health record use, and the presence of other hospital-focused practice specialties.

—Leslie Flores, MHA

- The number of survey participants is larger than ever. This year SHM received eligible responses from 499 different hospitalist groups, an increase of about 7% over 2012. Respondents continue to represent all employer/ownership models and geographic regions, in roughly similar proportions to previous surveys. And we continue to get good participation by both academic and nonacademic hospital medicine groups. This means we have more—and more reliable—information than ever for different subgroups of hospitalists.

- The report is more accessible and easier to read than it has ever been. This year SHM has produced the SOHM report in full color, with professional layout and graphics; it’s a pleasure to read compared to previous versions. And, for the first time, SHM is making available a web-based version of the full report, so that you can refer to it anywhere and at any time.

As a consultant, I refer to my copy of the SOHM report almost every day and find it indispensable as a source of context when offering advice to my clients. And I’m always interested to see the diverse ways in which hospitalist groups across the country use survey information to make decisions about how to run their practices and to explain their environments to hospital leaders and other stakeholders.

I encourage you to obtain a copy of the SOHM report and review it carefully; you’ll almost certainly find more than one interesting and useful tidbit of information. Use the report to assess how your practice compares to your peers, but always keep in mind that surveys don’t tell you what should be—they only tell you what currently is. New best practices not reflected in survey data are emerging all the time, and the ways others do things won’t always be right for your group’s unique situation and needs. Whether you are partners or employees, you and your colleagues “own” the success of your practice and are the best judges of what is right for you.

Leslie Flores is a PAC member and partner of Nelson Flores Hospital Medicine Consultants.

For the last six months or so, not a week has gone by in which someone hasn’t asked me when the new SHM survey report will be released. The anticipation level is high, and rightly so. This will be the first new look at hospitalist practice characteristics in two years, and boy, have they been an eventful two years!

On behalf of SHM and the SHM Practice Analysis Committee (PAC), I’m thrilled to introduce SHM’s 2014 State of Hospital Medicine Report (SOHM) and the resumption of the monthly “Survey Insights” article written by PAC members. Here are a few key things you should know about the new SOHM report:

- The content is more wide-ranging than ever. SHM leaves the collection of hospitalist compensation and productivity data to the Medical Group Management Association—SHM licenses compensation and production data from MGMA and has incorporated it into the new SOHM report—but covers just about every other aspect of hospitalist group structure and operations imaginable. In addition to traditional questions regarding scope of services, staffing and scheduling models, and financial support, this year’s report includes new information about hospitalist back-up staffing plans, how academic hospitalist time is allocated, accountable care organization participation, electronic health record use, and the presence of other hospital-focused practice specialties.

—Leslie Flores, MHA

- The number of survey participants is larger than ever. This year SHM received eligible responses from 499 different hospitalist groups, an increase of about 7% over 2012. Respondents continue to represent all employer/ownership models and geographic regions, in roughly similar proportions to previous surveys. And we continue to get good participation by both academic and nonacademic hospital medicine groups. This means we have more—and more reliable—information than ever for different subgroups of hospitalists.

- The report is more accessible and easier to read than it has ever been. This year SHM has produced the SOHM report in full color, with professional layout and graphics; it’s a pleasure to read compared to previous versions. And, for the first time, SHM is making available a web-based version of the full report, so that you can refer to it anywhere and at any time.

As a consultant, I refer to my copy of the SOHM report almost every day and find it indispensable as a source of context when offering advice to my clients. And I’m always interested to see the diverse ways in which hospitalist groups across the country use survey information to make decisions about how to run their practices and to explain their environments to hospital leaders and other stakeholders.

I encourage you to obtain a copy of the SOHM report and review it carefully; you’ll almost certainly find more than one interesting and useful tidbit of information. Use the report to assess how your practice compares to your peers, but always keep in mind that surveys don’t tell you what should be—they only tell you what currently is. New best practices not reflected in survey data are emerging all the time, and the ways others do things won’t always be right for your group’s unique situation and needs. Whether you are partners or employees, you and your colleagues “own” the success of your practice and are the best judges of what is right for you.

Leslie Flores is a PAC member and partner of Nelson Flores Hospital Medicine Consultants.

Principles and Characteristics of an HMG

With the continuing growth of the specialty of hospital medicine, the capabilities and performance of hospital medicine groups (HMGs) varies significantly. There are few guidelines that HMGs can reference as tools to guide self‐improvement. To address this deficiency, the Society of Hospital Medicine (SHM) Board of Directors authorized a process to identify the key principles and characteristics of an effective HMG.

METHODS

Topic Development and Validation Prework

In providing direction to this effort, the SHM board felt that the principles and characteristics should be directed at both hospitals and hospitalists, addressing the full range of managerial, organizational, clinical, and quality activities necessary to achieve effectiveness. Furthermore, the board defined effectiveness as consisting of 2 components. First, the HMG must assure that the patients managed by hospitalists receive high‐quality care that is sensitive to their needs and preferences. Second, the HMG must understand that the central role of the hospitalist is to coordinate patient care and foster interdisciplinary communication across the care continuum to provide optimal patient outcomes.

The SHM board appointed an HMG Characteristics Workgroup consisting of individuals who have experience with a wide array of HMG models and who could offer expert opinions on the subject. The HMG Characteristics Workgroup felt it important to review the work of other organizations that develop and administer criteria, standards, and/or requirements for healthcare organizations. Examples cited were the American College of Surgeons[1]; The Joint Commission[2]; American Nurse Credentialing Center[3]; the National Committee for Quality Assurance[4]; the American Medical Group Association[5]; and the American Association of Critical‐Care Nurses.[6]

In March 2012 and April 2012, SHM staff reviewed the websites and published materials of these organizations. For each program, information was captured on the qualifications of applicants, history of the program, timing of administering the program, the nature of recognition granted, and the program's keys to success. The summary of these findings was shared with the workgroup.

Background research and the broad scope of characteristics to be addressed led to the workgroup's decision to develop the principles and characteristics using a consensus process, emphasizing expert opinion supplemented by feedback from a broad group of stakeholders.

Initial Draft

During April 2012 and May 2012, the HMG Characteristics Workgroup identified 3 domains for the key characteristics: (1) program structure and operations, (2) clinical care delivery, and (3) organizational performance improvement. Over the course of several meetings, the HMG Characteristics Workgroup developed an initial draft of 83 characteristics, grouped into 29 subgroups within the 3 domains.

From June 2012 to November 2012, this initial draft was reviewed by a broad cross section of the hospital medicine community including members of SHM's committees, a group of academic hospitalists, focus groups in 2 communities (Philadelphia and Boston), and the leaders of several regional and national hospitalist management companies. Quantitative and qualitative feedback was obtained.

In November 2012, the SHM Board of Directors held its annual leadership meeting, attended by approximately 25 national hospitalist thought leaders and chairpersons of SHM committees. At this meeting, a series of exercises were conducted in which these leaders of the hospital medicine movement, including the SHM board members, were each assigned individual characteristics and asked to review and edit them for clarity and appropriateness.

As a result of feedback at that meeting and subsequent discussion by the SHM board, the workgroup was asked to modify the characteristics in 3 ways. First, the list should be streamlined, reducing the number of characteristics. Second, the 3 domains should be eliminated, and a better organizing framework should be created. Third, additional context should be added to the list of characteristics.

Second Draft

During the period from November 2012 to December 2012, the HMG Characteristics Workgroup went through a 2‐step Delphi process to consolidate characteristics and/or eliminate characteristics that were redundant or unnecessary. In the first step, members of the workgroup rated each characteristic from 1 to 3. A rating of 1 meant not important; good quality, but not required for an effective HMG. A rating of 2 meant important; most effective HMGs will meet requirement. A rating of 3 meant highly important; mandatory for an effective HMG. In the second step, members of the workgroup received feedback on the scores for each characteristic and came to a consensus on which characteristics should be eliminated or merged with other characteristics.

As a result, the number of characteristics was reduced and consolidated from 83 to 47, and a new framing structure was defined, replacing the 3 domains with 10 organizing principles. Finally, a rationale for each characteristic was added, defending its inclusion in the list. In addition, consideration was given to including a section describing how an HMG could demonstrate that their organization met each characteristic. However, the workgroup and the board decided that these demonstration requirements should be vetted before they were published.

From January 2013 to June 2013, the revised key principles and characteristics were reviewed by selected chairpersons of SHM committees and by 2 focus groups of HMG leaders. These reviews were conducted at the SHM Annual Meeting. Finally, in June 2013, the Committee on Clinical Leadership of the American Hospital Association reviewed and commented on the draft of the principles and characteristics.

In addition, based on feedback received from the reviewers, the wording of many of the characteristics went through revisions to assure precision and clarity. Before submission to the Journal of Hospital Medicine, a professional editor was engaged to assure that the format and language of the characteristics were clear and consistent.

Final Approval

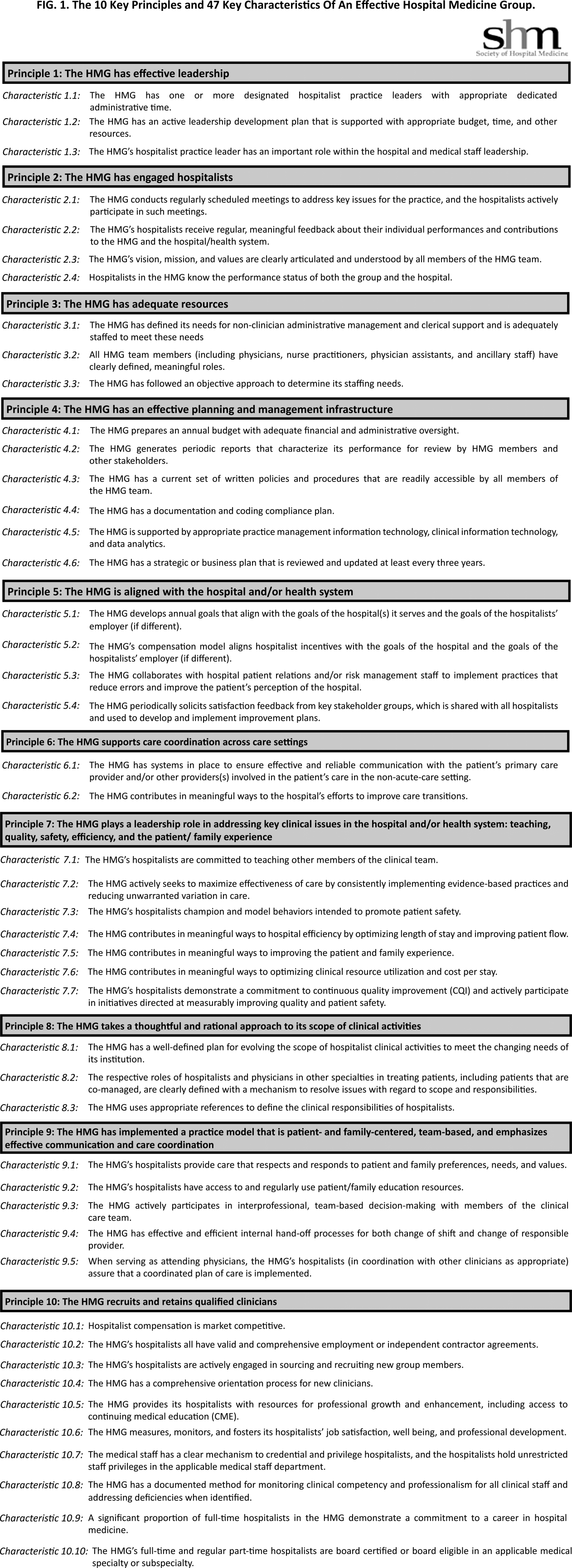

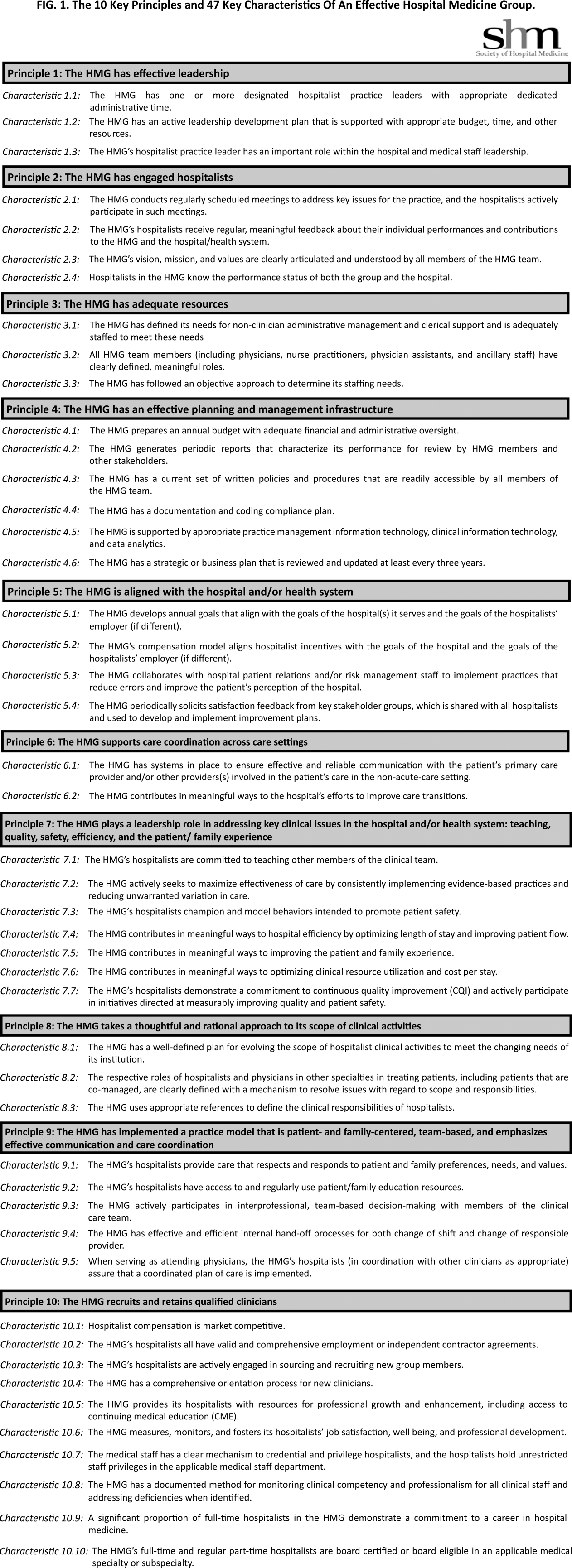

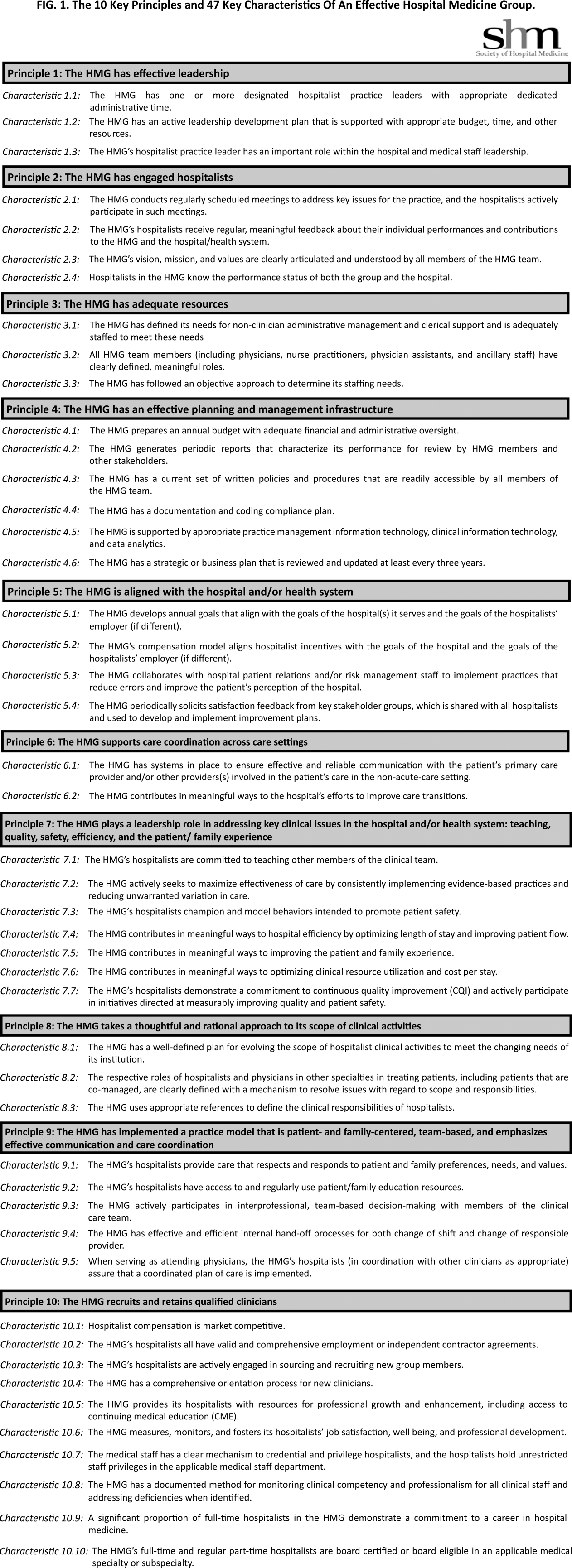

The final draft of the 10 principles and 47 characteristics was approved for publication at a meeting of the SHM Board of Directors in September 2013 (Figure 1).

RESULTS

A recurring issue that the workgroup addressed was the applicability of the characteristics from 1 practice setting to another. Confounding factors include the HMG's employment/organizational model (eg, hospital employed, academic, multispecialty group, private practice, and management company), its population served (eg, adult vs pediatric, more than 1 hospital), and the type of hospital served (eg, academic vs community, the hospital has more than 1 HMG). The workgroup has made an effort to assure that all 47 characteristics can be applied to every type of HMG.

In developing the 10 principles, the workgroup attempted to construct a list of the basic ingredients needed to build and sustain an effective HMG. These 10 principles stand on their own, independent of the 47 key characteristics, and include issues such as effective leadership, clinician engagement, adequate resources, management infrastructure, key hospitalist roles and responsibilities, alignment with the hospital, and the recruitment and retention of qualified hospitalists.

A more detailed version of the Key Principles and Characteristics of an Effective HMG is available in the online version of this article (see Supporting Information, Appendix, in the online version of this article). The online Appendix includes the rationales for each of the characteristics, guidance on how to provide feedback to the SHM on the framework, and the SHM's plan for further development of the key principles and characteristics.

DISCUSSION

To address the variability in capabilities and performance of HMGs, these principles and characteristics are designed to provide a framework for HMGs seeking to conduct self‐assessments and develop pathways for improvement.

Although there may be HMG arrangements that do not directly involve the hospital and its executive team, and therefore alternative approaches may make sense, for most HMGs hospitals are directly involved with the HMG as either an employer or a contractor. For that reason, the Key Principles and Characteristics of an Effective HMG is written for 2 audiences: the executive leadership of the hospital (most specifically the chief medical officer or a similar role) and the hospitalists in the HMG (most specifically the practice medical director). To address the key characteristics requires the active participation of both parties. For the hospital executives, the framework establishes expectations for the HMG. For the hospitalists, the framework provides guidance in the development of an improvement plan.

Hospital executives and hospitalists can use the key characteristics in a broad spectrum of ways. The easiest and least formalized approach would be to use the framework as the basis of an ongoing dialogue between the hospital leadership and the HMG. A more formal approach would be to use the framework to guide the planning and budgeting activities of the HMG. Finally, a hospital or health system can use the key principles and characteristics as a way to evaluate their affiliated HMG(s)for example, the HMG must address 80% of the 47 characteristics.

The Key Principles and Characteristics of an Effective HMG should be considered akin to the Core Competencies in Hospital Medicine previously published in the Journal of Hospital Medicine.[7] However, instead of focusing on the competencies of individual physicians, this framework focuses on the characteristics of hospitalist groups. Just as a physician or other healthcare provider is not expected to demonstrate competency for every element in the core competencies document, an HMG does not need to have all 47 characteristics to be effective. Effective hospitalists may have skills other than those listed in the Core Competencies in Hospital Medicine. Similarly, the 47 characteristics do not represent an exhaustive list of every desirable HMG attribute. In general, effective HMGs should possess most of the characteristics.

In applying the framework, the HMG should not simply attempt to evaluate each characteristic with a yes or no assessment. For HMGs responding yes, there may be a wide range of performancefrom meeting the bare minimum requirements to employing sophisticated, expansive measures to excel in the characteristic.

SHM encourages hospital leaders and HMG leaders to use these characteristics to perform an HMG self‐assessment and to develop a plan. The plan could address implementation of selected characteristics that are not currently being addressed by the HMG or the development of additional behaviors, tools, resources, and capabilities that more fully incorporate those characteristics for which the HMG meets only minimum requirements. In addition, the plan could address the impact that a larger organization (eg, health system, hospital, or employer) may have on a given characteristic.

As outlined above, the process used to develop the Key Principles and Characteristics of an Effective HMG was grounded in expert opinion and extensive review and feedback. HMGs that use the framework should recognize that others might have a different opinion. For example, characteristic 5.2 states, The HMG's compensation model aligns hospitalist incentives with the goals of the hospital and the goals of the hospitalist's employer (if different). There are likely to be experienced hospitalist leaders who believe that an effective HMG does not need to have an incentive compensation system. However, the consensus process employed to develop the key characteristics led to the conclusion that an effective HMG should have an incentive compensation system.

The publication of the Key Principles and Characteristics of an Effective HMG may lead to negative and/or unintended consequences. A self‐assessment by an HMG using this framework could require a significant level of effort on behalf of the HMG, whereas implementing remedial efforts to address the characteristics could require an investment of time and money that could take away from other important issues facing the HMG. Many HMGs may be held accountable for addressing these characteristics without the necessary financial support from their hospital or medical group. Finally, the publication of the document could create a backlash from members of the hospitalist community who do not think that the SHM should be in the business of defining what characterizes an effective HMG, rather that this definition should be left to the marketplace.

Despite these concerns, the leadership of the SHM expects that the publication of the Key Principles and Characteristics of an Effective HMG will lead to overall improvement in the capabilities and performance of HMGs.

CONCLUSIONS

The Key Principles and Characteristics of an Effective HMG have been designed to be aspirational, helping to raise the bar for the specialty of hospital medicine. These principles and characteristics could provide a framework for HMGs seeking to conduct self‐assessments, outlining a pathway for improvement, and better defining the central role of hospitalists in coordinating team‐based, patient‐centered care in the acute care setting.

Acknowledgments

Disclosures: Patrick Cawley, MD: none; Steven Deitelzweig, MD: none; Leslie Flores, MHA: provides consulting to hospital medicine groups; Joseph A. Miller, MS: none; John Nelson, MD: provides consulting to hospital medicine groups; Scott Rissmiller, MD: none; Laurence Wellikson, MD: none; Winthrop F. Whitcomb, MD: provides consulting to hospital medicine groups.

- American College of Surgeons. New verification site visit outcomes. Available at: http://www.facs.org/trauma/verifivisitoutcomes.html. Accessed September 3, 2013.

- Hospital accreditation standards 2012. Oakbrook Terrace, IL: The Joint Commission; 2012. Available at: Amazon.com: http://www.amazon.com/Hospital‐Accreditation‐Standards‐Joint‐Commission/dp/1599404257

- The magnet model: components and sources of evidence. Silver Spring, MD: American Nurse Credentialing Center; 2011. Available at: Amazon.com: http://www.amazon.com/Magnet‐Model‐Components‐Sources‐Evidence/dp/1935213229.

- Patient Centered Medical Home Standards and Guidelines. National Committee for Quality Assurance. Available at: https://inetshop01.pub.ncqa.org/Publications/deptCate.asp?dept_id=21(suppl 1):2–95.

With the continuing growth of the specialty of hospital medicine, the capabilities and performance of hospital medicine groups (HMGs) varies significantly. There are few guidelines that HMGs can reference as tools to guide self‐improvement. To address this deficiency, the Society of Hospital Medicine (SHM) Board of Directors authorized a process to identify the key principles and characteristics of an effective HMG.

METHODS

Topic Development and Validation Prework

In providing direction to this effort, the SHM board felt that the principles and characteristics should be directed at both hospitals and hospitalists, addressing the full range of managerial, organizational, clinical, and quality activities necessary to achieve effectiveness. Furthermore, the board defined effectiveness as consisting of 2 components. First, the HMG must assure that the patients managed by hospitalists receive high‐quality care that is sensitive to their needs and preferences. Second, the HMG must understand that the central role of the hospitalist is to coordinate patient care and foster interdisciplinary communication across the care continuum to provide optimal patient outcomes.

The SHM board appointed an HMG Characteristics Workgroup consisting of individuals who have experience with a wide array of HMG models and who could offer expert opinions on the subject. The HMG Characteristics Workgroup felt it important to review the work of other organizations that develop and administer criteria, standards, and/or requirements for healthcare organizations. Examples cited were the American College of Surgeons[1]; The Joint Commission[2]; American Nurse Credentialing Center[3]; the National Committee for Quality Assurance[4]; the American Medical Group Association[5]; and the American Association of Critical‐Care Nurses.[6]

In March 2012 and April 2012, SHM staff reviewed the websites and published materials of these organizations. For each program, information was captured on the qualifications of applicants, history of the program, timing of administering the program, the nature of recognition granted, and the program's keys to success. The summary of these findings was shared with the workgroup.

Background research and the broad scope of characteristics to be addressed led to the workgroup's decision to develop the principles and characteristics using a consensus process, emphasizing expert opinion supplemented by feedback from a broad group of stakeholders.

Initial Draft

During April 2012 and May 2012, the HMG Characteristics Workgroup identified 3 domains for the key characteristics: (1) program structure and operations, (2) clinical care delivery, and (3) organizational performance improvement. Over the course of several meetings, the HMG Characteristics Workgroup developed an initial draft of 83 characteristics, grouped into 29 subgroups within the 3 domains.

From June 2012 to November 2012, this initial draft was reviewed by a broad cross section of the hospital medicine community including members of SHM's committees, a group of academic hospitalists, focus groups in 2 communities (Philadelphia and Boston), and the leaders of several regional and national hospitalist management companies. Quantitative and qualitative feedback was obtained.

In November 2012, the SHM Board of Directors held its annual leadership meeting, attended by approximately 25 national hospitalist thought leaders and chairpersons of SHM committees. At this meeting, a series of exercises were conducted in which these leaders of the hospital medicine movement, including the SHM board members, were each assigned individual characteristics and asked to review and edit them for clarity and appropriateness.

As a result of feedback at that meeting and subsequent discussion by the SHM board, the workgroup was asked to modify the characteristics in 3 ways. First, the list should be streamlined, reducing the number of characteristics. Second, the 3 domains should be eliminated, and a better organizing framework should be created. Third, additional context should be added to the list of characteristics.

Second Draft

During the period from November 2012 to December 2012, the HMG Characteristics Workgroup went through a 2‐step Delphi process to consolidate characteristics and/or eliminate characteristics that were redundant or unnecessary. In the first step, members of the workgroup rated each characteristic from 1 to 3. A rating of 1 meant not important; good quality, but not required for an effective HMG. A rating of 2 meant important; most effective HMGs will meet requirement. A rating of 3 meant highly important; mandatory for an effective HMG. In the second step, members of the workgroup received feedback on the scores for each characteristic and came to a consensus on which characteristics should be eliminated or merged with other characteristics.

As a result, the number of characteristics was reduced and consolidated from 83 to 47, and a new framing structure was defined, replacing the 3 domains with 10 organizing principles. Finally, a rationale for each characteristic was added, defending its inclusion in the list. In addition, consideration was given to including a section describing how an HMG could demonstrate that their organization met each characteristic. However, the workgroup and the board decided that these demonstration requirements should be vetted before they were published.

From January 2013 to June 2013, the revised key principles and characteristics were reviewed by selected chairpersons of SHM committees and by 2 focus groups of HMG leaders. These reviews were conducted at the SHM Annual Meeting. Finally, in June 2013, the Committee on Clinical Leadership of the American Hospital Association reviewed and commented on the draft of the principles and characteristics.

In addition, based on feedback received from the reviewers, the wording of many of the characteristics went through revisions to assure precision and clarity. Before submission to the Journal of Hospital Medicine, a professional editor was engaged to assure that the format and language of the characteristics were clear and consistent.

Final Approval

The final draft of the 10 principles and 47 characteristics was approved for publication at a meeting of the SHM Board of Directors in September 2013 (Figure 1).

RESULTS

A recurring issue that the workgroup addressed was the applicability of the characteristics from 1 practice setting to another. Confounding factors include the HMG's employment/organizational model (eg, hospital employed, academic, multispecialty group, private practice, and management company), its population served (eg, adult vs pediatric, more than 1 hospital), and the type of hospital served (eg, academic vs community, the hospital has more than 1 HMG). The workgroup has made an effort to assure that all 47 characteristics can be applied to every type of HMG.

In developing the 10 principles, the workgroup attempted to construct a list of the basic ingredients needed to build and sustain an effective HMG. These 10 principles stand on their own, independent of the 47 key characteristics, and include issues such as effective leadership, clinician engagement, adequate resources, management infrastructure, key hospitalist roles and responsibilities, alignment with the hospital, and the recruitment and retention of qualified hospitalists.

A more detailed version of the Key Principles and Characteristics of an Effective HMG is available in the online version of this article (see Supporting Information, Appendix, in the online version of this article). The online Appendix includes the rationales for each of the characteristics, guidance on how to provide feedback to the SHM on the framework, and the SHM's plan for further development of the key principles and characteristics.

DISCUSSION

To address the variability in capabilities and performance of HMGs, these principles and characteristics are designed to provide a framework for HMGs seeking to conduct self‐assessments and develop pathways for improvement.

Although there may be HMG arrangements that do not directly involve the hospital and its executive team, and therefore alternative approaches may make sense, for most HMGs hospitals are directly involved with the HMG as either an employer or a contractor. For that reason, the Key Principles and Characteristics of an Effective HMG is written for 2 audiences: the executive leadership of the hospital (most specifically the chief medical officer or a similar role) and the hospitalists in the HMG (most specifically the practice medical director). To address the key characteristics requires the active participation of both parties. For the hospital executives, the framework establishes expectations for the HMG. For the hospitalists, the framework provides guidance in the development of an improvement plan.

Hospital executives and hospitalists can use the key characteristics in a broad spectrum of ways. The easiest and least formalized approach would be to use the framework as the basis of an ongoing dialogue between the hospital leadership and the HMG. A more formal approach would be to use the framework to guide the planning and budgeting activities of the HMG. Finally, a hospital or health system can use the key principles and characteristics as a way to evaluate their affiliated HMG(s)for example, the HMG must address 80% of the 47 characteristics.

The Key Principles and Characteristics of an Effective HMG should be considered akin to the Core Competencies in Hospital Medicine previously published in the Journal of Hospital Medicine.[7] However, instead of focusing on the competencies of individual physicians, this framework focuses on the characteristics of hospitalist groups. Just as a physician or other healthcare provider is not expected to demonstrate competency for every element in the core competencies document, an HMG does not need to have all 47 characteristics to be effective. Effective hospitalists may have skills other than those listed in the Core Competencies in Hospital Medicine. Similarly, the 47 characteristics do not represent an exhaustive list of every desirable HMG attribute. In general, effective HMGs should possess most of the characteristics.

In applying the framework, the HMG should not simply attempt to evaluate each characteristic with a yes or no assessment. For HMGs responding yes, there may be a wide range of performancefrom meeting the bare minimum requirements to employing sophisticated, expansive measures to excel in the characteristic.

SHM encourages hospital leaders and HMG leaders to use these characteristics to perform an HMG self‐assessment and to develop a plan. The plan could address implementation of selected characteristics that are not currently being addressed by the HMG or the development of additional behaviors, tools, resources, and capabilities that more fully incorporate those characteristics for which the HMG meets only minimum requirements. In addition, the plan could address the impact that a larger organization (eg, health system, hospital, or employer) may have on a given characteristic.

As outlined above, the process used to develop the Key Principles and Characteristics of an Effective HMG was grounded in expert opinion and extensive review and feedback. HMGs that use the framework should recognize that others might have a different opinion. For example, characteristic 5.2 states, The HMG's compensation model aligns hospitalist incentives with the goals of the hospital and the goals of the hospitalist's employer (if different). There are likely to be experienced hospitalist leaders who believe that an effective HMG does not need to have an incentive compensation system. However, the consensus process employed to develop the key characteristics led to the conclusion that an effective HMG should have an incentive compensation system.

The publication of the Key Principles and Characteristics of an Effective HMG may lead to negative and/or unintended consequences. A self‐assessment by an HMG using this framework could require a significant level of effort on behalf of the HMG, whereas implementing remedial efforts to address the characteristics could require an investment of time and money that could take away from other important issues facing the HMG. Many HMGs may be held accountable for addressing these characteristics without the necessary financial support from their hospital or medical group. Finally, the publication of the document could create a backlash from members of the hospitalist community who do not think that the SHM should be in the business of defining what characterizes an effective HMG, rather that this definition should be left to the marketplace.

Despite these concerns, the leadership of the SHM expects that the publication of the Key Principles and Characteristics of an Effective HMG will lead to overall improvement in the capabilities and performance of HMGs.

CONCLUSIONS

The Key Principles and Characteristics of an Effective HMG have been designed to be aspirational, helping to raise the bar for the specialty of hospital medicine. These principles and characteristics could provide a framework for HMGs seeking to conduct self‐assessments, outlining a pathway for improvement, and better defining the central role of hospitalists in coordinating team‐based, patient‐centered care in the acute care setting.

Acknowledgments

Disclosures: Patrick Cawley, MD: none; Steven Deitelzweig, MD: none; Leslie Flores, MHA: provides consulting to hospital medicine groups; Joseph A. Miller, MS: none; John Nelson, MD: provides consulting to hospital medicine groups; Scott Rissmiller, MD: none; Laurence Wellikson, MD: none; Winthrop F. Whitcomb, MD: provides consulting to hospital medicine groups.

With the continuing growth of the specialty of hospital medicine, the capabilities and performance of hospital medicine groups (HMGs) varies significantly. There are few guidelines that HMGs can reference as tools to guide self‐improvement. To address this deficiency, the Society of Hospital Medicine (SHM) Board of Directors authorized a process to identify the key principles and characteristics of an effective HMG.

METHODS

Topic Development and Validation Prework

In providing direction to this effort, the SHM board felt that the principles and characteristics should be directed at both hospitals and hospitalists, addressing the full range of managerial, organizational, clinical, and quality activities necessary to achieve effectiveness. Furthermore, the board defined effectiveness as consisting of 2 components. First, the HMG must assure that the patients managed by hospitalists receive high‐quality care that is sensitive to their needs and preferences. Second, the HMG must understand that the central role of the hospitalist is to coordinate patient care and foster interdisciplinary communication across the care continuum to provide optimal patient outcomes.

The SHM board appointed an HMG Characteristics Workgroup consisting of individuals who have experience with a wide array of HMG models and who could offer expert opinions on the subject. The HMG Characteristics Workgroup felt it important to review the work of other organizations that develop and administer criteria, standards, and/or requirements for healthcare organizations. Examples cited were the American College of Surgeons[1]; The Joint Commission[2]; American Nurse Credentialing Center[3]; the National Committee for Quality Assurance[4]; the American Medical Group Association[5]; and the American Association of Critical‐Care Nurses.[6]

In March 2012 and April 2012, SHM staff reviewed the websites and published materials of these organizations. For each program, information was captured on the qualifications of applicants, history of the program, timing of administering the program, the nature of recognition granted, and the program's keys to success. The summary of these findings was shared with the workgroup.

Background research and the broad scope of characteristics to be addressed led to the workgroup's decision to develop the principles and characteristics using a consensus process, emphasizing expert opinion supplemented by feedback from a broad group of stakeholders.

Initial Draft

During April 2012 and May 2012, the HMG Characteristics Workgroup identified 3 domains for the key characteristics: (1) program structure and operations, (2) clinical care delivery, and (3) organizational performance improvement. Over the course of several meetings, the HMG Characteristics Workgroup developed an initial draft of 83 characteristics, grouped into 29 subgroups within the 3 domains.

From June 2012 to November 2012, this initial draft was reviewed by a broad cross section of the hospital medicine community including members of SHM's committees, a group of academic hospitalists, focus groups in 2 communities (Philadelphia and Boston), and the leaders of several regional and national hospitalist management companies. Quantitative and qualitative feedback was obtained.

In November 2012, the SHM Board of Directors held its annual leadership meeting, attended by approximately 25 national hospitalist thought leaders and chairpersons of SHM committees. At this meeting, a series of exercises were conducted in which these leaders of the hospital medicine movement, including the SHM board members, were each assigned individual characteristics and asked to review and edit them for clarity and appropriateness.

As a result of feedback at that meeting and subsequent discussion by the SHM board, the workgroup was asked to modify the characteristics in 3 ways. First, the list should be streamlined, reducing the number of characteristics. Second, the 3 domains should be eliminated, and a better organizing framework should be created. Third, additional context should be added to the list of characteristics.

Second Draft

During the period from November 2012 to December 2012, the HMG Characteristics Workgroup went through a 2‐step Delphi process to consolidate characteristics and/or eliminate characteristics that were redundant or unnecessary. In the first step, members of the workgroup rated each characteristic from 1 to 3. A rating of 1 meant not important; good quality, but not required for an effective HMG. A rating of 2 meant important; most effective HMGs will meet requirement. A rating of 3 meant highly important; mandatory for an effective HMG. In the second step, members of the workgroup received feedback on the scores for each characteristic and came to a consensus on which characteristics should be eliminated or merged with other characteristics.

As a result, the number of characteristics was reduced and consolidated from 83 to 47, and a new framing structure was defined, replacing the 3 domains with 10 organizing principles. Finally, a rationale for each characteristic was added, defending its inclusion in the list. In addition, consideration was given to including a section describing how an HMG could demonstrate that their organization met each characteristic. However, the workgroup and the board decided that these demonstration requirements should be vetted before they were published.

From January 2013 to June 2013, the revised key principles and characteristics were reviewed by selected chairpersons of SHM committees and by 2 focus groups of HMG leaders. These reviews were conducted at the SHM Annual Meeting. Finally, in June 2013, the Committee on Clinical Leadership of the American Hospital Association reviewed and commented on the draft of the principles and characteristics.

In addition, based on feedback received from the reviewers, the wording of many of the characteristics went through revisions to assure precision and clarity. Before submission to the Journal of Hospital Medicine, a professional editor was engaged to assure that the format and language of the characteristics were clear and consistent.

Final Approval

The final draft of the 10 principles and 47 characteristics was approved for publication at a meeting of the SHM Board of Directors in September 2013 (Figure 1).

RESULTS

A recurring issue that the workgroup addressed was the applicability of the characteristics from 1 practice setting to another. Confounding factors include the HMG's employment/organizational model (eg, hospital employed, academic, multispecialty group, private practice, and management company), its population served (eg, adult vs pediatric, more than 1 hospital), and the type of hospital served (eg, academic vs community, the hospital has more than 1 HMG). The workgroup has made an effort to assure that all 47 characteristics can be applied to every type of HMG.

In developing the 10 principles, the workgroup attempted to construct a list of the basic ingredients needed to build and sustain an effective HMG. These 10 principles stand on their own, independent of the 47 key characteristics, and include issues such as effective leadership, clinician engagement, adequate resources, management infrastructure, key hospitalist roles and responsibilities, alignment with the hospital, and the recruitment and retention of qualified hospitalists.

A more detailed version of the Key Principles and Characteristics of an Effective HMG is available in the online version of this article (see Supporting Information, Appendix, in the online version of this article). The online Appendix includes the rationales for each of the characteristics, guidance on how to provide feedback to the SHM on the framework, and the SHM's plan for further development of the key principles and characteristics.

DISCUSSION

To address the variability in capabilities and performance of HMGs, these principles and characteristics are designed to provide a framework for HMGs seeking to conduct self‐assessments and develop pathways for improvement.

Although there may be HMG arrangements that do not directly involve the hospital and its executive team, and therefore alternative approaches may make sense, for most HMGs hospitals are directly involved with the HMG as either an employer or a contractor. For that reason, the Key Principles and Characteristics of an Effective HMG is written for 2 audiences: the executive leadership of the hospital (most specifically the chief medical officer or a similar role) and the hospitalists in the HMG (most specifically the practice medical director). To address the key characteristics requires the active participation of both parties. For the hospital executives, the framework establishes expectations for the HMG. For the hospitalists, the framework provides guidance in the development of an improvement plan.

Hospital executives and hospitalists can use the key characteristics in a broad spectrum of ways. The easiest and least formalized approach would be to use the framework as the basis of an ongoing dialogue between the hospital leadership and the HMG. A more formal approach would be to use the framework to guide the planning and budgeting activities of the HMG. Finally, a hospital or health system can use the key principles and characteristics as a way to evaluate their affiliated HMG(s)for example, the HMG must address 80% of the 47 characteristics.

The Key Principles and Characteristics of an Effective HMG should be considered akin to the Core Competencies in Hospital Medicine previously published in the Journal of Hospital Medicine.[7] However, instead of focusing on the competencies of individual physicians, this framework focuses on the characteristics of hospitalist groups. Just as a physician or other healthcare provider is not expected to demonstrate competency for every element in the core competencies document, an HMG does not need to have all 47 characteristics to be effective. Effective hospitalists may have skills other than those listed in the Core Competencies in Hospital Medicine. Similarly, the 47 characteristics do not represent an exhaustive list of every desirable HMG attribute. In general, effective HMGs should possess most of the characteristics.

In applying the framework, the HMG should not simply attempt to evaluate each characteristic with a yes or no assessment. For HMGs responding yes, there may be a wide range of performancefrom meeting the bare minimum requirements to employing sophisticated, expansive measures to excel in the characteristic.

SHM encourages hospital leaders and HMG leaders to use these characteristics to perform an HMG self‐assessment and to develop a plan. The plan could address implementation of selected characteristics that are not currently being addressed by the HMG or the development of additional behaviors, tools, resources, and capabilities that more fully incorporate those characteristics for which the HMG meets only minimum requirements. In addition, the plan could address the impact that a larger organization (eg, health system, hospital, or employer) may have on a given characteristic.

As outlined above, the process used to develop the Key Principles and Characteristics of an Effective HMG was grounded in expert opinion and extensive review and feedback. HMGs that use the framework should recognize that others might have a different opinion. For example, characteristic 5.2 states, The HMG's compensation model aligns hospitalist incentives with the goals of the hospital and the goals of the hospitalist's employer (if different). There are likely to be experienced hospitalist leaders who believe that an effective HMG does not need to have an incentive compensation system. However, the consensus process employed to develop the key characteristics led to the conclusion that an effective HMG should have an incentive compensation system.

The publication of the Key Principles and Characteristics of an Effective HMG may lead to negative and/or unintended consequences. A self‐assessment by an HMG using this framework could require a significant level of effort on behalf of the HMG, whereas implementing remedial efforts to address the characteristics could require an investment of time and money that could take away from other important issues facing the HMG. Many HMGs may be held accountable for addressing these characteristics without the necessary financial support from their hospital or medical group. Finally, the publication of the document could create a backlash from members of the hospitalist community who do not think that the SHM should be in the business of defining what characterizes an effective HMG, rather that this definition should be left to the marketplace.

Despite these concerns, the leadership of the SHM expects that the publication of the Key Principles and Characteristics of an Effective HMG will lead to overall improvement in the capabilities and performance of HMGs.

CONCLUSIONS

The Key Principles and Characteristics of an Effective HMG have been designed to be aspirational, helping to raise the bar for the specialty of hospital medicine. These principles and characteristics could provide a framework for HMGs seeking to conduct self‐assessments, outlining a pathway for improvement, and better defining the central role of hospitalists in coordinating team‐based, patient‐centered care in the acute care setting.

Acknowledgments

Disclosures: Patrick Cawley, MD: none; Steven Deitelzweig, MD: none; Leslie Flores, MHA: provides consulting to hospital medicine groups; Joseph A. Miller, MS: none; John Nelson, MD: provides consulting to hospital medicine groups; Scott Rissmiller, MD: none; Laurence Wellikson, MD: none; Winthrop F. Whitcomb, MD: provides consulting to hospital medicine groups.

- American College of Surgeons. New verification site visit outcomes. Available at: http://www.facs.org/trauma/verifivisitoutcomes.html. Accessed September 3, 2013.

- Hospital accreditation standards 2012. Oakbrook Terrace, IL: The Joint Commission; 2012. Available at: Amazon.com: http://www.amazon.com/Hospital‐Accreditation‐Standards‐Joint‐Commission/dp/1599404257

- The magnet model: components and sources of evidence. Silver Spring, MD: American Nurse Credentialing Center; 2011. Available at: Amazon.com: http://www.amazon.com/Magnet‐Model‐Components‐Sources‐Evidence/dp/1935213229.

- Patient Centered Medical Home Standards and Guidelines. National Committee for Quality Assurance. Available at: https://inetshop01.pub.ncqa.org/Publications/deptCate.asp?dept_id=21(suppl 1):2–95.

- American College of Surgeons. New verification site visit outcomes. Available at: http://www.facs.org/trauma/verifivisitoutcomes.html. Accessed September 3, 2013.

- Hospital accreditation standards 2012. Oakbrook Terrace, IL: The Joint Commission; 2012. Available at: Amazon.com: http://www.amazon.com/Hospital‐Accreditation‐Standards‐Joint‐Commission/dp/1599404257

- The magnet model: components and sources of evidence. Silver Spring, MD: American Nurse Credentialing Center; 2011. Available at: Amazon.com: http://www.amazon.com/Magnet‐Model‐Components‐Sources‐Evidence/dp/1935213229.

- Patient Centered Medical Home Standards and Guidelines. National Committee for Quality Assurance. Available at: https://inetshop01.pub.ncqa.org/Publications/deptCate.asp?dept_id=21(suppl 1):2–95.

Advanced-Practice Providers Have More to Offer Hospital Medicine Groups

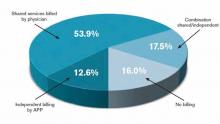

Advanced-practice providers (APPs) continue to make their presence felt in the world of hospital medicine. According to survey data from the 2012 State of Hospital Medicine report, more than half (53.9%) of respondent groups serving adults have nurse practitioners (NP) and/or physician assistants (PA) integrated into their practices. The median ratio of APPs to hospitalist physicians in these groups has remained about the same as in previous surveys, with respondents reporting 0.2 FTE NPs per FTE physician, and 0.1 FTE PAs per FTE physician. We’ve also learned that APPs tend to be stable members of most hospitalist practices, with more than 70% of groups reporting no turnover among their APPs during the survey period.

Unfortunately, we don’t yet have much information on the specific roles APPs are filling in HM practices; hopefully, this will be a subject for the next State of Hospital Medicine survey, scheduled to launch in January 2014.

The 2012 survey did provide new information about how APP work is billed by HM groups. More than half the time, APP work is billed as a shared service under a physician’s provider number (see Table 1). Only on rare occasions is APP work billed separately under the APP’s provider number.

Perhaps most surprising of all, 16% of adult HM groups with APPs reported that their APPs don’t generally provide billable services, or no charges were submitted to payors for their services. This figure rose to 23% for hospital-employed groups.

Almost everywhere I go in my consulting work, we are asked about the value APPs can provide to hospitalist practice, and what their optimal roles are. I am extremely supportive of integrating APPs into hospitalist practice and believe they can play valuable roles supporting both excellent patient care and overall group efficiency.

But in my experience, many HM groups fail to execute well on this promise. As the survey results suggest, sometimes APPs are relegated to nonbillable tasks that could be performed by individuals at a lower skill level. Sometimes the hospitalists tend to think of the APPs as “free” help, and no real attempt is made to account for their contribution or capture their billable work. And some groups are so focused on ensuring they capture the 100% reimbursement available by billing under the physician’s name (rather than the 85% reimbursement typically available to APPs) that they lose sight of the fact that the extra physician time and effort involved might cost more than the incremental additional reimbursement received.

As a specialty, we still have a lot to learn about the optimal ways to deploy APPs to support high-quality, effective hospitalist practice. In the meantime, it can be valuable for HM groups to ensure that APPs are functioning in roles that take advantage of their advanced skills and licensure scope, and that efforts are being made to ensure the capture of all billable services provided.

I hope you will plan to participate in the 2014 State of Hospital Medicine survey and share your own practice’s experience with APPs.

Leslie Flores is a partner in Nelson Flores Hospital Medicine Consultants and a member of SHM’s Practice Analysis Committee.

Advanced-practice providers (APPs) continue to make their presence felt in the world of hospital medicine. According to survey data from the 2012 State of Hospital Medicine report, more than half (53.9%) of respondent groups serving adults have nurse practitioners (NP) and/or physician assistants (PA) integrated into their practices. The median ratio of APPs to hospitalist physicians in these groups has remained about the same as in previous surveys, with respondents reporting 0.2 FTE NPs per FTE physician, and 0.1 FTE PAs per FTE physician. We’ve also learned that APPs tend to be stable members of most hospitalist practices, with more than 70% of groups reporting no turnover among their APPs during the survey period.

Unfortunately, we don’t yet have much information on the specific roles APPs are filling in HM practices; hopefully, this will be a subject for the next State of Hospital Medicine survey, scheduled to launch in January 2014.

The 2012 survey did provide new information about how APP work is billed by HM groups. More than half the time, APP work is billed as a shared service under a physician’s provider number (see Table 1). Only on rare occasions is APP work billed separately under the APP’s provider number.

Perhaps most surprising of all, 16% of adult HM groups with APPs reported that their APPs don’t generally provide billable services, or no charges were submitted to payors for their services. This figure rose to 23% for hospital-employed groups.

Almost everywhere I go in my consulting work, we are asked about the value APPs can provide to hospitalist practice, and what their optimal roles are. I am extremely supportive of integrating APPs into hospitalist practice and believe they can play valuable roles supporting both excellent patient care and overall group efficiency.

But in my experience, many HM groups fail to execute well on this promise. As the survey results suggest, sometimes APPs are relegated to nonbillable tasks that could be performed by individuals at a lower skill level. Sometimes the hospitalists tend to think of the APPs as “free” help, and no real attempt is made to account for their contribution or capture their billable work. And some groups are so focused on ensuring they capture the 100% reimbursement available by billing under the physician’s name (rather than the 85% reimbursement typically available to APPs) that they lose sight of the fact that the extra physician time and effort involved might cost more than the incremental additional reimbursement received.

As a specialty, we still have a lot to learn about the optimal ways to deploy APPs to support high-quality, effective hospitalist practice. In the meantime, it can be valuable for HM groups to ensure that APPs are functioning in roles that take advantage of their advanced skills and licensure scope, and that efforts are being made to ensure the capture of all billable services provided.

I hope you will plan to participate in the 2014 State of Hospital Medicine survey and share your own practice’s experience with APPs.

Leslie Flores is a partner in Nelson Flores Hospital Medicine Consultants and a member of SHM’s Practice Analysis Committee.

Advanced-practice providers (APPs) continue to make their presence felt in the world of hospital medicine. According to survey data from the 2012 State of Hospital Medicine report, more than half (53.9%) of respondent groups serving adults have nurse practitioners (NP) and/or physician assistants (PA) integrated into their practices. The median ratio of APPs to hospitalist physicians in these groups has remained about the same as in previous surveys, with respondents reporting 0.2 FTE NPs per FTE physician, and 0.1 FTE PAs per FTE physician. We’ve also learned that APPs tend to be stable members of most hospitalist practices, with more than 70% of groups reporting no turnover among their APPs during the survey period.

Unfortunately, we don’t yet have much information on the specific roles APPs are filling in HM practices; hopefully, this will be a subject for the next State of Hospital Medicine survey, scheduled to launch in January 2014.

The 2012 survey did provide new information about how APP work is billed by HM groups. More than half the time, APP work is billed as a shared service under a physician’s provider number (see Table 1). Only on rare occasions is APP work billed separately under the APP’s provider number.

Perhaps most surprising of all, 16% of adult HM groups with APPs reported that their APPs don’t generally provide billable services, or no charges were submitted to payors for their services. This figure rose to 23% for hospital-employed groups.

Almost everywhere I go in my consulting work, we are asked about the value APPs can provide to hospitalist practice, and what their optimal roles are. I am extremely supportive of integrating APPs into hospitalist practice and believe they can play valuable roles supporting both excellent patient care and overall group efficiency.

But in my experience, many HM groups fail to execute well on this promise. As the survey results suggest, sometimes APPs are relegated to nonbillable tasks that could be performed by individuals at a lower skill level. Sometimes the hospitalists tend to think of the APPs as “free” help, and no real attempt is made to account for their contribution or capture their billable work. And some groups are so focused on ensuring they capture the 100% reimbursement available by billing under the physician’s name (rather than the 85% reimbursement typically available to APPs) that they lose sight of the fact that the extra physician time and effort involved might cost more than the incremental additional reimbursement received.

As a specialty, we still have a lot to learn about the optimal ways to deploy APPs to support high-quality, effective hospitalist practice. In the meantime, it can be valuable for HM groups to ensure that APPs are functioning in roles that take advantage of their advanced skills and licensure scope, and that efforts are being made to ensure the capture of all billable services provided.

I hope you will plan to participate in the 2014 State of Hospital Medicine survey and share your own practice’s experience with APPs.

Leslie Flores is a partner in Nelson Flores Hospital Medicine Consultants and a member of SHM’s Practice Analysis Committee.

Survey Shows Five-Year Decrease in Employee Benefits, Paid Time Off for Hospitalists

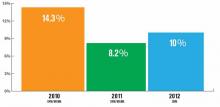

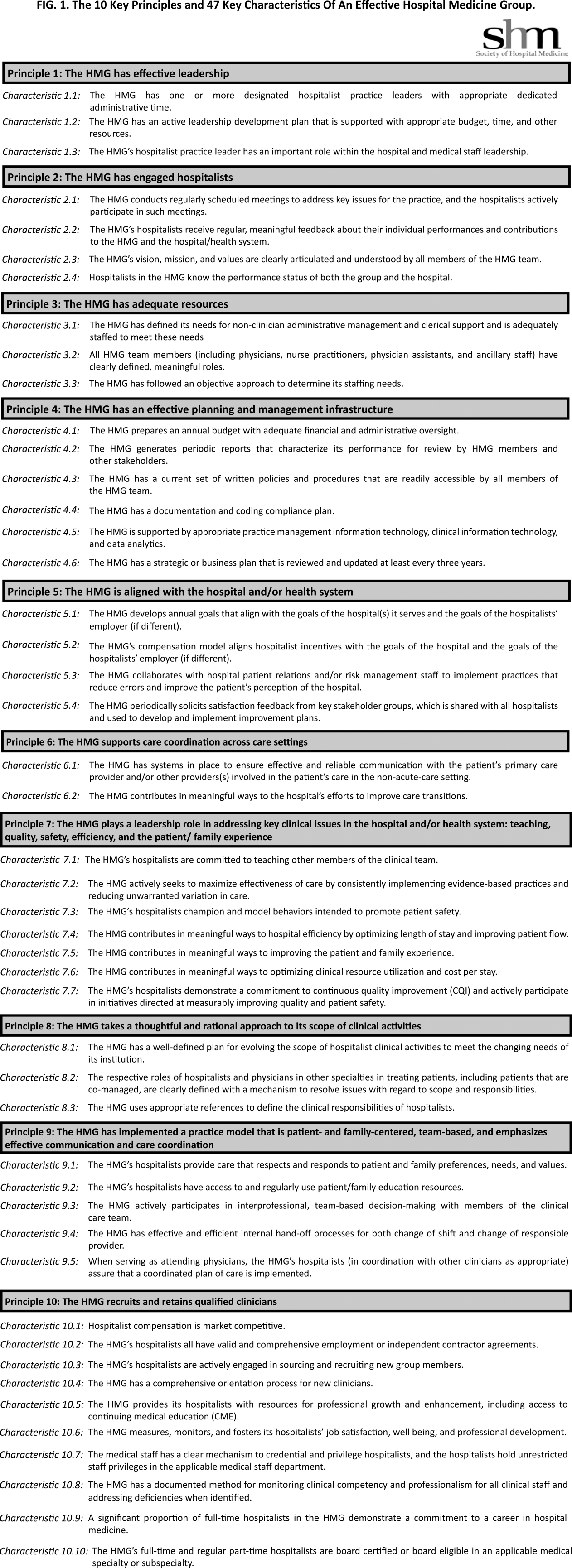

For the first time in several years, SHM included questions about employee benefits and paid time off in its 2012 State of Hospital Medicine survey. The median value of benefits per physician FTE reported by HM groups serving adults only was $26,000, according to the 2012 survey. But what a surprise it was when survey respondents in 2007 reported median benefits of $31,900.

I admit to being flummoxed by the decrease. The definition of “benefits” was identical in both surveys. The only difference is that in 2007, SHM collected actual benefit cost for each individual on the individual questionnaire; in 2012, we asked for the average benefits per FTE for the group. One possible explanation is that some respondents simply guessed about the average, because they didn’t have to report data for individual doctors. Of course, it’s also possible that groups are requiring physicians to pay a higher proportion of insurance premiums or are reducing retirement plan contributions due to the weak economy. But in the work I do with hospitalist groups around the country, I rarely see benefit costs below about $35,000.

Source: 2012 State of Hospital Medicine report

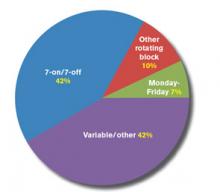

Another interesting finding from the 2012 survey is that 37% of adult medicine groups reported offering paid time off (PTO), down from 54% in 2007. Even among groups using a seven-on/seven-off schedule, the PTO rate was only 44%. Does this represent a survey design or respondent input error, differences in respondent populations, or an actual shift in the prevalence of PTO benefits? I suspect it’s the latter, because the median amount of PTO time awarded has also declined. In 2007, adult HMGs reported a median of 25 PTO days annually. In 2012, the median for those groups offering PTO was 160 hours of PTO, which represents somewhere around 13 to 20 days, depending on shift length.

Why might PTO benefits be declining? I suppose it could be belt-tightening associated with the poor economy. But I think many HM groups simply have found PTO benefits difficult to administer and fraught with unintended consequences. Many groups are so thinly staffed that for someone to take a PTO day, someone else must work extra to cover. Then, when the covering doctor takes PTO, the first doctor must work extra—effectively offsetting the value of PTO. And if a hospitalist takes PTO and also works extra shifts in the same pay period, do these two offset each other? Or does the doctor get paid for both the PTO days and the extra shift days?

For clinicians such as hospitalists, whose work is defined in highly variable, shift-based schedules that include a lot of night and weekend work, it becomes very difficult to determine which of the days not worked were PTO days versus just days the doctor wasn’t scheduled.

Personally, I don’t think it makes much sense for most hospitalists to have PTO. Don’t get me wrong—I think hospitalists should be paid well and have generous amounts of time off in exchange for long, challenging workdays and a disproportionate amount of night and weekend work. But arbitrarily assigning some of the days not worked as PTO while others are just unscheduled days seems unnecessarily complex.

Time will tell if the specialty as a whole agrees with me or not.

Leslie Flores is a principal in Nelson Flores Hospital Medicine Consultants and a member of SHM’s Practice Analysis Committee.

For the first time in several years, SHM included questions about employee benefits and paid time off in its 2012 State of Hospital Medicine survey. The median value of benefits per physician FTE reported by HM groups serving adults only was $26,000, according to the 2012 survey. But what a surprise it was when survey respondents in 2007 reported median benefits of $31,900.

I admit to being flummoxed by the decrease. The definition of “benefits” was identical in both surveys. The only difference is that in 2007, SHM collected actual benefit cost for each individual on the individual questionnaire; in 2012, we asked for the average benefits per FTE for the group. One possible explanation is that some respondents simply guessed about the average, because they didn’t have to report data for individual doctors. Of course, it’s also possible that groups are requiring physicians to pay a higher proportion of insurance premiums or are reducing retirement plan contributions due to the weak economy. But in the work I do with hospitalist groups around the country, I rarely see benefit costs below about $35,000.

Source: 2012 State of Hospital Medicine report

Another interesting finding from the 2012 survey is that 37% of adult medicine groups reported offering paid time off (PTO), down from 54% in 2007. Even among groups using a seven-on/seven-off schedule, the PTO rate was only 44%. Does this represent a survey design or respondent input error, differences in respondent populations, or an actual shift in the prevalence of PTO benefits? I suspect it’s the latter, because the median amount of PTO time awarded has also declined. In 2007, adult HMGs reported a median of 25 PTO days annually. In 2012, the median for those groups offering PTO was 160 hours of PTO, which represents somewhere around 13 to 20 days, depending on shift length.

Why might PTO benefits be declining? I suppose it could be belt-tightening associated with the poor economy. But I think many HM groups simply have found PTO benefits difficult to administer and fraught with unintended consequences. Many groups are so thinly staffed that for someone to take a PTO day, someone else must work extra to cover. Then, when the covering doctor takes PTO, the first doctor must work extra—effectively offsetting the value of PTO. And if a hospitalist takes PTO and also works extra shifts in the same pay period, do these two offset each other? Or does the doctor get paid for both the PTO days and the extra shift days?

For clinicians such as hospitalists, whose work is defined in highly variable, shift-based schedules that include a lot of night and weekend work, it becomes very difficult to determine which of the days not worked were PTO days versus just days the doctor wasn’t scheduled.

Personally, I don’t think it makes much sense for most hospitalists to have PTO. Don’t get me wrong—I think hospitalists should be paid well and have generous amounts of time off in exchange for long, challenging workdays and a disproportionate amount of night and weekend work. But arbitrarily assigning some of the days not worked as PTO while others are just unscheduled days seems unnecessarily complex.

Time will tell if the specialty as a whole agrees with me or not.

Leslie Flores is a principal in Nelson Flores Hospital Medicine Consultants and a member of SHM’s Practice Analysis Committee.

For the first time in several years, SHM included questions about employee benefits and paid time off in its 2012 State of Hospital Medicine survey. The median value of benefits per physician FTE reported by HM groups serving adults only was $26,000, according to the 2012 survey. But what a surprise it was when survey respondents in 2007 reported median benefits of $31,900.

I admit to being flummoxed by the decrease. The definition of “benefits” was identical in both surveys. The only difference is that in 2007, SHM collected actual benefit cost for each individual on the individual questionnaire; in 2012, we asked for the average benefits per FTE for the group. One possible explanation is that some respondents simply guessed about the average, because they didn’t have to report data for individual doctors. Of course, it’s also possible that groups are requiring physicians to pay a higher proportion of insurance premiums or are reducing retirement plan contributions due to the weak economy. But in the work I do with hospitalist groups around the country, I rarely see benefit costs below about $35,000.

Source: 2012 State of Hospital Medicine report

Another interesting finding from the 2012 survey is that 37% of adult medicine groups reported offering paid time off (PTO), down from 54% in 2007. Even among groups using a seven-on/seven-off schedule, the PTO rate was only 44%. Does this represent a survey design or respondent input error, differences in respondent populations, or an actual shift in the prevalence of PTO benefits? I suspect it’s the latter, because the median amount of PTO time awarded has also declined. In 2007, adult HMGs reported a median of 25 PTO days annually. In 2012, the median for those groups offering PTO was 160 hours of PTO, which represents somewhere around 13 to 20 days, depending on shift length.

Why might PTO benefits be declining? I suppose it could be belt-tightening associated with the poor economy. But I think many HM groups simply have found PTO benefits difficult to administer and fraught with unintended consequences. Many groups are so thinly staffed that for someone to take a PTO day, someone else must work extra to cover. Then, when the covering doctor takes PTO, the first doctor must work extra—effectively offsetting the value of PTO. And if a hospitalist takes PTO and also works extra shifts in the same pay period, do these two offset each other? Or does the doctor get paid for both the PTO days and the extra shift days?

For clinicians such as hospitalists, whose work is defined in highly variable, shift-based schedules that include a lot of night and weekend work, it becomes very difficult to determine which of the days not worked were PTO days versus just days the doctor wasn’t scheduled.

Personally, I don’t think it makes much sense for most hospitalists to have PTO. Don’t get me wrong—I think hospitalists should be paid well and have generous amounts of time off in exchange for long, challenging workdays and a disproportionate amount of night and weekend work. But arbitrarily assigning some of the days not worked as PTO while others are just unscheduled days seems unnecessarily complex.

Time will tell if the specialty as a whole agrees with me or not.

Leslie Flores is a principal in Nelson Flores Hospital Medicine Consultants and a member of SHM’s Practice Analysis Committee.

Accuracy Matters When Compensation for Hospitalists Is at Stake

Not long ago, I received an email from a hospitalist group leader who was working with her CMO on a new compensation plan. The CMO, wanting to ensure that the proposed compensation per unit of work was appropriate, had taken the MGMA national median annual compensation for internal-medicine hospitalists ($234,437) and divided it by the national median annual work RVUs (4,185) to arrive at a targeted compensation per wRVU of $56.01.

The hospitalist leader, however, had the benefit of referring to her 2012 State of Hospital Medicine report, in which Table 6.30 reported an MGMA median compensation per wRVU for internal-medicine hospitalists of $58.28. That variance of more than two dollars per wRVU could mean an additional $8,000 or so in annual compensation to her and her colleagues, so she was seeking to understand why the report has a different number than the one calculated by her CMO.

The answer is that the CMO got caught in a common error of logic: The CMO assumed that the compensation median and the wRVU median were derived from exactly the same population, failing to consider that the underlying data sets might be different. Here’s what happened: Compensation data were reported for 3,192 internal-medicine hospitalists, but wRVUs were reported for only 2,389 of those hospitalists. So the analysis of compensation per wRVU can be accurately calculated only for those 2,389 hospitalists for whom both compensation and wRVUs were reported. The other 803 hospitalists for whom no wRVUs were reported had to be excluded from the ratio calculation. The CMO’s error was to calculate a ratio of two medians based on different data sets, rather than calculating the individual comp-to-wRVU ratios, then determining the median for that smaller data set.

A similar thing has happened over the years with nocturnist data. In SHM’s 2007-2008 compensation and productivity survey, and again in the 2011 SHM/MGMA State of Hospital Medicine report, the median compensation reported for nocturnists actually was lower than that reported for all adult hospitalists. In my work with hospitalist practices across the country, I’ve only run into one or two where the nocturnists earned less than the daytime doctors, so I was flummoxed by this finding. Turns out, I was making the same mistake of assuming I was looking at “nocturnist” and “all adult hospitalist” compensation for the same hospitalist groups. But the adult medicine groups using nocturnists are actually a small subset of all adult medicine groups, and the nocturnist data likely included at least a few pediatric hospitalist nocturnists. Because the underlying data sets are different, the two medians aren’t directly comparable.

When all is said and done, we don’t really care whether the average nocturnist earns more or less than the average non-nocturnist hospitalist. What we really want to know is, Do the nocturnists in a given group earn more than the non-nocturnists in the same group? That’s why this year SHM asked groups to report the average percent compensation differential between nocturnists and non-nocturnists in their groups. It turns out that groups serving adults only reported a median of 15% higher compensation for nocturnists, a far different result than users of previous surveys inferred.

The bottom line: Make sure you understand how the State of Hospital Medicine survey results are calculated. Many of the formulas used are described in Appendix B of the report, and if you have questions about others, feel free to contact SHM and ask.

Leslie Flores is a partner in Nelson Flores Hospital Medicine Consultants.

Not long ago, I received an email from a hospitalist group leader who was working with her CMO on a new compensation plan. The CMO, wanting to ensure that the proposed compensation per unit of work was appropriate, had taken the MGMA national median annual compensation for internal-medicine hospitalists ($234,437) and divided it by the national median annual work RVUs (4,185) to arrive at a targeted compensation per wRVU of $56.01.

The hospitalist leader, however, had the benefit of referring to her 2012 State of Hospital Medicine report, in which Table 6.30 reported an MGMA median compensation per wRVU for internal-medicine hospitalists of $58.28. That variance of more than two dollars per wRVU could mean an additional $8,000 or so in annual compensation to her and her colleagues, so she was seeking to understand why the report has a different number than the one calculated by her CMO.