User login

80% of Americans research recommendations post-visit

Confusion over health information and doctor advice is even higher among people who care for patients than among those who don’t provide care to their loved ones, the nationally representative survey from the AHIMA Foundation found.

The survey also shows that 80% of Americans – and an even higher portion of caregivers – are likely to research medical recommendations online after a doctor’s visit. But 1 in 4 people don’t know how to access their own medical records or find it difficult to do so.

The findings reflect the same low level of health literacy in the U.S. population that earlier surveys did. The results also indicate that little has changed since the Department of Health and Human Services released a National Action Plan to Improve Health Literacy in 2010.

That plan emphasized the need to develop and share accurate health information that helps people make decisions; to promote changes in the health care system that improve health information, communication, informed decision-making, and access to health services; and to increase the sharing and use of evidence-based health literacy practices.

According to the AHIMA Foundation report, 62% of Americans are not sure they understand their doctor’s advice and the health information discussed during a visit. Twenty-four percent say they don’t comprehend any of it, and 31% can’t remember what was said during the visit. Fifteen percent of those surveyed said they were more confused about their health than they were before the encounter with their doctor.

Caregivers have special issues

Forty-three percent of Americans are caregivers, the report notes, and 91% of those play an active role in managing someone else’s health. Millennials (65%) and Gen Xers (50%) are significantly more likely than Gen Zers (39%) and Boomers (20%) to be a caregiver.

Most caregivers have concerns about their loved ones’ ability to manage their own health. Most of them believe that doctors provide enough information, but 38% don’t believe a doctor can communicate effectively with the patient if the caregiver is not present.

Forty-three percent of caretakers don’t think their loved ones can understand medical information on their own. On the other hand, caregivers are more likely than people who don’t provide care to say the doctor confused them and to research the doctor’s advice after an appointment.

For many patients and caregivers, communications break down when they are with their health care provider. Twenty-two percent of Americans say they do not feel comfortable asking their doctor certain health questions. This inability to have a satisfactory dialogue with their doctor means that many patients leave their appointments without getting clear answers to their questions (24%) or without having an opportunity to ask any questions at all (17%).

This is not surprising, considering that a 2018 study found that doctors spend only 11 seconds, on average, listening to patients before interrupting them.

Depending on the internet

Overall, the AHIMA survey found, 42% of Americans research their doctor’s recommendations after an appointment. A higher percentage of caregivers than noncaregiver peers do so (47% vs. 38%). Eighty percent of respondents say they are “likely” to research their doctor’s advice online after a visit.

When they have a medical problem or a question about their condition, just as many Americans (59%) turn to the internet for an answer as contact their doctor directly, the survey found. Twenty-nine percent of the respondents consult friends, family, or colleagues; 23% look up medical records if they’re easily accessible; 19% ask pharmacists for advice; and 6% call an unspecified 800 number.

Americans feel secure in the health information they find on the internet. Among those who go online to look up information, 86% are confident that it is credible. And 42% report feeling relieved that they can find a lot of information about their health concerns. Respondents also say that the information they gather allows them to feel more confident in their doctor’s recommendations (35%) and that they feel better after having learned more on the internet than their doctor had told them (39%). Men are more likely than women to say that their confidence in their doctor’s recommendations increased after doing online research (40% vs. 30%).

Access to health records

Access to medical records would help people better understand their condition or diagnosis. But nearly half of Americans (48%) admit they don’t usually review their medical records until long after an appointment, and 52% say they rarely access their records at all.

One in four Americans say that they don’t know where to go to access their health information or that they didn’t find the process easy. More than half of those who have never had to find their records think the process would be difficult if they had to try.

Eighty-one percent of Americans use an online platform or portal to access their medical records or health information. Two-thirds of Americans who use an online portal trust that their medical information is kept safe and not shared with other people or organizations.

Four in five respondents agree that if they had access to all of their health information, including medical records, recommendations, conditions, and test results, they’d see an improvement in their health management. Fifty-nine percent of them believe they’d also be more confident about understanding their health, and 47% say they’d have greater trust in their doctor’s recommendations. Higher percentages of caregivers than noncaregivers say the same.

Younger people, those with a high school degree or less, and those who earn less than $50,000 are less likely than older, better educated, and more affluent people to understand their doctor’s health information and to ask questions of their providers.

People of color struggle with their relationships with doctors, are less satisfied than white people with the information they receive during visits, and are more likely than white peers to feel that if they had access to all their health information, they’d manage their health better and be more confident in their doctors’ recommendations, the survey found.

A version of this article first appeared on WebMD.com.

Confusion over health information and doctor advice is even higher among people who care for patients than among those who don’t provide care to their loved ones, the nationally representative survey from the AHIMA Foundation found.

The survey also shows that 80% of Americans – and an even higher portion of caregivers – are likely to research medical recommendations online after a doctor’s visit. But 1 in 4 people don’t know how to access their own medical records or find it difficult to do so.

The findings reflect the same low level of health literacy in the U.S. population that earlier surveys did. The results also indicate that little has changed since the Department of Health and Human Services released a National Action Plan to Improve Health Literacy in 2010.

That plan emphasized the need to develop and share accurate health information that helps people make decisions; to promote changes in the health care system that improve health information, communication, informed decision-making, and access to health services; and to increase the sharing and use of evidence-based health literacy practices.

According to the AHIMA Foundation report, 62% of Americans are not sure they understand their doctor’s advice and the health information discussed during a visit. Twenty-four percent say they don’t comprehend any of it, and 31% can’t remember what was said during the visit. Fifteen percent of those surveyed said they were more confused about their health than they were before the encounter with their doctor.

Caregivers have special issues

Forty-three percent of Americans are caregivers, the report notes, and 91% of those play an active role in managing someone else’s health. Millennials (65%) and Gen Xers (50%) are significantly more likely than Gen Zers (39%) and Boomers (20%) to be a caregiver.

Most caregivers have concerns about their loved ones’ ability to manage their own health. Most of them believe that doctors provide enough information, but 38% don’t believe a doctor can communicate effectively with the patient if the caregiver is not present.

Forty-three percent of caretakers don’t think their loved ones can understand medical information on their own. On the other hand, caregivers are more likely than people who don’t provide care to say the doctor confused them and to research the doctor’s advice after an appointment.

For many patients and caregivers, communications break down when they are with their health care provider. Twenty-two percent of Americans say they do not feel comfortable asking their doctor certain health questions. This inability to have a satisfactory dialogue with their doctor means that many patients leave their appointments without getting clear answers to their questions (24%) or without having an opportunity to ask any questions at all (17%).

This is not surprising, considering that a 2018 study found that doctors spend only 11 seconds, on average, listening to patients before interrupting them.

Depending on the internet

Overall, the AHIMA survey found, 42% of Americans research their doctor’s recommendations after an appointment. A higher percentage of caregivers than noncaregiver peers do so (47% vs. 38%). Eighty percent of respondents say they are “likely” to research their doctor’s advice online after a visit.

When they have a medical problem or a question about their condition, just as many Americans (59%) turn to the internet for an answer as contact their doctor directly, the survey found. Twenty-nine percent of the respondents consult friends, family, or colleagues; 23% look up medical records if they’re easily accessible; 19% ask pharmacists for advice; and 6% call an unspecified 800 number.

Americans feel secure in the health information they find on the internet. Among those who go online to look up information, 86% are confident that it is credible. And 42% report feeling relieved that they can find a lot of information about their health concerns. Respondents also say that the information they gather allows them to feel more confident in their doctor’s recommendations (35%) and that they feel better after having learned more on the internet than their doctor had told them (39%). Men are more likely than women to say that their confidence in their doctor’s recommendations increased after doing online research (40% vs. 30%).

Access to health records

Access to medical records would help people better understand their condition or diagnosis. But nearly half of Americans (48%) admit they don’t usually review their medical records until long after an appointment, and 52% say they rarely access their records at all.

One in four Americans say that they don’t know where to go to access their health information or that they didn’t find the process easy. More than half of those who have never had to find their records think the process would be difficult if they had to try.

Eighty-one percent of Americans use an online platform or portal to access their medical records or health information. Two-thirds of Americans who use an online portal trust that their medical information is kept safe and not shared with other people or organizations.

Four in five respondents agree that if they had access to all of their health information, including medical records, recommendations, conditions, and test results, they’d see an improvement in their health management. Fifty-nine percent of them believe they’d also be more confident about understanding their health, and 47% say they’d have greater trust in their doctor’s recommendations. Higher percentages of caregivers than noncaregivers say the same.

Younger people, those with a high school degree or less, and those who earn less than $50,000 are less likely than older, better educated, and more affluent people to understand their doctor’s health information and to ask questions of their providers.

People of color struggle with their relationships with doctors, are less satisfied than white people with the information they receive during visits, and are more likely than white peers to feel that if they had access to all their health information, they’d manage their health better and be more confident in their doctors’ recommendations, the survey found.

A version of this article first appeared on WebMD.com.

Confusion over health information and doctor advice is even higher among people who care for patients than among those who don’t provide care to their loved ones, the nationally representative survey from the AHIMA Foundation found.

The survey also shows that 80% of Americans – and an even higher portion of caregivers – are likely to research medical recommendations online after a doctor’s visit. But 1 in 4 people don’t know how to access their own medical records or find it difficult to do so.

The findings reflect the same low level of health literacy in the U.S. population that earlier surveys did. The results also indicate that little has changed since the Department of Health and Human Services released a National Action Plan to Improve Health Literacy in 2010.

That plan emphasized the need to develop and share accurate health information that helps people make decisions; to promote changes in the health care system that improve health information, communication, informed decision-making, and access to health services; and to increase the sharing and use of evidence-based health literacy practices.

According to the AHIMA Foundation report, 62% of Americans are not sure they understand their doctor’s advice and the health information discussed during a visit. Twenty-four percent say they don’t comprehend any of it, and 31% can’t remember what was said during the visit. Fifteen percent of those surveyed said they were more confused about their health than they were before the encounter with their doctor.

Caregivers have special issues

Forty-three percent of Americans are caregivers, the report notes, and 91% of those play an active role in managing someone else’s health. Millennials (65%) and Gen Xers (50%) are significantly more likely than Gen Zers (39%) and Boomers (20%) to be a caregiver.

Most caregivers have concerns about their loved ones’ ability to manage their own health. Most of them believe that doctors provide enough information, but 38% don’t believe a doctor can communicate effectively with the patient if the caregiver is not present.

Forty-three percent of caretakers don’t think their loved ones can understand medical information on their own. On the other hand, caregivers are more likely than people who don’t provide care to say the doctor confused them and to research the doctor’s advice after an appointment.

For many patients and caregivers, communications break down when they are with their health care provider. Twenty-two percent of Americans say they do not feel comfortable asking their doctor certain health questions. This inability to have a satisfactory dialogue with their doctor means that many patients leave their appointments without getting clear answers to their questions (24%) or without having an opportunity to ask any questions at all (17%).

This is not surprising, considering that a 2018 study found that doctors spend only 11 seconds, on average, listening to patients before interrupting them.

Depending on the internet

Overall, the AHIMA survey found, 42% of Americans research their doctor’s recommendations after an appointment. A higher percentage of caregivers than noncaregiver peers do so (47% vs. 38%). Eighty percent of respondents say they are “likely” to research their doctor’s advice online after a visit.

When they have a medical problem or a question about their condition, just as many Americans (59%) turn to the internet for an answer as contact their doctor directly, the survey found. Twenty-nine percent of the respondents consult friends, family, or colleagues; 23% look up medical records if they’re easily accessible; 19% ask pharmacists for advice; and 6% call an unspecified 800 number.

Americans feel secure in the health information they find on the internet. Among those who go online to look up information, 86% are confident that it is credible. And 42% report feeling relieved that they can find a lot of information about their health concerns. Respondents also say that the information they gather allows them to feel more confident in their doctor’s recommendations (35%) and that they feel better after having learned more on the internet than their doctor had told them (39%). Men are more likely than women to say that their confidence in their doctor’s recommendations increased after doing online research (40% vs. 30%).

Access to health records

Access to medical records would help people better understand their condition or diagnosis. But nearly half of Americans (48%) admit they don’t usually review their medical records until long after an appointment, and 52% say they rarely access their records at all.

One in four Americans say that they don’t know where to go to access their health information or that they didn’t find the process easy. More than half of those who have never had to find their records think the process would be difficult if they had to try.

Eighty-one percent of Americans use an online platform or portal to access their medical records or health information. Two-thirds of Americans who use an online portal trust that their medical information is kept safe and not shared with other people or organizations.

Four in five respondents agree that if they had access to all of their health information, including medical records, recommendations, conditions, and test results, they’d see an improvement in their health management. Fifty-nine percent of them believe they’d also be more confident about understanding their health, and 47% say they’d have greater trust in their doctor’s recommendations. Higher percentages of caregivers than noncaregivers say the same.

Younger people, those with a high school degree or less, and those who earn less than $50,000 are less likely than older, better educated, and more affluent people to understand their doctor’s health information and to ask questions of their providers.

People of color struggle with their relationships with doctors, are less satisfied than white people with the information they receive during visits, and are more likely than white peers to feel that if they had access to all their health information, they’d manage their health better and be more confident in their doctors’ recommendations, the survey found.

A version of this article first appeared on WebMD.com.

Now Takeda offers rebate if lung cancer drug fails to work

The rebate offer is for brigatinib (Alunbrig) which is approved for the treatment of adults with anaplastic lymphoma kinase positive (ALK+) metastatic non–small cell lung cancer (NSCLC) as detected by an FDA-approved test.

The move follows a rebate offer from Pfizer for crizotinib (Xalkori), which is also approved for ALK+ (as well as ROS1+) NSCLC, and also for ALK+ anaplastic large cell lymphoma

For its offer, Takeda has teamed up with Point32Health, the second-largest health plan in New England with about 2.3 million members. The new agreement will make brigatinib widely available to patients who may benefit from its use, say the companies.

If a patient is unable to remain on brigatinib for 3 months or longer because of effectiveness or tolerability, Takeda will refund a yet unspecified amount of money to Point32Health. Brigatinib’s list price is $17,000 for a month’s treatment.

“Given the importance of facilitating cutting-edge oncology treatment and also the reality that not all patients show a positive response, reimbursement for oncology treatments is an area that is prime for innovative financing approaches,” said Michael Sherman, MD, chief medical officer and executive vice president, Point32Health, in a statement. “Collaborating with Takeda to share risk makes this agreement a crucial milestone in bringing cost-effectiveness to cancer care.”

The Pfizer program for crizotinib is somewhat different. For one thing, Pfizer’s refund is offered to any patient who qualifies and not just those who are covered by a specific plan. Second, Takeda is thus far only refunding money to the insurer, whereas Pfizer will also reimburse patients for out-of-pocket expenses.

There is a similar approach that has been offered by Novartis for tisagenlecleucel (Kymriah), the CAR T-cell therapy that launched with a daunting price tag of $475,000. After receiving backlash over the cost, Novartis announced that if the drug does not work after the first month, patients pay nothing.

In addition, Italy has been using this system for several years. Pharmaceutical companies must refund money if the drug fails to work. In 2015, the state-run health care system collected 200 million euros ($220 million) in refunds.

A version of this article first appeared on Medscape.com.

The rebate offer is for brigatinib (Alunbrig) which is approved for the treatment of adults with anaplastic lymphoma kinase positive (ALK+) metastatic non–small cell lung cancer (NSCLC) as detected by an FDA-approved test.

The move follows a rebate offer from Pfizer for crizotinib (Xalkori), which is also approved for ALK+ (as well as ROS1+) NSCLC, and also for ALK+ anaplastic large cell lymphoma

For its offer, Takeda has teamed up with Point32Health, the second-largest health plan in New England with about 2.3 million members. The new agreement will make brigatinib widely available to patients who may benefit from its use, say the companies.

If a patient is unable to remain on brigatinib for 3 months or longer because of effectiveness or tolerability, Takeda will refund a yet unspecified amount of money to Point32Health. Brigatinib’s list price is $17,000 for a month’s treatment.

“Given the importance of facilitating cutting-edge oncology treatment and also the reality that not all patients show a positive response, reimbursement for oncology treatments is an area that is prime for innovative financing approaches,” said Michael Sherman, MD, chief medical officer and executive vice president, Point32Health, in a statement. “Collaborating with Takeda to share risk makes this agreement a crucial milestone in bringing cost-effectiveness to cancer care.”

The Pfizer program for crizotinib is somewhat different. For one thing, Pfizer’s refund is offered to any patient who qualifies and not just those who are covered by a specific plan. Second, Takeda is thus far only refunding money to the insurer, whereas Pfizer will also reimburse patients for out-of-pocket expenses.

There is a similar approach that has been offered by Novartis for tisagenlecleucel (Kymriah), the CAR T-cell therapy that launched with a daunting price tag of $475,000. After receiving backlash over the cost, Novartis announced that if the drug does not work after the first month, patients pay nothing.

In addition, Italy has been using this system for several years. Pharmaceutical companies must refund money if the drug fails to work. In 2015, the state-run health care system collected 200 million euros ($220 million) in refunds.

A version of this article first appeared on Medscape.com.

The rebate offer is for brigatinib (Alunbrig) which is approved for the treatment of adults with anaplastic lymphoma kinase positive (ALK+) metastatic non–small cell lung cancer (NSCLC) as detected by an FDA-approved test.

The move follows a rebate offer from Pfizer for crizotinib (Xalkori), which is also approved for ALK+ (as well as ROS1+) NSCLC, and also for ALK+ anaplastic large cell lymphoma

For its offer, Takeda has teamed up with Point32Health, the second-largest health plan in New England with about 2.3 million members. The new agreement will make brigatinib widely available to patients who may benefit from its use, say the companies.

If a patient is unable to remain on brigatinib for 3 months or longer because of effectiveness or tolerability, Takeda will refund a yet unspecified amount of money to Point32Health. Brigatinib’s list price is $17,000 for a month’s treatment.

“Given the importance of facilitating cutting-edge oncology treatment and also the reality that not all patients show a positive response, reimbursement for oncology treatments is an area that is prime for innovative financing approaches,” said Michael Sherman, MD, chief medical officer and executive vice president, Point32Health, in a statement. “Collaborating with Takeda to share risk makes this agreement a crucial milestone in bringing cost-effectiveness to cancer care.”

The Pfizer program for crizotinib is somewhat different. For one thing, Pfizer’s refund is offered to any patient who qualifies and not just those who are covered by a specific plan. Second, Takeda is thus far only refunding money to the insurer, whereas Pfizer will also reimburse patients for out-of-pocket expenses.

There is a similar approach that has been offered by Novartis for tisagenlecleucel (Kymriah), the CAR T-cell therapy that launched with a daunting price tag of $475,000. After receiving backlash over the cost, Novartis announced that if the drug does not work after the first month, patients pay nothing.

In addition, Italy has been using this system for several years. Pharmaceutical companies must refund money if the drug fails to work. In 2015, the state-run health care system collected 200 million euros ($220 million) in refunds.

A version of this article first appeared on Medscape.com.

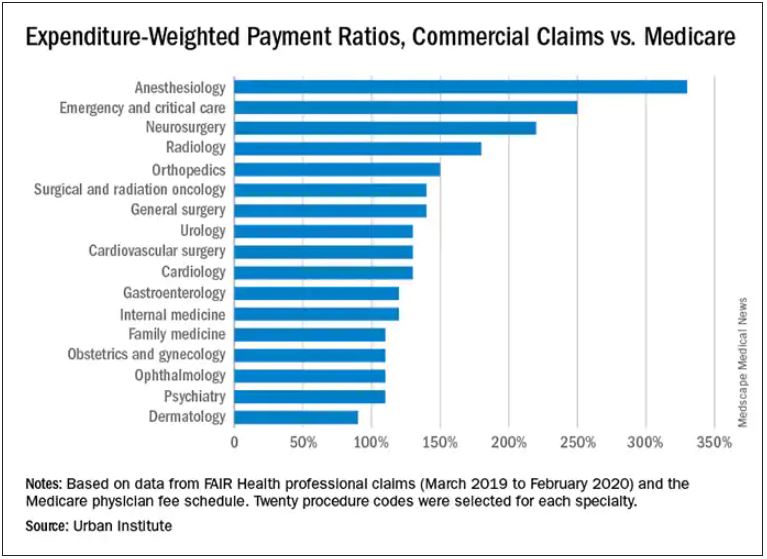

Which specialties get the biggest markups over Medicare rates?

Anesthesiologists charge private insurers more than 300% above Medicare rates, a markup that is higher than that of 16 other specialties, according to a study released by the Urban Institute.

The Washington-based nonprofit institute found that the lowest markups were in psychiatry, ophthalmology, ob.gyn., family medicine, gastroenterology, and internal medicine, at 110%-120% of Medicare rates. .

In the middle are cardiology and cardiovascular surgery (130%), urology (130%), general surgery, surgical and radiation oncology (all at 140%), and orthopedics (150%).

At the top end were radiology (180%), neurosurgery (220%), emergency and critical care (250%), and anesthesiology (330%).

The wide variation in payments could be cited in support of the idea of applying Medicare rates across all physician specialties, say the study authors. Although lowering practitioner payments might lead to savings, it “will also create more pushback from providers, especially if these rates are introduced in the employer market,” write researchers Stacey McMorrow, PhD, Robert A. Berenson, MD, and John Holahan, PhD.

It is not known whether lowering commercial payment rates might decrease patient access, they write.

The authors also note that specialties in which the potential for a fee reduction was greatest were also the specialties for which baseline compensation was highest – from $350,000 annually for emergency physicians to $800,000 a year for neurosurgeons. Annual compensation for ob.gyns., dermatologists, and opthalmologists is about $350,000 a year, which suggests that “these specialties are similarly well compensated by both Medicare and commercial insurers,” the authors write.

The investigators assessed the top 20 procedure codes by expenditure in each of 17 physician specialties. They estimated the commercial-to-Medicare payment ratio for each service and constructed weighted averages across services for each specialty at the national level and for 12 states for which data for all the specialties and services were available.

The researchers analyzed claims from the FAIR Health database between March 2019 and March 2020. That database represents 60 insurers covering 150 million people.

Pediatric and geriatric specialties, nonphysician practitioners, out-of-network clinicians, and ambulatory surgery center claims were excluded. Codes with modifiers, J codes, and clinical laboratory services were also not included.

The charges used in the study were not the actual contracted rates. The authors instead used “imputed allowed amounts” for each claim line. That method was used to protect the confidentiality of the negotiated rates.

With regard to all specialties, the lowest compensated services were procedures, evaluation and management, and tests, which received 140%-150% of the Medicare rate. Treatments and imaging were marked up 160%. Anesthesia was reimbursed at a rate 330% higher than the rate Medicare would pay.

The authors also assessed geographic variation for the 12 states for which they had data.

Similar to findings in other studies, the researchers found that the markup was lowest in Pennsylvania (120%) and highest in Wisconsin (260%). The U.S. average was 160%. California and Missouri were at 150%; Michigan was right at the average.

For physicians in Illinois, Louisiana, Colorado, Texas, and New York, markups were 170%-180% over the Medicare rate. Markups for clinicians in New Jersey (190%) and Arizona (200%) were closest to the Wisconsin rate.

The authors note some study limitations, including the fact that they excluded out-of-network practitioners, “and such payments may disproportionately affect certain specialties.”

A version of this article first appeared on Medscape.com.

Anesthesiologists charge private insurers more than 300% above Medicare rates, a markup that is higher than that of 16 other specialties, according to a study released by the Urban Institute.

The Washington-based nonprofit institute found that the lowest markups were in psychiatry, ophthalmology, ob.gyn., family medicine, gastroenterology, and internal medicine, at 110%-120% of Medicare rates. .

In the middle are cardiology and cardiovascular surgery (130%), urology (130%), general surgery, surgical and radiation oncology (all at 140%), and orthopedics (150%).

At the top end were radiology (180%), neurosurgery (220%), emergency and critical care (250%), and anesthesiology (330%).

The wide variation in payments could be cited in support of the idea of applying Medicare rates across all physician specialties, say the study authors. Although lowering practitioner payments might lead to savings, it “will also create more pushback from providers, especially if these rates are introduced in the employer market,” write researchers Stacey McMorrow, PhD, Robert A. Berenson, MD, and John Holahan, PhD.

It is not known whether lowering commercial payment rates might decrease patient access, they write.

The authors also note that specialties in which the potential for a fee reduction was greatest were also the specialties for which baseline compensation was highest – from $350,000 annually for emergency physicians to $800,000 a year for neurosurgeons. Annual compensation for ob.gyns., dermatologists, and opthalmologists is about $350,000 a year, which suggests that “these specialties are similarly well compensated by both Medicare and commercial insurers,” the authors write.

The investigators assessed the top 20 procedure codes by expenditure in each of 17 physician specialties. They estimated the commercial-to-Medicare payment ratio for each service and constructed weighted averages across services for each specialty at the national level and for 12 states for which data for all the specialties and services were available.

The researchers analyzed claims from the FAIR Health database between March 2019 and March 2020. That database represents 60 insurers covering 150 million people.

Pediatric and geriatric specialties, nonphysician practitioners, out-of-network clinicians, and ambulatory surgery center claims were excluded. Codes with modifiers, J codes, and clinical laboratory services were also not included.

The charges used in the study were not the actual contracted rates. The authors instead used “imputed allowed amounts” for each claim line. That method was used to protect the confidentiality of the negotiated rates.

With regard to all specialties, the lowest compensated services were procedures, evaluation and management, and tests, which received 140%-150% of the Medicare rate. Treatments and imaging were marked up 160%. Anesthesia was reimbursed at a rate 330% higher than the rate Medicare would pay.

The authors also assessed geographic variation for the 12 states for which they had data.

Similar to findings in other studies, the researchers found that the markup was lowest in Pennsylvania (120%) and highest in Wisconsin (260%). The U.S. average was 160%. California and Missouri were at 150%; Michigan was right at the average.

For physicians in Illinois, Louisiana, Colorado, Texas, and New York, markups were 170%-180% over the Medicare rate. Markups for clinicians in New Jersey (190%) and Arizona (200%) were closest to the Wisconsin rate.

The authors note some study limitations, including the fact that they excluded out-of-network practitioners, “and such payments may disproportionately affect certain specialties.”

A version of this article first appeared on Medscape.com.

Anesthesiologists charge private insurers more than 300% above Medicare rates, a markup that is higher than that of 16 other specialties, according to a study released by the Urban Institute.

The Washington-based nonprofit institute found that the lowest markups were in psychiatry, ophthalmology, ob.gyn., family medicine, gastroenterology, and internal medicine, at 110%-120% of Medicare rates. .

In the middle are cardiology and cardiovascular surgery (130%), urology (130%), general surgery, surgical and radiation oncology (all at 140%), and orthopedics (150%).

At the top end were radiology (180%), neurosurgery (220%), emergency and critical care (250%), and anesthesiology (330%).

The wide variation in payments could be cited in support of the idea of applying Medicare rates across all physician specialties, say the study authors. Although lowering practitioner payments might lead to savings, it “will also create more pushback from providers, especially if these rates are introduced in the employer market,” write researchers Stacey McMorrow, PhD, Robert A. Berenson, MD, and John Holahan, PhD.

It is not known whether lowering commercial payment rates might decrease patient access, they write.

The authors also note that specialties in which the potential for a fee reduction was greatest were also the specialties for which baseline compensation was highest – from $350,000 annually for emergency physicians to $800,000 a year for neurosurgeons. Annual compensation for ob.gyns., dermatologists, and opthalmologists is about $350,000 a year, which suggests that “these specialties are similarly well compensated by both Medicare and commercial insurers,” the authors write.

The investigators assessed the top 20 procedure codes by expenditure in each of 17 physician specialties. They estimated the commercial-to-Medicare payment ratio for each service and constructed weighted averages across services for each specialty at the national level and for 12 states for which data for all the specialties and services were available.

The researchers analyzed claims from the FAIR Health database between March 2019 and March 2020. That database represents 60 insurers covering 150 million people.

Pediatric and geriatric specialties, nonphysician practitioners, out-of-network clinicians, and ambulatory surgery center claims were excluded. Codes with modifiers, J codes, and clinical laboratory services were also not included.

The charges used in the study were not the actual contracted rates. The authors instead used “imputed allowed amounts” for each claim line. That method was used to protect the confidentiality of the negotiated rates.

With regard to all specialties, the lowest compensated services were procedures, evaluation and management, and tests, which received 140%-150% of the Medicare rate. Treatments and imaging were marked up 160%. Anesthesia was reimbursed at a rate 330% higher than the rate Medicare would pay.

The authors also assessed geographic variation for the 12 states for which they had data.

Similar to findings in other studies, the researchers found that the markup was lowest in Pennsylvania (120%) and highest in Wisconsin (260%). The U.S. average was 160%. California and Missouri were at 150%; Michigan was right at the average.

For physicians in Illinois, Louisiana, Colorado, Texas, and New York, markups were 170%-180% over the Medicare rate. Markups for clinicians in New Jersey (190%) and Arizona (200%) were closest to the Wisconsin rate.

The authors note some study limitations, including the fact that they excluded out-of-network practitioners, “and such payments may disproportionately affect certain specialties.”

A version of this article first appeared on Medscape.com.

Pfizer offers refund if drug ‘doesn’t work’

The high cost of new cancer drugs has been the subject of many debates and discussions, but the issue remains largely unresolved.

Now, one pharmaceutical company is offering a refund if its drug “doesn’t work.”

For what it says is the first time in the industry,

“Through this pilot program, Pfizer will offer a warranty to patients and health plans -- Medicare Part D, commercial and those who pay cash -- who are prescribed Xalkori for an FDA [US Food and Drug Administration]–approved indication,” said a company spokesperson.

Although Pfizer claims that its pilot program is a first in the industry, there have been others that are similar.

In 2017, Novartis offered something similar for tisagenlecleucel (Kymriah), the CAR T-cell therapy that launched with a daunting price tag of $475,000. After receiving backlash over the cost, Novartis announced that if the drug does not work after the first month, patients pay nothing.

Italy has been using this system for several years. Pharmaceutical companies must refund money if the drug fails to work. In 2015, the state-run healthcare system collected €200 million ($220 million) in refunds.

Pfizer pledge

Crizotinib is a selective tyrosine kinase inhibitor used mainly in the treatment of metastatic non–small cell lung cancer for patients whose tumors are positive for ALK or ROS1, as detected by an FDA-approved test. This indication was approved a decade ago. Another indication, ALK-positive anaplastic large cell lymphoma, was added earlier this year.

Details of the Pfizer Pledge are posted on Pfizer’s website. Eligible patients are those for whom crizotinib is discontinued before the fourth 30-day supply is dispensed by the patient’s pharmacy.

“The warranty will reimburse an amount equal to the cost paid for the medicine,” the spokesperson added. “The insurance-backed warranty pilot program will be insured and managed by AIG.”

This program is only available for patients who reside in the United States.

If use of crizotinib is discontinued and documentation of ineffectiveness is provided, Pfizer will refund the out-of-pocket amount that was paid for up to the first three bottles (30-day supply) of crizotinib, up to a maximum of $19,144 for each month’s supply, or a total of $57,432. Pfizer will also refund the cost that was paid by Medicare or a commercial insurer.

“Also, we have made sure to develop a program that also allows for Medicare patients to be eligible, since they are exempt from copay cards and at risk for significant financial burden when starting an oncology treatment,” said the spokesperson.

The pilot program is available to patients who began taking crizotinib from June 1, 2021, through December 31, 2021.

So far, Pfizer is offering this warranty only for crizotinib, but that may change in the future.

“Once the pilot is complete, we will assess learnings and consider whether to build a more robust, scalable program capable of supporting multiple products,” the Pfizer spokesperson commented.

Previous scheme ended in court

Pfizer had previously tried a different approach to reducing drug costs: it had attempted to offer copay support programs to Medicare patients who were prescribed its cardiac drug tafamidis (Vyndaqe, Vyndamax).

Tafamidis, launched in 2019, is used for patients with transthyretin amyloid cardiomyopathy. For those patients, it has been shown to reduce all-cause mortality and cardiovascular hospitalizations. It costs about $225,000 a year and has been described as the most expensive cardiovascular drug in the United States.

Earlier this month, a court dismissed Pfizer’s challenge to an anti-kickback law that prevented the company from offering copay support programs to Medicare patients.

The judge ruled that Pfizer’s plan to offer direct payments to patients violated a federal ban on “knowingly or willfully” providing financial support to induce drug purchases, even in the absence of corrupt intent.

Pharmaceutical manufacturers are forbidden from subsidizing copayments for Medicare beneficiaries but are allowed to donate to independent nonprofit organizations that offer copay assistance. Pfizer sued the U.S. Department of Health and Human Services in June 2020 to get a court ruling that their proposed programs were legal.

The new pledge program for crizotinib operates from a different premise, the Pfizer spokesperson commented.

A version of this article first appeared on Medscape.com.

The high cost of new cancer drugs has been the subject of many debates and discussions, but the issue remains largely unresolved.

Now, one pharmaceutical company is offering a refund if its drug “doesn’t work.”

For what it says is the first time in the industry,

“Through this pilot program, Pfizer will offer a warranty to patients and health plans -- Medicare Part D, commercial and those who pay cash -- who are prescribed Xalkori for an FDA [US Food and Drug Administration]–approved indication,” said a company spokesperson.

Although Pfizer claims that its pilot program is a first in the industry, there have been others that are similar.

In 2017, Novartis offered something similar for tisagenlecleucel (Kymriah), the CAR T-cell therapy that launched with a daunting price tag of $475,000. After receiving backlash over the cost, Novartis announced that if the drug does not work after the first month, patients pay nothing.

Italy has been using this system for several years. Pharmaceutical companies must refund money if the drug fails to work. In 2015, the state-run healthcare system collected €200 million ($220 million) in refunds.

Pfizer pledge

Crizotinib is a selective tyrosine kinase inhibitor used mainly in the treatment of metastatic non–small cell lung cancer for patients whose tumors are positive for ALK or ROS1, as detected by an FDA-approved test. This indication was approved a decade ago. Another indication, ALK-positive anaplastic large cell lymphoma, was added earlier this year.

Details of the Pfizer Pledge are posted on Pfizer’s website. Eligible patients are those for whom crizotinib is discontinued before the fourth 30-day supply is dispensed by the patient’s pharmacy.

“The warranty will reimburse an amount equal to the cost paid for the medicine,” the spokesperson added. “The insurance-backed warranty pilot program will be insured and managed by AIG.”

This program is only available for patients who reside in the United States.

If use of crizotinib is discontinued and documentation of ineffectiveness is provided, Pfizer will refund the out-of-pocket amount that was paid for up to the first three bottles (30-day supply) of crizotinib, up to a maximum of $19,144 for each month’s supply, or a total of $57,432. Pfizer will also refund the cost that was paid by Medicare or a commercial insurer.

“Also, we have made sure to develop a program that also allows for Medicare patients to be eligible, since they are exempt from copay cards and at risk for significant financial burden when starting an oncology treatment,” said the spokesperson.

The pilot program is available to patients who began taking crizotinib from June 1, 2021, through December 31, 2021.

So far, Pfizer is offering this warranty only for crizotinib, but that may change in the future.

“Once the pilot is complete, we will assess learnings and consider whether to build a more robust, scalable program capable of supporting multiple products,” the Pfizer spokesperson commented.

Previous scheme ended in court

Pfizer had previously tried a different approach to reducing drug costs: it had attempted to offer copay support programs to Medicare patients who were prescribed its cardiac drug tafamidis (Vyndaqe, Vyndamax).

Tafamidis, launched in 2019, is used for patients with transthyretin amyloid cardiomyopathy. For those patients, it has been shown to reduce all-cause mortality and cardiovascular hospitalizations. It costs about $225,000 a year and has been described as the most expensive cardiovascular drug in the United States.

Earlier this month, a court dismissed Pfizer’s challenge to an anti-kickback law that prevented the company from offering copay support programs to Medicare patients.

The judge ruled that Pfizer’s plan to offer direct payments to patients violated a federal ban on “knowingly or willfully” providing financial support to induce drug purchases, even in the absence of corrupt intent.

Pharmaceutical manufacturers are forbidden from subsidizing copayments for Medicare beneficiaries but are allowed to donate to independent nonprofit organizations that offer copay assistance. Pfizer sued the U.S. Department of Health and Human Services in June 2020 to get a court ruling that their proposed programs were legal.

The new pledge program for crizotinib operates from a different premise, the Pfizer spokesperson commented.

A version of this article first appeared on Medscape.com.

The high cost of new cancer drugs has been the subject of many debates and discussions, but the issue remains largely unresolved.

Now, one pharmaceutical company is offering a refund if its drug “doesn’t work.”

For what it says is the first time in the industry,

“Through this pilot program, Pfizer will offer a warranty to patients and health plans -- Medicare Part D, commercial and those who pay cash -- who are prescribed Xalkori for an FDA [US Food and Drug Administration]–approved indication,” said a company spokesperson.

Although Pfizer claims that its pilot program is a first in the industry, there have been others that are similar.

In 2017, Novartis offered something similar for tisagenlecleucel (Kymriah), the CAR T-cell therapy that launched with a daunting price tag of $475,000. After receiving backlash over the cost, Novartis announced that if the drug does not work after the first month, patients pay nothing.

Italy has been using this system for several years. Pharmaceutical companies must refund money if the drug fails to work. In 2015, the state-run healthcare system collected €200 million ($220 million) in refunds.

Pfizer pledge

Crizotinib is a selective tyrosine kinase inhibitor used mainly in the treatment of metastatic non–small cell lung cancer for patients whose tumors are positive for ALK or ROS1, as detected by an FDA-approved test. This indication was approved a decade ago. Another indication, ALK-positive anaplastic large cell lymphoma, was added earlier this year.

Details of the Pfizer Pledge are posted on Pfizer’s website. Eligible patients are those for whom crizotinib is discontinued before the fourth 30-day supply is dispensed by the patient’s pharmacy.

“The warranty will reimburse an amount equal to the cost paid for the medicine,” the spokesperson added. “The insurance-backed warranty pilot program will be insured and managed by AIG.”

This program is only available for patients who reside in the United States.

If use of crizotinib is discontinued and documentation of ineffectiveness is provided, Pfizer will refund the out-of-pocket amount that was paid for up to the first three bottles (30-day supply) of crizotinib, up to a maximum of $19,144 for each month’s supply, or a total of $57,432. Pfizer will also refund the cost that was paid by Medicare or a commercial insurer.

“Also, we have made sure to develop a program that also allows for Medicare patients to be eligible, since they are exempt from copay cards and at risk for significant financial burden when starting an oncology treatment,” said the spokesperson.

The pilot program is available to patients who began taking crizotinib from June 1, 2021, through December 31, 2021.

So far, Pfizer is offering this warranty only for crizotinib, but that may change in the future.

“Once the pilot is complete, we will assess learnings and consider whether to build a more robust, scalable program capable of supporting multiple products,” the Pfizer spokesperson commented.

Previous scheme ended in court

Pfizer had previously tried a different approach to reducing drug costs: it had attempted to offer copay support programs to Medicare patients who were prescribed its cardiac drug tafamidis (Vyndaqe, Vyndamax).

Tafamidis, launched in 2019, is used for patients with transthyretin amyloid cardiomyopathy. For those patients, it has been shown to reduce all-cause mortality and cardiovascular hospitalizations. It costs about $225,000 a year and has been described as the most expensive cardiovascular drug in the United States.

Earlier this month, a court dismissed Pfizer’s challenge to an anti-kickback law that prevented the company from offering copay support programs to Medicare patients.

The judge ruled that Pfizer’s plan to offer direct payments to patients violated a federal ban on “knowingly or willfully” providing financial support to induce drug purchases, even in the absence of corrupt intent.

Pharmaceutical manufacturers are forbidden from subsidizing copayments for Medicare beneficiaries but are allowed to donate to independent nonprofit organizations that offer copay assistance. Pfizer sued the U.S. Department of Health and Human Services in June 2020 to get a court ruling that their proposed programs were legal.

The new pledge program for crizotinib operates from a different premise, the Pfizer spokesperson commented.

A version of this article first appeared on Medscape.com.

Patient loses prostate after biopsy slide switched; more

It’s difficult enough when a patient’s prostate is removed because of cancer. But it’s another thing altogether when the prostate is removed because of a medical error, as a report on 3 CBS Philly, among other news outlets, makes clear.

The patient, Eric Spangs, lives in southeastern Pennsylvania. Testing indicated an elevation in prostate-specific antigen (PSA) level. He subsequently underwent biopsy of the prostate, which appeared to indicate cancer. In time, though, Mr. Spangs learned there had been an error: the tissue section used in the microscopic diagnosis had come from the biopsy specimen of a different patient. Mr. Spangs himself didn’t actually have cancer.

Ordinarily, such news would be cause for celebration. But this was far from a normal situ ation: Following his initial cancer diagnosis, Mr. Spangs underwent a radical laparoscopic prostatectomy at a local hospital.

“It’s devastated me emotionally and physically,” Mr. Spangs said. It has also been emotionally devastating for his wife, Melissa. (The couple has five children.)

Their attorney, Aaron Freiwald, has filed a suit against the health system to which the local hospital belongs and the area’s largest urologic practice.

The Spangs wish to caution other patients not to make the same mistake they did: they failed to get a second opinion from an oncology specialist, as recommended by the American Cancer Society. (Eric Spangs did receive a second opinion from someone at the urologic practice, but that practice doesn’t specialize in oncology.)

The Spangs also worry about the patient who received the false-negative biopsy result. They have been assured, however, that that patient will be properly notified of his actual cancer status.

Fertility specialist uses own sperm to impregnate patients

A suit claims that a Rochester, N.Y., gynecologist and fertility specialist used his own sperm to inseminate multiple patients, according to a story reported by the Associated Press and other news outlets.

The suit was filed last month by the daughter — call her “Harriet Jones” — of one of the women who received fertility services from the doctor during the 1980s. Ms. Jones’s suit alleges that at the time, the doctor told her mother that the sperm donor would be a medical student at the University of Rochester. In fact, the donor was the doctor himself. He kept that fact a secret for years, even after Ms. Jones — his own daughter — sought him out for gynecologic services.

The secret gradually began to come to light in 2016, when Ms. Jones’s nonbiological father — the man who had helped to raise her — died. Curious about her biological father, Ms. Jones sought to learn his identity from the Rochester gynecologist who had treated her mother and was now her own gynecologist. The doctor said he couldn’t be of help; he claimed he hadn’t kept the relevant records.

Ms. Jones then submitted a blood sample to a direct-to-consumer genetic testing company. The results surprised her: Not only did she learn of her ethnicity, but she also discovered the existence of two half siblings, who were donor-conceived in 1984 and 1985, respectively, the very period when her own mother was undergoing insemination procedures. Ms. Jones subsequently discovered the existence of additional half siblings, all born in the first half of the 1980s.

Initially elated by the discoveries, Ms. Jones soon grew despondent and anxious. She suffered from migraine headaches, among other symptoms. Her biological father, it seemed, had been “a serial sperm donor.”

Still, she continued to go to her Rochester doctor for treatment, having no reason to suspect anything untoward about him. Her visits, including those for prolonged menstrual bleeding, involved routine breast and pelvic exams, transvaginal ultrasounds, and intrauterine contraceptive placements under sedation.

Over this period, her doctor was friendly, asking her a variety of questions about her personal life. During one especially strange visit, however, he began chuckling and said, “You’re a really good kid, such a good kid.” During this visit, he invited his wife into the exam room, presumably to meet Ms. Jones.

It was at this moment that Ms. Jones had a revelation: Could her gynecologist actually be her biological father?

In May 2021, Ms. Jones and a half brother with whom she had been in touch contacted the gynecologist’s daughter from his first marriage. All three underwent genetic testing. The results showed a 99.99% chance of a genetic link.

Ms. Jones has said in her suit that “no reasonable woman” would have submitted to pelvic examinations and other examinations by a doctor whom she knew to be her father.

Besides fraud, her suit alleges medical malpractice, battery, infliction of mental distress, and lack of informed consent. She is seeking compensation for all harm caused to her, including past and future economic damages, past unreimbursed medical expenses, and future expenses related to her mental health treatment and care.

The story included no further details about the civil litigation. As for criminal charges, it’s unlikely Ms. Jones’s biological father — her gynecologist — will face criminal charges for his alleged crimes because they fall outside of the state’s statute of limitations.

Parents say daughter’s stroke wasn’t identified

The Georgia parents of a young woman who died from a stroke following a series of alleged misdiagnoses are suing multiple practitioners, reports Legal Newswire and other news outlets

In June 2019, Michaela Smith was training for her job as a detention officer when she began experiencing a variety of symptoms, including headache, shortness of breath, throat swelling, and slurred speech. She was taken to the emergency department (ED) at Hamilton Medical Center, in Dalton, Ga.

There, she was examined by an attending ED doctor, who ordered a CT scan. The results were read by radiologist Michael J. Cooney, MD. In his reading, the Smith family’s lawsuit alleges, Dr. Cooney failed to identify the basilar artery sign, which is a key indicator of a vessel occlusion in stroke patients. Dr. Cooney concluded that Ms. Smith’s scan showed no acute intracranial abnormality. He sent her home without further discharge instructions.

At home, Ms. Smith fell asleep but awoke in an altered mental state, one of several classic stroke symptoms that she had been experiencing. She returned to the ED. This time, she was examined by David F. Hawkins, MD, an ED physician. Although his differential diagnosis identified Ms. Smith’s symptoms as most likely stroke related, Dr. Hawkins allegedly failed to immediately corroborate his findings with additional vascular imaging. Later in the day, Ms. Smith did undergo an MRI, which a second radiologist, Kevin F. Johnson, MD, misread as showing no signs of ischemia in her basilar artery, according to the lawsuit.

That same day, Dr. Hawkins conferred with a second neurologist, Jeffrey T. Glass, MD, who recommended that Ms. Smith be admitted to the hospital because of her deteriorating condition. The Smiths’ suit claims that Dr. Glass also failed to diagnosis their daughter’s underlying condition, although he did sign off on her transfer to Baroness Erlanger Hospital, in Chattanooga, Tenn.

There, Ms. Smith’s condition continued to worsen. She soon required mechanical ventilation and tube feeding. On July 3, 2019, she was pronounced dead.

“This is an egregious case of negligence,” said the attorney representing the Smiths, who are suing the physicians involved and their practices, as well as Hamilton Medical Center and several unnamed defendants.

“Although two radiology studies and her clinical presentation indicated that Michaela was having a catastrophic stroke, her doctors repeatedly misread the studies as normal, failed to diagnose the stroke, and failed to treat her deficits as a neurological emergency,” the family’s lawyer stated.

At press time, there had been no response from any of the defendants or their attorneys.

A version of this article first appeared on Medscape.com.

It’s difficult enough when a patient’s prostate is removed because of cancer. But it’s another thing altogether when the prostate is removed because of a medical error, as a report on 3 CBS Philly, among other news outlets, makes clear.

The patient, Eric Spangs, lives in southeastern Pennsylvania. Testing indicated an elevation in prostate-specific antigen (PSA) level. He subsequently underwent biopsy of the prostate, which appeared to indicate cancer. In time, though, Mr. Spangs learned there had been an error: the tissue section used in the microscopic diagnosis had come from the biopsy specimen of a different patient. Mr. Spangs himself didn’t actually have cancer.

Ordinarily, such news would be cause for celebration. But this was far from a normal situ ation: Following his initial cancer diagnosis, Mr. Spangs underwent a radical laparoscopic prostatectomy at a local hospital.

“It’s devastated me emotionally and physically,” Mr. Spangs said. It has also been emotionally devastating for his wife, Melissa. (The couple has five children.)

Their attorney, Aaron Freiwald, has filed a suit against the health system to which the local hospital belongs and the area’s largest urologic practice.

The Spangs wish to caution other patients not to make the same mistake they did: they failed to get a second opinion from an oncology specialist, as recommended by the American Cancer Society. (Eric Spangs did receive a second opinion from someone at the urologic practice, but that practice doesn’t specialize in oncology.)

The Spangs also worry about the patient who received the false-negative biopsy result. They have been assured, however, that that patient will be properly notified of his actual cancer status.

Fertility specialist uses own sperm to impregnate patients

A suit claims that a Rochester, N.Y., gynecologist and fertility specialist used his own sperm to inseminate multiple patients, according to a story reported by the Associated Press and other news outlets.

The suit was filed last month by the daughter — call her “Harriet Jones” — of one of the women who received fertility services from the doctor during the 1980s. Ms. Jones’s suit alleges that at the time, the doctor told her mother that the sperm donor would be a medical student at the University of Rochester. In fact, the donor was the doctor himself. He kept that fact a secret for years, even after Ms. Jones — his own daughter — sought him out for gynecologic services.

The secret gradually began to come to light in 2016, when Ms. Jones’s nonbiological father — the man who had helped to raise her — died. Curious about her biological father, Ms. Jones sought to learn his identity from the Rochester gynecologist who had treated her mother and was now her own gynecologist. The doctor said he couldn’t be of help; he claimed he hadn’t kept the relevant records.

Ms. Jones then submitted a blood sample to a direct-to-consumer genetic testing company. The results surprised her: Not only did she learn of her ethnicity, but she also discovered the existence of two half siblings, who were donor-conceived in 1984 and 1985, respectively, the very period when her own mother was undergoing insemination procedures. Ms. Jones subsequently discovered the existence of additional half siblings, all born in the first half of the 1980s.

Initially elated by the discoveries, Ms. Jones soon grew despondent and anxious. She suffered from migraine headaches, among other symptoms. Her biological father, it seemed, had been “a serial sperm donor.”

Still, she continued to go to her Rochester doctor for treatment, having no reason to suspect anything untoward about him. Her visits, including those for prolonged menstrual bleeding, involved routine breast and pelvic exams, transvaginal ultrasounds, and intrauterine contraceptive placements under sedation.

Over this period, her doctor was friendly, asking her a variety of questions about her personal life. During one especially strange visit, however, he began chuckling and said, “You’re a really good kid, such a good kid.” During this visit, he invited his wife into the exam room, presumably to meet Ms. Jones.

It was at this moment that Ms. Jones had a revelation: Could her gynecologist actually be her biological father?

In May 2021, Ms. Jones and a half brother with whom she had been in touch contacted the gynecologist’s daughter from his first marriage. All three underwent genetic testing. The results showed a 99.99% chance of a genetic link.

Ms. Jones has said in her suit that “no reasonable woman” would have submitted to pelvic examinations and other examinations by a doctor whom she knew to be her father.

Besides fraud, her suit alleges medical malpractice, battery, infliction of mental distress, and lack of informed consent. She is seeking compensation for all harm caused to her, including past and future economic damages, past unreimbursed medical expenses, and future expenses related to her mental health treatment and care.

The story included no further details about the civil litigation. As for criminal charges, it’s unlikely Ms. Jones’s biological father — her gynecologist — will face criminal charges for his alleged crimes because they fall outside of the state’s statute of limitations.

Parents say daughter’s stroke wasn’t identified

The Georgia parents of a young woman who died from a stroke following a series of alleged misdiagnoses are suing multiple practitioners, reports Legal Newswire and other news outlets

In June 2019, Michaela Smith was training for her job as a detention officer when she began experiencing a variety of symptoms, including headache, shortness of breath, throat swelling, and slurred speech. She was taken to the emergency department (ED) at Hamilton Medical Center, in Dalton, Ga.

There, she was examined by an attending ED doctor, who ordered a CT scan. The results were read by radiologist Michael J. Cooney, MD. In his reading, the Smith family’s lawsuit alleges, Dr. Cooney failed to identify the basilar artery sign, which is a key indicator of a vessel occlusion in stroke patients. Dr. Cooney concluded that Ms. Smith’s scan showed no acute intracranial abnormality. He sent her home without further discharge instructions.

At home, Ms. Smith fell asleep but awoke in an altered mental state, one of several classic stroke symptoms that she had been experiencing. She returned to the ED. This time, she was examined by David F. Hawkins, MD, an ED physician. Although his differential diagnosis identified Ms. Smith’s symptoms as most likely stroke related, Dr. Hawkins allegedly failed to immediately corroborate his findings with additional vascular imaging. Later in the day, Ms. Smith did undergo an MRI, which a second radiologist, Kevin F. Johnson, MD, misread as showing no signs of ischemia in her basilar artery, according to the lawsuit.

That same day, Dr. Hawkins conferred with a second neurologist, Jeffrey T. Glass, MD, who recommended that Ms. Smith be admitted to the hospital because of her deteriorating condition. The Smiths’ suit claims that Dr. Glass also failed to diagnosis their daughter’s underlying condition, although he did sign off on her transfer to Baroness Erlanger Hospital, in Chattanooga, Tenn.

There, Ms. Smith’s condition continued to worsen. She soon required mechanical ventilation and tube feeding. On July 3, 2019, she was pronounced dead.

“This is an egregious case of negligence,” said the attorney representing the Smiths, who are suing the physicians involved and their practices, as well as Hamilton Medical Center and several unnamed defendants.

“Although two radiology studies and her clinical presentation indicated that Michaela was having a catastrophic stroke, her doctors repeatedly misread the studies as normal, failed to diagnose the stroke, and failed to treat her deficits as a neurological emergency,” the family’s lawyer stated.

At press time, there had been no response from any of the defendants or their attorneys.

A version of this article first appeared on Medscape.com.

It’s difficult enough when a patient’s prostate is removed because of cancer. But it’s another thing altogether when the prostate is removed because of a medical error, as a report on 3 CBS Philly, among other news outlets, makes clear.

The patient, Eric Spangs, lives in southeastern Pennsylvania. Testing indicated an elevation in prostate-specific antigen (PSA) level. He subsequently underwent biopsy of the prostate, which appeared to indicate cancer. In time, though, Mr. Spangs learned there had been an error: the tissue section used in the microscopic diagnosis had come from the biopsy specimen of a different patient. Mr. Spangs himself didn’t actually have cancer.

Ordinarily, such news would be cause for celebration. But this was far from a normal situ ation: Following his initial cancer diagnosis, Mr. Spangs underwent a radical laparoscopic prostatectomy at a local hospital.

“It’s devastated me emotionally and physically,” Mr. Spangs said. It has also been emotionally devastating for his wife, Melissa. (The couple has five children.)

Their attorney, Aaron Freiwald, has filed a suit against the health system to which the local hospital belongs and the area’s largest urologic practice.

The Spangs wish to caution other patients not to make the same mistake they did: they failed to get a second opinion from an oncology specialist, as recommended by the American Cancer Society. (Eric Spangs did receive a second opinion from someone at the urologic practice, but that practice doesn’t specialize in oncology.)

The Spangs also worry about the patient who received the false-negative biopsy result. They have been assured, however, that that patient will be properly notified of his actual cancer status.

Fertility specialist uses own sperm to impregnate patients

A suit claims that a Rochester, N.Y., gynecologist and fertility specialist used his own sperm to inseminate multiple patients, according to a story reported by the Associated Press and other news outlets.

The suit was filed last month by the daughter — call her “Harriet Jones” — of one of the women who received fertility services from the doctor during the 1980s. Ms. Jones’s suit alleges that at the time, the doctor told her mother that the sperm donor would be a medical student at the University of Rochester. In fact, the donor was the doctor himself. He kept that fact a secret for years, even after Ms. Jones — his own daughter — sought him out for gynecologic services.

The secret gradually began to come to light in 2016, when Ms. Jones’s nonbiological father — the man who had helped to raise her — died. Curious about her biological father, Ms. Jones sought to learn his identity from the Rochester gynecologist who had treated her mother and was now her own gynecologist. The doctor said he couldn’t be of help; he claimed he hadn’t kept the relevant records.

Ms. Jones then submitted a blood sample to a direct-to-consumer genetic testing company. The results surprised her: Not only did she learn of her ethnicity, but she also discovered the existence of two half siblings, who were donor-conceived in 1984 and 1985, respectively, the very period when her own mother was undergoing insemination procedures. Ms. Jones subsequently discovered the existence of additional half siblings, all born in the first half of the 1980s.

Initially elated by the discoveries, Ms. Jones soon grew despondent and anxious. She suffered from migraine headaches, among other symptoms. Her biological father, it seemed, had been “a serial sperm donor.”

Still, she continued to go to her Rochester doctor for treatment, having no reason to suspect anything untoward about him. Her visits, including those for prolonged menstrual bleeding, involved routine breast and pelvic exams, transvaginal ultrasounds, and intrauterine contraceptive placements under sedation.

Over this period, her doctor was friendly, asking her a variety of questions about her personal life. During one especially strange visit, however, he began chuckling and said, “You’re a really good kid, such a good kid.” During this visit, he invited his wife into the exam room, presumably to meet Ms. Jones.

It was at this moment that Ms. Jones had a revelation: Could her gynecologist actually be her biological father?

In May 2021, Ms. Jones and a half brother with whom she had been in touch contacted the gynecologist’s daughter from his first marriage. All three underwent genetic testing. The results showed a 99.99% chance of a genetic link.

Ms. Jones has said in her suit that “no reasonable woman” would have submitted to pelvic examinations and other examinations by a doctor whom she knew to be her father.

Besides fraud, her suit alleges medical malpractice, battery, infliction of mental distress, and lack of informed consent. She is seeking compensation for all harm caused to her, including past and future economic damages, past unreimbursed medical expenses, and future expenses related to her mental health treatment and care.

The story included no further details about the civil litigation. As for criminal charges, it’s unlikely Ms. Jones’s biological father — her gynecologist — will face criminal charges for his alleged crimes because they fall outside of the state’s statute of limitations.

Parents say daughter’s stroke wasn’t identified

The Georgia parents of a young woman who died from a stroke following a series of alleged misdiagnoses are suing multiple practitioners, reports Legal Newswire and other news outlets

In June 2019, Michaela Smith was training for her job as a detention officer when she began experiencing a variety of symptoms, including headache, shortness of breath, throat swelling, and slurred speech. She was taken to the emergency department (ED) at Hamilton Medical Center, in Dalton, Ga.

There, she was examined by an attending ED doctor, who ordered a CT scan. The results were read by radiologist Michael J. Cooney, MD. In his reading, the Smith family’s lawsuit alleges, Dr. Cooney failed to identify the basilar artery sign, which is a key indicator of a vessel occlusion in stroke patients. Dr. Cooney concluded that Ms. Smith’s scan showed no acute intracranial abnormality. He sent her home without further discharge instructions.

At home, Ms. Smith fell asleep but awoke in an altered mental state, one of several classic stroke symptoms that she had been experiencing. She returned to the ED. This time, she was examined by David F. Hawkins, MD, an ED physician. Although his differential diagnosis identified Ms. Smith’s symptoms as most likely stroke related, Dr. Hawkins allegedly failed to immediately corroborate his findings with additional vascular imaging. Later in the day, Ms. Smith did undergo an MRI, which a second radiologist, Kevin F. Johnson, MD, misread as showing no signs of ischemia in her basilar artery, according to the lawsuit.

That same day, Dr. Hawkins conferred with a second neurologist, Jeffrey T. Glass, MD, who recommended that Ms. Smith be admitted to the hospital because of her deteriorating condition. The Smiths’ suit claims that Dr. Glass also failed to diagnosis their daughter’s underlying condition, although he did sign off on her transfer to Baroness Erlanger Hospital, in Chattanooga, Tenn.

There, Ms. Smith’s condition continued to worsen. She soon required mechanical ventilation and tube feeding. On July 3, 2019, she was pronounced dead.

“This is an egregious case of negligence,” said the attorney representing the Smiths, who are suing the physicians involved and their practices, as well as Hamilton Medical Center and several unnamed defendants.

“Although two radiology studies and her clinical presentation indicated that Michaela was having a catastrophic stroke, her doctors repeatedly misread the studies as normal, failed to diagnose the stroke, and failed to treat her deficits as a neurological emergency,” the family’s lawyer stated.

At press time, there had been no response from any of the defendants or their attorneys.

A version of this article first appeared on Medscape.com.

New land mines in your next (and even current) employment contract

Physician employment contracts include some new dangers. This includes physicians taking a new job, but it also includes already-employed doctors who are being asked to resign a new contract that contains new conditions. A number of these new clauses have arisen because of COVID-19. When the pandemic dramatically reduced patient flow, many employers didn’t have enough money to pay doctors and didn’t always have physicians in the right location or practice setting.

Vowing this would never happen again, some employers have rewritten their physician contracts to make it easier to reassign and terminate physicians.

Here are 12 potential land mines in a physician employment contract, some of which were added as a result of the pandemic.

You could be immediately terminated without notice

One outcome of the pandemic is the growing use of “force majeure” clauses, which give the employer the right to reduce your compensation or even terminate you due to a natural disaster, which could include COVID.

“COVID made employers aware of the potential impact of disasters on their operations,” said Dan Shay, a health law attorney at Alice Gosfield & Associates in Philadelphia. “Therefore, even as the threat of COVID abates in many places, employers are continuing to put this provision in the contract.”

What can you do? “One way to get some protection is to rule out a termination without cause in the first year,” said Michael A. Cassidy, a physician contract attorney at Tucker Arensberg in Pittsburgh.

The force majeure clause is less likely to affect salary, but could impact bonus and incentive tied to performance. It’s wise to try to specifically limit how much the force majeure could reduce pay tied to performance, and to be prepared to negotiate that aspect of your contract.

No protections if you’re let go through no fault of your own

You could lose your job if your employer could not generate enough business and has to let some doctors go. This happened quite often in the early days of the COVID pandemic.

In these situations, the doctor has not done anything wrong to prompt the termination, but the restrictive covenant may still apply, meaning that the doctor would have to leave the area to find work.

What can you do? You’re in a good position to get this changed, said Christopher L. Nuland, a solo physician contract attorney in Jacksonville, Fla. “Many employers recognize that it would be draconian to require a restrictive covenant in this case, and they will agree to modify this provision.”

Similarly, the employer may not cover your tail insurance even if you were let go from your work through no fault of your own. Most malpractice policies for employer physicians require buying an extra policy, called a tail, if you leave. In some cases, the employer won’t provide a tail and will make the departing doctor buy it.

In these cases, “try for a compromise, such as stipulating that the party that caused the termination should pay for the tail,” Mr. Nuland said. “The employer may not agree to anything more than that because they want to set up a disincentive against you leaving.”

Employer could unilaterally alter your compensation