User login

ObGyns’ choice of practice environment is a big deal

ObGyns are mindfully choosing their practice environments. The trend, as reported by the American College of Obstetricians and Gynecologists (ACOG),1 shows movement from private practice to employment: an increasing number of ObGyns have joined large practices and are employed. Overall, fewer than half of US physicians owned their medical practice in 2016, reported the American Medical Association (AMA).2 This is the first time that the majority of physicians are not practice owners.

Although employed ObGyns earn 9% less than self-employed ObGyns, ($276,000 vs $300,000, respectively), trading a higher salary for less time spent on administrative tasks seems to be worth the pay cut, reports Medscape. Employed ObGyns reported receiving additional benefits that might not have been available to self-employed ObGyns: professional liability coverage, employer-subsidized health and dental insurance, paid time off, and a retirement plan with employer match.3

What matters to ObGyns when choosing a practice setting?

Several decisions about practice setting need to be made at the beginning and throughout a career, among them the type of practice, desired salary, work-life balance, (the latter 2 may be influenced by practice type), and location.

Type of practice

“Patients benefit when physicians practice in settings they find professionally and personally rewarding,” said AMA President Andrew W. Gurman, MD. “The AMA is committed to helping physicians navigate their practice options and offers innovative strategies and resources to ensure physicians in all practice sizes and setting can thrive in the changing health environment.”2

More and more, that environment is a practice wholly owned by physicians. The AMA reports that in 2016, 55.8% of physicians worked in such a practice (including physicians who have an ownership stake in the practice, those who are employed by the practice, and those who are independent contractors).2 An approximate 13.8% of physicians worked at practices with more than 50 physicians in 2016. The majority (57.8%), however, practiced in groups with 10 or fewer physicians. The most common practice type was the single-specialty group (42.8%), followed by the multispecialty group practice (24.6%).2

Paying physicians a salary instead of compensating them based on volume may improve physician satisfaction—it removes the need to deal with complex fee-for-service systems, say Ian Larkin, PhD, and George Loewenstein, PhD. In fee-for-service payment arrangements, physicians may be encouraged to order more tests and procedures because doing so may increase income. A better strategy, say Larkin and Loewenstein, is to switch to a straight salary system. Known for their quality of care and comparatively low costs, the Mayo Clinic, Cleveland Clinic, and Kaiser Permanente have successfully implemented this payment system.4

Related article:

ObGyn salaries jumped in the last year

Desired salary

The mean income for ObGyns rose by 3% in 2016 over 2015 ($286,000 compared with $277,000), according to Medscape.5 This jump follows a gradual increase over the last few years ($249,000 in 2014; $243,000 in 2013; $242,000 in 2012; $220,000 in 2011).1,5,6

The highest earnings among all physicians were orthopedists ($489,000), plastic surgeons ($440,000), and cardiologists ($410,000). Pediatricians were the lowest paid physicians at $202,000.3

Fair compensation. Fewer than half (48%) of ObGyns who completed the Medscape survey felt they were fairly compensated in 2016, and 41% of those who were dissatisfied with their compensation believed they deserved to be earning between 11% and 25% more. When asked if they would still choose medicine, 72% of ObGyns answered affirmatively. Of those who would choose medicine again, 76% would choose obstetrics and gynecology once more.3

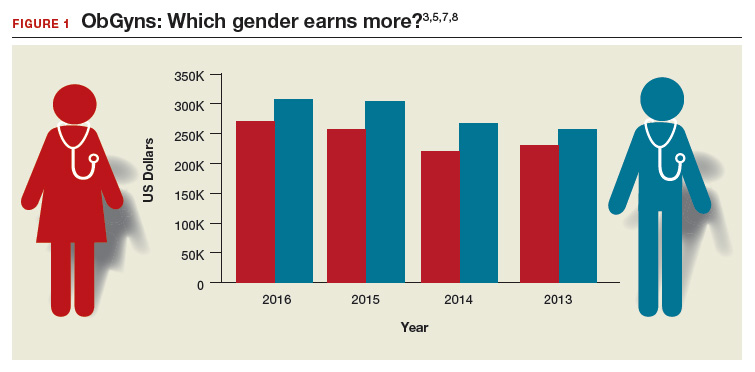

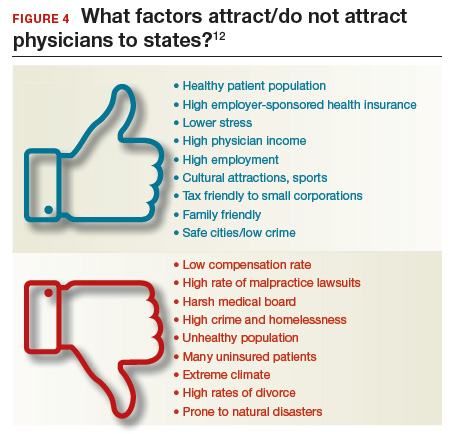

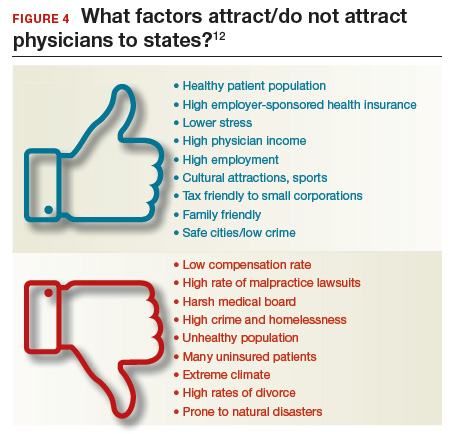

Gender differences. As in years past, full-time male ObGyns reported higher earnings (13%) than female ObGyns ($306,000 vs $270,000, respectively; (FIGURE 1).3,5,7,8

Among ObGyns who responded to the 2017 Medscape survey, 14% of women and 10% of men indicated that they work part-time.3 Last year, 13% of female ObGyns reported part-time employment versus 16% of male ObGyns.6

Among the ObGyns who answered the 2017 survey, there was a gender gap in participation related to race. Although more men than women responded to the survey, more women than men ObGyns among black/African American (women, 78%), Asian (women, 69%), and white/Caucasian (women, 53%) groups responded. Men outweighed women only among Hispanic/Latino ObGyns (60%) who answered the survey.3

Read about work-life balance, job satisfaction, and burnout

Work-life balance

ACOG predicts that mid-career and younger ObGyns will focus on work-life balance issues. Practice sites (ambulatory, hospital, or a combination) that offer part-time schedules or extra time for nonprofessional matters are becoming the most desirable to these practitioners.1

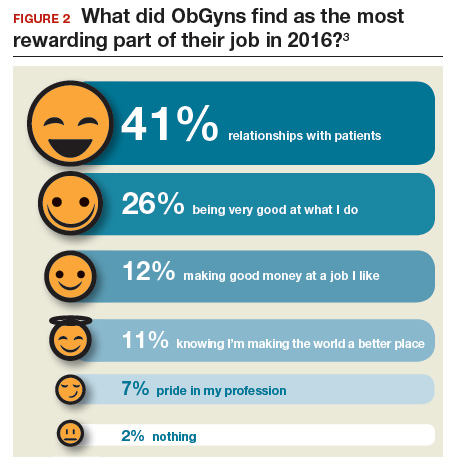

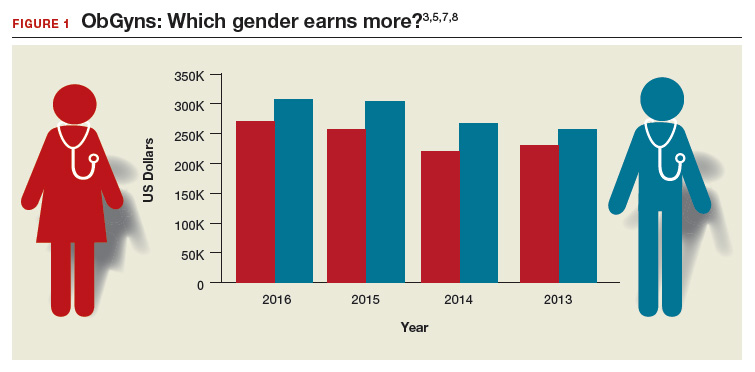

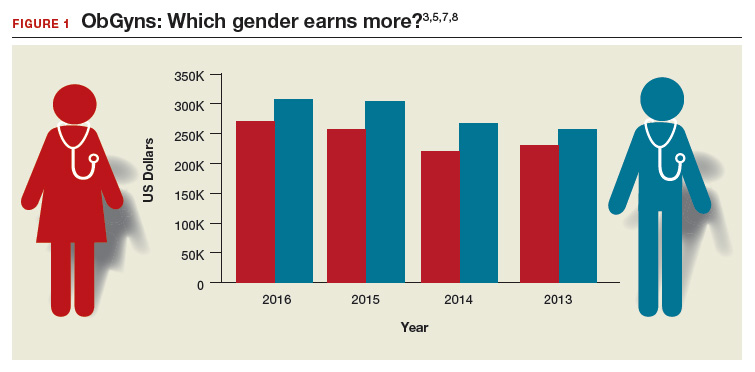

What satisfies and dissatisfies ObGyns? ObGyns reported to Medscape that their relationships with patients (41% of respondents) was the most rewarding part of their job (FIGURE 2).3

There are many job aspects that dissatisfy ObGyns, including1,3,9:

- too many bureaucratic tasks

- the short time allotted for each patient office visit

- electronic health records (EHR) and increased computerization

- not feeling appreciated or properly compensated

- spending too many hours at work

- the impact of regulatory changes on clinical practice.

Bureaucratic tasks remain a primary cause for burnout among all physicians.10 This year, 56% of all physicians reported spending 10 hours or more per week on paperwork and administrative tasks, up from 35% in the 2014 report. More than half (54%) of ObGyns reported spending 10 hours or more on paperwork.3 For every hour of face-to-face patient time, physicians spent nearly 2 additional hours on their EHR and administration tasks.9

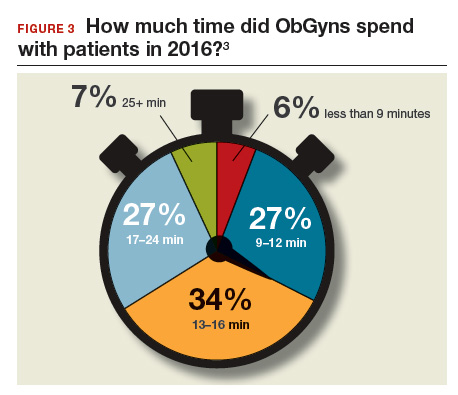

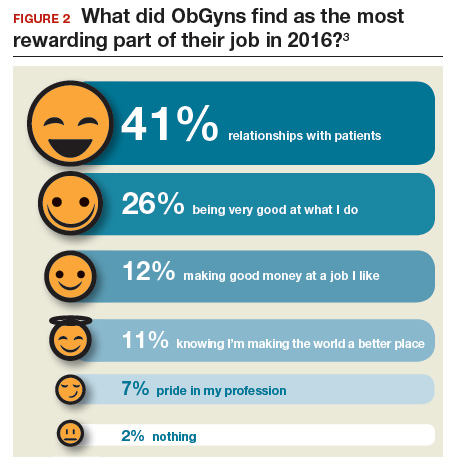

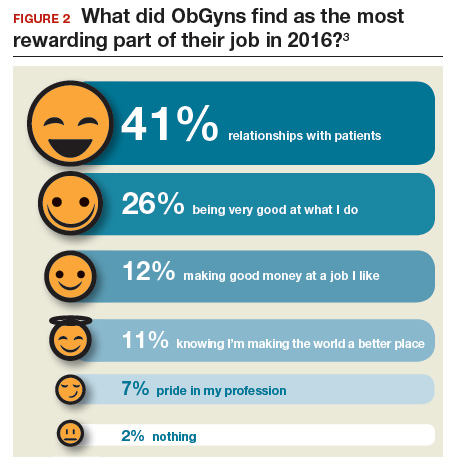

Time with patients. Medscape reported that 38% of ObGyns spent more than 45 hours per week with patients (FIGURE 3).

ACOG notes that ObGyns are increasingly referring patients to subspecialists, which frustrates patients and increases their costs.1

ObGyns rank high in burnout rates. Burnout rates for physicians are twice that of other working adults.1 ObGyns rank second (56%) in burn out (Emergency Medicine, 59%).10 When Medscape survey respondents were asked to grade their burnout level from 1 to 7 (1 = “It does not interfere with my life;” 7 = “It is so severe that I am thinking of leaving medicine altogether”), ObGyns ranked their burnout level at 4.3.10 Female physicians reported a higher percentage of burnout than their male colleagues (55% vs 45%, respectively).10 An estimated 40% to 75% of ObGyns experienced some level of burnout.1

According to ACOG, the specialty is included among the “noncontrollable” lifestyle specialties, especially for those aged 50 years or younger. Many Millennials (born 1980 to 2000) do not view their work and professional achievement as central to their lives; ObGyns aged younger than 35 years want to work fewer hours per week compared with their older colleagues, says ACOG. However, when this option is unavailable, an increasing number of Millennials report lowered job satisfaction.1

Related article:

What can administrators and ObGyns do together to reduce physician burnout?

Mindfulness about quality of life. The relationship of burnout to quality of life issues is gaining in awareness. In a recent

“We need to stop blaming individuals and treat physician burnout as a system issue…If it affects half our physicians, it is indirectly affecting half our patients,” notes Tait Shanafelt, MD, a hematologist and physician-burnout researcher at the Mayo Clinic.9 He says that burnout relates to a physician’s “professional spirit of life, and it primarily affects individuals whose work involves an intense interaction with people.”9

The Mayo Clinic in Minneapolis, Minnesota, has taken a lead in developing a space for their physicians to “reset” by offering a room where health professionals can retreat if they need a moment to recover from a traumatic event.9

Read about what factors attract ObGyns to specific locations

Location, location, location

Specific areas of the country are more attractive for their higher compensation rates. The highest average compensation was reported by ObGyns in the North Central area ($339,000), West ($301,000), and Great Lakes ($297,000) regions, while the lowest compensation rates were found in the Northwest ($260,000), Southwest ($268,000), and South Central ($275,000) areas.3

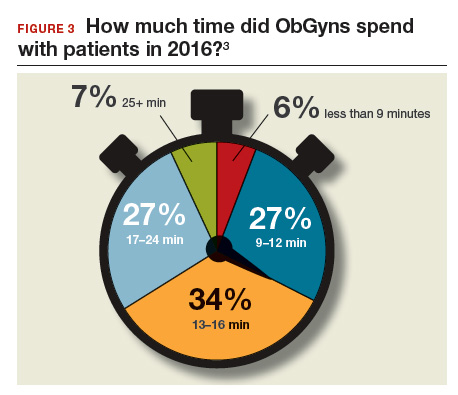

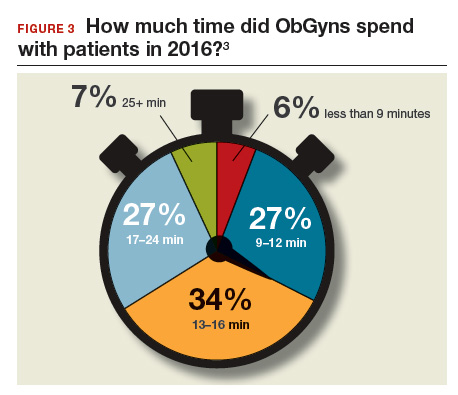

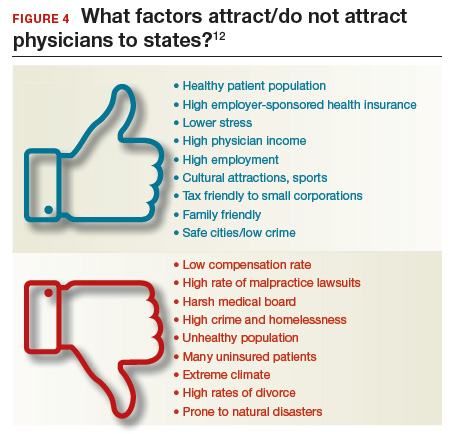

Key factors, such as healthy patient populations, higher rates of health insurance coverage, and lower stress levels attract physicians (FIGURE 4). Minnesota ranked the #1 best place to practice because it has the 4th healthiest population, 2nd highest rate of employer-sponsored health insurance, the 17th lowest number of malpractice lawsuits, and a medical board that is the 3rd least harsh in the nation.12 Unfortunate situations such as the highest malpractice rates per capita, least healthy population, 8th lowest rate of employer-sponsored health insurance, and the 9th lowest compensation rate for physicians make Louisiana the worst place to practice in 2017.12

Supply and demand creates substantial geographic imbalances in the number of ObGyns in the United States. ACOG pro-jects that the need for ObGyns will increase nationally by 6% in the next 10 years, although demand will vary geographically from a 27% increase in Nevada to an 11% decrease in West Virginia.1 Especially vulnerable states (Arizona, Washington, Utah, Idaho) currently have an insufficient supply of ObGyns and are projected to see an increased future demand. Florida, Texas, North Carolina, and Nevada will be at risk, according to ACOG, because the adult female population is expected to increase.1

2017 Medscape survey demographics

The Medscape Compensation Report 2017 is a based on the responses of 19,270 physicians across 27+ specialties, 5% of whom were ObGyns. Data were collected in an online survey conducted from December 20, 2016, to March 7, 2017.3

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

- American Congress of Obstetricians and Gynecologists. The Obstetrician-Gynecologist Workforce in the United States: Facts, Figures, and Implications, 2017. https://www.acog.org/Resources-And-Publications/The-Ob-Gyn-Workforce/The-Obstetrician-Gynecologist-Workforce-in-the-United-States. Accessed June 7, 2017.

- Murphy B. For the first time, physician practice owners are not the majority. AMA Wire. https://wire.ama-assn.org/practice-management/first-time-physician-practice-owners-are-not-majority?utm_source=BulletinHealthCare&utm_medium=email&utm_term=060117&utm_content=general&utm_campaign=article_alert-morning_rounds_daily. Published May 31, 2017. Accessed June 7, 2017.

- Grisham S. Medscape Ob/Gyn Compensation Report 2017. Medscape Website. http://www.medscape.com/slideshow/compensation-2017-ob-gyn-6008576. Published April 12, 2017. Accessed June 7, 2017.

- Larkin I, Loewenstein G. Business model—Related conflict of interests in medicine: Problems and potential solutions. JAMA. 2017;317(17):1745–1746.

- Peckham C. Medscape Ob/Gyn Compensation Report 2016. Medscape Website. http://www.medscape.com/features/slideshow/compensation/2016/womenshealth. Published April 1, 2016. Accessed June 7, 2017.

- Reale D, Christie K. ObGyn salaries jumped in the last year. OBG Manag. 2016;28(7):25–27, 30, 37.

- Peckham C. Medscape Ob/Gyn Compensation Report 2015. Medscape Website. http://www.medscape.com/features/slideshow/compensation/2015/womenshealth. Published April 21, 2015. Accessed July 24, 2017.

- Peckham C. Medscape Ob/Gyn Compensation Report 2014. Medscape Website. http://www.medscape.com/features/slideshow/compensation/2014/womenshealth. Published April 14, 2014. Accessed July 24, 2017.

- Parks T. AMA burnout by specialty. AMA Wire. https://wire.ama-assn.org/life-career/report-reveals-severity-burnout-specialty. Published January 31, 2017. Accessed June 7, 2017.

- Peckham C. Medscape Lifestyle Report 2017: Race and Ethnicity, Bias and Burnout. Medscape Website. http://www.medscape.com/features/slideshow/lifestyle/2017/overview#page=1. Published January 11, 2017. Accessed June 7, 2017.

- DiVenere L. ObGyn burnout: ACOG takes aim. OBG Manag. 2016;28(9):25,30,32,33.

- Page L. Best and Worst Places to Practice 2017. Medscape Website. http://www.medscape.com/slideshow/best-places-to-practice-2017-6008688?src=wnl_physrep_170510_mscpmrk_bestplaces2017&impID=1345406&faf. Published May 10, 2017. Accessed June 7, 2017.

ObGyns are mindfully choosing their practice environments. The trend, as reported by the American College of Obstetricians and Gynecologists (ACOG),1 shows movement from private practice to employment: an increasing number of ObGyns have joined large practices and are employed. Overall, fewer than half of US physicians owned their medical practice in 2016, reported the American Medical Association (AMA).2 This is the first time that the majority of physicians are not practice owners.

Although employed ObGyns earn 9% less than self-employed ObGyns, ($276,000 vs $300,000, respectively), trading a higher salary for less time spent on administrative tasks seems to be worth the pay cut, reports Medscape. Employed ObGyns reported receiving additional benefits that might not have been available to self-employed ObGyns: professional liability coverage, employer-subsidized health and dental insurance, paid time off, and a retirement plan with employer match.3

What matters to ObGyns when choosing a practice setting?

Several decisions about practice setting need to be made at the beginning and throughout a career, among them the type of practice, desired salary, work-life balance, (the latter 2 may be influenced by practice type), and location.

Type of practice

“Patients benefit when physicians practice in settings they find professionally and personally rewarding,” said AMA President Andrew W. Gurman, MD. “The AMA is committed to helping physicians navigate their practice options and offers innovative strategies and resources to ensure physicians in all practice sizes and setting can thrive in the changing health environment.”2

More and more, that environment is a practice wholly owned by physicians. The AMA reports that in 2016, 55.8% of physicians worked in such a practice (including physicians who have an ownership stake in the practice, those who are employed by the practice, and those who are independent contractors).2 An approximate 13.8% of physicians worked at practices with more than 50 physicians in 2016. The majority (57.8%), however, practiced in groups with 10 or fewer physicians. The most common practice type was the single-specialty group (42.8%), followed by the multispecialty group practice (24.6%).2

Paying physicians a salary instead of compensating them based on volume may improve physician satisfaction—it removes the need to deal with complex fee-for-service systems, say Ian Larkin, PhD, and George Loewenstein, PhD. In fee-for-service payment arrangements, physicians may be encouraged to order more tests and procedures because doing so may increase income. A better strategy, say Larkin and Loewenstein, is to switch to a straight salary system. Known for their quality of care and comparatively low costs, the Mayo Clinic, Cleveland Clinic, and Kaiser Permanente have successfully implemented this payment system.4

Related article:

ObGyn salaries jumped in the last year

Desired salary

The mean income for ObGyns rose by 3% in 2016 over 2015 ($286,000 compared with $277,000), according to Medscape.5 This jump follows a gradual increase over the last few years ($249,000 in 2014; $243,000 in 2013; $242,000 in 2012; $220,000 in 2011).1,5,6

The highest earnings among all physicians were orthopedists ($489,000), plastic surgeons ($440,000), and cardiologists ($410,000). Pediatricians were the lowest paid physicians at $202,000.3

Fair compensation. Fewer than half (48%) of ObGyns who completed the Medscape survey felt they were fairly compensated in 2016, and 41% of those who were dissatisfied with their compensation believed they deserved to be earning between 11% and 25% more. When asked if they would still choose medicine, 72% of ObGyns answered affirmatively. Of those who would choose medicine again, 76% would choose obstetrics and gynecology once more.3

Gender differences. As in years past, full-time male ObGyns reported higher earnings (13%) than female ObGyns ($306,000 vs $270,000, respectively; (FIGURE 1).3,5,7,8

Among ObGyns who responded to the 2017 Medscape survey, 14% of women and 10% of men indicated that they work part-time.3 Last year, 13% of female ObGyns reported part-time employment versus 16% of male ObGyns.6

Among the ObGyns who answered the 2017 survey, there was a gender gap in participation related to race. Although more men than women responded to the survey, more women than men ObGyns among black/African American (women, 78%), Asian (women, 69%), and white/Caucasian (women, 53%) groups responded. Men outweighed women only among Hispanic/Latino ObGyns (60%) who answered the survey.3

Read about work-life balance, job satisfaction, and burnout

Work-life balance

ACOG predicts that mid-career and younger ObGyns will focus on work-life balance issues. Practice sites (ambulatory, hospital, or a combination) that offer part-time schedules or extra time for nonprofessional matters are becoming the most desirable to these practitioners.1

What satisfies and dissatisfies ObGyns? ObGyns reported to Medscape that their relationships with patients (41% of respondents) was the most rewarding part of their job (FIGURE 2).3

There are many job aspects that dissatisfy ObGyns, including1,3,9:

- too many bureaucratic tasks

- the short time allotted for each patient office visit

- electronic health records (EHR) and increased computerization

- not feeling appreciated or properly compensated

- spending too many hours at work

- the impact of regulatory changes on clinical practice.

Bureaucratic tasks remain a primary cause for burnout among all physicians.10 This year, 56% of all physicians reported spending 10 hours or more per week on paperwork and administrative tasks, up from 35% in the 2014 report. More than half (54%) of ObGyns reported spending 10 hours or more on paperwork.3 For every hour of face-to-face patient time, physicians spent nearly 2 additional hours on their EHR and administration tasks.9

Time with patients. Medscape reported that 38% of ObGyns spent more than 45 hours per week with patients (FIGURE 3).

ACOG notes that ObGyns are increasingly referring patients to subspecialists, which frustrates patients and increases their costs.1

ObGyns rank high in burnout rates. Burnout rates for physicians are twice that of other working adults.1 ObGyns rank second (56%) in burn out (Emergency Medicine, 59%).10 When Medscape survey respondents were asked to grade their burnout level from 1 to 7 (1 = “It does not interfere with my life;” 7 = “It is so severe that I am thinking of leaving medicine altogether”), ObGyns ranked their burnout level at 4.3.10 Female physicians reported a higher percentage of burnout than their male colleagues (55% vs 45%, respectively).10 An estimated 40% to 75% of ObGyns experienced some level of burnout.1

According to ACOG, the specialty is included among the “noncontrollable” lifestyle specialties, especially for those aged 50 years or younger. Many Millennials (born 1980 to 2000) do not view their work and professional achievement as central to their lives; ObGyns aged younger than 35 years want to work fewer hours per week compared with their older colleagues, says ACOG. However, when this option is unavailable, an increasing number of Millennials report lowered job satisfaction.1

Related article:

What can administrators and ObGyns do together to reduce physician burnout?

Mindfulness about quality of life. The relationship of burnout to quality of life issues is gaining in awareness. In a recent

“We need to stop blaming individuals and treat physician burnout as a system issue…If it affects half our physicians, it is indirectly affecting half our patients,” notes Tait Shanafelt, MD, a hematologist and physician-burnout researcher at the Mayo Clinic.9 He says that burnout relates to a physician’s “professional spirit of life, and it primarily affects individuals whose work involves an intense interaction with people.”9

The Mayo Clinic in Minneapolis, Minnesota, has taken a lead in developing a space for their physicians to “reset” by offering a room where health professionals can retreat if they need a moment to recover from a traumatic event.9

Read about what factors attract ObGyns to specific locations

Location, location, location

Specific areas of the country are more attractive for their higher compensation rates. The highest average compensation was reported by ObGyns in the North Central area ($339,000), West ($301,000), and Great Lakes ($297,000) regions, while the lowest compensation rates were found in the Northwest ($260,000), Southwest ($268,000), and South Central ($275,000) areas.3

Key factors, such as healthy patient populations, higher rates of health insurance coverage, and lower stress levels attract physicians (FIGURE 4). Minnesota ranked the #1 best place to practice because it has the 4th healthiest population, 2nd highest rate of employer-sponsored health insurance, the 17th lowest number of malpractice lawsuits, and a medical board that is the 3rd least harsh in the nation.12 Unfortunate situations such as the highest malpractice rates per capita, least healthy population, 8th lowest rate of employer-sponsored health insurance, and the 9th lowest compensation rate for physicians make Louisiana the worst place to practice in 2017.12

Supply and demand creates substantial geographic imbalances in the number of ObGyns in the United States. ACOG pro-jects that the need for ObGyns will increase nationally by 6% in the next 10 years, although demand will vary geographically from a 27% increase in Nevada to an 11% decrease in West Virginia.1 Especially vulnerable states (Arizona, Washington, Utah, Idaho) currently have an insufficient supply of ObGyns and are projected to see an increased future demand. Florida, Texas, North Carolina, and Nevada will be at risk, according to ACOG, because the adult female population is expected to increase.1

2017 Medscape survey demographics

The Medscape Compensation Report 2017 is a based on the responses of 19,270 physicians across 27+ specialties, 5% of whom were ObGyns. Data were collected in an online survey conducted from December 20, 2016, to March 7, 2017.3

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

ObGyns are mindfully choosing their practice environments. The trend, as reported by the American College of Obstetricians and Gynecologists (ACOG),1 shows movement from private practice to employment: an increasing number of ObGyns have joined large practices and are employed. Overall, fewer than half of US physicians owned their medical practice in 2016, reported the American Medical Association (AMA).2 This is the first time that the majority of physicians are not practice owners.

Although employed ObGyns earn 9% less than self-employed ObGyns, ($276,000 vs $300,000, respectively), trading a higher salary for less time spent on administrative tasks seems to be worth the pay cut, reports Medscape. Employed ObGyns reported receiving additional benefits that might not have been available to self-employed ObGyns: professional liability coverage, employer-subsidized health and dental insurance, paid time off, and a retirement plan with employer match.3

What matters to ObGyns when choosing a practice setting?

Several decisions about practice setting need to be made at the beginning and throughout a career, among them the type of practice, desired salary, work-life balance, (the latter 2 may be influenced by practice type), and location.

Type of practice

“Patients benefit when physicians practice in settings they find professionally and personally rewarding,” said AMA President Andrew W. Gurman, MD. “The AMA is committed to helping physicians navigate their practice options and offers innovative strategies and resources to ensure physicians in all practice sizes and setting can thrive in the changing health environment.”2

More and more, that environment is a practice wholly owned by physicians. The AMA reports that in 2016, 55.8% of physicians worked in such a practice (including physicians who have an ownership stake in the practice, those who are employed by the practice, and those who are independent contractors).2 An approximate 13.8% of physicians worked at practices with more than 50 physicians in 2016. The majority (57.8%), however, practiced in groups with 10 or fewer physicians. The most common practice type was the single-specialty group (42.8%), followed by the multispecialty group practice (24.6%).2

Paying physicians a salary instead of compensating them based on volume may improve physician satisfaction—it removes the need to deal with complex fee-for-service systems, say Ian Larkin, PhD, and George Loewenstein, PhD. In fee-for-service payment arrangements, physicians may be encouraged to order more tests and procedures because doing so may increase income. A better strategy, say Larkin and Loewenstein, is to switch to a straight salary system. Known for their quality of care and comparatively low costs, the Mayo Clinic, Cleveland Clinic, and Kaiser Permanente have successfully implemented this payment system.4

Related article:

ObGyn salaries jumped in the last year

Desired salary

The mean income for ObGyns rose by 3% in 2016 over 2015 ($286,000 compared with $277,000), according to Medscape.5 This jump follows a gradual increase over the last few years ($249,000 in 2014; $243,000 in 2013; $242,000 in 2012; $220,000 in 2011).1,5,6

The highest earnings among all physicians were orthopedists ($489,000), plastic surgeons ($440,000), and cardiologists ($410,000). Pediatricians were the lowest paid physicians at $202,000.3

Fair compensation. Fewer than half (48%) of ObGyns who completed the Medscape survey felt they were fairly compensated in 2016, and 41% of those who were dissatisfied with their compensation believed they deserved to be earning between 11% and 25% more. When asked if they would still choose medicine, 72% of ObGyns answered affirmatively. Of those who would choose medicine again, 76% would choose obstetrics and gynecology once more.3

Gender differences. As in years past, full-time male ObGyns reported higher earnings (13%) than female ObGyns ($306,000 vs $270,000, respectively; (FIGURE 1).3,5,7,8

Among ObGyns who responded to the 2017 Medscape survey, 14% of women and 10% of men indicated that they work part-time.3 Last year, 13% of female ObGyns reported part-time employment versus 16% of male ObGyns.6

Among the ObGyns who answered the 2017 survey, there was a gender gap in participation related to race. Although more men than women responded to the survey, more women than men ObGyns among black/African American (women, 78%), Asian (women, 69%), and white/Caucasian (women, 53%) groups responded. Men outweighed women only among Hispanic/Latino ObGyns (60%) who answered the survey.3

Read about work-life balance, job satisfaction, and burnout

Work-life balance

ACOG predicts that mid-career and younger ObGyns will focus on work-life balance issues. Practice sites (ambulatory, hospital, or a combination) that offer part-time schedules or extra time for nonprofessional matters are becoming the most desirable to these practitioners.1

What satisfies and dissatisfies ObGyns? ObGyns reported to Medscape that their relationships with patients (41% of respondents) was the most rewarding part of their job (FIGURE 2).3

There are many job aspects that dissatisfy ObGyns, including1,3,9:

- too many bureaucratic tasks

- the short time allotted for each patient office visit

- electronic health records (EHR) and increased computerization

- not feeling appreciated or properly compensated

- spending too many hours at work

- the impact of regulatory changes on clinical practice.

Bureaucratic tasks remain a primary cause for burnout among all physicians.10 This year, 56% of all physicians reported spending 10 hours or more per week on paperwork and administrative tasks, up from 35% in the 2014 report. More than half (54%) of ObGyns reported spending 10 hours or more on paperwork.3 For every hour of face-to-face patient time, physicians spent nearly 2 additional hours on their EHR and administration tasks.9

Time with patients. Medscape reported that 38% of ObGyns spent more than 45 hours per week with patients (FIGURE 3).

ACOG notes that ObGyns are increasingly referring patients to subspecialists, which frustrates patients and increases their costs.1

ObGyns rank high in burnout rates. Burnout rates for physicians are twice that of other working adults.1 ObGyns rank second (56%) in burn out (Emergency Medicine, 59%).10 When Medscape survey respondents were asked to grade their burnout level from 1 to 7 (1 = “It does not interfere with my life;” 7 = “It is so severe that I am thinking of leaving medicine altogether”), ObGyns ranked their burnout level at 4.3.10 Female physicians reported a higher percentage of burnout than their male colleagues (55% vs 45%, respectively).10 An estimated 40% to 75% of ObGyns experienced some level of burnout.1

According to ACOG, the specialty is included among the “noncontrollable” lifestyle specialties, especially for those aged 50 years or younger. Many Millennials (born 1980 to 2000) do not view their work and professional achievement as central to their lives; ObGyns aged younger than 35 years want to work fewer hours per week compared with their older colleagues, says ACOG. However, when this option is unavailable, an increasing number of Millennials report lowered job satisfaction.1

Related article:

What can administrators and ObGyns do together to reduce physician burnout?

Mindfulness about quality of life. The relationship of burnout to quality of life issues is gaining in awareness. In a recent

“We need to stop blaming individuals and treat physician burnout as a system issue…If it affects half our physicians, it is indirectly affecting half our patients,” notes Tait Shanafelt, MD, a hematologist and physician-burnout researcher at the Mayo Clinic.9 He says that burnout relates to a physician’s “professional spirit of life, and it primarily affects individuals whose work involves an intense interaction with people.”9

The Mayo Clinic in Minneapolis, Minnesota, has taken a lead in developing a space for their physicians to “reset” by offering a room where health professionals can retreat if they need a moment to recover from a traumatic event.9

Read about what factors attract ObGyns to specific locations

Location, location, location

Specific areas of the country are more attractive for their higher compensation rates. The highest average compensation was reported by ObGyns in the North Central area ($339,000), West ($301,000), and Great Lakes ($297,000) regions, while the lowest compensation rates were found in the Northwest ($260,000), Southwest ($268,000), and South Central ($275,000) areas.3

Key factors, such as healthy patient populations, higher rates of health insurance coverage, and lower stress levels attract physicians (FIGURE 4). Minnesota ranked the #1 best place to practice because it has the 4th healthiest population, 2nd highest rate of employer-sponsored health insurance, the 17th lowest number of malpractice lawsuits, and a medical board that is the 3rd least harsh in the nation.12 Unfortunate situations such as the highest malpractice rates per capita, least healthy population, 8th lowest rate of employer-sponsored health insurance, and the 9th lowest compensation rate for physicians make Louisiana the worst place to practice in 2017.12

Supply and demand creates substantial geographic imbalances in the number of ObGyns in the United States. ACOG pro-jects that the need for ObGyns will increase nationally by 6% in the next 10 years, although demand will vary geographically from a 27% increase in Nevada to an 11% decrease in West Virginia.1 Especially vulnerable states (Arizona, Washington, Utah, Idaho) currently have an insufficient supply of ObGyns and are projected to see an increased future demand. Florida, Texas, North Carolina, and Nevada will be at risk, according to ACOG, because the adult female population is expected to increase.1

2017 Medscape survey demographics

The Medscape Compensation Report 2017 is a based on the responses of 19,270 physicians across 27+ specialties, 5% of whom were ObGyns. Data were collected in an online survey conducted from December 20, 2016, to March 7, 2017.3

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

- American Congress of Obstetricians and Gynecologists. The Obstetrician-Gynecologist Workforce in the United States: Facts, Figures, and Implications, 2017. https://www.acog.org/Resources-And-Publications/The-Ob-Gyn-Workforce/The-Obstetrician-Gynecologist-Workforce-in-the-United-States. Accessed June 7, 2017.

- Murphy B. For the first time, physician practice owners are not the majority. AMA Wire. https://wire.ama-assn.org/practice-management/first-time-physician-practice-owners-are-not-majority?utm_source=BulletinHealthCare&utm_medium=email&utm_term=060117&utm_content=general&utm_campaign=article_alert-morning_rounds_daily. Published May 31, 2017. Accessed June 7, 2017.

- Grisham S. Medscape Ob/Gyn Compensation Report 2017. Medscape Website. http://www.medscape.com/slideshow/compensation-2017-ob-gyn-6008576. Published April 12, 2017. Accessed June 7, 2017.

- Larkin I, Loewenstein G. Business model—Related conflict of interests in medicine: Problems and potential solutions. JAMA. 2017;317(17):1745–1746.

- Peckham C. Medscape Ob/Gyn Compensation Report 2016. Medscape Website. http://www.medscape.com/features/slideshow/compensation/2016/womenshealth. Published April 1, 2016. Accessed June 7, 2017.

- Reale D, Christie K. ObGyn salaries jumped in the last year. OBG Manag. 2016;28(7):25–27, 30, 37.

- Peckham C. Medscape Ob/Gyn Compensation Report 2015. Medscape Website. http://www.medscape.com/features/slideshow/compensation/2015/womenshealth. Published April 21, 2015. Accessed July 24, 2017.

- Peckham C. Medscape Ob/Gyn Compensation Report 2014. Medscape Website. http://www.medscape.com/features/slideshow/compensation/2014/womenshealth. Published April 14, 2014. Accessed July 24, 2017.

- Parks T. AMA burnout by specialty. AMA Wire. https://wire.ama-assn.org/life-career/report-reveals-severity-burnout-specialty. Published January 31, 2017. Accessed June 7, 2017.

- Peckham C. Medscape Lifestyle Report 2017: Race and Ethnicity, Bias and Burnout. Medscape Website. http://www.medscape.com/features/slideshow/lifestyle/2017/overview#page=1. Published January 11, 2017. Accessed June 7, 2017.

- DiVenere L. ObGyn burnout: ACOG takes aim. OBG Manag. 2016;28(9):25,30,32,33.

- Page L. Best and Worst Places to Practice 2017. Medscape Website. http://www.medscape.com/slideshow/best-places-to-practice-2017-6008688?src=wnl_physrep_170510_mscpmrk_bestplaces2017&impID=1345406&faf. Published May 10, 2017. Accessed June 7, 2017.

- American Congress of Obstetricians and Gynecologists. The Obstetrician-Gynecologist Workforce in the United States: Facts, Figures, and Implications, 2017. https://www.acog.org/Resources-And-Publications/The-Ob-Gyn-Workforce/The-Obstetrician-Gynecologist-Workforce-in-the-United-States. Accessed June 7, 2017.

- Murphy B. For the first time, physician practice owners are not the majority. AMA Wire. https://wire.ama-assn.org/practice-management/first-time-physician-practice-owners-are-not-majority?utm_source=BulletinHealthCare&utm_medium=email&utm_term=060117&utm_content=general&utm_campaign=article_alert-morning_rounds_daily. Published May 31, 2017. Accessed June 7, 2017.

- Grisham S. Medscape Ob/Gyn Compensation Report 2017. Medscape Website. http://www.medscape.com/slideshow/compensation-2017-ob-gyn-6008576. Published April 12, 2017. Accessed June 7, 2017.

- Larkin I, Loewenstein G. Business model—Related conflict of interests in medicine: Problems and potential solutions. JAMA. 2017;317(17):1745–1746.

- Peckham C. Medscape Ob/Gyn Compensation Report 2016. Medscape Website. http://www.medscape.com/features/slideshow/compensation/2016/womenshealth. Published April 1, 2016. Accessed June 7, 2017.

- Reale D, Christie K. ObGyn salaries jumped in the last year. OBG Manag. 2016;28(7):25–27, 30, 37.

- Peckham C. Medscape Ob/Gyn Compensation Report 2015. Medscape Website. http://www.medscape.com/features/slideshow/compensation/2015/womenshealth. Published April 21, 2015. Accessed July 24, 2017.

- Peckham C. Medscape Ob/Gyn Compensation Report 2014. Medscape Website. http://www.medscape.com/features/slideshow/compensation/2014/womenshealth. Published April 14, 2014. Accessed July 24, 2017.

- Parks T. AMA burnout by specialty. AMA Wire. https://wire.ama-assn.org/life-career/report-reveals-severity-burnout-specialty. Published January 31, 2017. Accessed June 7, 2017.

- Peckham C. Medscape Lifestyle Report 2017: Race and Ethnicity, Bias and Burnout. Medscape Website. http://www.medscape.com/features/slideshow/lifestyle/2017/overview#page=1. Published January 11, 2017. Accessed June 7, 2017.

- DiVenere L. ObGyn burnout: ACOG takes aim. OBG Manag. 2016;28(9):25,30,32,33.

- Page L. Best and Worst Places to Practice 2017. Medscape Website. http://www.medscape.com/slideshow/best-places-to-practice-2017-6008688?src=wnl_physrep_170510_mscpmrk_bestplaces2017&impID=1345406&faf. Published May 10, 2017. Accessed June 7, 2017.

How to sell your ObGyn practice

For ObGyns, 2 intensely stressful career milestones are the day you start your practice and the day you decide to put it up for sale.

One of us, Dr. Baum, started a practice in 1976. At that time, many clinicians seemed to work right up until the day they died—in mid-examination or with scalpel in hand! Today, clinicians seriously contemplate leaving an active practice at age 55, 60, or, more traditionally, 65.

ObGyns in group practice, even those with only 1 or 2 partners, presumably have in place a well-thought-out and properly drafted contract with buyout and phase-down provisions. For members of a group practice, it is imperative to critically review and discuss contractual arrangements periodically and decide if they make sense as much now as they did at the start. ObGyns who continually revisit their contracts probably have an exit strategy that is fairly self-executing and effective and that will provide the seller with a seamless transition to retirement.

A solo ObGyn who is selling a practice has 3 basic options: find a successor physician, sell to a hospital or to a larger group, or close the practice.

Related article:

ObGyns’ choice of practice environment is a big deal

Preparing your practice for sale

Regardless of who will take over your practice, you need to prepare for its transition.

The most important aspect of selling your practice is knowing its finances and ensuring that they are in order. Any serious buyer will ask to examine your books, see how you are running the business, and assess its vitality and potential growth. Simply, a buyer will want to know where your revenue comes from and where it goes.

Your practice will be attractive to a buyer if it shows a stable or growing revenue base, an attractive payer mix, reasonable overhead, and personal income that is steady if not increasing. If your earning capacity is low or declining, you will need to explain why.

Timing is key

We strongly recommend beginning the process 3 to 5 years before your intended exit.

By starting early, up to 5 years in advance, you can maximize the likelihood that your practice will retain all or most of its value. Moreover, you can use the long lead time to thoroughly explore all available options and find a committed buyer.

Selling a practice can be a complicated affair, and many ObGyns do not have the requisite skills. So much of the success in selling depends on the specifics of the practice, the physician, and the market (the hospital and physician environment).

Identifying potential buyers

Other ObGyns. Recruiting an ObGyn to take over your practice seems to be the best option but can prove very difficult in today’s environment. Many younger clinicians are either joining large groups or becoming hospital employees.

Other physician groups. While working your way down your list of potential buyers, you should also be quietly, subtly, and tactfully assessing other practices, even your competitors, to see if any are candidates for merging with and/or acquiring yours and all your charts, records, and referring physicians.

Hospitals. In today’s health care environment, in which more than half of clinicians are becoming hospital employees, selling to your associated hospital may be a viable option.

Your practice is probably contributing millions of dollars in income to that hospital each year, and of course the hospital would like to maintain this revenue stream. You should consider talking to the hospital’s CEO or medical director.

Hospitals also know that, if you leave and the market cannot absorb the resulting increase in demand for care, patients may go elsewhere, to a competing hospital or outside the community. Rather than lose your market share, a hospital may consider the obvious solution: recruit a replacement ObGyn for your practice.

Your goal here is to negotiate an agreement in which your hospital will recruit a replacement ObGyn, provide financial support, and transition your practice to that ObGyn over a specified period.

The hospital could acquire your practice and either employ you during the transition or provide recruiting support and an income guarantee to help your practice pay the new physician’s salary. Whether to sell or remain independent is often driven by the needs and desires of the recruit. As the vast majority of clinicians coming out of training are seeking employment, in most cases the agreement will require a sale.

Selling to a hospital a few years before your retirement can be a plus. You might find employment a welcome respite from the daunting responsibility of managing your own practice. Life can become much less stressful as you introduce and transition your patients to the new ObGyn. You will be working less, taking fewer calls, and maintaining or even increasing your income, all without the burden of managing the practice.

Read about determining your practice’s value

Putting a monetary value on your practice

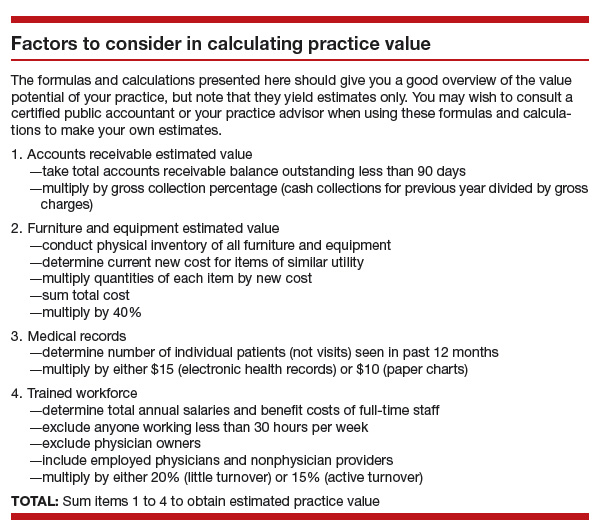

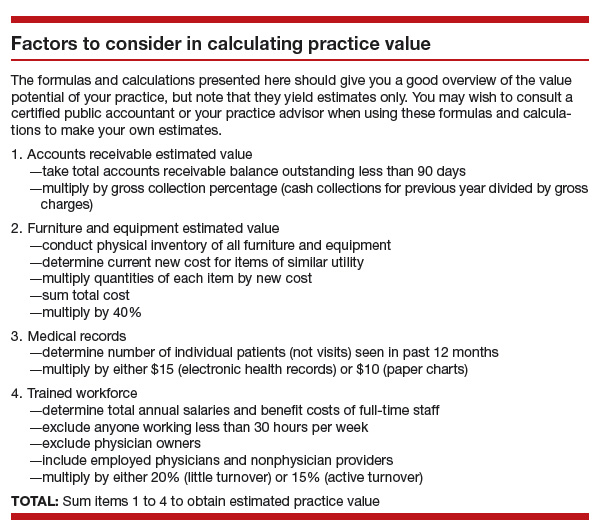

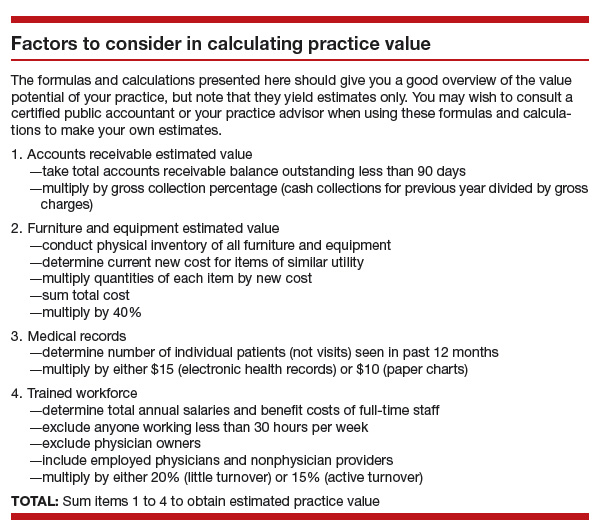

After deciding to sell your practice, you need to determine its value. Buying a practice may be the largest financial transaction a young ObGyn will ever make. For a retiring physician, valuation of a practice may reflect a career’s worth of “sweat equity.”

What is your practice worth?

All ObGyns believe their practice is worth far more than any young ObGyn or hospital is willing to pay for it. After all, you have spent a medical lifetime creating, building, and nurturing your practice. You have cared for several thousand patients, who have been loyal and may want to stay with the practice under its new ObGyn. So, how does a retiring physician put a value on his or her practice and then “cast the net” to the marketplace? How do you find a buyer who will pay the asking price and then help the practice make the transition from seller to buyer and continue to serve their patients?

The buyer’s perspective on value. In a pure sense, the value of any asset is what a potential buyer is willing to pay. From a value standpoint, the price that potential buyers are willing to pay varies by the specifics of the situation, regardless of what a valuation or practice appraisal might indicate.

For example, once your plan to retire becomes known, why would a young ObGyn agree to pay X dollars for all your medical records? After all, the potential buyer knows that your existing patients and your referral base will need to seek care from another ObGyn after you leave, and they will likely stay with the practice if they feel they will be treated well by the new clinician.

A hospital may take a similar tack but more often will be willing to pay fair market value for your practice. Hospitals, however, cannot legally pay more than fair market value as determined by an independent appraiser.

Related article:

Four pillars of a successful practice: 1. Keep your current patients happy

Valuation methods

The valuation of any business generally is approached in terms of market, assets, and income.

The market approach usually is taken only with regard to office real estate. Given the lack of reliable and comparable sales information, this approach is seldom used in the valuation of medical practices. If you own your office real estate, a real estate appraiser will establish its fair market value.

In the assets approach, the individual assets of a medical practice are valued on the basis of their current market values. These assets are either tangible or intangible.

Tangible assets can be seen and touched. Furniture, equipment, and office real estate are examples.

The fair market value of used furniture and equipment is most often determined by replacement cost. The value of these items is limited. Usually it starts at 50% of the cost of buying new furniture or equipment of the same utility. From there, the value is lowered on the basis of the age and condition of the items.

Often, the market value of major ObGyn office equipment, such as a DXA (dual-energy x-ray absorptiometry) scanner, is based on similar items for sale or recently sold in the used secondary equipment market.

Tangible assets may include accounts receivable (A/R). A/R represents uncollected payment for work performed. Most buyers want to avoid paying for A/R and assuming the risk of collections. Generally, you should expect to retain your A/R and pay a small or nominal fee to have the buyer handle the collections after you have retired.

Intangible assets are not physical. Examples include the physician’s name, phone number, reputation, referral base, trained staff, and medical records—in other words, what gets patients to keep coming back. Most physicians value these goodwill or “blue-sky” assets highly. Today, unfortunately, most sellers are unable to reap any financial benefit from their intangible assets.

The income approach is based on the premise that the value of any business is in the income it generates for its owner. In simple terms, value in the income approach is a multiple of the cash the business generates after expenses.

Read important keys to transitioning the practice

Transitioning the practice: Role of the seller and the buyer

First and very important is the contract agreement regarding the overlap period, when both the exiting ObGyn and the new ObGyn are at the practice. We suggest making the overlap a minimum of 6 months and a maximum of 1 year. During this period, the exiting physician can introduce the incoming physician to the patients. A face-to-face introduction can amount to an endorsement, which can ease a patient’s mind and help her decide to take on the new ObGyn and philosophy rather than search elsewhere for obstetric and gynecologic care. The new ObGyn also can use the overlap period to become familiar and comfortable with the staff and learn the process for physician and staff management of case flow, from scheduling and examination to insurance and patient follow-up.

We suggest that the exiting ObGyn send a farewell/welcome letter to patients and referring physicians. The letter should state the exiting ObGyn’s intention to leave (or retire from) the practice and should introduce the ObGyn who will be taking over.

The exiting ObGyn should also take the new ObGyn to meet the physicians who have been providing referrals over the years. We suggest visiting each referring physician’s office to make the introduction. Another good way to introduce a new ObGyn to referring physicians and other professionals—endocrinologists, cardiologists, nurses, pharmaceutical representatives—is to host an open house at your practice. Invite the staff members of the referring physicians as well, since they can be invaluable in making referrals.

We recommend that the exiting ObGyn spend the money to update all the practice’s stationery, brochures, and print materials and ensure they look professional. Note that it is not acceptable to place the new ObGyn’s name under the exiting ObGyn’s name. If the practice has a website, introduce the new physician there and make any necessary updates regarding office hours and accepted insurance plans.

If the exiting ObGyn’s practice lacks a robust Internet and social media presence, the new ObGyn should establish one. We recommend setting up an interactive website that patients can use to make appointments and pay bills. The website should have an email component that can be used to ask questions, raise concerns, and get answers. We also recommend opening Facebook, YouTube, and Twitter accounts for the practice and being active on these social media.

In our experience, smoothly transitioning practices can achieve patient retention rates as high as 90% to 95%. For practices without a plan, however, these rates may be as low as 50%, or worse. Therefore, work out a plan in advance, and include the steps described here, so that on arrival the new ObGyn can hit the ground running.

Acquiring a successful medical practice is doable and offers many advantages, such as autonomy and the ability to make business decisions affecting the practice. Despite all the changes happening in health care, we still think this is the best way to go.

Related article:

Four pillars of a successful practice: 4. Motivate your staff

Bottom line

Selling an ObGyn practice can be a daunting process. However, deciding to sell your practice, performing the valuation, and ensuring a smooth transition are part and parcel of making the transfer a success, equitable for both the buyer and the seller.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

For ObGyns, 2 intensely stressful career milestones are the day you start your practice and the day you decide to put it up for sale.

One of us, Dr. Baum, started a practice in 1976. At that time, many clinicians seemed to work right up until the day they died—in mid-examination or with scalpel in hand! Today, clinicians seriously contemplate leaving an active practice at age 55, 60, or, more traditionally, 65.

ObGyns in group practice, even those with only 1 or 2 partners, presumably have in place a well-thought-out and properly drafted contract with buyout and phase-down provisions. For members of a group practice, it is imperative to critically review and discuss contractual arrangements periodically and decide if they make sense as much now as they did at the start. ObGyns who continually revisit their contracts probably have an exit strategy that is fairly self-executing and effective and that will provide the seller with a seamless transition to retirement.

A solo ObGyn who is selling a practice has 3 basic options: find a successor physician, sell to a hospital or to a larger group, or close the practice.

Related article:

ObGyns’ choice of practice environment is a big deal

Preparing your practice for sale

Regardless of who will take over your practice, you need to prepare for its transition.

The most important aspect of selling your practice is knowing its finances and ensuring that they are in order. Any serious buyer will ask to examine your books, see how you are running the business, and assess its vitality and potential growth. Simply, a buyer will want to know where your revenue comes from and where it goes.

Your practice will be attractive to a buyer if it shows a stable or growing revenue base, an attractive payer mix, reasonable overhead, and personal income that is steady if not increasing. If your earning capacity is low or declining, you will need to explain why.

Timing is key

We strongly recommend beginning the process 3 to 5 years before your intended exit.

By starting early, up to 5 years in advance, you can maximize the likelihood that your practice will retain all or most of its value. Moreover, you can use the long lead time to thoroughly explore all available options and find a committed buyer.

Selling a practice can be a complicated affair, and many ObGyns do not have the requisite skills. So much of the success in selling depends on the specifics of the practice, the physician, and the market (the hospital and physician environment).

Identifying potential buyers

Other ObGyns. Recruiting an ObGyn to take over your practice seems to be the best option but can prove very difficult in today’s environment. Many younger clinicians are either joining large groups or becoming hospital employees.

Other physician groups. While working your way down your list of potential buyers, you should also be quietly, subtly, and tactfully assessing other practices, even your competitors, to see if any are candidates for merging with and/or acquiring yours and all your charts, records, and referring physicians.

Hospitals. In today’s health care environment, in which more than half of clinicians are becoming hospital employees, selling to your associated hospital may be a viable option.

Your practice is probably contributing millions of dollars in income to that hospital each year, and of course the hospital would like to maintain this revenue stream. You should consider talking to the hospital’s CEO or medical director.

Hospitals also know that, if you leave and the market cannot absorb the resulting increase in demand for care, patients may go elsewhere, to a competing hospital or outside the community. Rather than lose your market share, a hospital may consider the obvious solution: recruit a replacement ObGyn for your practice.

Your goal here is to negotiate an agreement in which your hospital will recruit a replacement ObGyn, provide financial support, and transition your practice to that ObGyn over a specified period.

The hospital could acquire your practice and either employ you during the transition or provide recruiting support and an income guarantee to help your practice pay the new physician’s salary. Whether to sell or remain independent is often driven by the needs and desires of the recruit. As the vast majority of clinicians coming out of training are seeking employment, in most cases the agreement will require a sale.

Selling to a hospital a few years before your retirement can be a plus. You might find employment a welcome respite from the daunting responsibility of managing your own practice. Life can become much less stressful as you introduce and transition your patients to the new ObGyn. You will be working less, taking fewer calls, and maintaining or even increasing your income, all without the burden of managing the practice.

Read about determining your practice’s value

Putting a monetary value on your practice

After deciding to sell your practice, you need to determine its value. Buying a practice may be the largest financial transaction a young ObGyn will ever make. For a retiring physician, valuation of a practice may reflect a career’s worth of “sweat equity.”

What is your practice worth?

All ObGyns believe their practice is worth far more than any young ObGyn or hospital is willing to pay for it. After all, you have spent a medical lifetime creating, building, and nurturing your practice. You have cared for several thousand patients, who have been loyal and may want to stay with the practice under its new ObGyn. So, how does a retiring physician put a value on his or her practice and then “cast the net” to the marketplace? How do you find a buyer who will pay the asking price and then help the practice make the transition from seller to buyer and continue to serve their patients?

The buyer’s perspective on value. In a pure sense, the value of any asset is what a potential buyer is willing to pay. From a value standpoint, the price that potential buyers are willing to pay varies by the specifics of the situation, regardless of what a valuation or practice appraisal might indicate.

For example, once your plan to retire becomes known, why would a young ObGyn agree to pay X dollars for all your medical records? After all, the potential buyer knows that your existing patients and your referral base will need to seek care from another ObGyn after you leave, and they will likely stay with the practice if they feel they will be treated well by the new clinician.

A hospital may take a similar tack but more often will be willing to pay fair market value for your practice. Hospitals, however, cannot legally pay more than fair market value as determined by an independent appraiser.

Related article:

Four pillars of a successful practice: 1. Keep your current patients happy

Valuation methods

The valuation of any business generally is approached in terms of market, assets, and income.

The market approach usually is taken only with regard to office real estate. Given the lack of reliable and comparable sales information, this approach is seldom used in the valuation of medical practices. If you own your office real estate, a real estate appraiser will establish its fair market value.

In the assets approach, the individual assets of a medical practice are valued on the basis of their current market values. These assets are either tangible or intangible.

Tangible assets can be seen and touched. Furniture, equipment, and office real estate are examples.

The fair market value of used furniture and equipment is most often determined by replacement cost. The value of these items is limited. Usually it starts at 50% of the cost of buying new furniture or equipment of the same utility. From there, the value is lowered on the basis of the age and condition of the items.

Often, the market value of major ObGyn office equipment, such as a DXA (dual-energy x-ray absorptiometry) scanner, is based on similar items for sale or recently sold in the used secondary equipment market.

Tangible assets may include accounts receivable (A/R). A/R represents uncollected payment for work performed. Most buyers want to avoid paying for A/R and assuming the risk of collections. Generally, you should expect to retain your A/R and pay a small or nominal fee to have the buyer handle the collections after you have retired.

Intangible assets are not physical. Examples include the physician’s name, phone number, reputation, referral base, trained staff, and medical records—in other words, what gets patients to keep coming back. Most physicians value these goodwill or “blue-sky” assets highly. Today, unfortunately, most sellers are unable to reap any financial benefit from their intangible assets.

The income approach is based on the premise that the value of any business is in the income it generates for its owner. In simple terms, value in the income approach is a multiple of the cash the business generates after expenses.

Read important keys to transitioning the practice

Transitioning the practice: Role of the seller and the buyer

First and very important is the contract agreement regarding the overlap period, when both the exiting ObGyn and the new ObGyn are at the practice. We suggest making the overlap a minimum of 6 months and a maximum of 1 year. During this period, the exiting physician can introduce the incoming physician to the patients. A face-to-face introduction can amount to an endorsement, which can ease a patient’s mind and help her decide to take on the new ObGyn and philosophy rather than search elsewhere for obstetric and gynecologic care. The new ObGyn also can use the overlap period to become familiar and comfortable with the staff and learn the process for physician and staff management of case flow, from scheduling and examination to insurance and patient follow-up.

We suggest that the exiting ObGyn send a farewell/welcome letter to patients and referring physicians. The letter should state the exiting ObGyn’s intention to leave (or retire from) the practice and should introduce the ObGyn who will be taking over.

The exiting ObGyn should also take the new ObGyn to meet the physicians who have been providing referrals over the years. We suggest visiting each referring physician’s office to make the introduction. Another good way to introduce a new ObGyn to referring physicians and other professionals—endocrinologists, cardiologists, nurses, pharmaceutical representatives—is to host an open house at your practice. Invite the staff members of the referring physicians as well, since they can be invaluable in making referrals.

We recommend that the exiting ObGyn spend the money to update all the practice’s stationery, brochures, and print materials and ensure they look professional. Note that it is not acceptable to place the new ObGyn’s name under the exiting ObGyn’s name. If the practice has a website, introduce the new physician there and make any necessary updates regarding office hours and accepted insurance plans.

If the exiting ObGyn’s practice lacks a robust Internet and social media presence, the new ObGyn should establish one. We recommend setting up an interactive website that patients can use to make appointments and pay bills. The website should have an email component that can be used to ask questions, raise concerns, and get answers. We also recommend opening Facebook, YouTube, and Twitter accounts for the practice and being active on these social media.

In our experience, smoothly transitioning practices can achieve patient retention rates as high as 90% to 95%. For practices without a plan, however, these rates may be as low as 50%, or worse. Therefore, work out a plan in advance, and include the steps described here, so that on arrival the new ObGyn can hit the ground running.

Acquiring a successful medical practice is doable and offers many advantages, such as autonomy and the ability to make business decisions affecting the practice. Despite all the changes happening in health care, we still think this is the best way to go.

Related article:

Four pillars of a successful practice: 4. Motivate your staff

Bottom line

Selling an ObGyn practice can be a daunting process. However, deciding to sell your practice, performing the valuation, and ensuring a smooth transition are part and parcel of making the transfer a success, equitable for both the buyer and the seller.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

For ObGyns, 2 intensely stressful career milestones are the day you start your practice and the day you decide to put it up for sale.

One of us, Dr. Baum, started a practice in 1976. At that time, many clinicians seemed to work right up until the day they died—in mid-examination or with scalpel in hand! Today, clinicians seriously contemplate leaving an active practice at age 55, 60, or, more traditionally, 65.

ObGyns in group practice, even those with only 1 or 2 partners, presumably have in place a well-thought-out and properly drafted contract with buyout and phase-down provisions. For members of a group practice, it is imperative to critically review and discuss contractual arrangements periodically and decide if they make sense as much now as they did at the start. ObGyns who continually revisit their contracts probably have an exit strategy that is fairly self-executing and effective and that will provide the seller with a seamless transition to retirement.

A solo ObGyn who is selling a practice has 3 basic options: find a successor physician, sell to a hospital or to a larger group, or close the practice.

Related article:

ObGyns’ choice of practice environment is a big deal

Preparing your practice for sale

Regardless of who will take over your practice, you need to prepare for its transition.

The most important aspect of selling your practice is knowing its finances and ensuring that they are in order. Any serious buyer will ask to examine your books, see how you are running the business, and assess its vitality and potential growth. Simply, a buyer will want to know where your revenue comes from and where it goes.

Your practice will be attractive to a buyer if it shows a stable or growing revenue base, an attractive payer mix, reasonable overhead, and personal income that is steady if not increasing. If your earning capacity is low or declining, you will need to explain why.

Timing is key

We strongly recommend beginning the process 3 to 5 years before your intended exit.

By starting early, up to 5 years in advance, you can maximize the likelihood that your practice will retain all or most of its value. Moreover, you can use the long lead time to thoroughly explore all available options and find a committed buyer.

Selling a practice can be a complicated affair, and many ObGyns do not have the requisite skills. So much of the success in selling depends on the specifics of the practice, the physician, and the market (the hospital and physician environment).

Identifying potential buyers

Other ObGyns. Recruiting an ObGyn to take over your practice seems to be the best option but can prove very difficult in today’s environment. Many younger clinicians are either joining large groups or becoming hospital employees.

Other physician groups. While working your way down your list of potential buyers, you should also be quietly, subtly, and tactfully assessing other practices, even your competitors, to see if any are candidates for merging with and/or acquiring yours and all your charts, records, and referring physicians.

Hospitals. In today’s health care environment, in which more than half of clinicians are becoming hospital employees, selling to your associated hospital may be a viable option.

Your practice is probably contributing millions of dollars in income to that hospital each year, and of course the hospital would like to maintain this revenue stream. You should consider talking to the hospital’s CEO or medical director.

Hospitals also know that, if you leave and the market cannot absorb the resulting increase in demand for care, patients may go elsewhere, to a competing hospital or outside the community. Rather than lose your market share, a hospital may consider the obvious solution: recruit a replacement ObGyn for your practice.

Your goal here is to negotiate an agreement in which your hospital will recruit a replacement ObGyn, provide financial support, and transition your practice to that ObGyn over a specified period.

The hospital could acquire your practice and either employ you during the transition or provide recruiting support and an income guarantee to help your practice pay the new physician’s salary. Whether to sell or remain independent is often driven by the needs and desires of the recruit. As the vast majority of clinicians coming out of training are seeking employment, in most cases the agreement will require a sale.

Selling to a hospital a few years before your retirement can be a plus. You might find employment a welcome respite from the daunting responsibility of managing your own practice. Life can become much less stressful as you introduce and transition your patients to the new ObGyn. You will be working less, taking fewer calls, and maintaining or even increasing your income, all without the burden of managing the practice.

Read about determining your practice’s value

Putting a monetary value on your practice

After deciding to sell your practice, you need to determine its value. Buying a practice may be the largest financial transaction a young ObGyn will ever make. For a retiring physician, valuation of a practice may reflect a career’s worth of “sweat equity.”

What is your practice worth?

All ObGyns believe their practice is worth far more than any young ObGyn or hospital is willing to pay for it. After all, you have spent a medical lifetime creating, building, and nurturing your practice. You have cared for several thousand patients, who have been loyal and may want to stay with the practice under its new ObGyn. So, how does a retiring physician put a value on his or her practice and then “cast the net” to the marketplace? How do you find a buyer who will pay the asking price and then help the practice make the transition from seller to buyer and continue to serve their patients?

The buyer’s perspective on value. In a pure sense, the value of any asset is what a potential buyer is willing to pay. From a value standpoint, the price that potential buyers are willing to pay varies by the specifics of the situation, regardless of what a valuation or practice appraisal might indicate.

For example, once your plan to retire becomes known, why would a young ObGyn agree to pay X dollars for all your medical records? After all, the potential buyer knows that your existing patients and your referral base will need to seek care from another ObGyn after you leave, and they will likely stay with the practice if they feel they will be treated well by the new clinician.

A hospital may take a similar tack but more often will be willing to pay fair market value for your practice. Hospitals, however, cannot legally pay more than fair market value as determined by an independent appraiser.

Related article:

Four pillars of a successful practice: 1. Keep your current patients happy

Valuation methods

The valuation of any business generally is approached in terms of market, assets, and income.

The market approach usually is taken only with regard to office real estate. Given the lack of reliable and comparable sales information, this approach is seldom used in the valuation of medical practices. If you own your office real estate, a real estate appraiser will establish its fair market value.

In the assets approach, the individual assets of a medical practice are valued on the basis of their current market values. These assets are either tangible or intangible.

Tangible assets can be seen and touched. Furniture, equipment, and office real estate are examples.

The fair market value of used furniture and equipment is most often determined by replacement cost. The value of these items is limited. Usually it starts at 50% of the cost of buying new furniture or equipment of the same utility. From there, the value is lowered on the basis of the age and condition of the items.

Often, the market value of major ObGyn office equipment, such as a DXA (dual-energy x-ray absorptiometry) scanner, is based on similar items for sale or recently sold in the used secondary equipment market.

Tangible assets may include accounts receivable (A/R). A/R represents uncollected payment for work performed. Most buyers want to avoid paying for A/R and assuming the risk of collections. Generally, you should expect to retain your A/R and pay a small or nominal fee to have the buyer handle the collections after you have retired.

Intangible assets are not physical. Examples include the physician’s name, phone number, reputation, referral base, trained staff, and medical records—in other words, what gets patients to keep coming back. Most physicians value these goodwill or “blue-sky” assets highly. Today, unfortunately, most sellers are unable to reap any financial benefit from their intangible assets.

The income approach is based on the premise that the value of any business is in the income it generates for its owner. In simple terms, value in the income approach is a multiple of the cash the business generates after expenses.

Read important keys to transitioning the practice

Transitioning the practice: Role of the seller and the buyer

First and very important is the contract agreement regarding the overlap period, when both the exiting ObGyn and the new ObGyn are at the practice. We suggest making the overlap a minimum of 6 months and a maximum of 1 year. During this period, the exiting physician can introduce the incoming physician to the patients. A face-to-face introduction can amount to an endorsement, which can ease a patient’s mind and help her decide to take on the new ObGyn and philosophy rather than search elsewhere for obstetric and gynecologic care. The new ObGyn also can use the overlap period to become familiar and comfortable with the staff and learn the process for physician and staff management of case flow, from scheduling and examination to insurance and patient follow-up.

We suggest that the exiting ObGyn send a farewell/welcome letter to patients and referring physicians. The letter should state the exiting ObGyn’s intention to leave (or retire from) the practice and should introduce the ObGyn who will be taking over.

The exiting ObGyn should also take the new ObGyn to meet the physicians who have been providing referrals over the years. We suggest visiting each referring physician’s office to make the introduction. Another good way to introduce a new ObGyn to referring physicians and other professionals—endocrinologists, cardiologists, nurses, pharmaceutical representatives—is to host an open house at your practice. Invite the staff members of the referring physicians as well, since they can be invaluable in making referrals.

We recommend that the exiting ObGyn spend the money to update all the practice’s stationery, brochures, and print materials and ensure they look professional. Note that it is not acceptable to place the new ObGyn’s name under the exiting ObGyn’s name. If the practice has a website, introduce the new physician there and make any necessary updates regarding office hours and accepted insurance plans.

If the exiting ObGyn’s practice lacks a robust Internet and social media presence, the new ObGyn should establish one. We recommend setting up an interactive website that patients can use to make appointments and pay bills. The website should have an email component that can be used to ask questions, raise concerns, and get answers. We also recommend opening Facebook, YouTube, and Twitter accounts for the practice and being active on these social media.

In our experience, smoothly transitioning practices can achieve patient retention rates as high as 90% to 95%. For practices without a plan, however, these rates may be as low as 50%, or worse. Therefore, work out a plan in advance, and include the steps described here, so that on arrival the new ObGyn can hit the ground running.

Acquiring a successful medical practice is doable and offers many advantages, such as autonomy and the ability to make business decisions affecting the practice. Despite all the changes happening in health care, we still think this is the best way to go.

Related article:

Four pillars of a successful practice: 4. Motivate your staff

Bottom line

Selling an ObGyn practice can be a daunting process. However, deciding to sell your practice, performing the valuation, and ensuring a smooth transition are part and parcel of making the transfer a success, equitable for both the buyer and the seller.

Share your thoughts! Send your Letter to the Editor to [email protected]. Please include your name and the city and state in which you practice.

IN THIS ARTICLE

Six Steps to Reduce Taxes on Investments: Minimizing What You Pay in a Tough Environment

Orthopedic physicians in the highest income tax brackets may have been presented with an unpleasant surprise in recent years when they learned of their investment tax liability. A prolonged period of strong domestic stock performance from 2009 to 2016, combined with the implementation of The American Taxpayer Relief Act of 2012, may have resulted in significantly higher taxes for many of you.

The top ordinary income tax rates increased by 24% when including the Net Investment Income surtax, while the top capital gains rate was increased by more than 58%. Writing a large check to the Internal Revenue Service serves as a harsh reminder that tax planning requires attention throughout the year, and is not a technique you can properly manage a few weeks before an April 15 deadline.

Proper tax planning became more critical as we moved into an era of higher taxes. A multi-year bull market for domestic stocks has caused many traditional investment vehicles to hold large amounts of unrealized gains, which can become realized gains if you are not careful. Most major equity indices took a breath in 2015 and finished the year in the red, which created a planning opportunity for astute investors and their advisors. Stocks in the US and emerging market countries quickly bounced back in 2016; however, European stocks struggled and continue to trade well below peak levels reached nearly a decade ago. Investors who missed the opportunity to offset gains of the prior 2 years may have an opportunity to reduce their tax bill in 2017.

In this article, we will provide you with 6 suggestions that could save you thousands of dollars in investment taxes over the next several years.