User login

Eighty percent of ED physicians say mental health crisis response needs overhaul

After a survey found that 80% of 1,500 U.S. emergency physicians think the system for treating persons in acute mental health crisis is broken, emergency medicine professionals teamed up with mental health workers and patient advocates nationwide to call for a new model of care.

The Coalition on Psychiatric Emergencies, or COPE, is focused on improving the delivery of emergency psychiatric care, and is supported by more than 30 national emergency medicine, mental health, and patient advocate groups, including the American College of Emergency Physicians, the American Psychiatric Association, and the National Alliance on Mental Illness.

“It’s time we think about doing things differently,” Dr. Michael J. Gerardi, COPE Steering Committee Chair and immediate past president of ACEP, said in a statement. “Through this unique collaboration, the Coalition on Psychiatric Emergencies will focus on developing a more unified treatment model and improving the treatment experience for both patients and health care providers. We want to provide the best care for all our patients and reduce health care costs.”

Among its several goals, the coalition seeks to shorten the time between when a person in mental health crisis presents in the ED and is admitted to an inpatient psychiatric bed. In a recent NAMI survey of 1,400 families, 38% waited more than 7 hours in the ED before seeing a mental health professional. For 21% of those families, the wait was more than 10 hours.

COPE also seeks adequate education and training for all emergency personnel who care for patients experiencing psychiatric emergencies.

“Emergency department staff need proper training not only on how to handle behavioral health emergencies, but also on how to initiate care for patients who may remain in the ED setting for long periods of time,” Dr. Lorenzo Norris, director of inpatient psychiatric services at George Washington University Hospital, Washington, said in an interview. “Establishing these new systems will likely require robust funding efforts.

‘‘There is a growing need for change. At our hospital, we have definitely seen an uptick in the number of patients seeking emergency psychiatric care,” Dr. Norris said. “Our approach has been to hire a clinician whose sole duty is to work collaboratively with patients and ED staff. It’s the first step in our ultimate goal of creating an ED behavioral health team that includes a psychiatrist, an emergency physician, nursing staff, social worker, and others who can provide the patient with comprehensive care at the initial point of contact.”

Currently in the U.S., there are no standard protocols for a psychiatric emergency, according to the National Institute of Mental Health. The online survey was conducted within the ACEP membership between July 1-31, 2015. The response rate was 6% and the margin of error of 2.5 percent.

On Twitter @whitneymcknight

After a survey found that 80% of 1,500 U.S. emergency physicians think the system for treating persons in acute mental health crisis is broken, emergency medicine professionals teamed up with mental health workers and patient advocates nationwide to call for a new model of care.

The Coalition on Psychiatric Emergencies, or COPE, is focused on improving the delivery of emergency psychiatric care, and is supported by more than 30 national emergency medicine, mental health, and patient advocate groups, including the American College of Emergency Physicians, the American Psychiatric Association, and the National Alliance on Mental Illness.

“It’s time we think about doing things differently,” Dr. Michael J. Gerardi, COPE Steering Committee Chair and immediate past president of ACEP, said in a statement. “Through this unique collaboration, the Coalition on Psychiatric Emergencies will focus on developing a more unified treatment model and improving the treatment experience for both patients and health care providers. We want to provide the best care for all our patients and reduce health care costs.”

Among its several goals, the coalition seeks to shorten the time between when a person in mental health crisis presents in the ED and is admitted to an inpatient psychiatric bed. In a recent NAMI survey of 1,400 families, 38% waited more than 7 hours in the ED before seeing a mental health professional. For 21% of those families, the wait was more than 10 hours.

COPE also seeks adequate education and training for all emergency personnel who care for patients experiencing psychiatric emergencies.

“Emergency department staff need proper training not only on how to handle behavioral health emergencies, but also on how to initiate care for patients who may remain in the ED setting for long periods of time,” Dr. Lorenzo Norris, director of inpatient psychiatric services at George Washington University Hospital, Washington, said in an interview. “Establishing these new systems will likely require robust funding efforts.

‘‘There is a growing need for change. At our hospital, we have definitely seen an uptick in the number of patients seeking emergency psychiatric care,” Dr. Norris said. “Our approach has been to hire a clinician whose sole duty is to work collaboratively with patients and ED staff. It’s the first step in our ultimate goal of creating an ED behavioral health team that includes a psychiatrist, an emergency physician, nursing staff, social worker, and others who can provide the patient with comprehensive care at the initial point of contact.”

Currently in the U.S., there are no standard protocols for a psychiatric emergency, according to the National Institute of Mental Health. The online survey was conducted within the ACEP membership between July 1-31, 2015. The response rate was 6% and the margin of error of 2.5 percent.

On Twitter @whitneymcknight

After a survey found that 80% of 1,500 U.S. emergency physicians think the system for treating persons in acute mental health crisis is broken, emergency medicine professionals teamed up with mental health workers and patient advocates nationwide to call for a new model of care.

The Coalition on Psychiatric Emergencies, or COPE, is focused on improving the delivery of emergency psychiatric care, and is supported by more than 30 national emergency medicine, mental health, and patient advocate groups, including the American College of Emergency Physicians, the American Psychiatric Association, and the National Alliance on Mental Illness.

“It’s time we think about doing things differently,” Dr. Michael J. Gerardi, COPE Steering Committee Chair and immediate past president of ACEP, said in a statement. “Through this unique collaboration, the Coalition on Psychiatric Emergencies will focus on developing a more unified treatment model and improving the treatment experience for both patients and health care providers. We want to provide the best care for all our patients and reduce health care costs.”

Among its several goals, the coalition seeks to shorten the time between when a person in mental health crisis presents in the ED and is admitted to an inpatient psychiatric bed. In a recent NAMI survey of 1,400 families, 38% waited more than 7 hours in the ED before seeing a mental health professional. For 21% of those families, the wait was more than 10 hours.

COPE also seeks adequate education and training for all emergency personnel who care for patients experiencing psychiatric emergencies.

“Emergency department staff need proper training not only on how to handle behavioral health emergencies, but also on how to initiate care for patients who may remain in the ED setting for long periods of time,” Dr. Lorenzo Norris, director of inpatient psychiatric services at George Washington University Hospital, Washington, said in an interview. “Establishing these new systems will likely require robust funding efforts.

‘‘There is a growing need for change. At our hospital, we have definitely seen an uptick in the number of patients seeking emergency psychiatric care,” Dr. Norris said. “Our approach has been to hire a clinician whose sole duty is to work collaboratively with patients and ED staff. It’s the first step in our ultimate goal of creating an ED behavioral health team that includes a psychiatrist, an emergency physician, nursing staff, social worker, and others who can provide the patient with comprehensive care at the initial point of contact.”

Currently in the U.S., there are no standard protocols for a psychiatric emergency, according to the National Institute of Mental Health. The online survey was conducted within the ACEP membership between July 1-31, 2015. The response rate was 6% and the margin of error of 2.5 percent.

On Twitter @whitneymcknight

Key clinical point: A new model of psychiatric ED care is being developed by the Coalition on Psychiatric Emergencies (COPE), to improve care, outcomes, and net costs.

Major finding: Eight in 10 emergency physicians believe a lack of training and resources keeps them from meeting a growing demand for emergency mental health services.

Data source: American College of Emergency Physicians survey of 1,500 physicians nationwide.

Disclosures: COPE is underwritten in part by Teva Pharmaceuticals.

NIH, CDC get boost in House budget bill

The National Institutes of Health would see an almost 10% increase in funding under a budget deal announced Dec. 15 by House Speaker Paul Ryan (R-Wisc.).

Other provisions in the omnibus budget agreement include an increased budget for the Centers for Disease Control and Prevention, level budgets for the Centers for Medicare & Medicaid Services and the Office of the National Coordinator for Health Information Technology, and a reduced budget for the Agency for Healthcare Research and Quality.

The bill also prevents any new or additional spending on the Affordable Care Act.

The National Institutes of Health will see its budget increase to $32 billion, $2 billion more than the fiscal 2015 budget and $1 billion more than the White House had requested. The increases are targeted to a number of specific research areas, including Alzheimer’s disease, the BRAIN Initiative, antibiotics research, as well as for the Precision Medicine Initiative. The NIH increase also reflects increased budget levels for all individual institutes and centers.

CDC’s budget is increased by about $308 million – almost double the White House–requested increase – to $7.2 billion. The proposal prioritizes funding on disease prevention and biodefense research to prevent against infectious diseases as well as bioterrorism attacks, and helping the agency modernize laboratory facilities and work with states to address antibiotic resistance.

It also includes $70 million to target prescription drug abuse, $160 million for the Division for Heart Disease and Stroke Prevention, $170 million to help address preventable chronic diseases, $160 million in block grants for states to address their individual health needs, and $1.4 billion in budgeting for states to use for emergency preparedness for bioterror attacks or pandemic disease emergencies.

The budget proprosal also cuts more than $30 million from the Agency for Healthcare Research and Quality (AHRQ). The White House had asked for funding of the AHRQ to remain static.

Both the Centers for Medicare & Medicaid Services and the Office of the National Coordinator for Health Information Technology saw their budgets remain level; however, the bill makes no changes to the Meaningful Use program.

As part of Congress’ ongoing oversight into prescription drug pricing, the budget bill is calling for the U.S. Department of Health & Human Services to prepare a report examining the prices.

According to a committee report accompanying the bill language, HHS will prepare a report on prices, net of rebate, of the top 10 most commonly prescribed drugs and the top 10 highest-cost drugs paid under Medicare Part B and Part D, Medicaid, and by the Department of Veterans Affairs since 2003. The report, due 180 days after the enactment of the bill, would also evaluate access to drugs under the four programs as well as patient satisfaction with care.

The House is expected to vote on the budget proposal as early as Dec. 18.

The National Institutes of Health would see an almost 10% increase in funding under a budget deal announced Dec. 15 by House Speaker Paul Ryan (R-Wisc.).

Other provisions in the omnibus budget agreement include an increased budget for the Centers for Disease Control and Prevention, level budgets for the Centers for Medicare & Medicaid Services and the Office of the National Coordinator for Health Information Technology, and a reduced budget for the Agency for Healthcare Research and Quality.

The bill also prevents any new or additional spending on the Affordable Care Act.

The National Institutes of Health will see its budget increase to $32 billion, $2 billion more than the fiscal 2015 budget and $1 billion more than the White House had requested. The increases are targeted to a number of specific research areas, including Alzheimer’s disease, the BRAIN Initiative, antibiotics research, as well as for the Precision Medicine Initiative. The NIH increase also reflects increased budget levels for all individual institutes and centers.

CDC’s budget is increased by about $308 million – almost double the White House–requested increase – to $7.2 billion. The proposal prioritizes funding on disease prevention and biodefense research to prevent against infectious diseases as well as bioterrorism attacks, and helping the agency modernize laboratory facilities and work with states to address antibiotic resistance.

It also includes $70 million to target prescription drug abuse, $160 million for the Division for Heart Disease and Stroke Prevention, $170 million to help address preventable chronic diseases, $160 million in block grants for states to address their individual health needs, and $1.4 billion in budgeting for states to use for emergency preparedness for bioterror attacks or pandemic disease emergencies.

The budget proprosal also cuts more than $30 million from the Agency for Healthcare Research and Quality (AHRQ). The White House had asked for funding of the AHRQ to remain static.

Both the Centers for Medicare & Medicaid Services and the Office of the National Coordinator for Health Information Technology saw their budgets remain level; however, the bill makes no changes to the Meaningful Use program.

As part of Congress’ ongoing oversight into prescription drug pricing, the budget bill is calling for the U.S. Department of Health & Human Services to prepare a report examining the prices.

According to a committee report accompanying the bill language, HHS will prepare a report on prices, net of rebate, of the top 10 most commonly prescribed drugs and the top 10 highest-cost drugs paid under Medicare Part B and Part D, Medicaid, and by the Department of Veterans Affairs since 2003. The report, due 180 days after the enactment of the bill, would also evaluate access to drugs under the four programs as well as patient satisfaction with care.

The House is expected to vote on the budget proposal as early as Dec. 18.

The National Institutes of Health would see an almost 10% increase in funding under a budget deal announced Dec. 15 by House Speaker Paul Ryan (R-Wisc.).

Other provisions in the omnibus budget agreement include an increased budget for the Centers for Disease Control and Prevention, level budgets for the Centers for Medicare & Medicaid Services and the Office of the National Coordinator for Health Information Technology, and a reduced budget for the Agency for Healthcare Research and Quality.

The bill also prevents any new or additional spending on the Affordable Care Act.

The National Institutes of Health will see its budget increase to $32 billion, $2 billion more than the fiscal 2015 budget and $1 billion more than the White House had requested. The increases are targeted to a number of specific research areas, including Alzheimer’s disease, the BRAIN Initiative, antibiotics research, as well as for the Precision Medicine Initiative. The NIH increase also reflects increased budget levels for all individual institutes and centers.

CDC’s budget is increased by about $308 million – almost double the White House–requested increase – to $7.2 billion. The proposal prioritizes funding on disease prevention and biodefense research to prevent against infectious diseases as well as bioterrorism attacks, and helping the agency modernize laboratory facilities and work with states to address antibiotic resistance.

It also includes $70 million to target prescription drug abuse, $160 million for the Division for Heart Disease and Stroke Prevention, $170 million to help address preventable chronic diseases, $160 million in block grants for states to address their individual health needs, and $1.4 billion in budgeting for states to use for emergency preparedness for bioterror attacks or pandemic disease emergencies.

The budget proprosal also cuts more than $30 million from the Agency for Healthcare Research and Quality (AHRQ). The White House had asked for funding of the AHRQ to remain static.

Both the Centers for Medicare & Medicaid Services and the Office of the National Coordinator for Health Information Technology saw their budgets remain level; however, the bill makes no changes to the Meaningful Use program.

As part of Congress’ ongoing oversight into prescription drug pricing, the budget bill is calling for the U.S. Department of Health & Human Services to prepare a report examining the prices.

According to a committee report accompanying the bill language, HHS will prepare a report on prices, net of rebate, of the top 10 most commonly prescribed drugs and the top 10 highest-cost drugs paid under Medicare Part B and Part D, Medicaid, and by the Department of Veterans Affairs since 2003. The report, due 180 days after the enactment of the bill, would also evaluate access to drugs under the four programs as well as patient satisfaction with care.

The House is expected to vote on the budget proposal as early as Dec. 18.

Senate calls for childproof packaging for ‘e-cig juice’

The Senate passed a bill that would require childproof packaging for liquid nicotine products.

The Child Nicotine Poisoning Prevention Act of 2015 (S. 142), also would codify Food and Drug Administration authority to regulate the packaging of liquid nicotine that is used to refill various electronic nicotine delivery systems.

S. 142 passed by unanimous consent in the Senate on Dec. 10. The House of Representatives has not taken action on the bill.

“Just a small amount of this stuff can injure or even kill a small child,” Sen. Bill Nelson (D-Fla.), the bill’s sponsor, said in a statement. “Making these bottles childproof is just common sense.”

In 2014, poison control centers received more than 3,000 calls related to e-cigarette nicotine exposure, including one toddler death, according to a statement from the American Academy of Pediatrics.

“With e-cigarettes becoming more and more common in households across the country, we cannot afford to wait another day to protect children from poisonous liquid nicotine,” AAP President Dr. Sandra Hassink said.

The Senate passed a bill that would require childproof packaging for liquid nicotine products.

The Child Nicotine Poisoning Prevention Act of 2015 (S. 142), also would codify Food and Drug Administration authority to regulate the packaging of liquid nicotine that is used to refill various electronic nicotine delivery systems.

S. 142 passed by unanimous consent in the Senate on Dec. 10. The House of Representatives has not taken action on the bill.

“Just a small amount of this stuff can injure or even kill a small child,” Sen. Bill Nelson (D-Fla.), the bill’s sponsor, said in a statement. “Making these bottles childproof is just common sense.”

In 2014, poison control centers received more than 3,000 calls related to e-cigarette nicotine exposure, including one toddler death, according to a statement from the American Academy of Pediatrics.

“With e-cigarettes becoming more and more common in households across the country, we cannot afford to wait another day to protect children from poisonous liquid nicotine,” AAP President Dr. Sandra Hassink said.

The Senate passed a bill that would require childproof packaging for liquid nicotine products.

The Child Nicotine Poisoning Prevention Act of 2015 (S. 142), also would codify Food and Drug Administration authority to regulate the packaging of liquid nicotine that is used to refill various electronic nicotine delivery systems.

S. 142 passed by unanimous consent in the Senate on Dec. 10. The House of Representatives has not taken action on the bill.

“Just a small amount of this stuff can injure or even kill a small child,” Sen. Bill Nelson (D-Fla.), the bill’s sponsor, said in a statement. “Making these bottles childproof is just common sense.”

In 2014, poison control centers received more than 3,000 calls related to e-cigarette nicotine exposure, including one toddler death, according to a statement from the American Academy of Pediatrics.

“With e-cigarettes becoming more and more common in households across the country, we cannot afford to wait another day to protect children from poisonous liquid nicotine,” AAP President Dr. Sandra Hassink said.

Medicare audits: What leads to an exclusion?

WASHINGTON – While the line between an inadvertent billing mistake and intentional coding deception might be blurry, federal investigators are crystal clear about what drives them to exclude health providers from government health programs.

Rejection from Medicaid and Medicare comes down to severity and accountability, said Lisa Re, branch chief of administrative and civil remedies for the Health and Human Services Department Office of Counsel to Inspector General.

“At the end of the day, what we’re looking at is the seriousness of the conduct, cooperation with the compliance program, and whether or not there’s been a sense of financial responsibility – that the program has been made whole from the harm that was done,” Ms. Re said at a meeting sponsored by the American Bar Association.

In 2015, the Office of Inspector General (OIG) excluded 4,112 individuals and entities from participation in federal health care programs, up from 4,017 in 2014, according to a the OIG’s semiannual report to Congress published Nov. 30.

The office expects to recover nearly $3.4 billion in incorrect payments in 2015, down from $4.9 billion last year. The office also reported 925 criminal actions and 682 civil actions in 2015 involving false claims, unjust-enrichment lawsuits, civil settlements, and administrative recoveries.

When it comes to exclusions, investigators rely on the facts and circumstances of each individual case, Ms. Re said. Certain behaviors such as repeated disregard of government inquires and ongoing overbilling can lead to exclusions.

“We’re not trying to punish anyone,” Ms. Re said. “Exclusion is purely remedial. It’s a question of whether or not you have demonstrated sufficient trustworthiness for us to continue doing business with you.”

The OIG considers two types of exclusions – mandatory and permissive. The agency is obligated to exclude a provider if that professional is convicted of program-related crimes, is convicted of patient abuse or neglect, receives a felony health fraud conviction, or is convicted of two mandatory exclusion offenses. The OIG can use its discretion in situations in which a provider receives a misdemeanor conviction related to health fraud, has a license suspended or revoked, fails to disclose required information, fails to take corrective action, or makes false statements to the government, among others. Reinstatement of excluded entities and individuals is not automatic once the exclusion period ends. Those wishing to again participate in a federal health care program must apply for and receive reinstatement permission from the OIG.

Ms. Re stressed that her office is transparent about possible or upcoming exclusions during a payment investigation. If health professionals come under billing scrutiny, she encourages them and their attorneys to contact OIG officials to inquire whether an exclusion is likely or expected.

On Twitter @legal_med

WASHINGTON – While the line between an inadvertent billing mistake and intentional coding deception might be blurry, federal investigators are crystal clear about what drives them to exclude health providers from government health programs.

Rejection from Medicaid and Medicare comes down to severity and accountability, said Lisa Re, branch chief of administrative and civil remedies for the Health and Human Services Department Office of Counsel to Inspector General.

“At the end of the day, what we’re looking at is the seriousness of the conduct, cooperation with the compliance program, and whether or not there’s been a sense of financial responsibility – that the program has been made whole from the harm that was done,” Ms. Re said at a meeting sponsored by the American Bar Association.

In 2015, the Office of Inspector General (OIG) excluded 4,112 individuals and entities from participation in federal health care programs, up from 4,017 in 2014, according to a the OIG’s semiannual report to Congress published Nov. 30.

The office expects to recover nearly $3.4 billion in incorrect payments in 2015, down from $4.9 billion last year. The office also reported 925 criminal actions and 682 civil actions in 2015 involving false claims, unjust-enrichment lawsuits, civil settlements, and administrative recoveries.

When it comes to exclusions, investigators rely on the facts and circumstances of each individual case, Ms. Re said. Certain behaviors such as repeated disregard of government inquires and ongoing overbilling can lead to exclusions.

“We’re not trying to punish anyone,” Ms. Re said. “Exclusion is purely remedial. It’s a question of whether or not you have demonstrated sufficient trustworthiness for us to continue doing business with you.”

The OIG considers two types of exclusions – mandatory and permissive. The agency is obligated to exclude a provider if that professional is convicted of program-related crimes, is convicted of patient abuse or neglect, receives a felony health fraud conviction, or is convicted of two mandatory exclusion offenses. The OIG can use its discretion in situations in which a provider receives a misdemeanor conviction related to health fraud, has a license suspended or revoked, fails to disclose required information, fails to take corrective action, or makes false statements to the government, among others. Reinstatement of excluded entities and individuals is not automatic once the exclusion period ends. Those wishing to again participate in a federal health care program must apply for and receive reinstatement permission from the OIG.

Ms. Re stressed that her office is transparent about possible or upcoming exclusions during a payment investigation. If health professionals come under billing scrutiny, she encourages them and their attorneys to contact OIG officials to inquire whether an exclusion is likely or expected.

On Twitter @legal_med

WASHINGTON – While the line between an inadvertent billing mistake and intentional coding deception might be blurry, federal investigators are crystal clear about what drives them to exclude health providers from government health programs.

Rejection from Medicaid and Medicare comes down to severity and accountability, said Lisa Re, branch chief of administrative and civil remedies for the Health and Human Services Department Office of Counsel to Inspector General.

“At the end of the day, what we’re looking at is the seriousness of the conduct, cooperation with the compliance program, and whether or not there’s been a sense of financial responsibility – that the program has been made whole from the harm that was done,” Ms. Re said at a meeting sponsored by the American Bar Association.

In 2015, the Office of Inspector General (OIG) excluded 4,112 individuals and entities from participation in federal health care programs, up from 4,017 in 2014, according to a the OIG’s semiannual report to Congress published Nov. 30.

The office expects to recover nearly $3.4 billion in incorrect payments in 2015, down from $4.9 billion last year. The office also reported 925 criminal actions and 682 civil actions in 2015 involving false claims, unjust-enrichment lawsuits, civil settlements, and administrative recoveries.

When it comes to exclusions, investigators rely on the facts and circumstances of each individual case, Ms. Re said. Certain behaviors such as repeated disregard of government inquires and ongoing overbilling can lead to exclusions.

“We’re not trying to punish anyone,” Ms. Re said. “Exclusion is purely remedial. It’s a question of whether or not you have demonstrated sufficient trustworthiness for us to continue doing business with you.”

The OIG considers two types of exclusions – mandatory and permissive. The agency is obligated to exclude a provider if that professional is convicted of program-related crimes, is convicted of patient abuse or neglect, receives a felony health fraud conviction, or is convicted of two mandatory exclusion offenses. The OIG can use its discretion in situations in which a provider receives a misdemeanor conviction related to health fraud, has a license suspended or revoked, fails to disclose required information, fails to take corrective action, or makes false statements to the government, among others. Reinstatement of excluded entities and individuals is not automatic once the exclusion period ends. Those wishing to again participate in a federal health care program must apply for and receive reinstatement permission from the OIG.

Ms. Re stressed that her office is transparent about possible or upcoming exclusions during a payment investigation. If health professionals come under billing scrutiny, she encourages them and their attorneys to contact OIG officials to inquire whether an exclusion is likely or expected.

On Twitter @legal_med

AT THE WASHINGTON HEALTH LAW SUMMIT

Federal rule could reduce payments for out-of-network emergency services

Emergency physician leaders are outraged over a new federal regulation that they say could drastically lower payments for out-of-network emergency services. The final regulation, which affirms interim regulations by the U.S. Department of Health & Human Services, allows health plans to use a vague methodology to calculate reimbursement for out-of-network emergency services.

The American College of Emergency Physicians has worked for years to have the rule’s language revised, said Dr. Jeffrey Bettinger, a member of ACEP’s reimbursement committee and founder of a health care business consulting firm in Pinecrest, Fla. “They released final regulations which not only kept worrisome language ... but it actually made it worse.”

The regulation, published Nov. 18 in the Federal Register, outlines patient protections under the Affordable Care Act, including how health plans must calculate coverage for out-of-network emergency services. The regulation states that a patient’s group health plan must reimburse out-of-network emergency services by paying the greatest of three possible (GOT) amounts:

• The median amount negotiated with in-network providers for the emergency service furnished.

• The amount for the emergency service calculated using the same method the plan generally uses to determine payments for out-of-network services (such as the usual, customary, and reasonable amount).

• The amount that would be paid under Medicare for the emergency service.

Under these options, the second choice is nearly always the greatest of the three amounts, and the last option – Medicare’s rate – is likely to be lowest, Dr. Bettinger said.

ACEP has long been concerned about the second option because it lacks specificity and essentially leaves it up to health insurance plans to establish a Medicare-related method to reimburse emergency physicians for out-of-network services. The college lobbied for government officials to require more transparency from insurers who chose to pay under option two – for instance, by tying their methods to a usual, customary, and reasonable database or another model that was academically validated, Dr. Bettinger said. The interim rule used the language, “such as the usual, customary, and reasonable charges,” rather than “amount” under option two. Under the final rule, the phrase “usual, customary, and reasonable amount,” is even more ambiguous than the proposed language, Dr. Bettinger said.

“It’s a nebulous term,” he said. “Its totally nontransparent. There’s no database that we know of that keeps track of what that number is. Honestly it’s interpreted by the insurance companies to dramatically lower the payments they are making for out-of-network emergency services.”

In the final regulation, HHS acknowledged concerns by health providers about the level of payment for out-of-network emergency services and the need for more transparency by insurers.

“The departments believe that this concern is addressed by our requirement that the amount be the greatest of the three amounts specified,” according to the regulation.

America’s Health Insurance Plans (AHIP), the national trade association for health insurers, declined to comment specifically about the final rule. However, AHIP spokesman Courtney Jay said that ACEP “isn’t addressing the amount patients are being charged for emergency services.” He noted a recent AHIP report finding that average billed charges submitted by out-of-network providers, including emergency physicians, far exceed Medicare reimbursement for the same service performed in the same geographic area. According to the September 2015 analysis, among 97 procedures studied, average out-of-network billed charges were from 118% to 1,382% of amounts paid by Medicare. High out-of-network charges impose significant burdens on consumers and result in high out-of-network expenses for patients due to balance billing by providers, according to AHIP.

The final regulation does not prohibit balance billing; however, if a patient resides in a state that bans balance billing, the “greatest of three” rule does not apply. Rather, emergency physicians in such states would be reimbursed based on the unique reimbursement method for out-of-network emergency services in their state. This could problematic for emergency physicians in states that prohibit balance billing, Dr. Bettinger said.

“Some states that have specific payment regulations won’t be impacted to a large degree,” he said. “Other states that have prohibitions have less clearly defined payment formulas. These states will be impacted by the final rule.”

ACEP is considering taking legal action against the government over the rule, said ACEP President Jay A. Kaplan.

“This new ruling will significantly benefit health insurance companies at the expense of physicians, because they know hospital emergency departments have a federal mandate to care for everyone, regardless of ability to pay,” Dr. Kaplan said in a statement. “They will continue to shift costs onto patients and medical providers, as well as shrink the number of doctors available in plans. Instead of requiring health plans to pay fairly, this ruling guarantees that insurance companies can pay whatever they want for emergency care. If history tells us anything, it’s that insurance companies prefer to pay as close to nothing as possible, while building their war chest for profits and litigation.”

HHS officials did not respond to requests for comment.

On Twitter @legal_med

Emergency physician leaders are outraged over a new federal regulation that they say could drastically lower payments for out-of-network emergency services. The final regulation, which affirms interim regulations by the U.S. Department of Health & Human Services, allows health plans to use a vague methodology to calculate reimbursement for out-of-network emergency services.

The American College of Emergency Physicians has worked for years to have the rule’s language revised, said Dr. Jeffrey Bettinger, a member of ACEP’s reimbursement committee and founder of a health care business consulting firm in Pinecrest, Fla. “They released final regulations which not only kept worrisome language ... but it actually made it worse.”

The regulation, published Nov. 18 in the Federal Register, outlines patient protections under the Affordable Care Act, including how health plans must calculate coverage for out-of-network emergency services. The regulation states that a patient’s group health plan must reimburse out-of-network emergency services by paying the greatest of three possible (GOT) amounts:

• The median amount negotiated with in-network providers for the emergency service furnished.

• The amount for the emergency service calculated using the same method the plan generally uses to determine payments for out-of-network services (such as the usual, customary, and reasonable amount).

• The amount that would be paid under Medicare for the emergency service.

Under these options, the second choice is nearly always the greatest of the three amounts, and the last option – Medicare’s rate – is likely to be lowest, Dr. Bettinger said.

ACEP has long been concerned about the second option because it lacks specificity and essentially leaves it up to health insurance plans to establish a Medicare-related method to reimburse emergency physicians for out-of-network services. The college lobbied for government officials to require more transparency from insurers who chose to pay under option two – for instance, by tying their methods to a usual, customary, and reasonable database or another model that was academically validated, Dr. Bettinger said. The interim rule used the language, “such as the usual, customary, and reasonable charges,” rather than “amount” under option two. Under the final rule, the phrase “usual, customary, and reasonable amount,” is even more ambiguous than the proposed language, Dr. Bettinger said.

“It’s a nebulous term,” he said. “Its totally nontransparent. There’s no database that we know of that keeps track of what that number is. Honestly it’s interpreted by the insurance companies to dramatically lower the payments they are making for out-of-network emergency services.”

In the final regulation, HHS acknowledged concerns by health providers about the level of payment for out-of-network emergency services and the need for more transparency by insurers.

“The departments believe that this concern is addressed by our requirement that the amount be the greatest of the three amounts specified,” according to the regulation.

America’s Health Insurance Plans (AHIP), the national trade association for health insurers, declined to comment specifically about the final rule. However, AHIP spokesman Courtney Jay said that ACEP “isn’t addressing the amount patients are being charged for emergency services.” He noted a recent AHIP report finding that average billed charges submitted by out-of-network providers, including emergency physicians, far exceed Medicare reimbursement for the same service performed in the same geographic area. According to the September 2015 analysis, among 97 procedures studied, average out-of-network billed charges were from 118% to 1,382% of amounts paid by Medicare. High out-of-network charges impose significant burdens on consumers and result in high out-of-network expenses for patients due to balance billing by providers, according to AHIP.

The final regulation does not prohibit balance billing; however, if a patient resides in a state that bans balance billing, the “greatest of three” rule does not apply. Rather, emergency physicians in such states would be reimbursed based on the unique reimbursement method for out-of-network emergency services in their state. This could problematic for emergency physicians in states that prohibit balance billing, Dr. Bettinger said.

“Some states that have specific payment regulations won’t be impacted to a large degree,” he said. “Other states that have prohibitions have less clearly defined payment formulas. These states will be impacted by the final rule.”

ACEP is considering taking legal action against the government over the rule, said ACEP President Jay A. Kaplan.

“This new ruling will significantly benefit health insurance companies at the expense of physicians, because they know hospital emergency departments have a federal mandate to care for everyone, regardless of ability to pay,” Dr. Kaplan said in a statement. “They will continue to shift costs onto patients and medical providers, as well as shrink the number of doctors available in plans. Instead of requiring health plans to pay fairly, this ruling guarantees that insurance companies can pay whatever they want for emergency care. If history tells us anything, it’s that insurance companies prefer to pay as close to nothing as possible, while building their war chest for profits and litigation.”

HHS officials did not respond to requests for comment.

On Twitter @legal_med

Emergency physician leaders are outraged over a new federal regulation that they say could drastically lower payments for out-of-network emergency services. The final regulation, which affirms interim regulations by the U.S. Department of Health & Human Services, allows health plans to use a vague methodology to calculate reimbursement for out-of-network emergency services.

The American College of Emergency Physicians has worked for years to have the rule’s language revised, said Dr. Jeffrey Bettinger, a member of ACEP’s reimbursement committee and founder of a health care business consulting firm in Pinecrest, Fla. “They released final regulations which not only kept worrisome language ... but it actually made it worse.”

The regulation, published Nov. 18 in the Federal Register, outlines patient protections under the Affordable Care Act, including how health plans must calculate coverage for out-of-network emergency services. The regulation states that a patient’s group health plan must reimburse out-of-network emergency services by paying the greatest of three possible (GOT) amounts:

• The median amount negotiated with in-network providers for the emergency service furnished.

• The amount for the emergency service calculated using the same method the plan generally uses to determine payments for out-of-network services (such as the usual, customary, and reasonable amount).

• The amount that would be paid under Medicare for the emergency service.

Under these options, the second choice is nearly always the greatest of the three amounts, and the last option – Medicare’s rate – is likely to be lowest, Dr. Bettinger said.

ACEP has long been concerned about the second option because it lacks specificity and essentially leaves it up to health insurance plans to establish a Medicare-related method to reimburse emergency physicians for out-of-network services. The college lobbied for government officials to require more transparency from insurers who chose to pay under option two – for instance, by tying their methods to a usual, customary, and reasonable database or another model that was academically validated, Dr. Bettinger said. The interim rule used the language, “such as the usual, customary, and reasonable charges,” rather than “amount” under option two. Under the final rule, the phrase “usual, customary, and reasonable amount,” is even more ambiguous than the proposed language, Dr. Bettinger said.

“It’s a nebulous term,” he said. “Its totally nontransparent. There’s no database that we know of that keeps track of what that number is. Honestly it’s interpreted by the insurance companies to dramatically lower the payments they are making for out-of-network emergency services.”

In the final regulation, HHS acknowledged concerns by health providers about the level of payment for out-of-network emergency services and the need for more transparency by insurers.

“The departments believe that this concern is addressed by our requirement that the amount be the greatest of the three amounts specified,” according to the regulation.

America’s Health Insurance Plans (AHIP), the national trade association for health insurers, declined to comment specifically about the final rule. However, AHIP spokesman Courtney Jay said that ACEP “isn’t addressing the amount patients are being charged for emergency services.” He noted a recent AHIP report finding that average billed charges submitted by out-of-network providers, including emergency physicians, far exceed Medicare reimbursement for the same service performed in the same geographic area. According to the September 2015 analysis, among 97 procedures studied, average out-of-network billed charges were from 118% to 1,382% of amounts paid by Medicare. High out-of-network charges impose significant burdens on consumers and result in high out-of-network expenses for patients due to balance billing by providers, according to AHIP.

The final regulation does not prohibit balance billing; however, if a patient resides in a state that bans balance billing, the “greatest of three” rule does not apply. Rather, emergency physicians in such states would be reimbursed based on the unique reimbursement method for out-of-network emergency services in their state. This could problematic for emergency physicians in states that prohibit balance billing, Dr. Bettinger said.

“Some states that have specific payment regulations won’t be impacted to a large degree,” he said. “Other states that have prohibitions have less clearly defined payment formulas. These states will be impacted by the final rule.”

ACEP is considering taking legal action against the government over the rule, said ACEP President Jay A. Kaplan.

“This new ruling will significantly benefit health insurance companies at the expense of physicians, because they know hospital emergency departments have a federal mandate to care for everyone, regardless of ability to pay,” Dr. Kaplan said in a statement. “They will continue to shift costs onto patients and medical providers, as well as shrink the number of doctors available in plans. Instead of requiring health plans to pay fairly, this ruling guarantees that insurance companies can pay whatever they want for emergency care. If history tells us anything, it’s that insurance companies prefer to pay as close to nothing as possible, while building their war chest for profits and litigation.”

HHS officials did not respond to requests for comment.

On Twitter @legal_med

Women physicians outnumber men in ob.gyn., lag in other specialties

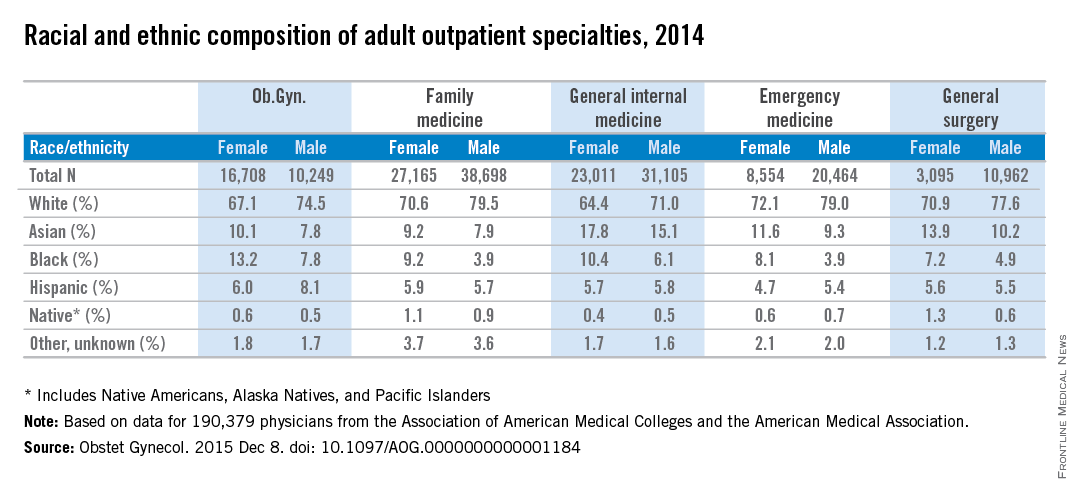

Ob.gyn. is the only one of the five largest adult outpatient specialties in which women make up the majority of physicians, according to a new study.

Women made up almost 62% of ob.gyns. in 2014, but none of the other four specialties – family medicine, general internal medicine, emergency medicine, and general surgery – reached 50%, reported Dr. William F. Rayburn of the University of New Mexico, Albuquerque, and his associates.

The cross-sectional study of 190,379 physicians also showed that racial and ethnic composition differed between the five specialties, although whites made up the largest racial group in each. Among the minority groups, Asians made up the largest proportion of physicians in the study and were actually overrepresented, compared with the overall U.S. population. Internal medicine had the largest Asian population, followed by general surgery. Asians, along with black physicians, were more likely to be female in each specialty, the investigators said (Obstet Gynecol. 2015 Dec 8. doi: 10.1097/AOG.0000000000001184).

At 18.4%, ob.gyn. had the largest proportion of the underrepresented minorities – blacks, Hispanics, and Natives (Native Americans, Alaska Natives, and Pacific Islanders). Black physicians represented a larger share of ob.gyns. (11.1%) than in any of the other specialties, according to data from the Association of American Medical Colleges and the American Medical Association.

The investigators did not report any conflicts of interest.

Ob.gyn. is the only one of the five largest adult outpatient specialties in which women make up the majority of physicians, according to a new study.

Women made up almost 62% of ob.gyns. in 2014, but none of the other four specialties – family medicine, general internal medicine, emergency medicine, and general surgery – reached 50%, reported Dr. William F. Rayburn of the University of New Mexico, Albuquerque, and his associates.

The cross-sectional study of 190,379 physicians also showed that racial and ethnic composition differed between the five specialties, although whites made up the largest racial group in each. Among the minority groups, Asians made up the largest proportion of physicians in the study and were actually overrepresented, compared with the overall U.S. population. Internal medicine had the largest Asian population, followed by general surgery. Asians, along with black physicians, were more likely to be female in each specialty, the investigators said (Obstet Gynecol. 2015 Dec 8. doi: 10.1097/AOG.0000000000001184).

At 18.4%, ob.gyn. had the largest proportion of the underrepresented minorities – blacks, Hispanics, and Natives (Native Americans, Alaska Natives, and Pacific Islanders). Black physicians represented a larger share of ob.gyns. (11.1%) than in any of the other specialties, according to data from the Association of American Medical Colleges and the American Medical Association.

The investigators did not report any conflicts of interest.

Ob.gyn. is the only one of the five largest adult outpatient specialties in which women make up the majority of physicians, according to a new study.

Women made up almost 62% of ob.gyns. in 2014, but none of the other four specialties – family medicine, general internal medicine, emergency medicine, and general surgery – reached 50%, reported Dr. William F. Rayburn of the University of New Mexico, Albuquerque, and his associates.

The cross-sectional study of 190,379 physicians also showed that racial and ethnic composition differed between the five specialties, although whites made up the largest racial group in each. Among the minority groups, Asians made up the largest proportion of physicians in the study and were actually overrepresented, compared with the overall U.S. population. Internal medicine had the largest Asian population, followed by general surgery. Asians, along with black physicians, were more likely to be female in each specialty, the investigators said (Obstet Gynecol. 2015 Dec 8. doi: 10.1097/AOG.0000000000001184).

At 18.4%, ob.gyn. had the largest proportion of the underrepresented minorities – blacks, Hispanics, and Natives (Native Americans, Alaska Natives, and Pacific Islanders). Black physicians represented a larger share of ob.gyns. (11.1%) than in any of the other specialties, according to data from the Association of American Medical Colleges and the American Medical Association.

The investigators did not report any conflicts of interest.

FROM OBSTETRICS AND GYNECOLOGY

Cigna CEO David Cordani: ACA marketplace is still in ‘version 1.0’

Just days after UnitedHealth Group’s CEO said their move into the new marketplace was a mistake, Cigna CEO David Cordani reaffirmed that his company remains committed for 2016, although the firm is so far losing money on that business.

Cigna has a small share of the health law market with only 230,000 individual customers this year. But that could grow rapidly if a $54 billion purchase bid by insurer Anthem wins federal approval because Anthem is a big player in the individual market. The deal is one of two giant mergers in the works: Aetna is also working to get approval to buy Humana.

If Cigna’s deal is approved, Mr. Cordani is expected to remain with the new company as president and chief operating officer. He sat down with Julie Appleby of Kaiser Health News to discuss the marketplace. This interview has been edited for length.

When looking at the merger, many have asked how can having fewer insurers competing be good for consumers?

When you look at Cigna and Anthem, we are amazingly complementary. Cigna’s strength is for employers … we have unbelievably diverse global set of programs. Anthem is a strong U.S.-based corporation [with] a history and focus really around the individual market and small employers in the states it operates in. We were not historically in the individual market. We’re actually going to create more choice than less. We will be able to take Anthem’s individual infrastructure beyond the 14 states [in which it now operates].

What else?

We’ll take their leading Medicaid program and our leading Medicare program and put them together to design solutions for the dual-eligible population. In terms of employer marketplace, we will be able to bring population health and management programs to their employer programs and help expand the geographic footprint.

UnitedHealth’s CEO last month said the insurer is losing hundreds of millions of dollars on its individual insurance market business and hinted it might pull back from the market in 2017. While Cigna is smaller in that market, did you lose money or make money on Affordable Care Act business in 2014 and 2015?

When the law put in place the exchanges, we took a bit of a different public position than many of our competitors. We saw the exchange marketplace as a potentially attractive long-term viable market. We also said we viewed 2014, 2015, and 2016 as version 1.0 of that market and that it would take those 3 years for the market to shake itself out. We said from day 1 we didn’t expect to make money on it. We didn’t make money on it in 2014 and we aren’t making money on it in 2015.

Two of the reasons United gave for the losses were people moving in and out of the market and higher costs for people who signed up after the official 3-month open enrollment period closed. [There are a number of special exemptions that allow sign-ups during other times of the year.] How could the law be tweaked to lessen those concerns?

Societally, we are just starting to understand how the market is operating. What is the other market with some similarity? Medicare Advantage [the private alternative to traditional Medicare]. It has a one-time limited enrollment period [that is shorter than the ACA] – I think that’s a good thing. Compress the enrollment period, focus it and have a limited number of exceptions.

Secondly, [provide] more flexibility on how [insurers’ provider] networks are designed.

What Medicare Advantage shows us is by offering more choice, and choice is not necessarily different names of insurers, but benefit designs and network configurations, you get the right choice for you … as opposed to socializing things down.

[The market] has to also have a real focus on transparency [for consumers]. It can have more choice aided by transparency [and] network visibility for individuals to understand what they are buying before they sign up.

Only about 40% of the people eligible to enroll have – and they’re mainly concentrated in the income levels with the highest subsidies. What can be done to encourage more people to enroll?

You have to ask the consumer why they’re not enrolling. There’s a perceived affordability challenge. Perception is reality.

If [insurers] are allowed more flexibility in benefit and network configuration, we’re probably going to get solutions that are much more relevant to a part of the population that is not buying.

How would that work? Would you set higher deductibles to get lower premiums?

If you have an individual with a chronic disease, say asthma, you can have a program that is passive: If they want to enroll in a care management plan, they can. Or they can be incented to enroll. Or you can have a plan that is binary: If [you] have that [condition] [you] have to be in that [care management] program. Those are all choices. What we know is if [a patient is] asthmatic and more actively managed, the health outcomes and therefore the affordability can be quite different. This is a case where if you have a chronic illness, you need to be in a management program. We know the quality outcomes will be better and cost outcomes will be more sustainable.

In late December, Cigna will stop paying brokers commissions if they sell gold-level individual plans, which cover more costs than do the less expensive bronze and silver level plans. What is Cigna’s concern with gold products?

Adverse selection. [It’s not that policyholders] are necessarily older or sicker. The whole way the benefits are configured and the way marketplace is working – the performance of those plans – is much less reasonable than all the other plans.

Either there will be more flexibility to configure them in a way to make them sustainable or there won’t be gold plans.

So is Cigna staying in the market?

We’re in for 2016.

How about 2017?

We haven’t made a comment relative to 2017. We view 2014, 2015, and 2016 as version 1.0.

Kaiser Health News is a national health policy news service that is part of the nonpartisan Henry K. Kaiser Family Foundation.

Just days after UnitedHealth Group’s CEO said their move into the new marketplace was a mistake, Cigna CEO David Cordani reaffirmed that his company remains committed for 2016, although the firm is so far losing money on that business.

Cigna has a small share of the health law market with only 230,000 individual customers this year. But that could grow rapidly if a $54 billion purchase bid by insurer Anthem wins federal approval because Anthem is a big player in the individual market. The deal is one of two giant mergers in the works: Aetna is also working to get approval to buy Humana.

If Cigna’s deal is approved, Mr. Cordani is expected to remain with the new company as president and chief operating officer. He sat down with Julie Appleby of Kaiser Health News to discuss the marketplace. This interview has been edited for length.

When looking at the merger, many have asked how can having fewer insurers competing be good for consumers?

When you look at Cigna and Anthem, we are amazingly complementary. Cigna’s strength is for employers … we have unbelievably diverse global set of programs. Anthem is a strong U.S.-based corporation [with] a history and focus really around the individual market and small employers in the states it operates in. We were not historically in the individual market. We’re actually going to create more choice than less. We will be able to take Anthem’s individual infrastructure beyond the 14 states [in which it now operates].

What else?

We’ll take their leading Medicaid program and our leading Medicare program and put them together to design solutions for the dual-eligible population. In terms of employer marketplace, we will be able to bring population health and management programs to their employer programs and help expand the geographic footprint.

UnitedHealth’s CEO last month said the insurer is losing hundreds of millions of dollars on its individual insurance market business and hinted it might pull back from the market in 2017. While Cigna is smaller in that market, did you lose money or make money on Affordable Care Act business in 2014 and 2015?

When the law put in place the exchanges, we took a bit of a different public position than many of our competitors. We saw the exchange marketplace as a potentially attractive long-term viable market. We also said we viewed 2014, 2015, and 2016 as version 1.0 of that market and that it would take those 3 years for the market to shake itself out. We said from day 1 we didn’t expect to make money on it. We didn’t make money on it in 2014 and we aren’t making money on it in 2015.

Two of the reasons United gave for the losses were people moving in and out of the market and higher costs for people who signed up after the official 3-month open enrollment period closed. [There are a number of special exemptions that allow sign-ups during other times of the year.] How could the law be tweaked to lessen those concerns?

Societally, we are just starting to understand how the market is operating. What is the other market with some similarity? Medicare Advantage [the private alternative to traditional Medicare]. It has a one-time limited enrollment period [that is shorter than the ACA] – I think that’s a good thing. Compress the enrollment period, focus it and have a limited number of exceptions.

Secondly, [provide] more flexibility on how [insurers’ provider] networks are designed.

What Medicare Advantage shows us is by offering more choice, and choice is not necessarily different names of insurers, but benefit designs and network configurations, you get the right choice for you … as opposed to socializing things down.

[The market] has to also have a real focus on transparency [for consumers]. It can have more choice aided by transparency [and] network visibility for individuals to understand what they are buying before they sign up.

Only about 40% of the people eligible to enroll have – and they’re mainly concentrated in the income levels with the highest subsidies. What can be done to encourage more people to enroll?

You have to ask the consumer why they’re not enrolling. There’s a perceived affordability challenge. Perception is reality.

If [insurers] are allowed more flexibility in benefit and network configuration, we’re probably going to get solutions that are much more relevant to a part of the population that is not buying.

How would that work? Would you set higher deductibles to get lower premiums?

If you have an individual with a chronic disease, say asthma, you can have a program that is passive: If they want to enroll in a care management plan, they can. Or they can be incented to enroll. Or you can have a plan that is binary: If [you] have that [condition] [you] have to be in that [care management] program. Those are all choices. What we know is if [a patient is] asthmatic and more actively managed, the health outcomes and therefore the affordability can be quite different. This is a case where if you have a chronic illness, you need to be in a management program. We know the quality outcomes will be better and cost outcomes will be more sustainable.

In late December, Cigna will stop paying brokers commissions if they sell gold-level individual plans, which cover more costs than do the less expensive bronze and silver level plans. What is Cigna’s concern with gold products?

Adverse selection. [It’s not that policyholders] are necessarily older or sicker. The whole way the benefits are configured and the way marketplace is working – the performance of those plans – is much less reasonable than all the other plans.

Either there will be more flexibility to configure them in a way to make them sustainable or there won’t be gold plans.

So is Cigna staying in the market?

We’re in for 2016.

How about 2017?

We haven’t made a comment relative to 2017. We view 2014, 2015, and 2016 as version 1.0.

Kaiser Health News is a national health policy news service that is part of the nonpartisan Henry K. Kaiser Family Foundation.

Just days after UnitedHealth Group’s CEO said their move into the new marketplace was a mistake, Cigna CEO David Cordani reaffirmed that his company remains committed for 2016, although the firm is so far losing money on that business.

Cigna has a small share of the health law market with only 230,000 individual customers this year. But that could grow rapidly if a $54 billion purchase bid by insurer Anthem wins federal approval because Anthem is a big player in the individual market. The deal is one of two giant mergers in the works: Aetna is also working to get approval to buy Humana.

If Cigna’s deal is approved, Mr. Cordani is expected to remain with the new company as president and chief operating officer. He sat down with Julie Appleby of Kaiser Health News to discuss the marketplace. This interview has been edited for length.

When looking at the merger, many have asked how can having fewer insurers competing be good for consumers?

When you look at Cigna and Anthem, we are amazingly complementary. Cigna’s strength is for employers … we have unbelievably diverse global set of programs. Anthem is a strong U.S.-based corporation [with] a history and focus really around the individual market and small employers in the states it operates in. We were not historically in the individual market. We’re actually going to create more choice than less. We will be able to take Anthem’s individual infrastructure beyond the 14 states [in which it now operates].

What else?

We’ll take their leading Medicaid program and our leading Medicare program and put them together to design solutions for the dual-eligible population. In terms of employer marketplace, we will be able to bring population health and management programs to their employer programs and help expand the geographic footprint.

UnitedHealth’s CEO last month said the insurer is losing hundreds of millions of dollars on its individual insurance market business and hinted it might pull back from the market in 2017. While Cigna is smaller in that market, did you lose money or make money on Affordable Care Act business in 2014 and 2015?

When the law put in place the exchanges, we took a bit of a different public position than many of our competitors. We saw the exchange marketplace as a potentially attractive long-term viable market. We also said we viewed 2014, 2015, and 2016 as version 1.0 of that market and that it would take those 3 years for the market to shake itself out. We said from day 1 we didn’t expect to make money on it. We didn’t make money on it in 2014 and we aren’t making money on it in 2015.

Two of the reasons United gave for the losses were people moving in and out of the market and higher costs for people who signed up after the official 3-month open enrollment period closed. [There are a number of special exemptions that allow sign-ups during other times of the year.] How could the law be tweaked to lessen those concerns?

Societally, we are just starting to understand how the market is operating. What is the other market with some similarity? Medicare Advantage [the private alternative to traditional Medicare]. It has a one-time limited enrollment period [that is shorter than the ACA] – I think that’s a good thing. Compress the enrollment period, focus it and have a limited number of exceptions.

Secondly, [provide] more flexibility on how [insurers’ provider] networks are designed.

What Medicare Advantage shows us is by offering more choice, and choice is not necessarily different names of insurers, but benefit designs and network configurations, you get the right choice for you … as opposed to socializing things down.

[The market] has to also have a real focus on transparency [for consumers]. It can have more choice aided by transparency [and] network visibility for individuals to understand what they are buying before they sign up.

Only about 40% of the people eligible to enroll have – and they’re mainly concentrated in the income levels with the highest subsidies. What can be done to encourage more people to enroll?

You have to ask the consumer why they’re not enrolling. There’s a perceived affordability challenge. Perception is reality.

If [insurers] are allowed more flexibility in benefit and network configuration, we’re probably going to get solutions that are much more relevant to a part of the population that is not buying.

How would that work? Would you set higher deductibles to get lower premiums?

If you have an individual with a chronic disease, say asthma, you can have a program that is passive: If they want to enroll in a care management plan, they can. Or they can be incented to enroll. Or you can have a plan that is binary: If [you] have that [condition] [you] have to be in that [care management] program. Those are all choices. What we know is if [a patient is] asthmatic and more actively managed, the health outcomes and therefore the affordability can be quite different. This is a case where if you have a chronic illness, you need to be in a management program. We know the quality outcomes will be better and cost outcomes will be more sustainable.

In late December, Cigna will stop paying brokers commissions if they sell gold-level individual plans, which cover more costs than do the less expensive bronze and silver level plans. What is Cigna’s concern with gold products?

Adverse selection. [It’s not that policyholders] are necessarily older or sicker. The whole way the benefits are configured and the way marketplace is working – the performance of those plans – is much less reasonable than all the other plans.

Either there will be more flexibility to configure them in a way to make them sustainable or there won’t be gold plans.

So is Cigna staying in the market?

We’re in for 2016.

How about 2017?

We haven’t made a comment relative to 2017. We view 2014, 2015, and 2016 as version 1.0.

Kaiser Health News is a national health policy news service that is part of the nonpartisan Henry K. Kaiser Family Foundation.

Analysis finds 28.8% prevalence of depression in residents

The estimated prevalence of depression or depressive symptoms was 28.8% among residents and interns worldwide in a meta-analysis of 54 studies of the issue, according to a report published online December 8 in JAMA.

The depression rate ranged from 20.9% to 43.2%, depending on the instrument used to assess symptoms. Eleven studies used the Beck Depression Inventory (BDI), 11 used the Center for Epidemiological Studies Depression Scale (CES-D), 8 used the two-item Primary Care Evaluation of Mental Disorders questionnaire (PRIME-MD), 7 used the nine-item Patient Health Questionnaire (PHQ-9), 4 used the Zung Self-Rating Depression Scale (SDS), 3 used the Harvard Department of Psychiatry/National Depression Screening Day Scale (HANDS), and 11 used other validated methods, said Dr. Douglas A. Mata of the department of pathology, Brigham and Women’s Hospital and Harvard Medical School, Boston, and his associates.

“It is important to note that the vast majority of participants were assessed through self-report inventories that measured depressive symptoms, rather than gold-standard diagnostic clinical interviews for major depressive disorder,” they said.

The meta-analysis included 31 cross-sectional and 23 longitudinal studies published in peer-reviewed journals since 1963 and involving 17,560 residents or interns in North America (35 studies), Asia (9 studies), Europe (5 studies), South America (4 studies), and Africa (1 study). When the results were pooled, the overall prevalence of depression or depressive symptoms was 28.8% (4,969 of 17,560 participants).

In a sensitivity analysis, no individual study affected the overall prevalence estimate by more than 1%. Further analyses showed no significant differences in the prevalence of depression between cross-sectional and longitudinal studies, between U.S. studies and those performed in other countries, between studies of nonsurgical residents only vs. studies of all types of residents, or between studies of interns only vs. studies of upper level residents only. This suggests that the underlying causes of depressive symptoms “are common to the residency experience,” Dr. Mata and his associates said (JAMA. 2015 Dec 8. doi: 10.1001/jama.2015.15845).

The prevalence of depression increased over time. Although this rise was characterized as modest, “it is notable, given efforts by the Accreditation Council for Graduate Medical Education, European Working Time Directive, and others to limit trainee duty hours and improve work conditions. [This] trend may reflect the medical community’s increased awareness of depression or developments external to medical education. Future studies should explore specific factors that may explain this trend,” the investigators said.

The study findings indicate that the long-term health of physicians may be affected, since depression has been linked to a higher risk of future depressive episodes and greater long-term morbidity. Patient care may also be affected, given the established association between physician depression and lower-quality care, they added.

|

Dr. Thomas L. Schwenk |

The meta-analysis by Mata et al. makes it clear that the extent of significant depressive symptomatology, if not overt clinical depression, among physicians-in-training is extraordinarily and unacceptably high. Relieving the burden of depression in these individuals is an issue of professional performance in addition to one of human compassion.

A national conversation about the fundamental structure and function of the graduate medical education system is long overdue, not unlike the discussion that reformed undergraduate medical education after the Flexner Report. The high burden of depressive symptoms among residents and interns has reached a crisis level. It is a marker for deeper and more profound problems in the medical education system, which require equally profound solutions.

Dr. Thomas L. Schwenk is at the University of Nevada, Reno. He reported having no relevant financial disclosures. Dr. Schwenk made these remarks in an editorial accompanying Dr. Mata’s report (JAMA 2015;314:2357-8).

|

Dr. Thomas L. Schwenk |

The meta-analysis by Mata et al. makes it clear that the extent of significant depressive symptomatology, if not overt clinical depression, among physicians-in-training is extraordinarily and unacceptably high. Relieving the burden of depression in these individuals is an issue of professional performance in addition to one of human compassion.

A national conversation about the fundamental structure and function of the graduate medical education system is long overdue, not unlike the discussion that reformed undergraduate medical education after the Flexner Report. The high burden of depressive symptoms among residents and interns has reached a crisis level. It is a marker for deeper and more profound problems in the medical education system, which require equally profound solutions.

Dr. Thomas L. Schwenk is at the University of Nevada, Reno. He reported having no relevant financial disclosures. Dr. Schwenk made these remarks in an editorial accompanying Dr. Mata’s report (JAMA 2015;314:2357-8).

|

Dr. Thomas L. Schwenk |

The meta-analysis by Mata et al. makes it clear that the extent of significant depressive symptomatology, if not overt clinical depression, among physicians-in-training is extraordinarily and unacceptably high. Relieving the burden of depression in these individuals is an issue of professional performance in addition to one of human compassion.

A national conversation about the fundamental structure and function of the graduate medical education system is long overdue, not unlike the discussion that reformed undergraduate medical education after the Flexner Report. The high burden of depressive symptoms among residents and interns has reached a crisis level. It is a marker for deeper and more profound problems in the medical education system, which require equally profound solutions.

Dr. Thomas L. Schwenk is at the University of Nevada, Reno. He reported having no relevant financial disclosures. Dr. Schwenk made these remarks in an editorial accompanying Dr. Mata’s report (JAMA 2015;314:2357-8).

The estimated prevalence of depression or depressive symptoms was 28.8% among residents and interns worldwide in a meta-analysis of 54 studies of the issue, according to a report published online December 8 in JAMA.

The depression rate ranged from 20.9% to 43.2%, depending on the instrument used to assess symptoms. Eleven studies used the Beck Depression Inventory (BDI), 11 used the Center for Epidemiological Studies Depression Scale (CES-D), 8 used the two-item Primary Care Evaluation of Mental Disorders questionnaire (PRIME-MD), 7 used the nine-item Patient Health Questionnaire (PHQ-9), 4 used the Zung Self-Rating Depression Scale (SDS), 3 used the Harvard Department of Psychiatry/National Depression Screening Day Scale (HANDS), and 11 used other validated methods, said Dr. Douglas A. Mata of the department of pathology, Brigham and Women’s Hospital and Harvard Medical School, Boston, and his associates.

“It is important to note that the vast majority of participants were assessed through self-report inventories that measured depressive symptoms, rather than gold-standard diagnostic clinical interviews for major depressive disorder,” they said.

The meta-analysis included 31 cross-sectional and 23 longitudinal studies published in peer-reviewed journals since 1963 and involving 17,560 residents or interns in North America (35 studies), Asia (9 studies), Europe (5 studies), South America (4 studies), and Africa (1 study). When the results were pooled, the overall prevalence of depression or depressive symptoms was 28.8% (4,969 of 17,560 participants).

In a sensitivity analysis, no individual study affected the overall prevalence estimate by more than 1%. Further analyses showed no significant differences in the prevalence of depression between cross-sectional and longitudinal studies, between U.S. studies and those performed in other countries, between studies of nonsurgical residents only vs. studies of all types of residents, or between studies of interns only vs. studies of upper level residents only. This suggests that the underlying causes of depressive symptoms “are common to the residency experience,” Dr. Mata and his associates said (JAMA. 2015 Dec 8. doi: 10.1001/jama.2015.15845).