User login

Improving Epistaxis Knowledge and Management Among Nursing Staff

From the University of Chicago Medical Center, Chicago, IL.

Abstract

Background: Epistaxis is a common chief complaint addressed by otolaryngologists. A review of the literature showed that there is a deficit in epistaxis education within the nursing community. Conversations with our nursing colleagues confirmed this unmet demand.

Objective: This quality improvement project aimed to increase general epistaxis knowledge, perceived comfort level managing nosebleeds, and perceived ability to stop nosebleeds among our nursing staff.

Methods: Data were collected through a survey administered before and after our intervention. The survey tested general epistaxis knowledge and assessed comfort and confidence in stopping epistaxis. Our intervention was an educational session covering pertinent epistaxis etiology and management. Quality improvement principles were used to optimize delivery of the intervention.

Results: A total of 51 nurses participated in the project. After participating in the in-service educational session, nurses answered significantly more epistaxis general knowledge questions correctly (mean [SD] difference, 2.07 [1.10] questions; 95% CI, 1.74-2.39; P < .001). There was no statistically significant difference in additional correct questions when stratified by clinical experience or clinical setting (P = .128 and P = 0.446, respectively). Nurses also reported feeling significantly more comfortable and significantly more confident in managing nosebleeds after the in-service (P = .007 and P < 0.001, respectively); 74.46% of nurses had an improvement in comfort level in managing epistaxis and 43.90% of nurses had an improvement in confidence in stopping epistaxis. After we moved the educational session from mid-shift to shift change, the nursing staff reported more satisfaction while maintaining similar improvements in knowledge and confidence.

Conclusion: We were able to significantly increase epistaxis knowledge, improve comfort levels managing epistaxis, and improve confidence in successful epistaxis management. Nurses of varying clinical experience and different clinical settings benefitted equally from our intervention.

Keywords: nosebleed; in-service; quality improvement.

Epistaxis, or nosebleed, is estimated to be the chief complaint in 1 in 200 emergency department visits in the United States.1 Additionally, it represents up to one-third of otolaryngology-related emergency room admissions.2 There is no existing literature, to our best knowledge, specifically investigating the incidence of epistaxis after a patient is admitted. Anecdotally, inpatients who develop epistaxis account for an appreciable number of consults to otolaryngology (ENT). Epistaxis is a cross-disciplinary issue, occurring in a range of clinical settings. For example, patients with epistaxis can present to the emergency department or to an outpatient primary care clinic before being referred to ENT. Additionally, inpatients on many different services can develop spontaneous epistaxis due to a variety of environmental and iatrogenic factors, such as dry air, use of nasal cannula, and initiation of anticoagulation. Based on the experience of our ENT providers and discussions with our nursing colleagues, we concluded that there was an interest in epistaxis management training among our nursing workforce.

The presence of unmet demand for epistaxis education among our nursing colleagues was supported by our literature review. A study performed in England surveyed emergency department nurses on first aid measures for management of epistaxis, including ideal head positioning, location of pressure application, and duration of pressure application.3 Overall, only 12% to 14% of the nursing staff answered all 3 questions correctly.3 Additionally, 73% to 78% of the nursing staff felt that their training in epistaxis management was inadequate, and 88% desired further training in epistaxis management.3 If generalized, this study confirms the demand for further epistaxis education among nurses.

In-services have previously been shown to be effective educational tools within the nursing community. A study in Ethiopia that evaluated pain management knowledge and attitudes before and after an in-service found a significant improvement in mean rank score of nurses’ knowledge and attitudes regarding pain management after they participated in the in-service.4 Scores on the knowledge survey improved from 41.4% before the intervention to 63.0% post intervention.4 A study in Connecticut evaluated nurses’ confidence in discussing suicidal ideation with patients and knowledge surrounding suicide precautions.5 After participating in an in-service, nurses were significantly more confident in discussing suicidal ideation with patients; application of appropriate suicide precautions also increased after the in-service.5

Our aim was for nurses to have an improvement in overall epistaxis knowledge, perceived comfort level managing nosebleeds, and perceived ability to stop nosebleeds after attending our in-service. Additionally, an overarching priority was to provide high-quality epistaxis education based on the literature and best practice guidelines.

Methods

Setting

This study was carried out at an 811-bed quaternary care center located in Chicago, Illinois. In fiscal year 2021, there were 91 643 emergency department visits and 33 805 hospital admissions. At our flagship hospital, 2658 patients were diagnosed with epistaxis during fiscal year 2021. The emergency department saw 533 patients with epistaxis, with 342 requiring admission and 191 being discharged. Separately, 566 inpatients received a diagnosis of epistaxis during their admission. The remainder of the patients with epistaxis were seen on an outpatient basis.

Data Collection

Data were collected from nurses on 5 different inpatient units. An email with information about the in-service was sent to the nurse managers of the inpatient units. These 5 units were included because the nurse managers responded to the email and facilitated delivery of the in-service. Data collection took place from August to December 2020.

Intervention

A quality improvement team composed of a resident physician champion, nurse educators, and nurse managers was formed. The physician champion was a senior otolaryngology resident who was responsible for designing and administering the pre-test, in-service, and post test. The nurse educators and nurse managers helped coordinate times for the in-service and promoted the in-service for their staff.

Our intervention was an educational in-service, a technique that is commonly used at our institution for nurse education. In-services typically involve delivering a lecture on a clinically relevant topic to a group of nurses on a unit. In developing the in-service, a top priority was to present high-quality evidence-based material. There is an abundance of information in the literature surrounding epistaxis management. The clinical practice guideline published by the American Academy of Otolaryngology lists nasal compression, application of vasoconstrictors, nasal packing, and nasal cautery as first-line treatments for the management of epistaxis.6 Nasal packing and nasal cautery tend to be perceived as interventions that require a certain level of expertise and specialized supplies. As such, these interventions are not often performed by floor nurses. In contrast, nasal compression and application of vasoconstrictors require only a few easily accessible supplies, and the risks are relatively minimal. When performing nasal compression, the clinical practice guidelines recommend firm, sustained compression to the lower third of the nose for 5 minutes or longer.6 Topical vasoconstrictors are generally underutilized in epistaxis management. In a study looking at a random sample of all US emergency department visits from 1992 to 2001, only 18% of visits used an epistaxis-related medication.2 Oxymetazoline hydrochloride is a topical vasoconstrictor that is commonly used as a nasal decongestant. However, its vasoconstrictor properties also make it a useful tool for controlling epistaxis. In a study looking at emergency department visits at the University of Texas Health Science Center, 65% of patients had resolution of nosebleed with application of oxymetazoline hydrochloride as the only intervention, with another 18% experiencing resolution of nosebleed with a combination of oxymetazoline hydrochloride and silver nitrate cautery.7 Based on review of the literature, nasal compression and application of vasoconstrictors seemed to be low-resource interventions with minimal morbidity. Therefore, management centered around nasal compression and use of topical vasoconstrictors seemed appropriate for our nursing staff.

The in-service included information about the etiology and management of epistaxis. Particular emphasis was placed on addressing and debunking common misconceptions about nosebleed management. With regards to management, our presentation focused on the use of topical vasoconstrictors and firm pressure to the lower third of the nose for at least 5 minutes. Nasal packing and nasal cautery were presented as procedures that ENT would perform. After the in-service, questions from the nurses were answered as time permitted.

Testing and Outcomes

A pre-test was administered before each in-service. The pre-test components comprised a knowledge survey and a descriptive survey. The general epistaxis knowledge questions on the pre-test included the location of blood vessels most commonly responsible for nosebleeds, the ideal positioning of a patient during a nosebleed, the appropriate location to hold pressure during a nosebleed, and the appropriate duration to hold pressure during a nosebleed. The descriptive survey portion asked nurses to rate whether they felt “very comfortable,” “comfortable,” “uncomfortable,” or “very uncomfortable” managing nosebleeds. It also asked whether nurses thought they would be able to “always,” “usually,” “rarely,” or “never” stop nosebleeds on the floor. We collected demographic information, including gender identity, years of clinical experience, and primary clinical environment.

The post test asked the same questions as the pre-test and was administered immediately after the in-service in order to assess its impact. We also established an ongoing dialogue with our nursing colleagues to obtain feedback on the sessions.

Primary outcomes of interest were the difference in general epistaxis knowledge questions answered correctly between the pre-test and the post test; the difference in comfort level in managing epistaxis before and after the in-service; and the difference in confidence to stop nosebleeds before and after the in-service. A secondary outcome was determining the audience for the in-service. Specifically, we wanted to determine whether there were different outcomes based on clinical setting or years of clinical experience. If nurses in a certain clinical environment or beyond a certain experience level did not show significant improvement from pre-test to post test, we would not target them for the in-service. Another secondary outcome was determining optimal timing for delivery of the in-service. We wanted to determine if there was a nursing preference for delivering the in-service at mid-shift vs shift change.

Analysis

Statistical calculations were performed using Stata 15 (StataCorp LLC). A P value < .05 was considered to be statistically significant. Where applicable, 95% confidence intervals (CI) were calculated. T-test was used to determine whether there was a statistically significant difference between pre-test and post-test epistaxis knowledge question scores. T-test was also used to determine whether there was a statistically significant difference in test scores between nurses receiving the in-service at mid-shift vs shift change. Pearson chi-squared tests were used to determine if there was a statistically significant difference between pre-test and post-test perceptions of epistaxis management, and to investigate outcomes between different subsets of nurses.

SQUIRE 2.0 guidelines were utilized to provide a framework for this project and to structure the manuscript.8 This study met criteria for exemption from institutional review board approval.

Results

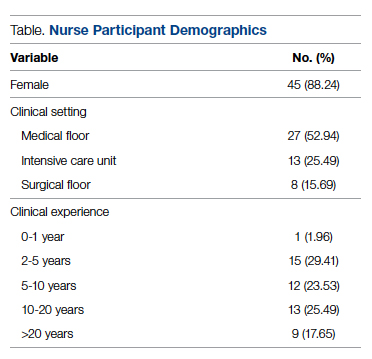

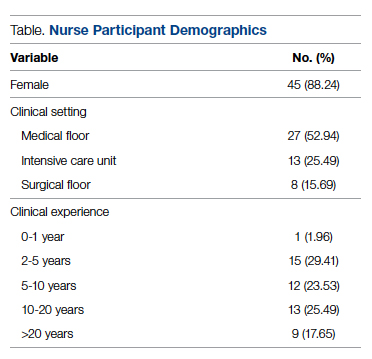

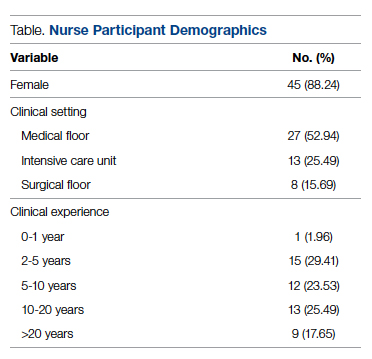

Fifty-one nurses took part in this project (Table). The majority of participants identified as female (88.24%), and just over half worked on medical floors (52.94%), with most of the remainder working in intensive care (25.49%) and surgical (15.69%) settings. There was a wide range of clinical experience, with 1.96% reporting 0 to 1 years of experience, 29.41% reporting 2 to 5 years, 23.53% reporting 5 to 10 years, 25.49% reporting 10 to 20 years, and 17.65% reporting more than 20 years.

There were unanswered questions on both the pre-test and post test. There was no consistently unanswered question. Omitted answers on the epistaxis knowledge questions were recorded as an “incorrect” answer. Omitted answers on the perception questions were considered null values and not considered in final analysis.

Primary Measures

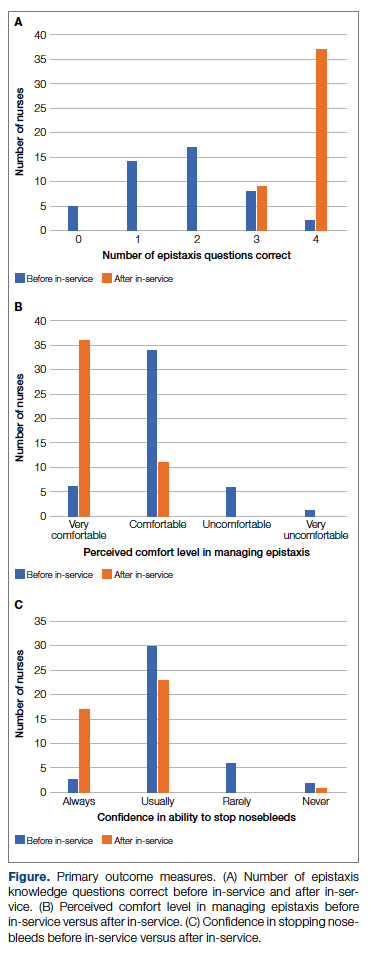

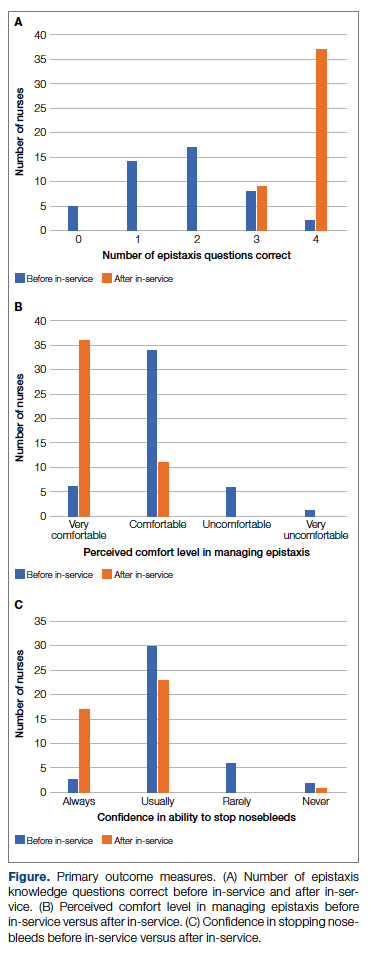

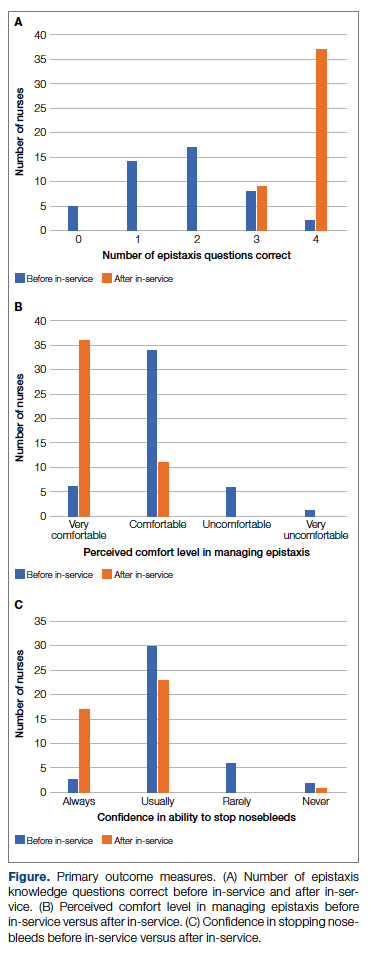

General epistaxis knowledge (Figure, part A) improved from the pre-test, where out of 4 questions, the mean (SD) score was 1.74 (1.02) correct questions, to the post-test, where out of 4 questions, the mean score was 3.80 (0.40) correct questions. After participating in the in-service, nurses answered significantly more questions about epistaxis general knowledge correctly (mean difference, 2.07 [1.10]; 95% CI, 1.74-2.39; P < .001), and 80.43% of them got a perfect score on the epistaxis knowledge questions.

The second primary measure was the difference in comfort level in managing nosebleed. After participating in the in-service, nurses felt significantly more comfortable in managing nosebleeds (Figure, part B; P = .007), with 74.46% of nurses having an improved comfort level managing nosebleeds. Before the in-service, 12.76% of nurses felt “very comfortable” in managing nosebleeds vs more than three-quarters (76.59%) after the in-service. Of those who answered that they felt “comfortable” managing nosebleeds on the pre-test, 82.35% improved to feeling “very comfortable” in managing nosebleeds. Before the in-service, 14.89% of nurses felt “uncomfortable” or “very uncomfortable” in managing nosebleeds, and this decreased to 0 post intervention. After the in-service, 100.00% of nurses felt “comfortable” or “very comfortable” in managing nosebleeds.

After receiving the in-service, nurses felt significantly more confident in stopping nosebleeds (Figure, part C; P < .001), with 43.90% of them having an improvement in confidence in stopping epistaxis. Before the in-service, 7.31% of nurses felt that they would “always” be able to stop a nose-bleed, and this increased to 41.46% after the in-service. Of those who answered that they felt that they would “usually” be able to stop a nosebleed on the pre-test, 36.67% changed their answer to state that they would “always” be able to stop a nosebleed on the post test. Before the in-service, 19.51% of nurses felt that they would “rarely” or “never” be able to stop a nosebleed, and this decreased to 2.44% after the in-service.

Secondary Measures

All of the nurses who participated either “strongly agreed” or “agreed” that they learned something new from the in-service. However, to determine whether there was a population who would benefit most from the in-service, we stratified the data by years of clinical experience. There was no statistically significant difference in whether nurses with varying clinical experience learned something new (P = .148): 100% of nurses with 0-1 years of experience, 80.00% of nurses with 2-5 years of experience, 100% of nurses with 5-10 years of experience, 69.23% of nurses with 10-20 years of experience, and 100% of nurses with >20 years of experience “strongly agreed” that they learned something new from this in-service. There was no statistically significant difference on the post test compared to the pre-test in additional correct questions when stratified by clinical experience (P = .128). Second, when we stratified by clinical setting, we did not find a statistically significant difference in whether nurses in different clinical settings learned something new (P = .929): 88.89% of nurses in the medical setting, 87.50% of nurses in the surgical setting, and 84.62% of nurses in the intensive care setting “strongly agreed” that they learned something new from this presentation. On investigating additional questions correct on the post test compared to the pre-test, there was no statistically significant difference in additional correct questions when stratified by clinical setting (P = .446).

Optimal timing of the in-service was another important outcome. Initially, the in-service was administered at mid-shift, with 9 nurses participating at mid-shift, but our nursing colleagues gave unanimous feedback that this was a suboptimal time for delivery of an in-service. We changed the timing of the in-service to shift change; 42 nurses received the in-service at shift-change. There was no statistically significant difference in scores on the epistaxis knowledge questions between these two groups (P = .123). This indicated to us that changing the timing of the delivery resulted in similarly improved outcomes while having the added benefit of being preferred by our nursing colleagues.

Discussion

In undertaking this project, our primary aims were to improve epistaxis knowledge and perceived management in our nursing staff. Among our nursing staff, we were able to significantly increase epistaxis knowledge, improve comfort levels managing epistaxis, and improve confidence in successful epistaxis management. We also found that nurses of varying clinical experience and different clinical settings benefited equally from our intervention. Using quality improvement principles, we optimized our delivery. Our in-service focused on educating nurses to use epistaxis management techniques that were resource-efficient and low risk.

After participating in the in-service, nurses answered significantly more questions about epistaxis general knowledge correctly (Figure, part A; mean difference, 2.07 questions [1.10]; 95% CI, 1.74-2.39; P < .001), felt significantly more comfortable in managing nosebleeds (Figure, part B; P = .007), and felt significantly more confident in stopping nosebleeds (Figure, part C; P < .001). Based on these results, we successfully achieved our primary aims.

Our secondary aim was to determine the audience that would benefit the most from the in-service. All of the nurses who participated either “strongly agreed” or “agreed” that they learned something new from the in-service. There was no statistically significant difference in whether nurses of varying clinical experience learned something new (P = .148) or in additional correct questions when stratified by clinical experience (P =.128). Also, there was no statistically significant difference in whether nurses in different clinical settings learned something new (P = .929) or in additional correct questions when stratified by clinical setting (P = .446). These results indicated to us that all participants learned something new and that there was no specific target audience, but rather that all participants benefitted from our session.

Our nursing colleagues gave us feedback that the timing of the in-service during mid-shift was not ideal. It was difficult to gather nurses mid-shift due to pressing patient-care duties. Nurses also found it difficult to give their full attention at this time. Nurses, nurse educators, and nurse managers suggested that we conduct the in-service at shift change in order to capture a larger population and take advantage of time relatively free of clinical duties. Giving the in-service at a time with relatively fewer clinical responsibilities allowed for a more robust question-and-answer session. It also allowed our nursing colleagues to pay full attention to the in-service. There was no statistically significant difference in epistaxis general knowledge questions answered correctly; this indicates that the quality of the education session did not vary greatly. However, our nursing colleagues strongly preferred the in-service at shift change. By making this modification to our intervention, we were able to optimize our intervention.

The previously mentioned study in England reported that only 12% to 14% of their nursing staff got a perfect score on epistaxis knowledge questions. Prior to our study, there was no literature investigating the impact of an in-service on epistaxis knowledge. After our intervention, 80.43% of our nurses got a perfect score on the epistaxis knowledge questions. We believe that this is a fair comparison because our post-test questions were identical to the survey questions used in the previously mentioned study in England, with the addition of one question.3 Further, the findings of our study are consistent with other studies regarding the positive effect of in-service education on knowledge and attitudes surrounding clinical topics. Similar to the study in Ethiopia investigating nurses’ knowledge surrounding pain management, our study noted a significant improvement in nurses’ knowledge after participating in the in-service.4 Also, when comparing our study to the study performed in Connecticut investigating nurses’ confidence surrounding suicide precautions, we found a similar significant improvement in confidence in management after participating in the in-service.5

Given our reliance on a survey as a tool to collect information, our study was subject to nonresponse bias. For each main outcome question, there was a handful of nonresponders. While this likely indicated either overlooking a question or deferring to answer due to clinical inexperience or nonapplicable clinical role, it is possible that this may have represented a respondent who did not benefit from the in-service. Another source of possible bias is sampling bias. Attempts were made to capture a wide range of nurses at the in-service. However, if a nurse was not interested in the topic material, whether due to abundant clinical experience or disinterest, it is possible that they may not have attended. Additionally, the cohort was selected purely based on responses from nursing managers to the initial email. It is possible that nonresponding units may have benefitted differently from this in-service.

There were several limitations within our analysis. We did not collect data assessing the long-term retention of epistaxis knowledge and management techniques. It is possible that epistaxis knowledge, comfort in managing nosebleeds, and perceived confidence in stopping nosebleeds decreased back to baseline several months after the in-service. Ideally, we would have been able to collect this data to assess retention of the in-service information. Unfortunately, a significant number of nurses who initially participated in the project became lost to follow-up, making such data collection impossible. Additionally, there was no assessment of actual ability to stop nosebleeds before vs after this in-service. Perceived management of epistaxis vs actual management of epistaxis are 2 vastly different things. However, this data would have been difficult to collect, and it likely would not have been in the best interest of patients, especially before the in-service was administered. As an improvement to this project, we could have assessed how many nosebleeds nurses had seen and successfully stopped after the in-service. As previously mentioned, this was not possible due to losing a significant number of nurses to follow-up. Finally, we did not collect objective data on preference for administration of in-service at mid-shift vs shift change. We relied on subjective data from conversations with our colleagues. By collecting objective data, we could have supported this change to our intervention with data.

The primary challenge to sustainability for this intervention is nursing turnover. With each wave of departing nurses and new nursing hires, the difficulty of ensuring a consistent knowledge base and management standards within our nursing workforce became clearer. After optimizing our intervention, our solution was to provide a hospital-wide in-service, which was recorded and uploaded to an institution-wide in-service library. In this way, a nurse with the desire to learn about epistaxis management could access the material at any point in time. Another solution would have been to appoint champions for epistaxis management within each major department to deliver the epistaxis in-service to new hires and new rotators within the department. However, given the turnover witnessed in our study cohort, this may not be sustainable long term.

Conclusion

Epistaxis is a chief complaint that can present in many different clinical settings and situations. Therefore, the ability to stop epistaxis in a timely and effective fashion is valuable. Our study demonstrated that in-services can improve epistaxis knowledge and improve perceived epistaxis management. Ideally, this intervention will lead to improved patient care. Given that epistaxis is a ubiquitous issue, this study may benefit other institutions who want to improve care for patients with epistaxis.

Next steps for this intervention include utilizing in-services for epistaxis education at other institutions and collecting long-term data within our own institution. Collecting long-term data would allow us to assess the retention of epistaxis knowledge from our in-service.

Acknowledgments: The author thanks the nurse managers, nurse educators, and staff nurses involved in this project, as well as Dr. Louis Portugal for providing mentorship throughout this process and Dr. Dara Adams for assisting with statistical analysis.

Corresponding author: Avery Nelson, MD, University of Chicago Medical Center, 5841 S Maryland Ave, MC 1035, Chicago, IL 60637; [email protected]

Disclosures: None reported.

1. Pallin DJ, Chng Y-M, McKay MP, et al. Epidemiology of epistaxis in US emergency departments, 1992 to 2001. Ann Emerg Med. 2005;46(1):77-81. doi:10.1016/j.annemergmed.2004.12.014

2. Walker TWM, Macfarlane TV, McGarry GW. The epidemiology and chronobiology of epistaxis: An investigation of Scottish hospital admissions 1995-2004. Clin Otolaryngol. 2007;32(5):361-365. doi:10.1111/j.1749-4486.2007.01530.x

3. Hakim N, Mummadi SM, Jolly K, et al. Nurse-led epistaxis management within the emergency department. Br J Nurs. 2018;27(1):41-46. doi:10.12968/bjon.2018.27.1.41

4. Germossa GN, Sjetne IS, Hellesø R. The impact of an in-service educational program on nurses’ knowledge and attitudes regarding pain management in an Ethiopian University Hospital. Front Public Health. 2018;6:229. doi:10.3389/fpubh.2018.00229

5. Manister NN, Murray S, Burke JM, Finegan M, McKiernan ME. Effectiveness of nursing education to prevent inpatient suicide. J Contin Educ Nurs. 2017;48(9):413-419. doi:10.3928/00220124-20170816-07

6. Tunkel DE, Anne S, Payne SC, et al. Clinical practice guideline: nosebleed (epistaxis) executive summary. Otolaryngol Head Neck Surg. 2020;162(1):S1-S38. doi:10.1177/0194599819890327

7. Krempl GA, Noorily AD. Use of oxymetazoline in the management of epistaxis. Ann Otol Rhinol Laryngol. 1995;104(9 Part 1):704-706. doi:10.1177/000348949510400906

8. Ogrinc G, Davies L, Goodman D, et al. SQUIRE 2.0—standards for quality improvement reporting excellence—revised publication guidelines from a detailed consensus process. J Am Coll Surg. 2016;222(3):317-323. doi:10.1016/j.jamcollsurg.2015.07.456

From the University of Chicago Medical Center, Chicago, IL.

Abstract

Background: Epistaxis is a common chief complaint addressed by otolaryngologists. A review of the literature showed that there is a deficit in epistaxis education within the nursing community. Conversations with our nursing colleagues confirmed this unmet demand.

Objective: This quality improvement project aimed to increase general epistaxis knowledge, perceived comfort level managing nosebleeds, and perceived ability to stop nosebleeds among our nursing staff.

Methods: Data were collected through a survey administered before and after our intervention. The survey tested general epistaxis knowledge and assessed comfort and confidence in stopping epistaxis. Our intervention was an educational session covering pertinent epistaxis etiology and management. Quality improvement principles were used to optimize delivery of the intervention.

Results: A total of 51 nurses participated in the project. After participating in the in-service educational session, nurses answered significantly more epistaxis general knowledge questions correctly (mean [SD] difference, 2.07 [1.10] questions; 95% CI, 1.74-2.39; P < .001). There was no statistically significant difference in additional correct questions when stratified by clinical experience or clinical setting (P = .128 and P = 0.446, respectively). Nurses also reported feeling significantly more comfortable and significantly more confident in managing nosebleeds after the in-service (P = .007 and P < 0.001, respectively); 74.46% of nurses had an improvement in comfort level in managing epistaxis and 43.90% of nurses had an improvement in confidence in stopping epistaxis. After we moved the educational session from mid-shift to shift change, the nursing staff reported more satisfaction while maintaining similar improvements in knowledge and confidence.

Conclusion: We were able to significantly increase epistaxis knowledge, improve comfort levels managing epistaxis, and improve confidence in successful epistaxis management. Nurses of varying clinical experience and different clinical settings benefitted equally from our intervention.

Keywords: nosebleed; in-service; quality improvement.

Epistaxis, or nosebleed, is estimated to be the chief complaint in 1 in 200 emergency department visits in the United States.1 Additionally, it represents up to one-third of otolaryngology-related emergency room admissions.2 There is no existing literature, to our best knowledge, specifically investigating the incidence of epistaxis after a patient is admitted. Anecdotally, inpatients who develop epistaxis account for an appreciable number of consults to otolaryngology (ENT). Epistaxis is a cross-disciplinary issue, occurring in a range of clinical settings. For example, patients with epistaxis can present to the emergency department or to an outpatient primary care clinic before being referred to ENT. Additionally, inpatients on many different services can develop spontaneous epistaxis due to a variety of environmental and iatrogenic factors, such as dry air, use of nasal cannula, and initiation of anticoagulation. Based on the experience of our ENT providers and discussions with our nursing colleagues, we concluded that there was an interest in epistaxis management training among our nursing workforce.

The presence of unmet demand for epistaxis education among our nursing colleagues was supported by our literature review. A study performed in England surveyed emergency department nurses on first aid measures for management of epistaxis, including ideal head positioning, location of pressure application, and duration of pressure application.3 Overall, only 12% to 14% of the nursing staff answered all 3 questions correctly.3 Additionally, 73% to 78% of the nursing staff felt that their training in epistaxis management was inadequate, and 88% desired further training in epistaxis management.3 If generalized, this study confirms the demand for further epistaxis education among nurses.

In-services have previously been shown to be effective educational tools within the nursing community. A study in Ethiopia that evaluated pain management knowledge and attitudes before and after an in-service found a significant improvement in mean rank score of nurses’ knowledge and attitudes regarding pain management after they participated in the in-service.4 Scores on the knowledge survey improved from 41.4% before the intervention to 63.0% post intervention.4 A study in Connecticut evaluated nurses’ confidence in discussing suicidal ideation with patients and knowledge surrounding suicide precautions.5 After participating in an in-service, nurses were significantly more confident in discussing suicidal ideation with patients; application of appropriate suicide precautions also increased after the in-service.5

Our aim was for nurses to have an improvement in overall epistaxis knowledge, perceived comfort level managing nosebleeds, and perceived ability to stop nosebleeds after attending our in-service. Additionally, an overarching priority was to provide high-quality epistaxis education based on the literature and best practice guidelines.

Methods

Setting

This study was carried out at an 811-bed quaternary care center located in Chicago, Illinois. In fiscal year 2021, there were 91 643 emergency department visits and 33 805 hospital admissions. At our flagship hospital, 2658 patients were diagnosed with epistaxis during fiscal year 2021. The emergency department saw 533 patients with epistaxis, with 342 requiring admission and 191 being discharged. Separately, 566 inpatients received a diagnosis of epistaxis during their admission. The remainder of the patients with epistaxis were seen on an outpatient basis.

Data Collection

Data were collected from nurses on 5 different inpatient units. An email with information about the in-service was sent to the nurse managers of the inpatient units. These 5 units were included because the nurse managers responded to the email and facilitated delivery of the in-service. Data collection took place from August to December 2020.

Intervention

A quality improvement team composed of a resident physician champion, nurse educators, and nurse managers was formed. The physician champion was a senior otolaryngology resident who was responsible for designing and administering the pre-test, in-service, and post test. The nurse educators and nurse managers helped coordinate times for the in-service and promoted the in-service for their staff.

Our intervention was an educational in-service, a technique that is commonly used at our institution for nurse education. In-services typically involve delivering a lecture on a clinically relevant topic to a group of nurses on a unit. In developing the in-service, a top priority was to present high-quality evidence-based material. There is an abundance of information in the literature surrounding epistaxis management. The clinical practice guideline published by the American Academy of Otolaryngology lists nasal compression, application of vasoconstrictors, nasal packing, and nasal cautery as first-line treatments for the management of epistaxis.6 Nasal packing and nasal cautery tend to be perceived as interventions that require a certain level of expertise and specialized supplies. As such, these interventions are not often performed by floor nurses. In contrast, nasal compression and application of vasoconstrictors require only a few easily accessible supplies, and the risks are relatively minimal. When performing nasal compression, the clinical practice guidelines recommend firm, sustained compression to the lower third of the nose for 5 minutes or longer.6 Topical vasoconstrictors are generally underutilized in epistaxis management. In a study looking at a random sample of all US emergency department visits from 1992 to 2001, only 18% of visits used an epistaxis-related medication.2 Oxymetazoline hydrochloride is a topical vasoconstrictor that is commonly used as a nasal decongestant. However, its vasoconstrictor properties also make it a useful tool for controlling epistaxis. In a study looking at emergency department visits at the University of Texas Health Science Center, 65% of patients had resolution of nosebleed with application of oxymetazoline hydrochloride as the only intervention, with another 18% experiencing resolution of nosebleed with a combination of oxymetazoline hydrochloride and silver nitrate cautery.7 Based on review of the literature, nasal compression and application of vasoconstrictors seemed to be low-resource interventions with minimal morbidity. Therefore, management centered around nasal compression and use of topical vasoconstrictors seemed appropriate for our nursing staff.

The in-service included information about the etiology and management of epistaxis. Particular emphasis was placed on addressing and debunking common misconceptions about nosebleed management. With regards to management, our presentation focused on the use of topical vasoconstrictors and firm pressure to the lower third of the nose for at least 5 minutes. Nasal packing and nasal cautery were presented as procedures that ENT would perform. After the in-service, questions from the nurses were answered as time permitted.

Testing and Outcomes

A pre-test was administered before each in-service. The pre-test components comprised a knowledge survey and a descriptive survey. The general epistaxis knowledge questions on the pre-test included the location of blood vessels most commonly responsible for nosebleeds, the ideal positioning of a patient during a nosebleed, the appropriate location to hold pressure during a nosebleed, and the appropriate duration to hold pressure during a nosebleed. The descriptive survey portion asked nurses to rate whether they felt “very comfortable,” “comfortable,” “uncomfortable,” or “very uncomfortable” managing nosebleeds. It also asked whether nurses thought they would be able to “always,” “usually,” “rarely,” or “never” stop nosebleeds on the floor. We collected demographic information, including gender identity, years of clinical experience, and primary clinical environment.

The post test asked the same questions as the pre-test and was administered immediately after the in-service in order to assess its impact. We also established an ongoing dialogue with our nursing colleagues to obtain feedback on the sessions.

Primary outcomes of interest were the difference in general epistaxis knowledge questions answered correctly between the pre-test and the post test; the difference in comfort level in managing epistaxis before and after the in-service; and the difference in confidence to stop nosebleeds before and after the in-service. A secondary outcome was determining the audience for the in-service. Specifically, we wanted to determine whether there were different outcomes based on clinical setting or years of clinical experience. If nurses in a certain clinical environment or beyond a certain experience level did not show significant improvement from pre-test to post test, we would not target them for the in-service. Another secondary outcome was determining optimal timing for delivery of the in-service. We wanted to determine if there was a nursing preference for delivering the in-service at mid-shift vs shift change.

Analysis

Statistical calculations were performed using Stata 15 (StataCorp LLC). A P value < .05 was considered to be statistically significant. Where applicable, 95% confidence intervals (CI) were calculated. T-test was used to determine whether there was a statistically significant difference between pre-test and post-test epistaxis knowledge question scores. T-test was also used to determine whether there was a statistically significant difference in test scores between nurses receiving the in-service at mid-shift vs shift change. Pearson chi-squared tests were used to determine if there was a statistically significant difference between pre-test and post-test perceptions of epistaxis management, and to investigate outcomes between different subsets of nurses.

SQUIRE 2.0 guidelines were utilized to provide a framework for this project and to structure the manuscript.8 This study met criteria for exemption from institutional review board approval.

Results

Fifty-one nurses took part in this project (Table). The majority of participants identified as female (88.24%), and just over half worked on medical floors (52.94%), with most of the remainder working in intensive care (25.49%) and surgical (15.69%) settings. There was a wide range of clinical experience, with 1.96% reporting 0 to 1 years of experience, 29.41% reporting 2 to 5 years, 23.53% reporting 5 to 10 years, 25.49% reporting 10 to 20 years, and 17.65% reporting more than 20 years.

There were unanswered questions on both the pre-test and post test. There was no consistently unanswered question. Omitted answers on the epistaxis knowledge questions were recorded as an “incorrect” answer. Omitted answers on the perception questions were considered null values and not considered in final analysis.

Primary Measures

General epistaxis knowledge (Figure, part A) improved from the pre-test, where out of 4 questions, the mean (SD) score was 1.74 (1.02) correct questions, to the post-test, where out of 4 questions, the mean score was 3.80 (0.40) correct questions. After participating in the in-service, nurses answered significantly more questions about epistaxis general knowledge correctly (mean difference, 2.07 [1.10]; 95% CI, 1.74-2.39; P < .001), and 80.43% of them got a perfect score on the epistaxis knowledge questions.

The second primary measure was the difference in comfort level in managing nosebleed. After participating in the in-service, nurses felt significantly more comfortable in managing nosebleeds (Figure, part B; P = .007), with 74.46% of nurses having an improved comfort level managing nosebleeds. Before the in-service, 12.76% of nurses felt “very comfortable” in managing nosebleeds vs more than three-quarters (76.59%) after the in-service. Of those who answered that they felt “comfortable” managing nosebleeds on the pre-test, 82.35% improved to feeling “very comfortable” in managing nosebleeds. Before the in-service, 14.89% of nurses felt “uncomfortable” or “very uncomfortable” in managing nosebleeds, and this decreased to 0 post intervention. After the in-service, 100.00% of nurses felt “comfortable” or “very comfortable” in managing nosebleeds.

After receiving the in-service, nurses felt significantly more confident in stopping nosebleeds (Figure, part C; P < .001), with 43.90% of them having an improvement in confidence in stopping epistaxis. Before the in-service, 7.31% of nurses felt that they would “always” be able to stop a nose-bleed, and this increased to 41.46% after the in-service. Of those who answered that they felt that they would “usually” be able to stop a nosebleed on the pre-test, 36.67% changed their answer to state that they would “always” be able to stop a nosebleed on the post test. Before the in-service, 19.51% of nurses felt that they would “rarely” or “never” be able to stop a nosebleed, and this decreased to 2.44% after the in-service.

Secondary Measures

All of the nurses who participated either “strongly agreed” or “agreed” that they learned something new from the in-service. However, to determine whether there was a population who would benefit most from the in-service, we stratified the data by years of clinical experience. There was no statistically significant difference in whether nurses with varying clinical experience learned something new (P = .148): 100% of nurses with 0-1 years of experience, 80.00% of nurses with 2-5 years of experience, 100% of nurses with 5-10 years of experience, 69.23% of nurses with 10-20 years of experience, and 100% of nurses with >20 years of experience “strongly agreed” that they learned something new from this in-service. There was no statistically significant difference on the post test compared to the pre-test in additional correct questions when stratified by clinical experience (P = .128). Second, when we stratified by clinical setting, we did not find a statistically significant difference in whether nurses in different clinical settings learned something new (P = .929): 88.89% of nurses in the medical setting, 87.50% of nurses in the surgical setting, and 84.62% of nurses in the intensive care setting “strongly agreed” that they learned something new from this presentation. On investigating additional questions correct on the post test compared to the pre-test, there was no statistically significant difference in additional correct questions when stratified by clinical setting (P = .446).

Optimal timing of the in-service was another important outcome. Initially, the in-service was administered at mid-shift, with 9 nurses participating at mid-shift, but our nursing colleagues gave unanimous feedback that this was a suboptimal time for delivery of an in-service. We changed the timing of the in-service to shift change; 42 nurses received the in-service at shift-change. There was no statistically significant difference in scores on the epistaxis knowledge questions between these two groups (P = .123). This indicated to us that changing the timing of the delivery resulted in similarly improved outcomes while having the added benefit of being preferred by our nursing colleagues.

Discussion

In undertaking this project, our primary aims were to improve epistaxis knowledge and perceived management in our nursing staff. Among our nursing staff, we were able to significantly increase epistaxis knowledge, improve comfort levels managing epistaxis, and improve confidence in successful epistaxis management. We also found that nurses of varying clinical experience and different clinical settings benefited equally from our intervention. Using quality improvement principles, we optimized our delivery. Our in-service focused on educating nurses to use epistaxis management techniques that were resource-efficient and low risk.

After participating in the in-service, nurses answered significantly more questions about epistaxis general knowledge correctly (Figure, part A; mean difference, 2.07 questions [1.10]; 95% CI, 1.74-2.39; P < .001), felt significantly more comfortable in managing nosebleeds (Figure, part B; P = .007), and felt significantly more confident in stopping nosebleeds (Figure, part C; P < .001). Based on these results, we successfully achieved our primary aims.

Our secondary aim was to determine the audience that would benefit the most from the in-service. All of the nurses who participated either “strongly agreed” or “agreed” that they learned something new from the in-service. There was no statistically significant difference in whether nurses of varying clinical experience learned something new (P = .148) or in additional correct questions when stratified by clinical experience (P =.128). Also, there was no statistically significant difference in whether nurses in different clinical settings learned something new (P = .929) or in additional correct questions when stratified by clinical setting (P = .446). These results indicated to us that all participants learned something new and that there was no specific target audience, but rather that all participants benefitted from our session.

Our nursing colleagues gave us feedback that the timing of the in-service during mid-shift was not ideal. It was difficult to gather nurses mid-shift due to pressing patient-care duties. Nurses also found it difficult to give their full attention at this time. Nurses, nurse educators, and nurse managers suggested that we conduct the in-service at shift change in order to capture a larger population and take advantage of time relatively free of clinical duties. Giving the in-service at a time with relatively fewer clinical responsibilities allowed for a more robust question-and-answer session. It also allowed our nursing colleagues to pay full attention to the in-service. There was no statistically significant difference in epistaxis general knowledge questions answered correctly; this indicates that the quality of the education session did not vary greatly. However, our nursing colleagues strongly preferred the in-service at shift change. By making this modification to our intervention, we were able to optimize our intervention.

The previously mentioned study in England reported that only 12% to 14% of their nursing staff got a perfect score on epistaxis knowledge questions. Prior to our study, there was no literature investigating the impact of an in-service on epistaxis knowledge. After our intervention, 80.43% of our nurses got a perfect score on the epistaxis knowledge questions. We believe that this is a fair comparison because our post-test questions were identical to the survey questions used in the previously mentioned study in England, with the addition of one question.3 Further, the findings of our study are consistent with other studies regarding the positive effect of in-service education on knowledge and attitudes surrounding clinical topics. Similar to the study in Ethiopia investigating nurses’ knowledge surrounding pain management, our study noted a significant improvement in nurses’ knowledge after participating in the in-service.4 Also, when comparing our study to the study performed in Connecticut investigating nurses’ confidence surrounding suicide precautions, we found a similar significant improvement in confidence in management after participating in the in-service.5

Given our reliance on a survey as a tool to collect information, our study was subject to nonresponse bias. For each main outcome question, there was a handful of nonresponders. While this likely indicated either overlooking a question or deferring to answer due to clinical inexperience or nonapplicable clinical role, it is possible that this may have represented a respondent who did not benefit from the in-service. Another source of possible bias is sampling bias. Attempts were made to capture a wide range of nurses at the in-service. However, if a nurse was not interested in the topic material, whether due to abundant clinical experience or disinterest, it is possible that they may not have attended. Additionally, the cohort was selected purely based on responses from nursing managers to the initial email. It is possible that nonresponding units may have benefitted differently from this in-service.

There were several limitations within our analysis. We did not collect data assessing the long-term retention of epistaxis knowledge and management techniques. It is possible that epistaxis knowledge, comfort in managing nosebleeds, and perceived confidence in stopping nosebleeds decreased back to baseline several months after the in-service. Ideally, we would have been able to collect this data to assess retention of the in-service information. Unfortunately, a significant number of nurses who initially participated in the project became lost to follow-up, making such data collection impossible. Additionally, there was no assessment of actual ability to stop nosebleeds before vs after this in-service. Perceived management of epistaxis vs actual management of epistaxis are 2 vastly different things. However, this data would have been difficult to collect, and it likely would not have been in the best interest of patients, especially before the in-service was administered. As an improvement to this project, we could have assessed how many nosebleeds nurses had seen and successfully stopped after the in-service. As previously mentioned, this was not possible due to losing a significant number of nurses to follow-up. Finally, we did not collect objective data on preference for administration of in-service at mid-shift vs shift change. We relied on subjective data from conversations with our colleagues. By collecting objective data, we could have supported this change to our intervention with data.

The primary challenge to sustainability for this intervention is nursing turnover. With each wave of departing nurses and new nursing hires, the difficulty of ensuring a consistent knowledge base and management standards within our nursing workforce became clearer. After optimizing our intervention, our solution was to provide a hospital-wide in-service, which was recorded and uploaded to an institution-wide in-service library. In this way, a nurse with the desire to learn about epistaxis management could access the material at any point in time. Another solution would have been to appoint champions for epistaxis management within each major department to deliver the epistaxis in-service to new hires and new rotators within the department. However, given the turnover witnessed in our study cohort, this may not be sustainable long term.

Conclusion

Epistaxis is a chief complaint that can present in many different clinical settings and situations. Therefore, the ability to stop epistaxis in a timely and effective fashion is valuable. Our study demonstrated that in-services can improve epistaxis knowledge and improve perceived epistaxis management. Ideally, this intervention will lead to improved patient care. Given that epistaxis is a ubiquitous issue, this study may benefit other institutions who want to improve care for patients with epistaxis.

Next steps for this intervention include utilizing in-services for epistaxis education at other institutions and collecting long-term data within our own institution. Collecting long-term data would allow us to assess the retention of epistaxis knowledge from our in-service.

Acknowledgments: The author thanks the nurse managers, nurse educators, and staff nurses involved in this project, as well as Dr. Louis Portugal for providing mentorship throughout this process and Dr. Dara Adams for assisting with statistical analysis.

Corresponding author: Avery Nelson, MD, University of Chicago Medical Center, 5841 S Maryland Ave, MC 1035, Chicago, IL 60637; [email protected]

Disclosures: None reported.

From the University of Chicago Medical Center, Chicago, IL.

Abstract

Background: Epistaxis is a common chief complaint addressed by otolaryngologists. A review of the literature showed that there is a deficit in epistaxis education within the nursing community. Conversations with our nursing colleagues confirmed this unmet demand.

Objective: This quality improvement project aimed to increase general epistaxis knowledge, perceived comfort level managing nosebleeds, and perceived ability to stop nosebleeds among our nursing staff.

Methods: Data were collected through a survey administered before and after our intervention. The survey tested general epistaxis knowledge and assessed comfort and confidence in stopping epistaxis. Our intervention was an educational session covering pertinent epistaxis etiology and management. Quality improvement principles were used to optimize delivery of the intervention.

Results: A total of 51 nurses participated in the project. After participating in the in-service educational session, nurses answered significantly more epistaxis general knowledge questions correctly (mean [SD] difference, 2.07 [1.10] questions; 95% CI, 1.74-2.39; P < .001). There was no statistically significant difference in additional correct questions when stratified by clinical experience or clinical setting (P = .128 and P = 0.446, respectively). Nurses also reported feeling significantly more comfortable and significantly more confident in managing nosebleeds after the in-service (P = .007 and P < 0.001, respectively); 74.46% of nurses had an improvement in comfort level in managing epistaxis and 43.90% of nurses had an improvement in confidence in stopping epistaxis. After we moved the educational session from mid-shift to shift change, the nursing staff reported more satisfaction while maintaining similar improvements in knowledge and confidence.

Conclusion: We were able to significantly increase epistaxis knowledge, improve comfort levels managing epistaxis, and improve confidence in successful epistaxis management. Nurses of varying clinical experience and different clinical settings benefitted equally from our intervention.

Keywords: nosebleed; in-service; quality improvement.

Epistaxis, or nosebleed, is estimated to be the chief complaint in 1 in 200 emergency department visits in the United States.1 Additionally, it represents up to one-third of otolaryngology-related emergency room admissions.2 There is no existing literature, to our best knowledge, specifically investigating the incidence of epistaxis after a patient is admitted. Anecdotally, inpatients who develop epistaxis account for an appreciable number of consults to otolaryngology (ENT). Epistaxis is a cross-disciplinary issue, occurring in a range of clinical settings. For example, patients with epistaxis can present to the emergency department or to an outpatient primary care clinic before being referred to ENT. Additionally, inpatients on many different services can develop spontaneous epistaxis due to a variety of environmental and iatrogenic factors, such as dry air, use of nasal cannula, and initiation of anticoagulation. Based on the experience of our ENT providers and discussions with our nursing colleagues, we concluded that there was an interest in epistaxis management training among our nursing workforce.

The presence of unmet demand for epistaxis education among our nursing colleagues was supported by our literature review. A study performed in England surveyed emergency department nurses on first aid measures for management of epistaxis, including ideal head positioning, location of pressure application, and duration of pressure application.3 Overall, only 12% to 14% of the nursing staff answered all 3 questions correctly.3 Additionally, 73% to 78% of the nursing staff felt that their training in epistaxis management was inadequate, and 88% desired further training in epistaxis management.3 If generalized, this study confirms the demand for further epistaxis education among nurses.

In-services have previously been shown to be effective educational tools within the nursing community. A study in Ethiopia that evaluated pain management knowledge and attitudes before and after an in-service found a significant improvement in mean rank score of nurses’ knowledge and attitudes regarding pain management after they participated in the in-service.4 Scores on the knowledge survey improved from 41.4% before the intervention to 63.0% post intervention.4 A study in Connecticut evaluated nurses’ confidence in discussing suicidal ideation with patients and knowledge surrounding suicide precautions.5 After participating in an in-service, nurses were significantly more confident in discussing suicidal ideation with patients; application of appropriate suicide precautions also increased after the in-service.5

Our aim was for nurses to have an improvement in overall epistaxis knowledge, perceived comfort level managing nosebleeds, and perceived ability to stop nosebleeds after attending our in-service. Additionally, an overarching priority was to provide high-quality epistaxis education based on the literature and best practice guidelines.

Methods

Setting

This study was carried out at an 811-bed quaternary care center located in Chicago, Illinois. In fiscal year 2021, there were 91 643 emergency department visits and 33 805 hospital admissions. At our flagship hospital, 2658 patients were diagnosed with epistaxis during fiscal year 2021. The emergency department saw 533 patients with epistaxis, with 342 requiring admission and 191 being discharged. Separately, 566 inpatients received a diagnosis of epistaxis during their admission. The remainder of the patients with epistaxis were seen on an outpatient basis.

Data Collection

Data were collected from nurses on 5 different inpatient units. An email with information about the in-service was sent to the nurse managers of the inpatient units. These 5 units were included because the nurse managers responded to the email and facilitated delivery of the in-service. Data collection took place from August to December 2020.

Intervention

A quality improvement team composed of a resident physician champion, nurse educators, and nurse managers was formed. The physician champion was a senior otolaryngology resident who was responsible for designing and administering the pre-test, in-service, and post test. The nurse educators and nurse managers helped coordinate times for the in-service and promoted the in-service for their staff.

Our intervention was an educational in-service, a technique that is commonly used at our institution for nurse education. In-services typically involve delivering a lecture on a clinically relevant topic to a group of nurses on a unit. In developing the in-service, a top priority was to present high-quality evidence-based material. There is an abundance of information in the literature surrounding epistaxis management. The clinical practice guideline published by the American Academy of Otolaryngology lists nasal compression, application of vasoconstrictors, nasal packing, and nasal cautery as first-line treatments for the management of epistaxis.6 Nasal packing and nasal cautery tend to be perceived as interventions that require a certain level of expertise and specialized supplies. As such, these interventions are not often performed by floor nurses. In contrast, nasal compression and application of vasoconstrictors require only a few easily accessible supplies, and the risks are relatively minimal. When performing nasal compression, the clinical practice guidelines recommend firm, sustained compression to the lower third of the nose for 5 minutes or longer.6 Topical vasoconstrictors are generally underutilized in epistaxis management. In a study looking at a random sample of all US emergency department visits from 1992 to 2001, only 18% of visits used an epistaxis-related medication.2 Oxymetazoline hydrochloride is a topical vasoconstrictor that is commonly used as a nasal decongestant. However, its vasoconstrictor properties also make it a useful tool for controlling epistaxis. In a study looking at emergency department visits at the University of Texas Health Science Center, 65% of patients had resolution of nosebleed with application of oxymetazoline hydrochloride as the only intervention, with another 18% experiencing resolution of nosebleed with a combination of oxymetazoline hydrochloride and silver nitrate cautery.7 Based on review of the literature, nasal compression and application of vasoconstrictors seemed to be low-resource interventions with minimal morbidity. Therefore, management centered around nasal compression and use of topical vasoconstrictors seemed appropriate for our nursing staff.

The in-service included information about the etiology and management of epistaxis. Particular emphasis was placed on addressing and debunking common misconceptions about nosebleed management. With regards to management, our presentation focused on the use of topical vasoconstrictors and firm pressure to the lower third of the nose for at least 5 minutes. Nasal packing and nasal cautery were presented as procedures that ENT would perform. After the in-service, questions from the nurses were answered as time permitted.

Testing and Outcomes

A pre-test was administered before each in-service. The pre-test components comprised a knowledge survey and a descriptive survey. The general epistaxis knowledge questions on the pre-test included the location of blood vessels most commonly responsible for nosebleeds, the ideal positioning of a patient during a nosebleed, the appropriate location to hold pressure during a nosebleed, and the appropriate duration to hold pressure during a nosebleed. The descriptive survey portion asked nurses to rate whether they felt “very comfortable,” “comfortable,” “uncomfortable,” or “very uncomfortable” managing nosebleeds. It also asked whether nurses thought they would be able to “always,” “usually,” “rarely,” or “never” stop nosebleeds on the floor. We collected demographic information, including gender identity, years of clinical experience, and primary clinical environment.

The post test asked the same questions as the pre-test and was administered immediately after the in-service in order to assess its impact. We also established an ongoing dialogue with our nursing colleagues to obtain feedback on the sessions.

Primary outcomes of interest were the difference in general epistaxis knowledge questions answered correctly between the pre-test and the post test; the difference in comfort level in managing epistaxis before and after the in-service; and the difference in confidence to stop nosebleeds before and after the in-service. A secondary outcome was determining the audience for the in-service. Specifically, we wanted to determine whether there were different outcomes based on clinical setting or years of clinical experience. If nurses in a certain clinical environment or beyond a certain experience level did not show significant improvement from pre-test to post test, we would not target them for the in-service. Another secondary outcome was determining optimal timing for delivery of the in-service. We wanted to determine if there was a nursing preference for delivering the in-service at mid-shift vs shift change.

Analysis

Statistical calculations were performed using Stata 15 (StataCorp LLC). A P value < .05 was considered to be statistically significant. Where applicable, 95% confidence intervals (CI) were calculated. T-test was used to determine whether there was a statistically significant difference between pre-test and post-test epistaxis knowledge question scores. T-test was also used to determine whether there was a statistically significant difference in test scores between nurses receiving the in-service at mid-shift vs shift change. Pearson chi-squared tests were used to determine if there was a statistically significant difference between pre-test and post-test perceptions of epistaxis management, and to investigate outcomes between different subsets of nurses.

SQUIRE 2.0 guidelines were utilized to provide a framework for this project and to structure the manuscript.8 This study met criteria for exemption from institutional review board approval.

Results

Fifty-one nurses took part in this project (Table). The majority of participants identified as female (88.24%), and just over half worked on medical floors (52.94%), with most of the remainder working in intensive care (25.49%) and surgical (15.69%) settings. There was a wide range of clinical experience, with 1.96% reporting 0 to 1 years of experience, 29.41% reporting 2 to 5 years, 23.53% reporting 5 to 10 years, 25.49% reporting 10 to 20 years, and 17.65% reporting more than 20 years.

There were unanswered questions on both the pre-test and post test. There was no consistently unanswered question. Omitted answers on the epistaxis knowledge questions were recorded as an “incorrect” answer. Omitted answers on the perception questions were considered null values and not considered in final analysis.

Primary Measures

General epistaxis knowledge (Figure, part A) improved from the pre-test, where out of 4 questions, the mean (SD) score was 1.74 (1.02) correct questions, to the post-test, where out of 4 questions, the mean score was 3.80 (0.40) correct questions. After participating in the in-service, nurses answered significantly more questions about epistaxis general knowledge correctly (mean difference, 2.07 [1.10]; 95% CI, 1.74-2.39; P < .001), and 80.43% of them got a perfect score on the epistaxis knowledge questions.

The second primary measure was the difference in comfort level in managing nosebleed. After participating in the in-service, nurses felt significantly more comfortable in managing nosebleeds (Figure, part B; P = .007), with 74.46% of nurses having an improved comfort level managing nosebleeds. Before the in-service, 12.76% of nurses felt “very comfortable” in managing nosebleeds vs more than three-quarters (76.59%) after the in-service. Of those who answered that they felt “comfortable” managing nosebleeds on the pre-test, 82.35% improved to feeling “very comfortable” in managing nosebleeds. Before the in-service, 14.89% of nurses felt “uncomfortable” or “very uncomfortable” in managing nosebleeds, and this decreased to 0 post intervention. After the in-service, 100.00% of nurses felt “comfortable” or “very comfortable” in managing nosebleeds.

After receiving the in-service, nurses felt significantly more confident in stopping nosebleeds (Figure, part C; P < .001), with 43.90% of them having an improvement in confidence in stopping epistaxis. Before the in-service, 7.31% of nurses felt that they would “always” be able to stop a nose-bleed, and this increased to 41.46% after the in-service. Of those who answered that they felt that they would “usually” be able to stop a nosebleed on the pre-test, 36.67% changed their answer to state that they would “always” be able to stop a nosebleed on the post test. Before the in-service, 19.51% of nurses felt that they would “rarely” or “never” be able to stop a nosebleed, and this decreased to 2.44% after the in-service.

Secondary Measures

All of the nurses who participated either “strongly agreed” or “agreed” that they learned something new from the in-service. However, to determine whether there was a population who would benefit most from the in-service, we stratified the data by years of clinical experience. There was no statistically significant difference in whether nurses with varying clinical experience learned something new (P = .148): 100% of nurses with 0-1 years of experience, 80.00% of nurses with 2-5 years of experience, 100% of nurses with 5-10 years of experience, 69.23% of nurses with 10-20 years of experience, and 100% of nurses with >20 years of experience “strongly agreed” that they learned something new from this in-service. There was no statistically significant difference on the post test compared to the pre-test in additional correct questions when stratified by clinical experience (P = .128). Second, when we stratified by clinical setting, we did not find a statistically significant difference in whether nurses in different clinical settings learned something new (P = .929): 88.89% of nurses in the medical setting, 87.50% of nurses in the surgical setting, and 84.62% of nurses in the intensive care setting “strongly agreed” that they learned something new from this presentation. On investigating additional questions correct on the post test compared to the pre-test, there was no statistically significant difference in additional correct questions when stratified by clinical setting (P = .446).

Optimal timing of the in-service was another important outcome. Initially, the in-service was administered at mid-shift, with 9 nurses participating at mid-shift, but our nursing colleagues gave unanimous feedback that this was a suboptimal time for delivery of an in-service. We changed the timing of the in-service to shift change; 42 nurses received the in-service at shift-change. There was no statistically significant difference in scores on the epistaxis knowledge questions between these two groups (P = .123). This indicated to us that changing the timing of the delivery resulted in similarly improved outcomes while having the added benefit of being preferred by our nursing colleagues.

Discussion

In undertaking this project, our primary aims were to improve epistaxis knowledge and perceived management in our nursing staff. Among our nursing staff, we were able to significantly increase epistaxis knowledge, improve comfort levels managing epistaxis, and improve confidence in successful epistaxis management. We also found that nurses of varying clinical experience and different clinical settings benefited equally from our intervention. Using quality improvement principles, we optimized our delivery. Our in-service focused on educating nurses to use epistaxis management techniques that were resource-efficient and low risk.

After participating in the in-service, nurses answered significantly more questions about epistaxis general knowledge correctly (Figure, part A; mean difference, 2.07 questions [1.10]; 95% CI, 1.74-2.39; P < .001), felt significantly more comfortable in managing nosebleeds (Figure, part B; P = .007), and felt significantly more confident in stopping nosebleeds (Figure, part C; P < .001). Based on these results, we successfully achieved our primary aims.

Our secondary aim was to determine the audience that would benefit the most from the in-service. All of the nurses who participated either “strongly agreed” or “agreed” that they learned something new from the in-service. There was no statistically significant difference in whether nurses of varying clinical experience learned something new (P = .148) or in additional correct questions when stratified by clinical experience (P =.128). Also, there was no statistically significant difference in whether nurses in different clinical settings learned something new (P = .929) or in additional correct questions when stratified by clinical setting (P = .446). These results indicated to us that all participants learned something new and that there was no specific target audience, but rather that all participants benefitted from our session.

Our nursing colleagues gave us feedback that the timing of the in-service during mid-shift was not ideal. It was difficult to gather nurses mid-shift due to pressing patient-care duties. Nurses also found it difficult to give their full attention at this time. Nurses, nurse educators, and nurse managers suggested that we conduct the in-service at shift change in order to capture a larger population and take advantage of time relatively free of clinical duties. Giving the in-service at a time with relatively fewer clinical responsibilities allowed for a more robust question-and-answer session. It also allowed our nursing colleagues to pay full attention to the in-service. There was no statistically significant difference in epistaxis general knowledge questions answered correctly; this indicates that the quality of the education session did not vary greatly. However, our nursing colleagues strongly preferred the in-service at shift change. By making this modification to our intervention, we were able to optimize our intervention.

The previously mentioned study in England reported that only 12% to 14% of their nursing staff got a perfect score on epistaxis knowledge questions. Prior to our study, there was no literature investigating the impact of an in-service on epistaxis knowledge. After our intervention, 80.43% of our nurses got a perfect score on the epistaxis knowledge questions. We believe that this is a fair comparison because our post-test questions were identical to the survey questions used in the previously mentioned study in England, with the addition of one question.3 Further, the findings of our study are consistent with other studies regarding the positive effect of in-service education on knowledge and attitudes surrounding clinical topics. Similar to the study in Ethiopia investigating nurses’ knowledge surrounding pain management, our study noted a significant improvement in nurses’ knowledge after participating in the in-service.4 Also, when comparing our study to the study performed in Connecticut investigating nurses’ confidence surrounding suicide precautions, we found a similar significant improvement in confidence in management after participating in the in-service.5

Given our reliance on a survey as a tool to collect information, our study was subject to nonresponse bias. For each main outcome question, there was a handful of nonresponders. While this likely indicated either overlooking a question or deferring to answer due to clinical inexperience or nonapplicable clinical role, it is possible that this may have represented a respondent who did not benefit from the in-service. Another source of possible bias is sampling bias. Attempts were made to capture a wide range of nurses at the in-service. However, if a nurse was not interested in the topic material, whether due to abundant clinical experience or disinterest, it is possible that they may not have attended. Additionally, the cohort was selected purely based on responses from nursing managers to the initial email. It is possible that nonresponding units may have benefitted differently from this in-service.

There were several limitations within our analysis. We did not collect data assessing the long-term retention of epistaxis knowledge and management techniques. It is possible that epistaxis knowledge, comfort in managing nosebleeds, and perceived confidence in stopping nosebleeds decreased back to baseline several months after the in-service. Ideally, we would have been able to collect this data to assess retention of the in-service information. Unfortunately, a significant number of nurses who initially participated in the project became lost to follow-up, making such data collection impossible. Additionally, there was no assessment of actual ability to stop nosebleeds before vs after this in-service. Perceived management of epistaxis vs actual management of epistaxis are 2 vastly different things. However, this data would have been difficult to collect, and it likely would not have been in the best interest of patients, especially before the in-service was administered. As an improvement to this project, we could have assessed how many nosebleeds nurses had seen and successfully stopped after the in-service. As previously mentioned, this was not possible due to losing a significant number of nurses to follow-up. Finally, we did not collect objective data on preference for administration of in-service at mid-shift vs shift change. We relied on subjective data from conversations with our colleagues. By collecting objective data, we could have supported this change to our intervention with data.

The primary challenge to sustainability for this intervention is nursing turnover. With each wave of departing nurses and new nursing hires, the difficulty of ensuring a consistent knowledge base and management standards within our nursing workforce became clearer. After optimizing our intervention, our solution was to provide a hospital-wide in-service, which was recorded and uploaded to an institution-wide in-service library. In this way, a nurse with the desire to learn about epistaxis management could access the material at any point in time. Another solution would have been to appoint champions for epistaxis management within each major department to deliver the epistaxis in-service to new hires and new rotators within the department. However, given the turnover witnessed in our study cohort, this may not be sustainable long term.

Conclusion