User login

DEA expands drug take-back program to hospitals, clinics

Expanding on its successful National Prescription Drug Take-Back Program, the Drug Enforcement Administration will now allow hospitals and clinics with on-site pharmacies to collect excess prescription controlled substances for disposal on an ongoing basis.

The new regulations are designed to further minimize prescription drug abuse and diversion, according to the DEA. They were issued Sept. 8, and take effect Oct. 9.

Under the regulations, manufacturers, distributors, reverse distributors, retail pharmacies, registered narcotics treatment programs, and hospitals and clinics with an on-site pharmacy can operate disposal programs. Voluntary collection receptacles can be maintained at long-term care facilities as well.

Collected medications must be stored at registered locations in a securely locked, substantially constructed cabinet or a securely locked room with controlled access and may not be stored along with noncontrolled substances, according to the regulations.

Nearly 110 U.S. residents die every day from drug-related overdoses – half of those opioid related, according to the DEA.

"The road to prescription drug abuse is often through the medicine cabinet," Michael Botticelli, acting director of National Drug Control Policy, said during a press conference. "We know that 70% of people who initiate drug use get these drugs free from friends and family. These regulations create new, convenient, and environmentally friendly ways for people to get unneeded prescriptions out of their homes, preventing the possibility of misuse that so often leads to addiction."

The DEA’s National Prescription Drug Take-Back Program events began in September 2010. Eight national events have collected more than 4.1 million pounds of medication at 6,000 sites operated by law enforcement agents across all 50 states; the next one is scheduled for Sept. 27.

Expanding on its successful National Prescription Drug Take-Back Program, the Drug Enforcement Administration will now allow hospitals and clinics with on-site pharmacies to collect excess prescription controlled substances for disposal on an ongoing basis.

The new regulations are designed to further minimize prescription drug abuse and diversion, according to the DEA. They were issued Sept. 8, and take effect Oct. 9.

Under the regulations, manufacturers, distributors, reverse distributors, retail pharmacies, registered narcotics treatment programs, and hospitals and clinics with an on-site pharmacy can operate disposal programs. Voluntary collection receptacles can be maintained at long-term care facilities as well.

Collected medications must be stored at registered locations in a securely locked, substantially constructed cabinet or a securely locked room with controlled access and may not be stored along with noncontrolled substances, according to the regulations.

Nearly 110 U.S. residents die every day from drug-related overdoses – half of those opioid related, according to the DEA.

"The road to prescription drug abuse is often through the medicine cabinet," Michael Botticelli, acting director of National Drug Control Policy, said during a press conference. "We know that 70% of people who initiate drug use get these drugs free from friends and family. These regulations create new, convenient, and environmentally friendly ways for people to get unneeded prescriptions out of their homes, preventing the possibility of misuse that so often leads to addiction."

The DEA’s National Prescription Drug Take-Back Program events began in September 2010. Eight national events have collected more than 4.1 million pounds of medication at 6,000 sites operated by law enforcement agents across all 50 states; the next one is scheduled for Sept. 27.

Expanding on its successful National Prescription Drug Take-Back Program, the Drug Enforcement Administration will now allow hospitals and clinics with on-site pharmacies to collect excess prescription controlled substances for disposal on an ongoing basis.

The new regulations are designed to further minimize prescription drug abuse and diversion, according to the DEA. They were issued Sept. 8, and take effect Oct. 9.

Under the regulations, manufacturers, distributors, reverse distributors, retail pharmacies, registered narcotics treatment programs, and hospitals and clinics with an on-site pharmacy can operate disposal programs. Voluntary collection receptacles can be maintained at long-term care facilities as well.

Collected medications must be stored at registered locations in a securely locked, substantially constructed cabinet or a securely locked room with controlled access and may not be stored along with noncontrolled substances, according to the regulations.

Nearly 110 U.S. residents die every day from drug-related overdoses – half of those opioid related, according to the DEA.

"The road to prescription drug abuse is often through the medicine cabinet," Michael Botticelli, acting director of National Drug Control Policy, said during a press conference. "We know that 70% of people who initiate drug use get these drugs free from friends and family. These regulations create new, convenient, and environmentally friendly ways for people to get unneeded prescriptions out of their homes, preventing the possibility of misuse that so often leads to addiction."

The DEA’s National Prescription Drug Take-Back Program events began in September 2010. Eight national events have collected more than 4.1 million pounds of medication at 6,000 sites operated by law enforcement agents across all 50 states; the next one is scheduled for Sept. 27.

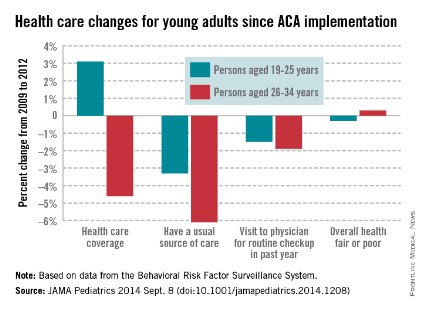

Health care coverage down for 26- to 34-year-olds

Health care coverage has increased for Americans aged 19-25 years but decreased for those aged 26-34 years since implementation of the Affordable Care Act in 2010, according to a study published online Sept. 8 in JAMA Pediatrics.

From 2009 to 2012, health care coverage rose 3.1% for 19- to 25-year-olds but decreased 4.6% among those aged 26-34. Both groups were less likely to have a usual source of care, but the decrease was larger for the older age group (–6.1% vs. –3.3%), Dr. Meera Kotagal of the University of Washington, Seattle, and her associates reported.

There was, however, no significant difference between the age groups for visits to a physician for a routine checkup in the past year, with 19- to 25-year-olds down 1.5% and 26- to 34-year-olds down 1.9%. The investigators noted that, despite these largely negative changes, there was no significant change in self-reported health status: –0.3% for those aged 19-25 and 0.3% for those aged 26-34.

"Young adults, given their overall healthy status, may not desire regular primary care, and thus an expansion in coverage may not lead these individuals to have a usual source. The proportion of young adults who reported a recent physician’s visit ... has declined yearly since 2003," Dr. Kotagal and her associates wrote (JAMA Pediatr. 2014 Sept. 8 (doi:10.1001/jamapediatrics.2014.1208).

This analysis was based on data for 2009 and 2012 from the Behavioral Risk Factor Surveillance System. The investigators did not report any conflicts of interest.

Health care coverage has increased for Americans aged 19-25 years but decreased for those aged 26-34 years since implementation of the Affordable Care Act in 2010, according to a study published online Sept. 8 in JAMA Pediatrics.

From 2009 to 2012, health care coverage rose 3.1% for 19- to 25-year-olds but decreased 4.6% among those aged 26-34. Both groups were less likely to have a usual source of care, but the decrease was larger for the older age group (–6.1% vs. –3.3%), Dr. Meera Kotagal of the University of Washington, Seattle, and her associates reported.

There was, however, no significant difference between the age groups for visits to a physician for a routine checkup in the past year, with 19- to 25-year-olds down 1.5% and 26- to 34-year-olds down 1.9%. The investigators noted that, despite these largely negative changes, there was no significant change in self-reported health status: –0.3% for those aged 19-25 and 0.3% for those aged 26-34.

"Young adults, given their overall healthy status, may not desire regular primary care, and thus an expansion in coverage may not lead these individuals to have a usual source. The proportion of young adults who reported a recent physician’s visit ... has declined yearly since 2003," Dr. Kotagal and her associates wrote (JAMA Pediatr. 2014 Sept. 8 (doi:10.1001/jamapediatrics.2014.1208).

This analysis was based on data for 2009 and 2012 from the Behavioral Risk Factor Surveillance System. The investigators did not report any conflicts of interest.

Health care coverage has increased for Americans aged 19-25 years but decreased for those aged 26-34 years since implementation of the Affordable Care Act in 2010, according to a study published online Sept. 8 in JAMA Pediatrics.

From 2009 to 2012, health care coverage rose 3.1% for 19- to 25-year-olds but decreased 4.6% among those aged 26-34. Both groups were less likely to have a usual source of care, but the decrease was larger for the older age group (–6.1% vs. –3.3%), Dr. Meera Kotagal of the University of Washington, Seattle, and her associates reported.

There was, however, no significant difference between the age groups for visits to a physician for a routine checkup in the past year, with 19- to 25-year-olds down 1.5% and 26- to 34-year-olds down 1.9%. The investigators noted that, despite these largely negative changes, there was no significant change in self-reported health status: –0.3% for those aged 19-25 and 0.3% for those aged 26-34.

"Young adults, given their overall healthy status, may not desire regular primary care, and thus an expansion in coverage may not lead these individuals to have a usual source. The proportion of young adults who reported a recent physician’s visit ... has declined yearly since 2003," Dr. Kotagal and her associates wrote (JAMA Pediatr. 2014 Sept. 8 (doi:10.1001/jamapediatrics.2014.1208).

This analysis was based on data for 2009 and 2012 from the Behavioral Risk Factor Surveillance System. The investigators did not report any conflicts of interest.

FROM JAMA PEDIATRICS

Federation finalizes telemedicine compact for legislative review

The Federation of State Medical Boards has completed the drafting of its interstate medical licensure compact and is ready for state legislatures to consider the proposal.

The proposed interstate compact would expedite the process of multistate physician licensure and help expand the practice of telemedicine. In a Sept. 5 statement, Dr. Humayun J. Chaudhry, CEO of the Federation of State Medical Boards (FSMB), said the compact’s language design is finished and that state legislatures and medical boards can now weigh adoption of the model legislation.

"The FSMB is pleased to have supported the state medical board community as it developed this compact to streamline licensure, while maintaining patient protection as a top priority," Dr. Chaudhry said in the statement.

The FSMB House of Delegates unanimously approved the development of an interstate compact to streamline medical licensure and facilitate multistate practice at its 2013 annual meeting. Under the proposed system, states and doctors would voluntarily enter into the compact, and approved physicians would be under the jurisdiction of the state medical board in which the patient was located at the time of the medical interaction. State boards of medicine would retain their individual authority for discipline and oversight, according to the proposed compact. The compact system is expected to significantly reduce barriers to the process of gaining licensure in multiple states, while helping to facilitate licensure portability and telemedicine.

The American Medical Association said the interstate compact aligns with its efforts to modernize state medical licensure and allow for an expedited pathway in participating states.

"State-based licensure is an important tenet of accountability, ensuring that physicians are qualified through the review of their education, training, character, and professional disciplinary histories," AMA President Dr. Robert M. Wah said in a statement. "We applaud the FSMB for developing the interstate compact and other reforms designed to simplify and improve the licensure process for physicians practicing across state lines as well as providing telemedicine services in multiple states."

Each individual state board will now work with their state legislators and stakeholder community to determine whether participation in the compact is ideal for their jurisdiction. The FSMB will continue to serve as a resource for interested states, the federation said. Four state boards have endorsed the compact thus far, and several more states have begun discussions with state legislators and other stakeholders in anticipation of introducing the model compact during the 2015 legislative session.

On Twitter @legal_med

The Federation of State Medical Boards has completed the drafting of its interstate medical licensure compact and is ready for state legislatures to consider the proposal.

The proposed interstate compact would expedite the process of multistate physician licensure and help expand the practice of telemedicine. In a Sept. 5 statement, Dr. Humayun J. Chaudhry, CEO of the Federation of State Medical Boards (FSMB), said the compact’s language design is finished and that state legislatures and medical boards can now weigh adoption of the model legislation.

"The FSMB is pleased to have supported the state medical board community as it developed this compact to streamline licensure, while maintaining patient protection as a top priority," Dr. Chaudhry said in the statement.

The FSMB House of Delegates unanimously approved the development of an interstate compact to streamline medical licensure and facilitate multistate practice at its 2013 annual meeting. Under the proposed system, states and doctors would voluntarily enter into the compact, and approved physicians would be under the jurisdiction of the state medical board in which the patient was located at the time of the medical interaction. State boards of medicine would retain their individual authority for discipline and oversight, according to the proposed compact. The compact system is expected to significantly reduce barriers to the process of gaining licensure in multiple states, while helping to facilitate licensure portability and telemedicine.

The American Medical Association said the interstate compact aligns with its efforts to modernize state medical licensure and allow for an expedited pathway in participating states.

"State-based licensure is an important tenet of accountability, ensuring that physicians are qualified through the review of their education, training, character, and professional disciplinary histories," AMA President Dr. Robert M. Wah said in a statement. "We applaud the FSMB for developing the interstate compact and other reforms designed to simplify and improve the licensure process for physicians practicing across state lines as well as providing telemedicine services in multiple states."

Each individual state board will now work with their state legislators and stakeholder community to determine whether participation in the compact is ideal for their jurisdiction. The FSMB will continue to serve as a resource for interested states, the federation said. Four state boards have endorsed the compact thus far, and several more states have begun discussions with state legislators and other stakeholders in anticipation of introducing the model compact during the 2015 legislative session.

On Twitter @legal_med

The Federation of State Medical Boards has completed the drafting of its interstate medical licensure compact and is ready for state legislatures to consider the proposal.

The proposed interstate compact would expedite the process of multistate physician licensure and help expand the practice of telemedicine. In a Sept. 5 statement, Dr. Humayun J. Chaudhry, CEO of the Federation of State Medical Boards (FSMB), said the compact’s language design is finished and that state legislatures and medical boards can now weigh adoption of the model legislation.

"The FSMB is pleased to have supported the state medical board community as it developed this compact to streamline licensure, while maintaining patient protection as a top priority," Dr. Chaudhry said in the statement.

The FSMB House of Delegates unanimously approved the development of an interstate compact to streamline medical licensure and facilitate multistate practice at its 2013 annual meeting. Under the proposed system, states and doctors would voluntarily enter into the compact, and approved physicians would be under the jurisdiction of the state medical board in which the patient was located at the time of the medical interaction. State boards of medicine would retain their individual authority for discipline and oversight, according to the proposed compact. The compact system is expected to significantly reduce barriers to the process of gaining licensure in multiple states, while helping to facilitate licensure portability and telemedicine.

The American Medical Association said the interstate compact aligns with its efforts to modernize state medical licensure and allow for an expedited pathway in participating states.

"State-based licensure is an important tenet of accountability, ensuring that physicians are qualified through the review of their education, training, character, and professional disciplinary histories," AMA President Dr. Robert M. Wah said in a statement. "We applaud the FSMB for developing the interstate compact and other reforms designed to simplify and improve the licensure process for physicians practicing across state lines as well as providing telemedicine services in multiple states."

Each individual state board will now work with their state legislators and stakeholder community to determine whether participation in the compact is ideal for their jurisdiction. The FSMB will continue to serve as a resource for interested states, the federation said. Four state boards have endorsed the compact thus far, and several more states have begun discussions with state legislators and other stakeholders in anticipation of introducing the model compact during the 2015 legislative session.

On Twitter @legal_med

Young adults using emergency departments less in post-ACA world

Young adults are using emergency departments less following the implementation of expanded coverage under the Affordable Care Act, though the number of patients from this population has not significantly changed.

According to new research published in Health Affairs, ED visits by young adults increased by 3.8 visits/1,000 people between pre-ACA implementation (Sept. 1, 2009-Aug. 31, 2010) and post-ACA implementation (2011 calendar year), while the control group of adults ages 26-31 [years] increased by 6.5/1,000 people. "The difference-in-differences analysis estimated an absolute difference of –2.7%/1,000 people among the younger group, compared to the older group. After regression adjustment ... the difference-in-differences analysis estimated a reduction of 2.1% in young adults ages 19-25 [years], compared to people ages 26-31 [years]."

Researchers analyzed data from three states – California, Florida, and New York – and also found that among people aged 26-31 years, the probability of an ED visit between pre-and post-ACA implementation increased by 2.2%, while young adults aged 19-25 years had a smaller increase of 1.9%.

Findings were published online Sept. 8 and are scheduled to appear in the September issue of Health Affairs (2014 [doi:10.1377/hthaff.2014.0103]).

"Our results suggest that the ACA’s dependent coverage provision is associated with a relative decrease in the number of ED visits for young adults but a minimum relative decrease in the rate at which they ever used the ED," reported Tina Hernandez-Boussard of the departments of surgery and biomedical informatics at Stanford (Calif.) University, and her associates.

The authors state that the research and analysis showed that "ED use by young adults ages 19-25 expanded by a modest amount after the implementation of the ACA insurance expansion but that ED use by people ages 26-31, who were not including in the ACA expansion, grew faster. Relatively slower growth in use by the younger group is consistent with the view that the ACA decreased ED use in this age group."

Dr. Hernandez-Boussard and her associates suggest that better coverage of young adults "could have facilitated better access to health care in non-ED settings such as doctors’ offices, which could have reduced the use of ED care."

Young adults are using emergency departments less following the implementation of expanded coverage under the Affordable Care Act, though the number of patients from this population has not significantly changed.

According to new research published in Health Affairs, ED visits by young adults increased by 3.8 visits/1,000 people between pre-ACA implementation (Sept. 1, 2009-Aug. 31, 2010) and post-ACA implementation (2011 calendar year), while the control group of adults ages 26-31 [years] increased by 6.5/1,000 people. "The difference-in-differences analysis estimated an absolute difference of –2.7%/1,000 people among the younger group, compared to the older group. After regression adjustment ... the difference-in-differences analysis estimated a reduction of 2.1% in young adults ages 19-25 [years], compared to people ages 26-31 [years]."

Researchers analyzed data from three states – California, Florida, and New York – and also found that among people aged 26-31 years, the probability of an ED visit between pre-and post-ACA implementation increased by 2.2%, while young adults aged 19-25 years had a smaller increase of 1.9%.

Findings were published online Sept. 8 and are scheduled to appear in the September issue of Health Affairs (2014 [doi:10.1377/hthaff.2014.0103]).

"Our results suggest that the ACA’s dependent coverage provision is associated with a relative decrease in the number of ED visits for young adults but a minimum relative decrease in the rate at which they ever used the ED," reported Tina Hernandez-Boussard of the departments of surgery and biomedical informatics at Stanford (Calif.) University, and her associates.

The authors state that the research and analysis showed that "ED use by young adults ages 19-25 expanded by a modest amount after the implementation of the ACA insurance expansion but that ED use by people ages 26-31, who were not including in the ACA expansion, grew faster. Relatively slower growth in use by the younger group is consistent with the view that the ACA decreased ED use in this age group."

Dr. Hernandez-Boussard and her associates suggest that better coverage of young adults "could have facilitated better access to health care in non-ED settings such as doctors’ offices, which could have reduced the use of ED care."

Young adults are using emergency departments less following the implementation of expanded coverage under the Affordable Care Act, though the number of patients from this population has not significantly changed.

According to new research published in Health Affairs, ED visits by young adults increased by 3.8 visits/1,000 people between pre-ACA implementation (Sept. 1, 2009-Aug. 31, 2010) and post-ACA implementation (2011 calendar year), while the control group of adults ages 26-31 [years] increased by 6.5/1,000 people. "The difference-in-differences analysis estimated an absolute difference of –2.7%/1,000 people among the younger group, compared to the older group. After regression adjustment ... the difference-in-differences analysis estimated a reduction of 2.1% in young adults ages 19-25 [years], compared to people ages 26-31 [years]."

Researchers analyzed data from three states – California, Florida, and New York – and also found that among people aged 26-31 years, the probability of an ED visit between pre-and post-ACA implementation increased by 2.2%, while young adults aged 19-25 years had a smaller increase of 1.9%.

Findings were published online Sept. 8 and are scheduled to appear in the September issue of Health Affairs (2014 [doi:10.1377/hthaff.2014.0103]).

"Our results suggest that the ACA’s dependent coverage provision is associated with a relative decrease in the number of ED visits for young adults but a minimum relative decrease in the rate at which they ever used the ED," reported Tina Hernandez-Boussard of the departments of surgery and biomedical informatics at Stanford (Calif.) University, and her associates.

The authors state that the research and analysis showed that "ED use by young adults ages 19-25 expanded by a modest amount after the implementation of the ACA insurance expansion but that ED use by people ages 26-31, who were not including in the ACA expansion, grew faster. Relatively slower growth in use by the younger group is consistent with the view that the ACA decreased ED use in this age group."

Dr. Hernandez-Boussard and her associates suggest that better coverage of young adults "could have facilitated better access to health care in non-ED settings such as doctors’ offices, which could have reduced the use of ED care."

FROM HEALTH AFFAIRS

Obama gets do-over in ACA subsidy lawsuit

The Obama administration is getting a second chance to show that providing tax subsidies through the Affordable Care Act’s federally run insurance marketplace is legal.

On Sept. 4, the District of Columbia Circuit of the U.S. Court of Appeals granted the government’s petition for a rehearing en banc in Halbig v. Burwell. The rehearing will be heard by all 17 judges on the court and the previous ruling made by a three-judge panel of the court has been vacated.

The earlier ruling, issued on July 22, was 2-1 in favor of the plaintiffs and, had it been upheld, had the potential to strip insurance subsidies from about 5 million Americans who had purchased health plans through the federally run marketplace.

Also on July 22, the 4th Circuit of the U.S. Court of Appeals in Virginia handed down a conflicting ruling, siding unanimously with the government in a similar case, King v. Burwell. The King plaintiffs have already appealed to the Supreme Court, but the high court has not indicated whether it will consider the case.

At issue is whether the federal government has the authority to issue tax subsidies to consumers from 36 states who purchase insurance on the federal marketplace since the ACA specifies only that subsidies would be available on the state-run marketplaces. The plaintiffs have argued that the administration is overstepping its authority by also offering subsidies on the federal marketplace. But administration officials maintain that Congress intended the subsidies to be offered to all eligible consumers regardless of who operates the marketplace.

The D.C. appellate court will hear oral arguments in Halbig v. Burwell on Dec. 17.

On Twitter @maryellenny

The Obama administration is getting a second chance to show that providing tax subsidies through the Affordable Care Act’s federally run insurance marketplace is legal.

On Sept. 4, the District of Columbia Circuit of the U.S. Court of Appeals granted the government’s petition for a rehearing en banc in Halbig v. Burwell. The rehearing will be heard by all 17 judges on the court and the previous ruling made by a three-judge panel of the court has been vacated.

The earlier ruling, issued on July 22, was 2-1 in favor of the plaintiffs and, had it been upheld, had the potential to strip insurance subsidies from about 5 million Americans who had purchased health plans through the federally run marketplace.

Also on July 22, the 4th Circuit of the U.S. Court of Appeals in Virginia handed down a conflicting ruling, siding unanimously with the government in a similar case, King v. Burwell. The King plaintiffs have already appealed to the Supreme Court, but the high court has not indicated whether it will consider the case.

At issue is whether the federal government has the authority to issue tax subsidies to consumers from 36 states who purchase insurance on the federal marketplace since the ACA specifies only that subsidies would be available on the state-run marketplaces. The plaintiffs have argued that the administration is overstepping its authority by also offering subsidies on the federal marketplace. But administration officials maintain that Congress intended the subsidies to be offered to all eligible consumers regardless of who operates the marketplace.

The D.C. appellate court will hear oral arguments in Halbig v. Burwell on Dec. 17.

On Twitter @maryellenny

The Obama administration is getting a second chance to show that providing tax subsidies through the Affordable Care Act’s federally run insurance marketplace is legal.

On Sept. 4, the District of Columbia Circuit of the U.S. Court of Appeals granted the government’s petition for a rehearing en banc in Halbig v. Burwell. The rehearing will be heard by all 17 judges on the court and the previous ruling made by a three-judge panel of the court has been vacated.

The earlier ruling, issued on July 22, was 2-1 in favor of the plaintiffs and, had it been upheld, had the potential to strip insurance subsidies from about 5 million Americans who had purchased health plans through the federally run marketplace.

Also on July 22, the 4th Circuit of the U.S. Court of Appeals in Virginia handed down a conflicting ruling, siding unanimously with the government in a similar case, King v. Burwell. The King plaintiffs have already appealed to the Supreme Court, but the high court has not indicated whether it will consider the case.

At issue is whether the federal government has the authority to issue tax subsidies to consumers from 36 states who purchase insurance on the federal marketplace since the ACA specifies only that subsidies would be available on the state-run marketplaces. The plaintiffs have argued that the administration is overstepping its authority by also offering subsidies on the federal marketplace. But administration officials maintain that Congress intended the subsidies to be offered to all eligible consumers regardless of who operates the marketplace.

The D.C. appellate court will hear oral arguments in Halbig v. Burwell on Dec. 17.

On Twitter @maryellenny

Health spending growth still low, but expected to speed up over next decade

WASHINGTON – The current trend of low growth in health care spending is expected to end in 2016 as more patients gain insurance coverage and the U.S. population continues to age, according to an analysis from the Centers for Medicare & Medicaid Services.

For the fifth year in a row, overall health care spending in 2013 grew less than 4% – significantly lower than historical growth rates, Andrea Sisko, an economist in the Office of the Actuary at the CMS, said at a press briefing. Spending growth was down, in part, because of sequestration’s 2% Medicare cut and because Medicare beneficiaries used fewer physician and hospital services. Lingering effects of the 2009 recession also meant that privately insured patients spent less on health care.

The Affordable Care Act had some impact on the growth in health spending in 2013, Ms. Sisko said. The ACA’s temporary increase in Medicaid primary care payments helped to almost double the growth in that program’s spending. Overall Medicaid spending grew almost 7% in 2013 (vs. 3% in 2012); physician payment increases by the states and enhanced benefits contributed to the overall spending growth. The analysis was published Sept. 3 in the journal Health Affairs (doi: 10.1377/hlthaff.2014.0560).

The change in Medicaid was one of few areas where the economists definitively could say that the ACA either fueled or restrained spending growth.

"We are no longer estimating or quantifying the impacts of the Affordable Care Act on national health spending," said Ms. Sisko, who noted that after 4 years, it has become difficult to tease out the law’s effects.

Overall spending on physician services grew 3.3% in 2013, but could grow by almost 6% in 2014. After a slight decline in 2015, growth is expected to be about 6% yearly from 2016 to 2023, according to the analysis.

Future growth in spending on physician services will come as more Americans gain health insurance coverage. The projected dip in 2015 is tied to the end of the temporary Medicaid pay boost, which ends in December2014. For 2016-2023, physician spending is expected to rebound as more U.S. residents become eligible for Medicare.

Spending for physician services is expected to make up about 20% of U.S. health care spending through 2023, with hospitals consuming 32% and prescription drugs 9%.

While future health care spending growth is expected to slightly outpace economic growth (6% for health care spending vs. 5% for overall spending), that growth rate is still lower than the 7% yearly increases seen in the 1990s and through the mid-2000s, Ms. Sisko said. The growth rates will be lower in part because they will be based on a historically low baseline of the last 4-5 years, Ms. Sisko added.

Drug costs, for instance, will not have the double-digit growth seen in the late 1990s, said coauthor Sean Keehan, also an economist at the CMS Office of the Actuary. Unlike in the 1990s, payers now seem to have more leverage to negotiate lower rates from physicians and hospitals, and thus keep costs and spending down.

The physician spending figures assume that Congress will override the fee cuts mandated by the Sustainable Growth Rate formula and instead keep fees flat in 2015, and then give a 0.6% increase from 2016 to 2023. They also assume that the budget sequestration will continue.

On Twitter @aliciaault

WASHINGTON – The current trend of low growth in health care spending is expected to end in 2016 as more patients gain insurance coverage and the U.S. population continues to age, according to an analysis from the Centers for Medicare & Medicaid Services.

For the fifth year in a row, overall health care spending in 2013 grew less than 4% – significantly lower than historical growth rates, Andrea Sisko, an economist in the Office of the Actuary at the CMS, said at a press briefing. Spending growth was down, in part, because of sequestration’s 2% Medicare cut and because Medicare beneficiaries used fewer physician and hospital services. Lingering effects of the 2009 recession also meant that privately insured patients spent less on health care.

The Affordable Care Act had some impact on the growth in health spending in 2013, Ms. Sisko said. The ACA’s temporary increase in Medicaid primary care payments helped to almost double the growth in that program’s spending. Overall Medicaid spending grew almost 7% in 2013 (vs. 3% in 2012); physician payment increases by the states and enhanced benefits contributed to the overall spending growth. The analysis was published Sept. 3 in the journal Health Affairs (doi: 10.1377/hlthaff.2014.0560).

The change in Medicaid was one of few areas where the economists definitively could say that the ACA either fueled or restrained spending growth.

"We are no longer estimating or quantifying the impacts of the Affordable Care Act on national health spending," said Ms. Sisko, who noted that after 4 years, it has become difficult to tease out the law’s effects.

Overall spending on physician services grew 3.3% in 2013, but could grow by almost 6% in 2014. After a slight decline in 2015, growth is expected to be about 6% yearly from 2016 to 2023, according to the analysis.

Future growth in spending on physician services will come as more Americans gain health insurance coverage. The projected dip in 2015 is tied to the end of the temporary Medicaid pay boost, which ends in December2014. For 2016-2023, physician spending is expected to rebound as more U.S. residents become eligible for Medicare.

Spending for physician services is expected to make up about 20% of U.S. health care spending through 2023, with hospitals consuming 32% and prescription drugs 9%.

While future health care spending growth is expected to slightly outpace economic growth (6% for health care spending vs. 5% for overall spending), that growth rate is still lower than the 7% yearly increases seen in the 1990s and through the mid-2000s, Ms. Sisko said. The growth rates will be lower in part because they will be based on a historically low baseline of the last 4-5 years, Ms. Sisko added.

Drug costs, for instance, will not have the double-digit growth seen in the late 1990s, said coauthor Sean Keehan, also an economist at the CMS Office of the Actuary. Unlike in the 1990s, payers now seem to have more leverage to negotiate lower rates from physicians and hospitals, and thus keep costs and spending down.

The physician spending figures assume that Congress will override the fee cuts mandated by the Sustainable Growth Rate formula and instead keep fees flat in 2015, and then give a 0.6% increase from 2016 to 2023. They also assume that the budget sequestration will continue.

On Twitter @aliciaault

WASHINGTON – The current trend of low growth in health care spending is expected to end in 2016 as more patients gain insurance coverage and the U.S. population continues to age, according to an analysis from the Centers for Medicare & Medicaid Services.

For the fifth year in a row, overall health care spending in 2013 grew less than 4% – significantly lower than historical growth rates, Andrea Sisko, an economist in the Office of the Actuary at the CMS, said at a press briefing. Spending growth was down, in part, because of sequestration’s 2% Medicare cut and because Medicare beneficiaries used fewer physician and hospital services. Lingering effects of the 2009 recession also meant that privately insured patients spent less on health care.

The Affordable Care Act had some impact on the growth in health spending in 2013, Ms. Sisko said. The ACA’s temporary increase in Medicaid primary care payments helped to almost double the growth in that program’s spending. Overall Medicaid spending grew almost 7% in 2013 (vs. 3% in 2012); physician payment increases by the states and enhanced benefits contributed to the overall spending growth. The analysis was published Sept. 3 in the journal Health Affairs (doi: 10.1377/hlthaff.2014.0560).

The change in Medicaid was one of few areas where the economists definitively could say that the ACA either fueled or restrained spending growth.

"We are no longer estimating or quantifying the impacts of the Affordable Care Act on national health spending," said Ms. Sisko, who noted that after 4 years, it has become difficult to tease out the law’s effects.

Overall spending on physician services grew 3.3% in 2013, but could grow by almost 6% in 2014. After a slight decline in 2015, growth is expected to be about 6% yearly from 2016 to 2023, according to the analysis.

Future growth in spending on physician services will come as more Americans gain health insurance coverage. The projected dip in 2015 is tied to the end of the temporary Medicaid pay boost, which ends in December2014. For 2016-2023, physician spending is expected to rebound as more U.S. residents become eligible for Medicare.

Spending for physician services is expected to make up about 20% of U.S. health care spending through 2023, with hospitals consuming 32% and prescription drugs 9%.

While future health care spending growth is expected to slightly outpace economic growth (6% for health care spending vs. 5% for overall spending), that growth rate is still lower than the 7% yearly increases seen in the 1990s and through the mid-2000s, Ms. Sisko said. The growth rates will be lower in part because they will be based on a historically low baseline of the last 4-5 years, Ms. Sisko added.

Drug costs, for instance, will not have the double-digit growth seen in the late 1990s, said coauthor Sean Keehan, also an economist at the CMS Office of the Actuary. Unlike in the 1990s, payers now seem to have more leverage to negotiate lower rates from physicians and hospitals, and thus keep costs and spending down.

The physician spending figures assume that Congress will override the fee cuts mandated by the Sustainable Growth Rate formula and instead keep fees flat in 2015, and then give a 0.6% increase from 2016 to 2023. They also assume that the budget sequestration will continue.

On Twitter @aliciaault

AT A HEALTH AFFAIRS BRIEFING

Patient-centered medical home shows cost savings potential

Medicare paid less for beneficiaries who received health care services as part of a National Committee for Quality Assurance–recognized patient-centered medical home, compared with those in traditional delivery models, according to new research.

Researchers examined practice-level patterns and costliness of care for Medicare fee-for-service beneficiaries who received medical treatment between July 1, 2007, and June 30, 2010, from one of 308 NCQA-recognized patient-centered medical homes (PCMHs) vs. a comparison group of beneficiaries who received health care from medical practices lacking that recognition. The Centers for Medicare & Medicaid Services funded the study.

Baseline health care utilization "was lower among NCQA-recognized PCMHs across all utilization measures used in this study," according to the report, published July 30 online in Health Services Research (2014 [doi:10.1111/1475-6773.12217]). "For example, the number of hospitalizations (per 1,000 beneficiaries) for any condition was 27% lower than in the comparison group (189 vs. 258), whereas emergency department visits (per 1,000 beneficiaries) for any condition were 21% lower (405 vs. 513)," reported Martijn van Hasselt of the University of North Carolina at Greensboro and his associates. RTI International conducted the study. "Average Medicare payments per Medicare [fee-for-service] beneficiary, except for [federally qualified health center] payments were also lower for NCQA-recognized PCMHs. For example, average total Medicare payments were 25% lower than for the comparison group ($5,382 vs. $7,169)," the report continued:

Researchers also found that emergency department visits declined for practices with PCMH recognition, though other utilization outcomes, including hospitalizations, 30-day readmissions and annual visits were not affected by receipt of recognition.

"Our findings suggest that the practices recognized as PCMHs were able to prevent some emergency department visits, perhaps through more efficient care coordination and care management," the authors stated. No financial disclosures were made by the study’s authors.

Findings of PCMH’s potential contradict results from a 3-year pilot study detailed in the Feb. 26 issue of JAMA, which showed that small- and medium-size primary care practices that had created PCMHs were not successful in reducing costs or curbing hospital and emergency department visits (JAMA 2014;311:815-25 [doi:10.1001/jama.2014.353]).

Medicare paid less for beneficiaries who received health care services as part of a National Committee for Quality Assurance–recognized patient-centered medical home, compared with those in traditional delivery models, according to new research.

Researchers examined practice-level patterns and costliness of care for Medicare fee-for-service beneficiaries who received medical treatment between July 1, 2007, and June 30, 2010, from one of 308 NCQA-recognized patient-centered medical homes (PCMHs) vs. a comparison group of beneficiaries who received health care from medical practices lacking that recognition. The Centers for Medicare & Medicaid Services funded the study.

Baseline health care utilization "was lower among NCQA-recognized PCMHs across all utilization measures used in this study," according to the report, published July 30 online in Health Services Research (2014 [doi:10.1111/1475-6773.12217]). "For example, the number of hospitalizations (per 1,000 beneficiaries) for any condition was 27% lower than in the comparison group (189 vs. 258), whereas emergency department visits (per 1,000 beneficiaries) for any condition were 21% lower (405 vs. 513)," reported Martijn van Hasselt of the University of North Carolina at Greensboro and his associates. RTI International conducted the study. "Average Medicare payments per Medicare [fee-for-service] beneficiary, except for [federally qualified health center] payments were also lower for NCQA-recognized PCMHs. For example, average total Medicare payments were 25% lower than for the comparison group ($5,382 vs. $7,169)," the report continued:

Researchers also found that emergency department visits declined for practices with PCMH recognition, though other utilization outcomes, including hospitalizations, 30-day readmissions and annual visits were not affected by receipt of recognition.

"Our findings suggest that the practices recognized as PCMHs were able to prevent some emergency department visits, perhaps through more efficient care coordination and care management," the authors stated. No financial disclosures were made by the study’s authors.

Findings of PCMH’s potential contradict results from a 3-year pilot study detailed in the Feb. 26 issue of JAMA, which showed that small- and medium-size primary care practices that had created PCMHs were not successful in reducing costs or curbing hospital and emergency department visits (JAMA 2014;311:815-25 [doi:10.1001/jama.2014.353]).

Medicare paid less for beneficiaries who received health care services as part of a National Committee for Quality Assurance–recognized patient-centered medical home, compared with those in traditional delivery models, according to new research.

Researchers examined practice-level patterns and costliness of care for Medicare fee-for-service beneficiaries who received medical treatment between July 1, 2007, and June 30, 2010, from one of 308 NCQA-recognized patient-centered medical homes (PCMHs) vs. a comparison group of beneficiaries who received health care from medical practices lacking that recognition. The Centers for Medicare & Medicaid Services funded the study.

Baseline health care utilization "was lower among NCQA-recognized PCMHs across all utilization measures used in this study," according to the report, published July 30 online in Health Services Research (2014 [doi:10.1111/1475-6773.12217]). "For example, the number of hospitalizations (per 1,000 beneficiaries) for any condition was 27% lower than in the comparison group (189 vs. 258), whereas emergency department visits (per 1,000 beneficiaries) for any condition were 21% lower (405 vs. 513)," reported Martijn van Hasselt of the University of North Carolina at Greensboro and his associates. RTI International conducted the study. "Average Medicare payments per Medicare [fee-for-service] beneficiary, except for [federally qualified health center] payments were also lower for NCQA-recognized PCMHs. For example, average total Medicare payments were 25% lower than for the comparison group ($5,382 vs. $7,169)," the report continued:

Researchers also found that emergency department visits declined for practices with PCMH recognition, though other utilization outcomes, including hospitalizations, 30-day readmissions and annual visits were not affected by receipt of recognition.

"Our findings suggest that the practices recognized as PCMHs were able to prevent some emergency department visits, perhaps through more efficient care coordination and care management," the authors stated. No financial disclosures were made by the study’s authors.

Findings of PCMH’s potential contradict results from a 3-year pilot study detailed in the Feb. 26 issue of JAMA, which showed that small- and medium-size primary care practices that had created PCMHs were not successful in reducing costs or curbing hospital and emergency department visits (JAMA 2014;311:815-25 [doi:10.1001/jama.2014.353]).

FROM HEALTH SERVICES RESEARCH

CMS finalizes marketplace autoenrollment rule

Patients insured through the federally operated health insurance marketplace will be automatically reenrolled in their current coverage if they fail to change their previous plan, the Centers for Medicare & Medicaid Services announced Sept. 2.

Participants in these Affordable Care Act plans will receive notices before open enrollment begins explaining how they can return to the marketplace and shop for additional assistance and new plans. Insurers will provide information regarding 2015 premiums and tax credits.

If participants do nothing, they will be autoenrolled in the same plan as their 2014 plan year with the same tax credit. Open enrollment begins Nov. 15.

According to the final rule, participants whose 2013 tax returns indicate they have high income or did not grant marketplace administrators permission to access updated tax information will be autoenrolled without financial assistance if they don’t update their plan.

"We are committed to providing a simple, familiar process for consumers to renew their coverage next year," Marilyn Tavenner, administrator of the Centers for Medicare & Medicaid Services, said in a statement. "Consumers should use this time to evaluate their health needs, browse other options, and see if they qualify for additional financial assistance. However, consumers who are happy with their plan and have no changes to their income or family situation can be auto-enrolled in their same plan next year, similar to how it is done in the employer insurance market today."

On Twitter @legal_med

Patients insured through the federally operated health insurance marketplace will be automatically reenrolled in their current coverage if they fail to change their previous plan, the Centers for Medicare & Medicaid Services announced Sept. 2.

Participants in these Affordable Care Act plans will receive notices before open enrollment begins explaining how they can return to the marketplace and shop for additional assistance and new plans. Insurers will provide information regarding 2015 premiums and tax credits.

If participants do nothing, they will be autoenrolled in the same plan as their 2014 plan year with the same tax credit. Open enrollment begins Nov. 15.

According to the final rule, participants whose 2013 tax returns indicate they have high income or did not grant marketplace administrators permission to access updated tax information will be autoenrolled without financial assistance if they don’t update their plan.

"We are committed to providing a simple, familiar process for consumers to renew their coverage next year," Marilyn Tavenner, administrator of the Centers for Medicare & Medicaid Services, said in a statement. "Consumers should use this time to evaluate their health needs, browse other options, and see if they qualify for additional financial assistance. However, consumers who are happy with their plan and have no changes to their income or family situation can be auto-enrolled in their same plan next year, similar to how it is done in the employer insurance market today."

On Twitter @legal_med

Patients insured through the federally operated health insurance marketplace will be automatically reenrolled in their current coverage if they fail to change their previous plan, the Centers for Medicare & Medicaid Services announced Sept. 2.

Participants in these Affordable Care Act plans will receive notices before open enrollment begins explaining how they can return to the marketplace and shop for additional assistance and new plans. Insurers will provide information regarding 2015 premiums and tax credits.

If participants do nothing, they will be autoenrolled in the same plan as their 2014 plan year with the same tax credit. Open enrollment begins Nov. 15.

According to the final rule, participants whose 2013 tax returns indicate they have high income or did not grant marketplace administrators permission to access updated tax information will be autoenrolled without financial assistance if they don’t update their plan.

"We are committed to providing a simple, familiar process for consumers to renew their coverage next year," Marilyn Tavenner, administrator of the Centers for Medicare & Medicaid Services, said in a statement. "Consumers should use this time to evaluate their health needs, browse other options, and see if they qualify for additional financial assistance. However, consumers who are happy with their plan and have no changes to their income or family situation can be auto-enrolled in their same plan next year, similar to how it is done in the employer insurance market today."

On Twitter @legal_med

CMS finalizes ‘flexibility’ in EHR meaningful use program

Physicians and hospitals will have more time to meet Stage 2 requirements under the federal government’s meaningful use program for the adoption of electronic health records.

Officials at the Centers for Medicare & Medicaid Services have been saying for months that they wanted to give physicians and hospitals greater flexibility in meeting the requirements of the EHR Incentive Programs, which offer bonuses for the "meaningful use" of certified EHR systems. The final rule cements a new timetable for Stage 2 of the program and allows providers to use older certified technology for longer, while vendors catch up with a backlog of demand.

Under the rule, the CMS officially extends Stage 2 of the program through 2016 for providers who were early adopters under the program, attesting to meaningful use in 2011 or 2012. Stage 3 of the meaningful use program will begin in 2017 for these providers, giving them an additional year to meet the more advanced requirements.

The rule also gives physicians more time to attest using older technology. Physicians can use the 2011 edition certified EHR technology or a combination of 2011 and 2014 edition certified product for the reporting period in 2014. All providers will be required to use 2014 edition certified products beginning in 2015.

But the American College of Physicians said the changes are "too little, too late."

Even with the increased flexibility to use older certified products, physicians will be able to attest for only Stage 1 until they have full access to 2014 edition certified technology, according to Dr. Peter Basch, chair of the ACP Medical Informatics Committee and the medical director for ambulatory EHR and health IT policy at MedStar Health in Washington. And that will impair their ability to prepare for Stage 2 attestation.

"Cut-over from their Stage 1 reporting configuration to their Stage 2 reporting configuration cannot be done overnight," Dr. Basch said. "Staffing and workflow changes take weeks, if not months, to accomplish."

And the new final rule does nothing to address other concerns raised by physicians. The American Medical Association has repeatedly called on the CMS to make more significant changes to the program, including lowering the threshold to earn incentives under the program. The AMA has urged the CMS to using a 75% pass rate as the standard for achieving meaningful use, as well as allowing physicians who meet 50% of meaningful use requirements to avoid financial penalties.

On Twitter @maryellenny

Physicians and hospitals will have more time to meet Stage 2 requirements under the federal government’s meaningful use program for the adoption of electronic health records.

Officials at the Centers for Medicare & Medicaid Services have been saying for months that they wanted to give physicians and hospitals greater flexibility in meeting the requirements of the EHR Incentive Programs, which offer bonuses for the "meaningful use" of certified EHR systems. The final rule cements a new timetable for Stage 2 of the program and allows providers to use older certified technology for longer, while vendors catch up with a backlog of demand.

Under the rule, the CMS officially extends Stage 2 of the program through 2016 for providers who were early adopters under the program, attesting to meaningful use in 2011 or 2012. Stage 3 of the meaningful use program will begin in 2017 for these providers, giving them an additional year to meet the more advanced requirements.

The rule also gives physicians more time to attest using older technology. Physicians can use the 2011 edition certified EHR technology or a combination of 2011 and 2014 edition certified product for the reporting period in 2014. All providers will be required to use 2014 edition certified products beginning in 2015.

But the American College of Physicians said the changes are "too little, too late."

Even with the increased flexibility to use older certified products, physicians will be able to attest for only Stage 1 until they have full access to 2014 edition certified technology, according to Dr. Peter Basch, chair of the ACP Medical Informatics Committee and the medical director for ambulatory EHR and health IT policy at MedStar Health in Washington. And that will impair their ability to prepare for Stage 2 attestation.

"Cut-over from their Stage 1 reporting configuration to their Stage 2 reporting configuration cannot be done overnight," Dr. Basch said. "Staffing and workflow changes take weeks, if not months, to accomplish."

And the new final rule does nothing to address other concerns raised by physicians. The American Medical Association has repeatedly called on the CMS to make more significant changes to the program, including lowering the threshold to earn incentives under the program. The AMA has urged the CMS to using a 75% pass rate as the standard for achieving meaningful use, as well as allowing physicians who meet 50% of meaningful use requirements to avoid financial penalties.

On Twitter @maryellenny

Physicians and hospitals will have more time to meet Stage 2 requirements under the federal government’s meaningful use program for the adoption of electronic health records.

Officials at the Centers for Medicare & Medicaid Services have been saying for months that they wanted to give physicians and hospitals greater flexibility in meeting the requirements of the EHR Incentive Programs, which offer bonuses for the "meaningful use" of certified EHR systems. The final rule cements a new timetable for Stage 2 of the program and allows providers to use older certified technology for longer, while vendors catch up with a backlog of demand.

Under the rule, the CMS officially extends Stage 2 of the program through 2016 for providers who were early adopters under the program, attesting to meaningful use in 2011 or 2012. Stage 3 of the meaningful use program will begin in 2017 for these providers, giving them an additional year to meet the more advanced requirements.

The rule also gives physicians more time to attest using older technology. Physicians can use the 2011 edition certified EHR technology or a combination of 2011 and 2014 edition certified product for the reporting period in 2014. All providers will be required to use 2014 edition certified products beginning in 2015.

But the American College of Physicians said the changes are "too little, too late."

Even with the increased flexibility to use older certified products, physicians will be able to attest for only Stage 1 until they have full access to 2014 edition certified technology, according to Dr. Peter Basch, chair of the ACP Medical Informatics Committee and the medical director for ambulatory EHR and health IT policy at MedStar Health in Washington. And that will impair their ability to prepare for Stage 2 attestation.

"Cut-over from their Stage 1 reporting configuration to their Stage 2 reporting configuration cannot be done overnight," Dr. Basch said. "Staffing and workflow changes take weeks, if not months, to accomplish."

And the new final rule does nothing to address other concerns raised by physicians. The American Medical Association has repeatedly called on the CMS to make more significant changes to the program, including lowering the threshold to earn incentives under the program. The AMA has urged the CMS to using a 75% pass rate as the standard for achieving meaningful use, as well as allowing physicians who meet 50% of meaningful use requirements to avoid financial penalties.

On Twitter @maryellenny

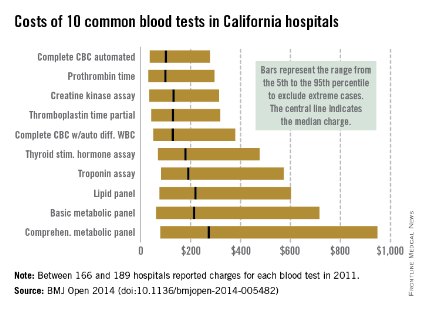

Blood test charges vary widely among California hospitals

Charges for 10 common blood tests showed wide variation among hospitals in California, with the cost of one test ranging from $10 to more than $10,000, Dr. Renee Y. Hsia and her associates reported in BMJ Open.

In 2011, minimum charges for the examined blood tests ranged from $10 to $44. Maximum charges, with the exception of a creatine kinase assay at $628, were all more than $6,000. The highest charge for a lipid panel was $10,169 – more than a thousand times higher than the low of $10, according to Dr. Hsia and her associates (BMJ Open 2014 [doi: 10.1136/bmjopen-2014-005482]).

Large price differences remained after extreme cases were excluded (see graph). The test with the smallest variation between the 5th and 95th percentiles, an automated complete blood count, had a range of $37 to $278 (median, $100). A complete metabolic panel had the largest variation among the 10 blood tests, costing anywhere from $79 to $948 (median, $273).

Teaching hospitals charged significantly less than other hospitals for 7 of the 10 tests, and government hospitals charged less for 5 of the 10, but "it is notable how few characteristics were significant predictors of the charges patients faced. ... A hospital’s case mix and labor cost did not affect charges, nor did the competitiveness of the market or the percentage of uninsured people in the county," wrote Dr. Hsia of the University of California, San Francisco, and her associates.

The study used data from the California Office of Statewide Health Planning and Development. Of the 307 hospitals that reported charges in 2011, between 166 and 189 reported charges for each of the 10 tests included in the study.

Charges for 10 common blood tests showed wide variation among hospitals in California, with the cost of one test ranging from $10 to more than $10,000, Dr. Renee Y. Hsia and her associates reported in BMJ Open.

In 2011, minimum charges for the examined blood tests ranged from $10 to $44. Maximum charges, with the exception of a creatine kinase assay at $628, were all more than $6,000. The highest charge for a lipid panel was $10,169 – more than a thousand times higher than the low of $10, according to Dr. Hsia and her associates (BMJ Open 2014 [doi: 10.1136/bmjopen-2014-005482]).

Large price differences remained after extreme cases were excluded (see graph). The test with the smallest variation between the 5th and 95th percentiles, an automated complete blood count, had a range of $37 to $278 (median, $100). A complete metabolic panel had the largest variation among the 10 blood tests, costing anywhere from $79 to $948 (median, $273).

Teaching hospitals charged significantly less than other hospitals for 7 of the 10 tests, and government hospitals charged less for 5 of the 10, but "it is notable how few characteristics were significant predictors of the charges patients faced. ... A hospital’s case mix and labor cost did not affect charges, nor did the competitiveness of the market or the percentage of uninsured people in the county," wrote Dr. Hsia of the University of California, San Francisco, and her associates.

The study used data from the California Office of Statewide Health Planning and Development. Of the 307 hospitals that reported charges in 2011, between 166 and 189 reported charges for each of the 10 tests included in the study.

Charges for 10 common blood tests showed wide variation among hospitals in California, with the cost of one test ranging from $10 to more than $10,000, Dr. Renee Y. Hsia and her associates reported in BMJ Open.

In 2011, minimum charges for the examined blood tests ranged from $10 to $44. Maximum charges, with the exception of a creatine kinase assay at $628, were all more than $6,000. The highest charge for a lipid panel was $10,169 – more than a thousand times higher than the low of $10, according to Dr. Hsia and her associates (BMJ Open 2014 [doi: 10.1136/bmjopen-2014-005482]).

Large price differences remained after extreme cases were excluded (see graph). The test with the smallest variation between the 5th and 95th percentiles, an automated complete blood count, had a range of $37 to $278 (median, $100). A complete metabolic panel had the largest variation among the 10 blood tests, costing anywhere from $79 to $948 (median, $273).

Teaching hospitals charged significantly less than other hospitals for 7 of the 10 tests, and government hospitals charged less for 5 of the 10, but "it is notable how few characteristics were significant predictors of the charges patients faced. ... A hospital’s case mix and labor cost did not affect charges, nor did the competitiveness of the market or the percentage of uninsured people in the county," wrote Dr. Hsia of the University of California, San Francisco, and her associates.

The study used data from the California Office of Statewide Health Planning and Development. Of the 307 hospitals that reported charges in 2011, between 166 and 189 reported charges for each of the 10 tests included in the study.

FROM BMJ OPEN