User login

Should Hospitalists Who Fail to Provide a Standard of Care Be Paid for Subsequent Care?

A 72-year-old male with a history of CHF is admitted for elective total hip arthroplasty. On postoperative day one, he develops dyspnea and hypoxia, and is diagnosed with acute pulmonary edema by the hospitalist co-managing his care. Furosemide is prescribed, and he improves, and by day four is ready for discharge following another dose of diuretics. Overnight, he develops acute onset of shortness of breath and is diagnosed with a pulmonary embolism (PE). Under new regulations, the hospital will not be reimbursed for the extra cost associated with subsequent patient care. Should the hospitalist be paid for the subsequent care?

PRO

Nonpayment won’t improve quality or significantly decrease costs

The real essence of the question raised in the clinical case above is “Should doctors profit from errors?” The answer might be “It’s better than the alternative.” Allow me to explain. There essentially are two reasons to withhold payment in this scenario: one, as a mechanism for promoting quality; two, as a mechanism for decreasing costs to the payor.

The quality argument assumes the physician will deliver higher-quality care (i.e., prescribe chemical thromboprophylaxis) if a threat of nonpayment exists. This concept is simply hogwash. If expensive medical malpractice threats fail as quality-improvement (QI) mechanisms, it is absurd to think withholding a few subsequent-care charges will generate better results.

The key issue is the type of error involved. As defined by Lucien Leape, MD, in his celebrated 1994 article on medical errors, “mistakes” reflect failures during attentional behaviors, or incorrect choices.1 “Slips” reflect lapses in concentration. “Slips occur in the face of competing sensory or emotional distractions, fatigue, and stress,” and “reducing the risk of slips requires attention to the designs of protocols, devices, and work environments.”

Misjudging the type of error—in this case, a slip (find me a hospitalist who doesn’t know total hip arthroplasty requires thrombophrophylaxis)—and misapplying corrective actions will have little to no effect on outcomes. Thus, pay-withholding schemes can have a negative net effect by diverting resources from QI projects that truly improve patient outcomes.

Withholding payment in this case generates approximately $160 in direct savings to the payor (assuming Medicare payments for one 99233 and two 99232 subsequent care visits), yet the operational costs are not negligible and must be factored into the equation. The payor needs to first determine who is truly at fault: the hospitalist or the orthopedic surgeon. Answering that question requires the payor to review the co-management agreement, perhaps aided by an attorney. That’s a costly endeavor.

For the sake of argument, let’s assume in this case the hospitalist is at fault. The next step is determining if the hospitalist who failed to prescribe prophylaxis prior to the PE is the same hospitalist caring for the patient after the PE. It is inappropriate to withhold payment to hospitalist A if hospitalist B made the error. Again, significant manpower will be required to determine fault, as this is not information one finds on a UB-04 claim form submitted to Medicare.

Further eroding the $160 savings is the cost of determining whether a contraindication exists: Bleeding ulcer? Subdural hematoma? Heparinoid allergy? Let us not forget the additional costs in copying, shipping, warehousing, and eventual shredding of the records. One can readily see that the operational costs can quickly negate the $160 anticipated savings. In fact, it’s likely a negative return on investment.

Clearly, withholding payment in this scenario is an ineffective mechanism for improving quality or decreasing cost. I am not generally a proponent of rewarding failure, and perhaps as we usher in a new era of healthcare reform, the system will be redesigned in such a way that better aligns quality and cost-control measures. However, under the current system, payment denial as outlined above likely does more harm than good.

CON

Withhold payment when medical errors are easily identifiable

When I first learned of the proposal to withhold Medicare payment for hospital-acquired conditions (HACs), I had mixed emotions. On the one hand, I firmly believe that physicians should be accountable for their work; on the other hand, this policy seems to conflict sharply with the “no blame” mantra that has been prevalent in patient safety for more than a decade.2 More recently, though, many have argued for balancing the pursuit of system fixes for quality and patient-safety issues with the development of a culture of accountability.3

In theory, the HACs should meet the following criteria: They should be high-cost conditions, high-volume conditions, or both; they should be identifiable through ICD-9-CM coding as complicating conditions (CCs) or major complicating conditions (MCCs) that result in a higher-paying MS-DRG; and they should be reasonably preventable through the application of evidence-based guidelines. Some HACs are jaw-dropping lapses in care (e.g., leaving foreign bodies in during surgery). Other HACs seem to me to be much less preventable, especially fall injuries and catheter-associated urinary tract infections (UTIs). Several experts have written eloquently regarding the limitations of these new measures, particularly emphasizing the potential for increased administrative burden on hospitals and the potential for unintended consequences.4,5

However, in the case described above involving a hospitalist, I have no reservations in limiting payment to the provider. To me, failing to prescribe VTE prophylaxis in an elderly, immobilized, post-op hip replacement patient with a CHF exacerbation is the hospitalist’s equivalent to a surgeon leaving behind a sponge in an appendectomy. It also meets the elements outlined in the HAC withholding program:

- It is high-cost. The 2007 MS-DRG payment for elective hip arthroplasty was $9,863, but adding an MCC increased that cost by one-third.6

- It is readily identifiable, though one concern might be that hospitals would perform unnecessary pre-operative testing to identify asymptomatic DVT, incurring increased testing and treatment costs and increasing the incidence of bleeding complications.

- It is very preventable. Without thromboprophylaxis, 40% to 60% of hip arthroplasty patients will develop an asymptomatic DVT, and 1 in 300 will die from a PE. However, such fatal events are exceedingly rare with appropriate prevention.7

Ultimately, I think a policy of nonpayment for this case keeps with the culture of accountability we need to foster in healthcare. The financial implications of nonpayment will drive hospital innovation and force the hospital to police provider behavior in more effective ways. This is likely to be a painful process, similar to the tribulations experienced with implementing pay-for-performance programs. The Centers for Medicare and Medicaid Services (CMS) needs to be flexible in adding—and removing—new HACs based on good evidence.

Regardless, the goal of achieving a safer, more effective healthcare system remains.

References

- Leape LL. Error in medicine. JAMA. 1994;272(23):1851-1857.

- Institute of Medicine. To Err Is Human: Building a Safer Healthcare System. Washington, D.C.: National Academies Press; 2000.

- Wachter RM, Pronovost PJ. Balancing “no blame” with accountability in patient safety. N Engl J Med. 2009;361:1401-1406.

- Saint S, Meddings JA, Calfee D, Kowalski CP, Krein SL. Catheter-associated urinary tract infection and the Medicare rule changes. Ann Intern Med. 2009;150(12):877-884.

- Inouye SK, Brown CJ, Tinetti ME. Medicare nonpayment, hospital falls, and unintended consequences. N Engl J Med. 2009;360(23):2390-2393.

- Wachter RM, Foster NE, Dudley RA. Medicare’s decision to withhold payment for hospital errors: the devil is in the det. Jt Comm J Qual Patient Saf. 2008;34(2):116-123.

- Geerts WH, Bergqvist D, Pineo GF, et al. Prevention of venous thromboembolism: American College of Chest Physicians Evidence-Based Clinical Practice Guidelines (8th Edition). Chest. 2008;133(6 Suppl):381S-453S.

The opinions expressed herein are those of the authors and do not represent those of SHM or The Hospitalist.

A 72-year-old male with a history of CHF is admitted for elective total hip arthroplasty. On postoperative day one, he develops dyspnea and hypoxia, and is diagnosed with acute pulmonary edema by the hospitalist co-managing his care. Furosemide is prescribed, and he improves, and by day four is ready for discharge following another dose of diuretics. Overnight, he develops acute onset of shortness of breath and is diagnosed with a pulmonary embolism (PE). Under new regulations, the hospital will not be reimbursed for the extra cost associated with subsequent patient care. Should the hospitalist be paid for the subsequent care?

PRO

Nonpayment won’t improve quality or significantly decrease costs

The real essence of the question raised in the clinical case above is “Should doctors profit from errors?” The answer might be “It’s better than the alternative.” Allow me to explain. There essentially are two reasons to withhold payment in this scenario: one, as a mechanism for promoting quality; two, as a mechanism for decreasing costs to the payor.

The quality argument assumes the physician will deliver higher-quality care (i.e., prescribe chemical thromboprophylaxis) if a threat of nonpayment exists. This concept is simply hogwash. If expensive medical malpractice threats fail as quality-improvement (QI) mechanisms, it is absurd to think withholding a few subsequent-care charges will generate better results.

The key issue is the type of error involved. As defined by Lucien Leape, MD, in his celebrated 1994 article on medical errors, “mistakes” reflect failures during attentional behaviors, or incorrect choices.1 “Slips” reflect lapses in concentration. “Slips occur in the face of competing sensory or emotional distractions, fatigue, and stress,” and “reducing the risk of slips requires attention to the designs of protocols, devices, and work environments.”

Misjudging the type of error—in this case, a slip (find me a hospitalist who doesn’t know total hip arthroplasty requires thrombophrophylaxis)—and misapplying corrective actions will have little to no effect on outcomes. Thus, pay-withholding schemes can have a negative net effect by diverting resources from QI projects that truly improve patient outcomes.

Withholding payment in this case generates approximately $160 in direct savings to the payor (assuming Medicare payments for one 99233 and two 99232 subsequent care visits), yet the operational costs are not negligible and must be factored into the equation. The payor needs to first determine who is truly at fault: the hospitalist or the orthopedic surgeon. Answering that question requires the payor to review the co-management agreement, perhaps aided by an attorney. That’s a costly endeavor.

For the sake of argument, let’s assume in this case the hospitalist is at fault. The next step is determining if the hospitalist who failed to prescribe prophylaxis prior to the PE is the same hospitalist caring for the patient after the PE. It is inappropriate to withhold payment to hospitalist A if hospitalist B made the error. Again, significant manpower will be required to determine fault, as this is not information one finds on a UB-04 claim form submitted to Medicare.

Further eroding the $160 savings is the cost of determining whether a contraindication exists: Bleeding ulcer? Subdural hematoma? Heparinoid allergy? Let us not forget the additional costs in copying, shipping, warehousing, and eventual shredding of the records. One can readily see that the operational costs can quickly negate the $160 anticipated savings. In fact, it’s likely a negative return on investment.

Clearly, withholding payment in this scenario is an ineffective mechanism for improving quality or decreasing cost. I am not generally a proponent of rewarding failure, and perhaps as we usher in a new era of healthcare reform, the system will be redesigned in such a way that better aligns quality and cost-control measures. However, under the current system, payment denial as outlined above likely does more harm than good.

CON

Withhold payment when medical errors are easily identifiable

When I first learned of the proposal to withhold Medicare payment for hospital-acquired conditions (HACs), I had mixed emotions. On the one hand, I firmly believe that physicians should be accountable for their work; on the other hand, this policy seems to conflict sharply with the “no blame” mantra that has been prevalent in patient safety for more than a decade.2 More recently, though, many have argued for balancing the pursuit of system fixes for quality and patient-safety issues with the development of a culture of accountability.3

In theory, the HACs should meet the following criteria: They should be high-cost conditions, high-volume conditions, or both; they should be identifiable through ICD-9-CM coding as complicating conditions (CCs) or major complicating conditions (MCCs) that result in a higher-paying MS-DRG; and they should be reasonably preventable through the application of evidence-based guidelines. Some HACs are jaw-dropping lapses in care (e.g., leaving foreign bodies in during surgery). Other HACs seem to me to be much less preventable, especially fall injuries and catheter-associated urinary tract infections (UTIs). Several experts have written eloquently regarding the limitations of these new measures, particularly emphasizing the potential for increased administrative burden on hospitals and the potential for unintended consequences.4,5

However, in the case described above involving a hospitalist, I have no reservations in limiting payment to the provider. To me, failing to prescribe VTE prophylaxis in an elderly, immobilized, post-op hip replacement patient with a CHF exacerbation is the hospitalist’s equivalent to a surgeon leaving behind a sponge in an appendectomy. It also meets the elements outlined in the HAC withholding program:

- It is high-cost. The 2007 MS-DRG payment for elective hip arthroplasty was $9,863, but adding an MCC increased that cost by one-third.6

- It is readily identifiable, though one concern might be that hospitals would perform unnecessary pre-operative testing to identify asymptomatic DVT, incurring increased testing and treatment costs and increasing the incidence of bleeding complications.

- It is very preventable. Without thromboprophylaxis, 40% to 60% of hip arthroplasty patients will develop an asymptomatic DVT, and 1 in 300 will die from a PE. However, such fatal events are exceedingly rare with appropriate prevention.7

Ultimately, I think a policy of nonpayment for this case keeps with the culture of accountability we need to foster in healthcare. The financial implications of nonpayment will drive hospital innovation and force the hospital to police provider behavior in more effective ways. This is likely to be a painful process, similar to the tribulations experienced with implementing pay-for-performance programs. The Centers for Medicare and Medicaid Services (CMS) needs to be flexible in adding—and removing—new HACs based on good evidence.

Regardless, the goal of achieving a safer, more effective healthcare system remains.

References

- Leape LL. Error in medicine. JAMA. 1994;272(23):1851-1857.

- Institute of Medicine. To Err Is Human: Building a Safer Healthcare System. Washington, D.C.: National Academies Press; 2000.

- Wachter RM, Pronovost PJ. Balancing “no blame” with accountability in patient safety. N Engl J Med. 2009;361:1401-1406.

- Saint S, Meddings JA, Calfee D, Kowalski CP, Krein SL. Catheter-associated urinary tract infection and the Medicare rule changes. Ann Intern Med. 2009;150(12):877-884.

- Inouye SK, Brown CJ, Tinetti ME. Medicare nonpayment, hospital falls, and unintended consequences. N Engl J Med. 2009;360(23):2390-2393.

- Wachter RM, Foster NE, Dudley RA. Medicare’s decision to withhold payment for hospital errors: the devil is in the det. Jt Comm J Qual Patient Saf. 2008;34(2):116-123.

- Geerts WH, Bergqvist D, Pineo GF, et al. Prevention of venous thromboembolism: American College of Chest Physicians Evidence-Based Clinical Practice Guidelines (8th Edition). Chest. 2008;133(6 Suppl):381S-453S.

The opinions expressed herein are those of the authors and do not represent those of SHM or The Hospitalist.

A 72-year-old male with a history of CHF is admitted for elective total hip arthroplasty. On postoperative day one, he develops dyspnea and hypoxia, and is diagnosed with acute pulmonary edema by the hospitalist co-managing his care. Furosemide is prescribed, and he improves, and by day four is ready for discharge following another dose of diuretics. Overnight, he develops acute onset of shortness of breath and is diagnosed with a pulmonary embolism (PE). Under new regulations, the hospital will not be reimbursed for the extra cost associated with subsequent patient care. Should the hospitalist be paid for the subsequent care?

PRO

Nonpayment won’t improve quality or significantly decrease costs

The real essence of the question raised in the clinical case above is “Should doctors profit from errors?” The answer might be “It’s better than the alternative.” Allow me to explain. There essentially are two reasons to withhold payment in this scenario: one, as a mechanism for promoting quality; two, as a mechanism for decreasing costs to the payor.

The quality argument assumes the physician will deliver higher-quality care (i.e., prescribe chemical thromboprophylaxis) if a threat of nonpayment exists. This concept is simply hogwash. If expensive medical malpractice threats fail as quality-improvement (QI) mechanisms, it is absurd to think withholding a few subsequent-care charges will generate better results.

The key issue is the type of error involved. As defined by Lucien Leape, MD, in his celebrated 1994 article on medical errors, “mistakes” reflect failures during attentional behaviors, or incorrect choices.1 “Slips” reflect lapses in concentration. “Slips occur in the face of competing sensory or emotional distractions, fatigue, and stress,” and “reducing the risk of slips requires attention to the designs of protocols, devices, and work environments.”

Misjudging the type of error—in this case, a slip (find me a hospitalist who doesn’t know total hip arthroplasty requires thrombophrophylaxis)—and misapplying corrective actions will have little to no effect on outcomes. Thus, pay-withholding schemes can have a negative net effect by diverting resources from QI projects that truly improve patient outcomes.

Withholding payment in this case generates approximately $160 in direct savings to the payor (assuming Medicare payments for one 99233 and two 99232 subsequent care visits), yet the operational costs are not negligible and must be factored into the equation. The payor needs to first determine who is truly at fault: the hospitalist or the orthopedic surgeon. Answering that question requires the payor to review the co-management agreement, perhaps aided by an attorney. That’s a costly endeavor.

For the sake of argument, let’s assume in this case the hospitalist is at fault. The next step is determining if the hospitalist who failed to prescribe prophylaxis prior to the PE is the same hospitalist caring for the patient after the PE. It is inappropriate to withhold payment to hospitalist A if hospitalist B made the error. Again, significant manpower will be required to determine fault, as this is not information one finds on a UB-04 claim form submitted to Medicare.

Further eroding the $160 savings is the cost of determining whether a contraindication exists: Bleeding ulcer? Subdural hematoma? Heparinoid allergy? Let us not forget the additional costs in copying, shipping, warehousing, and eventual shredding of the records. One can readily see that the operational costs can quickly negate the $160 anticipated savings. In fact, it’s likely a negative return on investment.

Clearly, withholding payment in this scenario is an ineffective mechanism for improving quality or decreasing cost. I am not generally a proponent of rewarding failure, and perhaps as we usher in a new era of healthcare reform, the system will be redesigned in such a way that better aligns quality and cost-control measures. However, under the current system, payment denial as outlined above likely does more harm than good.

CON

Withhold payment when medical errors are easily identifiable

When I first learned of the proposal to withhold Medicare payment for hospital-acquired conditions (HACs), I had mixed emotions. On the one hand, I firmly believe that physicians should be accountable for their work; on the other hand, this policy seems to conflict sharply with the “no blame” mantra that has been prevalent in patient safety for more than a decade.2 More recently, though, many have argued for balancing the pursuit of system fixes for quality and patient-safety issues with the development of a culture of accountability.3

In theory, the HACs should meet the following criteria: They should be high-cost conditions, high-volume conditions, or both; they should be identifiable through ICD-9-CM coding as complicating conditions (CCs) or major complicating conditions (MCCs) that result in a higher-paying MS-DRG; and they should be reasonably preventable through the application of evidence-based guidelines. Some HACs are jaw-dropping lapses in care (e.g., leaving foreign bodies in during surgery). Other HACs seem to me to be much less preventable, especially fall injuries and catheter-associated urinary tract infections (UTIs). Several experts have written eloquently regarding the limitations of these new measures, particularly emphasizing the potential for increased administrative burden on hospitals and the potential for unintended consequences.4,5

However, in the case described above involving a hospitalist, I have no reservations in limiting payment to the provider. To me, failing to prescribe VTE prophylaxis in an elderly, immobilized, post-op hip replacement patient with a CHF exacerbation is the hospitalist’s equivalent to a surgeon leaving behind a sponge in an appendectomy. It also meets the elements outlined in the HAC withholding program:

- It is high-cost. The 2007 MS-DRG payment for elective hip arthroplasty was $9,863, but adding an MCC increased that cost by one-third.6

- It is readily identifiable, though one concern might be that hospitals would perform unnecessary pre-operative testing to identify asymptomatic DVT, incurring increased testing and treatment costs and increasing the incidence of bleeding complications.

- It is very preventable. Without thromboprophylaxis, 40% to 60% of hip arthroplasty patients will develop an asymptomatic DVT, and 1 in 300 will die from a PE. However, such fatal events are exceedingly rare with appropriate prevention.7

Ultimately, I think a policy of nonpayment for this case keeps with the culture of accountability we need to foster in healthcare. The financial implications of nonpayment will drive hospital innovation and force the hospital to police provider behavior in more effective ways. This is likely to be a painful process, similar to the tribulations experienced with implementing pay-for-performance programs. The Centers for Medicare and Medicaid Services (CMS) needs to be flexible in adding—and removing—new HACs based on good evidence.

Regardless, the goal of achieving a safer, more effective healthcare system remains.

References

- Leape LL. Error in medicine. JAMA. 1994;272(23):1851-1857.

- Institute of Medicine. To Err Is Human: Building a Safer Healthcare System. Washington, D.C.: National Academies Press; 2000.

- Wachter RM, Pronovost PJ. Balancing “no blame” with accountability in patient safety. N Engl J Med. 2009;361:1401-1406.

- Saint S, Meddings JA, Calfee D, Kowalski CP, Krein SL. Catheter-associated urinary tract infection and the Medicare rule changes. Ann Intern Med. 2009;150(12):877-884.

- Inouye SK, Brown CJ, Tinetti ME. Medicare nonpayment, hospital falls, and unintended consequences. N Engl J Med. 2009;360(23):2390-2393.

- Wachter RM, Foster NE, Dudley RA. Medicare’s decision to withhold payment for hospital errors: the devil is in the det. Jt Comm J Qual Patient Saf. 2008;34(2):116-123.

- Geerts WH, Bergqvist D, Pineo GF, et al. Prevention of venous thromboembolism: American College of Chest Physicians Evidence-Based Clinical Practice Guidelines (8th Edition). Chest. 2008;133(6 Suppl):381S-453S.

The opinions expressed herein are those of the authors and do not represent those of SHM or The Hospitalist.

Admit Documentation

In light of the recent elimination of consultation codes from the Medicare Physician Fee Schedule, physicians of all specialties are being asked to report initial hospital care services (99221-99223) for their first encounter with a patient.1 This leaves hospitalists with questions about the billing and financial implications of reporting admissions services.

Here’s a typical scenario: Dr. A admits a Medicare patient to the hospital from the ED for hyperglycemia and dehydration in the setting of uncontrolled diabetes. He performs and documents an initial hospital-care service on day one of the admission. On day two, another hospitalist, Dr. B, who works in the same HM group, sees the patient for the first time. What should each of the physicians report for their first encounter with the patient?

Each hospitalist should select the CPT code that best fits the service and their role in the case. Remember, only one physician is named “attending of record” or “admitting physician.”

When billing during the course of the hospitalization, consider all physicians of the same specialty in the same provider group as the “admitting physician/group.”

Admissions Service

On day one, Dr. A admits the patient. He performs and documents a comprehensive history, a comprehensive exam, and medical decision-making of high complexity. The documentation corresponds to the highest initial admission service, 99223. Given the recent Medicare billing changes, the attending of record is required to append modifier “AI” (principal physician of record) to the admission service (e.g., 99223-AI).

The purpose of this modifier is “to identify the physician who oversees the patient’s care from all other physicians who may be furnishing specialty care.”2 This modifier has no financial implications. It does not increase or decrease the payment associated with the reported visit level (i.e., 99223 is reimbursed at a national rate of approximately $190, with or without modifier AI).

Initial Encounter by Team Members

As previously stated, the elimination of consultation services requires physicians to report their initial hospital encounter with an initial hospital-care code (i.e., 99221-99223). However, Medicare states that “physicians in the same group practice who are in the same specialty must bill and be paid as though they were a single physician.”3 This means followup services performed on days subsequent to a group member’s initial admission service must be reported with subsequent hospital-care codes (99231-99233). Therefore, in the scenario above, Dr. B is obligated to report the appropriate subsequent hospital-care code for his patient encounter on day two.

Incomplete Documentation

Initial hospital-care services (99221-99223) require the physician to obtain, perform, and document the necessary elements of history, physical exam, and medical decision-making in support of the code reported on the claim. There are occasions when the physician’s documentation does not support the lowest code (i.e., 99221). A reasonable approach is to report the service with an unlisted E&M code (99499). “Unlisted” codes do not have a payor-recognized code description or fee. When reporting an unlisted code, the biller must manually enter a charge description (e.g., expanded problem-focused admissions service) and a fee. A payor-prompted request for documentation is likely before payment is made.

Some payors have more specific references to the situation and allow for options. Two options exist for coding services that do not meet the work and/or medical necessity requirements of 99221-99223: report an unlisted E&M service (99499); or report a subsequent hospital care code (99231-99233) that appropriately reflects physician work and medical necessity for the service, and avoids mandatory medical record submission and manual medical review.4

In fact, Medicare Administrator Contractor TrailBlazer Health’s Web site (www.trailblazerhealth.com) offers guidance to physicians who are unsure if subsequent hospital care is an appropriate choice for this dilemma: “TrailBlazer recognizes provider reluctance to miscode initial hospital care as subsequent hospital care. However, doing so is preferable in that it allows Medicare to process and pay the claims much more efficiently. For those concerned about miscoding these services, please understand that TrailBlazer will not find fault with providers who choose this option when records appropriately demonstrate the work and medical necessity of the subsequent code chosen.”4 TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center, Philadelphia. She also is faculty for SHM’s inpatient coding course.

References

- CMS announces payment, policy changes for physicians services to Medicare beneficiaries in 2010. Centers for Medicare and Medicaid Services Web site. Available at: www.cms.hhs.gov/apps/media/ press/release.asp?Counter=3539&intNumPerPage=10&checkDate=&checkKey=&srchType=1&numDays=3500&srchOpt=0&srchData=&keywordType=All&chkNewsType=1%2C+2%2C+3%2C+4%2C+5&intPage=&showAll=&pYear=&year=&desc=&cboOrder=date. Accessed Nov. 12, 2009.

- Revisions to Consultation Services Payment Policy. Medicare Learning Network Web site. Available at: www.cms.hhs.gov/MLNMattersArticles/downloads/ MM6740.pdf. Accessed Jan. 16, 2010.

- Medicare Claims Processing Manual: Chapter 12, Section 30.6.5. CMS Web site. Available at: www.cms.hhs.gov/manuals/downloads/clm104c12.pdf. Accessed Jan. 16, 2010.

- Update-evaluation and management services formerly coded as consultations. Trailblazer Health Enterprises Web site. Available at: www.trailblazerhealth.com/Tools/Notices.aspx?DomainID=1. Accessed Jan. 17, 2010.

- Beebe M, Dalton J, Espronceda M, Evans D, Glenn R. Current Procedural Terminology Professional Edition. Chicago: American Medical Association Press; 2009;14-15.

In light of the recent elimination of consultation codes from the Medicare Physician Fee Schedule, physicians of all specialties are being asked to report initial hospital care services (99221-99223) for their first encounter with a patient.1 This leaves hospitalists with questions about the billing and financial implications of reporting admissions services.

Here’s a typical scenario: Dr. A admits a Medicare patient to the hospital from the ED for hyperglycemia and dehydration in the setting of uncontrolled diabetes. He performs and documents an initial hospital-care service on day one of the admission. On day two, another hospitalist, Dr. B, who works in the same HM group, sees the patient for the first time. What should each of the physicians report for their first encounter with the patient?

Each hospitalist should select the CPT code that best fits the service and their role in the case. Remember, only one physician is named “attending of record” or “admitting physician.”

When billing during the course of the hospitalization, consider all physicians of the same specialty in the same provider group as the “admitting physician/group.”

Admissions Service

On day one, Dr. A admits the patient. He performs and documents a comprehensive history, a comprehensive exam, and medical decision-making of high complexity. The documentation corresponds to the highest initial admission service, 99223. Given the recent Medicare billing changes, the attending of record is required to append modifier “AI” (principal physician of record) to the admission service (e.g., 99223-AI).

The purpose of this modifier is “to identify the physician who oversees the patient’s care from all other physicians who may be furnishing specialty care.”2 This modifier has no financial implications. It does not increase or decrease the payment associated with the reported visit level (i.e., 99223 is reimbursed at a national rate of approximately $190, with or without modifier AI).

Initial Encounter by Team Members

As previously stated, the elimination of consultation services requires physicians to report their initial hospital encounter with an initial hospital-care code (i.e., 99221-99223). However, Medicare states that “physicians in the same group practice who are in the same specialty must bill and be paid as though they were a single physician.”3 This means followup services performed on days subsequent to a group member’s initial admission service must be reported with subsequent hospital-care codes (99231-99233). Therefore, in the scenario above, Dr. B is obligated to report the appropriate subsequent hospital-care code for his patient encounter on day two.

Incomplete Documentation

Initial hospital-care services (99221-99223) require the physician to obtain, perform, and document the necessary elements of history, physical exam, and medical decision-making in support of the code reported on the claim. There are occasions when the physician’s documentation does not support the lowest code (i.e., 99221). A reasonable approach is to report the service with an unlisted E&M code (99499). “Unlisted” codes do not have a payor-recognized code description or fee. When reporting an unlisted code, the biller must manually enter a charge description (e.g., expanded problem-focused admissions service) and a fee. A payor-prompted request for documentation is likely before payment is made.

Some payors have more specific references to the situation and allow for options. Two options exist for coding services that do not meet the work and/or medical necessity requirements of 99221-99223: report an unlisted E&M service (99499); or report a subsequent hospital care code (99231-99233) that appropriately reflects physician work and medical necessity for the service, and avoids mandatory medical record submission and manual medical review.4

In fact, Medicare Administrator Contractor TrailBlazer Health’s Web site (www.trailblazerhealth.com) offers guidance to physicians who are unsure if subsequent hospital care is an appropriate choice for this dilemma: “TrailBlazer recognizes provider reluctance to miscode initial hospital care as subsequent hospital care. However, doing so is preferable in that it allows Medicare to process and pay the claims much more efficiently. For those concerned about miscoding these services, please understand that TrailBlazer will not find fault with providers who choose this option when records appropriately demonstrate the work and medical necessity of the subsequent code chosen.”4 TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center, Philadelphia. She also is faculty for SHM’s inpatient coding course.

References

- CMS announces payment, policy changes for physicians services to Medicare beneficiaries in 2010. Centers for Medicare and Medicaid Services Web site. Available at: www.cms.hhs.gov/apps/media/ press/release.asp?Counter=3539&intNumPerPage=10&checkDate=&checkKey=&srchType=1&numDays=3500&srchOpt=0&srchData=&keywordType=All&chkNewsType=1%2C+2%2C+3%2C+4%2C+5&intPage=&showAll=&pYear=&year=&desc=&cboOrder=date. Accessed Nov. 12, 2009.

- Revisions to Consultation Services Payment Policy. Medicare Learning Network Web site. Available at: www.cms.hhs.gov/MLNMattersArticles/downloads/ MM6740.pdf. Accessed Jan. 16, 2010.

- Medicare Claims Processing Manual: Chapter 12, Section 30.6.5. CMS Web site. Available at: www.cms.hhs.gov/manuals/downloads/clm104c12.pdf. Accessed Jan. 16, 2010.

- Update-evaluation and management services formerly coded as consultations. Trailblazer Health Enterprises Web site. Available at: www.trailblazerhealth.com/Tools/Notices.aspx?DomainID=1. Accessed Jan. 17, 2010.

- Beebe M, Dalton J, Espronceda M, Evans D, Glenn R. Current Procedural Terminology Professional Edition. Chicago: American Medical Association Press; 2009;14-15.

In light of the recent elimination of consultation codes from the Medicare Physician Fee Schedule, physicians of all specialties are being asked to report initial hospital care services (99221-99223) for their first encounter with a patient.1 This leaves hospitalists with questions about the billing and financial implications of reporting admissions services.

Here’s a typical scenario: Dr. A admits a Medicare patient to the hospital from the ED for hyperglycemia and dehydration in the setting of uncontrolled diabetes. He performs and documents an initial hospital-care service on day one of the admission. On day two, another hospitalist, Dr. B, who works in the same HM group, sees the patient for the first time. What should each of the physicians report for their first encounter with the patient?

Each hospitalist should select the CPT code that best fits the service and their role in the case. Remember, only one physician is named “attending of record” or “admitting physician.”

When billing during the course of the hospitalization, consider all physicians of the same specialty in the same provider group as the “admitting physician/group.”

Admissions Service

On day one, Dr. A admits the patient. He performs and documents a comprehensive history, a comprehensive exam, and medical decision-making of high complexity. The documentation corresponds to the highest initial admission service, 99223. Given the recent Medicare billing changes, the attending of record is required to append modifier “AI” (principal physician of record) to the admission service (e.g., 99223-AI).

The purpose of this modifier is “to identify the physician who oversees the patient’s care from all other physicians who may be furnishing specialty care.”2 This modifier has no financial implications. It does not increase or decrease the payment associated with the reported visit level (i.e., 99223 is reimbursed at a national rate of approximately $190, with or without modifier AI).

Initial Encounter by Team Members

As previously stated, the elimination of consultation services requires physicians to report their initial hospital encounter with an initial hospital-care code (i.e., 99221-99223). However, Medicare states that “physicians in the same group practice who are in the same specialty must bill and be paid as though they were a single physician.”3 This means followup services performed on days subsequent to a group member’s initial admission service must be reported with subsequent hospital-care codes (99231-99233). Therefore, in the scenario above, Dr. B is obligated to report the appropriate subsequent hospital-care code for his patient encounter on day two.

Incomplete Documentation

Initial hospital-care services (99221-99223) require the physician to obtain, perform, and document the necessary elements of history, physical exam, and medical decision-making in support of the code reported on the claim. There are occasions when the physician’s documentation does not support the lowest code (i.e., 99221). A reasonable approach is to report the service with an unlisted E&M code (99499). “Unlisted” codes do not have a payor-recognized code description or fee. When reporting an unlisted code, the biller must manually enter a charge description (e.g., expanded problem-focused admissions service) and a fee. A payor-prompted request for documentation is likely before payment is made.

Some payors have more specific references to the situation and allow for options. Two options exist for coding services that do not meet the work and/or medical necessity requirements of 99221-99223: report an unlisted E&M service (99499); or report a subsequent hospital care code (99231-99233) that appropriately reflects physician work and medical necessity for the service, and avoids mandatory medical record submission and manual medical review.4

In fact, Medicare Administrator Contractor TrailBlazer Health’s Web site (www.trailblazerhealth.com) offers guidance to physicians who are unsure if subsequent hospital care is an appropriate choice for this dilemma: “TrailBlazer recognizes provider reluctance to miscode initial hospital care as subsequent hospital care. However, doing so is preferable in that it allows Medicare to process and pay the claims much more efficiently. For those concerned about miscoding these services, please understand that TrailBlazer will not find fault with providers who choose this option when records appropriately demonstrate the work and medical necessity of the subsequent code chosen.”4 TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center, Philadelphia. She also is faculty for SHM’s inpatient coding course.

References

- CMS announces payment, policy changes for physicians services to Medicare beneficiaries in 2010. Centers for Medicare and Medicaid Services Web site. Available at: www.cms.hhs.gov/apps/media/ press/release.asp?Counter=3539&intNumPerPage=10&checkDate=&checkKey=&srchType=1&numDays=3500&srchOpt=0&srchData=&keywordType=All&chkNewsType=1%2C+2%2C+3%2C+4%2C+5&intPage=&showAll=&pYear=&year=&desc=&cboOrder=date. Accessed Nov. 12, 2009.

- Revisions to Consultation Services Payment Policy. Medicare Learning Network Web site. Available at: www.cms.hhs.gov/MLNMattersArticles/downloads/ MM6740.pdf. Accessed Jan. 16, 2010.

- Medicare Claims Processing Manual: Chapter 12, Section 30.6.5. CMS Web site. Available at: www.cms.hhs.gov/manuals/downloads/clm104c12.pdf. Accessed Jan. 16, 2010.

- Update-evaluation and management services formerly coded as consultations. Trailblazer Health Enterprises Web site. Available at: www.trailblazerhealth.com/Tools/Notices.aspx?DomainID=1. Accessed Jan. 17, 2010.

- Beebe M, Dalton J, Espronceda M, Evans D, Glenn R. Current Procedural Terminology Professional Edition. Chicago: American Medical Association Press; 2009;14-15.

Patient Distribution

Editor’s note: This is the first of a three-part series.

My experience is that some, maybe even most, hospitalists tend to assume there is a standard or “right” way to organize things like work schedules, compensation, or even the assignment of patients among the group’s providers. Some will say things like “SHM says the best hospitalist schedule is …” or “The best way to compensate hospitalists is …”

But there really isn’t a “best” way to manage any particular attribute of a practice. Don’t make the mistake of assuming your method is best, or that it’s the way “everybody else does it.” Although scheduling and compensation are marquee issues for hospitalists, approaches to distributing new patients is much less visible. Many groups tend to assume their method is the only reasonable approach. The best approach, however, varies from one practice to the next. You should be open to hearing approaches to scheduling that are different from your own.

Assign Patients by “Load Leveling”

I’ve come across a lot—and I mean a lot—of different approaches to distributing new patients in HM groups around the country, but it seems pretty clear that the most common method is to undertake “load leveling” on a daily or ongoing basis.

For example, groups that have a separate night shift (the night doctor performs no daytime work the day before or the day after a night shift) typically distribute the night’s new patients with the intent of having each daytime doctor start with the same number of patients. The group might more heavily weight some patients, such as those in the ICU (e.g., each ICU patient counts as 1.5 or two non-ICU patients), but most groups don’t. Over the course of the day shift, new referrals will be distributed evenly among the doctors one at a time, sort of like dealing a deck of cards.

This approach aims to avoid significant imbalances in patient loads and has the potential cultural benefit of everyone sharing equally in busy and slow days. Groups that use it tend to see it as the best option because it is the fairest way to divide up the workload.

Practices that use load-leveling almost always use a schedule built on shifts of a predetermined and fixed duration. For example, say the day shift always works from 7 a.m. to 7 p.m. This schedule usually has the majority of compensation paid via a fixed annual salary or fixed shift rate. One potential problem with this approach is that the doctor who is efficient and discharges a lot of patients today is “rewarded” with more new patients tomorrow. Hospitalists who are allergic to work might have an incentive to have a patient wait until tomorrow to discharge to avoid having to assume the care of yet another patient tomorrow morning. Hospital executives who are focused on length-of-stay management might be concerned if they knew this was a potential issue. Of course, the reverse is true as well. In a practice that doesn’t aggressively undertake load-leveling, a less-than-admirable hospitalist could push patients to discharge earlier than optimal just to have one less patient the next day.

Another cost of this approach is that the distribution of patients can be time-consuming each morning. It also offers the opportunity for some in the group to decide they’re treated unfairly. For instance, you might hear the occasional “just last Tuesday, I started with 16 patients, compared with 15 for everyone else. Now you want me to do it again? You’re being unfair to me; it’s someone else’s turn to take the extra patient.”

Assignment by Location

Groups that use “unit-based” hospitalists distribute patients according to the unit the patient is admitted to—and the hospitalist covering that unit. The pros and cons of unit-based hospitalists are many (see “A Unit-Based Approach,” September 2007), but there is an obvious tension between keeping patient loads even among hospitalists and ensuring that all of a hospitalist’s patients are on “their” unit. Practicality usually requires a compromise between pure unit-based assignment and load-leveling.

Uneven Assignments

Some groups assign patients according to a predetermined algorithm and employ load-leveling only when patient loads become extremely unbalanced. For example, Dr. Jones gets all the new referrals today, and Dr. James gets them tomorrow. The idea is that patient loads end up close to even over time, even if they’re unbalanced on any given day.

A system like this allows everyone, including the hospitalists themselves, ED staff, etc., to know who will take the next patient. It decreases the need to communicate the “who’s next” information time after time during the course of the day. In small- to medium-sized practices, it could mean no one needs to function as the triage doctor (i.e., the person who inefficiently answers the service calls, scribbles down clinical information, then calls the hospitalist who is due to take the next patient and relays all the pertinent patient info). This system allows the

hospitalists to know which days will be harder (e.g., taking on the care of new patients) and which days will be easier (e.g., rounding but not assuming care of new patients). Allowing uneven loads also eliminates the need to spend energy working to even the loads and risking that some in the group feel as if they aren’t being treated fairly.

Uncommon yet Intriguing Approaches

Pair referring primary-care physicians (PCPs) with specific hospitalists. I’ve encountered two groups that had hospitalists always admit patients from the same PCPs. In other words, hospitalist Dr. Hancock always serves as attending for patients referred by the same nine PCPs, and hospitalist Dr. Franklin always attends to patients from a different set of PCPs. It seems to me that there could be tremendous benefit in working closely with the same PCPs, most notably getting to know the PCPs’ office staff. But this system raises the risk of creating out-of-balance patient loads, among other problems. It is really attractive to me, but most groups will decide its costs outweigh its benefits.

Hospitalist and patient stay connected during admission. I’m not aware of any group that uses this method (let me know if you do!), but there could be benefits to having each patient see the same hospitalist during each hospital stay. Of course, that is assuming the hospitalist is on duty. Hospitalist and patient could be paired upon the patient’s first admission. The hospitalist could form an excellent relationship with the patient and family; the time spent by the hospitalist getting to know patients on admission would be reduced, and I suspect there might be some benefit in the quality of care.

This method, however, likely results in the most uneven patient loads, and load-leveling would be difficult, if not impossible. Even if hospitalist and patient did form a tight bond, there is a high probability that the hospitalist would be off for the duration of the patient’s next admission. So despite what I suspect are tremendous benefits, this approach may not be feasible for any group.

In next month’s column, I will discuss issues related to the way patients are distributed. TH

Dr. Nelson has been a practicing hospitalist since 1988 and is co-founder and past president of SHM. He is a principal in Nelson Flores Hospital Medicine Consultants, a national hospitalist practice management consulting firm (www.nelsonflores.com). He is co-director and faculty for SHM’s “Best Practices in Managing a Hospital Medicine Program” course. This column represents his views and is not intended to reflect an official position of SHM.

Editor’s note: This is the first of a three-part series.

My experience is that some, maybe even most, hospitalists tend to assume there is a standard or “right” way to organize things like work schedules, compensation, or even the assignment of patients among the group’s providers. Some will say things like “SHM says the best hospitalist schedule is …” or “The best way to compensate hospitalists is …”

But there really isn’t a “best” way to manage any particular attribute of a practice. Don’t make the mistake of assuming your method is best, or that it’s the way “everybody else does it.” Although scheduling and compensation are marquee issues for hospitalists, approaches to distributing new patients is much less visible. Many groups tend to assume their method is the only reasonable approach. The best approach, however, varies from one practice to the next. You should be open to hearing approaches to scheduling that are different from your own.

Assign Patients by “Load Leveling”

I’ve come across a lot—and I mean a lot—of different approaches to distributing new patients in HM groups around the country, but it seems pretty clear that the most common method is to undertake “load leveling” on a daily or ongoing basis.

For example, groups that have a separate night shift (the night doctor performs no daytime work the day before or the day after a night shift) typically distribute the night’s new patients with the intent of having each daytime doctor start with the same number of patients. The group might more heavily weight some patients, such as those in the ICU (e.g., each ICU patient counts as 1.5 or two non-ICU patients), but most groups don’t. Over the course of the day shift, new referrals will be distributed evenly among the doctors one at a time, sort of like dealing a deck of cards.

This approach aims to avoid significant imbalances in patient loads and has the potential cultural benefit of everyone sharing equally in busy and slow days. Groups that use it tend to see it as the best option because it is the fairest way to divide up the workload.

Practices that use load-leveling almost always use a schedule built on shifts of a predetermined and fixed duration. For example, say the day shift always works from 7 a.m. to 7 p.m. This schedule usually has the majority of compensation paid via a fixed annual salary or fixed shift rate. One potential problem with this approach is that the doctor who is efficient and discharges a lot of patients today is “rewarded” with more new patients tomorrow. Hospitalists who are allergic to work might have an incentive to have a patient wait until tomorrow to discharge to avoid having to assume the care of yet another patient tomorrow morning. Hospital executives who are focused on length-of-stay management might be concerned if they knew this was a potential issue. Of course, the reverse is true as well. In a practice that doesn’t aggressively undertake load-leveling, a less-than-admirable hospitalist could push patients to discharge earlier than optimal just to have one less patient the next day.

Another cost of this approach is that the distribution of patients can be time-consuming each morning. It also offers the opportunity for some in the group to decide they’re treated unfairly. For instance, you might hear the occasional “just last Tuesday, I started with 16 patients, compared with 15 for everyone else. Now you want me to do it again? You’re being unfair to me; it’s someone else’s turn to take the extra patient.”

Assignment by Location

Groups that use “unit-based” hospitalists distribute patients according to the unit the patient is admitted to—and the hospitalist covering that unit. The pros and cons of unit-based hospitalists are many (see “A Unit-Based Approach,” September 2007), but there is an obvious tension between keeping patient loads even among hospitalists and ensuring that all of a hospitalist’s patients are on “their” unit. Practicality usually requires a compromise between pure unit-based assignment and load-leveling.

Uneven Assignments

Some groups assign patients according to a predetermined algorithm and employ load-leveling only when patient loads become extremely unbalanced. For example, Dr. Jones gets all the new referrals today, and Dr. James gets them tomorrow. The idea is that patient loads end up close to even over time, even if they’re unbalanced on any given day.

A system like this allows everyone, including the hospitalists themselves, ED staff, etc., to know who will take the next patient. It decreases the need to communicate the “who’s next” information time after time during the course of the day. In small- to medium-sized practices, it could mean no one needs to function as the triage doctor (i.e., the person who inefficiently answers the service calls, scribbles down clinical information, then calls the hospitalist who is due to take the next patient and relays all the pertinent patient info). This system allows the

hospitalists to know which days will be harder (e.g., taking on the care of new patients) and which days will be easier (e.g., rounding but not assuming care of new patients). Allowing uneven loads also eliminates the need to spend energy working to even the loads and risking that some in the group feel as if they aren’t being treated fairly.

Uncommon yet Intriguing Approaches

Pair referring primary-care physicians (PCPs) with specific hospitalists. I’ve encountered two groups that had hospitalists always admit patients from the same PCPs. In other words, hospitalist Dr. Hancock always serves as attending for patients referred by the same nine PCPs, and hospitalist Dr. Franklin always attends to patients from a different set of PCPs. It seems to me that there could be tremendous benefit in working closely with the same PCPs, most notably getting to know the PCPs’ office staff. But this system raises the risk of creating out-of-balance patient loads, among other problems. It is really attractive to me, but most groups will decide its costs outweigh its benefits.

Hospitalist and patient stay connected during admission. I’m not aware of any group that uses this method (let me know if you do!), but there could be benefits to having each patient see the same hospitalist during each hospital stay. Of course, that is assuming the hospitalist is on duty. Hospitalist and patient could be paired upon the patient’s first admission. The hospitalist could form an excellent relationship with the patient and family; the time spent by the hospitalist getting to know patients on admission would be reduced, and I suspect there might be some benefit in the quality of care.

This method, however, likely results in the most uneven patient loads, and load-leveling would be difficult, if not impossible. Even if hospitalist and patient did form a tight bond, there is a high probability that the hospitalist would be off for the duration of the patient’s next admission. So despite what I suspect are tremendous benefits, this approach may not be feasible for any group.

In next month’s column, I will discuss issues related to the way patients are distributed. TH

Dr. Nelson has been a practicing hospitalist since 1988 and is co-founder and past president of SHM. He is a principal in Nelson Flores Hospital Medicine Consultants, a national hospitalist practice management consulting firm (www.nelsonflores.com). He is co-director and faculty for SHM’s “Best Practices in Managing a Hospital Medicine Program” course. This column represents his views and is not intended to reflect an official position of SHM.

Editor’s note: This is the first of a three-part series.

My experience is that some, maybe even most, hospitalists tend to assume there is a standard or “right” way to organize things like work schedules, compensation, or even the assignment of patients among the group’s providers. Some will say things like “SHM says the best hospitalist schedule is …” or “The best way to compensate hospitalists is …”

But there really isn’t a “best” way to manage any particular attribute of a practice. Don’t make the mistake of assuming your method is best, or that it’s the way “everybody else does it.” Although scheduling and compensation are marquee issues for hospitalists, approaches to distributing new patients is much less visible. Many groups tend to assume their method is the only reasonable approach. The best approach, however, varies from one practice to the next. You should be open to hearing approaches to scheduling that are different from your own.

Assign Patients by “Load Leveling”

I’ve come across a lot—and I mean a lot—of different approaches to distributing new patients in HM groups around the country, but it seems pretty clear that the most common method is to undertake “load leveling” on a daily or ongoing basis.

For example, groups that have a separate night shift (the night doctor performs no daytime work the day before or the day after a night shift) typically distribute the night’s new patients with the intent of having each daytime doctor start with the same number of patients. The group might more heavily weight some patients, such as those in the ICU (e.g., each ICU patient counts as 1.5 or two non-ICU patients), but most groups don’t. Over the course of the day shift, new referrals will be distributed evenly among the doctors one at a time, sort of like dealing a deck of cards.

This approach aims to avoid significant imbalances in patient loads and has the potential cultural benefit of everyone sharing equally in busy and slow days. Groups that use it tend to see it as the best option because it is the fairest way to divide up the workload.

Practices that use load-leveling almost always use a schedule built on shifts of a predetermined and fixed duration. For example, say the day shift always works from 7 a.m. to 7 p.m. This schedule usually has the majority of compensation paid via a fixed annual salary or fixed shift rate. One potential problem with this approach is that the doctor who is efficient and discharges a lot of patients today is “rewarded” with more new patients tomorrow. Hospitalists who are allergic to work might have an incentive to have a patient wait until tomorrow to discharge to avoid having to assume the care of yet another patient tomorrow morning. Hospital executives who are focused on length-of-stay management might be concerned if they knew this was a potential issue. Of course, the reverse is true as well. In a practice that doesn’t aggressively undertake load-leveling, a less-than-admirable hospitalist could push patients to discharge earlier than optimal just to have one less patient the next day.

Another cost of this approach is that the distribution of patients can be time-consuming each morning. It also offers the opportunity for some in the group to decide they’re treated unfairly. For instance, you might hear the occasional “just last Tuesday, I started with 16 patients, compared with 15 for everyone else. Now you want me to do it again? You’re being unfair to me; it’s someone else’s turn to take the extra patient.”

Assignment by Location

Groups that use “unit-based” hospitalists distribute patients according to the unit the patient is admitted to—and the hospitalist covering that unit. The pros and cons of unit-based hospitalists are many (see “A Unit-Based Approach,” September 2007), but there is an obvious tension between keeping patient loads even among hospitalists and ensuring that all of a hospitalist’s patients are on “their” unit. Practicality usually requires a compromise between pure unit-based assignment and load-leveling.

Uneven Assignments

Some groups assign patients according to a predetermined algorithm and employ load-leveling only when patient loads become extremely unbalanced. For example, Dr. Jones gets all the new referrals today, and Dr. James gets them tomorrow. The idea is that patient loads end up close to even over time, even if they’re unbalanced on any given day.

A system like this allows everyone, including the hospitalists themselves, ED staff, etc., to know who will take the next patient. It decreases the need to communicate the “who’s next” information time after time during the course of the day. In small- to medium-sized practices, it could mean no one needs to function as the triage doctor (i.e., the person who inefficiently answers the service calls, scribbles down clinical information, then calls the hospitalist who is due to take the next patient and relays all the pertinent patient info). This system allows the

hospitalists to know which days will be harder (e.g., taking on the care of new patients) and which days will be easier (e.g., rounding but not assuming care of new patients). Allowing uneven loads also eliminates the need to spend energy working to even the loads and risking that some in the group feel as if they aren’t being treated fairly.

Uncommon yet Intriguing Approaches

Pair referring primary-care physicians (PCPs) with specific hospitalists. I’ve encountered two groups that had hospitalists always admit patients from the same PCPs. In other words, hospitalist Dr. Hancock always serves as attending for patients referred by the same nine PCPs, and hospitalist Dr. Franklin always attends to patients from a different set of PCPs. It seems to me that there could be tremendous benefit in working closely with the same PCPs, most notably getting to know the PCPs’ office staff. But this system raises the risk of creating out-of-balance patient loads, among other problems. It is really attractive to me, but most groups will decide its costs outweigh its benefits.

Hospitalist and patient stay connected during admission. I’m not aware of any group that uses this method (let me know if you do!), but there could be benefits to having each patient see the same hospitalist during each hospital stay. Of course, that is assuming the hospitalist is on duty. Hospitalist and patient could be paired upon the patient’s first admission. The hospitalist could form an excellent relationship with the patient and family; the time spent by the hospitalist getting to know patients on admission would be reduced, and I suspect there might be some benefit in the quality of care.

This method, however, likely results in the most uneven patient loads, and load-leveling would be difficult, if not impossible. Even if hospitalist and patient did form a tight bond, there is a high probability that the hospitalist would be off for the duration of the patient’s next admission. So despite what I suspect are tremendous benefits, this approach may not be feasible for any group.

In next month’s column, I will discuss issues related to the way patients are distributed. TH

Dr. Nelson has been a practicing hospitalist since 1988 and is co-founder and past president of SHM. He is a principal in Nelson Flores Hospital Medicine Consultants, a national hospitalist practice management consulting firm (www.nelsonflores.com). He is co-director and faculty for SHM’s “Best Practices in Managing a Hospital Medicine Program” course. This column represents his views and is not intended to reflect an official position of SHM.

Necessary Evil: Change

The amount and complexity of medical knowledge we need to keep up with is changing and growing at a remarkable rate. I was trained in an era in which it was taken as a given that congestive heart failure patients should not receive beta-blockers; now it is a big mistake if we don’t prescribe them in most cases. But even before starting medical school, most of us realize that things will change a lot, and many of us see that as a good thing. It keeps our work interesting. Just recently, our hospital had a guest speaker who talked about potential medical applications of nanotechnology. It was way over my head, but it sounded pretty cool.

While I was prepared for ongoing changes in medical knowledge, I failed to anticipate how quickly the business of medicine would change during my career. I think the need to keep up with ever-increasing financial and regulatory issues siphons a lot of time and energy that could be used to keep up with the medical knowledge base. I wasn’t prepared for this when I started my career.

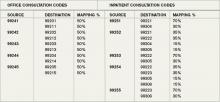

Because it is the start of a new year, I thought I would highlight one issue related to CPT coding: Medicare stopped recognizing consult codes as of Jan. 1 (see “Consultation Elimination,” p. 31).

What It Means for Hospitalists

The good news is that we can just use initial hospital visit codes, inpatient or observation, for all new visits. For example, it won’t matter anymore whether I’m admitting and serving as attending for a patient, or whether a surgeon admitted the patient and asked me to consult for preoperative medical evaluation (“clearance”). I should use the same CPT code in either situation, simply appending a modifier if I’m the admitting physician. And for billing purposes, we won’t have to worry about documenting which doctor requested that we see the patient, though it is a good idea to document it as part of the clinical record anyway.

But it gets a little more complicated. The codes aren’t going away or being removed from the CPT “bible” published by the American Medical Association (AMA). Instead, Medicare simply won’t recognize them anymore. Other payors probably will follow suit within a few months, but that isn’t certain. So it is possible that when asked by a surgeon to provide a preoperative evaluation, you will need to bill an initial hospital (or office or nursing facility) care visit if the patient is on Medicare but bill a consult code if the patient has other insurance. You should check with your billers to ensure you’re doing this correctly.

Medicare-paid consults are at a slightly higher rate than the equivalent service billed as initial hospital care (e.g., when the hospitalist is attending). So a higher reimbursing code has been replaced with one that pays a little less. For example, a 99253 consultation code requires a detailed history, detailed examination, and medical decision-making of low complexity; last year, 99253 was reimbursed by Medicare at an average rate of $114.69. The equivalent admission code for a detailed history, detailed examination, and low-complexity medical decision-making is a 99221 code, for which Medicare pays about $99.90. This represents a difference of about 14%.

However, the net financial impact of this change probably will be positive for most HM groups because you probably bill very few initial consult codes, and instead were stuck billing a follow-up visit code when seeing co-management “consults” (i.e., a patient admitted by a surgeon who asks you to follow and manage diabetes and other medical issues). Now, at least in the case of Medicare, it is appropriate for us to bill an initial hospital visit code, which provides significantly higher reimbursement than follow-up codes.

In addition, there is a modest (about 0.3%) proposed increase in work relative value units attached to the initial hospital visit codes, which will benefit us not only when we’re consulting, but also when we admit and serve as a patient’s attending.

Some specialists may be less interested in consulting on our patients because the initial visit codes will reimburse a little less than similar consultation codes. I don’t anticipate this will be a significant problem for most of us, particularly since many specialists bill the highest level of consultation code (99255), which pays about the same as the equivalent admission code (99223).

Although I think elimination of the use of consultation codes seems like a reasonable step toward simplifying how hospitalists bill for our services, keeping up with these frequent coding changes requires a high level of diligence on our part, and on the part of our administrative and clerical staffs. And it consumes time and resources that I—and my team—could better spend keeping up with changes in clinical practice.

Perhaps when all the dust settles around the healthcare reform debate, we will begin to move toward new, more creative payment models that will allow us to focus on what we do best. TH

Dr. Nelson has been a practicing hospitalist since 1988 and is cofounder and past president of SHM. He is a principal in Nelson Flores Hospital Medicine Consultants, a national hospitalist practice management consulting firm (www.nelsonflores.com). He is also course co-director and faculty for SHM’s “Best Practices in Managing a Hospital Medicine Program” course. This column represents his views and is not intended to reflect an official position of SHM.

The amount and complexity of medical knowledge we need to keep up with is changing and growing at a remarkable rate. I was trained in an era in which it was taken as a given that congestive heart failure patients should not receive beta-blockers; now it is a big mistake if we don’t prescribe them in most cases. But even before starting medical school, most of us realize that things will change a lot, and many of us see that as a good thing. It keeps our work interesting. Just recently, our hospital had a guest speaker who talked about potential medical applications of nanotechnology. It was way over my head, but it sounded pretty cool.

While I was prepared for ongoing changes in medical knowledge, I failed to anticipate how quickly the business of medicine would change during my career. I think the need to keep up with ever-increasing financial and regulatory issues siphons a lot of time and energy that could be used to keep up with the medical knowledge base. I wasn’t prepared for this when I started my career.

Because it is the start of a new year, I thought I would highlight one issue related to CPT coding: Medicare stopped recognizing consult codes as of Jan. 1 (see “Consultation Elimination,” p. 31).

What It Means for Hospitalists

The good news is that we can just use initial hospital visit codes, inpatient or observation, for all new visits. For example, it won’t matter anymore whether I’m admitting and serving as attending for a patient, or whether a surgeon admitted the patient and asked me to consult for preoperative medical evaluation (“clearance”). I should use the same CPT code in either situation, simply appending a modifier if I’m the admitting physician. And for billing purposes, we won’t have to worry about documenting which doctor requested that we see the patient, though it is a good idea to document it as part of the clinical record anyway.

But it gets a little more complicated. The codes aren’t going away or being removed from the CPT “bible” published by the American Medical Association (AMA). Instead, Medicare simply won’t recognize them anymore. Other payors probably will follow suit within a few months, but that isn’t certain. So it is possible that when asked by a surgeon to provide a preoperative evaluation, you will need to bill an initial hospital (or office or nursing facility) care visit if the patient is on Medicare but bill a consult code if the patient has other insurance. You should check with your billers to ensure you’re doing this correctly.

Medicare-paid consults are at a slightly higher rate than the equivalent service billed as initial hospital care (e.g., when the hospitalist is attending). So a higher reimbursing code has been replaced with one that pays a little less. For example, a 99253 consultation code requires a detailed history, detailed examination, and medical decision-making of low complexity; last year, 99253 was reimbursed by Medicare at an average rate of $114.69. The equivalent admission code for a detailed history, detailed examination, and low-complexity medical decision-making is a 99221 code, for which Medicare pays about $99.90. This represents a difference of about 14%.

However, the net financial impact of this change probably will be positive for most HM groups because you probably bill very few initial consult codes, and instead were stuck billing a follow-up visit code when seeing co-management “consults” (i.e., a patient admitted by a surgeon who asks you to follow and manage diabetes and other medical issues). Now, at least in the case of Medicare, it is appropriate for us to bill an initial hospital visit code, which provides significantly higher reimbursement than follow-up codes.

In addition, there is a modest (about 0.3%) proposed increase in work relative value units attached to the initial hospital visit codes, which will benefit us not only when we’re consulting, but also when we admit and serve as a patient’s attending.

Some specialists may be less interested in consulting on our patients because the initial visit codes will reimburse a little less than similar consultation codes. I don’t anticipate this will be a significant problem for most of us, particularly since many specialists bill the highest level of consultation code (99255), which pays about the same as the equivalent admission code (99223).

Although I think elimination of the use of consultation codes seems like a reasonable step toward simplifying how hospitalists bill for our services, keeping up with these frequent coding changes requires a high level of diligence on our part, and on the part of our administrative and clerical staffs. And it consumes time and resources that I—and my team—could better spend keeping up with changes in clinical practice.

Perhaps when all the dust settles around the healthcare reform debate, we will begin to move toward new, more creative payment models that will allow us to focus on what we do best. TH

Dr. Nelson has been a practicing hospitalist since 1988 and is cofounder and past president of SHM. He is a principal in Nelson Flores Hospital Medicine Consultants, a national hospitalist practice management consulting firm (www.nelsonflores.com). He is also course co-director and faculty for SHM’s “Best Practices in Managing a Hospital Medicine Program” course. This column represents his views and is not intended to reflect an official position of SHM.

The amount and complexity of medical knowledge we need to keep up with is changing and growing at a remarkable rate. I was trained in an era in which it was taken as a given that congestive heart failure patients should not receive beta-blockers; now it is a big mistake if we don’t prescribe them in most cases. But even before starting medical school, most of us realize that things will change a lot, and many of us see that as a good thing. It keeps our work interesting. Just recently, our hospital had a guest speaker who talked about potential medical applications of nanotechnology. It was way over my head, but it sounded pretty cool.

While I was prepared for ongoing changes in medical knowledge, I failed to anticipate how quickly the business of medicine would change during my career. I think the need to keep up with ever-increasing financial and regulatory issues siphons a lot of time and energy that could be used to keep up with the medical knowledge base. I wasn’t prepared for this when I started my career.

Because it is the start of a new year, I thought I would highlight one issue related to CPT coding: Medicare stopped recognizing consult codes as of Jan. 1 (see “Consultation Elimination,” p. 31).

What It Means for Hospitalists

The good news is that we can just use initial hospital visit codes, inpatient or observation, for all new visits. For example, it won’t matter anymore whether I’m admitting and serving as attending for a patient, or whether a surgeon admitted the patient and asked me to consult for preoperative medical evaluation (“clearance”). I should use the same CPT code in either situation, simply appending a modifier if I’m the admitting physician. And for billing purposes, we won’t have to worry about documenting which doctor requested that we see the patient, though it is a good idea to document it as part of the clinical record anyway.