User login

Hospitalists Choose Quality Metrics Most Important to Them

Fantasy sports, hospital medicine, and quality metrics. Those were the unique elements of an RIV poster presented by Noppon Setji, MD, medical director of the Duke University Medical Center’s hospital medicine program in Durham, N.C., at HM15.

Dr. Setji, who participates in a fantasy football league for physicians, says he aimed to apply the approaches of fantasy sports leagues to hospitalist quality metrics.1 Dr. Setji wanted to find a way to recognize high-performing hospitalists in his group on a regular basis, beyond the group metrics that had been reported to faculty members—and to create greater accountability and evaluate physicians’ performance over time.

A team developed a survey instrument compiling common clinical process and outcome measures for hospitalists, and faculty members were asked to rate how important the various metrics were to them individually as indicators of physician performance. Their responses were combined into a weighted, composite hospital medicine provider performance score, which reflects the relative value practicing hospitalists assign to available performance measures. Results are easily tabulated on an Excel spreadsheet, Dr. Setji says.

Every three months—or football quarter—the top overall performer is awarded two bottles of wine and possession of the traveling trophy.

“We’re always looking for ways to measure our performance,” Dr. Setji says, “and we all want to know how we’re doing relative to our peers.”

Reference

- Setji NP, Bae JG, Griffith BC, Daley C. Fantasy physician leagues? Introducing the physician equivalent of the Qbr (Quarterly Metric-Based Rating) [abstract]. J Hosp Med. 2015;10(suppl 2).

Fantasy sports, hospital medicine, and quality metrics. Those were the unique elements of an RIV poster presented by Noppon Setji, MD, medical director of the Duke University Medical Center’s hospital medicine program in Durham, N.C., at HM15.

Dr. Setji, who participates in a fantasy football league for physicians, says he aimed to apply the approaches of fantasy sports leagues to hospitalist quality metrics.1 Dr. Setji wanted to find a way to recognize high-performing hospitalists in his group on a regular basis, beyond the group metrics that had been reported to faculty members—and to create greater accountability and evaluate physicians’ performance over time.

A team developed a survey instrument compiling common clinical process and outcome measures for hospitalists, and faculty members were asked to rate how important the various metrics were to them individually as indicators of physician performance. Their responses were combined into a weighted, composite hospital medicine provider performance score, which reflects the relative value practicing hospitalists assign to available performance measures. Results are easily tabulated on an Excel spreadsheet, Dr. Setji says.

Every three months—or football quarter—the top overall performer is awarded two bottles of wine and possession of the traveling trophy.

“We’re always looking for ways to measure our performance,” Dr. Setji says, “and we all want to know how we’re doing relative to our peers.”

Reference

- Setji NP, Bae JG, Griffith BC, Daley C. Fantasy physician leagues? Introducing the physician equivalent of the Qbr (Quarterly Metric-Based Rating) [abstract]. J Hosp Med. 2015;10(suppl 2).

Fantasy sports, hospital medicine, and quality metrics. Those were the unique elements of an RIV poster presented by Noppon Setji, MD, medical director of the Duke University Medical Center’s hospital medicine program in Durham, N.C., at HM15.

Dr. Setji, who participates in a fantasy football league for physicians, says he aimed to apply the approaches of fantasy sports leagues to hospitalist quality metrics.1 Dr. Setji wanted to find a way to recognize high-performing hospitalists in his group on a regular basis, beyond the group metrics that had been reported to faculty members—and to create greater accountability and evaluate physicians’ performance over time.

A team developed a survey instrument compiling common clinical process and outcome measures for hospitalists, and faculty members were asked to rate how important the various metrics were to them individually as indicators of physician performance. Their responses were combined into a weighted, composite hospital medicine provider performance score, which reflects the relative value practicing hospitalists assign to available performance measures. Results are easily tabulated on an Excel spreadsheet, Dr. Setji says.

Every three months—or football quarter—the top overall performer is awarded two bottles of wine and possession of the traveling trophy.

“We’re always looking for ways to measure our performance,” Dr. Setji says, “and we all want to know how we’re doing relative to our peers.”

Reference

- Setji NP, Bae JG, Griffith BC, Daley C. Fantasy physician leagues? Introducing the physician equivalent of the Qbr (Quarterly Metric-Based Rating) [abstract]. J Hosp Med. 2015;10(suppl 2).

Small Bowel Block in Elderly Merits Full Hospitalization

NEW YORK (Reuters Health) - The "vast majority" of elderly patients admitted with small bowel obstruction (SBO) are hospitalized for more than two days, and the diagnosis alone should allow appropriate Medicare coverage, according to a new study.

In a paper online July 1 in Annals of Surgery, Dr. Zara Cooper, of Brigham and Women's Hospital, Boston, and colleagues noted that their study was prompted by the Two-Midnight Rule established by the Centers for Medicare & Medicaid Services (CMS) in 2013.

The authors explained that if a physician expects a patient to need a hospital stay that crosses two midnights and thus admits the patient, related costs may be covered. However, shorter stays are deemed as observational and can raise the possibility of non-reimbursement for hospitals.

For example, if someone is admitted as an inpatient, but discharged in less than two days, payment will be made only if it can be documented that a longer stay was reasonably expected and unforeseen circumstances led to the shorter stay. Hospital stays that are incorrectly classified or have improperly documented changes in admission status will not be paid.

However, Dr. Cooper told Reuters Health by email, "Older patients with SBO, a very common diagnosis, should be presumed to be admitted for more than two midnights and hospitals should not get penalized."

She and her colleagues pointed out that SBO accounts for about 15% of surgical admissions to U.S. hospitals and more than $1 billion in annual hospital charges. However, diagnosis requires surgeons to observe patients to determine if surgery is warranted.

Thus, the authors wrote, "It is critically important for surgeons to correctly assign admission status for patients with SBO to ensure that hospitals are reimbursed appropriately, and patients are not unduly burdened."

The investigators examined data on 855 older patients admitted with SBO from 2006 and 2013. Of these, 816 (95%) stayed for two midnights or longer. This was true of all patients aged 85 years or older (n=108, approximately 13%).

The only significant difference in clinical characteristics was the presence of inflammatory bowel disease. Of five such patients, only one stayed for less than two midnights.

"Based on our study and others," the investigators wrote, "we propose that hospital admission for SBO in elderly patients is sufficient justification for the reasonable expectation" of the required length of stay for reimbursement.

This also may be true of other conditions. Dr. Cooper concluded, "More studies like this are needed in surgical patients to better understand the impact of CMS admission guidelines. The rule may not make sense in certain populations, leading to heavy and unfair penalties for hospitals."

The authors reported no disclosures.

NEW YORK (Reuters Health) - The "vast majority" of elderly patients admitted with small bowel obstruction (SBO) are hospitalized for more than two days, and the diagnosis alone should allow appropriate Medicare coverage, according to a new study.

In a paper online July 1 in Annals of Surgery, Dr. Zara Cooper, of Brigham and Women's Hospital, Boston, and colleagues noted that their study was prompted by the Two-Midnight Rule established by the Centers for Medicare & Medicaid Services (CMS) in 2013.

The authors explained that if a physician expects a patient to need a hospital stay that crosses two midnights and thus admits the patient, related costs may be covered. However, shorter stays are deemed as observational and can raise the possibility of non-reimbursement for hospitals.

For example, if someone is admitted as an inpatient, but discharged in less than two days, payment will be made only if it can be documented that a longer stay was reasonably expected and unforeseen circumstances led to the shorter stay. Hospital stays that are incorrectly classified or have improperly documented changes in admission status will not be paid.

However, Dr. Cooper told Reuters Health by email, "Older patients with SBO, a very common diagnosis, should be presumed to be admitted for more than two midnights and hospitals should not get penalized."

She and her colleagues pointed out that SBO accounts for about 15% of surgical admissions to U.S. hospitals and more than $1 billion in annual hospital charges. However, diagnosis requires surgeons to observe patients to determine if surgery is warranted.

Thus, the authors wrote, "It is critically important for surgeons to correctly assign admission status for patients with SBO to ensure that hospitals are reimbursed appropriately, and patients are not unduly burdened."

The investigators examined data on 855 older patients admitted with SBO from 2006 and 2013. Of these, 816 (95%) stayed for two midnights or longer. This was true of all patients aged 85 years or older (n=108, approximately 13%).

The only significant difference in clinical characteristics was the presence of inflammatory bowel disease. Of five such patients, only one stayed for less than two midnights.

"Based on our study and others," the investigators wrote, "we propose that hospital admission for SBO in elderly patients is sufficient justification for the reasonable expectation" of the required length of stay for reimbursement.

This also may be true of other conditions. Dr. Cooper concluded, "More studies like this are needed in surgical patients to better understand the impact of CMS admission guidelines. The rule may not make sense in certain populations, leading to heavy and unfair penalties for hospitals."

The authors reported no disclosures.

NEW YORK (Reuters Health) - The "vast majority" of elderly patients admitted with small bowel obstruction (SBO) are hospitalized for more than two days, and the diagnosis alone should allow appropriate Medicare coverage, according to a new study.

In a paper online July 1 in Annals of Surgery, Dr. Zara Cooper, of Brigham and Women's Hospital, Boston, and colleagues noted that their study was prompted by the Two-Midnight Rule established by the Centers for Medicare & Medicaid Services (CMS) in 2013.

The authors explained that if a physician expects a patient to need a hospital stay that crosses two midnights and thus admits the patient, related costs may be covered. However, shorter stays are deemed as observational and can raise the possibility of non-reimbursement for hospitals.

For example, if someone is admitted as an inpatient, but discharged in less than two days, payment will be made only if it can be documented that a longer stay was reasonably expected and unforeseen circumstances led to the shorter stay. Hospital stays that are incorrectly classified or have improperly documented changes in admission status will not be paid.

However, Dr. Cooper told Reuters Health by email, "Older patients with SBO, a very common diagnosis, should be presumed to be admitted for more than two midnights and hospitals should not get penalized."

She and her colleagues pointed out that SBO accounts for about 15% of surgical admissions to U.S. hospitals and more than $1 billion in annual hospital charges. However, diagnosis requires surgeons to observe patients to determine if surgery is warranted.

Thus, the authors wrote, "It is critically important for surgeons to correctly assign admission status for patients with SBO to ensure that hospitals are reimbursed appropriately, and patients are not unduly burdened."

The investigators examined data on 855 older patients admitted with SBO from 2006 and 2013. Of these, 816 (95%) stayed for two midnights or longer. This was true of all patients aged 85 years or older (n=108, approximately 13%).

The only significant difference in clinical characteristics was the presence of inflammatory bowel disease. Of five such patients, only one stayed for less than two midnights.

"Based on our study and others," the investigators wrote, "we propose that hospital admission for SBO in elderly patients is sufficient justification for the reasonable expectation" of the required length of stay for reimbursement.

This also may be true of other conditions. Dr. Cooper concluded, "More studies like this are needed in surgical patients to better understand the impact of CMS admission guidelines. The rule may not make sense in certain populations, leading to heavy and unfair penalties for hospitals."

The authors reported no disclosures.

Drug manufacturers delayed reporting serious unexpected adverse events

Drug manufacturers did not report about 10% of serious and unexpected adverse events to the U.S. Food and Drug Administration within the required time period, investigators reported online in JAMA Internal Medicine.

Moreover, manufacturers were more likely to delay reporting serious and unexpected drug-related deaths than other AEs, said Paul Ma, Ph.D., of the University of Minnesota, Minneapolis, and his associates.

“As the FDA uses this information to update drug warnings, delays in reporting can have important public health consequences, particularly if manufacturers selectively delay reporting based on relevant patient outcomes,” the researchers said. “While increased enforcement may decrease violations, a simple alternative would be to recommend direct submission of reports to the FDA rather than via the manufacturer.”

Health providers and consumers can report adverse events to either drug manufacturers or the FDA under current regulations. Manufacturers have 15 days to forward reports of “expedited” events, defined as both unexpected (not included in the current FDA label) and serious (deaths, life-threatening drug reactions, new or prolonged inpatient hospitalizations, persistent or major disabilities, or birth defects). Although the extent to which drug manufacturers followed the 15-day requirement was unknown, there had been media reports of delays, the researchers noted (JAMA Intern. Med. 2015 July 27 [doi: 10.1001/jamainternmed.2015.3565]).

To better quantify the problem, Dr. Ma and his associates studied expedited AEs reported to the FDA Adverse Event Reporting System between 2004 and June 2014. Among 1.6 million reports, manufacturers failed to report 9.94% within the 15-day window, including more than 40,000 deaths. “Strikingly, AEs with patient death were more likely to be delayed,” added the investigators. “It is possible that manufacturers spend additional time in verifying reports concerning deaths, but this discretion is outside the scope of the current regulatory regime.”

Manufacturers reported about 90% of AEs that did not involve death on time, compared with 88% of those that did involve death. Furthermore, patient death remained linked to delayed reporting after accounting for multiple concurrent prescriptions; who reported the AE to the manufacturer; whether reported electronically or on paper; and the age, sex, and weight of patients.

“Further research is needed to better understand the mechanisms behind the manufacturers’ delayed reporting and the optimal regulatory policy toward mandatory disclosures of AEs,” the researchers concluded.

The Minnesota Accounting Research Center and the National Institute of Aging helped fund the research. The investigators disclosed no conflicts of interest.

“Our awareness of the potential adverse effects (AEs) of newly approved drugs and devices is limited. Premarket trials are often small and of limited duration, and the patients in clinical trials are healthier than unselected patients in routine clinical practice. Thus, the public and physicians rely on the U.S. Food and Drug Administration (FDA) Adverse Event Reporting System to inform us of unknown or unsuspected risks associated with use of drugs and devices.”

“Such reporting delays [as those found in the study] should never occur, as they mean that more patients are exposed to potentially avoidable serious harm, including death. However, no disciplinary actions have been taken when companies fail to submit reports to the FDA in the time frame required. Clearly, the lack of consequences contributes to a lack of deterrence for these illegal and dangerous delays.

“There is another enforcement tool that the FDA could begin to deploy immediately: suspending drug sales or withdrawing drug approval. Federal regulations give the FDA the power to withdraw drug approval ‘if an applicant fails to establish and maintain records and make [timely] reports [as] required under this section.’ One improvement would be for AE reports to go directly to the FDA instead of via the manufacturer, as recommended by” Dr. Ma and his associates.

Dr. Rita F. Redberg is director of women’s cardiovascular services at the Philip R. Lee Institute for Health Policy Studies at the University of California, San Francisco. She reported no conflicts of interest. These comments were taken from her accompanying editorial (JAMA Intern. Med. 2015 July 27 [doi:10.1001/jamainternmed.2015.356]).

“Our awareness of the potential adverse effects (AEs) of newly approved drugs and devices is limited. Premarket trials are often small and of limited duration, and the patients in clinical trials are healthier than unselected patients in routine clinical practice. Thus, the public and physicians rely on the U.S. Food and Drug Administration (FDA) Adverse Event Reporting System to inform us of unknown or unsuspected risks associated with use of drugs and devices.”

“Such reporting delays [as those found in the study] should never occur, as they mean that more patients are exposed to potentially avoidable serious harm, including death. However, no disciplinary actions have been taken when companies fail to submit reports to the FDA in the time frame required. Clearly, the lack of consequences contributes to a lack of deterrence for these illegal and dangerous delays.

“There is another enforcement tool that the FDA could begin to deploy immediately: suspending drug sales or withdrawing drug approval. Federal regulations give the FDA the power to withdraw drug approval ‘if an applicant fails to establish and maintain records and make [timely] reports [as] required under this section.’ One improvement would be for AE reports to go directly to the FDA instead of via the manufacturer, as recommended by” Dr. Ma and his associates.

Dr. Rita F. Redberg is director of women’s cardiovascular services at the Philip R. Lee Institute for Health Policy Studies at the University of California, San Francisco. She reported no conflicts of interest. These comments were taken from her accompanying editorial (JAMA Intern. Med. 2015 July 27 [doi:10.1001/jamainternmed.2015.356]).

“Our awareness of the potential adverse effects (AEs) of newly approved drugs and devices is limited. Premarket trials are often small and of limited duration, and the patients in clinical trials are healthier than unselected patients in routine clinical practice. Thus, the public and physicians rely on the U.S. Food and Drug Administration (FDA) Adverse Event Reporting System to inform us of unknown or unsuspected risks associated with use of drugs and devices.”

“Such reporting delays [as those found in the study] should never occur, as they mean that more patients are exposed to potentially avoidable serious harm, including death. However, no disciplinary actions have been taken when companies fail to submit reports to the FDA in the time frame required. Clearly, the lack of consequences contributes to a lack of deterrence for these illegal and dangerous delays.

“There is another enforcement tool that the FDA could begin to deploy immediately: suspending drug sales or withdrawing drug approval. Federal regulations give the FDA the power to withdraw drug approval ‘if an applicant fails to establish and maintain records and make [timely] reports [as] required under this section.’ One improvement would be for AE reports to go directly to the FDA instead of via the manufacturer, as recommended by” Dr. Ma and his associates.

Dr. Rita F. Redberg is director of women’s cardiovascular services at the Philip R. Lee Institute for Health Policy Studies at the University of California, San Francisco. She reported no conflicts of interest. These comments were taken from her accompanying editorial (JAMA Intern. Med. 2015 July 27 [doi:10.1001/jamainternmed.2015.356]).

Drug manufacturers did not report about 10% of serious and unexpected adverse events to the U.S. Food and Drug Administration within the required time period, investigators reported online in JAMA Internal Medicine.

Moreover, manufacturers were more likely to delay reporting serious and unexpected drug-related deaths than other AEs, said Paul Ma, Ph.D., of the University of Minnesota, Minneapolis, and his associates.

“As the FDA uses this information to update drug warnings, delays in reporting can have important public health consequences, particularly if manufacturers selectively delay reporting based on relevant patient outcomes,” the researchers said. “While increased enforcement may decrease violations, a simple alternative would be to recommend direct submission of reports to the FDA rather than via the manufacturer.”

Health providers and consumers can report adverse events to either drug manufacturers or the FDA under current regulations. Manufacturers have 15 days to forward reports of “expedited” events, defined as both unexpected (not included in the current FDA label) and serious (deaths, life-threatening drug reactions, new or prolonged inpatient hospitalizations, persistent or major disabilities, or birth defects). Although the extent to which drug manufacturers followed the 15-day requirement was unknown, there had been media reports of delays, the researchers noted (JAMA Intern. Med. 2015 July 27 [doi: 10.1001/jamainternmed.2015.3565]).

To better quantify the problem, Dr. Ma and his associates studied expedited AEs reported to the FDA Adverse Event Reporting System between 2004 and June 2014. Among 1.6 million reports, manufacturers failed to report 9.94% within the 15-day window, including more than 40,000 deaths. “Strikingly, AEs with patient death were more likely to be delayed,” added the investigators. “It is possible that manufacturers spend additional time in verifying reports concerning deaths, but this discretion is outside the scope of the current regulatory regime.”

Manufacturers reported about 90% of AEs that did not involve death on time, compared with 88% of those that did involve death. Furthermore, patient death remained linked to delayed reporting after accounting for multiple concurrent prescriptions; who reported the AE to the manufacturer; whether reported electronically or on paper; and the age, sex, and weight of patients.

“Further research is needed to better understand the mechanisms behind the manufacturers’ delayed reporting and the optimal regulatory policy toward mandatory disclosures of AEs,” the researchers concluded.

The Minnesota Accounting Research Center and the National Institute of Aging helped fund the research. The investigators disclosed no conflicts of interest.

Drug manufacturers did not report about 10% of serious and unexpected adverse events to the U.S. Food and Drug Administration within the required time period, investigators reported online in JAMA Internal Medicine.

Moreover, manufacturers were more likely to delay reporting serious and unexpected drug-related deaths than other AEs, said Paul Ma, Ph.D., of the University of Minnesota, Minneapolis, and his associates.

“As the FDA uses this information to update drug warnings, delays in reporting can have important public health consequences, particularly if manufacturers selectively delay reporting based on relevant patient outcomes,” the researchers said. “While increased enforcement may decrease violations, a simple alternative would be to recommend direct submission of reports to the FDA rather than via the manufacturer.”

Health providers and consumers can report adverse events to either drug manufacturers or the FDA under current regulations. Manufacturers have 15 days to forward reports of “expedited” events, defined as both unexpected (not included in the current FDA label) and serious (deaths, life-threatening drug reactions, new or prolonged inpatient hospitalizations, persistent or major disabilities, or birth defects). Although the extent to which drug manufacturers followed the 15-day requirement was unknown, there had been media reports of delays, the researchers noted (JAMA Intern. Med. 2015 July 27 [doi: 10.1001/jamainternmed.2015.3565]).

To better quantify the problem, Dr. Ma and his associates studied expedited AEs reported to the FDA Adverse Event Reporting System between 2004 and June 2014. Among 1.6 million reports, manufacturers failed to report 9.94% within the 15-day window, including more than 40,000 deaths. “Strikingly, AEs with patient death were more likely to be delayed,” added the investigators. “It is possible that manufacturers spend additional time in verifying reports concerning deaths, but this discretion is outside the scope of the current regulatory regime.”

Manufacturers reported about 90% of AEs that did not involve death on time, compared with 88% of those that did involve death. Furthermore, patient death remained linked to delayed reporting after accounting for multiple concurrent prescriptions; who reported the AE to the manufacturer; whether reported electronically or on paper; and the age, sex, and weight of patients.

“Further research is needed to better understand the mechanisms behind the manufacturers’ delayed reporting and the optimal regulatory policy toward mandatory disclosures of AEs,” the researchers concluded.

The Minnesota Accounting Research Center and the National Institute of Aging helped fund the research. The investigators disclosed no conflicts of interest.

FROM JAMA INTERNAL MEDICINE

Key clinical point: Drug manufacturers delayed reporting about 10% of serious unexpected adverse events to the FDA.

Major finding: Manufacturers broke the 15-day deadline for about 10% of such events, and those involving deaths were more likely to be delayed than others.

Data source: Analysis of 1.6 million serious and unexpected AEs reported to the FDA Adverse Event Reporting System between 2004 and June 2014.

Disclosures: The Minnesota Accounting Research Center and the National Institute of Aging helped fund the research. The investigators disclosed no conflicts of interest.

Value-based care poses new legal risks for doctors

The government’s push toward value-based care aims to fix a broken reimbursement system and improve quality of care for patients. But the new payment models also bring new legal risks for physicians, experts and anti-fraud officials warn.

“Novel payment methodologies may present new program integrity vulnerabilities,” Dr. Shantanu Agrawal, director of the Center for Program Integrity at the Centers for Medicare & Medicaid Services, said at a recent American Bar Association meeting. “As they assume financial risk, providers are also assuming program integrity risk. Without adequate controls, provider-run systems may be relatively vulnerable.”

The Department of Health and Human Services plans to have 30% of Medicare payments in value-based payment structures by the end of 2016, and 50% by the end of 2018. The transition will be driven through investments in alternative payment models such as Accountable Care Organizations (ACOs), advanced primary care medical home models, bundled payments models, and integrated care demonstrations for Medicare and Medicaid patients.

At the end of 2014, value-based payments represented 20% of Medicare fee-for-service payments to providers, according to CMS data. The rate was fueled by government programs such as the Medicare Shared Savings Program (MSSP), Pioneer ACOs, the Bundled Payments for Care Improvement Initiative, and the Comprehensive Primary Care Initiative. Meanwhile, HHS is encouraging private payers, marketplace plans, Medicare Advantage plans, and state Medicaid programs to move in the same value-based direction.

With so many new regulations, mandates, and programs coming down the pipeline, physicians are likely not thinking about the legal dangers that may arise with alternative payment structures, said Mark S. Kopson, a health law attorney in Bloomfield Hills, Mich., and chair of the American Health Lawyers Association’s Payers, Plans and Managed Care Practice Group.

Fee-for-service models can involve claims “about excess treatments and unnecessary services to drive up reimbursement,” Mr. Kopson said in an interview. “When you get into these [value-based] types of programs, it’s the exact opposite. The real threat is the withholding of necessary care in order to reduce expenses and therefore drive up those margins for the providers.”

To avoid such claims, physicians should ensure that their charts include the reasoning behind treatment decisions and a thorough record of why certain treatments were chosen and diagnoses were made, Mr. Kopson advised.

“Going forward, your charting better be completely accurate and detailed so that you don’t leave room for the government to make an argument that you should have provided this or that additional treatment,” he said.

Inaccurate reporting of enrollment data or financial information within new payment models could also land doctors in legal trouble, according to CMS officials.

Problematic reports, enrollee data, or other information physicians are required to submit to the government could be considered falsification and lead to False Claims Act violations.

“Providers are responsible for the information reported and should ensure that the appropriate checks and balances are in place that verify data is reported timely and accurately,” Tony A. Salters, a CMS spokesman, said in an interview. “For some models, providers must attest to the accuracy of this data. [To] report inaccurately could result in violations of federal laws.”

Physician-run payment models, such as doctor-led ACOs, may also draw legal scrutiny if physicians fail to prevent bad behavior by de facto partners. Physicians must ensure that all costs claimed by subcontractors, other providers, and suppliers who are paid from or authorized by the provider-run system, have been validated, Mr. Salters said.

“Doctors need to be aware that other entities who become new partners should hold themselves to the same high standards,” he said. “Providers should have basic financial mechanisms in place, with more sophisticated systems requiring more sophisticated methods,” to ensure validation.

CMS officials recommend doctors conduct independent audits of their accounts, manual validation of record system accuracy, and periodic verification of subcontractor claims to confirm the accuracy of claims and costs within new payment models.

These are “all routine steps that practitioners can take in their own offices but which are even more important when the doctor assumes responsibility for a larger scope of services,” Mr. Salters said.

Gaps in documentation surrounding bundled payments can be another legal land mine, Mr. Kopson noted. Adequate records of the care spectrum are essential to prevent accusations that care was not provided during a single episode of care, or over a specific period of time.

“You have to capture and document all the services you are delivering, and have accurate tracking in place for the entire continuum of care,” Mr. Kopson said.

CMS recommends that physicians establish a strong compliance program to assist with anti-fraud controls of new payment systems. When creating or updating a compliance program, government officials said providers should consider the unique characteristics of the model in which they participate.

On Twitter @legal_med

The government’s push toward value-based care aims to fix a broken reimbursement system and improve quality of care for patients. But the new payment models also bring new legal risks for physicians, experts and anti-fraud officials warn.

“Novel payment methodologies may present new program integrity vulnerabilities,” Dr. Shantanu Agrawal, director of the Center for Program Integrity at the Centers for Medicare & Medicaid Services, said at a recent American Bar Association meeting. “As they assume financial risk, providers are also assuming program integrity risk. Without adequate controls, provider-run systems may be relatively vulnerable.”

The Department of Health and Human Services plans to have 30% of Medicare payments in value-based payment structures by the end of 2016, and 50% by the end of 2018. The transition will be driven through investments in alternative payment models such as Accountable Care Organizations (ACOs), advanced primary care medical home models, bundled payments models, and integrated care demonstrations for Medicare and Medicaid patients.

At the end of 2014, value-based payments represented 20% of Medicare fee-for-service payments to providers, according to CMS data. The rate was fueled by government programs such as the Medicare Shared Savings Program (MSSP), Pioneer ACOs, the Bundled Payments for Care Improvement Initiative, and the Comprehensive Primary Care Initiative. Meanwhile, HHS is encouraging private payers, marketplace plans, Medicare Advantage plans, and state Medicaid programs to move in the same value-based direction.

With so many new regulations, mandates, and programs coming down the pipeline, physicians are likely not thinking about the legal dangers that may arise with alternative payment structures, said Mark S. Kopson, a health law attorney in Bloomfield Hills, Mich., and chair of the American Health Lawyers Association’s Payers, Plans and Managed Care Practice Group.

Fee-for-service models can involve claims “about excess treatments and unnecessary services to drive up reimbursement,” Mr. Kopson said in an interview. “When you get into these [value-based] types of programs, it’s the exact opposite. The real threat is the withholding of necessary care in order to reduce expenses and therefore drive up those margins for the providers.”

To avoid such claims, physicians should ensure that their charts include the reasoning behind treatment decisions and a thorough record of why certain treatments were chosen and diagnoses were made, Mr. Kopson advised.

“Going forward, your charting better be completely accurate and detailed so that you don’t leave room for the government to make an argument that you should have provided this or that additional treatment,” he said.

Inaccurate reporting of enrollment data or financial information within new payment models could also land doctors in legal trouble, according to CMS officials.

Problematic reports, enrollee data, or other information physicians are required to submit to the government could be considered falsification and lead to False Claims Act violations.

“Providers are responsible for the information reported and should ensure that the appropriate checks and balances are in place that verify data is reported timely and accurately,” Tony A. Salters, a CMS spokesman, said in an interview. “For some models, providers must attest to the accuracy of this data. [To] report inaccurately could result in violations of federal laws.”

Physician-run payment models, such as doctor-led ACOs, may also draw legal scrutiny if physicians fail to prevent bad behavior by de facto partners. Physicians must ensure that all costs claimed by subcontractors, other providers, and suppliers who are paid from or authorized by the provider-run system, have been validated, Mr. Salters said.

“Doctors need to be aware that other entities who become new partners should hold themselves to the same high standards,” he said. “Providers should have basic financial mechanisms in place, with more sophisticated systems requiring more sophisticated methods,” to ensure validation.

CMS officials recommend doctors conduct independent audits of their accounts, manual validation of record system accuracy, and periodic verification of subcontractor claims to confirm the accuracy of claims and costs within new payment models.

These are “all routine steps that practitioners can take in their own offices but which are even more important when the doctor assumes responsibility for a larger scope of services,” Mr. Salters said.

Gaps in documentation surrounding bundled payments can be another legal land mine, Mr. Kopson noted. Adequate records of the care spectrum are essential to prevent accusations that care was not provided during a single episode of care, or over a specific period of time.

“You have to capture and document all the services you are delivering, and have accurate tracking in place for the entire continuum of care,” Mr. Kopson said.

CMS recommends that physicians establish a strong compliance program to assist with anti-fraud controls of new payment systems. When creating or updating a compliance program, government officials said providers should consider the unique characteristics of the model in which they participate.

On Twitter @legal_med

The government’s push toward value-based care aims to fix a broken reimbursement system and improve quality of care for patients. But the new payment models also bring new legal risks for physicians, experts and anti-fraud officials warn.

“Novel payment methodologies may present new program integrity vulnerabilities,” Dr. Shantanu Agrawal, director of the Center for Program Integrity at the Centers for Medicare & Medicaid Services, said at a recent American Bar Association meeting. “As they assume financial risk, providers are also assuming program integrity risk. Without adequate controls, provider-run systems may be relatively vulnerable.”

The Department of Health and Human Services plans to have 30% of Medicare payments in value-based payment structures by the end of 2016, and 50% by the end of 2018. The transition will be driven through investments in alternative payment models such as Accountable Care Organizations (ACOs), advanced primary care medical home models, bundled payments models, and integrated care demonstrations for Medicare and Medicaid patients.

At the end of 2014, value-based payments represented 20% of Medicare fee-for-service payments to providers, according to CMS data. The rate was fueled by government programs such as the Medicare Shared Savings Program (MSSP), Pioneer ACOs, the Bundled Payments for Care Improvement Initiative, and the Comprehensive Primary Care Initiative. Meanwhile, HHS is encouraging private payers, marketplace plans, Medicare Advantage plans, and state Medicaid programs to move in the same value-based direction.

With so many new regulations, mandates, and programs coming down the pipeline, physicians are likely not thinking about the legal dangers that may arise with alternative payment structures, said Mark S. Kopson, a health law attorney in Bloomfield Hills, Mich., and chair of the American Health Lawyers Association’s Payers, Plans and Managed Care Practice Group.

Fee-for-service models can involve claims “about excess treatments and unnecessary services to drive up reimbursement,” Mr. Kopson said in an interview. “When you get into these [value-based] types of programs, it’s the exact opposite. The real threat is the withholding of necessary care in order to reduce expenses and therefore drive up those margins for the providers.”

To avoid such claims, physicians should ensure that their charts include the reasoning behind treatment decisions and a thorough record of why certain treatments were chosen and diagnoses were made, Mr. Kopson advised.

“Going forward, your charting better be completely accurate and detailed so that you don’t leave room for the government to make an argument that you should have provided this or that additional treatment,” he said.

Inaccurate reporting of enrollment data or financial information within new payment models could also land doctors in legal trouble, according to CMS officials.

Problematic reports, enrollee data, or other information physicians are required to submit to the government could be considered falsification and lead to False Claims Act violations.

“Providers are responsible for the information reported and should ensure that the appropriate checks and balances are in place that verify data is reported timely and accurately,” Tony A. Salters, a CMS spokesman, said in an interview. “For some models, providers must attest to the accuracy of this data. [To] report inaccurately could result in violations of federal laws.”

Physician-run payment models, such as doctor-led ACOs, may also draw legal scrutiny if physicians fail to prevent bad behavior by de facto partners. Physicians must ensure that all costs claimed by subcontractors, other providers, and suppliers who are paid from or authorized by the provider-run system, have been validated, Mr. Salters said.

“Doctors need to be aware that other entities who become new partners should hold themselves to the same high standards,” he said. “Providers should have basic financial mechanisms in place, with more sophisticated systems requiring more sophisticated methods,” to ensure validation.

CMS officials recommend doctors conduct independent audits of their accounts, manual validation of record system accuracy, and periodic verification of subcontractor claims to confirm the accuracy of claims and costs within new payment models.

These are “all routine steps that practitioners can take in their own offices but which are even more important when the doctor assumes responsibility for a larger scope of services,” Mr. Salters said.

Gaps in documentation surrounding bundled payments can be another legal land mine, Mr. Kopson noted. Adequate records of the care spectrum are essential to prevent accusations that care was not provided during a single episode of care, or over a specific period of time.

“You have to capture and document all the services you are delivering, and have accurate tracking in place for the entire continuum of care,” Mr. Kopson said.

CMS recommends that physicians establish a strong compliance program to assist with anti-fraud controls of new payment systems. When creating or updating a compliance program, government officials said providers should consider the unique characteristics of the model in which they participate.

On Twitter @legal_med

Good news, bad news in the Medicare trustees report

As Medicare approaches its 50th anniversary next week, the federal program got some welcome financial news Wednesday: Its giant hospital trust fund will be solvent until 2030, and its long-term outlook has improved, according to a report from the program’s trustees.

But the report warned that several million Medicare beneficiaries could see their Medicare Part B monthly premiums skyrocket by 52% in January – from $104.90 to $159.30. Medicare Part B, which is paid for by a combination of federal funds and beneficiary premiums, generally covers physician and outpatient costs.

The huge rate hike is predicted because of a confluence of two factors: Medicare Part B costs increased more than expected last year, and Social Security is not expected to have a cost of living increase next year. By law, the cost of higher Medicare Part B premiums can’t be passed on to most Medicare beneficiaries when they don’t get a Social Security raise. As a result, the higher Medicare costs have to be covered by just 30% of Medicare beneficiaries. This includes the 2.8 million Medicare enrollees new to the program next year, 3.1 million Medicare beneficiaries with incomes higher than $85,000 a year, and 1.6 million Medicare beneficiaries who pay their premium directly instead of having it deducted from Social Security. An additional 9 million people affected by the higher rates are so called “dual eligibles” – those on Medicare and Medicaid. States pay the Medicare Part B premium for duals.

Medicare Part B premiums are set largely by a complicated formula written into law. The trustees’ predictions on premiums are typically close to the final rates that are announced each fall by the U.S. Department of Health & Human Services.

HHS Secretary Sylvia M. Burwell said she will examine her options and make a final decision on rates in October. “Seventy percent of enrollees in Part B will have no change in premiums,” she said at a briefing with other program trustees.

A senior government official, speaking only on background at a Treasury Department briefing on the report, said the projected premium increase in Part B is “atypical” and noted that outpatient health services were among those services that saw higher than expected costs last year. Another senior government official said Ms. Burwell has several “policy options” to lessen the premium increases but would not say what they are.

If the Social Security program determines in the next 2 months that a cost of living increase is needed for next year, that could diminish the premium hikes because they could be spread over millions more beneficiaries. But currently that is not expected.

Medicare advocacy groups expressed concern about the projected rate increase. Judith Stein, executive director of the Center for Medicare Advocacy, said she is concerned the predicted Medicare Part B premium hike signals that, for many, the program is becoming too expensive. She said the higher premiums will force more seniors to join Medicare Advantage, which offers lower costs but also restricts which providers they can use.

“I am concerned that people will start to rail against Medicare rather than love it, as they have for 50 years,” Ms. Stein said.

“We are pleased to see that 70% of people with Medicare are expected to have a stable Part B premium, and it is concerning to us that 30% could see an increase,” said Stacy Sanders, federal policy director at the Medicare Rights Center. “When the final premium amounts are released, we are committed to educating people about their Part B premium, and most importantly, about the potential availability of [programs] that can help with the cost of the Part B premium.”

The possible huge Medicare Part B premium increase overshadowed a generally positive report about the financial health of the Medicare Part A, which covers hospital costs.

The trustees report noted that the financial health of the program is being helped by factors such as an improved economy, while other factors such as more seniors in private Medicare Advantage are increasing costs. The government pays higher costs for those in Medicare Advantage, which is managed care.

While 2030 remained unchanged as the year that the program’s funds would be exhausted, the report said the program’s long-term outlook was improved. That improvement was largely due to assumptions that health costs will grow at a slower rate after 2050.

In 2014, Medicare provided health insurance coverage to 53.8 million people at a cost of $613 billion – roughly the GDP of Argentina. The average value of the Medicare benefit per enrollee was $12,432, about 2% higher than last year.

Medicare turns 50 on July 30 – eligible for its own AARP card – but it is increasingly feeling the strains of retiring baby boomers.

Medicare is adding 10,000 new beneficiaries a day as baby boomers reach age 65. The Obama administration is in the midst of overhauling the way Medicare pays doctors and hospitals to emphasize quality results over the sheer volume of procedures, tests and services. The HHS has set a goal of tying 30% of payments under traditional Medicare to new models of care by the end of 2016 and an increasing share thereafter.

The trustees report also cautioned that the Social Security Disability Insurance program, which covers 11 million people, is projected to become insolvent in the fourth quarter of 2016, unchanged from last year. President Barack Obama has proposed shifting funding from another Social Security trust fund to address the imbalance.

The projected trust fund insolvency doesn’t mean that Medicare is “running out of money.” Even in 2030, when the hospital trust fund is projected for exhaustion, incoming payroll taxes and other revenues will cover 86% of program costs.

The Medicare trustees are Ms. Burwell, Treasury Secretary and Managing Trustee Jacob Lew, Labor Secretary Thomas Perez, and Acting Social Security Commissioner Carolyn Colvin. Two other members are public representatives who are appointed by the president: Charles Blahous III and Robert Reischauer. CMS Acting Administrator Andy Slavitt is designated as secretary of the board.

Kaiser Health News is a nonprofit national health policy news service. KHN’s coverage of aging and long-term care issues is supported in part by a grant from The SCAN Foundation.

As Medicare approaches its 50th anniversary next week, the federal program got some welcome financial news Wednesday: Its giant hospital trust fund will be solvent until 2030, and its long-term outlook has improved, according to a report from the program’s trustees.

But the report warned that several million Medicare beneficiaries could see their Medicare Part B monthly premiums skyrocket by 52% in January – from $104.90 to $159.30. Medicare Part B, which is paid for by a combination of federal funds and beneficiary premiums, generally covers physician and outpatient costs.

The huge rate hike is predicted because of a confluence of two factors: Medicare Part B costs increased more than expected last year, and Social Security is not expected to have a cost of living increase next year. By law, the cost of higher Medicare Part B premiums can’t be passed on to most Medicare beneficiaries when they don’t get a Social Security raise. As a result, the higher Medicare costs have to be covered by just 30% of Medicare beneficiaries. This includes the 2.8 million Medicare enrollees new to the program next year, 3.1 million Medicare beneficiaries with incomes higher than $85,000 a year, and 1.6 million Medicare beneficiaries who pay their premium directly instead of having it deducted from Social Security. An additional 9 million people affected by the higher rates are so called “dual eligibles” – those on Medicare and Medicaid. States pay the Medicare Part B premium for duals.

Medicare Part B premiums are set largely by a complicated formula written into law. The trustees’ predictions on premiums are typically close to the final rates that are announced each fall by the U.S. Department of Health & Human Services.

HHS Secretary Sylvia M. Burwell said she will examine her options and make a final decision on rates in October. “Seventy percent of enrollees in Part B will have no change in premiums,” she said at a briefing with other program trustees.

A senior government official, speaking only on background at a Treasury Department briefing on the report, said the projected premium increase in Part B is “atypical” and noted that outpatient health services were among those services that saw higher than expected costs last year. Another senior government official said Ms. Burwell has several “policy options” to lessen the premium increases but would not say what they are.

If the Social Security program determines in the next 2 months that a cost of living increase is needed for next year, that could diminish the premium hikes because they could be spread over millions more beneficiaries. But currently that is not expected.

Medicare advocacy groups expressed concern about the projected rate increase. Judith Stein, executive director of the Center for Medicare Advocacy, said she is concerned the predicted Medicare Part B premium hike signals that, for many, the program is becoming too expensive. She said the higher premiums will force more seniors to join Medicare Advantage, which offers lower costs but also restricts which providers they can use.

“I am concerned that people will start to rail against Medicare rather than love it, as they have for 50 years,” Ms. Stein said.

“We are pleased to see that 70% of people with Medicare are expected to have a stable Part B premium, and it is concerning to us that 30% could see an increase,” said Stacy Sanders, federal policy director at the Medicare Rights Center. “When the final premium amounts are released, we are committed to educating people about their Part B premium, and most importantly, about the potential availability of [programs] that can help with the cost of the Part B premium.”

The possible huge Medicare Part B premium increase overshadowed a generally positive report about the financial health of the Medicare Part A, which covers hospital costs.

The trustees report noted that the financial health of the program is being helped by factors such as an improved economy, while other factors such as more seniors in private Medicare Advantage are increasing costs. The government pays higher costs for those in Medicare Advantage, which is managed care.

While 2030 remained unchanged as the year that the program’s funds would be exhausted, the report said the program’s long-term outlook was improved. That improvement was largely due to assumptions that health costs will grow at a slower rate after 2050.

In 2014, Medicare provided health insurance coverage to 53.8 million people at a cost of $613 billion – roughly the GDP of Argentina. The average value of the Medicare benefit per enrollee was $12,432, about 2% higher than last year.

Medicare turns 50 on July 30 – eligible for its own AARP card – but it is increasingly feeling the strains of retiring baby boomers.

Medicare is adding 10,000 new beneficiaries a day as baby boomers reach age 65. The Obama administration is in the midst of overhauling the way Medicare pays doctors and hospitals to emphasize quality results over the sheer volume of procedures, tests and services. The HHS has set a goal of tying 30% of payments under traditional Medicare to new models of care by the end of 2016 and an increasing share thereafter.

The trustees report also cautioned that the Social Security Disability Insurance program, which covers 11 million people, is projected to become insolvent in the fourth quarter of 2016, unchanged from last year. President Barack Obama has proposed shifting funding from another Social Security trust fund to address the imbalance.

The projected trust fund insolvency doesn’t mean that Medicare is “running out of money.” Even in 2030, when the hospital trust fund is projected for exhaustion, incoming payroll taxes and other revenues will cover 86% of program costs.

The Medicare trustees are Ms. Burwell, Treasury Secretary and Managing Trustee Jacob Lew, Labor Secretary Thomas Perez, and Acting Social Security Commissioner Carolyn Colvin. Two other members are public representatives who are appointed by the president: Charles Blahous III and Robert Reischauer. CMS Acting Administrator Andy Slavitt is designated as secretary of the board.

Kaiser Health News is a nonprofit national health policy news service. KHN’s coverage of aging and long-term care issues is supported in part by a grant from The SCAN Foundation.

As Medicare approaches its 50th anniversary next week, the federal program got some welcome financial news Wednesday: Its giant hospital trust fund will be solvent until 2030, and its long-term outlook has improved, according to a report from the program’s trustees.

But the report warned that several million Medicare beneficiaries could see their Medicare Part B monthly premiums skyrocket by 52% in January – from $104.90 to $159.30. Medicare Part B, which is paid for by a combination of federal funds and beneficiary premiums, generally covers physician and outpatient costs.

The huge rate hike is predicted because of a confluence of two factors: Medicare Part B costs increased more than expected last year, and Social Security is not expected to have a cost of living increase next year. By law, the cost of higher Medicare Part B premiums can’t be passed on to most Medicare beneficiaries when they don’t get a Social Security raise. As a result, the higher Medicare costs have to be covered by just 30% of Medicare beneficiaries. This includes the 2.8 million Medicare enrollees new to the program next year, 3.1 million Medicare beneficiaries with incomes higher than $85,000 a year, and 1.6 million Medicare beneficiaries who pay their premium directly instead of having it deducted from Social Security. An additional 9 million people affected by the higher rates are so called “dual eligibles” – those on Medicare and Medicaid. States pay the Medicare Part B premium for duals.

Medicare Part B premiums are set largely by a complicated formula written into law. The trustees’ predictions on premiums are typically close to the final rates that are announced each fall by the U.S. Department of Health & Human Services.

HHS Secretary Sylvia M. Burwell said she will examine her options and make a final decision on rates in October. “Seventy percent of enrollees in Part B will have no change in premiums,” she said at a briefing with other program trustees.

A senior government official, speaking only on background at a Treasury Department briefing on the report, said the projected premium increase in Part B is “atypical” and noted that outpatient health services were among those services that saw higher than expected costs last year. Another senior government official said Ms. Burwell has several “policy options” to lessen the premium increases but would not say what they are.

If the Social Security program determines in the next 2 months that a cost of living increase is needed for next year, that could diminish the premium hikes because they could be spread over millions more beneficiaries. But currently that is not expected.

Medicare advocacy groups expressed concern about the projected rate increase. Judith Stein, executive director of the Center for Medicare Advocacy, said she is concerned the predicted Medicare Part B premium hike signals that, for many, the program is becoming too expensive. She said the higher premiums will force more seniors to join Medicare Advantage, which offers lower costs but also restricts which providers they can use.

“I am concerned that people will start to rail against Medicare rather than love it, as they have for 50 years,” Ms. Stein said.

“We are pleased to see that 70% of people with Medicare are expected to have a stable Part B premium, and it is concerning to us that 30% could see an increase,” said Stacy Sanders, federal policy director at the Medicare Rights Center. “When the final premium amounts are released, we are committed to educating people about their Part B premium, and most importantly, about the potential availability of [programs] that can help with the cost of the Part B premium.”

The possible huge Medicare Part B premium increase overshadowed a generally positive report about the financial health of the Medicare Part A, which covers hospital costs.

The trustees report noted that the financial health of the program is being helped by factors such as an improved economy, while other factors such as more seniors in private Medicare Advantage are increasing costs. The government pays higher costs for those in Medicare Advantage, which is managed care.

While 2030 remained unchanged as the year that the program’s funds would be exhausted, the report said the program’s long-term outlook was improved. That improvement was largely due to assumptions that health costs will grow at a slower rate after 2050.

In 2014, Medicare provided health insurance coverage to 53.8 million people at a cost of $613 billion – roughly the GDP of Argentina. The average value of the Medicare benefit per enrollee was $12,432, about 2% higher than last year.

Medicare turns 50 on July 30 – eligible for its own AARP card – but it is increasingly feeling the strains of retiring baby boomers.

Medicare is adding 10,000 new beneficiaries a day as baby boomers reach age 65. The Obama administration is in the midst of overhauling the way Medicare pays doctors and hospitals to emphasize quality results over the sheer volume of procedures, tests and services. The HHS has set a goal of tying 30% of payments under traditional Medicare to new models of care by the end of 2016 and an increasing share thereafter.

The trustees report also cautioned that the Social Security Disability Insurance program, which covers 11 million people, is projected to become insolvent in the fourth quarter of 2016, unchanged from last year. President Barack Obama has proposed shifting funding from another Social Security trust fund to address the imbalance.

The projected trust fund insolvency doesn’t mean that Medicare is “running out of money.” Even in 2030, when the hospital trust fund is projected for exhaustion, incoming payroll taxes and other revenues will cover 86% of program costs.

The Medicare trustees are Ms. Burwell, Treasury Secretary and Managing Trustee Jacob Lew, Labor Secretary Thomas Perez, and Acting Social Security Commissioner Carolyn Colvin. Two other members are public representatives who are appointed by the president: Charles Blahous III and Robert Reischauer. CMS Acting Administrator Andy Slavitt is designated as secretary of the board.

Kaiser Health News is a nonprofit national health policy news service. KHN’s coverage of aging and long-term care issues is supported in part by a grant from The SCAN Foundation.

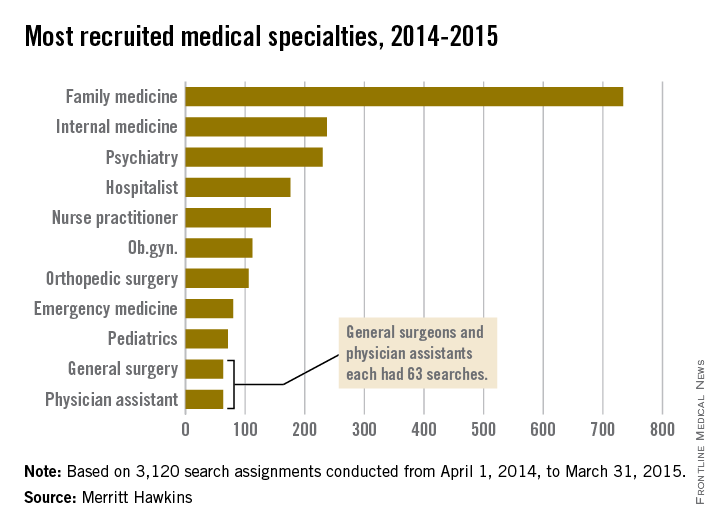

Family medicine most in demand specialty during 2014-2015

For the ninth straight year, family medicine was the most recruited medical specialty, according to a new report from physician job placement firm Merritt Hawkins.

During 2014-2015, there were 734 search assignments performed for doctors in family medicine, nearly one-quarter of the 3,120 total searches conducted during the period from April 1, 2014, to March 31, 2015, according to the company’s 2015 Review of Physician and Advanced Practitioner Recruiting Incentives. No other specialty came close to this number of search requests.

Internal medicine, the other primary care specialty and a nine-year stalwart of the faraway second position, finished the year with 237 recruitments, Merritt Hawkins reported.

Psychiatry was the most recruited non–primary care specialty with 230 searches, falling just short of usurping internal medicine in second place. Other specialty categories with more than 100 recruitments in 2014-2015 were hospital medicine with 176, nurse practitioner with 143, ob.gyn. with 112, and orthopedic surgery with 106.

Demand for primary physicians, NPs, gynecologists, and physicians who work with chronic illness increased from the 2013-2014 period. “Implementation of population health management through integrated systems such as accountable care organizations is likely to keep demand strong for these types of clinicians,” Travis Singleton, senior vice president of Merritt Hawkins, said in a written statement.

Nearly all new employments were done by a hospital or other large employer, and only 5% of recruitment was conducted by private, independent practices, continuing the decline of private practice. Value-based incentives have decreased, with 23% of employers basing the bonus on value, compared with 39% 2 years ago, according to Merritt Hawkins.

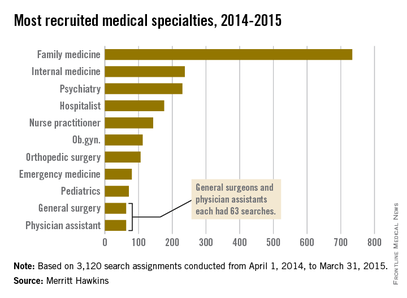

For the ninth straight year, family medicine was the most recruited medical specialty, according to a new report from physician job placement firm Merritt Hawkins.

During 2014-2015, there were 734 search assignments performed for doctors in family medicine, nearly one-quarter of the 3,120 total searches conducted during the period from April 1, 2014, to March 31, 2015, according to the company’s 2015 Review of Physician and Advanced Practitioner Recruiting Incentives. No other specialty came close to this number of search requests.

Internal medicine, the other primary care specialty and a nine-year stalwart of the faraway second position, finished the year with 237 recruitments, Merritt Hawkins reported.

Psychiatry was the most recruited non–primary care specialty with 230 searches, falling just short of usurping internal medicine in second place. Other specialty categories with more than 100 recruitments in 2014-2015 were hospital medicine with 176, nurse practitioner with 143, ob.gyn. with 112, and orthopedic surgery with 106.

Demand for primary physicians, NPs, gynecologists, and physicians who work with chronic illness increased from the 2013-2014 period. “Implementation of population health management through integrated systems such as accountable care organizations is likely to keep demand strong for these types of clinicians,” Travis Singleton, senior vice president of Merritt Hawkins, said in a written statement.

Nearly all new employments were done by a hospital or other large employer, and only 5% of recruitment was conducted by private, independent practices, continuing the decline of private practice. Value-based incentives have decreased, with 23% of employers basing the bonus on value, compared with 39% 2 years ago, according to Merritt Hawkins.

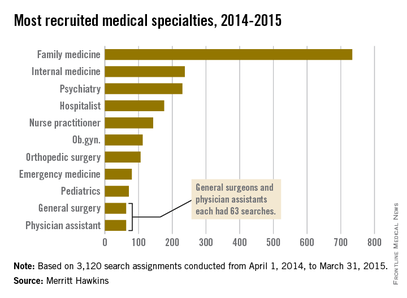

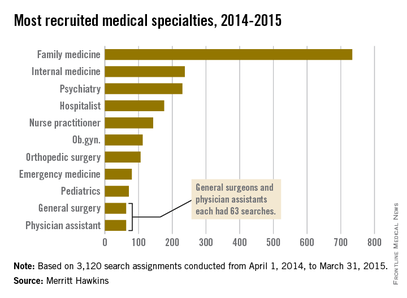

For the ninth straight year, family medicine was the most recruited medical specialty, according to a new report from physician job placement firm Merritt Hawkins.

During 2014-2015, there were 734 search assignments performed for doctors in family medicine, nearly one-quarter of the 3,120 total searches conducted during the period from April 1, 2014, to March 31, 2015, according to the company’s 2015 Review of Physician and Advanced Practitioner Recruiting Incentives. No other specialty came close to this number of search requests.

Internal medicine, the other primary care specialty and a nine-year stalwart of the faraway second position, finished the year with 237 recruitments, Merritt Hawkins reported.

Psychiatry was the most recruited non–primary care specialty with 230 searches, falling just short of usurping internal medicine in second place. Other specialty categories with more than 100 recruitments in 2014-2015 were hospital medicine with 176, nurse practitioner with 143, ob.gyn. with 112, and orthopedic surgery with 106.

Demand for primary physicians, NPs, gynecologists, and physicians who work with chronic illness increased from the 2013-2014 period. “Implementation of population health management through integrated systems such as accountable care organizations is likely to keep demand strong for these types of clinicians,” Travis Singleton, senior vice president of Merritt Hawkins, said in a written statement.

Nearly all new employments were done by a hospital or other large employer, and only 5% of recruitment was conducted by private, independent practices, continuing the decline of private practice. Value-based incentives have decreased, with 23% of employers basing the bonus on value, compared with 39% 2 years ago, according to Merritt Hawkins.

AMA Town Hall: Doctors call for meaningful use delay

Stage 3 of meaningful use should be delayed until Medicare value-based care programs are developed.

To move the Centers for Medicare & Medicaid Services toward that goal, the American Medical Association has created a new website – Break the Red Tape – where physicians can share their good and bad experiences with electronic health records (EHRs) in an effort to help policymakers understand the landscape.

“We want to hear … both what is working so that we can help try to make that happen, but we also need to hear what is not working so that we can send a clear message through our stories, through our real-world experience, to those in policymaking so that they can help us to craft better policies and a better program that will make electronic health records and the policies that the federal government that seek to advance and support the adoption of those tools more effective,” Dr. Stephen Stack, AMA president said July 20 during a town hall event in Atlanta.

At the event, physicians shared how EHRs have affected their practices; many of the comments were negative, though a few bright spots, including electronic prescribing, were highlighted.

Dr. Stack summed up the majority of comments under two key points – usability and interoperability.

“We’ve got to fix the usability, and you all have clearly shown through your stories that information is not being exchanged and that’s not our fault because we didn’t write the code and we didn’t build the wires that connect it,” he said.

Usability issues have translated to decreased productivity, even for those who are experienced in with EHRs. Dr. Melissa Rhodes, a pulmonary, critical care, and sleep physician at Respiratory Consultants of Georgia, said that even though she has been using EHRs since 2006, she still faces a loss of patient care time.

“Every time they have more regulations, more things that I have to answer, takes time away from the patient,” Dr. Rhodes said. She said that she currently sees two-thirds of the patients she could see, and added that she is now asking prospective employees if they know how to type, acknowledging that without that skill, her work flow would be even less productive.

Another comment on usability came from Dr. Albert Johary, a solo-practice internist in Dunwoody, Ga., who has participated in meaningful use for 4 years. He highlighted smoking cessation to illustrate how EHRs are making things more challenging. Prior to EHRs, he would chart that a patient was wanting help to quit smoking and note a prescription for varenicline.

With the EHR he is using now, which he did not identify, he said that he must account for a number of different steps.

“What I’ve started doing is I am doing this in front of the patients,” Dr. Johary said. “I am trying to work with it. I think meaningful use is not necessarily a bad thing,” but even giving notes to a patient is “a four- or five-step process.”

Interoperability “is a major issue” as well, he said, noting that he is part of the Emory Integrated Health Network and now is having to switch EHRs because of the lack of interoperability with the network.

Dr. Stack noted that the AMA supports the alignment of meaningful use with the coming value-based payment reforms. “We do believe that we should pause Stage 3 meaningful use so that it can align with these other new payment delivery models as we go forward,” he said. “We are now going to have the MIPS [Merit-based Incentive Payment System] program, which is going to have meaningful use as a substantial portion of it,” Dr. Stack continued. “We think that the rule making for these two should happen concurrently so that it makes sense when it comes out, not that we do them wrong the first time and have to redo them again to make it all make sense.”

Stage 3 of meaningful use should be delayed until Medicare value-based care programs are developed.

To move the Centers for Medicare & Medicaid Services toward that goal, the American Medical Association has created a new website – Break the Red Tape – where physicians can share their good and bad experiences with electronic health records (EHRs) in an effort to help policymakers understand the landscape.

“We want to hear … both what is working so that we can help try to make that happen, but we also need to hear what is not working so that we can send a clear message through our stories, through our real-world experience, to those in policymaking so that they can help us to craft better policies and a better program that will make electronic health records and the policies that the federal government that seek to advance and support the adoption of those tools more effective,” Dr. Stephen Stack, AMA president said July 20 during a town hall event in Atlanta.

At the event, physicians shared how EHRs have affected their practices; many of the comments were negative, though a few bright spots, including electronic prescribing, were highlighted.

Dr. Stack summed up the majority of comments under two key points – usability and interoperability.

“We’ve got to fix the usability, and you all have clearly shown through your stories that information is not being exchanged and that’s not our fault because we didn’t write the code and we didn’t build the wires that connect it,” he said.

Usability issues have translated to decreased productivity, even for those who are experienced in with EHRs. Dr. Melissa Rhodes, a pulmonary, critical care, and sleep physician at Respiratory Consultants of Georgia, said that even though she has been using EHRs since 2006, she still faces a loss of patient care time.

“Every time they have more regulations, more things that I have to answer, takes time away from the patient,” Dr. Rhodes said. She said that she currently sees two-thirds of the patients she could see, and added that she is now asking prospective employees if they know how to type, acknowledging that without that skill, her work flow would be even less productive.

Another comment on usability came from Dr. Albert Johary, a solo-practice internist in Dunwoody, Ga., who has participated in meaningful use for 4 years. He highlighted smoking cessation to illustrate how EHRs are making things more challenging. Prior to EHRs, he would chart that a patient was wanting help to quit smoking and note a prescription for varenicline.

With the EHR he is using now, which he did not identify, he said that he must account for a number of different steps.

“What I’ve started doing is I am doing this in front of the patients,” Dr. Johary said. “I am trying to work with it. I think meaningful use is not necessarily a bad thing,” but even giving notes to a patient is “a four- or five-step process.”

Interoperability “is a major issue” as well, he said, noting that he is part of the Emory Integrated Health Network and now is having to switch EHRs because of the lack of interoperability with the network.

Dr. Stack noted that the AMA supports the alignment of meaningful use with the coming value-based payment reforms. “We do believe that we should pause Stage 3 meaningful use so that it can align with these other new payment delivery models as we go forward,” he said. “We are now going to have the MIPS [Merit-based Incentive Payment System] program, which is going to have meaningful use as a substantial portion of it,” Dr. Stack continued. “We think that the rule making for these two should happen concurrently so that it makes sense when it comes out, not that we do them wrong the first time and have to redo them again to make it all make sense.”

Stage 3 of meaningful use should be delayed until Medicare value-based care programs are developed.

To move the Centers for Medicare & Medicaid Services toward that goal, the American Medical Association has created a new website – Break the Red Tape – where physicians can share their good and bad experiences with electronic health records (EHRs) in an effort to help policymakers understand the landscape.

“We want to hear … both what is working so that we can help try to make that happen, but we also need to hear what is not working so that we can send a clear message through our stories, through our real-world experience, to those in policymaking so that they can help us to craft better policies and a better program that will make electronic health records and the policies that the federal government that seek to advance and support the adoption of those tools more effective,” Dr. Stephen Stack, AMA president said July 20 during a town hall event in Atlanta.

At the event, physicians shared how EHRs have affected their practices; many of the comments were negative, though a few bright spots, including electronic prescribing, were highlighted.

Dr. Stack summed up the majority of comments under two key points – usability and interoperability.

“We’ve got to fix the usability, and you all have clearly shown through your stories that information is not being exchanged and that’s not our fault because we didn’t write the code and we didn’t build the wires that connect it,” he said.

Usability issues have translated to decreased productivity, even for those who are experienced in with EHRs. Dr. Melissa Rhodes, a pulmonary, critical care, and sleep physician at Respiratory Consultants of Georgia, said that even though she has been using EHRs since 2006, she still faces a loss of patient care time.

“Every time they have more regulations, more things that I have to answer, takes time away from the patient,” Dr. Rhodes said. She said that she currently sees two-thirds of the patients she could see, and added that she is now asking prospective employees if they know how to type, acknowledging that without that skill, her work flow would be even less productive.

Another comment on usability came from Dr. Albert Johary, a solo-practice internist in Dunwoody, Ga., who has participated in meaningful use for 4 years. He highlighted smoking cessation to illustrate how EHRs are making things more challenging. Prior to EHRs, he would chart that a patient was wanting help to quit smoking and note a prescription for varenicline.

With the EHR he is using now, which he did not identify, he said that he must account for a number of different steps.